- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 13-12-2011

No change in rates (FF again targeted 0%-1/4%) with mid-'13 assurance, no mention of IOER or communications. FOMC reiterates will continue to assess in light of incoming info, employ tools incl adjust securities holdings. Says econ expanded 'moderately' since Nov. meeting notwithstanding global slowdown. Data 'point to some improvement in overall labor mkt' but repeats unemp rate elevated. Biz invst increasing less rapidly. Infl will 'settle' to meet mandate. Infl expectatns stable. No explicit mention of EZ. Vote was 9-1, with Chicago Fed's Evans dissenting again, wants more easing.

The euro dropped after Chancellor Angela Merkel told German coalition lawmakers that the 500 billion euro cap on Europe’s planned permanent bailout fund will stay in place.

The dollar declined against the yen before the Federal Reserve holds a meeting today amid speculation officials will maintain their pledge to keep borrowing costs at almost zero.

The European Financial Stability Facility sold 1.97 billion euros of 91-day bills at an average yield of 0.222 percent, the Bundesbank said today. The sale was its first fund-raising since European leaders agree on a closer fiscal accord and additional resources to combat the region’s debt crisis at a summit in Brussels last week.

Currently:

Dow 12,089.81 +68.42 +0.57%Nasdaq2,617.03 +4.77 +0.18%

S&P 1,242.38 +5.91 +0.48%

Stocks rose after open even after U.S. retail sales increased in November at the slowest pace in five months.

Then stocks pared gains after a report that German Chancellor Angela Merkel is rejecting an increase in the upper limit of funding for Europe’s permanent bailout mechanism.

American equities joined a global selloff yesterday as Moody’s Investors Service and Fitch Ratings said last week’s summit did little to ease pressure on Europe’s struggling governments and Intel Corp. (INTC) cut its revenue forecast.

FTSE 5,490 +62.29 +1.15%

CAC 3,079 -10.87 -0.35%

DAX 5,774 -11.17 -0.19%

Currently gold is at $1662,50 per once.

Markets are expected to remain volatile ahead of the FOMC rate decision expected later in the day, with expectations the Fed could have left rates unchanged near its zero range in order to support growth further especially when unemployment fell to 8.6% and personal spending improved, while the economy started to recover in a faster pace.

Resistance 2:1254 (Dec 12 high)

Resistance 1:1244 (session high)

Current price: 1231,75

Support 1 : 1221 (Dec 9-12 low, 38,2 % 1147-1267)

Support 2 : 1208 (50,0 % 1147-1267)

Support 3 : 1193 (61,8 % 1147-1267)

Euro flushing the reported stops below the figure as confidence in the eurozone wanes and as risk-appetites are pared with US stocks giving back earlier gains. Bids seen around $1.3050.

Offers $1.5775/80, $1.5730/35, $1.5700/10, $1.5610/15

Bids $1.5540/35, $1.5530/25, $1.5470/65

USD/JPY Y77.30, Y77.20, Y77.10, Y76.85

AUD/USD $1.0050, $1.0115, $1.0135, $1.0230, $1.0250, $1.0295, $1.0300

EUR/GBP stg0.8580

GBP/USD $1.5750, $1.5500

EUR/JPY Y104.50

EUR/CHF Chf1.2300

U.S. stock futures rose before the Federal Reserve meeting statement and as European equities rallied after Spain sold more debt than planned at an auction.

Stock-futures rose even after a report showed that retail sales rose in November at the slowest pace in five months. The Federal Reserve will probably revise its pledge to keep interest rates close to zero through mid-2013 as the need for large scale asset purchases diminishes, according to economists in a Bloomberg News survey.

Crude oil: $98.62 (+0.9%).

Data:

06:30 France CPI (November) unadjusted 0.3%

06:30 France CPI (November) unadjusted Y/Y 2.5%

06:30 France HICP (November) Y/Y 2.7%

09:30 UK HICP (November) 0.2%

09:30 UK HICP (November) Y/Y 4.8%

09:30 UK HICP ex EFAT (November) Y/Y 3.2%

09:30 UK Retail prices (November) 0.2%

09:30 UK Retail prices (November) Y/Y 5.2%

09:30 UK RPI-X (November) Y/Y 5.3%

10:00 Germany ZEW economic expectations index (December) -53.8

The dollar declined against the yen before the Federal Reserve holds a policy meeting today amid speculation officials will maintain their pledge to keep borrowing costs at almost a record low.

