- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 23-12-2011

The euro weakened against most of its major peers as French gross domestic product grew at a slower pace than previously estimated, adding to concern the European economy is stalling. France’s GDP rose 0.3 percent from the second quarter, when it fell 0.1 percent, French statistics institute Insee in Paris said today. It had previously reported a gain o 0.4 percent. In the year, the economy expanded 1.5 percent, down from 1.7 percent in the previous quarter.

The 17-nation common currency fluctuated against the dollar as U.S. durable goods orders rose more than forecast, adding to evidence of economic growth in America and a sign of decoupling between the U.S and the euro area. Orders for U.S. durable goods jumped in November by the most in four months, data showed today, helping to offset weaker-than-forecast consumer spending. Sales of new U.S. homes rose in November to a seven-month high, adding to evidence of stabilization in the housing market. Purchases of single-family properties increased 1.6 percent to a 315,000 annual pace, figures from the Commerce Department showed today in Washington. Congress passed a two-month payroll tax cut extension eight days before its scheduled expiration after House Republicans dropped their objections under growing political pressure. European Central Bank Executive Board member Lorenzo Bini Smaghi said policy makers shouldn’t shirk from using quantitative easing if it’s needed to avoid deflation.

Canada’s currency reached to its strongest level in more than a week versus the greenback after reports showed the economic recovery gaining momentum in the U.S., the nation’s largest trading partner. The loonie, as the currency is known for the image of the waterfowl on the dollar coin, rose 0.1 percent to C$1.0188, after earlier reaching C$1.0181, the strongest level since Dec. 12.

IntercontinentalExchange Inc.’s Dollar Index, a gauge of the greenback against the currencies of six major U.S. trading partners, was little changed at 79.948.

Economy showing 'positive signs;' improvement not fast enough

European stocks rose, capping the first weekly rally since Dec. 2, as U.S. durable-goods orders and new home sales increased, reinforcing optimism that the recovery in the world’s largest economy is gathering strength.

Orders for U.S. durable goods rose in November by the most in four months as an increase in demand for aircraft outweighed declines in spending on computers and equipment.

Bookings for equipment meant to last at least three years rose 3.8 percent after no change in the prior month that was previously reported as a decline, data from the Commerce Department showed today in Washington.

A separate report showed sales of new U.S. homes rose to a seven-month high in November. Purchases of single-family properties increased 1.6 percent to a 315,000 annual pace, pushing the number of new homes on the market to a record low.

National benchmark indexes climbed in all 18 western- European (SXXP) stock markets. The U.K.’s FTSE 100 Index rose 1 percent, Germany’s DAX gained 0.5 percent and France’s CAC 40 gained 1 percent.

Wavin soared 22 percent to 9.58 euros as it granted access to Mexichem to carry out due diligence, after the Latin American chemical producer increased its bid for Wavin to 10 euros from 9 euros.

BP rose 2.1 percent to 459.70 pence, while Total SA added 2.1 percent to 38.64 euros. Crude oil climbed for a fifth day in New York, the longest stretch of gains since Nov. 8.

EDP-Energias de Portugal dropped 0.3 percent to 2.32 euros, erasing an earlier gain of 3.7 percent, after Fitch Ratings reaffirmed the company’s long-term credit rating at BBB+. EDP had advanced after Portugal said China Three Gorges Corp. will pick up a stake in the company.

U.S. stocks rose, extending the weekly rally for the Standard & Poor’s 500 Index, as expansion in U.S. industrial purchases and stronger new-home sales offset weaker-than-forecast consumer spending.

Orders for U.S. durable goods rose in November by 3.8 percent, the most (SPXL1) in four months, and more than the 2.2 percent economists had predicted, data from the Commerce Department showed today in Washington. Consumer spending and incomes rose less than forecast in November, while sales of new U.S. homes rose 1.6 percent to a 315,000 annual pace in November, a seven- month high, and matching the forecast, data show.

