- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 22-12-2011

The euro fell against the U.S. dollar after the release of macroeconomic data on applications for unemployment insurance in the United States. The dollar has grown, despite the negative data on GDP for the third quarter, where the value was 1.8% versus 2.0%. Significant impact on the market have data on the labor market, where the value was 364 thousand vs. 376 thousand in government in Italy, Mario Monti won a confidence vote in the Senate on measures of austerity.

The British pound rose against the U.S. dollar after the published statistics showed thatUK GDP has exceeded the preliminary estimate. GDP grew in the third quarter of 2011 by 0.6% over the previous three months. Bank of England, King said that the prospects for growth and market conditions have deteriorated, and he is concerned about the threat posed by the debt crisis. In this case, the dependence on central bank has increased.King believes that banks need to raise capital without reducing the volume of lending.

European stocks advanced, extending this week’s gains, after U.S. jobless claims unexpectedly fell last week to the lowest since April 2008, indicating the recovery in the world’s largest economy is on track.

U.S. jobless claims unexpectedly dropped last week to the lowest since April 2008, a sign that the U.S. labor market is strengthening. Jobless claims fell by 4,000 to 364,000 in the week ended Dec. 17, Labor Department figures showed today in Washington. The median forecast of 45 economists surveyed by Bloomberg News projected an increase to 380,000.

Another report showed American consumer confidence rose more than forecast in December, to a six-month high. The Thomson Reuters/University of Michigan final index of consumer sentiment climbed to 69.9 from 64.1 at the end of November. The median estimate in a Bloomberg News survey called for 68 after a preliminary reading of 67.7.

In the U.K., economic growth accelerated more than previously estimated in the third quarter in an increase that the Bank of England says is unlikely to be repeated as the euro- area debt crisis curbs bank lending and dents confidence. Gross domestic product rose 0.6 percent from the previous quarter, faster than the 0.5 percent previously estimated, the Office for National Statistics said today in London.

National benchmark indexes climbed in 15 of the 18 western- European (SXXP) stock markets. The U.K.’s FTSE 100 Index rose 1.3 percent, Germany’s DAX advanced 1.1 percent and France’s CAC 40 gained 1.4 percent.

IAG advanced 3.3 percent to 149.9 pence after agreeing to buy Lufthansa’s BMI unit in the U.K. for 172.5 million pounds ($270.5 million), fending off a counterbid from Virgin Atlantic Airways Ltd. IAG said the acquisition will boost its operating profit by 100 million euros in 2015. Lufthansa added 1.9 percent to 9.20 euros.

Deutsche Bank, Germany’s largest lender, rose 3.2 percent to 29.29 euros. BNP Paribas, France’s biggest, added 3.4 percent to 30.24 euros. A gauge of banks was the best performer among the 19 industry groups on the Stoxx 600, gaining 2 percent.

BHP Billiton Ltd, the world’s largest mining company, increased 1.9 percent to 1,870 pence as copper climbed on the London Metal Exchange.

Stagecoach, the operator of Britain’s biggest rail-commuter franchise, retreated 3.4 percent to 260.9 pence after the shares were downgraded to “underweight” from “overweight” at JPMorgan by equity analyst David Pitura, who set the six-month target price at 280 pence.

Canada's provinces need to implement austerity measures

BoC rate policy should continue to be "accommodative"

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher for a third day, as better- than-estimated jobless claims, consumer confidence and leading indicators bolstered optimism in the world’s largest economy.

Stocks rose today as the number of applications for unemployment benefits unexpectedly dropped last week to the lowest since April 2008. Confidence among U.S. consumers rose more than forecast in December, to a six-month high, according to the Thomson Reuters/University of Michigan sentiment index, as Americans began wrapping up their holiday spending. The index of U.S. leading indicators climbed more than estimated in November, a sign that the economy will keep growing in 2012.

