- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 03-02-2022

Goldman Sachs (GS) cites survey data indicating a surge in absenteeism during the month to expect Omicron-led temporary declines in the US Nonfarm Payroll (NFP) data on the order of 500-1000K.

GS also mentions, “We estimate an unchanged unemployment rate of 3.9%—in line with consensus—reflecting likely declines in both household employment and labor force participation due to the virus wave.”

It’s worth noting that a negative surprise from US ADP Employment Change for January, to -301K versus +207K forecast, hints at a negative print of the headlines US job numbers. However, the broad consensus is still positive and hence may surprise the markets in case of an upbeat figure.

The same should propel the US dollar to consolidate the weekly losses, the biggest since March 2020.

Read: Nonfarm Payrolls Preview: Win-win-win for the dollar? Low expectations, weak greenback point higher

- The Australian dollar weakened vs. the kiwi, attributed to central bank policy divergence.

- On Friday at 00:30 GMT, the RBA will release its Statement of Monetary Policy (SoMP), with its updated forecasts.

- AUD/NZD is downward biased in the near term, as bears eye the 1.0700 figure.

The AUD/NZD retreats from a weekly high at 1.0770 during the day to 1.0715 at the time of writing. On Thursday, the FX complex benefitted risk-sensitive currencies, though, in the pair, the NZD was in charge.

The Australian dollar was on the wrong foot on Thursday. In part, RBA’s stubbornness to push back hiking rates despite ending the Quantitative Easing (QE) program boosts the NZD, which is on its way for the third consecutive rate hike in each of the last three RBNZ meetings. Central bank policy divergence between the RBA and the RBNZ would favor the latter.

In the meantime, at 00:30 GMT, the Reserve Bank of Australia (RBA) would unveil its State of Monetary Policy (SoMP) report to update its forecasts, and that would provide AUD/NZD traders some impetus if it gives any hawkish signal. Market participants widely expect it to maintain a dovish stance.

Meanwhile, the economic docket for New Zealand just featured Building Permits for December on its monthly reading. The figures came in line with the previous reading, up 0.6%.

AUD/NZD Price Forecast: Technical outlook

The AUD/NZD remains upward biased, though it faced strong resistance around 1.0770 on Thursday, at the beginning of the Asian session, a level that could not be recovered through the day. That said, the AUD/NZD pair formed a bearish engulfing candle pattern that covers the price action of the last two trading days.

That said, the AUD/NZD in the near term is downward biased, and its first support would be 1.0700. A breach of the latter would expose January 28 daily low at 1.0655, followed by the January 24 cycle low at 1.0632.

“Cabinet Ministers believe there is ‘50/50’ chance that Boris Johnson will be forced out of office after four of his most senior aides quit Downing Street and his Chancellor publicly rebuked him,” said the Times while conveying political hardships for UK PM Johnson during early Friday morning in Asia.

More to come.

- GBP/USD remains sidelined at two-week top after five-day uptrend.

- MACD, RSI signal further upside but key trend lines, 200-DMA challenge bulls.

- Sellers need validation from 100-DMA, Fibonacci retracement levels can add to trading filters.

GBP/USD bulls take a breather around a fortnight high surrounding 1.3600, during the sixth positive day amid Friday’s Asian session.

In doing so, the cable pair justifies the clear upside break of the 50% Fibonacci retracement (Fibo.) of the July-December 2021 downside, as well as sustained trading beyond the 100-DMA.

Also keeping the GBP/USD buyers hopeful is the firmer RSI line, not overbought, together with the MACD line that teases bulls.

That said, the quote is up for further advances towards a descending resistance line from July, close to 1.3635, as an immediate hurdle.

Following that, the 61.8% Fibo. and a resistance line from September, respectively near 1.3670 and 1.3690, will challenge the GBP/USD upside. It’s worth noting that the 200-DMA level of 1.3712 becomes the last defense for the bears.

Alternatively, pullback moves will initially aim for the 50% Fibo. and 100-DMA, surrounding 1.3570 and 1.3510, before declining towards the latest swing low, also comprising the 23.6% Fibonacci retracement, around 1.3350.

During the pair’s moves between 1.3510 and 1.3350, September’s low near 1.3410 will act as an intermediate halt.

Overall, GBP/USD is likely to extend the recent upside but the road to the north will be a bumpy one.

GBP/USD: Daily chart

Trend: Further upside expected

- AUD/USD dribbles at seven-day top after recently sluggish performance, stay positive on the week.

- Soft USD battles sour sentiment, mixed Aussie data to confuse pair traders.

- Key central banks played their role, US economics also flashed mixed signals.

- RBA SoMP will be closely watched considering strong inflation and policymakers’ refrain from rate hikes, US NFP is important too.

AUD/USD bulls seem running out of steam around the weekly top near 0.7140 amid the initial Asian session on Friday.

The Aussie pair refreshed seven-day high before stepping back from 0.7168. The pullback moves, however, remain lackluster as await the quarterly release of the Reserve Bank of Australia’s (RBA) Statement of Monetary Policy (SoMP). Also challenging the AUD/USD bulls could be the market’s familiar pre-NFP anxiety.

Starting with the central bank actions, the European Central Bank (ECB) and Bank of England (BOE) hawks raised inflation concerns the previous day and propelled the US Treasury yields the most in a week, also drowning the equities. However, the US Dollar Index (DXY) couldn’t be saved from a five-day fall that pushes the greenback gauge towards the biggest weekly fall since March 2020.

That said, the BOE raised benchmark interest rates by 0.25% whereas the ECB refrained from rejecting sooner rate hikes and rather signaled a major policy change brewing, without giving many details though.

Elsewhere, US ISM Services PMI for January and Q4 Nonfarm Productivity came in strong but Factory Orders for December and Q4 Unit Labor Costs weakened, which in turn kept the trades on their toe ahead of the key US Nonfarm Payrolls (NFP) for January. At home, Australia Trade Balance for December eased below 9423M to 8356M as Exports and Imports both decline to 1.0% and 5.0% versus 2.0% and 6.0% respective priors. However, Aussie Building Permits jumped to 8.2% MoM during the stated month against -1.0% market forecast and +3.6% previous readouts. Additionally, the National Australia Bank’s (NAB) Business Confidence also rallied to +18, beyond -10 market consensus and -1 prior.

Moving on, the RBA will release the quarterly SoMP including the Aussie central bank’s economic forecasts and outlook on economic risks at 00:30 GMT.

“The RBA SOMP could create volatility, but it’s difficult to envisage it not being consistent with recent dovish rhetoric, so we may well just coast into the weekend,” said ANZ ahead of the outcome.

The statement will be closely examined amid the recently high inflation fears pushing the major economies towards the rate hike while the RBA rejects any such concerns. Should there be an upward revision in the inflation and GDP forecasts, coupled with the statements suggesting hawkish bias, AUD/USD prices will further room for further upside. Though, odds of witnessing cautious remarks can’t be ruled out, which in turn may allow traders to consolidate recent gains.

Technical analysis

AUD/USD seesaws between 50-SMA and 200-SMA on the four-hour (4H) chart, respectively around 0.7095 and 0.7185. However, receding bullish bias of MACD and repeated failures to cross a fortnight-old resistance line, near 0.7145 at the latest, keep sellers hopeful.

- AUD/JPY grinds higher at two-week top, bracing for the first weekly gains in five.

- Market sentiment remains sour on hawkish central banks but JPY drops on firmer US Yields, virus woes in Japan.

- Aussie data came in mixed the previous day, Japan had light calendar.

- RBA SoMP will be eyed for rate hike concerns as RBA statement, Governor Lowe rejected the same despite strong inflation.

AUD/JPY bulls keep reins around a fortnight high past 82.00 as traders await RBA SoMP during early Friday morning in Asia.

The cross-currency pair cheered softer Japanese yen and comparatively better Aussie data, despite being mixed, to snap the four-week downtrend ahead of the key Aussie event.

US government bond yields rose the most in a week the previous day as the European Central Bank (ECB) and Bank of England (BOE) hawks raised inflation concerns. Among them, the BOE raised benchmark interest rates by 0.25% whereas the ECB refrained from rejecting sooner rate hikes and rather signaled a major policy change brewing, without giving many details though.

It’s worth noting, however, that the losses in equities and market’s cautious sentiment ahead of today’s US monthly jobs report, as well as the Reserve Bank of Australia’s (RBA) Statement of Monetary Policy (SoMP), challenges the AUD/JPY bulls of late.

Talking about data, Australia Trade Balance for December eased below 9423M to 8356M as Exports and Imports both decline to 1.0% and 5.0% versus 2.0% and 6.0% respective priors. However, Aussie Building Permits jumped to 8.2% MoM during the stated month against -1.0% market forecast and +3.6% previous readouts. Additionally, the National Australia Bank’s (NAB) Business Confidence also rallied to +18, beyond -10 market consensus and -1 prior.

RBA SoMP will convey the Aussie central bank’s economic forecasts and outlook on economic risks at 00:30 GMT. The statement will be closely examined amid the recently high inflation fears pushing the major economies towards the rate hike while the RBA rejects any such concerns. Should there be an upward revision in the inflation and GDP forecasts, coupled with the statements suggesting hawkish bias, AUD/JPY prices will further room for further upside. Though, odds of witnessing cautious remarks can’t be ruled out, which in turn may allow traders to consolidate recent gains.

Technical analysis

Although rebound from late December 2021 levels surrounding 80.40 keeps AUD/JPY buyers hopeful, a monthly resistance line precedes a convergence of the 100 and 200-DMAs, respectively near 82.30 and 82.50, to restrict the short-term upside of the pair.

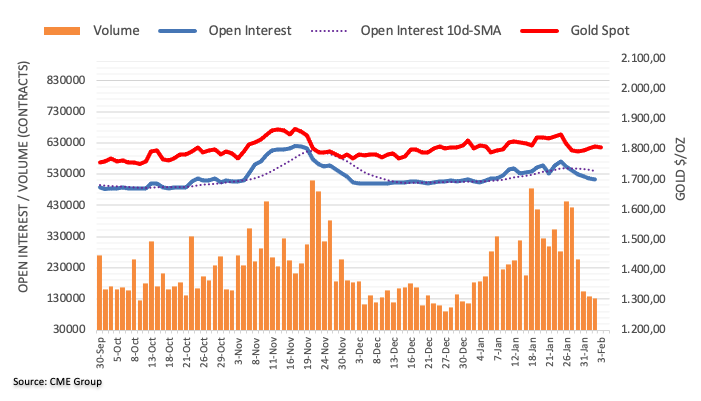

- Gold is consolidating at a critical area on the daily charts.

- Bears are monitoring the US dollar for further downside as we head into the NFP.

- Bulls will note the shortness of the dollar and look for some opportunities to buy it on the cheap.

The price of gold settled in the spot market on Thursday back in the $1,800's. It made a high of $1,809 and printed a low of $1,788.68. Central banks were the theme and the hawkishness has stripped the yellow metal down a level. The Bank of England and the European Central Banks are firming up on monetary policy, in line with the Fed which is raising the opportunity cost of holding non-yielding bullion.

However, besides the hawkishness at central banks, the US dollar has come unstuck this week from the Fed-bid. A chorus of Fed officials, weaker jobs data and a slide in ISM services from the prior month is weighing on the greenback that fell below 96 DXY on Thursday.

Following an initial drop, gold has found some solace ahead of Friday's US Nonfarm Payrolls data. This ''will be keenly watched by precious metal market participants, but we expect a weak jobs print is unlikely to sway the Fed from its decisively hawkish tone,'' analysts at TD Securities explained. However, the analysts also argued that ''a weaker-than-expected NFP report would reinforce the recent USD selloff.''