Congress passed a two-month payroll tax cut extension today, eight days before its scheduled expiration, after House Republicans dropped their objections under growing political pressure. House Speaker John Boehner agreed late yesterday to extend the tax cut, capping a month of wrangling that led to a revolt by House Republicans over the bipartisan deal passed by the Senate on Dec. 17 in an 89-10 vote. The plan approved today will go to President Barack Obama for his signature.

All 10 industries advanced at least 0.1 percent today, led by telephone-company shares. U.S. stock markets will be closed Dec. 26 for the Christmas holiday.

Rambus jumped 15 percent to $8.45. The agreement with Irvine, California-based Broadcom ends all litigation, including claims related to Broadcom’s alleged past use of patented Rambus technology. The license runs for five years, with undisclosed financial terms, Rambus said in a statement.

Verizon climbed 1.2 percent to $39.76. Disney increased 1.1 percent to $37.37, while Bank of America rallied 1.1 percent to $5.53.

Activity in the gold market on the eve of Christmas holidays came to an end. The volume of orders for durable goods in the U.S. rose in November compared with October at 3.8%, or$ 7.5 billion - up to 207 billion dollars. Thus, the November data were significantly better than forecasts of analysts, who expected growth rate of only 2%.

However, the negative impact on investor sentiment has statistics on expenditures and incomes of Americans in November, which showed growth of only 0.1%. Analysts had forecast growth of spending 0.3% of income - by 0.4%.

The growth potential of the "yellow metal" is now limited and trade corridor remains in effect for under $ 1605 - $ 1615 per troy ounce in February gold futures at the Comex trading in New York.

Oil headed for its biggest weekly gain in almost two months in New York after U.S. economic reports indicated that growth in the world’s biggest crude consumer will accelerate.

Futures rose as much as 0.6 percent, extending yesterday’s gain of 0.9 percent after U.S. initial jobless claims dropped to the lowest level since April 2008. Leading indicators climbed more than forecast in November, and consumer sentiment improved this month. Oil supplies fell the most in a decade last week, the Energy Department said Dec. 21.

U.S. initial unemployment claims fell by 4,000 to 364,000 last week, Labor Department figures showed yesterday. The Conference Board’s gauge of the outlook for the next three to six months rose 0.5 percent, versus a median forecast of 0.3 percent in a Bloomberg survey. The Thomson Reuters/University of Michigan final index of consumer sentiment increased more than expected in December.

Crude may rise next week on speculation that sanctions against Iran will curb supply from the world’s third-largest oil exporter, a separate Bloomberg survey showed.

The European Union and the U.S. are seeking support from the Middle East and Asia for sanctions to increase pressure on Iran to abandon a suspected nuclear weapons program. Iran’s navy will hold 10 days of maneuvers east of the Strait of Hormuz, state-run Fars news agency reported yesterday, citing Navy Commander Habibollah Sayari.

Crude for February delivery was at $99.78 a barrel, up 25 cents, in electronic trading on the New York Mercantile Exchange at 3:15 p.m. Singapore time. The contract yesterday rose 86 cents to $99.53, the highest settlement since Dec. 13. Prices are up 6.7 percent this week, the biggest gain since the period ended Oct. 28. Futures have climbed 9.3 percent this year after increasing 15 percent in 2010.

Brent oil for February was trading at $108.09 a barrel, up 20 cents, on the London-based ICE Futures Europe exchange. The European contract’s premium to Nymex crude was $8.19 a barrel, compared with a close yesterday of $8.36 that was the smallest differential since March 8. The spread surged to a record $27.88 on Oct. 14.