Dow 12,160.15 +52.41 +0.43%, Nasdaq 2,597.73 +19.76 +0.77%, S&P 500 1,251.54 +7.82 +0.63%

The KBW Bank Index gained 1.8 percent. Morgan Stanley added 3.8 percent to $15.48. Citigroup gained 4.7 percent to $27.32. JPMorgan rose 2.3 percent, the second-most in the Dow, to $33.07. Bank of America Corp. (BAC) advanced 2.1 percent to $5.34.

Akamai surged 18 percent to $31.39. Cotendo, founded in 2008 and based in Sunnyvale, California, has about 100 employees, half of them in Israel, where the company has a technology center, according to a statement today.

Yahoo! Inc. rallied 1.4 percent to $16.22. The company is considering cutting its 40 percent stake in Alibaba Group Holding Ltd. to about 15 percent, two people briefed on the matter said. Dana Lengkeek, a spokeswoman for Sunnyvale, California-based Yahoo, and Alibaba spokesman John Spelich both declined to comment.

Gold declined in New York for the third time in four days on signs of a strengthening U.S. job market and a drop in holdings by exchange-traded fund investors.

Applications for unemployment benefits unexpectedly dropped last week to the lowest since April 2008, the government reported today, boosting the dollar and reducing demand for gold as an alternative asset. Holdings in bullion-backed ETFs fell for a fifth day to the lowest level since Nov. 16, as investors sold the metal to cover losses in other markets, data compiled by Bloomberg show.

Gold futures for February delivery fell to $1,599.10 an ounce on the Comex in New York. Before today, the metal was up 14 percent this year. Prices dropped 6.9 percent last week after the Federal Reserve refrained from taking new action to boost economic growth.

Bullion-backed ETF holdings, which reached an all-time high of 2,360.81 metric tons on Dec. 14, fell to 2,329.921 tons yesterday.

Oil rose a fourth day in New York as the number of applications for unemployment benefits in the U.S. fell to the lowest level since April 2008, bolstering optimism that economic growth will accelerate.

Futures advanced as much as 0.7 percent after the Labor Department said that jobless claims dropped by 4,000 to 364,000 last week. The median forecast of 45 economists surveyed by Bloomberg News projected an increase to 380,000. U.S. oil supplies declined the most in a decade last week, an Energy Department report showed yesterday.

Crude oil for February delivery rose 80 cents, or 0.8 percent, to $99.47 a barrel at 9:38 a.m. on the New York Mercantile Exchange. Futures touched $99.50, the highest level since Dec. 14. Prices have risen 8.9 percent this year after climbing 15 percent in 2010.

Brent oil for February settlement increased 43 cents, or 0.4 percent, to $108.14 a barrel on the London-based ICE Futures Europe exchange.

U.S. crude oil stockpiles fell 10.6 million barrels last week, the largest decrease since February 2001, yesterday’s Energy Department report showed.

New York oil will average a record $100 a barrel next year as the U.S. averts recession, while Brent will decline from the 2011 mean, according to a Bloomberg News survey of analysts.

The $100 forecast for West Texas Intermediate oil, the U.S. benchmark, is based on the median of 27 analyst estimates compiled by Bloomberg, topping the all-time high of $99.75 set in 2008. WTI is on course to average $95 a barrel this year. Brent will average $109 next year, compared with $110.98 so far this year, a survey of 28 analysts showed.

Oil is up 25 percent this quarter, the biggest gain since the second quarter of 2009, as the European Union and the U.S. seek support from the Middle East and Asia for sanctions against Iran, the second-biggest producer in the Organization of Petroleum Exporting Countries.

EU nations, the U.S. and Asia-Pacific allies discussed possible measures in Rome on Dec. 20 and vowed to increase pressure on Iran to abandon a suspected nuclear weapons program, according to an Italian Foreign Ministry statement.

