- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 04-02-2022

- The commodity-linked New Zealand dollar ended Friday’s session with losses of 0.69%.

- The NZD/JPY retracement from weekly tops could lead to further losses below 76.00.

The NZD/JPY slumps for the second time in the week as traders get headed into the weekend. As Wall Street closed and thin liquidity conditions hit the FX market, the NZD/JPY is trading at 76.17 at the time of writing.

On Friday, Wall Street closed with gains, led by the Nasdaq, and the S&P 500, up 1.37% and 0.52%. Meanwhile, the Dow Jones Industrial finished flat in the day.

In the FX market, the low-yielder EUR was the gainer of the session, while the commodity currencies led by the AUD, CAD, and NZD were the principal losers, down 0.80%, 0.70%, and 0.69%, each.

NZD/JPY Price Forecast: Technical outlook

Putting Friday’s recap on the side, the NZD/JPY, as abovementioned, finished the week with losses but clung to the 76.00 figure. It is worth noting that the daily moving averages (DMAs) reside above the spot price, suggesting the pair might be headed downwards. Additionally, the failure of an upbreak of an upslope trendline drawn from August 2021 lows previous support-turned-resistance exacerbated the retracement from weekly tops near 76.80s towards the 76.10 area.

That said, the NZD/JPY first support would be 76.00. Breach of the latter would send the pair tumbling to February 3 low at 75.57, followed by January 26 cycle and YTD low at 75.21, a zone that could witness some buying pressure, before reaching 2021 yearly low at 74.55.

- GBP/JPY pulled back under 156.00 on Friday, though the bullish trend since January remains in play.

- The pair will be focused on risk appetite, comments from BoE’s Bailey and UK GDP figures next week.

Despite a modest rally in the US equity space that would normally have a positive impact on GBP/JPY, the pair pulled back on Friday, slipping back under and the 156.00 level, though finding support above 155.50. The pair still trades a decent amount above its pre-hawkish BoE surprise levels of under 155.50, however, and looks set to close out the week about 1.0% higher despite Friday’s 0.3% pullback from weekly highs in the 156.50 area.

Looking at the pair from a technical perspective, the bullish trend that has dominated since January 24 remains in play and, if anything, Friday’s pullback is just a reversion to this trend. Near-term technical momentum this continues to point higher and bulls will be hoping that risk appetite steadies at the start of next week and facilitates a recovery back towards this week’s highs in the 156.50 area and perhaps the 18 January highs just under 157.00 beyond that.

Fundamentally speaking, central bank divergence perhaps also favours further GBP/JPY upside, with BoJ governor Haruhiko Kuroda flexing his dovish credentials on Friday in stark contrast to the inflation concerned BoE that lifted rates for a second successive meeting this week. On which note, BoE Governor Andrew Bailey will be speaking next Wednesday ahead of the release of UK Q4 GDP and December activity figures on Friday. The data calendar in Japan contains a smattering of tier two releases that are unlikely to impact JPY.

- The S&P 500 reversed an early session dip to 4450 to trade above 4500, up more nearly 1.0%.

- Investors were digesting strong earnings from Amazon one day after the Facebook horror show and a strong US jobs report.

Trade was choppy towards the start of the US session as investors weighed up the implications of the latest much stronger than expected US labour market earnings on the outlook for Fed policy and interest rates. The S&P 500 was at one point trading as much as 0.5% lower as it slipped back to test the 4450 level, but has since seen an 70 point rally to trade in the 4520 area, now nearly 1.0% higher on the day. The index, despite reversing back sharply from near 4600 highs on Wednesday in wake of ugly earnings from Meta Platforms, looks set to close out the week about 2.3% higher.

Supporting sentiment on the final trading day of the week was a more than 15.0% rally in Amazon’s share price post-earnings which spurred a broader recovery in the Tech sector. Amazon will raise the price of its US Prime subscription to offset higher costs, the company announced in its latest earnings release. The S&P 500 GICS Consumer Discretionary index to which Amazon belongs rallied nearly 5.0%, while the big tech-dominated Information Technology and Communication Services indices also rose around 1.0% each. Strong earnings from Snapchat and Pinterest sent their shares a respective more than 60% and 12% higher each, adding to the broad tech sector tailwinds.

Coming up next week, earnings will remain in focus, though most of the mega-cap stocks have now reported. Otherwise, focus will remain on the macro picture, with US Consumer Price Inflation data scheduled for release on Wednesday. The Fed has explicitly said that any “worsening” of the inflation problem could see them act more aggressively, so any upside surprise is likely to see markets pricing in an increased likelihood that the bank hikes rates by 50bps in March.

- The AUD/JPY downward break at 82.00 exerts selling pressure on the pair.

- Dampened market sentiment mood exacerbated demand for the safe-haven JPY.

- A tweezers-top near the weekly tops looms and paves the way towards 80.00.

The AUD/JPY slides for the second time in the week, and from a technical perspective, it is forming a tweezers-top candle chart pattern, retreating from weekly tops around 82.27 to the 81.50s region. At the time of writing is trading at 81.55.

AUD/JPY Price Forecast: Technical outlook

AUD/JPY daily chart, shows that Friday’s price action in the Asian session seesawed around the daily pivot point and February 3 daily high, at 81.89 and 82.27, respectively. However, during the European session, dampened market mood conditions spurred a drop towards 81.32 for a 90-pip fall, stabilizing around the S1 daily pivot at 81.51.

That said, the AUD/JPY remains neutral-bearish biased. Friday’s price action witnessed a downward break of the 50-day moving average (DMA) at 81.58. In the event of a daily close below of it, that will confirm the tweezers-top, which could fuel another leg-down before confirming a bottom.

The AUD/JPY first support would be the February 1 low at 80.89. A downward break would expose the confluence of a bottom-trendline of a bullish-flag and the January 28 daily low at 80.36, followed by the psychological 80.00 barrier.

- EUR/JPY hit its highest levels since early November on Friday, rallying above January’s 131.60 highs to hit 132.00.

- Post-hawkish ECB euro momentum continued for a second day whilst the BoJ governor reiterated the bank’s ultra-loose stance.

EUR/JPY rallied above its early January highs in the 131.60s to hit the 132.00 level for the first time since early November on Friday, as post-hawkish ECB euro momentum continued for a second day. The pair, up a further 0.4% on Friday, has now surged about 2.0% since Wednesday’s close underneath 129.50. Even more impressive is the pair’s on-the-week gains, which currently stand at just under 2.8%, putting the pair on course for its best weekly gain since June 2020. EUR/JPY rallied at the start of the week in tandem with equities (which at the time were performing strongly), and also as the pair found support at a long-term uptrend that has supported the price action going all the way back to November 2020.

Some described the ECB’s hawkish shift on Thursday, where Christine Lagarde admitted the bank had become more concerned about the inflation outlook and refused to repeat her previous statement that a 2022 rate hike is unlikely, as a “pivotal” moment. That certainly seems to have been the case for EUR/JPY, with many traders now predicting the pair will test its H2 2021 highs around 133.50 in the coming weeks. Underscoring the widening ECB/BoJ policy differential that many expect will be a source of support for the pair in the coming quarters was typically dovish commentary from BoJ governor Haruhiko Kuroda during Friday’s Asia Pacific session.

Kuroda reiterated that the BoJ must maintain ultra-loose monetary policy as, compared to the likes of the US and Europe, inflation in Japan remains subdued due to delayed post-pandemic recovery and the public’s sticky deflationary mindset. “In Japan, nominal wages haven't risen much” Kuroda told the Japanese parliament in a testimony. “It's hard to see inflation sustainably reach our 2% target unless wages rise in tandem with prices”. Next week will likely be fairly quiet for EUR/JPY, with focus more on the Fed and broader risk appetite, amid a smattering of tier two Eurozone and Japanese data releases.

- The GBP/USD slides despite the BoE’s hikes rates, courtesy of Bailey’s“dovish” comments.

- US Treasury yields shoot through the roof after a positive US employment report.

- GBP/USD is neutral biased, but a leg-down is on the cards, as a bearish engulfing candle pattern looms.

The British pound extended its losses after the Bank of England’s (BoE) hiked 25 basis points, but dovish comments of BoE’s Bailey in the press conference sent the GBP/USD retreating from weekly tops. At the time of writing is trading at 1.3542.

In the meantime, a better than expected US employment report send US Treasury yields higher, led by 2s and 10s, rising between twelve and ten basis points, sitting at 1.318% and 1.92%, respectively. That underpins the greenback, which pares some of its earlier losses, up 0.07% in the day, clings to 95.44.

GBP/USD Price Forecast: Technical outlook

On Friday, during the overnight session, the GBP/USD plunged under 1.3600 for fundamental reasons, dropping more than 100-pips, but the downward move was capped at the 100-day moving average (DMA). However, it forms a bearish-engulfing candle, suggesting a leg-down is on the cards, before consolidating.

The GBP/USD’s first support level to challenge will be the confluence of the 100-DMA and the 38.2% Fibo retracement, around the 1.3507-20 range. A breach of the latter might send the pair dipping towards the confluence of the 50-DMA and the 50% Fibo retracement around 1.3433-55, followed by the 61.8% Fibonacci retracement at 1.3381.

- On Friday, the NZD/USD slides close to 1% during the day.

- Market sentiment is mixed, weighing on the AUD and boosting the greenback.

- January’s Nonfarm Payrolls report crushed the 150K expectations, US T-bond yields skyrocketed.

The New Zealand dollar plummets 80-pips in the North American session marches firmly towards 0.6600. At the time of writing is trading at 0.6605. European bourses closed in the red, depicting a mixed market mood. Across the pond, US equity indices fluctuate between gainers and losers, while in the FX complex, risk-sensitive currencies like the antipodeans, with the NZD down close to 1%.

It is worth noting that the US 10-year Treasury yield sits at 1.914%, retreated from 1.936%, a level not seen since December 2019, up to eight basis points in the day, underpinning the greenback, which sits at 95.41, up 0.04%.

Nonfarm Payrolls jumped above estimations, the NZD/USD tanks

In the early morning in the New York session, the US Nonfarm Payrolls for January showed that the US economy created 467K jobs, smashing the 150K, foreseen per reported by the Bureau of Labor Statistics (BLS). Since Wednesday, White House economic advisers and Philadelphia’s Fed President Harker warned that January’s employment report was expected to be bad, courtesy of a dismal ADP Private Employment report, which showed that companies slashed more than 300K jobs.

The US employment report showed that Average Hourly earnings rose by 5.7%, exerting further pressure on the Fed, as higher wages equals elevated inflation. Furthermore, the Unemployment Rate touched 4.0%, a tenth more elevated than the 3.9% estimated.

Next week, the New Zealand docket will feature Business NZ PMI, Electronic Retail Card Spending, and Business Inflation Expectations for Q1. On the US front, NZD/USD traders look forward to taking cues from the Balance Trade for December, unveiling on Tuesday, followed by the Consumer Price Index (CPI) on Thursday for January, and finally the University of Michigan Consumer Sentiment for February.

