- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-12-2011

The euro rose earlier after Luxembourg’s Jean- Claude Juncker said Europe should meet a deadline for arranging loans with the International Monetary Fund as part of a crisis- fighting package.

Currently:

Dow 11,859.16 -9.65 -0.08%

Nasdaq 2,555.17 +14.16 +0.56%

S&P 1,218.99 +3.24 +0.27%

U.S. stocks pared gains as optimism over the debt crisis fizzled after Fitch Ratings said it may downgrade ratings of European nations.

France, Belgium, Spain, Slovenia, Italy, Ireland and Cyprus had their debt ratings placed on rating watch negative by Fitch Ratings, indicating they face a heightened probability of downgrade in the near-term. Fitch said a “comprehensive solution” to the euro zone crisis is “technically and politically beyond reach.”

Gains in stocks were propelled earlier by optimism the European Union will meet a Dec. 19 deadline for funding a crisis-fighting package. Luxembourg’s Jean-Claude Juncker, who leads a group of finance ministers from the region, said the EU should meet the goal for arranging loans to the International Monetary Fund. An hour after Juncker’s comments, the Bundesbank said it won’t rush to a decision on the loans, which are to be provided by EU national central banks.

Resistance 2:1233 (50.0 % FIBO 1267-1200)

Resistance 1:1225 (Dec 14 high, line of resistance from Dec 8, session high, 38.2 % FIBO 1267-1200)

Current price: 1221,75

Support 1 : 1216 (intraday low)

Support 2 : 1208 (Dec 15 intraday low)

Support 3 : 1200 (area of Dec 15 low)

USD/JPY Y78.00

AUD/USD $0.9900, $1.0000, $1.0050 $1.0100, $1.0150, $1.0175

EUR/CHF Chf1.2345

GBP/JPY Y122.00

GBP/USD $1.5500, $1.5400

Today is the expiration of futures and options contracts on indexes and individual stocks, an event known as quadruple witching, which occurs once every three months.

U.S. equities rose as Luxembourg’s Jean-Claude Juncker, who leads the group of euro-area finance ministers, said the European Union should meet an informal Dec. 19 deadline for arranging loans to the International Monetary Fund as part of a crisis-fighting package. EU leaders decided at a Dec. 9 summit to channel an additional 200 billion euros ($261 billion) in loans to the IMF to help fight the euro region’s debt crisis.

Nikkei 8,402 +24.35 +0.29%

Hang Seng 18,285 +258.55 +1.43%

Shanghai Composite 2,225 +43.95 +2.02%

FTSE 5,409 +8.01 +0.15%

CAC 2,983 -15.90 -0.53%

DAX 5,740 +9.15 +0.16%

Crude oil: $93.94 (+0,1%).

Gold: $1589,10 (+0,8%).

08:30 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom BOE Gov King Speaks

10:00 Eurozone Trade Balance s.a. October 2.1 1.3 0.3

The euro headed for the steepest weekly drop versus the greenback in three months as European nations prepare for bill auctions next week amid concern policy makers can’t contain the region’s debt crisis.

France is scheduled to sell as much as 7 billion euros ($9.1 billion) of bills on Dec. 19. Spain and Greece will also offer short-term government securities next week. Gains in the euro were also limited after European Central Bank President Mario Draghi said yesterday there’s no “external savior” for indebted countries that don’t implement structural reforms and the central bank’s program of buying government bonds isn’t limitless.

The Swiss franc fell against higher- yielding currencies as gains in equity markets damped demand for safer assets.

Switzerland’s currency depreciated against 11 of 16 major peers tracked by Bloomberg, falling the most against the New Zealand dollar and the South African rand. It retreated from the strongest level in six weeks against the European single currency, reached yesterday after Swiss National Bank policy makers led by Chairman Philipp Hildebrand kept the franc’s ceiling at 1.20 per euro at a meeting in Zurich.

EUR/USD: the pair holds in range $1.3000-$ 1.3045, but showed new session high later.

GBP/USD: the pair showed new session high at $1.5550.

USD/JPY: the pair holds in range Y77.80-Y77.95.