The euro climbed against the greenback after the European bailout fund held its first auction of bills, attracting bids for more than three times the amount of securities that it sold.

The common currency erased earlier losses versus the yen after a German report showed investor confidence unexpectedly increased for the first time in 10 months.

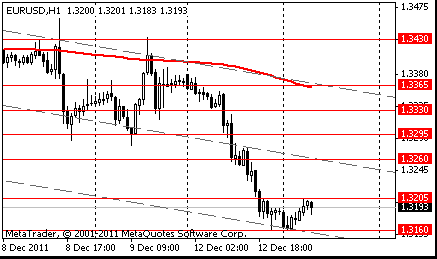

EUR/USD: the pair shown high in $1,3240 area but later returned back to $1.3200 area.

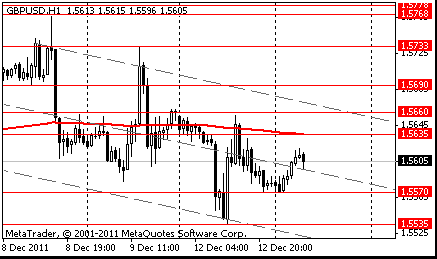

GBP/USD: the pair holds in $1.5560-$ 1.5630.

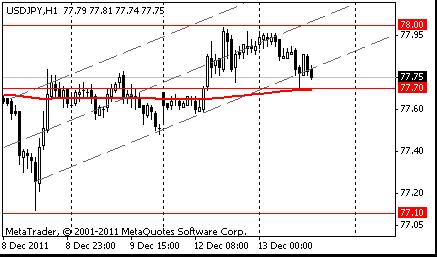

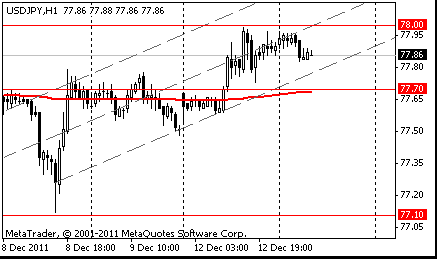

USD/JPY: the pair holds in Y77.70-Y78.00.

EUR/USD

Offers $1.3360/65, $1.3330/35, $1.3300/05, $1.3280, $1.3250

Bids $1.3150/60, $1.3100/10

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.00 (Dec 12 high)

The current price: Y77.79

Support 1:Y77.70 (MA (233) H1)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Resistance 3: Chf0.9490 (Feb 21 high)

Resistance 2: Chf0.9440 (Feb 2 high)

Resistance 1: Chf0.9385/90 (area of session high)

The current price: Chf0.9350

Support 1: Chf0.9340 (23.6% FIBO Chf0.9390-Chf0.9180)

Support 2: Chf0.9310 (38.2% FIBO Chf0.9390-Chf0.9180)

Support 3: Chf0.9285 (50.0% FIBO Chf0.9390-Chf0.9180)

Resistance 3 : $1.5690 (61.8% FIBO $1.5535-$1.5780)

Resistance 2 : $1.5660 (Dec 12 high)

Resistance 1 : $1.5630 (session high, MA(233) H1)

The current price: $1.5603

Support 1 : $1.5565 (session low)

Support 2 : $1.5535 (Dec 12 low)

Support 3 : $1.5495 (low of the European session on Nov 29)

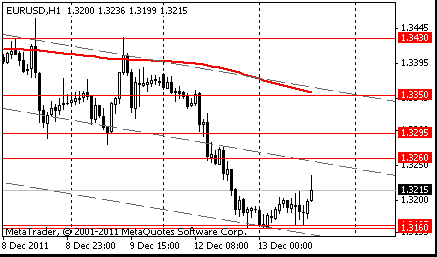

Resistance 3: $1.3350 (MA (233) H1)

Resistance 2: $1.3295 (50.0% FIBO $1.3160-$1.3430)

Resistance 1: $1.3260 (38.2% FIBO $1.3160-$1.3430)

The current price: $1.3215

Support 1 : $1.3160 (session low)

Support 2 : $1.3125 (Jan 5 low)

Support 3 : $1.3085 (Jan 13 low)

European stocks climbed as a report showed that investor confidence in Germany improved last month and Spain sold more 12 and 18-month notes than it had planned at a debt auction.