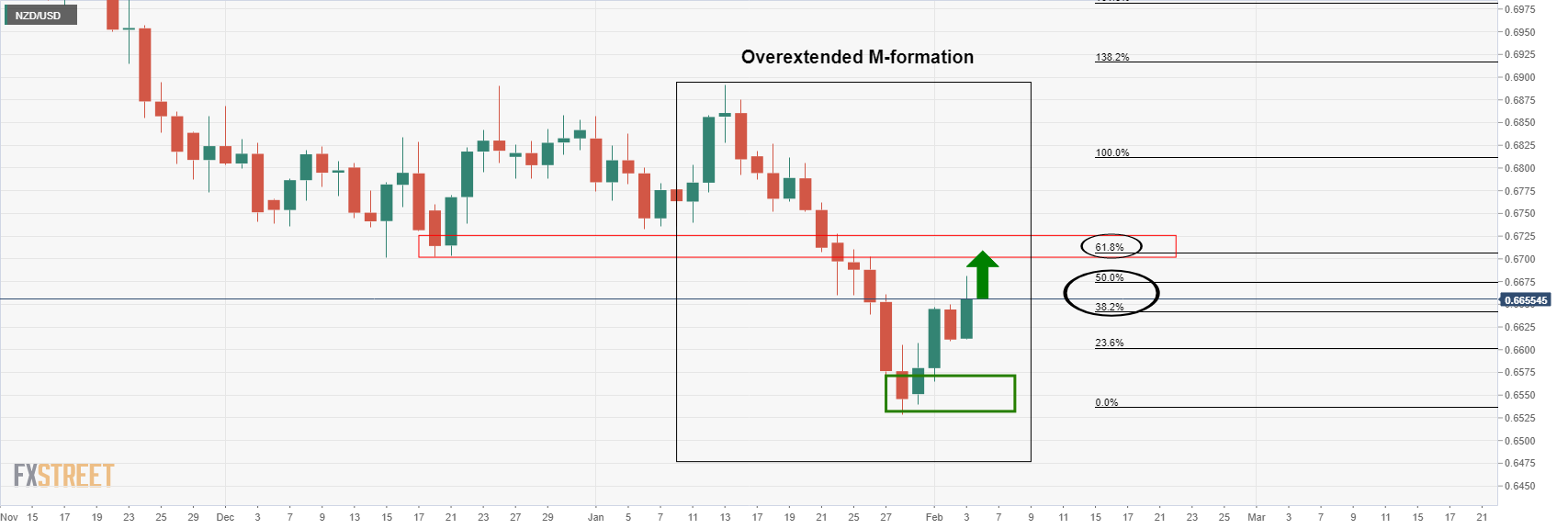

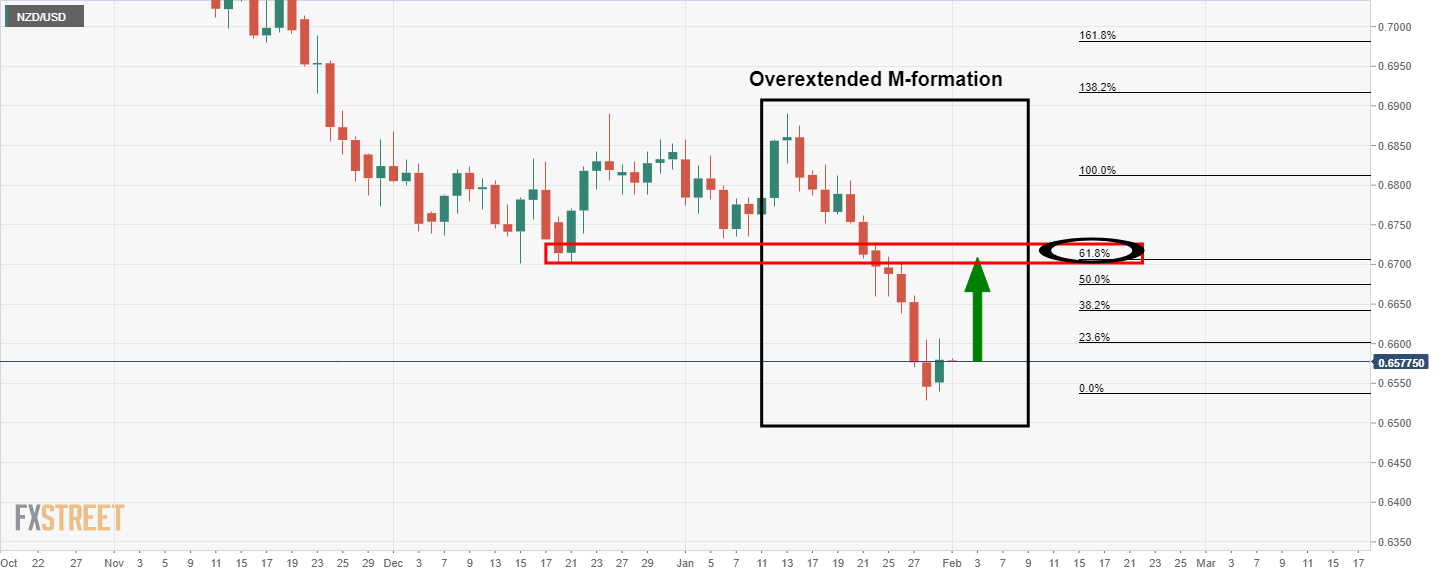

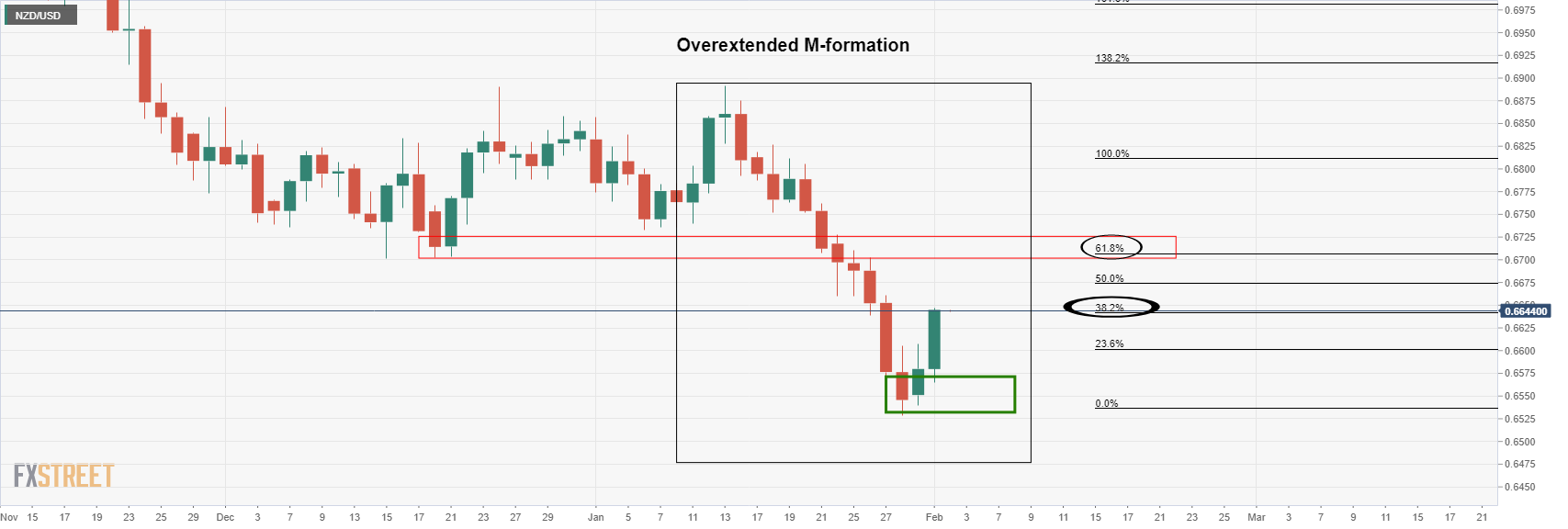

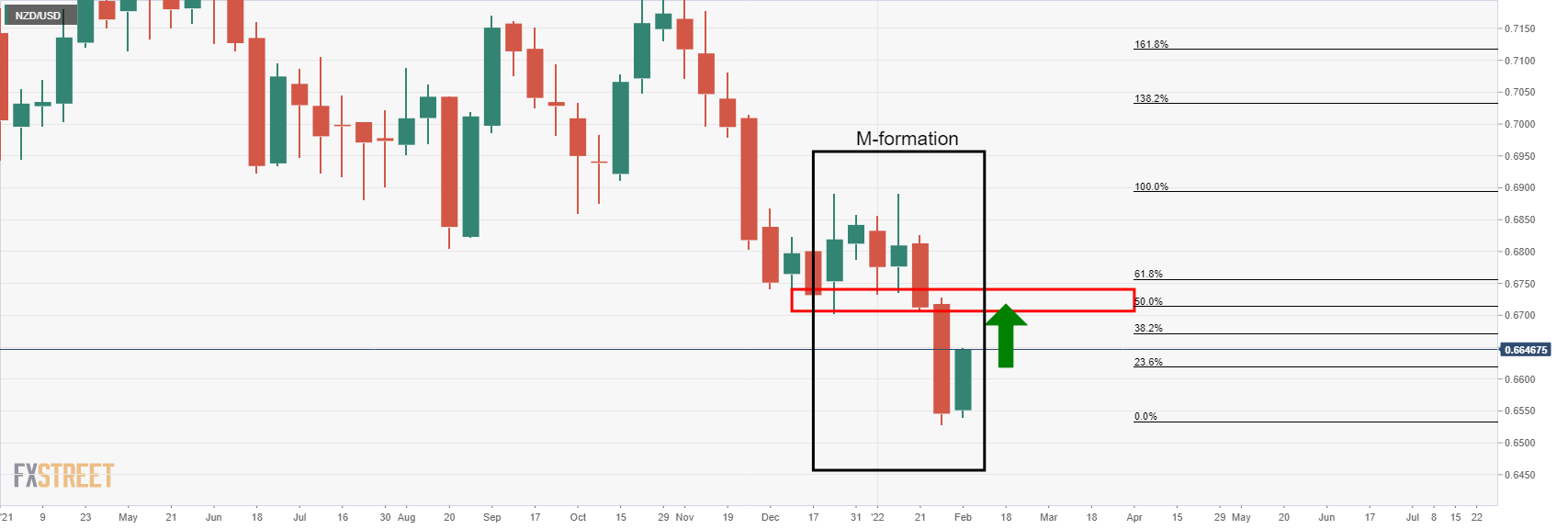

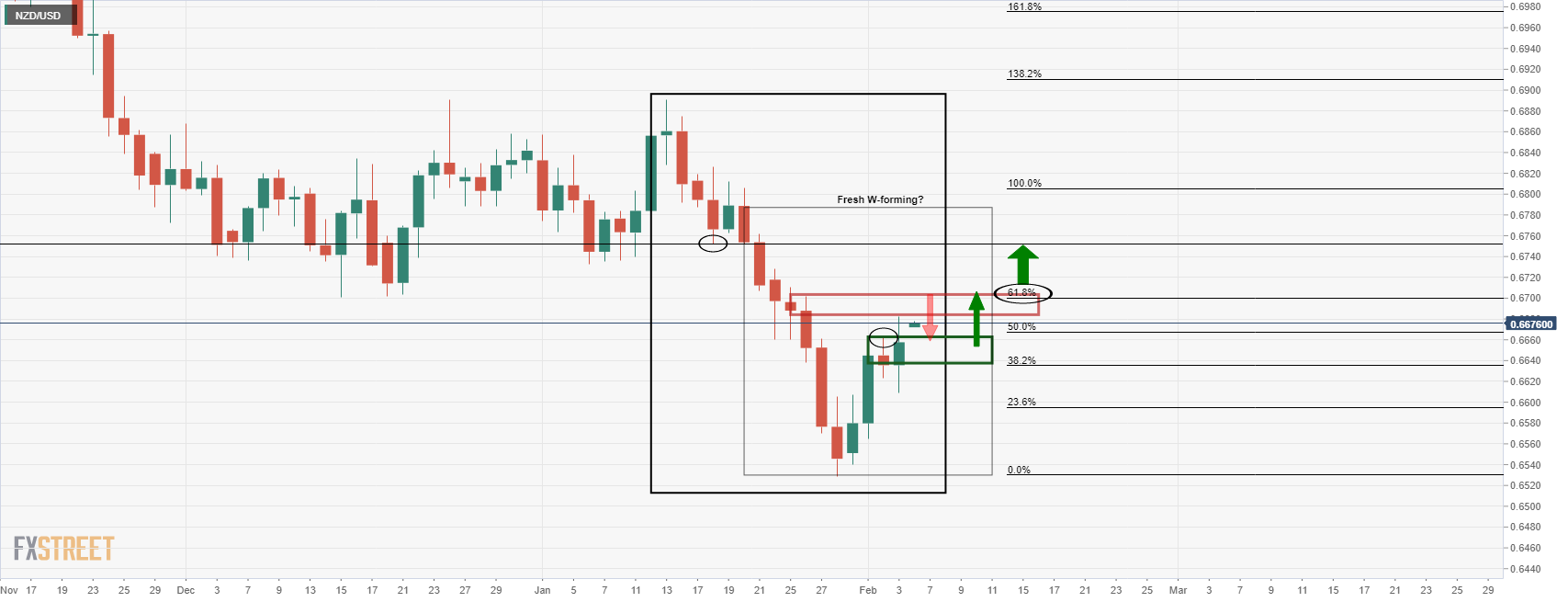

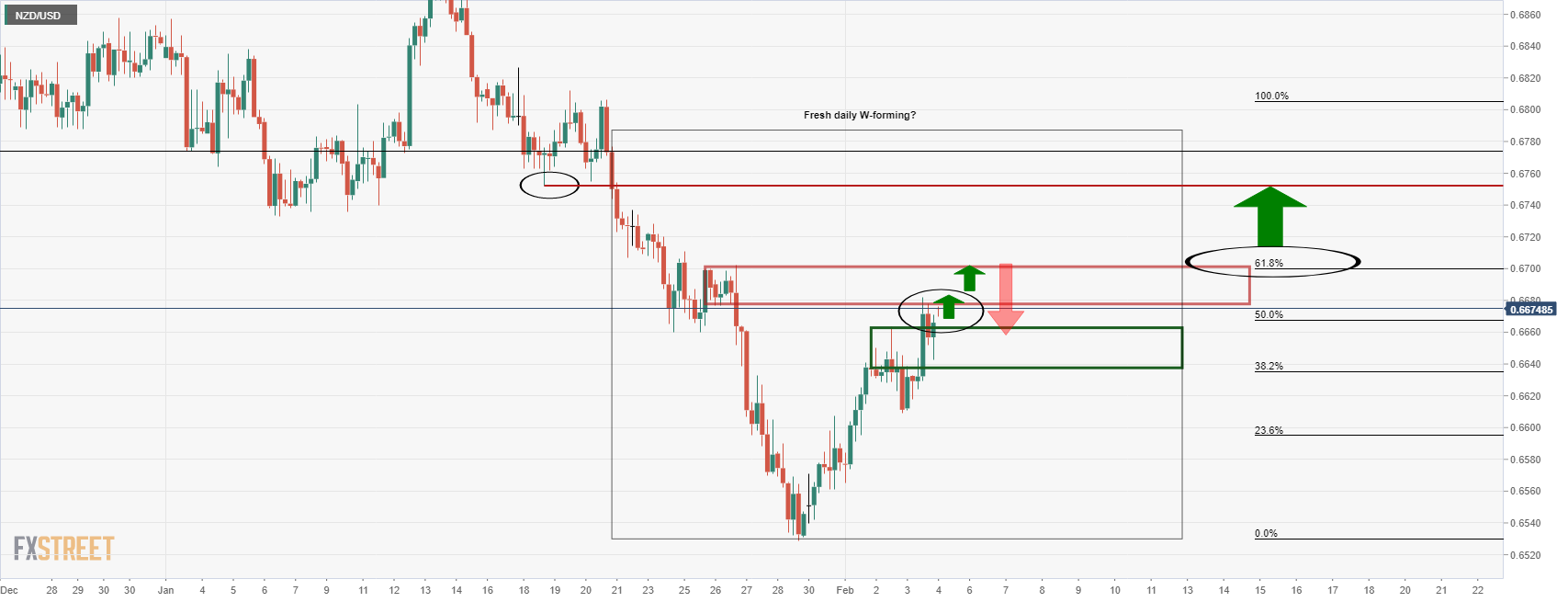

NZD/USD Price Forecast: Technical outlook

From a technical analysis perspective, the NZD/USD pair is downward biased. The NZD/USD daily moving averages (DMAs) persist above the spot price, in a bearish order, with a downward slope, signaling that the downtrend could accelerate In the near term. Friday’s price action appears to be forming a two-candle pattern, a bearish-engulfing candle, suggesting the pair might fall towards the YTD low.

That said, the NZD/USD first support would be 0.6600. A daily close under the figure would expose the January 28, daily high previous resistance-turned-support at 0.6588, followed by the YTD low at 0.6529.

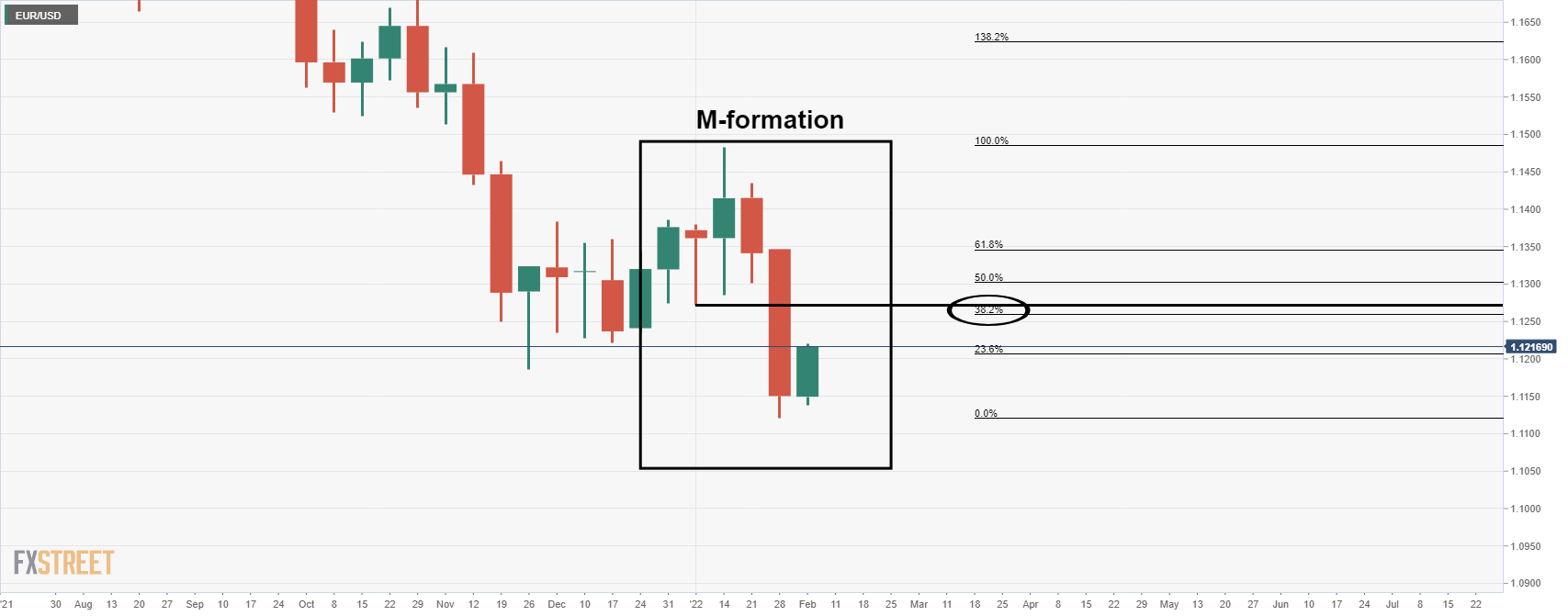

- EUR/USD’s rally stalled in wake of a strong US labour market report, though the pair remained well supported above 1.1400.

- The pair currently trades around 1.1450, up from sub-1.1420 post-NFP data lows but unable to breach last week’s 1.1480 highs.

- EUR/USD remains on course to end the week about 2.8% higher, its best performance since March 2020.

Strong US labour market data on Friday took some of the wind out of EUR/USD’s sails and, though not enough to trigger a lasting reversal back towards 1.1400, has at least prevented the pair from breaching January’s highs in the 1.1480s. Indeed, though the pair has recovered back from its sub-1.1420 post-NFP data session lows, it has been unable to recoup back to pre-data levels above 1.1460.

In the context of a sharp spike higher in yields across the US curve as bond markets price in a higher likelihood of more aggressive Fed tightening and a higher terminal rate, a slowdown in EUR/USD’s rally on Friday makes sense. At current levels in the 1.1450s, the pair still trades higher by about 0.2% on the day. On the week, the pair looks set to gain about 2.8%, its best performance since March 2020.

Some might find the eagerness with which EUR/USD bulls bought the post-NFP data dip back towards the 1.1400 level surprising. Others might argue that it demonstrates the strength of the shift in the market's view on the euro in wake of Thursday’s hawkish ECB meeting. Recall that ECB President Christine Lagarde on Thursday acknowledged rising Eurozone inflation risks and refused to repeat a prior statement that rate hikes in 2022 were unlikely. Market participants took this to mean that, for the first time, the ECB was admitting that hikes this year are a possibility, a “pivotal” shift according to some.