EUR/USD

Offers $1.3140/50, $1.3080, $1.3064, $1.3050

Bids $1.3000, $1.2985/80, $1.2970, $1.2960/45, $1.2910/00, $1.2875/60

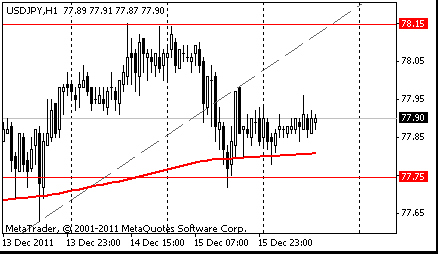

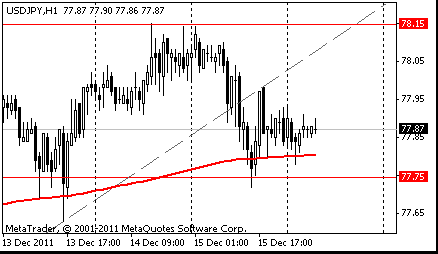

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high)

The current price: Y77.90

Support 1:Y77.75 (Dec 15 low)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

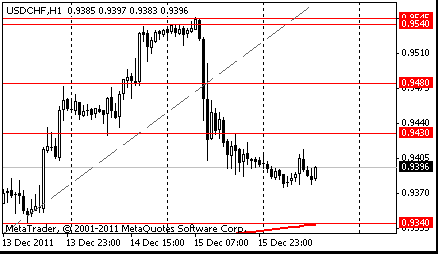

Resistance 3: Chf0.9540/45 (area of Dec 14-15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9430 (high of the American session on Dec 15)

The current price: Chf0.9386

Support 1: Chf0.9340 (Dec 13 high, MA (233) H1)

Support 2: Chf0.9290 (Dec 8 high)

Support 3: Chf0.9250 (Dec 12 low)

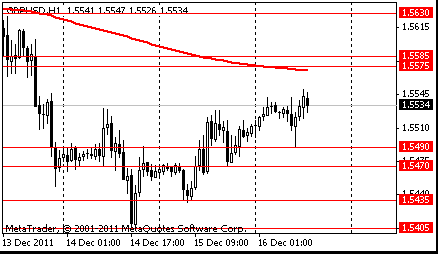

Resistance 3 : $1.5655 (Dec 12 high)

Resistance 2 : $1.5630 (61.8% FIBO $1.5405-$1.5765)

Resistance 1 : $1.5575/85 (MA (233) H1, 50.0% FIBO $1.5405-$1.5765)

The current price: $1.5534

Support 1 : $1.5490 (session low)

Support 2 : $1.5470 (low of the American session on Dec 15)

Support 3 : $1.5435 (Dec 15 low)

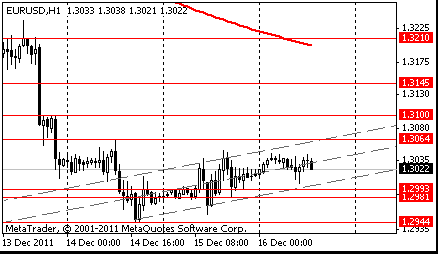

Resistance 3: $1.3145 (38.2% FIBO $1.2944-$1.3430)

Resistance 2: $1.3100 (psychological level)

Resistance 1: $1.3065 (Dec 14 high)

The current price: $1.3029

Support 1 : $1.2980 (low of the American session on Dec 15)

Support 2 : $1.2945 (Dec 14 low)

Support 3 : $1.2910 (Jan 11 low)

Italy’s Prime Minister Mario Monti will face a confidence vote in Parliament to speed passage of a 30 billion-euro ($39 billion) emergency budget plan aimed at spurring growth and cutting the euro-area’s second-biggest debt.

FTSE 100 5,442 +41.24 +0.76%

CAC 40 3,007 +8.07 +0.27%

Xetra DAX 5,757 +26.27 +0.46%

Petroleum Geo-Services ASA (PGS), the world’s third-biggest surveyor of oil and gas fields, rallied 5 percent to 57.40 kroner after it predicted earnings before interest, taxes, depreciation and amortization will rise to the range of $650 million to $700 million in 2012.

Credit Agricole SA (ACA), France’s second-largest bank by assets, gained 1.4 percent to 4.10 euros after it agreed to sell its private-equity unit to Coller Capital Ltd. for an undisclosed sum, to reduce risk-weighted assets by about 900 million euros.

Man Group Plc (EMG), the world’s largest hedge fund, fell 2 percent to 130.9 pence after Deutsche Bank AG cut the stock to “sell” from “buy.”

USD/JPY Y78.00

AUD/USD $0.9900, $1.0000, $1.0050 $1.0100, $1.0150, $1.0175

EUR/CHF Chf1.2345

GBP/JPY Y122.00

GBP/USD $1.5500, $1.5400

Nikkei 225 8,402 +24.35 +0.29%

Hang Seng 18,285 +258.55 +1.43%

S&P/ASX 200 4,159 +19.38 +0.47%

Shanghai Composite 2,225 +43.95 +2.02%

- FIRST FINE-TUNING OP DEC 20, SECOND FEB 28

- 1ST 3-YEAR LTRO SETTLES DEC 22, 2ND SETTLES MAR 1

The dollar and the yen declined against most of their major peers as evidence the U.S. economy is gaining momentum eased demand for havens. U.S. Labor Department figures yesterday showed initial jobless claims decreased by 19,000 to 366,000 last week, the fewest since May 2008. The median forecast of economists surveyed by Bloomberg News was 390,000.