China to grow by 7% in 2012

US to grow between 0% and 1% in 2012

Expect Euro zone recession in 2012

Resistance 3:1267 (high of December)

Resistance 2:1254 (Dec 12 high)

Resistance 1:1248 (Dec 20 high, session high)

Current price: 1245,50

Support 1 : 1239 (intraday low, support line from Dec 19)

Support 2 : 1232 (session low)

Support 3 : 1224 (Dec 16 high, Dec 21 low)

EUR/USD $1.3000(large), $1.3050, $1.3060, $1.3100, $1.2900, $1.2825

USD/JPY Y77.75, Y78.00, Y78.25, Y78.75AUD/USD $1.0125, $1.0000(very large), $0.9950, $0.9900

EUR/CHF Chf1.2140

EUR/GBP stg0.8300

GBP/USD $1.5710, $1.5585, $1.5510, $1.5400, $1.5380, $1.5850

EUR/JPY Y100.00

USD/CHF Chf0.9300, Chf0.9400

Stocks pared an earlier advance as revised Commerce Department figures showed gross domestic product climbed at a 1.8% annual rate from July through September, down from the 2% estimated last month.

The number of applications for unemployment benefits dropped last week to the lowest since April 2008, a sign that the U.S. labor market is strengthening heading into 2012. Jobless claims fell by 4,000 to 364,000 in the week ended Dec. 17, Labor Department figures showed. The median forecast of economists was 380,000.

Nikkei 8,395 -64.82 -0.77%

Hang Seng 18,378 -38.22 -0.21%

Shanghai Composite 2,186 -4.85 -0.22%

FTSE 5,439 +49.20 +0.91%

CAC 3,068 +37.69 +1.24%

DAX 5,837 +45.44 +0.78%

Crude oil: $98.84 (+0,2%).

Gold: $1609,10 (-0,3%).

EUR/USD

Offers $1.3200, $1.3145/50, $1.3130/35, $1.3100/05

Bids $1.3020, $1.3000/990, $1.2980, $1.2960/45

GBP/USD

Offers $1.5795/800, $1.5775/80, $1.5745/50

Bids $1.5648, $1.5620, $1.5600

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 highs)

Resistance 1: Y78.15 (Dec 14-15 and 19 highs)

Current price: Y78.07

Support 1:Y77.60 (Dec 13 and 16 lows)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

Resistance 3: Chf0.9545 (Dec 15 high)

Resistance 2: Chf0.9430 (61,8 % FIBO Chf0,9545-Chf0,9242)

Resistance 1: Chf0.9390/00 (area of Dec 19 and 21 highs and 50,0 % FIBO Chf0,9545-Chf0,9242)

Current price: Chf0.9355

Support 1: Chf0.9300 (area of session low)

Support 1: Chf0.9240 (Dec 21 low)

Support 2: Chf0.9180 (area of Dec 8-9 low)

Resistance 3 : $1.5890 (Nov 18 high)

Resistance 2 : $1.5770/80 (area of Nov 30, Dec 8 and 21 highs)

Resistance 1 : $1.5730 (session high)

Current price: $1.5690

Support 1 : $1.5650 (area of session low and Dec 21 low)

Support 2 : $1.5620 (low of american session on Dec 20)

Support 3 : $1.5560 (Dec 16 high, МА (200) for Н1)

Resistance 3: $ 1.3200 (area of Dec 21 high)

Resistance 2: $ 1.3120/30 (session high, resistance line from Oct 27)

Resistance 1: $ 1.3070 (intraday high)

Current price: $1.3067

Support 1 : $1.3020 (Dec 21 low)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2945 (Dec 14 low)

EUR/USD $1.3000(large), $1.3050, $1.3060, $1.3100, $1.2900, $1.2825

USD/JPY Y77.75, Y78.00, Y78.25, Y78.75AUD/USD $1.0125, $1.0000(very large), $0.9950, $0.9900