Eurozone money markets jumped to price in as much as 50bps worth of rate hikes by the end of December (from closer to 20bps before). Whilst this might be a stretch, the fact that the ECB is clearly tilted towards rate hikes in 2022 (the first time in a decade) is quite something. Whilst the shift in stance from the ECB might not be enough to result in a lasting EUR/USD rally, say, beyond resistance between current levels and the 1.1500 mark, it makes a return back below 1.1200 less likely. After all, the divergence between Fed and ECB policy is now likely to be not nearly as much as some had previously thought.

- Nonfarm Payrolls came better than foreseen by analysts, despite being talked down by the White House.

- Silver edges higher 0.18%, following the US Dollar footsteps.

- XAG/USD failure to reclaim an upslope trendline exerts downward pressure on the white metal.

Silver (XAG/USD) trims Thursday’s losses as the North American session progresses. At the time of writing, XAG/USD is trading at $22.43, advances 0.18%. The market sentiment is mixed, with European bourses trading in the red meanwhile, US stock indices are in the green post-US employment report.

In the meantime, the US 10-year T-bond yield, which correlates negatively with silver, advances ten basis points, up to 1.932%, underpins the greenback. The US Dollar Index, a measurement of the buck’s value against a basket of six rivals, edges up 0.18%, sitting above 95.59.

Nonfarm Payrolls rose above 450K, smashing expectations

Before Wall Street opened, the US Nonfarm Payrolls for January came at 467K more than the 150K, as the Bureau of Labor Statistics (BLS) revealed on Friday. During the week, White House economic advisers and Philadelphia’s Fed President Harker down talked about January’s employment report, which was expected worse than estimates, per the impact of the

Dissecting the NFP report, Average Hourly earnings rose by 5.7%, exerting further pressure on the Fed, as higher wages equals elevated inflation. Furthermore, the Unemployment Rate touched 4.0%, a tenth higher than the 3.9% estimated.

XAG/USD Price Forecast: Technical outlook

On Friday’s overnight session for North American traders, XAG/USD seesawed around the $22.40-64, $0.24 range. However, volatility picked up once American traders got to their desks and the US employment report hit the wires. The XAG/USD knee-jerk reaction sent silver towards February 3 daily low around $22.00, followed by a jump, towards $22.50, near the close of Thursday.

That said, XAG/USD is downward biased. Failure to reclaim above an upslope trendline previous support-turned-resistance exerts downward pressure on the non-yielding metal. XAG/USD’s first support would be January 28 daily low at $22.18. A breach of it would expose the January 7 low at $21.94, followed by December 15 cycle low at $21.42.

- USD/CAD rose to fresh weekly highs near 1.2800, 100 pips up from earlier lows on Friday.

- The catalyst for the bullish move was weak Canada/strong US labour market data.

USD/CAD got a double whammy of bullish impetus on Friday in the form of much stronger than expected US labour market data (USD bullish) and much weaker than forecast Canadian labour market data (CAD bearish). USD/CAD lurched to fresh weekly highs near 1.2800, a more than 100 pip or roughly 0.7% intra-day rally from earlier session lows in the 1.2660s. The pair appeared to run out of bullish momentum as it approached the 1.2800 level, with sellers coming in ahead of last week’s highs and a melt-up in crude oil prices helping to give the loonie a floor. WTI is up more than $2.0 on the day and at one point hit $93.00, fresh seven-year intra-day highs.

In light of the latest US and Canadian employment data for January, USD/CAD traders will now be reassessing their Fed/BoC calls for the coming months. Friday’s US jobs data, which saw a massive headline NFP beat, hot wage growth and a jump in labour force participation, has been interpreted as raising the risk of a 50bps move in March. Meanwhile, market commentators remarked that they did not think the latest Canadian numbers would deter the BoC from hiking by 25bps in March, given that the latest job losses relate to Omicron lockdowns and are expected to quickly come back.

Nonetheless, the latest data does highlight some economic divergence between the US and Canada and raises the risk that the Fed outpaces the BoC when it comes to monetary tightening this year, a fact that could offer USD/CAD long-term support. Next week, the main focus for USD/CAD trades will be on US Consumer Price Inflation data on Wednesday that may offer markets further reason to bet on a 50bps March hike from the Fed. Otherwise, Fed and BoC speak will be key themes to watch.

The May 29 presidential election in Colombia represents a risk to the Colombian peso, according to analysts at CIBC. They forecast USD/COP at 4200 by the end of the first quarter and at 4100 by mid-year.

Key Quotes:

“Banrep increased the overnight rate by 100 bps to 4.00%, against market consensus and our forecast for a 75bps increase. Banrep left the door open for similar rate increases in the short term as inflationary pressures remained in place and both core and headline inflation are above target.”

“We expect Banrep to increase the overnight rate by another 100bps in March and we revised our terminal rate forecast for Q3 to 7.50% (previously 7.25%).”

“Looking at USD/COP, although we recognize that the global supply shock and recent upside surprises to headline inflation suggest a front-loading of the tightening cycle, current political dynamics should prevent a sustained appreciation of the COP for most of H1.”

“The 2022 legislative and presidential election cycle is marked by a clear move to the left in the region, while locally, the protests at the end of 2019 and in early 2021 have supported the increase in popularity of leftist candidates (…) current local and regional trends suggest a much greater representation of the left in the next four years, adding another layer of risk ahead of the May 29 presidential election.”

“We anticipate USD/COP moves that are similar to, if not greater than, those experienced in Chile and Peru in 2021, bringing USD/COP above its historical highs before the end of Q1. Hence, we maintain our long.”

The official employment report showed better-than-expected numbers in January. Nonfarm payrolls increased by 467K despite the headwinds posed by record-high COVID cases in January, said analysts at Wells Fargo. They explain employment growth was broad-based across most industries, and upward revisions to the previous two months suggest that recent momentum in hiring remains very strong. They expected the FOMC to raise rates in March.

Key Quotes:

“The labor market’s recovery easily leapt over the hurdle thrown up by the Omicron wave in January. Nonfarm payrolls bested even the top end of expectations, rising by 467K. The net 709K revision to the prior two months' gains was also impressive. However, some of that can be attributed to the payroll benchmark revisions incorporated in today's report, which showed the jobs recovery progressing more slowly during the spring and early summer than previously reported and faster more recently.”

“This morning's employment report was likely music to the ears of FOMC officials. Solid employment gains despite the Omicron variant's emergence give Fed officials more evidence that the U.S. economy is getting better at dealing with the bumps in the road from the pandemic. Additionally, surging wage growth and rebounding labor force participation likely reassure the more dovish monetary policymakers that the recent hawkish pivot from the Federal Reserve was the correct call.”

“Perhaps the February employment report to be released on March 4 will show some payback, but we believe it would take nothing short of a complete collapse to derail the Fed's near-term tightening plans at this point. The first federal funds rate hike since 2018 appears to be a lock for March.”

Data released on Friday, showed the Canadian economy lost 200K jobs in January, more than expected. Analysts at CIBC point out most of the decline came from industries affected by tightening health restrictions and the numbers should not alter the plans of the Bank of Canada (BoC) of raising rates next month.

Key Quotes:

“The Canadian labour market failed to produce a positive surprise for the first time in a long time, with the 200K decline in jobs during January actually weaker than the consensus had expected (-110K). However, there was a good excuse, as most of the decline could be explained by job losses in services industries most impacted by tightening health restrictions at the start of the year. Because of that, today's report shouldn't alter expectations for a strong rebound upon reopening and also shouldn't deter the Bank of Canada from raising interest rates next month.”

“The sharp decline in hours worked tallies with our expectation that monthly GDP likely saw a drop of close to 1% to start the year, setting the quarter up for a flat reading. That would be in contrast to the trend stateside, where fewer restrictions meant that employment and overall economic growth appear to have gotten off to a faster start. However, given the sector and provincial composition of today's employment decline in Canada, we remain confident that jobs will return as restrictions continue to be lifted. We suspect that the Bank of Canada will feel the same way, and proceed with a rate hike in early March despite today's weak figures.”

- Mexican peso tumbles versus US dollar after the NFP.

- In a few hours, USD/MXN erased weekly losses and climbed back above the 20.70 area.

- Next week events include the Bank of Mexico meeting.

The USD/MXN jumped to 20.78 after the release of a better-than-expected NFP report. The greenback soared after the numbers, also supported by higher US yields.

US figures on Friday triggered a rally of the US dollar across the board, that pushed USD/MXN sharply to the upside, erasing weekly losses. The recovery of the Mexican peso came to an end. A decline back under 20.70 should put the pair back into the 20.70/20.50 range.

After a busy week, with key US employment data, now the attention turns to Banxico that next week will have its board meeting. Also in Mexico CPI numbers will be released.

“We expect Banxico to hike by 25bp. This meeting has a relatively high degree of uncertainty surrounding it, thanks to the new structure of the Banxico board, as the new Governor presides over her first meeting. We believe there is not insignificant risk that Banxico could once again hike by 50bp, as it would be justified by inflation dynamics”, said analysts at TD Securities.

What the central bank says could have an influence on the Mexican peso. Although its performance is likely to be driven by risk sentiment across financial markets.

“Although we maintain our call for a much higher USD/MXN for the rest of the year, the risks associated with other regional currencies during the first half of 2022 should favour the peso in the short term, keeping USD/MXN within the 20.30-21.00 range”, explained analysts at CIBC.

Analysts at MUFG Bank point out that higher yields across the Eurozone will help reverse the downward pressure on EUR/CHF. They see have a trade idea of a long position with a target at 1.0850, an entry-level 1.0550, and a stop loss at 1.0300.

Key Quotes:

“We are recommending a long EUR/CHF trade idea. The trade idea is to take advantage of the hawkish repricing of ECB rate hike expectations. The ECB’s hawkish policy shift is an important bullish pivot point for the EUR. We do not expect the SNB to quickly follow the ECB by speeding up their own tightening plans. The ECB policy shift has already helped EUR/CHF to rebound further above last month’s low of 1.0300. Nevertheless, we still believe there is scope for EUR/CHF to keep moving higher in the near-term.”

“EUR/CHF is still trading well below levels from just over a year ago when it was trading above the 1.1000- level. The recent sharp move higher in euro-zone yields is not yet fully reflected in a higher EUR/CHF rate.”

“We remain optimistic as well that a diplomatic solution will be found for the stand-off between the Ukraine and Russia. The main risks to our bullish view are: i) higher yields trigger a bigger correction lower for risk assets and boost safe have demand for the CHF, and ii) Russia invades the Ukraine triggering a sharp move higher for the CHF as it would be viewed as a negative shock for European economies.”

Markets are expecting too much tightening from the South African Reserve Bank (SARB) warn analysts at CIBC. They see the USD/ZAR at 15.75 by the end of the first quarter and at 16.00 by mid-year.