Resistance 3:1275 (high of November)

Resistance 2:1267 (high of December)

Resistance 1:1257 (session high)

Current price: 1252,35

Support 1 : 1250/49 (session low, Dec 21 high, support line from Dec 19)

Support 2 : 1239 (Dec 22 intraday low)

Support 3 : 1232 (Dec 22 low, 38,2 % FIBO 1195-1257)

EUR/USD $1.2950, $1.2975, $1.3000, $1.3030, $1.3100, $1.3200, $1.2825

USD/JPY Y77.30, Y77.95, Y78.00, Y78.65EUR/CHF Chf1.2400

USD/CHF Chf0.9350

USD/CAD C$1.0190, C$1.0200, C$1.0400

Consumer spending rose 0.1% in November, compared with the median estimate in a survey of economists of a 0.3% advance. Incomes also grew 0.1%, the weakest in three months, after a 0.4% rise in October.

Orders for U.S. durable goods rose in November by 3.8%, the most in four months, data from the Commerce Department showed today in Washington. An increase in demand for aircraft outweighed declines in spending on computers and equipment. Economists had predicted a 2.2% rise.

Hang Seng 18,629 +250.94 +1.37%

Shanghai Composite 2,205 +18.49 +0.85%

FTSE 5,513 +55.73 +1.02%

CAC 3,095 +23.10 +0.75%

DAX 5,858 +5.98 +0.10%

Crude oil: $100.00 (+0,5%).

Gold: $1608,30 (-0,1%).

Data:

06:30 France GDP (Q3) revised 0.3%

06:30 France GDP (Q3) revised Y/Y 1.5%

Flows were very light as markets moving down the gears ahead of the elongated Christmas weekend prompting a sharp cut back in liquidity.

Departing European Central Bank Executive Board member Lorenzo Bini Smaghi hinted Thursday that the ECB could take more aggressive action to intervene in Eurozone government bond markets. In his last interview before retiring from the ECB's Executive Board, Bini Smaghi argued that while the "concept of lender of last resort to governments is misplaced" the ECB could intervene more heavily on bond markets for monetary policy reasons. "The mandate of the ECB is to implement the single monetary policy of the euro area, with the objective of price stability," Bini Smaghi told the Financial Times.

EUR/USD: during european session the pair limits in $1,3060-$ 1.3100 area.

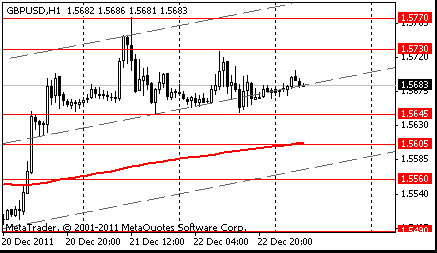

GBP/USD: during european session the pair limits in $1,5660-$ 1.5710 area.

USD/JPY: the pair has trading slightly above Y78,00.

US data starts at 1300GMT with the latest Building Permits Revision,

while data at 1330GMT includes durable goods orders and also Personal Income data. Then, at 1500GMT, US New home sales are forecast to rise to a 313,000 annual rate from the 307,000 rate in October. Late US data sees the 2115GMT release of Commercial & Industrial Loans.

GBP/USD

Offers $1.5795/800, $1.5775/80, $1.5745/50, $1.5730

Bids $1.5620, $1.5600, $1.5550

EUR/USD

Offers $1.3225/50, $1.3210/15, $1.3200, $1.3150/60, $1.3130

Bids $1.3000/990, $1.2980

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 highs)

Resistance 1: Y78.20 (session high)

Current price: Y78.04

Support 1:Y77.95 (МА (200) for Н1)

Support 2:Y77.60 (Dec 13 and 16 lows)

Support 3:Y77.50 (Dec 9 low)

Resistance 3: Chf0.9545 (Dec 15 high)

Resistance 2: Chf0.9430 (61,8 % FIBO Chf0,9545-Chf0,9242)

Resistance 1: Chf0.9390/00 (area of Dec 19 and 21 highs and 50,0 % FIBO Chf0,9545-Chf0,9242)

Current price: Chf0.9360

Support 1: Chf0.9330 (session low)

Support 2: Chf0.9300 (Dec 22 low)