''It works through two channels: rates and risk. Risk sentiment would likely welcome easier financial conditions, especially if Omicron explains the growth weakness. That said, our dashboard shows the USD reaching oversold levels again so we use this recent pullback as a buying opportunity ahead of next month's Fed meeting.''

Related to gold, the analysts explained that they ''expect the central bank to look past recent weakness as being related to Omicron's fallout, which suggests the precious metals complex will remain under pressure. Indeed, quantitative easing has influenced all asset prices by boosting liquidity premiums, which ignites fears that quantitative tightening will particularly weigh on asset prices including gold.''

The analysts added that ''with this market framework in mind, prices are vulnerable to a deeper consolidation in support of our tactical short gold position. With that said, CTAs have also resumed liquidations, and could once again target a net short position if markets fail to hold above $1803/oz on the day.

Gold technical analysis

As stated at the start of the week's analysis in the Chart of the Week, ''should this playout, and if the bears commit ... additional supply could be the straw that breaks the camel's back for a sizeable continuation to crack the trendline support as follows:

Gold live market

The wick to the downside could draw in some subsequent offers and the NFP's could be the catalyst. With that being said, if the greenback buckles again, then the focus should be on the upside for a deeper correction towards the higher Fibonaccis.

The M15 DXY chart is offering a bearish bias as follows:

I the prior analysis, however, it was stated that '' if the US dollar continues on its southerly trajectory, then the neckline of the M would be the last defence for a restest of the wedge resistance the $1,850's once again'':

- The British pound rallied up to 150-pips on Thursday’s BoE meeting.

- A mixed market mood was no excuse for the GBP to surge vs. the JPY.

- GBP/JPY is upward biased, as bulls get a breather on their way to 157.00.

On Thursday, the British pound surges courtesy of a Bank of England (BoE) rate hike, increasing to 0.50% their interest rates for the first time since 2008. At the time of writing, the GBP/JPY is trading at 156.39.

The market mood is downbeat, portrayed by US equities recording losses. Meantime, in the FX complex, safe-haven peers, like the JPY and the greenback, record losses against riskier ones, led by the GBP and the antipodeans.

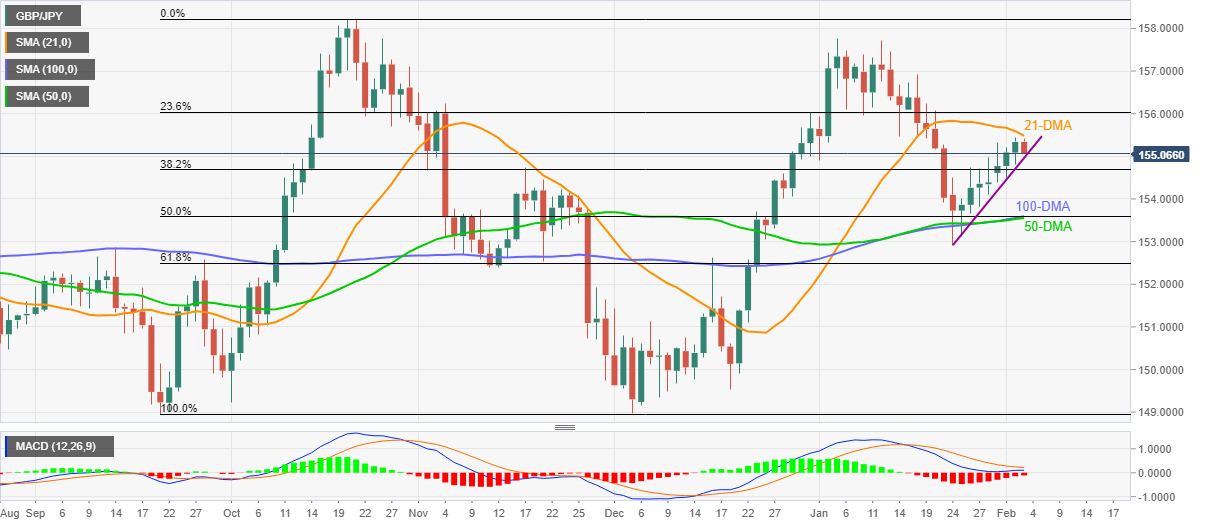

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY remained subdued in the overnight session, meandering around the central daily pivot around 155.19, ahead of the BoE monetary policy decision. Once the news crossed the wired, the GBP/JPY rose 120-pips towards the January 18 daily high, though it fell short 20-pips at 156.50, to retrace later to the R3 daily pivot at 156.21 as BoE’s Chief Andrew Bailey eased the monetary policy decision tone.

That said, the GBP/JPT, as shown by the daily moving averages (DMAs) residing below the spot prices, is upward biased. As the uptrend accelerates, the GBP/JPY would face resistance on the January 18 daily high at 156.90. A breach of the latter would expose a five-month-old downslope trendline lying in the 157.35-55 range. An upside break above would expose the October 20 cycle high at 158.21.

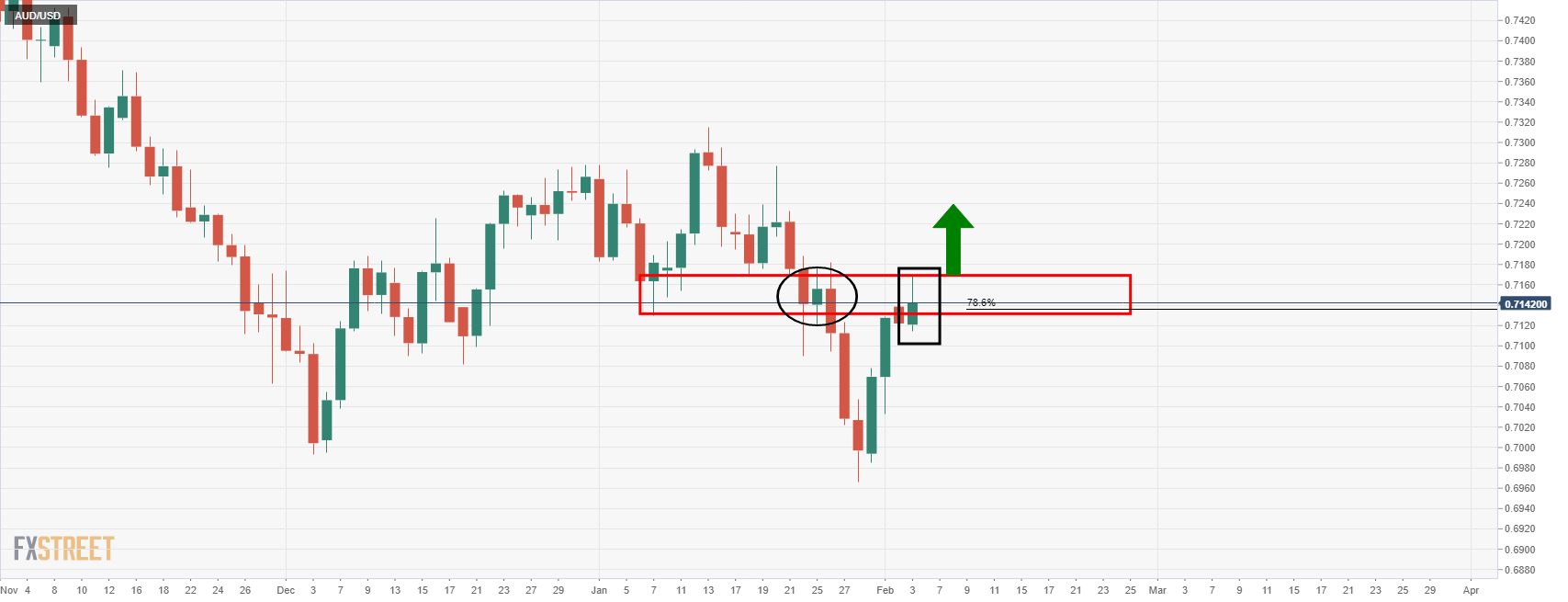

- AUD/USD is trapped at a wall of daily resistance.

- Traders need to see a shift out of H4 resistance ad support.

The day ahead will be key for AUD/USD that is technically overstretched, relatively so, with US Treasury yields rising across the curve after major central banks on Thursday said that there is considerable concern regarding the inflation environment.

''This should see local rates markets open to some selling pressure before the Reserve Bank of Australia Statement of Monetary Policy,'' analysts at ANZ Bank said. Therefore, the focus is on the resistance that the Aussie is facing on the daily chart as follows:

AUD/USD prior analysis

In the prior analysis, AUD/USD Price Analysis: Bears are on the lookout for an opportunity in the deceleration of the bullish daily correction, the resistance was noted as follows:

Bears were in anticipation of a Dijo close followed by a Bearish Engulfing as follows:

AUD/USD live market

Instead, we have seen a Bullish Engulfing which means there is nothing for traders to do on the downside, for now.

AUD/USD H4

The price is consolidated at this juncture and there needs to be a break of H4 structure, one way or the other before a trend would be offering trader's an opportunity.

