- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 26-12-2011

Nikkei 225 8,479 +84.18 +1.00%

Hang Seng 18,629 +250.94 +1.37%

S&P/ASX 200 4,140 +49.59 +1.21%

Shanghai Composite 2,190 -15.11 -0.69%

Japan will also apply to buy Chinese bonds next year, allowing the investment of renminbi that leaves China during the transactions, the Japanese government said in a statement after a meeting between Prime Minister Yoshihiko Noda and Chinese Premier Wen Jiabao in Beijing yesterday. Encouraging direct yen- yuan settlement should reduce currency risks and trading costs, Japan’s government said.

Home prices in 20 U.S. cities probably declined at a slower pace and consumer confidence improved, signs the economy gained strength heading into 2012, economists said before reports this week.

Property values dropped 3.2 percent in October from the same month in 2010, the smallest year-over-year decrease since January, according to the median forecast of 20 economists before a Dec. 27 report from S&P/Case-Shiller. Consumer confidence rose to a five-month high in December and more people signed contracts to buy previously owned homes than a month earlier, other data may show.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

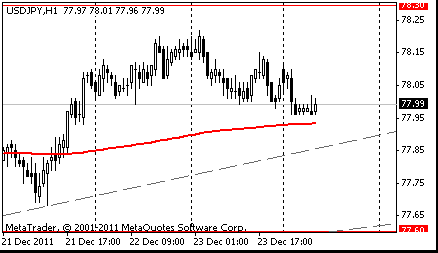

USD/JPY: on Asian session the pair fell.

On Monday the share markets of the Europe and America will be closed in connection with celebrating of Christmas. At 23:50 GMT Japan will publish the Report of meeting of Bank of Japan concerning a credit policy.

On Monday the euro fell for the first time in three days against the dollar as European finance ministers attempt to meet a self-imposed deadline for funding from the International Monetary Fund to address the region’s debt crisis. The 17-nation European currency has depreciated 2.8 percent versus the dollar this year and 6.6 percent against the yen. After falling to its weakest level against the dollar since January, the euro is poised to depreciate further as measures in the derivatives market show traders expect the blueprint unveiled by European leaders this month for a closer fiscal accord will fail to stem the declines. The yen dropped against most of its major counterparts amid concern a destabilization of the Korean peninsula will dim the outlook for Japan’s economy and security.

On Tuesday the euro rallied to a one-week high against the dollar after borrowing costs fell at a Spanish bill sale and German business confidence unexpectedly increased, easing concern the region’s debt crisis is worsening. The euro strengthened after the Ifo institute’s business climate index for Germany, based on a survey of 7,000 executives, rose to 107.2 this month from 106.6 in November, boosting optimism that Europe’s largest economy will avoid a recession next year. Economists expected a drop to 106, the median of 36 forecasts in a Bloomberg News survey showed. Spanish two-year notes rose for an eighth day and Italian bonds gained as the European Central Bank offered unlimited three-year loans to the region’s banks, boosting demand for higher-yielding assets, amid speculation banks bought the debt to use as collateral for ECB loans.

On Wednesday the euro fell against most of its major peers amid concern that European Central Bank measures to support its banking sector won’t be enough to arrest region’s worsening sovereign-debt crisis. The 17-nation currency erased an earlier advance as the ECB said it had awarded 489 billion euros ($637 billion) in 1,134- day loans to banks, more than the 293 billion euros forecast by economists, as investors bet the euro-region debt crisis is far from done. The euro-area economy will probably fail to grow next year after expanding 1.6 percent in 2011, while the U.S. is forecast to accelerate to 2.1 percent from 1.8 percent, according to Bloomberg surveys of economists.

On Thursday the euro fell against the U.S. dollar after the release of macroeconomic data on applications for unemployment insurance in the United States. The dollar has grown, despite the negative data on GDP for the third quarter, where the value was 1.8% versus 2.0%. Significant impact on the market have data on the labor market, where the value was 364 thousand vs. 376 thousand in government in Italy, Mario Monti won a confidence vote in the Senate on measures of austerity. The British pound rose against the U.S. dollar after the published statistics showed that UK GDP has exceeded the preliminary estimate. GDP grew in the third quarter of 2011 by 0.6% over the previous three months. Bank of England, King said that the prospects for growth and market conditions have deteriorated, and he is concerned about the threat posed by the debt crisis. In this case, the dependence on central bank has increased.King believes that banks need to raise capital without reducing the volume of lending.