Support 3: Chf0.9240 (Dec 21 low)

Resistance 3 : $1.5890 (Nov 18 high)

Resistance 2 : $1.5770/80 (area of Nov 30, Dec 8 and 21 highs)

Resistance 1 : $1.5730 (Dec 22 high)

Current price: $1.5669

Support 1 : $1.5650 (area of Dec 21-22 lows)

Support 2 : $1.5620 (low of american session on Dec 20)

Support 3 : $1.5570/60 (Dec 16 high, МА (200) for Н1)

Resistance 3: $ 1.3240 (area of Dec 13 low and support line from Jan'2011)

Resistance 2: $ 1.3200 (area of Dec 21 high)

Resistance 1: $ 1.3100/10 (session high, resistance line from Oct 27)

Current price: $1.3067

Support 1 : $1.3020 (area of Dec 21-22 lows)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2945 (Dec 14 low)

EUR/USD $1.2950, $1.2975, $1.3000, $1.3030, $1.3100, $1.3200, $1.2825

USD/JPY Y77.30, Y77.95, Y78.00, Y78.65EUR/CHF Chf1.2400

USD/CHF Chf0.9350

USD/CAD C$1.0190, C$1.0200, C$1.0400

Nikkei 225 8,395 -64.82 -0.77%

Hang Seng 18,629 +250.94 +1.37%

S&P/ASX 200 4,140 +49.59 +1.21%

Shanghai Composite 2,205 +18.49 +0.85%

Dec 23 Greek T-bill redemption for E2.0bln

Dec 23 Portugal T-bill redemption for E2.277bln

Dec 27 Italy T-bill redemption for E2.5bln

Dec 30 Italy T-bill redemption for E8.8bln

Jan 1 Denmark takes over EU presidency

Jan 10 EU Rehn speaks on Eurobonds to European parliament group

Jan 13 Greek T-bill redemption for E2.0bln

Jan 16 Italy T-bill redemption for E7.7bln

Jan 20 Greek T-bill redemption for E2.0bln

Jan 20 Spain T-bill redemption for E8.611bln

Jan 20 Portugal T-bill redemption for E3.958bln

Jan 22 Finnish presidential elections

Jan 23/24 EU FinMin meeting in Brussels

The dollar was set to fall against most of its 16 major peers this week as Asian shares extended a global rally, damping demand for lower-yielding assets.

The Australian dollar rose, extending its gains this week, before U.S. reports that may show improvements in home sales and consumer spending, boosting demand for higher-yielding currencies.

The so-called Aussie strengthened to a two-week high against the yen as Asian stocks extended a rally in global equities.

The New Zealand currency, known as the kiwi, briefly pared a weekly advance after an earthquake struck near the city of Christchurch. Demand for the South Pacific nations’ currencies was limited as Italy prepares to sell bonds next week amid concern Europe’s debt crisis will weigh on global growth. Italy is scheduled to auction 9 billion euros ($11.8 billion) of bills and as much as 2.5 billion euros of bonds on Dec. 28, followed by sales of debt maturing in 2014, 2018, 2021 and 2022 the next day.

S&P said this month it may cut the credit grades of 15 euro nations, including Italy, France and Germany.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair fell.

European data for Friday starts at 0630GMT with the detail of France Q3 GDP data, which is followed by France PPI for November at

0745GMT. UK data at 0930GMT includes BBA Banking Data, Mortgage Approvals as well as the latest Index of Services data. At 0830GMT, the Swiss National Bank is due to publish it's Q4 Quarterly Bulletin. US data starts at 1300GMT with the latest Building Permits Revision,

while data at 1330GMT includes durable goods orders and also Personal Income data. Then, at 1500GMT, US New home sales are forecast to rise to a 313,000 annual rate from the 307,000 rate in October. Late US data sees the 2115GMT release of Commercial & Industrial Loans.