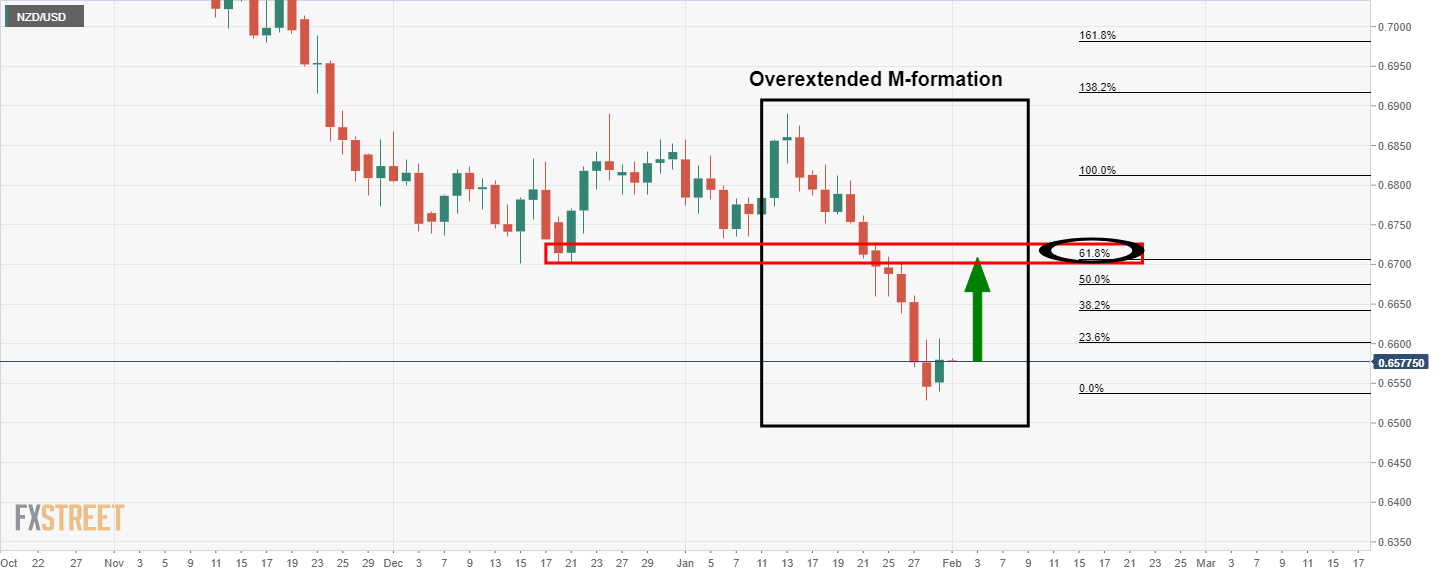

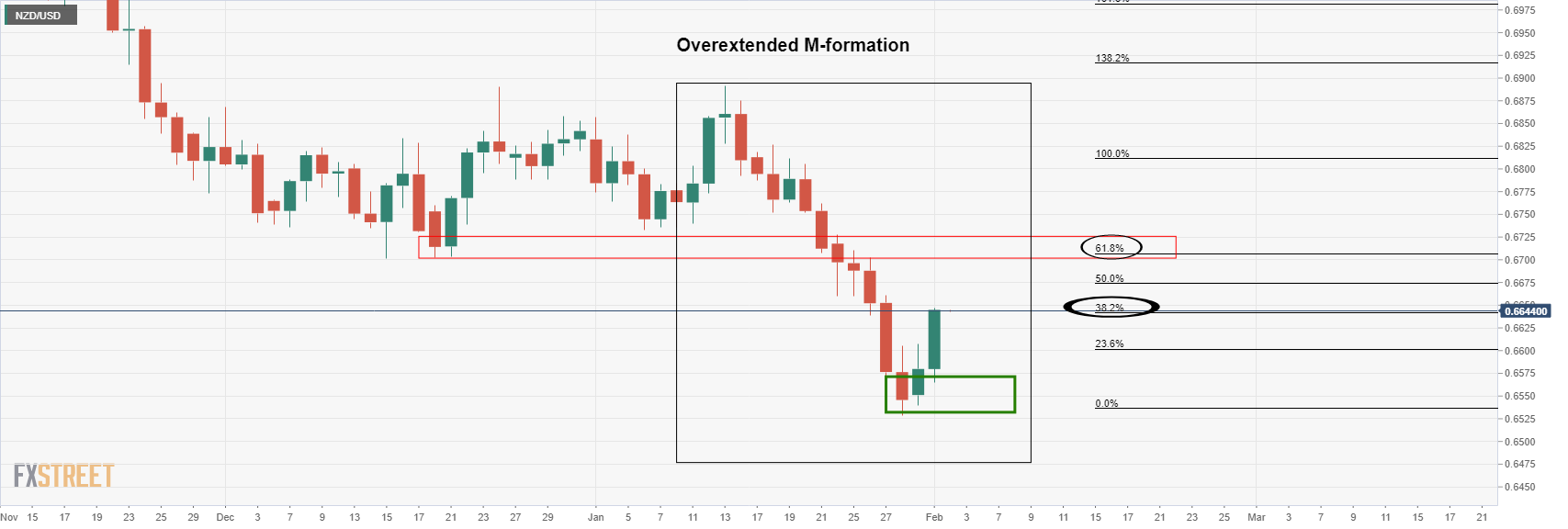

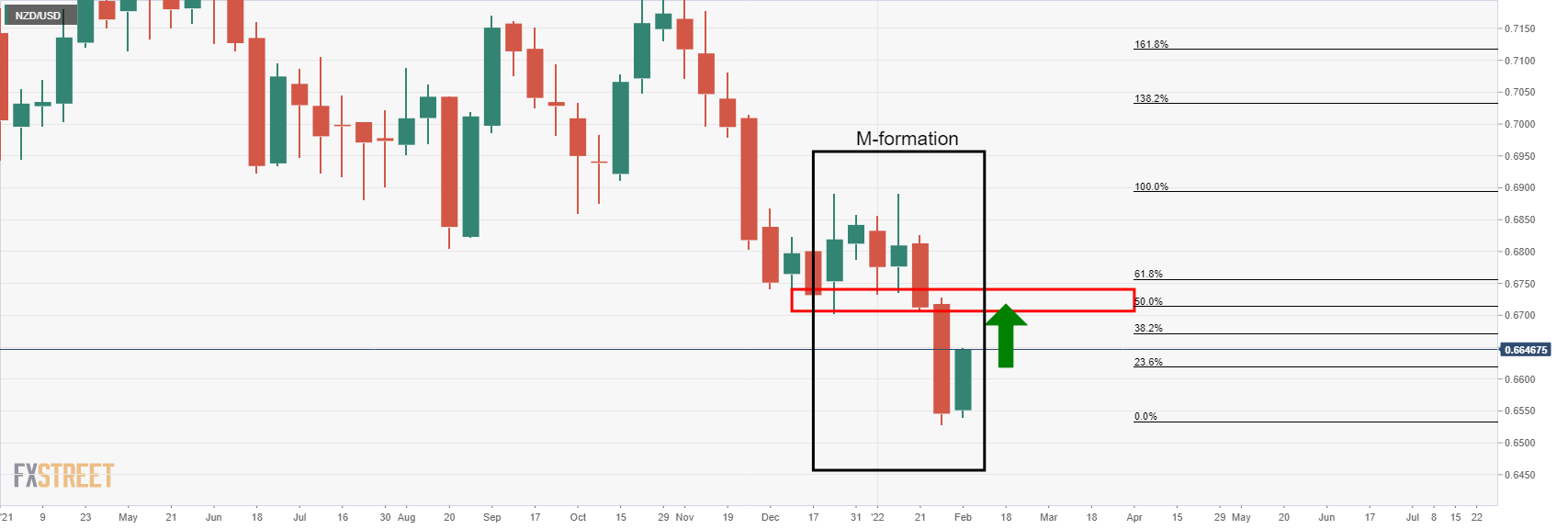

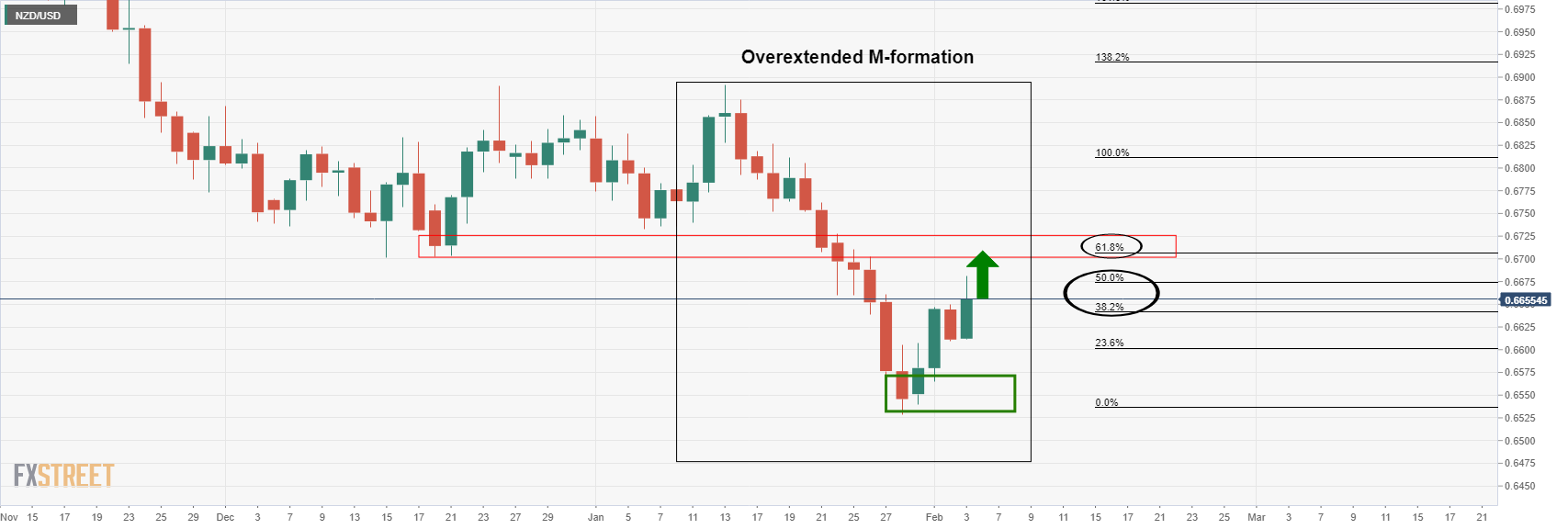

- NZD/USD bulls are homing in on the 61.8% golde ratio.

- Markets await the NFP key event which could propel the kiwi higher.

At 0.6661, the bulls are in charge and the bird of 0.5% higher on Thursday's business in the remaining hour or so of the North American session. The price has climbed from a low of 0.6609 to score a high of 0.6681 so far as traders await the outcome of Friday's US Nonfarm Payrolls event.

Thursday's focus was on the two central banks meeting, the Bank of England, which hiked by 0.25%, and the European Central Bank which sounded off a more hawkish than expected tone.

''The Kiwi is higher this morning, riding on the coattails of the EUR, which surged following comments from ECB President Lagarde that were perceived as hawkish. For the most part, Kiwi was an outperformer overnight, and only really lost ground to the EUR,'' analysts at ANZ Bank explained.

''The overall magnitude of the Kiwi rally was pretty tame though, which is probably to be expected ahead of key US jobs data tonight that has the potential to marginally reshape expectations for Fed policy, which will in turn have a bearing on the USD.''

Critical events coming up

The focus will now be on Friday's Nonfarm Payroll and the Bank of Australia's Statement of Monetary Policy, (SoMP).

The US NFP could throw more fuel on the US dollar bear's fire. Payrolls likely plunged in January, but only because of temporary Omicron fallout. However, despite the Federal Reserve being expected to look through any near term weakness in the labour market, ''if labour market weakness persists for a couple of months beyond this, then the Fed will rethink its likely rate path,'' analysts at Brown Brothers Harriman argued.

As for the SoMP, this will be monitored by NZD traders for any signs of bias one way or the other that could lead to volatility in the antipodeans on Friday. ''For now, it’s a global, rather than local, story for the Kiwi now that key data is out of the way, with 3wks to run to the RBNZ MPSm'' analysts at ANZ bank said in the note.

NZD/USD technical

Meanwhile, the upside is playing out as forecasted in the prior analysis as follows:

NZD/USD Price Analysis: Bulls eye a 61.8% golden ratio in the 0.67 area

NZD/USD weekly chart, prior analysis

''A 50% mean reversion of the weekly bearish leg of its own M-formation aligns with the daily target in the low 0.67 area.''

NZD/USD live market

The price has now met the daily chart's 50% mean reversion mark as well. A daily bullish close will underpin the bullish bias for a run to the 61.8% golden ratio, potentially to be achieved around the NFP event before the week is out.

- The S&P 500 slumped back below the 4500 level on Thursday, dropping over 2.0% on the day.

- Equity market sentiment took a battering after dour earnings guidance from tech giant Meta Platforms (Facebook).

- Focus now shifts to Amazon earnings after the closing bell and Friday’s US jobs report.

Major US equity indices turned sharply lower on Thursday after an ugly earnings report from Facebook combined with hawkish surprises from the BoE and ECB soured global equity market sentiment and shattered recent positive momentum. The S&P 500 fell back under the 4500 level, a drop of more than 2.0% on the day, with Wednesday and Tuesday’s healthy gains and more now having been given back. The index still trades higher by about 1.3% on the week, but now trades more than 2.0% below Wednesday’s intraday highs near 4600.

Meta Platforms (formerly Facebook) tanked a staggering more than 25%, wiping more than $200B off of the company’s market capitalization. If Meta shares close at current levels, that would mark the largest single-day valuation drop (in market cap terms, not percent) ever. The tech giant posted a weaker-than-expected earnings forecast, blaming new privacy changes on Apple devices and increasing competition from the likes of TikTok and YouTube. Meanwhile, for the first time in the company’s history, daily active users declined QoQ to 1.929B from 1.93B.