FTSE 100 5,455 +27.55 +0.51%

CAC 40 3,097 +7.57 +0.25%

Xetra DAX 5,830 +44.88 +0.78%

European banking shares lost 0.5 percent as a group after the industry was downgraded to “neutral” from “bullish” at Nomura Holdings Inc. BNP Paribas SA, France’s largest lender (BNP), lost 2.4 percent to 30.13 euros. Societe Generale SA, the country’s second-biggest (GLE), dropped 3.5 percent to 17.96 euros.

Commerzbank AG (CBK) dropped 4.3 percent to 1.17 euros after Germany’s Finance Ministry denied a Reuters report that it’s in talks with Commerzbank to offer state assistance, saying that communication between the government and the bank doesn’t go beyond “exchange of information.”

- Productivity Slowdown Due To Tight Credit

- No Reason To Think Impact Of QE Will Decline

E3.44 Bn 12-Month T-bills at 4.050%, covered 3.1 times.

E1.50 Bn 18-month T-bills at 4.226%, covered 5.0 times.

USD/JPY Y77.30, Y77.20, Y77.10, Y76.85

AUD/USD $1.0050, $1.0115, $1.0135, $1.0230, $1.0250, $1.0295, $1.0300

EUR/GBP stg0.8580

GBP/USD $1.5750, $1.5500

EUR/JPY Y104.50

EUR/CHF Chf1.2300

Nikkei 225 8,553 -101.01 -1.17%

Hang Seng 18,431 -145.13 -0.78%

S&P/ASX 200 4,193 -59.45 -1.40%

Shanghai Composite 2,249 -42.95 -1.87%

00:01 United Kingdom RICS House Price Balance November -24% -25% -17%

00:30 Australia National Australia Bank's Business Confidence November 2 2

00:30 Australia Housing starts Quarter III -4.7% -0.7% -6.8%

The Australian dollar climbed from two-week lows before a report forecast to show retail sales in the U.S. rose in November, adding to signs the world’s largest economy remains resilient. Retail sales in the U.S. probably increased 0.6 percent last month after a 0.5 percent gain in October, a Bloomberg survey of economists showed before the Commerce Department releases the data today.

The dollar reached a two-month high against the euro before three European nations and the region’s bailout fund sell bills amid speculation Standard & Poor’s may cut sovereign credit ratings in the common currency area.

Fitch Ratings and Moody’s Investors Service said yesterday that a European Union summit last week offered little help in ending the region’s debt crisis. The yen touched a two-week high against the euro before a German report today that may show investor confidence in Europe’s largest economy slid to a three- year low.

The pound gain after an index of U.K. house prices climbed in November from a four-month low because of an increase in demand, the Royal Institution of Chartered Surveyors said.

The gauge by London-based RICS rose to minus 17 percentage points from minus 24 points in October, the group said in an e- mailed report today.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair dropped.

USD/JPY: on Asian session the pair holds in range Y77.60-Y77.70.

European data for Tuesday starts at 0630GMT with France HICP data. The IEA monthly oil market report is due at 0900GMT, while at the

same time, the Bank of England's Spencer Dale speaks at an event at Bloomberg. The main core-European release for Tuesday is the german ZEW data at 1000GMT. UK inflation data at 0930GMT is expected to see CPI come in at 0.2% m/m, 4.8% y/y with core-CPI at 3.3% y/y.US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data, while at 1330GMT, US retail sales are expected to rise 0.5% in November after rising sharply in September and October. At 1730GMT, the FOMC monetary policy announcement is due. The

FOMC's final meeting of 2011 comes amid great uncertainty about the European debt crisis, America's own fiscal mess and the Chinese economy, among other things.

The euro fell to the lowest level in two months versus the dollar as Moody’s Investors Service said it will review the ratings of European Union nations after last week’s summit failed to produce decisive steps to end the debt crisis. Italian bonds slid as the nation sold 7 billion euros ($9.3 billion) of one-year bills to yield 5.95 percent, compared with an average 2.70 percent in the past five years. The securities fell even after the European Central Bank was said to have bought the nation’s debt. Italy has to repay about 53 billion euros in the first quarter, about a third of the region’s maturing bonds. The euro fell 1.5 percent to $1.3235 at 11:55 a.m. in New York, the lowest level since Oct. 4.