Key Quotes:

“The South African Reserve Bank has followed the November hike with a second 25bp move, taking rates to 4.0%. After beginning the process of unwinding pandemic-inspired policy easing at their previous meeting, it seems that the central bank remains biased towards a slow and progressive data-dependent tightening cycle. After witnessing CPI threaten the top of the 3-6% CPI target range in December, we expect a potential overshoot in early 2022.”

“The rates trajectory is set to remain data-dependent. Therefore, if the central bank is correct in assuming that prices will be back in line with the mid-point of the CPI target range in two years, 4.5%, this would suggest that the market is overly aggressive in terms of pricing in 100bp of tightening in H1 this year.”

“Although the SARB may have hiked at consecutive meetings, we do not expect another move until the May meeting. The ZAR has proved a top performer versus the USD and EUR over the last two months.”

“The ZAR is an emerging market currency that is partly sheltered from the impact of Fed hikes due to elevated nominal yields. However, market recognition of too much tightening being discounted, impacting real rates, suggests that the recent rapid accumulation of ZAR real money speculative positions risks correcting. As a result, we look for USD/ZAR to trade back towards 16.00 into mid-year.”

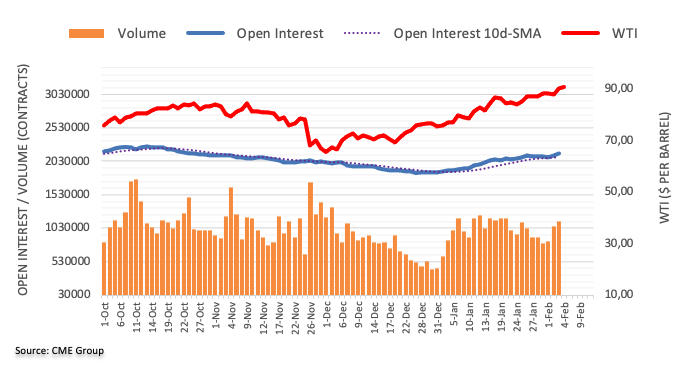

- WTI hit fresh seven-year highs at $93.00/barrel in recent trade as the recent melt-up accelerated.

- WTI is on course to post a seventh successive weekly gain during which time it has rallied over 30%.

Oil bulls put their foot on the accelerator on Friday, driving prices to fresh seven-year highs and leaving major crude benchmarks on course to post a seventh successive week of gains, with trading conditions increasingly resembling that of a “melt-up”. Front-month WTI futures surged nearly $3.0 on the session easily surpassing resistance in the mid-$91.00s and even hit the $93.00 level. That takes WTI’s weekly gains to close to $6.0 (nearly 7.0%) and the seven-week run of gains to more than 30% (recall WTI was trading around $70/barrel in mid-December).

Familiar themes were cited as behind the ongoing upside in oil prices; the winter storm that recently hit the US and sent temperatures plummeting, geopolitical tensions between Ukraine, Nato and Russia. A few analysts highlighted concerns that the US storm might impact US shale output in the Permian Basin. Market commentators also highlighted fresh evidence of OPEC+ struggles to lift output/exports; recent data showed Iraqi output in January was well below it allowed quota under the existing OPEC+ pact and Kazakhstan reportedly wants to keep more of its output at home to lower domestic prices and ease civil tensions.

“It may just be a matter of time until we're closing in on triple figures” remarked one analyst at OANDA. Commerzbank on Friday upped its Q1 2022 oil price forecast to $90/barrel from $80 before. However, Citi cautioned that the oil market may soon revert back into surplus, perhaps as soon as next quarter and recommended selling the Brent crude future for December delivery on the anticipation of crude oil build later in the year.

European Central Bank governing council member said on Friday that it would be logical for the ECB to hike its key interest rate at latest by next year, in an interview with Helingin Sanomat. The ECB will ensure that the inflation rate remains moderate in the medium-term, he added.

Market Reaction

The euro has not reacted to the latest comments from ECB's Rehn, with the market very much already expecting a few ECB rate hike by the end of 2022 in wake of Thursday's hawkish ECB meeting.

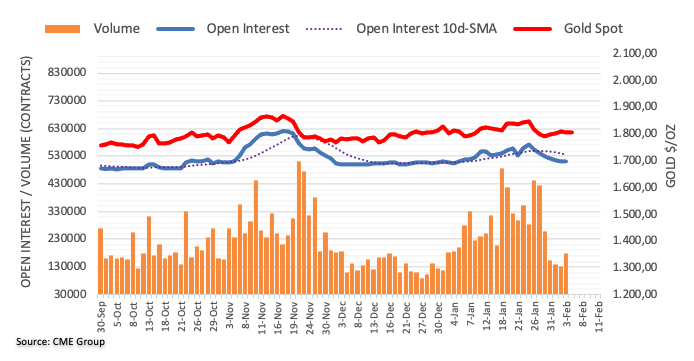

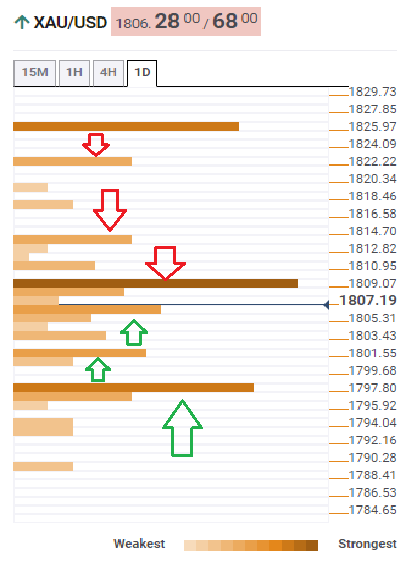

Gold is likely to remain inversely correlated with the benchmark 10-year US T-bond yield next week as investors will await the US January Consumer Price Index (CPI) data, which could impact the market odds of a 50 basis points (bps) Fed rate hike in March, FXStreet’s Eren Sengezer reports.

Next week's US CPI data could trigger a big reaction in XAU/USD

“On Thursday, the US Bureau of Labor Statistics will release CPI data. On a yearly basis, the CPI is forecast to rise to 7.2% from 7% in December. A stronger-than-expected reading could ramp up the probability of a 50 bps hike in March and weigh on XAU/USD.”

“In case the price stays above $1,805 (200-day SMA) and starts using this level as support, the next target on the upside is located at $1,820 (20-day SMA, Fibonacci 38.2% retracement of December-February uptrend) before $1,830 (Fibonacci 23.6% retracement).”

“In case $1,805 is confirmed as resistance, gold needs to make a daily close below $1,800 (100-day SMA, Fibonacci 61.8% retracement) to convince bears. In that case, $1,780 (static level) aligns as the next support.”

- US January’s Nonfarm Payrolls report crushed expectations to rise 467K vs. 150K.

- The Australian dollar edges lower during the North American session, down 1.02%.

- AUD/USD failure at the 50-DMA sent the pair tumbling under 0.7100 emphasizing its downward bias.

The AUD/USD snaps four days of gains losing on a better than expected US jobs report. At the time of writing, the AUD/USD is trading at 0.7066. A risk off-market mood keeps investors moving towards safe-haven assets, like the USD and the JPY.

In the meantime, the US Dollar Index, a gauge of the greenback’s value versus a basket of six peers, advances 0.24%, sitting at 95.59, underpinned by surging US T-bond yield, led by the 2-year up ten basis points, at 1.2998%.

US Nonfarm Payrolls surprise to the upside

In the meantime, the US Bureau of Labor Statistics (BLS) revealed the Nonfarm Payrolls reports for January, which added 467K employments, larger than the 150K estimated by analysts. During the week, White House economic advisers and Philadelphia’s Fed President Harker down talked about January’s employment report, which was expected worse than estimates, per the impact of the Covid-19 Omicron strain.

Digging deeper, the Unemployment Rate increased to 4.0%, a tenth higher but, the highlight was Average Hourly Earnings, which rose to 5.7% vs. 5.2% foreseen, which puts the Fed under pressure to hike rates more than the 25 bps priced in for the March meeting.

On the Australian dollar side, the Reserve Bank of Australia (RBA) Statement of Monetary Policy emphasized that the board is “prepared to be patient” and will monitor factors that could affect the Australian inflation outlook. The central bank reiterated that ending the QE program does not suggest a rate hike in the future.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is downward biased, per location of the daily moving averages (DMAs), which reside above the spot price. Furthermore, the AUD/USD failure at the 50-DMA opened the door for further losses, sending the pair tumbling under 0.7100. The AUD/USD first support would be 0.7100. A breach of the latter would expose January 28 daily low at 0.6967, followed by a downslope support trendline around 0.6930-45.

Revived discussion around the Fed's starting point for tightening is set to leave EUR/USD under the 1.15 level. A move below 1.14 should renew modest downside pressure but dips should be shallow, according to economists at TD Securities.

Material downside has been reduced

“With still some risk of accelerated tightening by the Fed, we think EUR/USD a break above 1.15 may be harder to achieve.”

“We think we will need to get through the early stages of Fed lift-off, potentially receive more clarity on terminal rate pricing before EUR can really take off.”

“For now, a move sub-1.14 would be significant from a tactical point of view, but we are mindful that dips could be shallow.”

- Canadian Ivey PMI rose to 50.7 in January from 45.0 in December.

- The loonie did not see any reaction to the latest data.

Canadian Ivey PMI rose to 50.7 in January from 45.0 in December, the latest survey from the Richard Ivey School of Business revealed. As with other PMI indicators, a result above 50 is generally associated with MoM growth in economic activity. Thus, Canada's Ivey PMI suggests business conditions in the country rose ever so slightly back into expansionary territory in January, as the economy started to tentatively recover from the rapid recent spread of the Omicron Covid-19 variant.

Market Reaction

The loonie did not react to the data.

- US dollar strengthens after a better-than-expected NFP.

- USD/JPY erases weekly losses with the latest rally.

The USD/JPY jumped from 114.90 to 115.38 following the release of the US employment report that showed better-than-expected numbers. The pair hit the highest level since Monday and it is holding above 115.00, with the bullish momentum intact.

After the ADP report and other labor indicators, the 150K increase in payrolls faced downside risk. The numbers came in the other way with a positive surprise. The number below consensus was the unemployment rate, which rose from 3.9% to 4%, but it was due to an increase in the labor participation from 61.9% to 62.2%.

“The Omicron wave has depressed economic activity, and this was meant to translate into weak hiring. It hasn't. 467k jobs created and massive upward revisions suggest a fundamentally very strong economy. With companies desperate to hire and the biggest issue being the lack of suitable staff, wages are rising sharply, and the Fed will respond”, says analysts from ING.

The numbers triggered a rally of the US dollar across the board and a sharp increase in US yields that weakened the Japanese yen. The US 10-year yield climbed to 1.91%, the highest since January 2020 and the 30-year reach 2.20%.