The more than 25% drop in Facebook’s share price on its own shaved 0.5% off the value of the S&P 500 index. But a contagion effect has seen other publicly traded social media companies also take a battering, with Twitter losing over 5.0%, Pinterest losing over 10% and Snapchat losing over 20%. Sentiment in other major tech/growth stocks, which had recovered well in recent days (spurred in part by good Alphabet earning on Tuesday) also soured. Microsoft was down about 3.0%, Alphabet (Google) was down just under 2.5%, Netflix was down 5.3%, Apple was down 0.7% and Amazon tanked 7.5% ahead of its Q4 earnings release which comes after the closing bell.

The underperformance of tech and growth names meant that the Nasdaq 100 index faired the worst of the major US indices, dropping 3.8% to nearly erase all of its gains for the week. The Dow also suffered dropping 1.3%. The S&P 500 CBOE volatility index or VIX jumped back to 25.0 from Wednesday’s lows just above 20.0. Equity investors now await the aforementioned earnings from Amazon ahead of the US labour market report on Friday. Tech/growth stocks have been suffering in recent weeks on Fed tightening fears and equity investors will be nervously watching the upcoming jobs report in the context of how it influences market expectations as to the timing and pace of Fed hikes/QT this year.

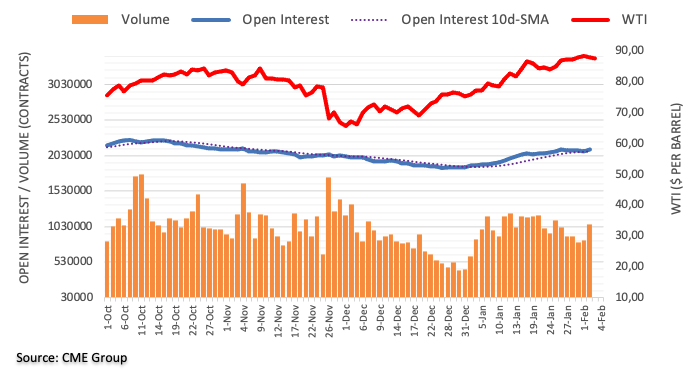

- WTI surged above $90.00 for the first time since October 2014 on Thursday.

- Analysts have been citing a cocktail of supportive factors.

Front-month WTI futures surged above the $90.00 level for the first time since 2014 in recent trade on Thursday, taking their on-the-day gains to more than $2.0, which would mark the best one-day performance in three weeks. No specific one fundamental catalyst can be singled out as behind the recent surge in prices that has seen WTi rebound more than $3.0 from intra-day lows under $87.00. but analysts/market commentators have been discussing a cocktail of bullish factors in recent days that have been supporting the bullish mood in oil markets.

Recent bullish factors:

Demand-side

Reopening. With the spread of Omicron fading in developed countries and China's zero Covid-19 approach (for now) working, demand has been improving in recent weeks as economies reopen following winter lockdowns/remain open. Underlying demand optimism was a return to US crude oil inventory declines last week, according to EIA data released on Wednesday.

Cold US weather. A large winter storm is expected to hit large parts of the US this week, bringing ice and snow to much of the country and increasing near-term demand for energy.

Supply-side

Measured OPEC+ output hikes and production issues. The group agreed on Wednesday to stick to its policy of lifting output quotas by 400K barrels per day each month, disappointing some who expected a larger hike to output quotas. Even if the cartel had hiked quotas by more, markets aren't convinced the group's actual output can keep up with the quota increases; various supply problems at smaller oil-producing OPEC+ nations have been well publicised as of late and the group's compliance stood at 122% at the end of December, said a Reuters survey.

Geopolitical risk premia. Tensions remain highly elevated between Russia, Ukraine and NATO. Some sort of military intervention by the Russians into Ukrainian seems to be the base case of many geopolitical strategists. The US and other NATO allies have pledged to hit Russia with massive sanctions if it further invades Ukraine, and the impact this will have on the country's gas and oil exports is highly uncertain.

What you need to know on Friday, February 4:

European currencies soared after central banks’ decisions, putting pressure on the greenback across the FX board.

The Bank of England hiked its policy rate by 25 basis points to 0.5% as expected, as all voting members aligned to hike, although 4 out of the 9 participants voted for a 0.50% hike. At the same time, MPC members voted unanimously to reduce government bond purchases. The central bank is now expecting inflation to peak at around 7% in April but then fall to 2.15% in a two-year period. GBP/USD hit 1.3627, now hovering around the 1.3600 level.

The European Central Bank left rates and maintained its guidance on interest rates and financial support. There was a modest twist in the wording of the statement, as policymakers removed the words “in either direction” in the paragraph related to being open to adjusting monetary policy as needed.

The EUR/USD pair rallied on comments from President Lagarde, as she did not rule out a rate hike this year, quite a hawkish shift from her December statement. Even further, he made it clear that policymakers are concerned about inflation, although he repeated that rate hikes would continue to depend on the three criteria of their forward guidance. Finally, Lagarde added that “Compared with our expectations in December, risks to the inflation outlook are tilted to the upside, particularly in the near term.” EUR/USD peaked at 1.1451 and currently trades in the 1.1430 price zone.

Commodity-linked currencies were little changed against the greenback. AUD/USD is unchanged at around 0.7130, while USD/CAD hovers around 1.2670.

The USD/JPY nears 115.00 at the end of the American session, as government bond yields edged higher. The yield on the 10-year Treasury note is currently at 1.82%.

Gold trimmed intraday losses and finished the day at around $1,805.00 a troy ounce. Crude oil prices rallied in the American afternoon, with WTI ending the day at $90 a barrel.

On Friday, the focus will be on the US Nonfarm Payrolls report. The country is expected to have added 150K new jobs in January, while the unemployment rate is foreseen steady at 3.9%.

Bitcoin price prepares to rebound after Russian finance minister vows to let banks sell cryptos

Like this article? Help us with some feedback by answering this survey:

Richmond Fed President Thomas Barkin said on Thursday that beginning interest rate hikes is a "straightforward call", although the ultimate level and pace of rate increases remains uncertain. Barkin continued that he sees no need to "restrain" the economy right now. Pandemic effects are still making it hard to anticipate labour market improvements, supply chains and the path of inflation, he added. The quest for the Fed right now, he continued, is to get policy "into a better position" should high inflation persist. Barkin said that he would like to get the Fed funds rate back to its pre-pandemic levels in the 1.5-1.75% area before assessing if it should be moved to a clearly "restrictive" level.

Market Reaction

Currency markets do not appear to have reacted much to the latest comments from Fed's Barkin.

- Silver rebounded well from support at $22.00 though still trades lower on the day under $22.50.

- Hawkish central banks in Europe spurred upside in global developed market yields, hurting the appeal of precious metals.

- Focus now shifts to Friday’s US jobs report; strong wage growth could send silver lower towards the mid-$21.00s.

Though the precious metal has enjoyed a sharp recovery from earlier session lows at just above $22.00 per troy ounce, rebounding nearly 2.0% to current levels in the $22.40s, it continues to trade lower by about 0.9% on the session, having started the day in the $22.60s. A sharp rise in US and global bond yields in wake of a double dose of hawkishness from two major European central bank has had precious metals markets on the back foot, despite sharp downside in the global equity space as a result of horrible Facebook earnings. Equity market downside would typically be associated with an increased safe-haven bid in precious metals, but the increase in the opportunity cost of holding non-yielding assets like silver (represented by higher yields) has robbed the metal of any potential gains.

Silver bulls will take heart having seen how well support in the form of annual lows in the $22.00 area held up on Thursday. But with the trajectory of global monetary policy now pointing firmly in the direction of tightening, not many will be betting on a long-term rebound. That suggests that the $22.00 level is vulnerable, though traders are unlikely to attempt to push silver below it ahead of Friday’s labour market report, to which Fed monetary policy tightening expectations will be highly sensitive. Metrics pertaining to wage growth have been flagged by Fed members are the thing to watch, suggesting any upside surprise in Friday’s Average Hourly Earnings data could trigger a hawkish shift in Fed policy expectations. Such an eventuality could be the catalyst to send silver under $22.00.

In this bearish scenario, attention would immediately turn to the next area of support in the $21.40s (a 4.4% drop from current levels), a double bottom from September and December 2021. In the longer run, if global developed market yields continue to buy into the tighter central bank policy story and yields continue to surge, silver could be looking at a break back towards support in the form of a high from all the way back to June 2016.

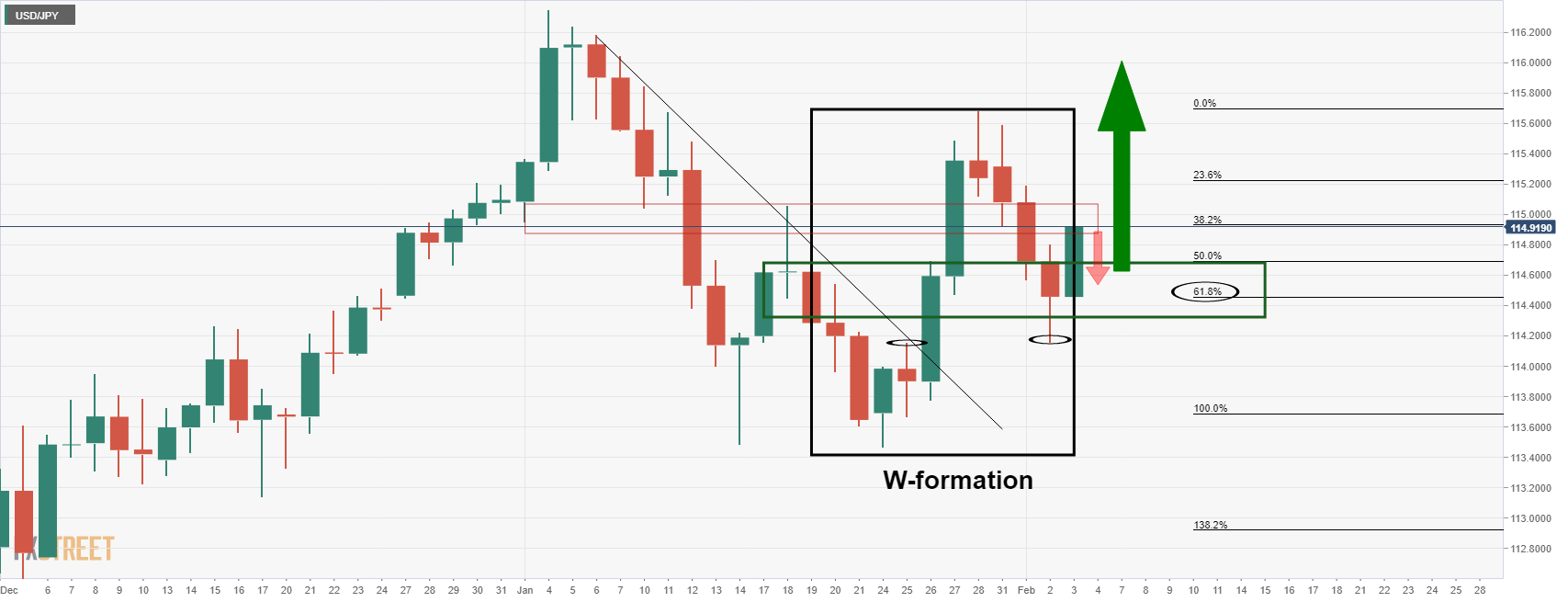

- USD/JPY is holding at critical daily chart support.

- The focus is on clearing through low volumes around 115 the figure.

The daily chart contains a complex market structure which the following illustration breaks down and arrives at a bullish conclusion.