The dollar and yen strengthened against a majority of their most-traded counterparts as investors sought safer assets on concern crisis-fighting efforts are failing to stop European borrowing costs from rising.

EUR/USD: yesterday the pair fallen on two figures.

GBP/USD: yesterday the pair decreased.

USD/JPY: yesterday the pair grown.

European data for Tuesday starts at 0630GMT with France HICP data. The IEA monthly oil market report is due at 0900GMT, while at the

same time, the Bank of England's Spencer Dale speaks at an event at Bloomberg. The main core-European release for Tuesday is the german ZEW data at 1000GMT. UK inflation data at 0930GMT is expected to see CPI come in at 0.2% m/m, 4.8% y/y with core-CPI at 3.3% y/y.US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data, while at 1330GMT, US retail sales are expected to rise 0.5% in November after rising sharply in September and October. At 1730GMT, the FOMC monetary policy announcement is due. The

FOMC's final meeting of 2011 comes amid great uncertainty about the European debt crisis, America's own fiscal mess and the Chinese economy, among other things.

Asian stocks pared gains as Moody’s Investors Service reiterated it plans to review the credit ratings of European nations even after an agreement to tighten fiscal controls in the region and boost a bailout fund.

Europe’s leaders outlined a “fiscal compact” to prevent future debt run-ups and accelerated the start of a planned 500 billion-euro rescue fund.

Japan’s Nikkei 225 Stock Average increased led by Olympus Corp., the endoscope maker at the center of an accounting scandal. The company’s shares jumped 7.8% after saying it will meet a Dec. 14 deadline to submit its accounts to avoid delisting.

Shares of exporters gained as confidence improved among consumers in the U.S., the world’s biggest economy. The Thomson Reuters/University of Michigan preliminary index of consumer sentiment rose to a six-month high of 67.7 in December from 64.1 in November, beating estimates. Canon Inc. rose 1.6%. Sony Corp. added 1.3%. Samsung Electronics climbed 2.9%.

European stocks fell as Moody’s Investors Service said it will review the credit ratings of all countries in the region following last week’s debt summit.

Moody’s said it will review the ratings of all EU countries in the first quarter, saying the summit failed to deliver “decisive policy measures” to end the debt crisis. The review will be completed in the first quarter of next year.

National benchmark indexes retreated in all 18 western European markets.

Axa dropped 6.5%. Allianz SE declined 6.5%. Assicurazioni Generali SpA lost 3.9%. S&P placed all three insurers on watch negative after the ratings company started reviewing the credit scores of 15 euro- area governments on Dec. 5.

Xstrata dropped 5.6%, Kazakhmys Plc slid 6.7%, BHP Billiton Ltd. slipped 3.3%. Copper fell as much as 3% in London trading as China’s exports cooled.

STMicroelectronics NV slid 3% , while Infineon Technologies AG slumped 2.4%. Intel Corp., the world’s largest chipmaker, reduced its fourth-quarter revenue forecast by about $1 billion, citing a shortage of hard-disk drives for personal computers.

U.S. stocks fell as Moody’s Investors Service and Fitch Ratings said last week’s summit did little to ease pressure on Europe’s struggling governments and Intel Corp. (INTC) cut its revenue forecast.

Moody’s said that last week’s EU summit failed to produce “decisive policy measures” to end the region’s crisis. Equities extended losses as Fitch said a comprehensive solution has not yet been offered and predicted a “significant economic downturn” in the region.

The blue-chip Dow and the technology sector also were stung by a profit warning from bellwether Intel, which shed 4.04%.

Diamond Foods tumbled 23% after the company said it would delay its quarterly filing due to an investigation into crop payments to walnut growers, adding that it expects to get a deficiency notice from Nasdaq.

Goodyear Tire lost 2.7%. Shortages as a result of Thailand's catastrophic flooding earlier this year could spread to the market for aircraft tires as soon as February or March, the company said.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.00 (Dec 12 high)

The current price: Y77.87

Support 1:Y77.70 (MA(233) H1)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y78.00.