The euro fell against the U.S. dollar after the release of macroeconomic data on applications for unemployment insurance in the United States. The dollar has grown, despite the negative data on GDP for the third quarter, where the value was 1.8% versus 2.0%. Significant impact on the market have data on the labor market, where the value was 364 thousand vs. 376 thousand in government in Italy, Mario Monti won a confidence vote in the Senate on measures of austerity.

The British pound rose against the U.S. dollar after the published statistics showed that UK GDP has exceeded the preliminary estimate. GDP grew in the third quarter of 2011 by 0.6% over the previous three months. Bank of England, King said that the prospects for growth and market conditions have deteriorated, and he is concerned about the threat posed by the debt crisis. In this case, the dependence on central bank has increased.King believes that banks need to raise capital without reducing the volume of lending.

EUR/USD: yesterday the pair has grown, but then decreased.

GBP/USD: yesterday the pair has grown, however lost the positions later.

USD/JPY: yesterday the pair advanced.

European data for Friday starts at 0630GMT with the detail of France Q3 GDP data, which is followed by France PPI for November at

0745GMT. UK data at 0930GMT includes BBA Banking Data, Mortgage Approvals as well as the latest Index of Services data. At 0830GMT, the Swiss National Bank is due to publish it's Q4 Quarterly Bulletin. US data starts at 1300GMT with the latest Building Permits Revision,

while data at 1330GMT includes durable goods orders and also Personal Income data. Then, at 1500GMT, US New home sales are forecast to rise to a 313,000 annual rate from the 307,000 rate in October. Late US data sees the 2115GMT release of Commercial & Industrial Loans.

Asian stocks dropped, snapping a two-day rally, as European lenders sought record loans from the central bank and U.S. home sales missed forecasts, damping the earnings outlook for exporters.

Futures on the Standard & Poor’s 500 Index (SPX) rose 0.6 percent today after the gauge added 0.2 percent yesterday, lifted by gains in energy and consumer shares. U.S. equities fell earlier after the ECB offered 489 billion euros ($645 billion) in 1,134- day loans to banks, the most ever in a single operation and more than economists’ estimates.

The increased funding sought by lenders may indicate institutions are wary of lending to each other amid a heightened risk of government and bank defaults.

Exporters to the U.S. declined after sales of existing homes in the world’s biggest economy missed economists’ estimates. A report by the National Association of Realtors revised down the number of existing home sales in the U.S. by an average of 14 percent since 2007, indicating the depth of the slump that contributed to the last recession.

Japan’s Nikkei 225 Stock Average (NKY) fell 0.8 percent before a public holiday tomorrow. South Korea’s Kospi Index lost 0.1 percent. Australia’s S&P/ASX 200 declined 1.2 percent and Hong Kong’s Hang Seng Index slid 0.2 percent. China’s Shanghai Composite Index dropped 0.2 percent, paring losses of as much as 1.9 percent.

Li & Fung dropped 2.9 percent to HK$14.14 in Hong Kong. Nissan Motor Co., which depends on North America for a third of its sales, lost 0.9 percent to 692 yen in Tokyo. Toshiba Corp., a maker of home appliances, medical equipment and power plants, fell 1 percent to 309 yen.

Advantest Corp., the world’s biggest maker of memory-chip testers, sank 4.5 percent to 740 yen, the lowest since November 1992. JPMorgan Chase & Co. cut its rating to “underweight” from “neutral,” citing weak orders.

Tokio Marine dropped 1.7 percent to 1,713 yen after it agreed to buy Delphi Financial Group Inc. for $2.7 billion in cash. acquisition comes amid waning demand in Japan, where the population is declining.

Kathmandu Holdings Ltd. plunged 25 percent to NZ$1.64 after the supplier of travel equipment said trading during the Christmas period hasn’t met expectations. The company said first-half earnings before interest, taxes, depreciation and amortization may drop from NZ$23.2 million ($17.8 million) a year ago.