Firstly, the old downtrend was broken on Jan. 26 and lower high of the 18th on Jan. 27. This price action left a W-formation on the charts. The price, as it typically does, moved back to retest the neckline of the W-formation on Feb.2's low in a correction.

USD/JPY daily chart

Since then, the price has stabilised around a 61.8% Fibonacci of the prior bullish breakout of the downtrend ad has started to move in on a historically low volume area near 115 the figure. There could be some selling pressure to hold off initial tests here, but if bulls commit to USD/JPY above 114.50, then, the price would be expected to be attracted towards 115.50 on a break of 115 the figure.

USD/JPY H4 chart

The lower time frames, such as the H4 chart can offer some deeper insight into the market structure and levels of importance. As illustrated, there are prospects of an inverse head ad shoulders forming from which the price would be expected to extend higher beyond 115.00 following a restest of support.

- The GBP/CAD climbs courtesy of the Bank of England’s (BoE) monetary policy, retraces at the press conference.

- The market sentiment has deteriorated as the North American session advances.

- GBP/CAD formed a bearish-harami, exposing the confluence of the 50 and the 100-SMAs in the 4-hour chart.

On Thursday, after a jump towards new weekly tops post-BoE around 1.7300, the GBP/CAD retreats but stays in the green during the day. At the time of writing, the GBP/CAD is trading at 1.7249.

Market sentiment conditions are depressed as European bourses printed losses between 0.27% and 1.76%. Across the pond is the same story, with major US equity indices recording losses, between 0.77% and almost 3%. In the FX market, the gainers are the EUR, NZD, and the GBP, while the CAD follows the CHF and the JPY as the laggards.

GBP/CAD Price Forecast: Technical outlook

The GBP/CAD 4-hour chart depicts the pair as upward biased. Even though the H4-simple moving averages (SMAs) are in a disorderly bullish/bearish order, they reside below the spot price, confirming the bias. However, the GBP/CAD tested the January 5 daily high at 1.7313 but failed to reclaim that price level, exposing the GBP to selling pressure.

That said, the GBP/CAD formed a bearish-harami pattern. On its way down, the GBP/CAD first support would be 1.7211. A breach of the latter would expose crucial support levels, like the January 14 daily high at 1.7187, followed by the 200-SMA at 1.7234, and then the confluence of the 50 and 100-SMAs around the 1.7096-83 area.

- GBP/USD bulls are cashing in following BoE rally ahead of critical US NFP data on Friday.

- 1.3660 could be targeted on any subsequent US dollar weakness around NFP.

At 1.3605, GBP/USD off its highs of the day by is still positive by some 0.23% following the Bank of England that raised interest rates to 0.5% on Thursday. Technically, there could be more to come as per the technical analysis below.

Meanwhile, the decision had been well telegraphed in the weeks leading into the meeting and markets had priced it in, but the clincher was the fact that nearly half its policymakers wanted a bigger increase to contain rampant price pressures. Back in December, the BoE was the first of the major central bank to actually raise its base rate since the pandemic began. It also signalled further modest tightening "in the coming months".

''In a surprise split decision, four of the nine Monetary Policy Committee members wanted to raise rates to 0.75% in what would have been the biggest increase in borrowing costs since the BoE became operationally independent 25 years ago,'' Reuters reported following the event. ''A slim majority, including Governor Andrew Bailey, voted for a 0.25 percentage point increase.''

BoE summary

In summary of the event, analysts at Rabobank sent out a note as follows:

-

The Bank of England’s MPC voted by a 5-4 majority to raise Bank rate to 0.50%. It got a bit more bang for its buck as Haskel, Mann, Ramsden and Saunders voted for a 50 bps increase.

-

The central bank ceases reinvestment of maturing gilts and starts to unwind its stock of corporate bonds. It reaffirmed to consider actively selling gilts when Bank rate reaches 1.00%.

-

It leans into an inflationary surge it has little control over and, as such, its policy remains hostage to fortune. In the press conference, which was dominated by questions on the real income squeeze, the policy makers seemed very aware of the numerous risks to growth.

-

The medium-term inflation forecasts suggest the peak in Bank rate might be much lower than the 1.50% the market is currently pricing. We forecast another 25 bps rate increase as soon as next meeting, before the MPC may decide it’s best to take a pause and re-assess.

As a consequence, cable vaulted over the psychological 1.3600 mark and printed a high of 1.3628. This was the highest level since Jan. 20. Additionally, UK gilts sold off, with the 10-year yield at its highest since January 2019.

The question now is whether there is more fuel in the sterling bull's tank. Fundamentally, maybe not. Analysts at Td Securities argued that ''GBP's recent price action has reflected a weaker USD rather than GBP strength. Plus, our market dashboard has been calling for a USD pullback recently, given positioning and valuations.''

The analysts added that ''now that things are cleaner, we like scaling back into USD longs, suggesting another near-term GBP top. Still, GBP should outperform the low-yielders, like EUR, CHF, JPY, in the interim.''

Moreover, a main takeaway from the meeting was the fact that the BoE governor, Andrew Bailey, told investors not to assume the central was embarking on a long series of rate hikes. He explained that there would have to be a trade-off between strong inflation and weakening growth as many households see their incomes squeezed.

Now its time to look into the US dollar

However, looking beyond that and away from UK domestics, Friday's Nonfarm Payrolls is now the focus. This could be the catalyst that sterling bulls might use to squeeze out the remaining drops from this bullish leg in cable.

Wednesday's shocking ADP report could be regarded as a bearish prelude for Friday's Nonfarm Payrolls. This might be an event that could hammer down the greenback's coffin that it was placed in on Thursday when DXY broke below 96 and tumbled to the day's lows following a worsening series of ISM Services data, (59.9 vs 62.3 prior).

As illustrated, the H4 chart is leaving a bearish wick, so if this is filled, then cable can keep going. The 15-min chart is bearish below the resistance and 95.10 is eyed.

Meanwhile, US officials have been hinting at an awful jobs number Friday and the ADP seems to have confirmed this on Thursday. (A total of -301k jobs were lost vs. an expected gain of 180k, while December was revised to 776k from 807k previously).

Traders will be cautious that while the Federal Reserve is expected to look through ay near term weakness in the labour market, and subsequently hikes in March regardless of tomorrow's jobs data outcome, as analysts at Brown Brothers Harriman explained, ''if labour market weakness persists for a couple of months beyond this, then the Fed will rethink its likely rate path.'' Therefore, a poor number could still hurt the greenback and enable GBP to glide higher.

GBP/USD technical analysis

As per the pre-BoE analysis, GBP/USD bulls stay on course ahead of the BoE event, the upside potential was highlighted as follows:

''The price has burst through what might have been expected to be a firmer resistance on the 4-hour charts near 1.3525. A break of 1.3580 could set the stage for a rally through to the 1.3660s to mitigate an old imbalance of price between here and there. ''

GBP/USD live market

The price extended the rally and has started to correct, penetrating the 38.2% Fibonacci retracement already with the 50% mean reversion in its sights where it meets a prior high. 1.3660 could be targeted on any subsequent US dollar weakness before the week is out.

- On Thursday, the shared currency advances 1.22% against the greenback.

- The ECB recognizes that inflations risks are tilted to the “upside,” not transitory.

- EUR/USD is bearish biased, but a daily close above 1.1440 could shift the bias towards a neutral-bullish.

The shared currency rallied almost 180-pips from the daily lows towards 1.1450, 20-pips above the 100-DMA. Nevertheless, it retreated somewhat on top of it, as bulls take a breather towards December’s 2021 highs around 1.1482. At the time of writing, the EUR/USD is trading at 1.1439.

ECB’s hawkish hold spurred a rally on the EUR

Thursday’s session did not disappoint at all. The ECB released its monetary policy decision, where the central bank kept everything unchanged. Nevertheless, it is worth noting that for the first time, the ECB acknowledged that “risks to the inflation outlook are tilted to the upside,” perceived as a hawkish hold by investors, as witnessed by the reaction of the pair.

One thing to punctual is that ECB’s President Christine Lagarde, when asked about hiking rates, backpedaled, refusing to say that “it is very unlikely that we will raise interest rates in the year 2022.” When Lagarde was asked about the possibility of ECB rate hikes in 2022, she said that “she never makes pledges without conditions; will be paying attention to data.”

Analysts at ING mentioned that “Lagarde opened the door to a speeding up of asset purchase reductions and a rate hike this year.”

Meanwhile, when Lagarde’s finished her press conference, Reuters reported that “ECB policymakers see policy change at the March meeting if inflation does not ease.”

In the meantime, the US economic docket featured the ISM Non-Manufacturing PMI for January, which came at 59.9, four-tenths higher than the 59.5 foreseen by analysts, but trailed December’s 62.3 reading. Moreover, Initial Jobless Claims for the week ending on January 29 came at 238K, better than the 245K foreseen by analysts, and lower than the previous week revised upwards, to 261K. The market mainly ignored the news, as EUR/USD traders were focused on the ECB.

Now that the ECB meeting is in the rearview mirror, EUR/USD traders focus on the US Nonfarm Payrolls report for January, expected at 199K. However, Wednesday’s ADP report with companies slashing 300K jobs could prelude the number.

EUR/USD Price Forecast: Technical outlook

The EUR/USD daily chart depicts the pair is testing the 100-DMA at 1.1430, after an upside break of the 50-DMA at 1.1312, in the 180-pip jump. Despite the sharp upward movement, from a technical perspective still bearish biased.

For the EUR/USD from a technical perspective, to shift from a bearish bias to a neutral-bullish stance, first would need a daily close above the confluence of the 100-DMA and Pitchfork’s channel top-trendline lying near the 100-DMA. In that outcome, the first resistance would be January 14 daily high at 1.1482, followed by 1.1500.

Failure at the above mentioned, then the EUR/USD would tumble below 1.1400. The following support would be an upslope trendline, drawn from November 2021, lows around 1.1320-40, and then the 50-DMA at 1.1312.