The post NFP rally put the USD/JPY on its way to the second daily gain in a row. The next resistance could be seen at 115.45, before last week highs at 115.65/70. Now the 115.00 zone has become the immediate support, followed by 114.78.

Technical levels

- Spot gold fell back to the $1800 level in recent trade after stronger than expected US labour market data.

- The strong NFP number, hot wage growth and rise in participation rate spurred a fresh build-up of Fed tightening bets.

Spot gold (XAU/USD) prices lurched back to the $1800 level in recent trade in wake of the latest much stronger than anticipated US labour market figures for January. Prior to the data, the precious metal had been trading closer to $1815 and with tentative on the day gains. Now, XAU/USD trades about 0.3% lower on the session as it undulates either side of the $1800 mark. Bears will be eyeing a test of Thursday’s post-hawkish BoE/ECB lows in the $1788 area, a break below which could open the door to an extension of technical selling that could push spot gold prices back towards weekly lows in the $1780 area.

The strong US labour market report saw a blowout headline NFP gain and hot wage growth, as well as the estimate as to the size of the US labour force increase by about 1.5M, spurring a surge in Fed tightening bets. Unsurprisingly, this sent US yields and the buck higher in a kneejerk response, weighing on the XAU/USD, which has a strong negative correlation to both. US money markets have upped their bets that the Fed hikes rates by 50bps in March to an implied 23% (from 14.3% on Thursday). Higher interest rates dim the appeal of non-yielding precious metals.

As gold traders assess this week in its entirety, hawkishness/central bank tightening will be top of mind, following hawkish surprises from the BoE and ECB on Thursday and now in wake of the latest US jobs report. A shift towards higher interest rates/more hawkish central banks is not typically an environment that bodes well for gold in the long-term, so the precious metal may struggle to find dip-buyers in the $1800 area. Attention now shifts to next week’s US Consumer Price Inflation data which, if hotter than expected, may also spur a fresh build-up of Fed tightening bets next week, suggesting further downside risks for XAU/USD.

GBP/USD failed to close above 1.36. Cable is now at risk of suffering substantial losses toward 1.34 and even 1.32, economists at Scotiabank report.

Resistance after 1.36 is seen at 1.3615/25

“Failure to firmly break past 1.36 leaves the GBP at risk of losses toward 1.34 initially and potentially 1.32 in relatively short order.”

“Intermediate support ahead of the 1.35 figure zone is ~1.3525 and the 50-day MA of 1.3512.”

“Resistance after 1.36 is 1.3615/25 and the mid-figure area.”

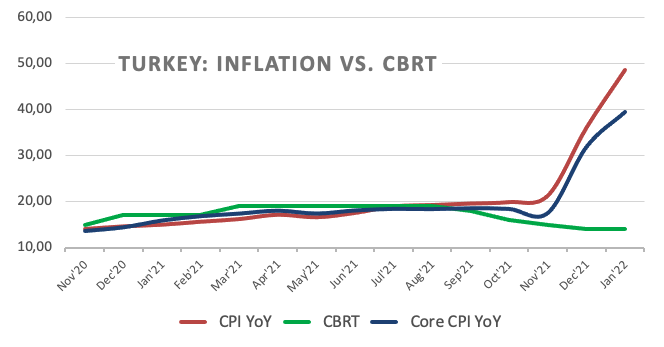

- USD/TRY keeps the consolidation well in place on Friday.

- Turkey’s CPI approached the 50% YoY in January.

- Focus is now on the CBRT event later in the month.

The Turkish lira depreciates once again and motivates USD/TRY to clinch the fourth consecutive session with gains, this time revisiting the 13.60 region on Friday.

USD/TRY up post-CPI, attention shifts to the CBRT

USD/TRY advances since Tuesday, although it remains well entrenched into the 13.00-14.00 range well in place since the beginning of the new year.

The lira came under pressure once again after inflation figures released on Thursday showed consumer prices rose at an annualized 48,69% in January and 11.10% from a month earlier. In addition, Producer Prices rose 10.45% inter-month and 93.53% vs. January 2021.

In the meantime, the pair should keep the side-lined mood unchanged in the near term ahead of the monetary policy meeting by the Turkish central bank (CBRT) on February 17.

Despite finmin N.Nebati already envisaged inflation around 50% later in the year, it seems that scenario could materialize much sooner than anticipated, which should morph into extra pressure for both the domestic currency and the government in the form of actions to finally start tackling the issue.

What to look for around TRY

The pair keeps the multi-session consolidative theme well in place, always within the 13.00-14.00 range. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy – thus supporting the inflows into the lira - the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are a sure recipe to keep the domestic currency under pressure for the time being.

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.17% at 13.5389 and a drop below 13.2657 (55-day SMA) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

EUR/USD strengthened sharply through 1.14 yesterday and is making further ground today. Economists at Scotiabank expect the euro to race higher towards the 1.15 level on a break above 1.1480/85.

The main challenge for EUR/USD is now 1.1480/85

“Yesterday’s close above the 100-day MA (today support at 1.1429, followed by the figure) and gains above its downtrend from last June act as highlights in the EUR’s bullish drive off of the low 1.11s just last Friday.”

“The main challenge for the EUR is now 1.1480/85 where it peaked in March (followed by a sharp decline under 1.12). A break past these levels opens up a test of 1.15 followed by the mid-figure area (38.2% Fib of Jun-Jan move at 1.1558) as resistance.”

While the Bank of England (BoE) raised rates for the second consecutive month by 0.25 points as expected, the decision was much more finely balanced than expected with four MPC members voting for a larger 0.50 rate hike. With most G10 central banks either hiking or shifting to a more hawkish stance (ECB), the scope for GBP strength is limited, in the view of economists at MUFG Bank.

UK rate market had moved to price in too many rate hikes

“The updated inflation forecasts showed that inflation is set to fall sharply below target to 1.6% in three years time based on market rates. The inflation forecasts were based on market rates showing the policy rate rising up towards 1.4% in 2023. We believe the sharp undershoot of inflation relative to target in 3yrs time will help contain rates and limit the potential for GBP strength.”

“We do not envisage GBP breaking sustainably to the upside on the back of this MPC announcement. Any gain from the current spot rate toward the 1.4000 level versus the US dollar is unlikely to be sustained while the increased hawkishness of the ECB with high anticipation ahead of the ECB meeting on 10th March means a low in EUR/GBP just below 0.8300 may now have been established for the coming months.”

- GBP/USD added to its heavy intraday losses and refreshed daily low in reaction to stellar NFP report.

- The US economy added 467K new jobs, while Average Hourly Earnings posted a strong MoM growth.

- The risk-off mood further benefitted the safe-haven greenback and contributed to the intraday slide.

The GBP/USD pair continued losing ground through the early European session and dived to the key 1.3500 psychological mark following the release of the US employment report.

As investors digested the hawkish Bank of England, the GBP/USD pair witnessed some profit-taking slide on Friday and snapped five days of the winning streak to a two-week high. The intraday selling picked up pace after the headline NFP print smashed market expectations and showed that the US economy added 467K jobs in January.

Adding to this, the previous month's reading was also revised sharply higher from 199K reported earlier to 501K. Moreover, Average Hourly Earnings posted a strong 0.7% MoM and 5.7% YoY growth, which helped offset an unexpected uptick in the US unemployment rate and provided a much-needed respite to the US dollar bulls.

Apart from this, the prevalent risk-off mood – as depicted by a generally weaker trading sentiment around the equity markets – prompted aggressive short-covering around the safe-haven buck. This, in turn, was seen as a key factor behind the GBP/USD pair's latest leg of a sudden fall over the past hour or so.

Technical levels to watch

- EUR/USD eases some ground following fresh tops past 1.1480.

- US Non-farm Payrolls rose by just 467K jobs in January.

- The unemployment rate ticked higher to 4.0%.

The buying interest around the single currency remains well and sound at the end of the week and pushes EUR/USD back to the mid-1.1400s in the wake of US NFP.

EUR/USD retreats from YTD tops

EUR/USD keeps the positive stance on Friday after the US economy created 467K jobs during January, bettering expectations for a gain of 150K jobs. The December's reading was revised to 510K (from 199K).

Further data showed the jobless rate rose to 4.0% and the critical Average Hourly Earnings – a proxy for inflation via wages – rose 0.7% MoM and expanded 5.7% over the last twelve months. Another key gauge, the Participation Rate, improved to 62.2%.

EUR/USD levels to watch

So far, spot is gaining 0.05% at 1.1440 and faces the next up barrier at 1.1483 (2022 high Feb.4) followed by 1.1500 (200-week SMA) and finally 1.1676 (200-day SMA). On the other hand, a break below 1.1308 (55-day SMA) would target 1.1121 (2022 low Jan.28) en route to 1.1100 (round level).

- Canada lost over 200K jobs in January, much more than expected and the unemployment rate jumped to 6.5% from 6.0%.

- USD/CAD lurched higher amid loonie weakness and USD strength post-strong US labour market data.

The Canadian economy lost 200.1K jobs in January, well below the median economist forecast that the economy would have shed 117.5K jobs on the month, according to the latest release from Statistics Canada released on Friday. The January drop in employment comes after 78.6K jobs were gained in December 2021 (revised up from 5.4K). The headline drop was driven by an 82.7K drop in full-time employment and a 117.4K drop in part-time employment. The unemployment rate, meanwhile, jumped to 6.5% in January from 6.0% in December, larger than the expected rise to 6.2%.

Market Reaction

The combination of much weaker than expected Canadian labour market numbers combined with much stronger than expected US labour market figures has seen USD/CAD lurch higher. The pair is currently trading in the 1.2760s, up from near-1.2720 in pre-data trade and now up about 0.7% on the day. USD/CAD bulls will now be eyeing a test of last week's highs just shy of the 1.2800 level on bets that the latest labour market figures will have hawkish implications for Fed policy versus dovish implications for BoC policy.

- The US economy added 467K jobs in January, well above the 150K forecast, while wage growth was hotter than expected.

- The dollar saw kneejerk strength, US yields rose and US equities fell in pre-market trade as markets upped Fed tightening bets.

Nonfarm Payrolls (NFP) rose by 467K in January versus the median forecast for a 150K rise, data published by the US Bureau of Labor Statistics showed on Friday. That marked a slight deceleration from December's pace of job gains when 503K jobs were added (revised up from 199K). The massive headline beat on expectations was driven by a 444K rise in private nonfarm payrolls (versus the expected 150K gain). Manufacturing payrolls saw a slightly smaller than expected gain of 13K versus the 25K forecast.

Average Hourly Earnings rose at a stronger MoM pace of 0.7% in January, above the expected 0.5% MoM gain and faster than December's 0.5% MoM gain, which had been revised lower from 0.6%. That helped push the YoY rate of Average Hourly Earnings growth to 5.7% from 5.0% in December (which had been upwardly revised from 4.7%). That was well above the expected YoY rate of 5.2%.