Among stocks that advanced, OneSteel jumped 10 percent to 75 Australian cents, the most on the MSCI Asia Pacific Index. The company said it’s not considering a debt or share sale, rejecting speculation it may need to raise capital. Deutsche Bank AG said last month there’s a “significant risk” the steelmaker may have to raise funds due to a likely breach of financial covenants.

European stocks advanced, extending this week’s gains, after U.S. jobless claims unexpectedly fell last week to the lowest since April 2008, indicating the recovery in the world’s largest economy is on track.

U.S. jobless claims unexpectedly dropped last week to the lowest since April 2008, a sign that the U.S. labor market is strengthening. Jobless claims fell by 4,000 to 364,000 in the week ended Dec. 17, Labor Department figures showed today in Washington. The median forecast of 45 economists surveyed by Bloomberg News projected an increase to 380,000.

Another report showed American consumer confidence rose more than forecast in December, to a six-month high. The Thomson Reuters/University of Michigan final index of consumer sentiment climbed to 69.9 from 64.1 at the end of November. The median estimate in a Bloomberg News survey called for 68 after a preliminary reading of 67.7.

In the U.K., economic growth accelerated more than previously estimated in the third quarter in an increase that the Bank of England says is unlikely to be repeated as the euro- area debt crisis curbs bank lending and dents confidence. Gross domestic product rose 0.6 percent from the previous quarter, faster than the 0.5 percent previously estimated, the Office for National Statistics said today in London.

National benchmark indexes climbed in 15 of the 18 western- European (SXXP) stock markets. The U.K.’s FTSE 100 Index rose 1.3 percent, Germany’s DAX advanced 1.1 percent and France’s CAC 40 gained 1.4 percent.

IAG advanced 3.3 percent to 149.9 pence after agreeing to buy Lufthansa’s BMI unit in the U.K. for 172.5 million pounds ($270.5 million), fending off a counterbid from Virgin Atlantic Airways Ltd. IAG said the acquisition will boost its operating profit by 100 million euros in 2015. Lufthansa added 1.9 percent to 9.20 euros.

Deutsche Bank, Germany’s largest lender, rose 3.2 percent to 29.29 euros. BNP Paribas, France’s biggest, added 3.4 percent to 30.24 euros. A gauge of banks was the best performer among the 19 industry groups on the Stoxx 600, gaining 2 percent.

BHP Billiton Ltd, the world’s largest mining company, increased 1.9 percent to 1,870 pence as copper climbed on the London Metal Exchange.

Stagecoach, the operator of Britain’s biggest rail-commuter franchise, retreated 3.4 percent to 260.9 pence after the shares were downgraded to “underweight” from “overweight” at JPMorgan by equity analyst David Pitura, who set the six-month target price at 280 pence.

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher for a third day, as better- than-estimated jobless claims, consumer confidence and leading indicators bolstered optimism in the world’s largest economy.

Stocks rose today as the number of applications for unemployment benefits unexpectedly dropped last week to the lowest since April 2008. Confidence among U.S. consumers rose more than forecast in December, to a six-month high, according to the Thomson Reuters/University of Michigan sentiment index, as Americans began wrapping up their holiday spending. The index of U.S. leading indicators climbed more than estimated in November, a sign that the economy will keep growing in 2012.

Nine out of 10 groups (SPXL1) in the S&P 500 rose as gauges of financial and energy shares added at least 1.1 percent. The Morgan Stanley Cyclical Index rallied 1.3 percent amid economic optimism. GE jumped 3 percent to $18.05. Exxon Mobil increased 1.4 percent to $84.29.

The KBW Bank Index gained 2.8 percent. Morgan Stanley added 6.5 percent to $15.88. Citigroup gained 5.9 percent to $27.65. Bank of America advanced 4.6 percent to $5.47. JPMorgan Chase & Co. (JPM) rose 3.5 percent to $33.45.