EUR/CHF Chf1.2140

EUR/GBP stg0.8300

GBP/USD $1.5710, $1.5585, $1.5510, $1.5400, $1.5380, $1.5850

EUR/JPY Y100.00

USD/CHF Chf0.9300, Chf0.9400

Nikkei 225 8,395 -64.82 -0.77%

Hang Seng 18,354 -62.25 -0.34%

S&P/ASX 200 4,091 -48.69 -1.18%

Shanghai Composite 2,185 -6.38 -0.29%

The dollar traded 0.8 percent from an 11-month high versus the euro before European Central Bank President Mario Draghi speaks today amid concern policy makers are struggling to contain the euro region’s debt crisis.

Euro held yesterday’s decline as France and Italy prepare to sell debt next week amid speculation Standard & Poor’s will cut the credit ratings of European countries. France will auction bills on Dec. 27, while Italy will offer debt maturing in 2014, 2018, 2021 and 2022 on Dec. 29. S&P said this month it may cut the credit grades of 15 euro nations, including Germany and France, the region’s biggest economies.

New Zealand’s dollar fell after the data. New Zealand’s economy grew faster than analysts estimated last quarter on Rugby World Cup spending, a boost the central bank may look past as it awaits more lasting recovery signs before raising record-low interest rates. Gross domestic product rose 0.8 percent in the three months ended Sept. 30 from the previous quarter, when it increased 0.1 percent, Statistics New Zealand said in a report released today in Wellington. Growth was faster than the 0.6 percent median projection in a Bloomberg News survey of 14 economists.

Australia’s dollar weakened against most its major counterparts as Asian stocks retreated, sapping demand for higher-yielding currencies.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair holds in range Y78.00-Y78.15.

On Thursday UK data sees the third release of Q3 GDP data at 0930GMT along with Q3 Balance of Payments data where the Current Account Balance is expected at -stg6.3 billion. There is no major core-European data due on Thursday but at 1600GMT, the ESRB is due to hold a press conference, including Mario Draghi and Mervyn King as well as Andrea Enria.

US data starts at 1130GMT when initial jobless claims are expected to rise 14,000 to 380,000 in the December 17 employment survey week. US data at 1500GMT includes leading indicators, the FHFA Home Price Index and also BLS mass layoffs. This is followed at 1530GMT by the weekly EIA Natural Gas Stocks data. Later US data sees the 2000GMT release of Treasury Allotments by Class and the 2130GMT release of M2 money supply data.

The euro fell against most of its major peers amid concern that European Central Bank measures to support its banking sector won’t be enough to arrest region’s worsening sovereign-debt crisis.

The 17-nation currency erased an earlier advance as the ECB said it had awarded 489 billion euros ($637 billion) in 1,134- day loans to banks, more than the 293 billion euros forecast by economists, as investors bet the euro-region debt crisis is far from done. The euro-area economy will probably fail to grow next year after expanding 1.6 percent in 2011, while the U.S. is forecast to accelerate to 2.1 percent from 1.8 percent, according to Bloomberg surveys of economists.

The franc weakened 0.3 percent to 1.2222 per euro and 0.5 percent to 93.64 centimes per dollar.

Yields on Italian two-year notes rose as much as 27 basis points, or 0.27 percentage point, to 5.25 percent, snapping four-straight days of declining borrowing costs, while Spanish debt yields with the same maturity increased 27 basis points to 3.5 percent, after falling for eight days.

EUR/USD: yesterday the pair has grown on a figure, however fell later.

GBP/USD: yesterday the pair has grown, but have lost the won positions later.

USD/JPY: yesterday the pair advanced.

On Thursday UK data sees the third release of Q3 GDP data at 0930GMT along with Q3 Balance of Payments data where the Current Account Balance is expected at -stg6.3 billion. There is no major core-European data due on Thursday but at 1600GMT, the ESRB is due to hold a press conference, including Mario Draghi and Mervyn King as well as Andrea Enria.