The unemployment rate unexpectedly rose a tad to 4.0% from 3.9% in December, against expectations for it to remain unchanged. But the U6 Underemployment Rate continued to decline, dropping to 7.1% in January from 7.3% in December. Meanwhile, the participation rate jumped to 62.2% from 61.9% in December, taking it to within 1.2% of its pre-pandemic levels.

Market Reaction

The much stronger than expected headline job gain, combined with unexpectedly high wage growth and still very robust labour market slack figures has seen the US dollar jump higher in recent trade. The DXY, which was trading around the 95.30 mark prior to the data, has lept to session highs above the 95.50 level, though still trades down about 1.7% on the week and remains on course for its worst week since March 2020.

In terms of other asset classes; US bond yields have surged across the curve in anticipation that strong wage growth and better than expected labour market outcomes will encourage the Fed to tighten monetary policy more aggressively this year. The US 2-year jumped 7bps on the data to fresh post-pandemic highs around 1.28%, the 5-year lept roughly 8bps on the data to also hit fresh post-pandemic highs around 1.75% and is now eyeing late 2019 highs just under 1.80%. The 10-year also jumped about 8bps on the data and is now flirting with the 1.90% level and last month's post-pandemic highs. The 30-year saw a slightly less convincing bounce of about 6bps, meaning the 5s 30s spread fell to fresh post-pandemic lows near 20bps.

US stocks, meanwhile, took a hit in pre-market trade as the hot labour market data pumped Fed tightening fears. S&P 500 futures dipped towards 4450 from around 4480 prior to the data and now trade more than 1.5% lower on the day. The post-strong Amazon earnings upside seen during Asia Pacific trade now seems firmly in the rear-view mirror.

The government has just announced that it will appoint Jens Stoltenberg as the new Governor of Norges Bank. Economists at Nordea do not see this appointment having an effect on Norges Bank’s monetary policy due to two key reasons.

Jens Stoltenberg not to make an impact on Norges Bank’s monetary policy

“Monetary policy is decided by Norges Bank’s Monetary Policy and Financial Stability Committee consisting of the Governor and four more members. Norges Bank’s committee is a collegial committee. This means that the committee takes decisions by consensus and that members collectively stand behind the final decision.”

“Monetary policy decisions are based on the recommendation and analyses provided by Norges Bank’s Monetary Policy Department, which is staffed by professional civil servants. The Monetary Policy and Financial Stability Committee usually follow the advice given by the professional staff.”

- NZD/USD has been ebbing lower amid pre-NFP profit-taking though remains within recent intraday ranges and up on the week.

- The pair currently trades in the 0.6630 area, with technicians eyeing 0.6530 support and 0.6700 resistance.

Pre-US jobs data nerves has seen NZD/USD pare some its recent gains this Friday, with the pair dipping back under the 0.6650 level in recent trade and currently trading lower by about 0.4% on the session. Profit-taking in the run-up to the release of the January US labour market report has seen the pair slide back from earlier weekly highs in the 0.6680s to current levels around 0.6630, though some dip-buying is offering some support ahead of Thursday’s 0.6610 lows. On the week, the kiwi still trades with gains of about 1.4% versus the buck, though things are likely to be choppy post-US jobs data release and a close at current levels seems unlikely.

Regarding the upcoming US data; the latest report from the US Bureau of Labour Statistics is expected to reveal a slowdown in the pace of US job creation last month as the rapid spread of the Omicron Covid-19 variant disrupted normal labour market churn. That could manifest itself in a negative headline non-farm payroll employment change number. FX market participants will also be paying close attention to measures of labour market slack and wage growth, as the Fed worries that labour market tightness and resultant wage growth presents upside risks to near-term inflation.

Indeed, the US dollar will be choppy on the Average Hourly Earning component of the upcoming report. An upside surprise could send NZD/USD lower as traders price in a more aggressive Fed hiking cycle, while a downside surprise could send the pair higher. To the downside, traders should keep an eye on support in the form of last week’s lows in the 0.6530s, while to the upside, resistance in the form of this week’s highs in the 0.6680s and the 2021 lows at 0.6700 should be noted.

European Central Bank Governing Council member and Bank of France head Francois Villeroy de Galhau noted on Friday that while the direction of Eurozone monetary policy is clear, one shouldn't rush to conclusions about timing. Reffering to Thursday's monetary policy decision, Villeroy said that the ECB retains full optionality on the decision that will be made in March and in the following quarters. We will stick to our sequencing, he added, noting that QE tapering will come first ahead of rate lift-off.

Market Reaction

The euro has not seen any reaction to Villeroy's latest remarks.

- USD/CHF gained strong traction on Friday, though the move up lacked any obvious catalyst.

- A softer risk tone could benefit the safe-haven CHF and cap gains amid the USD selling bias.

- The focus remains on the release of the closely-watched US monthly jobs data, or NFP report.

The USD/CHF pair added to its intraday gains and shot back closer to the overnight swing high, around the 0.9235 region heading into the North American session.

The pair caught some fresh bids on the last day of the week and might now be looking to build on the overnight bounce from the weekly low. The strong intraday move up, however, lacked any obvious fundamental catalyst and could be attributed to some repositioning trade ahead of the key US NFP report. This, in turn, warrants some caution before placing aggressive bullish bets around the USD/CHF pair amid the prevalent US dollar selling bias.

The USD languished near a two-and-half-week low touched earlier this Friday and was pressured by the post-ECB strength in the shared currency. Apart from this, retreating US Treasury bond yields turned out to be another factor that undermined the greenback. Conversely, a generally weaker tone around the equity markets should benefit the Swiss franc's safe-haven status and further contribute to keeping a lid on any meaningful upside for the USD/CHF pair.

The market focus will remain glued to the closely-watched US monthly employment report, which is expected to show that the economy added 150K jobs in January. Given Wednesday's awful ADP report on private-sector employment, there is a considerable risk of a negative surprise from the official figures. This would be enough to exert additional pressure on the already weaker greenback and attract fresh selling around the USD/CHF pair.

Technical levels to watch

Bank of England Chief Economist and Monetary Policy Committee member Huw Pill said on Friday that we should not anticipate rate hikes will be aggressive in the medium-term, according to Reuters.

Market Reaction

There has not been any notable reaction to the latest cautious comments from Pill, with GBP/USD continuing to consolidate in the mid-1.3500s as US labour market data is eyed and EUR/GBP continuing to trade close to six-week highs in the 0.8450 area.

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly jobs report for January later this Friday at 13:30 GMT. The Canadian economy is expected to have lost 117.5K new jobs during the reported month as against a growth of 54.7K reported in December. Adding to this, the unemployment rate is anticipated to rise from 5.9% to 6.2% in January and the Participation Rate is likely to remain unchanged at 65.3%.

Analysts at NBF offered a brief preview and explained: “We are calling for a -175K print that could lead to a 3-tick increase of the unemployment rate to 6.3%, assuming the participation rate fell back to 64.9%. With the health situation already improving, we expect January’s losses to be quickly erased.”

How could the data affect USD/CAD?

Ahead of the key release, a fresh bout of a short-covering move pushed the USD/CAD pair to a four-day high, around the 1.2735 region. That said, a weaker tone around the US dollar should hold back traders from placing aggressive bets and cap gains amid bullish crude oil prices, which tend to underpin the commodity-linked loonie.

Meanwhile, the data is likely to be overshadowed by the simultaneous release of the US monthly jobs report (NFP), suggesting that any immediate market reaction is more likely to be short-lived. Nevertheless, any significant divergence from the expected readings would influence the Canadian dollar and infuse some volatility around the major.

From a technical perspective, any subsequent move up might confront some resistance near the 1.2765 region. Some follow-through buying should allow bulls to make a fresh attempt to conquer the 1.2800 round-figure mark. This is closely followed by the January swing high, around the 1.2815 region, which if cleared decisively should pave the way for a further near-term appreciating move.

On the flip side, the 1.2700 mark now seems to protect the immediate downside. Failure to defend the mentioned support would make the USD/CAD pair vulnerable to retest the weekly low, around mid-1.2600s. A convincing break below would expose the very important 200-day SMA, currently around the 1.2515 region, and the key 1.2500 psychological mark.

Key Notes

• Canadian Jobs Preview: Forecasts from five major banks, Omicron to tame employment growth

• USD/CAD retakes 1.2700, bullish oil prices might cap gains ahead of US/Canadian jobs data

• USD/CAD Analysis: Traders seem non-committed ahead of US/Canadian jobs data

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

- Spot silver is stable in the $22.50 area ahead of the January US jobs report.

- Any upside wage growth surprise risks triggered a hawkish repricing of Fed tightening expectations, which could send XAG/USD towards $22.00.

Spot silver (XAG/USD) prices were stable close to the $22.50 per troy ounce level on Friday in the run-up to the release of the US January jobs report at 11330GMT. Since yesterday’s volatile price action, which saw XAG/USD lurch lower towards $22.00 before rebounding sharply, trade has calmed in typical pre-US jobs report fashion, as traders refrain from placing big bets. Fed officials have emphasised this week that the timing and pace of tightening this year is data-dependent, and that measures of wage growth are a key metric they are keeping an eye on. That suggests that any sizeable upside surprise in the upcoming Average Hourly Earnings growth data (which are released as part of the jobs report) could see a hawkish repricing of Fed tightening expectations.

After Thursday’s hawkish BoE/ECB due sent global developed market bond yields lurching higher, strong wage growth numbers could put further upwards pressure on yields, creating downside risks for precious metals. Higher yields increase the opportunity cost of holding non-yielding assets like silver. In this scenario, weekly lows at $22.00 will come into focus, with any bearish break opening the door to a run lower towards the 2021 double bottom at $21.50. In an environment where three of the world’s most important central banks (Fed, ECB, BoE) are all clearly moving towards a removal of stimulus/tightening of financial conditions, the long-term bullish case for silver is weakened.

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data. The popularly known NFP report is scheduled for release at 13:30 GMT and is expected to show that the economy added 150K new jobs in January, down from the previous month's disappointing reading of 199K. The unemployment rate is expected to hold steady at 3.9%. Given Wednesday's awful US ADP report on private-sector employment, market participants are bracing for a negative surprise from the official figures.

As Joseph Trevisani, Senior Analyst at FXStreet, explains: “The January job signs are poor. Though the correlation between ADP and NFP is not impressive when private payroll losses are combined with the labor market indicators, the odds of a negative month rise considerably.”

Analysts at Citibank were more pessimistic and explained: “We expect a soft 70K increase in January Nonfarm Payrolls, although with substantial two-sided risks due to the greater than usual uncertainty surrounding worker shortages related to the spread of the Omicron variant. That said, we expect a clearer continued downward trend in the unemployment rate to emerge in coming months.”

How could the data affect EUR/USD?