The Australian dollar rebounded from two- week lows as Asian stocks extended gains in equities globally, boosting demand for higher-yielding assets.

The euro headed for the steepest weekly drop versus the greenback in three months as European nations prepare for bill auctions next week amid concern policy makers can’t contain the region’s debt crisis.

France is scheduled to sell as much as 7 billion euros ($9.1 billion) of bills on Dec. 19. Spain and Greece will also offer short-term government securities next week. Gains in the euro were also limited after European Central Bank President Mario Draghi said yesterday there’s no “external savior” for indebted countries that don’t implement structural reforms and the central bank’s program of buying government bonds isn’t limitless.

EUR/USD: on Asian session the pair rose.

GBP/USD: on Asian session the pair rose.

USD/JPY: on Asian session the pair holds in range Y77.80-Y77.90

On Friday at 0830GMT when ECB President Mario Draghi chairs a panel on monetary policy and payment systems, with Bank of England Governor Mervyn King and former Fed vice chairman Donald Kohn. At 0900GMT, ECB Governing Council member Ewald Nowotny gives a press conference on financial stability, in Vienna.EMU data at 1000GMT sees construction output and the trade balance for october as well as Q3 labour costs data.US data starts at 1330, when consumer prices are expected to hold steady in November after falling in October. At 1615GMT, Chicago Federal Reserve Bank President Charles Evans takes part on a panel at the EC2 Conference

on econometric tools for policy making after the crisis, in Florence, Italy, while at 1700GMT, the Dallas Fed President delivers a speech on

the economic outlook at the Austin Chamber of Commerce 2012 Economic Forecast Luncheon in Austin.

Yesterday the euro rose after Spain sold more than its maximum target at a debt auction, easing concern the region’s debt crisis is worsening. The euro pared losses versus the yen after a report showed European manufacturing and service industries contracted less this month than economists forecast.

The euro rallied earlier after the currency’s 14-day relative strength index against the dollar fell to 29 yesterday, below the 30-level that some traders see as a sign a currency may be poised to reverse direction.

Gains in the euro were capped as speculation European leaders aren’t doing enough to resolve the debt crisis damped demand for the region’s currency.

The Swiss franc strengthened against all its major counterparts after the central bank refrained from introducing new measures to weaken the currency at a policy meeting.

The franc gained the most in eight weeks against the euro after Switzerland’s central bank left its limit on the currency unchanged, resisting pressure from exporters to further curb its strength as officials take time to assess deflation risks.

The dollar dropped as U.S. economic data showed a quickening recovery and European funding stress eased, damping demand for the safety of the U.S. currency.

EUR/USD: yesterday the pair was restored.

GBP/USD: yesterday the pair gain on a floor of a figure.

USD/JPY: yesterday the pair fell.

On Friday at 0830GMT when ECB President Mario Draghi chairs a panel on monetary policy and payment systems, with Bank of England Governor Mervyn King and former Fed vice chairman Donald Kohn. At 0900GMT, ECB Governing Council member Ewald Nowotny gives a press conference on financial stability, in Vienna.EMU data at 1000GMT sees construction output and the trade balance for october as well as Q3 labour costs data.US data starts at 1330, when consumer prices are expected to hold steady in November after falling in October. At 1615GMT, Chicago Federal Reserve Bank President Charles Evans takes part on a panel at the EC2 Conference

on econometric tools for policy making after the crisis, in Florence, Italy, while at 1700GMT, the Dallas Fed President delivers a speech on

the economic outlook at the Austin Chamber of Commerce 2012 Economic Forecast Luncheon in Austin.

Asian stocks fell amid signs of slowing economic growth in China and Japan, and as rising financing costs stoked concern Europe is losing its fight to contain the debt crisis.

Chinese manufacturing may contract for a second month, according to a survey by HSBC and Markit Economics.

A gauge of machinery makers on the Topix Index sank 2.7 percent after the Bank of Japan’s Tankan survey showed sentiment among the nation’s largest manufacturers deteriorated more than economists expected.

Nissan Motor Co. declined 2.8%. Nintendo Co lost 2%.

BHP Billiton Ltd., the world’s biggest mining company, fell 1.8%.

European stocks advanced amid speculation that this year’s slump in equities isn’t commensurate with the outlook for corporate earnings and as economic data from the U.S. and the euro area topped estimates.

Spanish government bonds advanced after the nation sold 6 billion euros ($7.8 billion) of debt at an auction today, more than the maximum target of 3.5 billion euros.