US data starts at 1130GMT when initial jobless claims are expected to rise 14,000 to 380,000 in the December 17 employment survey week. US data at 1500GMT includes leading indicators, the FHFA Home Price Index and also BLS mass layoffs. This is followed at 1530GMT by the weekly EIA Natural Gas Stocks data. Later US data sees the 2000GMT release of Treasury Allotments by Class and the 2130GMT release of M2 money supply data.

Asian stocks rose for a second day, with a benchmark index set for the biggest gain in almost three weeks, as China pledged support for exporters and small businesses and after improved U.S. and German economic data.

Japan’s Nikkei 225 Stock Average (NKY) increased 1.5 percent, while South Korea’s Kospi Index jumped 3.1 percent. Australia’s S&P/ASX 200 rose 2.1 percent. Hong Kong’s Hang Seng Index gained 1.9 percent.

The Hang Seng China Enterprises Index added 2.2 percent after Premier Wen Jiabao pledged to provide capital support for small and medium-sized companies affected by the nation’s slowing economic growth. The Shanghai Composite Index slipped 1.1 percent, erasing gains of as much as 1 percent.

Shares of Asian exporters advanced. Honda Motor Co., the Japanese carmaker that gets about 44 percent of its sales from North America, advanced 2.4 percent in Tokyo on speculation shipments will rise amid signs the U.S. economy is improving. Samsung Electronics Co., South Korea’s biggest exporter of devices such as mobile phones and semiconductors, climbed 4.5 percent to 1.057 million won in Seoul. James Hardie Industries SE (JHX), a maker of building materials that counts the U.S. as its biggest market, added 1.8 percent to A$6.66.

Stocks also gained as concern about Europe’s debt crisis eased after Spain sold 5.64 billion euros ($7.38 billion) of bills, more than the maximum target, and German business confidence unexpectedly grew.

Shipping stocks advanced on speculation a new alliance formed by Mitsui O.S.K. Lines Ltd., Hyundai Merchant Marine Co., Neptune Orient Lines Ltd. and three other lines on the Asia- Europe trade route will help stem a decline in rates.

Mitsui O.S.K., Japan’s second-biggest freight carrier by sales, increased 1.8 percent to 288 yen in Tokyo. Hyundai Merchant Marine, South Korea’s No. 2, jumped 4.5 percent to 25,400 won in Seoul. Neptune Orient Lines Ltd, Southeast Asia’s largest container carrier, gained 3.6 percent to S$1.15.

OneSteel, which tumbled 75 percent this year through yesterday, increased 7.1 percent to 68 Australian cents. Goldman Sachs recommended investors “buy” the stock, saying the company may benefit from a potential loosening of monetary policy in China.

Raw-material producers and energy companies advanced today after commodity prices rallied on the improving outlook for the U.S. and Europe and after Wen’s pledge of support for Chinese producers. China is the world’s biggest consumer of copper.

BHP Billiton Ltd. (BHP), which counts China’s as its No. 1 market, climbed 3 percent to A$35.13. Jiangxi Copper Co., China’s biggest producer of the metal, rose 1.9 percent to HK$16.84 in Hong Kong.

European stocks fell for the first time in three days as lenders sought more funds from the European Central Bank than economists had predicted, reducing optimism that the debt crisis will be contained.

The Frankfurt-based ECB awarded 489 billion euros ($640 billion) in 1,134-day loans, more than economists’ median estimate of 293 billion euros in a Bloomberg News survey. The ECB said 523 banks asked for the funds, which it will lend at the average of its benchmark rate over the term of the loans. They start tomorrow.

The banks borrowed enough cash to refinance almost two- thirds of the debt they have maturing next year amid concern that markets will remain frozen.

German Chancellor Angela Merkel’s government reduced its planned bond sales next year to 250 billion euros, compared with 270 billion euros proposed in the budget and 283 billion euros that it sold this year. The federal government will sell 170 billion euros in bonds and 80 billion euros in shorter maturities, the Frankfurt-based Federal Finance Agency said as it presented the provisional bond calendar for 2012 today.