Heading into the key release, the EUR/USD pair added to the overnight hawkish ECB-inspired strong gains and shot back closer to the January swing high, around the 1.1475-1.1480 region. The momentum was further sponsored by modest US dollar weakness. A disappointing NPF print would be enough to exert additional pressure on the already weaker greenback and set the stage for a further near-term appreciating move for the major. Conversely, a stronger reading might provide some respite to the USD bulls, though any immediate market reaction is likely to be short-lived amid diminishing odds for a 50 bps Fed rate hike in March. This, in turn, suggests that the path of least resistance for the pair is to the upside.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the major: “The 20-period SMA on the four-hour chart is about to make a bullish cross above the 200-period SMA, which could be taken as a sign that buyers remain in control of EUR/USD's action. The Relative Strength ındex (RSI) indicator on the same chart, however, is holding above 70, suggesting that the pair might need to make a technical correction before stretching higher.”

Eren also outlined important technical levels to trade the EUR/USD pair: “On the upside, 1.1480 (static level) aligns as the first resistance before 1.1500 (psychological level) and 1.1550 (static level). Supports are located at 1.1400 (psychological level), 1.1360 (static level) and 1.1320 (200-period SMA, 100-period SMA).”

Key Notes

• Nonfarm Payrolls Preview: Win-win-win for the dollar? Low expectations, weak greenback point higher

• ADP Employment Change and NFP: Omicron or ominous?

• EUR/USD Forecast: Euro rally could lose momentum on US jobs report

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

- EUR/USD pushes higher and targets the 2022 peaks near 1.1480.

- The 200-week SMA at 1.1500 comes next on the upside.

EUR/USD keeps the rally well and sound and already trades closer to the YTD tops past 1.1480 on Friday.

The ongoing strength is now poised to extend further considering the recent price action. Against that, the YTD top at 1.1482 (January 14) emerges as the next target closely followed by the 200-week SMA at 1.1500. Between 1.1500 and 1.1600 there are no resistance levels of note, leaving the October 2021 top at 1.1692 as a potential longer-term target.

The recent breakout of the 5-month resistance line, today near 1.1415, leaves extra gains well on the cards. In the longer run, the negative outlook is seen unchanged below the key 200-day SMA at 1.1676.

EUR/USD daily chart

- DXY moves further south and clinches fresh lows near 95.10.

- Further down emerges the 5-month support line near 95.00.

DXY comes under extra downside pressure and approaches the 95.00 zone at the end of the week.

While the index flirts with the 100-day SMA at 95.18, a breach of this level should expose the 5-month support line around 95.00. The loss of the latter opens the taps for extra weakness to, initially, the 2022 lows near 94.60 (January 14).

In the near term, the 5-month line near 95.00 is expected to hold the downside for the time being. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.48.

DXY daily chart

- EUR/JPY extends Thursday’s sharp uptick to the 132.00 area.

- Next on the upside comes the October 2021 tops near 133.50.

EUR/JPY rose sharply on Thursday following the ECB gathering, taking out some key barrier on its way up and meeting some resistance in the 132.00 neighbourhood on Friday.

In light of the recent price action, further recovery in the cross should be in the pipeline. Against this, further upside initially targets 132.53 (high November 4) followed by 132.91 (high October 29) and finally the October 2021 peak at 133.48 (October 20).

In the near term, extra upside looks likely above the 3-month support line, today near 130.90. In the longer run, and while above the 200-day SMA at 130.45, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

"We expect further modest tightening in the coming months if things play out as we expect," Bank of England Chief Economist Huw Pill said on Friday, as reported by Reuters.

Additional takeaways

"We are trying to avoid the emergence of second-round effects from energy shocks."

"We have to be cautious about communicating where the neutral rate is."

"Key to see our assumption that we don't see persistence in wage and cost developments."

"If we see developments not consistent with that assumption then we would have to consider further action."

"Inflation could fall below target depending on energy markets."

"As recovery progresses, we are looking for normalisation and inflation returning to target."

Market reaction

The British pound remained under modest selling pressure following these comments. As of writing, the GBP/USD pair was down 0.33% on a daily basis at 1.3552.

EUR/GBP has surged higher after holding key long-term support at 0.8281/17. A close above 0.8424 today would not only see a base established but also a large bullish “reversal week”, clearing the path to see further gains, economists at Credit Suisse report.

Close above 0.8424 to establish a base and a bullish “reversal week”

“The ggressive rally from key long-term support at 0.8281/17 after the ECB leaves not only a base threatening but also a potential bullish ‘reversal week’. A close above 0.8424 today is needed to confirm, which we would then look to provide the platform for a more sustained recovery. We would then see resistance next at 0.8465/74, then what we expect to be tougher resistance at the 200-day average at 0.8512/16, with a cap expected here at first.”

“The ‘measured base objective’ is seen at 0.8563.”

“Support is seen at 0.8419 initially, then 0.8404, with 0.8362 ideally holding to see an immediate upside bias maintained.”

EUR/JPY has surged above its downtrend from last October but more importantly its January highs. Analysts at Credit Suisse look for strength to extend to the top of the eight-month downtrend channel from June last year at 132.92/99.

Support moves to 130.50

“Resistance is seen next at the 78.6% retracement of the Q4 2021 fall at 132.18. Whilst this should be allowed to cap at first, a break in due course should see strength extend to 132.58 next ahead of what we expect to be tougher resistance at the top of the eight-month downtrend channel from June last year at 132.92/99. We expect this to then remain a tougher barrier.”

“Support is seen a t 131.44 initially, then 131.21 ahead of the back of the broken uptrend at 130.92. An immediate upside bias though should be maintained whilst above the overnight low and 200-day average at 130.50.”

A dramatic session for EUR/USD has seen the market surge sharply higher post the European Central Bank (ECB). A close above key price resistance at 1.1483/95 would mark a more important base, allowing further gains, economists at Credit Suisse report.

EUR/USD to see a more important base established above 1.1483/95

“A weekly close above key resistance at the January and March 2020 highs at 1.1483/95 would be seen to complete a base to provide the platform for a more sustained move higher. We would then see resistance next at 1.1513/24, then the 38.2% retracement of the 2021/2022 fall at 1.1558.”

“Whilst we would look for a fresh cap at 1.1558, certainly at first, a break in due course can see strength extend to test what we would look to be tougher resistance from its falling 200-day average, now seen at 1.1678.”

“Support is seen at 1.1445 initially, with an immediate upside bias seen whilst above 1.1414. Below can see a pullback to 1.1376/71, then 1.1331, but with a break below 1.1268/66 needed to see the risk turn lower again.”

- Retail Sales in the euro area fell sharply in December.

- EUR/USD stays in the positive territory near 1.1460.

Retail Sales in the euro area fell by 3% on a monthly basis in December, the data published by Eurostat showed on Friday. This print missed the market expectation for a decrease of 0.5%. In the EU, Retail Sales contracted by 2.8%.

"In December 2021 compared with December 2020, the calendar-adjusted retail sales index increased by 2.0% in the euro area and by 2.6% in the EU," the publication further read. "The annual average level of retail trade for the year 2021, compared with 2020, increased by 5.0% in the euro area and by 5.5% in the EU."

Market reaction

These figures don't seem to be having a noticeable impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was up 0.2% on the day at 1.1460.

- GBP/USD witnessed some selling on Friday and snapped five days of the winning streak.

- A more hawkish BoE decision should act as a tailwind for sterling and limit the downside.

- Investors also seemed reluctant to place aggressive bets ahead of the key US jobs data.

The GBP/USD pair remained on the defensive through the first half of the European session and was last seen hovering near the lower end of its daily trading range, around the 1.3570 region.

Having struggled to find acceptance above the 1.3600 mark, the GBP/USD pair witnessed some selling on Friday and for now, seems to have snapped five successive days of the winning streak. The downtick could be solely attributed to some profit-taking following a strong runup to a two-week high, around the 1.3625-1.3630 area touched after the Bank of England decision on Thursday.

It is worth recalling that the BoE hiked its benchmark interest rate by 25 bps to 0.50%. This marked the first back-to-back raises since 2004 and was backed by a more hawkish vote distribution, which showed that four out of nine MPC members backed an aggressive 50 bps increase in borrowing costs. This, in turn, should underpin sterling and limit losses for the GBP/USD pair.

On the other hand, the US dollar languished near a two-and-half-week low touched earlier this Friday, though some follow-through uptick in the US Treasury bond yields extended some support. The USD price dynamics, however, did little to provide any meaningful impetus to the GBP/USD pair. Moreover, investors seemed reluctant ahead of the release of the US NFP report.

The closely-watched monthly jobs data, due later during the early North American session, is expected to show that the US economy added 150K jobs in January, down from 199K in the previous month. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the GBP/USD pair, allowing traders to grab some short-term opportunities.

Technical levels to watch

- EUR/USD extends the rally to the 1.1470 region.

- Yields of the German 10y Bund record tops near the 0.20% level.

- Markets’ attention will be on the release of US Nonfarm Payrolls.

The buying pressure around the European currency remains well and sound and now lifts EUR/USD to fresh 3-week highs near 1.1470 on Friday.

EUR/USD bolstered by ECB, now looks to US NFP

EUR/USD advances for the sixth consecutive session for the first time since late-August/early-September 2021 and already trades at shouting distance from the YTD peaks in the 1.1480/85 band (January 14).

The renewed selling pressure around the greenback coupled with the surprising hawkish tilt at the ECB on Thursday lent extra wings to the pair’s weekly bounce, which already surpasses the 3% since 2022 lows recorded on January 28 near 1.1120.

In the wake of the ECB event and pari passu with the strong upside in the pair, yields of the key 10y German Bund advanced to new highs around 0.20%, an area last traded in February 2019.

In the domestic docket, German Factory Orders expanded 2.8% MoM in December and the Construction PMI improved to 54.4 in January. In the broader Euroland, Retail Sales for the month of December come next.

Across the pond, all the attention will be on the publication of the Nonfarm Payrolls and the Unemployment Rate for the month of January.

What to look for around EUR

EUR/USD extends the optimism for yet another session on Friday and approaches the 2022 high, always bolstered by the prevailing risk-on sentiment, which was in turn boosted by the hawkish message from the ECB event on Thursday. Rising speculation of a potential ECB lift-off in September/December continues to underpin the solid upside momentum in the pair, which remains also propped up by higher yields in the German money markets.

Key events in the euro area this week: EMU Retail Sales (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.20% at 1.1457 and faces the next up barrier at 1.1482 (2022 high Jan.14) followed by 1.1500 (200-week SMA) and finally 1.1676 (200-day SMA). On the other hand, a break below 1.1308 (55-day SMA) would target 1.1121 (2022 low Jan.28) en route to 1.1100 (round level).

- USD/CAD gained some positive traction for the second successive day on Friday.

- The uptick lacked any fundamental catalyst and could fizzle out rather quickly.

- The market focus will remain glued to the key US/Canadian employment details.

The USD/CAD pair added to its intraday gains and shot back above the 1.2700 round-figure mark during the early part of the European session.