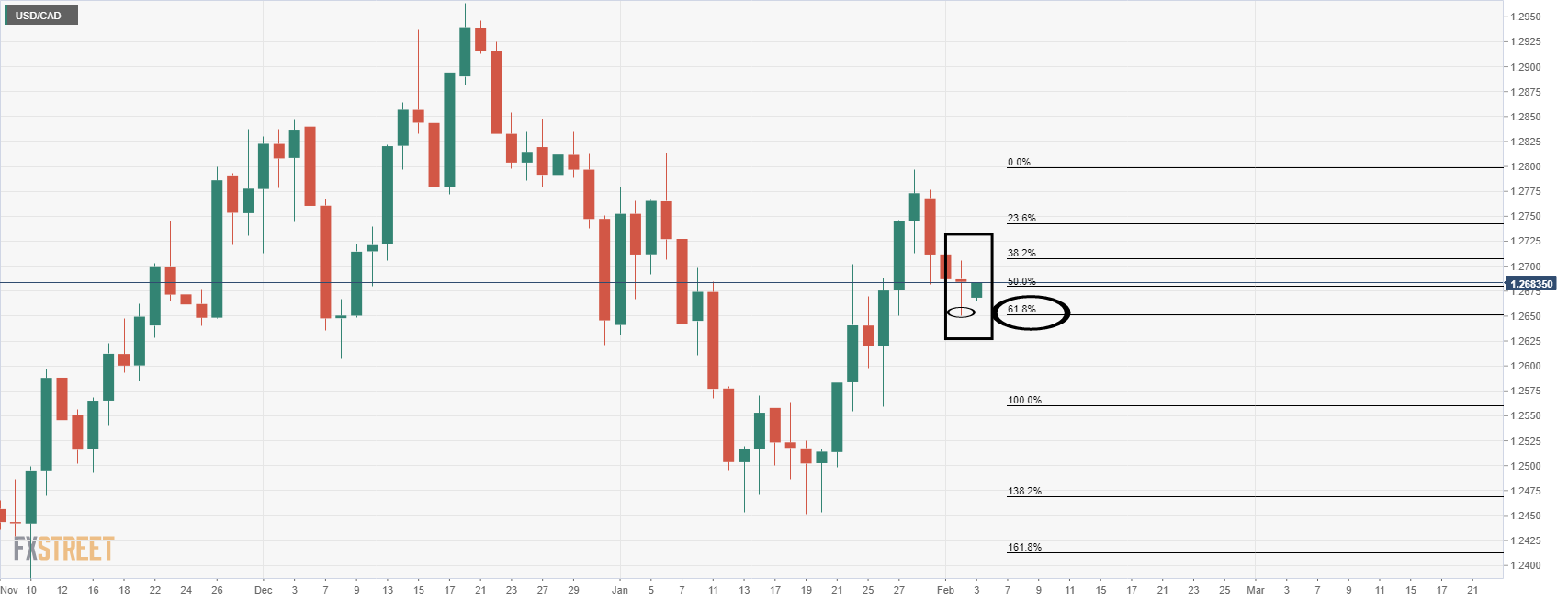

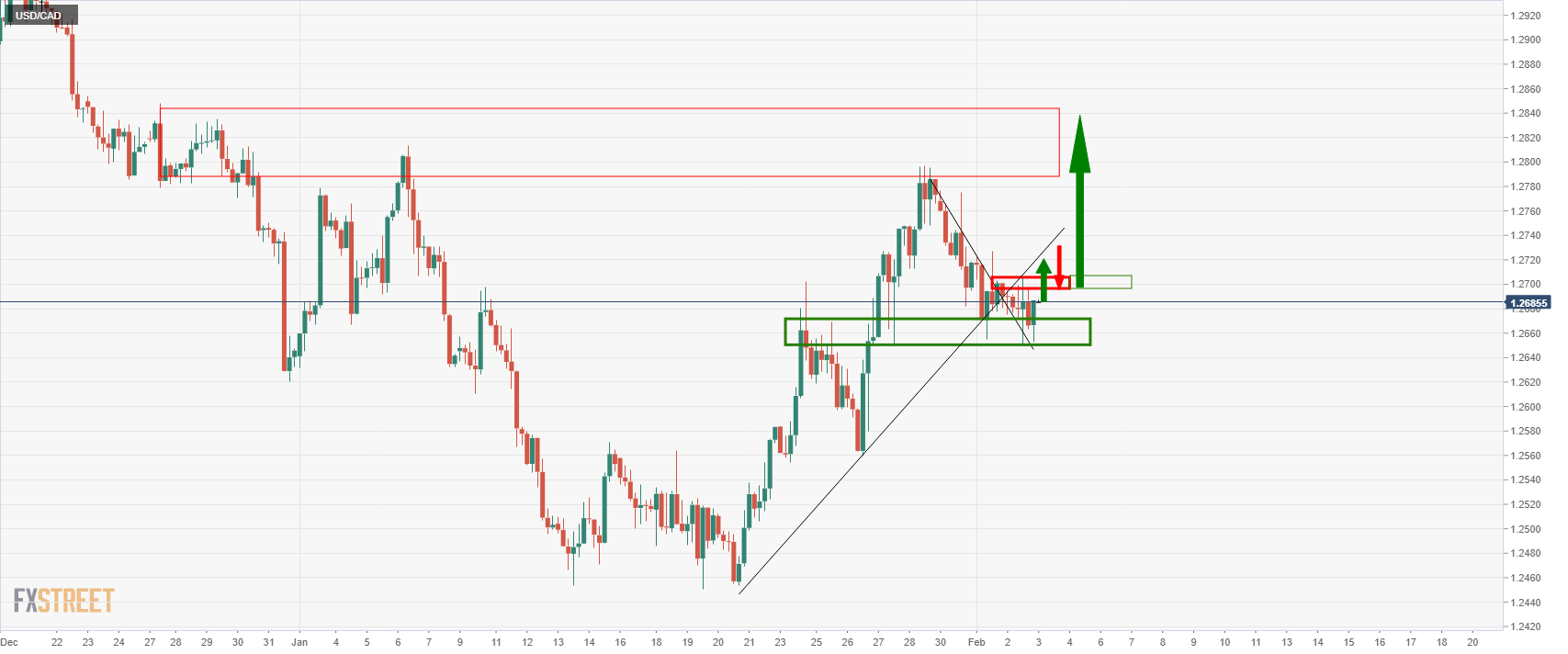

- USD/CAD has reversed back lower from earlier highs above 1.2700 as oil prices have advanced.

- Thursday’s US data dump didn’t have much FX market impact as focus shifts to Friday’s US and Canadian jobs reports.

- Forecasters have been growing more bearish on USD/CAD as of late, according to the latest Reuters poll.

USD/CAD has traded in a relatively directionless fashion on Thursday, initially strengthening towards above 1.2700 as the Canadian dollar weakened in tandem with an earnings-driven downturn in global equities, but more recently dropping back to the 1.2675 area on rising oil prices. At current levels, the pair is back to trading broadly flat on the day, with the latest US data dump having an only limited impact on FX markets with focus more on European central bank meetings.

For reference, the latest US ISM Services PMI survey for January was broadly in line with consensus, weakening to its lowest since March 2021 to reflect the spread of Omicron, but remaining at robust levels. Meanwhile, the latest US jobless claims report showed initial claims heading back lower again in an early sign that the pandemic impact on the US labour market began to ease in late January. Perhaps most importantly, Q4 Unit Labour Cost data came in substantially weaker than expected, dovetailing with last week’s alternative Q4 Employment Cost Index figures.

Traders will be looking to Friday’s US labour market report for further evidence of easing US wage pressures, which the Fed has recently flagged as a notable upside risk to inflation. If Average Hourly Earnings on Friday also disappoint, that could exacerbate recent USD weakness that has seen USD/CAD pull back from the upper 1.2700s. Note that there will also be plenty of focus on Friday’s Canadian labour market report, which is out at the same time as the US data.

Forecasts becoming more bullish

In other notable news, Reuters released a survey on Thursday that showed market participants have grown more bearish on USD/CAD amid expectations for further crude oil upside and amid bets the BoC will outpace the Fed regarding monetary tightening. The median three-month forecast according to the latest poll was for USD/CAD to drop to 1.2500 versus last month’s three-month forecast for USD/CAD to slip to 1.2600. The median 12-month forecast fell to 1.22 from 1.2350 one month ago.

Technical Outlook

Looking at USD/CAD over a longer time horizon and from a technical perspective, if the above forecasts prove correct, that implies USD/CAD will break to the south of a long-term uptrend that has been supporting the pair since last June in the next three-months. Again, assuming the forecasts are correct, USD/CAD would then break below its January lows in the mid-1.2400s and then plough below its Q4 2021 lows at 1.2300 over the course of the rest of the year. If the long-term uptrend is broken, such a move does seem likely from a technical standpoint.

Conversely, should the forecasts prove wrong and USD/CAD reverse higher, traders should keep an eye on the critical 1.2950 resistance zone that has capped the price action since late December 2020 and prior to that offered support going all the way back to late-2019. With USD/CAD having formed a long-term ascending triangle, a break above this resistance zone would be highly meaningful from a technical standpoint and would imply a push higher towards the next big resistance zone in the mid-1.30s.

On Friday, the official US employment report is due. Market consensus points to an increase of 150K in payrolls. Recent data, like the ADP report, warns about a negative reading. Analysts from TD Securities estimate a decline of 200K in jobs in January.

Key Quotes:

“Payrolls likely plunged in January, but only because of temporary Omicron fallout; if anything, we see downside risk to our -200k estimate. Several Fed officials have already made clear that they will discount weak data as temporary. Also, we see upside risk on average hourly earnings, with an already strong trend likely to be added to by temporary Omicron effects relating to the composition of payrolls and the length of the workweek. Our 0.6% m/m estimate for hourly earnings implies 5.3% y/y, up from 4.7% y/y in December.”

“A weaker-than-expected NFP report would reinforce the recent USD selloff. It works through two channels: rates and risk. Risk sentiment would likely welcome easier financial conditions, especially if Omicron explains the growth weakness. That said, our dashboard shows the USD reaching oversold levels again so we use this recent pullback as a buying opportunity ahead of next month's Fed meeting.”

Data released on Thursday showed the ISM Service Index dropped to the lowest level in 11 months in January. Analysts at Wells Fargo point out it reflects how a lack of available workers and persistent supply shortages “are weighing on firms' ability to keep up with activity in the service sector despite what is still a strong, if somewhat moderating, demand environment.”

Key Quotes:

“The ISM for the service sector fell 2.4 points to 59.9 in January. The decline was not quite as bad as feared by the consensus and is still at a level of expansion that is consistent with a steady pace of growth for the service sector. That said, throughout the comments and within the various subcomponents, there was a theme that just about everything is still in short supply and that is slowing production despite a robust demand environment.”

“Every supply-related indicator in the release suggests the same thing: supply chains are still a problem. Supplier deliveries rose 1.8 points to 65.7 last month, an indication that service-providers are still far from seeing a transition to smooth sourcing of products.”

“It is a mixed bag for hiring with five industries able to find people and add to payrolls and eight industries reporting outright reduction in employment in January. Overall the risk is to the downside for the labor market in January; the employment component fell 2.4 points to 52.3 and while that is still consistent with expansion, we still expect tomorrow's employment report to show a decline of 100K jobs in January.”

The Bank of England announced on Thursday it rose the key interest rate by 25 basis points as expected. Four members of the Monetary Policy Committee (MPC) voted for a 50 bps increase. Analysts at Rabobank, point out the medium-term inflation forecasts suggest the peak in the key rate might be much lower than the 1.50% the market is currently pricing. They forecast another 25 bps rate increase as soon as the next meeting.

Key Quotes:

“After bottling a widely expected rate increase in November and then defying the risks of Omicron when it pressed ahead with a 15 bps increase in December, the Bank of England MPC finally conformed to market expectations. But only just: the vote to raise the Bank rate to 0.50% was split 5-to-4. Policy makers Haskel, Mann, Ramsden and Saunders instead voted for a 50 bps increase, giving the MPC a bit more bang for the buck. Traders pulled forward bets on future rate increases: the market currently expects Bank rate to reach 1.00% in May.”

“We remain of the view that this tightening cycle is going to be more limited than what is currently priced in front-end rates and don’t expect the Bank of England to be able to match the Fed’s hiking pace this year or next. That said, the newfound hawkishness on the part of the Fed may provide the central bank with some cover. We forecast another 25 bps rate increase as soon as next meeting, before the MPC may decide it’s best to take a pause and re-assess.”

- The Australian dollar advances sharply in the week, 2.29%.

- The FX complex market sentiment is mixed, led by the EUR and the antipodeans.

- AUD/USD is downward biased though a leg-up towards the 100-DMA at 0.7252 is on the cards.

The Australian dollar extends its weekly gains on Thursday and is trading at 0.7152 at the time of writing. The market sentiment is downbeat in the equity markets. European and US stock indices print losses.

Meanwhile, in the FX complex, the market mood is mixed. The strongest currency is the EUR, followed by the antipodeans, whilst the JPY is the laggard.

The US Dollar Index, a gauge of the greenback’s value against its peers, sheds 0.44%, sitting at 95.51. Contrarily, US Treasury yields rise, with the 2-year reaching a daily high at 1..204% but retreated to 1.189% at press time.