On Friday the euro weakened against most of its major peers as French gross domestic product grew at a slower pace than previously estimated, adding to concern the European economy is stalling. France’s GDP rose 0.3 percent from the second quarter, when it fell 0.1 percent, French statistics institute Insee in Paris said today. It had previously reported a gain o 0.4 percent. In the year, the economy expanded 1.5 percent, down from 1.7 percent in the previous quarter. Canada’s currency reached to its strongest level in more than a week versus the greenback after reports showed the economic recovery gaining momentum in the U.S., the nation’s largest trading partner. The loonie, as the currency is known for the image of the waterfowl on the dollar coin, rose 0.1 percent to C$1.0188, after earlier reaching C$1.0181, the strongest level since Dec. 12.

Asian stocks rose, with a regional index heading for its first gain in three weeks, as a drop in U.S. jobless claims and an increase in consumer confidence added to signs the world’s biggest economy is weathering Europe’s debt crisis.

The regional index had fallen in the past two weeks as signs of slowing growth in China and concern that Europe’s debt crisis is worsening overshadowed improving U.S. data. Greece’s creditors are resisting pressure from the International Monetary Fund to accept bigger losses on holdings of the indebted nation’s government bonds, three people with direct knowledge of the discussions said.

South Korea’s Kospi Index rose 1.1 percent and Hong Kong’s Hang Seng Index also advanced 1.4 percent. China’s Shanghai Composite Index gained 0.9 percent. Australia’s S&P/ASX 200 Index increased 1.2 percent. Japanese markets are closed today for a holiday.

New Zealand’s NZX 50 Index added 0.3 percent, paring gains of as much as 0.7 percent after a magnitude 5.8 earthquake struck Christchurch, the country’s second-largest city.

Asian exporters gained as the number of Americans applying for unemployment benefits unexpectedly dropped last week to the lowest since April 2008 and consumer confidence rose more than forecast in December to a six-month high.

Samsung Electronics increased 1.5 percent to 1.068 million won in Seoul. Li & Fung Ltd. (494), a supplier of clothes and toys to Wal-Mart Stores Inc., rose 1.3 percent to HK$14.32 in Hong Kong. James Hardie climbed 3.6 percent to A$6.96.

Gloucester Coal surged 22 percent to A$8.55 in Sydney. Yanzhou Coal, China’s fourth-biggest coal producer, is buying the Sydney-based company for A$2.1 billion in a cash and share deal that values Gloucester at as much as A$10.16 a share, Gloucester said in a statement.

Yanzhou Coal, which will gain more mines and port access in Australia with the acquisition, climbed 6.6 percent to HK$16.74 in Hong Kong. Noble Group Ltd. (NOBL), the biggest shareholder of Gloucester, was unchanged on S$1.19 in Singapore.

Taiwanese insurance companies rallied after the nation’s financial regulator eased rules to allow life insurers to establish a mechanism for foreign-exchange hedging.

Cathay Financial Holding Co., Taiwan’s biggest life insurer by market value, jumped 6.9 percent to NT$33.3. China Life Insurance Co. gained 6.8 percent to NT$25. Shin Kong Financial Holding Co. climbed 6.6 percent to NT$8.83.

Keppel Corp., the world’s biggest builder of oil platforms, rose 3.1 percent to S$9.54 in Singapore. The company said its Fernvale unit won a contract valued at $809 million to build a semi-submersible drilling rig for Urca Drilling BV, a unit of Petroleo Brasileiro’s Sete Brasil.

European stocks rose, capping the first weekly rally since Dec. 2, as U.S. durable-goods orders and new home sales increased, reinforcing optimism that the recovery in the world’s largest economy is gathering strength.

Orders for U.S. durable goods rose in November by the most in four months as an increase in demand for aircraft outweighed declines in spending on computers and equipment.

Bookings for equipment meant to last at least three years rose 3.8 percent after no change in the prior month that was previously reported as a decline, data from the Commerce Department showed today in Washington.

A separate report showed sales of new U.S. homes rose to a seven-month high in November. Purchases of single-family properties increased 1.6 percent to a 315,000 annual pace, pushing the number of new homes on the market to a record low.