The head of the world’s biggest bond fund said he sees a more than one-in-three chance that the euro area will break apart and trigger a financial crisis akin to the one that devastated the global economy in 2008.

National benchmark indexes fell in 14 of the 18 western European markets. The U.K.’s FTSE 100 (UKX) slid 0.6 percent, while France’s CAC 40 retreated 0.8 percent and Germany’s DAX declined 1 percent.

SAP lost 6.1 percent to 39.92 euros, the largest decline since October 2009, and competitor Software AG fell 4.9 percent to 27.25 euros. Cap Gemini SA, a computer-services company, retreated 4.9 percent to 24.09 euros.

Oracle, the second-largest business-software maker, posted earnings before some costs in the quarter ended Nov. 30 of 54 cents a share, on revenue excluding certain items of $8.81 billion. Analysts had projected profit of 57 cents and sales of $9.23 billion, according to estimates compiled by Bloomberg.

UniCredit, Italy’s biggest bank, dropped 4.4 percent to 70.8 euro cents and France’s Societe Generale SA slid 3.4 percent to 16.63 euros. A gauge of banks in the Stoxx 600 slipped 0.7 percent.

Konecranes, the Finnish maker of container cranes, retreated 3.6 percent to 13.92 euros after saying it’s restructuring European operations and must cut 100 jobs.

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher for a second day, as gains in energy and consumer shares helped the market recover from an early drop after lower-than-estimated results at Oracle Corp.

The S&P 500 is down about 1.1 percent this year after tumbling 19 percent from this year’s high in April through Oct. 3 amid concern Europe’s debt crisis would derail global economic growth. Since then, it has rebounded 13 percent on better-than- estimated American economic data and steps taken by European leaders to tame the crisis.

U.S. equities followed European shares lower earlier as banks sought more funds from the European Central Bank than economists predicted. Banks borrowed enough cash from the ECB at its first three-year offering to refinance almost two-thirds of the debt they have maturing next year on concern that markets will remain frozen.

Spanish two-year government notes fell for the first time in nine days amid fading optimism that the ECB’s three-year loans to euro-area banks will restore confidence in sovereign borrowers. The ECB awarded 489 billion euros ($645 billion) in 1,134-day loans, the most ever in a single operation and more than economists’ median estimate of 293 billion euros in a Bloomberg News survey.

In the U.S., the number of existing homes sold was revised lower by an average 14 percent since 2007, the National Association of Realtors reported today, magnifying the depth of the slump that contributed to the last recession

Oracle plunged 12 percent to $25.10. Business-software companies are taking longer to close deals as companies gird for slow economic growth in the U.S. and the possibility of a recession in Europe next year, said Rick Sherlund, an analyst at Nomura Holdings Inc.

Walgreen Co., the largest U.S. drugstore chain, slumped 0.4 percent as profit trailed estimates. A dispute between the company and Express Scripts Inc., an employee-benefits manager, led to a loss of customers, hurting pharmacy demand. CVS Caremark Corp. and Rite Aid Corp. are trying to grab customers amid the standoff over the contract.

Research In Motion Ltd. surged 10 percent to $13.72 after reports Microsoft Corp. and Nokia Oyj mulled a bid while Amazon.com Inc. also considered buying the BlackBerry maker.

RIM "turned down takeover overtures" from Amazon because it wanted to fix shortcomings independently, Reuters reported yesterday. A Wall Street Journal article said Microsoft and Nokia "flirted with the idea of making a joint bid" in recent months. Both publications cited unidentified people familiar with the respective matters.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high)

The current price: Y78.05

Support 1:Y77.85 (MA (233) H1)

Support 2:Y77.70 (area of Dec 20-21 low)

Support 3:Y77.50 (Dec 9 low)

Comments: the pair is consolidated in range Y77.70-Y78.15. In focus resistance Y78.15.