Mixed US macroeconomic data weighs on the greenback

The US economic docket featured the ISM Non-Manufacturing PMI for January, which came at 59.9, four-tenths higher than the 59.5 foreseen by analysts, but trailed December’s 62.3 reading.

Anthony Nieves, chair of the ISM Services Business Committee, said that “respondents continue to be impacted by coronavirus pandemic-related supply chain issues, including capacity constraints, demand-pull inflation, logistical challenges, and labor shortages.” Concerning the impact of the Covid-19 Omicron variant, he stated that it “disrupted operations,” primarily due to the shortage of staff.

Initial Jobless Claims for the week ending on January 29 came at 238K, better than the 245K foreseen by analysts, and lower than the previous week revised upwards, to 261K. The market mainly ignored the news, per the pair’s reaction.

That said, AUD/USD trader’s focus is on the US Nonfarm Payrolls report for January, expected at 199K. However, Wednesday’s ADP report with companies slashing 300K jobs could be a prelude to the number

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains downward biased from a technical perspective. The daily moving averages (DMAs) are above the spot price, with the 50-DMA at 0.7163, the closest to the current price action. Nevertheless, recent fundamental developments and market sentiment could not be ruled out and would exert upward pressure on the pair.

So in the near term, an AUD/USD test to the confluence of the 100-DMA and a three-month-old downslope trendline around 0.7250-60 is on the cards. However, there would be some hurdles on the way up. The first resistance would be the aforementioned 50-DMA at 0.7163. A breach of it would expose 0.7200, followed by the target abovementioned.

- Euro jumps across the board following ECB meeting.

- EUR/CHF heads for biggest daily gain in years.

The EUR/CHF gained a hundred pips following the European Central Bank meeting as the euro strengthened across the board. The cross opened the day under 1.0400 and recently hit a fresh high at 1.0514, the highest level in two months.

The ECB kept interest rates unchanged as expected. The statement contained few changes from the December meeting. The positive news for the euro started with Lagarde’s press conference. She didn't push back against market pricing of rate hikes in 2022, sending Eurozone bond yields to the upside.

Later, reports mentioned the ECB policymakers see a policy change at the March meeting if inflation does ease. According to the report they see a faster pace of tapering the Asset Purchase Programme. Those reports helped the euro extends gains across the board.

Eurozone government bond yields are sharply higher on Thursday. The 10-german yield reached 0.159%, the highest level since March 2019. The moves in the European bond market also triggered volatility in currencies and commodities. Gold and silver tumbled and then rebounded sharply. Stocks in the US are in red.

The EUR/CHF is testing levels above 1.0500. A daily close above should point to further gains. The next resistance stands at 1.0535, followed by 1.0570. On the flip side, now 1.0445 is the immediate support.

Technical levels

- WTI has pushed higher from earlier sub-$87.00 lows to trade in the mid-$88.00s, up about 50 cents on the day.

- Oil has shrugged off equity market downside and hawkish BoE/ECB policy meetings to remain supported close to multi-year highs.

Oil prices have shrugged off earnings-related downside in the global equity space on Thursday, as well as more hawkish than expected BoE and ECB policy meetings, to remain supported close to multi-year highs. Front-month WTI futures have recovered from an earlier session dip below $87.00/barrel to hit session highs above $88.50 in recent trade, with the bulls eyeing a test of Wednesday’s post-OPEC announcement highs near $90.00. At current levels just under $88.50, WTI trades with gains of about 50 cents on the day.

Recall that the group opted to stick to its existing policy of increasing output at a measured pace of 400K barrels per day (BPD) each month in March. This disappointed some market participants (like Goldman Sachs) who had been calling for the OPEC+ to increase output at a quicker rate amid high oil prices and pressure from oil-importing nations, hence the rally in prices towards $90.00 at the time.

An explosion on a Nigeria oil-producing vessel with a daily capacity of 22K BPD, while not marking a significant interruption to global supply, highlighted some of the struggles that smaller oil-producing nations like Nigeria (and Angola, Libya etc.) have been having in recent months in keeping up with rising OPEC+ output quotas. OPEC+ compliance to their output pact stood at 122% at the end of December, a Reuters survey revealed recently, largely due to the struggles of smaller producers.

Traders on Thursday also cited expectations for a winter storm to arrive in the US, thus increasing energy demand there, and Wednesday’s bullish weekly US EIA crude oil inventory report as supportive of crude oil prices. But more broadly, against a backdrop of recovering global demand as the spread of Omicron eases (in developed markets, at least), tight supply (thanks largely to OPEC) and elevated geopolitical risk (thanks to the Russia/Ukraine crisis) oil markets remain in a bullish mood. A break above the $90.00 level for WTI could see the American benchmark for sweet light crude then surge to the next major area of resistance in the $91.50 area in the form of the January 2014 lows.

European Central Bank policymakers see a policy change at the March meeting if inflation does ease, said sources speaking to Reuters. The sources said that policymakers see a faster pace of tapering of the Asset Purchase Programme (APP) as its first point of call to fight higher inflation. According to the ECB's current policy, the APP will run at a rate of EUR 40B/month in Q2, EUR 30B/month in Q3 and then EUR 20B/month indefinitely from Q4. The sources added that a sizeable minority of ECB policymakers wanted to change policy at Thursday's meeting.

The latest sources speaking to Reuters dovetail with ECB sources who recently spoke to Bloomberg, who also said that ECB policymakers are prepared for a policy change. The sources speaking to Bloomberg added that the bank had reportedly agreed it sensible to no longer rule out a 2022 rate hike, which likely explains ECB President Christine Lagarde's refusal to reiteration her prior assertion that a 2022 hike was unlikely at Thursday's press conference. The Bloomberg sources said that ending the APP in Q3 was a possibility, though no decision had yet been made on any policy shift.

Market Reaction

The latest Reuters and Bloomberg sources continue to pump speculation about an earlier move to tighten policy by the ECB appears to be supporting the euro against its major G10 counterparts.

- EUR/GBP reversed 100 pips higher from just above late-2019/early-2020 lows in the 0.8280s after hawkish ECB commentary.

- President Lagarde refused to repeat her previous assertion that a rate hike in 2022 is very unlikely.

EUR/GBP has reversed sharply higher from its initial post-BoE session lows in the 0.8280s, where the pair came within a whisker of hitting multi-year lows from back in late-2019/early-2020, and now trades in the 0.8380s. That means the pair, having been as much as 0.5% lower on the day, now trades 0.75% higher. The reversal came after, in her usual post-ECB policy announcement press conference, President Christine Lagarde opted not to repeat her prior assertion that a 2022 rate hike was highly unlikely. The President instead opted to emphasise how the ECB would take a data-dependant approach and said she would make no pledges without conditionalities.

Market participants interpreted these comments from Lagarde as opening the door to a rate hike sometime later in 2022, boosting the euro substantially. Indeed, Bloomberg just report that, according to sources, the ECB is prepared to recalibrate its policy guidance at the March meeting when it releases new economic forecasts, with policymakers reportedly in agreement that it is not sensible to exclude the possibility of a 2022 rate hike. So it seems that the ECB has won the battle of hawkish surprises this Thursday, with EUR/GBP’s post BoE rate decision weakness having proven short-lived.

Recall that sterling was boosted prior to the ECB’s rate decision after the BoE hiked interest rates by 25bps and revealed that four out of nine rate-setters had actually wanted a larger 50bps move. EUR/GBP is now eyeing a test of the 0.8400 level. As the ECB tightening narrative gains more traction and tightening bets build, this could be a catalyst to disrupt EUR/GBP’s steady grind lower in recent months. Yes, the BoE is tightening too, and is a long way ahead of the ECB regarding policy normalisation, but there are serious doubts about the health of the UK economy with the cost of living crisis set to worsen substantially in April.

- Gold breaks under $1800 and drops to lowest since Monday.

- Price testing the $1790 support area; a break lower could trigger more losses.

- Metal under pressure despite the decline of the DXY, affected by higher US yields.

Gold lost more than $10 in a few minutes after breaking under $1800. XAU/USD bottomed at $1788, reaching the lowest level since Monday. It remains under pressure near $1790.

The decline took place even as the US dollar drops sharply. The DXY is down 0.45%, trading at 95.55, the lowest since January 20. In Wall Street the red dominates. The Nasdaq tumbles 2.15% and the Dow Jones drops by 0.85%. The deterioration in risk sentiment is not help for metals.

Higher US yields and technical factors pushed XAU/USD to the downside. The 10-year jumped from 1.78% to 1.84% in a few hours, while the 30-year yield rose to 2.18%, the highest level in a week.

The $1800 was a relevant intraday support. After breaking lower, gold accelerated to the downside. As of writing, it is testing the $1790 area, another relevant technical level. A daily close below should clear the way to more losses, exposing the next support at $1780 (Jan 28 low).

If XAU/USD manages to hold above $1790 it could rebound. A recovery above $1800 would alleviate the bearish pressure. The next resistance stands at $1810.

Technical levels

Federal Reserve Board nominee Philip Jefferson said on Thursday in a Senate hearing that inflation is high and has multiple components, with the pandemic having had very important impacts on supply chains. Monetary policy cannot address the supply side, he noted, but added that the directive is clear that the Fed must take steps to bring inflation back in line with its target.

Market Reaction

Jefferson's comments have not had a notable impact on markets, though markets will continue to monitor his remarks at the Senate hearing, as well as comments from fellow nominees Sarah Raskin and Lisa Cook.

- DXY accelerates losses and retests the 95.40 area.

- The ECB left policy rate unchanged, sees inflation receding in H2 2022.

- Initial Claims rose by 238K in the week to January 29.

The greenback quickly left behind the promising start of the session and slipped back into the negative territory well south of the 96.00 mark when tracked by the US Dollar Index (DXY) on Thursday.

US Dollar Index weaker on EUR strength

The index now navigates the area of 2-week lows around 95.50 in the wake of the press conference by Chairwoman C.Lagarde, all after the ECB left key rates unchanged at its event earlier on Thursday.

Indeed, the greenback came under extra pressure after buyers flocked once again to the European currency following Lagarde comments on inflation, which she sees grinding lower in the second half of the year. Lagarde also said the central bank will decide on the future of the bond buying pace at the March meeting, adding that there will be no move on rates until the bank finishes the net bond purchases.

In the US docket, Challenger Job Cuts increased a tad to 19.064K in January, Initial Claims rose by 238K in the week to January 29, the final Services PMI eased to 51.2, the ISM Non-Manufacturing PMI deflated to 59.9 and Factory Orders contracted at a monthly 0.4% in December.

What to look for around USD

The dollar quickly surrendered earlier gains, as the move beyond the 96.00 barrier lacked conviction and was sharply reversed following the ECB monetary policy meeting. Some reasons behind the strong correction in the buck seen as of late can be found in the improved mood in the risk-associated universe and dormant US yields (despite navigating the upper end of the recent range). However, the constructive outlook for the greenback is expected to remain unchanged for the time being on the back of higher yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery.

Key events in the US this week:) Initial Jobless Claims, ISM Non-Manufacturing PMI, Factory Orders (Thursday) – Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issues. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.45% at 95.54 and a break above 97.44 (2022 high Jan.28) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 95.42 (weekly low Feb.3) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).

- Headline ISM Services PMI was a touch higher than expected at 59.9 but still its weakest since March 2021.

- The market reaction to the latest data was muted.

The headline ISM Services PMI figure fell to 59.9 in January from 62.0 in December, slightly above the expected reading of 59.5 but still the lowest such reading since March 2021, according to the latest release by the Institute for Supply Management.