Resistance 3: Chf0.9490 (Feb 21 high)

Resistance 2: Chf0.9440 (Feb 2 high)

Resistance 1: Chf0.9390 (session high)

The current price: Chf0.9374

Support 1: Chf0.9340 (23.6% FIBO Chf0.9390-Chf0.9180)

Support 2: Chf0.9310 (38.2% FIBO Chf0.9390-Chf0.9180)

Support 3: Chf0.9285 (50.0% FIBO Chf0.9390-Chf0.9180)

Comments: the pair is on uptrend. In focus resistance Chf0.9390.

Resistance 3 : $1.5690 (61.8% FIBO $1.5535-$1.5780)

Resistance 2 : $1.5660 (Dec 12 high)

Resistance 1 : $1.5635 (MA(233) H1)

The current price: $1.5606

Support 1 : $1.5570 (session low)

Support 2 : $1.5535 (Dec 12 low)

Support 3 : $1.5495 (low of the European session on Nov 29)

Comments: the pair is on downtrend. In focus support $1.5570.

- Economic Slowdown Won't Match That In 2008

- Slowdown To Be Mild If EU Crisis Doesn't Worsen

- Lowers 2011 GDP Growth Forecast To 1.8% From 1.9%

- Cuts 2012 GDP Growth Forecast To 0.5% From 0.9%

- Sees Growth Rebounding To 1.9% In 2013

- Cuts 2012 Inflation Prediction To -0.3% From 0.3%

- Sees Inflation At 0.3% In 2013

- Sees 2012 Jobless Rate At 3.6% Vs 3.1% In 2011

Resistance 3: $1.3295 (38.2% FIBO $1.3160-$1.3430)

Resistance 2: $1.3260 (38.2% FIBO $1.3160-$1.3430)

Resistance 1: $1.3205 (session high)

The current price: $1.3189

Support 1 : $1.3160 (session low)

Support 2 : $1.3125 (Jan 5 low)

Support 3 : $1.3085 (Jan 13 low)

Comments: the pair is on downtrend. In focus support $1.3160.

Change % Change Last

Nikkei 8,654 +117.36 +1.37%

Hang Seng 18,576 -10.57 -0.06%

S&P/ASX 4,253 +49.83 +1.19%

Shanghai Composite 2,292 -23.73 -1.02%

FTSE 5,428 -101.35 -1.83%

CAC 3,090 -82.76 -2.61%

DAX 5,785 -201.28 -3.36%

Dow 12,021.54 -162.72 -1.34%

Nasdaq 2,612.26 -34.59 -1.31%

S&P 500 1,236.49 -18.70 -1.49%

10 Year Yield 2.01% -0.04

1 Euro $1.3186 +0.0113 +1.52%

Commodities

Oil $98.01 +0.24 +0.25%

Gold $1,669.10 +0.90 +0.05%

00:01 United Kingdom RICS House Price Balance November -24% -25%

00:30 Australia National Australia Bank's Business Confidence November 2

00:30 Australia Housing starts Quarter III -4.7% -0.7%

06:30 France CPI, m/m November 0.2% 0.2%

06:30 France CPI, y/y November 2.3% 2.4%

06:45 Switzerland SECO Economic Forecasts Quarter I

09:30 United Kingdom HICP, m/m November 0.1% 0.2%

09:30 United Kingdom HICP, Y/Y November 5.0% 4.8%

09:30 United Kingdom HICP ex EFAT, Y/Y November 3.4% 3.3%

09:30 United Kingdom Retail Price Index, m/m November 0.0% 0.2%

09:30 United Kingdom Retail prices, Y/Y November 5.4% 5.1%

09:30 United Kingdom RPI-X, Y/Y November 5.6% 5.3%

10:00 Germany ZEW Survey - Economic Sentiment December -55.2 -55.7

10:00 Eurozone ZEW Economic Sentiment December -59.1 -60.3

13:30 U.S. Retail sales November 0.5% 0.6%

13:30 U.S. Retail sales excluding auto November 0.6% 0.5%

15:00 U.S. Business inventories October 0.0% 0.5%

19:15 U.S. Fed Interest Rate Decision 0 0.00%-0.25% 0.00%-0.25%

23:30 Australia Westpac Consumer Confidence December 103.4

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.