A report showed Germany’s manufacturing industry contracted less than estimated. An index based on a survey of purchasing managers in the manufacturing industry rose to 48.1 this month from 47.9 in November, London-based Markit Economics said today. Economists had expected a drop to 47.5. Readings below 50 indicate a contraction. Germany’s services output unexpectedly rose, the report showed.

In France, the Purchasing & Services Managers’ Index rose to 48.7 in December from 47.3 in November. This topped the average economist estimate for a reading of 47.

Company news:

Insurance companies led the gains. Old Mutual Plc rallied 11% after saying it will sell its Nordic business for $3.3 billion.

Commerzbank AG rose 6.7%. Raiffeisen Bank International AG rallied 5.3%.

U.S. stocks rose as data on jobless claims and manufacturing signaling a strengthening economy overshadowed concern over Europe’s debt crisis.

Eight out of nine groups in the S&P increased, with utilities, health-care and consumer staples advancing at least 0.9%.

Stocks extended gains this morning after Labor Department figures showed initial jobless claims fell by 19,000 to 366,000 last week, the fewest since May 2008. The median of economists had projected 390,000.

Two reports showed manufacturing in the New York and Philadelphia regions expanded more than forecast in December. The Federal Reserve Bank of New York’s general economic index accelerated to the highest level in seven months, to 9.5 from 0.6 in November. Readings higher than zero signal expansion among companies in region, which covers New York, northern New Jersey and southern Connecticut.

The Federal Reserve Bank of Philadelphia’s general economic index increased to 10.3 in December from 3.6 last month, indicating expansion in the area covering eastern Pennsylvania, southern New Jersey and Delaware.

Equities pared early gains after IMF Managing Director Christine Lagarde said at an event in Washington today that Europe’s “crisis is not only unfolding, but escalating” and cannot be resolved by one group of countries.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high)

The current price: Y77.86

Support 1:Y77.75 (Dec 15 low)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

Comments: the pair is corrected remains in uptrend. In focus support Y77.75.

Resistance 3: Chf0.9540/45 (area of Dec 14-15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9430 (high of the American session on Dec 15)

The current price: Chf0.9386

Support 1: Chf0.9340 (Dec 13 high, MA (233) H1)

Support 2: Chf0.9290 (Dec 8 high)

Support 3: Chf0.9250 (Dec 12 low)

Comments: the pair decreases. In focus resistance Chf0.9430.

Resistance 3 : $1.5655 (Dec 12 high)

Resistance 2 : $1.5630 (61.8% FIBO $1.5405-$1.5765)

Resistance 1 : $1.5575/85 (MA (233) H1, 50.0% FIBO $1.5405-$1.5765)

The current price: $1.5524

Support 1 : $1.5500 (session low)

Support 2 : $1.5470 (low of the American session on Dec 15)

Support 3 : $1.5435 (Dec 15 low)

Comments: the pair is corrected remains in downtrend. In focus support $1.5500.

Resistance 3: $1.3145 (38.2% FIBO $1.2944-$1.3430)

Resistance 2: $1.3100 (psychological level)

Resistance 1: $1.3065 (Dec 14 high)

The current price: $1.3025

Support 1 : $1.2980 (low of the American session on Dec 15)

Support 2 : $1.2945 (Dec 14 low)

Support 3 : $1.2910 (Jan 11 low)

Comments: the pair is corrected remains in downtrend. In focus resistance $1.3064.

Change % Change Last

Nikkei 8,377 -141.76 -1.66%

Hang Seng 18,027 -327.59 -1.78%

S&P/ASX 4,140 -50.65 -1.21%

Shanghai Composite 2,181 -47.63 -2.14%

FTSE 5,401 +34.05 +0.63%

CAC 2,999 +22.56 +0.76%

DAX 5,731 +55.48 +0.98%

Dow 11,868.81 +45.33 +0.38%

Nasdaq 2,541.01 +1.70 +0.07%

S&P 500 1,215.76 +3.94 +0.33%

10 Year Yield 1.91% +0.01

Oil $93.65 -0.22 -0.23%

Gold $1,569.70 -7.50 -0.48%

00:01 United Kingdom Nationwide Consumer Confidence November 36 34

08:30 Eurozone ECB President Mario Draghi Speaks 0

08:30 United Kingdom BOE Gov King Speaks 0

10:00 Eurozone Trade Balance s.a. October 2.1 1.3

13:30 U.S. CPI, m/m November -0.1% 0.1%

13:30 U.S. CPI, Y/Y November 3.5% 3.5%

13:30 U.S. CPI excluding food and energy, m/m November 0.1% 0.1%

13:30 U.S. CPI excluding food and energy, Y/Y November 2.1% 2.1%

16:15 U.S. FOMC Member Charles Evans Speaks 0

17:00 U.S. FOMC Member Richard Fisher Speaks 0

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.