Subindices:

- Business Activity fell to 59.9 from 68.3 in December.

- Prices Paid fell to 82.3 from 83.9.

- New Orders fell to 61.7 from 62.1, its lowest since February 2020.

- Employment dropped to 52.3 from 54.7, its lowest since June 2021.

Market Reaction

The market reaction to the latest broadly in line with consensus ISM Services survey has been muted.

- After the ECB held rates unchanged, the euro rallied courtesy of the jump of the 2-year German Bund.

- ECB’s Lagarde said that the central bank would not hike rates until they completed the QE program.

- EUR/JPY is upward biased, as it broke the daily moving averages (DMAs) after the ECB’s monetary policy decision.

On Thursday, the shared currency advances as the North American session begins vs. the low-yielder Japanese yen, up 1.18%. At the time of writing, the EUR/JPY is trading at 130.88. The market sentiment is mixed, spurred by monetary policy decisions by the Bank of England (BoE) and the European Central Bank (ECB), which concerns the currency pair.

ECB held rates unchanged while the QE persists as scheduled

The ECB kept its deposit rates unchanged at -0.5% while emphasizing that the QE would end in March, when the APP will be lifted to €40 billion per month, followed by a reduction to €20 billion by Q4. The bank also reaffirmed its guidance that QE purchases would end before any increases to interest rates.

Read more: Breaking: ECB leaves rates unchanged, maintains guidance on interest rates and QE

At the ECB press conference, ECB President Christine Lagarde said that “We [ECB] will not hike rates until we have completed net asset purchases, will determine in March what we will apply to these net asset programs for the rest of 2022.” Nevertheless, Lagarde did not say that a rate hike in 2022 is unlikely.

That said, the EUR/JPY skyrocketed near 131.00 on the ECB’s monetary policy decision, which came in line with expectations. However, the 14 basis points jump in the 2-year German Bund spurred demand for the euro, to the detriment of the safe-haven status of the Japanese yen.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY daily chart depicts an upward bias. During the ECB’s monetary policy decision, it breached all the daily moving averages (DMAs) upwards. It faced resistance at a five-month-old downslope trendline, drawn from October 2021 highs that pass around 131.00.

To the upside, the first resistance would be the trendline mentioned above that looms around 131.00. An upside break would expose January 5 daily high at 131.60, followed by 132.00.

According to the final version of IHS Markit's Services PMI survey, the headline index was 51.2 in January, above the flash estimate for a 50.9 reading. The final Composite PMI came in 51.1 in January, also above the flash reading of 50.8.

Market Reaction

There does not seem to have been any notable reaction to the latest PMI numbers.

- EUR/USD reverses the initial pessimism and resumes the upside.

- The ECB left the key policy rate unchanged at its meeting.

- Chairwoman Lagarde expects inflation to recede later in 2022.

EUR/USD manages to return to the positive territory and regain upside pressure further north of the 1.1300 hurdle.

EUR/USD firmer on dollar selling, ECB

EUR/USD now advances for the fifth consecutive session following the upbeat tone at the ECB event and while Chair Lagarde’s press conference is under way.

Despite acknowledging current inflation pressures, Lagarde reiterated that consumer prices are seen losing upside traction later this year. She noted that the impact of the pandemic on the economy is fading away at the time when she said that high energy prices continue to hurt the economy and are largely behind the rise in inflation. She said that price pressures are more widespread and elevated inflation lasted more than estimated.

Lagarde noted that risks to the forecast remain mostly balance and the longer-term inflation measures look stable.

Once again, Lagarde reiterated the bank’s data dependent stance as well as its readiness to adapt all tool as needed. She expects the economic activity to remain somewhat depressed in H1 2022.

According to latest news by agency Bloomberg, money markets now see the ECB hiking rates by 10 bps as soon as in June.

What to look for around EUR

EUR/USD reversed the initial knee-jerk and resumed the sharp advance well north of the 1.1300 barrier on Wednesday, recording at the same time fresh weekly/monthly highs. The pair regained the buying pressure following the ECB and Lagarde’s presser, while the broad risk appetite trends also collaborated with the uptrend as well as some speculation of a sooner-than-anticipated ECB interest rate hike (September maybe?).

Key events in the euro area this week: EMU, Germany Final January Services PMI, ECB Meeting (Thursday) – EMU Retail Sales (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.74% at 1.1383 and faces the next up barrier at 1.1397 (weekly high Feb.3) seconded 1.1430 (100-day SMA) and finally 1.1482 (2022 high Jan.14). On the other hand, a break below 1.1121 (2022 low Jan.28) would target 1.1100 (round level) en route to 1.1000 (psychological level).

The USD/CAD drifts higher after losses stop in mid 1.26s again. Economists at Scotiabank expect the pair to edge higher towards the 1.2775/1.2800 area on a break above minor resistance at 1.2725.

Tighter monetary policy conditions in Canada to support CAD gains later in 2022

“Short-term price action is turning a little more constructive for the USD again after three tests – and rejections – of the mid 1.26 area since the turn of the month.”

“Short-term price action reflects firm demand for the USD on dips to the 1.2650/60 zone in the past three days, with near-term risks tilting towards a push above minor resistance at 1.2725; gains through here may allow the USD to push higher still towards 1.2775/00 into the end of the week.”

“Fed policymakers have indicated that balance sheet normalization may not start until much later in the year (once the Fed Funds target rate has reached 1% or so). Relatively tighter monetary policy conditions in Canada should help support CAD gains.”

Asked about the record Eurozone inflation print (for January) released earlier in the week, ECB President Christine Lagarde said that the ECB governing council showed unanimous concern about the impact on the public of current high inflation. In response to a question about whether a rate hike in 2022 remains highly unlikely in light of recent inflation surprises, Lagarde said that she never makes pledges without conditionalities and said that it was important to be attentive to that. She said the bank would be data-dependant and reassess the situation in March (when the ECB issues new economic forecasts) and would not rush into any decisions. She did not repeat the statement that a rate hike in 2022 is unlikely. Some might interpret this as Lagarde opening the door to a change in rate guidance in March which might validate market expectations for a rate hike in Q4 2022.

Market Reaction

The euro has been surging in recent trade in wake of remarks from Lagarde, with EUR/USD now above 1.1350 from under 1.1300 prior to the start of her press conference.

- GBP/USD struggled to capitalize on the post-BoE bullish spike to a two-week high.

- The intraday USD buying interest turned out to be a key factor that capped gains.

- Rebounding US bond yields, hawkish Fed expectations extended support to the USD.

The GBP/USD pair faded the post-BoE bullish spike to a fresh two-week high and was last seen trading with modest intraday gains, just below the 1.3600 mark.

The pair caught aggressive bids and rallied nearly 100 pips from the daily swing low, around the 1.3535 region, after the Bank of England announced its policy decision. As was widely expected, the UK central bank raised its benchmark interest rate by 25 bps to 0.50%. The hawkish tilt came from the vote distribution, wherein four out of nine MPC members voted for a 50 bps rate hike. This indicated that policymakers are keen to act amid rising inflationary pressures and provided a strong boost to the British pound.

Adding to this, policymakers also vote 9-0 to start unwinding the £895 billion quantitative easing program by ceasing reinvestment, starting with a maturity of March 2022 gilt. In the post-meeting press conference, the BoE Governor Andrew Bailey said that some further modest tightening is likely in the coming months. This further acted as a tailwind for sterling and pushed the GBP/USD pair to the 1.3625-1.3630 area, though the momentum ran out of the steam amid a goodish pickup in demand for the US dollar.

Despite the fact that Fed officials downplayed the prospects for a 50 bps rate hike in March, traders seem convinced that the Fed will tighten its policy at a faster pace than anticipated. This, along with a fresh leg up in the US Treasury bond yields and a softer tone around the equity markets, extended some support to the greenback. This, in turn, was seen as the only factor that capped the upside for the GBP/USD pair, instead attracted some selling at higher levels and led to a pullback of around 50 pips.

On the US economic data front, the Weekly Initial Jobless Claims fell to 238K during the week ended January 28 as against market expectations for a reading of 245K and the 261K previous. This, however, did little to provide any meaningful impetus, albeit remained supportive of the intraday USD strength. Thursday's US economic docket also features the release of ISM Services PMI, which might allow traders to grab some short-term opportunities around the GBP/USD pair. the focus would then shift to the US NFP report on Friday.

Technical levels to watch

European Central Bank President Christine Lagarde said on Thursday that the Eurozone economy continues to recover, with the economy less hurt by the pandemic, though growth will be subdued in Q1 as shortages restrain activity. Thereafter, the economy will pick up strongly over the course of the year and the labour market continues improving. Inflation will remain elevated for longer than previously expected, she added, with rising energy costs hurting incomes.

Additional Remarks:

"Bottlenecks may be starting to ease."

"The peristence of underlying inflation increases uncertain."

"Wage growth remains muted."

"Containment measures are affecting travel and toursim."

"This may still persist for some time."

"Most measures of underlying inflation have risen."

"Risks to the outlook are balanced."

"High energy costs could be a drag on consumption and investment."

"There is upside risk particularly in the near term."

Unit Labour Costs in the US rose less than expected in Q4, rising just 0.3% QoQ versus the forecasted 1.5% rise, according to the latest release from the Bureau of Labour Statistics and Department of Labour. Meanwhile, Nonfarm Productivity saw a much larger than expected 6.6% rate in Q4 versus consensus forecasts for a 3.2% rise.

Market Reaction

Lower than expected labour cost pressure as per the latest BLS/DoL report will ease pressure felt by the Fed to hike interest rates as aggressively in 2022. The dollar has, as a result, been selling off in recent trade, with the DXY dropping from around the 96.20 area to current levels around the 95.60s. Much of this could be as a result of a hawkish reaction to comments from ECB President Christine Lagarde, who didn't rule out a 2022 rate hike.

- Initial claims fell to 238K in the week ending on January 29, below consensus expectations.

- The dollar has been falling a result of weak Q4 Unit Labour Cost data rather than reacting to the jobless claims report

There were 238,000 initial claims for unemployment benefits in the US during the week ending January 29, data published by the US Department of Labor (DoL) revealed on Thursday. This reading followed last week's print of 261,000 (revised up from 260,000) and was below with consensus market expectations for 245,000. Continued Claims fell slightly less than expected to 1.628M in the week ending on January 22 from 1.672M the week prior (revised lower from 1.675M) and was slightly above the 1.62M expected. The insured unemployment rate remained unchanged at 1.2%.

Market Reaction

There was no discernable reaction to the latest jobless claims data, with the US dollar declining instead as a result of much weaker than expected Unit Labour Cost growth in Q4.

UK PM Boris Johnson on Thursday said that the UK faces a cost of living crunch and the government has to help people. The package to help with energy costs is necessary and huge, he added, saying that hopefully inflationary pressures will start tpo subside once the world economy regains momentum. When asked about the planned national insurance rise, Johnson said we have to put in the money to fix the health service.

Market Reaction

There has been no reaction to the latest comments from the PM, with focus much more on the BoE.

Bank of England Governor Bailey on Thursday said that, after adjusting for Covid, underlying wage growth is higher than we would expect for this stage of the economic cycle. We are seeing upwards upward movement in what firms expect wage settlements to be, he noted, though did say that he would not be using the phrase "wage-price spiral" as we are not in that territory.

Bailey said that this is a hard message, but we are facing a squeeze on real incomes in the UK this year, and that if the BoE doesn't raise the bank rate, the squeeze will be worse. Households are facing a lot of pressure, he added, including on those who are less able to afford it. Government measures will help households, he noted.