National benchmark indexes climbed in all 18 western- European (SXXP) stock markets. The U.K.’s FTSE 100 Index rose 1 percent, Germany’s DAX gained 0.5 percent and France’s CAC 40 gained 1 percent.

Wavin soared 22 percent to 9.58 euros as it granted access to Mexichem to carry out due diligence, after the Latin American chemical producer increased its bid for Wavin to 10 euros from 9 euros.

BP rose 2.1 percent to 459.70 pence, while Total SA added 2.1 percent to 38.64 euros. Crude oil climbed for a fifth day in New York, the longest stretch of gains since Nov. 8.

EDP-Energias de Portugal dropped 0.3 percent to 2.32 euros, erasing an earlier gain of 3.7 percent, after Fitch Ratings reaffirmed the company’s long-term credit rating at BBB+. EDP had advanced after Portugal said China Three Gorges Corp. will pick up a stake in the company.

U.S. stocks rose, pushing the Standard & Poor’s 500 Index to a 0.6 percent yearly rally, as expansion in U.S. industrial purchases and stronger new-home sales offset weaker-than-forecast consumer spending.

Orders for U.S. durable goods rose in November by 3.8 percent, the most in four months, and more than the 2.2 percent economists had predicted, data from the Commerce Department showed today in Washington. Consumer spending and incomes rose less than forecast in November, while sales of new U.S. homes rose 1.6 percent to a 315,000 annual pace in November, a seven- month high, and matching the forecast, data show.

Congress passed a two-month payroll tax cut extension today, eight days before its scheduled expiration, after House Republicans dropped their objections under growing political pressure. House Speaker John Boehner agreed late yesterday to extend the tax cut, capping a month of wrangling that led to a revolt by House Republicans over the bipartisan deal passed by the Senate on Dec. 17 in an 89-10 vote. The plan approved today will go to President Barack Obama for his signature.

Bank of America Corp. (BAC) and Walt Disney Co. rose at least 2 percent, pacing gains among the largest companies.

Rambus jumped 12 percent to $8.21. The agreement with Irvine, California-based Broadcom ends all litigation, including claims related to Broadcom’s alleged past use of patented Rambus technology. The license runs for five years, with undisclosed financial terms, Rambus said in a statement.

TripAdvisor Inc., which replaced Tellabs Inc. in the S&P 500 earlier this month, rallied 6.1 percent to $26.02 after plunging 11 percent yesterday. UBS AG rated it a new “neutral,” with a price forecast of $27.

Mead Johnson Nutrition Co. lost the most in the S&P 500 today, falling 5.1 percent to $65.29. The Food and Drug Administration said it may take until next week for test results to show whether infant formula made by the company spurred a bacterial infection that killed a newborn or if something else was at fault.

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.30/45 (area of Nov 1-4 high)

The current price: Y77.96

Support 1:Y77.60 (Dec 16 low)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Comments: the pair is on uptrend. In focus support Y77.60.

Resistance 3: Chf0.9540/45 (area of Dec 14-15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9400 (Dec 22 high)

The current price: Chf0.9366

Support 1: Chf0.9335 (Dec 23 low)

Support 2: Chf0.9305 (Dec 22 low)

Support 3: Chf0.9270 (Dec 20 low)

Comments: the pair advanced. In focus resistance Chf0.9400

Resistance 3 : $1.5770 (Dec 21 high)

Resistance 2 : $1.5730 (Dec 22 high)

Resistance 1 : $1.5645 (session high)

The current price: $1.5594

Support 1 : $1.5560 (Dec 16 high)

Support 2 : $1.5490 (Dec 20 low)

Support 3 : $1.5435 (Dec 15 low)

Comments: the pair is on uptrend. In focus resistance $1.5650.

Resistance 3: $1.3200 (Dec 21 high)

Resistance 2: $1.3130 (Dec 20 high)

Resistance 1: $1.3095 (Dec 23 high)

The current price: $1.3059

Support 1 : $1.3015 (Dec 22 low)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2945 (Dec 14 low)

Comments: the pair is on uptrend. In focus resistance $1.3095.

00:00 Australia Boxing Day

00:00 New Zealand Boxing Day

00:00 Germany St. Stephen's Day

00:00 Switzerland St. Stephen's Day

00:00 United Kingdom Boxing Day

00:00 Canada Boxing Day

00:00 U.S. Christmas Day

23:50 Japan Monetary Policy Meeting Minutes

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.