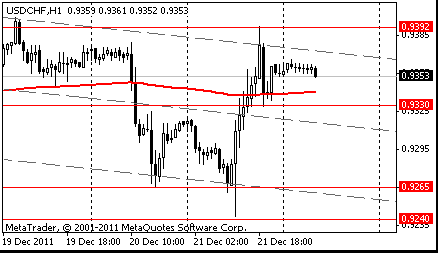

Resistance 3: Chf0.9545 (Dec 15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9390 (Dec 21 high)

The current price: Chf0.9353

Support 1: Chf0.9330 (low of the American session on Dec 21)

Support 2: Chf0.9265 (Dec 20 low)

Support 3: Chf0.9240 (Dec 21 low)

Comments: the pair is on downtrend. In focus support Chf0.9330.

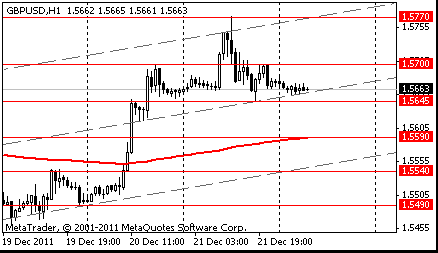

Resistance 3 : $1.5885 (Nov 18 high)

Resistance 2 : $1.5770 (Dec 21 high)

Resistance 1 : $1.5700 (high of the American session on Dec 21)

The current price: $1.5663

Support 1 : $1.5645 (Dec 21 low)

Support 2 : $1.5590 (MA (233) H1)

Support 3 : $1.5540 (support line from Dec 14)

Comments: the pair is on uptrend. In focus resistance $1.5700.

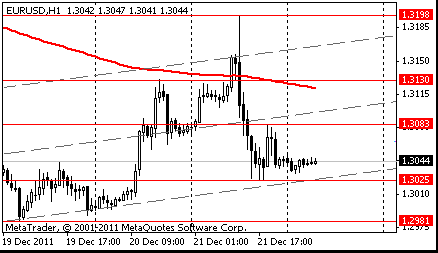

Resistance 3: $1.3200 (Dec 21 high)

Resistance 2: $1.3130 (MA (233) H1)

Resistance 1: $1.3085 (high of the American session on Dec 21)

The current price: $1.3044

Support 1 : $1.3025 (Dec 21 low)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2944 (Jan 14 low)

Comments: the pair is on uptrend. In focus resistance $1.3085.

Change % Change Last

Nikkei 225 8,460 +123.50 +1.48%

Hang Seng 18,416 +336.25 +1.86%

S&P/ASX 200 4,140 +86.42 +2.13%

Shanghai Composite 2,191 -24.78 -1.12%

FTSE 100 5,381 -38.98 -0.72%

CAC 40 3,028 -27.70 -0.91%

DAX 5,782 -65.04 -1.11%

Dow 12,107.74 +4.16 +0.03%

Nasdaq 2,577.97 -25.76 -0.99%

S&P 500 1,243.71 +2.41 +0.19%

10 Year Yield 1.97% +0.04 --

Oil $98.87 +0.20 +0.20%

Gold $1,615.30 +1.70 +0.11%

05:00 Japan BoJ monthly economic report December

09:30 United Kingdom Current account, bln Quarter III -2.0 -5.2

09:30 United Kingdom GDP final Quarter III +0.5% +0.5%

09:30 United Kingdom GDP final, y/y Quarter III +0.5% +0.5%

13:30 U.S. Initial Jobless Claims 17.12.2011 366 376

13:30 U.S. GDP, final, y/y Quarter III +2.0% +2.0%

13:30 U.S. PCE price index, q/q Quarter III +2.3% +2.3%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +2.0% +2.0%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index (Final) December 67.7 68.1

15:00 U.S. Leading Indicators November 0.9% 0.2%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.