Akamai surged 19 percent, the most in the S&P 500, to $31.63. The operator of a server network that lets businesses speed data delivery agreed to buy startup competitor Cotendo for about $268 million in cash. The deal helps Akamai “maintain its leadership position and high margins” by eliminating a competitor, according to a research note from Gray Powell, an analyst at Wells

Bed Bath & Beyond Inc. fell 6.3 percent to $57.58. The home furnishings retailer reported third-quarter sales of $2.34 billion, below the average analyst estimate of $2.35 billion in a Bloomberg survey.

American Greetings Corp. sank 21 percent to $13.39. The second-largest U.S. maker of greeting cards posted third-quarter earnings of 50 cents a share excluding some items, missing Northcoast Research’s estimate of 81 cents a share.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.45 (high of the American session on Nov 1)

Resistance 1: Y78.30 (Nov 29 high)

The current price: Y78.08

Support 1:Y78.00 (Dec 22 low)

Support 2:Y77.70 (area of Dec 20-21 low)

Support 3:Y77.50 (Dec 9 low)

Comments: the pair advanced. In focus resistance Y78.30.

Resistance 3: Chf0.9545 (Dec 15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9400 (Dec 22 high)

The current price: Chf0.9348

Support 1: Chf0.9340 (session low)

Support 2: Chf0.9305 (Dec 22 low)

Support 3: Chf0.9270 (Dec 20 low)

Comments: the pair advanced. In focus resistance Chf0.9400.

Resistance 3 : $1.5810 (Nov 17 high)

Resistance 2 : $1.5770 (Dec 21 high)

Resistance 1 : $1.5730 (Dec 22 high)

The current price: $1.5683

Support 1 : $1.5645 (Dec 21-22 low)

Support 2 : $1.5645 (MA (233) H1)

Support 3 : $1.5560 (support line from Dec 14)

Comments: the pair is on uptrend. In focus resistance $1.5730.

Resistance 3: $1.3200 (Dec 21 high)

Resistance 2: $1.3130 (Dec 20 high)

Resistance 1: $1.3110 (MA (233) H1)

The current price: $1.3069

Support 1 : $1.3015 (Dec 22 low)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2944 (Jan 14 low)

Comments: the pair is on uptrend. In focus resistance $1.3110.

Change % Change Last

Nikkei 225 8,395 -64.82 -0.77%

Hang Seng 18,378 -38.22 -0.21%

S&P/ASX 200 4,091 -48.69 -1.18%

Shanghai Composite 2,186 -4.85 -0.22%

FTSE 100 5,450 +60.55 +1.12%

CAC 40 3,068 +37.56 +1.24%

DAX 5,847 +55.47 +0.96%

Dow 12,169.65 +61.91 +0.51%

Nasdaq 2,599.45 +21.48 +0.83%

S&P 500 1,254.00 +10.28 +0.83%

10 Year Yield 1.95% -0.02 --

Oil $99.50 -0.03 -0.03%

Gold $1,606.20 -4.40 -0.27%

06:30 France GDP, q/q Quarter III +0.4% +0.4%

06:30 France GDP, Y/Y Quarter III +1.6% +1.6%

09:30 United Kingdom Mortgage Approvals October 35.3 36.3

10:00 Switzerland SNB Quarterly Bulletin IV quarter

13:30 Canada Gross Domestic Product (MoM) October +0.2% +0.1%

13:30 U.S. Durable Goods Orders November -0.7% +2.2%

13:30 U.S. Durable Goods Orders ex Transportation November +0.7% +0.5%

13:30 U.S. Durable goods orders ex defense November -1.8% +0.9%

13:30 U.S. Personal Income, m/m November +0.4% +0.3%

13:30 U.S. Personal spending November +0.1% +0.3%

13:30 U.S. PPI excluding food and energy, m/m November +0.1% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y November +1.7% +1.7%

15:00 U.S. New Home Sales November 307 314

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.