- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 02-02-2022

- GBP/USD struggles to extend four-day uptrend around a two-week high.

- Bullish Momentum, sustained trading beyond 100-day, 50-day EMAs keep buyers hopeful.

- Six-week-old support line adds to the downside filters, descending trend line from July lures buyers.

- Bank of England Interest Rate Decision: Gilts are the crucial topic

GBP/USD seesaws around a fortnight high near 1.3575 as traders brace for the Bank of England (BOE) monetary policy decision during Thursday’s Asian session.

The cable pair rose during the last four consecutive days to cross the 100-day EMA and the 50-day EMA but is struggling to surpass the 200-day EMA ahead of the key event. However, the upbeat Momentum line and likely hawkish outcome from the BOE keep GBP/USD buyers hopeful.

That said, a clear upside break of the 200-day EMA level of 1.3585 becomes necessary for the pair buyers to aim for a descending resistance line from late July, around 1.3635 at the latest.

Following that, an upward trajectory towards the January high of 1.3748 can’t be ruled out. Though, October 2021 tops near 1.3835 may test the GBP/USD bulls afterward.

Meanwhile, pullback moves will initially test the 100-day EMA level of 1.3538 before revisiting the 50-day EMA surrounding 1.3500.

Even if the quote drops below 1.3500, an ascending trend line from late December 2021, close to 1.3390, will be in focus.

GBP/USD: Daily chart

Trend: Further upside expected

Early Thursday morning in Asia, Reuters shared prepared statements from President Joe Biden's pick for various positions in the Federal Reserve (Fed), posted by the US Senate Committee.

“Sarah Bloom Raskin, President Joe Biden's pick to lead the Federal Reserve's regulatory work (Nominee for Fed’s Vice Chair for Supervision), plans to tell lawmakers on Thursday that it would not be her job to direct banks where to lend,” said Reuters.

The Nominee for Fed’s Vice Chair for Supervision also said her job would be to consult widely with experts inside and outside the Fed on how banks are managing their risks, rather than directing credit.

“Reducing inflation should be 'top priority for federal reserve while sustaining recovery,” mentions Fed Nominee Raskin.

Reuters adds, “Raskin has faced criticism from Republicans and some energy groups that if confirmed, she might discourage lending to fossil fuel companies.”

Moving on, US President Biden’s Nominee to the Federal Reserve Board Philip Jefferson said, per Reuters, “Tackling high inflation and keeping inflation expectations anchored should be a main priority for the central bank.”

"Today, the economy is facing two major challenges: the COVID-19 pandemic and inflation," Jefferson said in prepared remarks released ahead of a confirmation hearing on Thursday at the Senate Banking committee per Reuters.

"The spike in inflation we are seeing today threatens to heighten expectations of future inflation," adds US President Biden’s pick for Fed Board.

At last, Lisa Cook, one of U.S. President Joe Biden's nominees to the Federal Reserve Board, said the central bank's most important task is tackling high inflation, said Reuters.

“I agree with Chair Powell that our most important task is tackling inflation. High inflation is a grave threat to a long, sustained expansion," said Fed Board Nominee Cook.

FX reaction

The news adds to the market’s recently cautious sentiment ahead of the key monetary policy meetings by the European Central Bank and the Bank of England. However, the US dollar is yet to recover the latest losses.

Read: Forex Today: Dollar retains the weak stance ahead of BOE, ECB

- The NZD/JPY is flat as the Asian Pacific session begins.

- NZD/JPY Technical Outlook: The path of least resistance is downwards, further cemented by the daily close beneath 76.00.

The NZD/JPY slides as the New York session finishes, down some 0.25%. At the time of writing, the NZD/JPY is trading at 75.89. The overall market sentiment is upbeat, except for the FX market. The JPY and the CHF posted gains between 0.50% and 0.56%, respectively. Meanwhile, the high beta currencies ended in the red, led by the NZD, which lost 1.95%.

On Wednesday, the NZD/JPY reached a weekly high at 76,26, followed by a fall towards 76.00, as European traders got to their desks. The drop was courtesy of NZD's weakness due to mixed employment numbers. Later on the day, during the North American session, the pair gave way for JPY bulls, who pushed the pair below the 76.00 figure.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY is downward biased, as depicted by the daily moving averages (DMAs), with a downslope residing above the spot price. Furthermore, failure to print a daily close below the 76.00 figure opened the door for further losses. That said, the first support level would be July 20, 2021, a daily low at 75.27, followed by August 19, 2021, a daily low at 74.56.

Contrarily, in the event of the cross-currency pair holding its ground against JPY bulls, the first resistance would be 76.00. A break above that level could pave the way for further gains. The next resistance would be January 26 daily high at 76.67, followed by January 21 cycle high at 77.05.

- EUR/USD grinds higher at weekly top after four-day rebound from 20-month low.

- Steady RSI, looming bullish cross of MACD favor buyers.

- 100-DMA becomes the key hurdle, 10-DMA limits pullback moves.

- ECB February Preview: Euro bulls hope for a hawkish ECB on hot EU inflation

EUR/USD portrays the pre-ECB anxiety while edging higher past 1.1300 during early Thursday morning in Asia. That said, the major currency pair seesaws around 1.1305 after refreshing the weekly top to 1.1330 the previous day.

The pullback moves could be linked to the quote’s failure to provide a daily closing beyond the 50-DMA level of 1.1310.

However, sustained trading beyond the previous resistance line from January 14 and 10-DMA, respectively around 1.1180 and 1.1260, keeps the EUR/USD buyers hopeful as they brace for the key monetary policy meeting by the European Central Bank (ECB).

Also adding strength to the bullish bias is the steady RSI line and the MACD conditions that tease bulls.

It’s worth noting that a broad support zone from late November near 1.1185-75 becomes the key to challenge EUR/USD bears.

Alternatively, a clear upside break of the 50-DMA level of 1.1310 will enable the EUR/USD bulls to aim for the 100-DMA surrounding 1.1435.

During the run-up, December 2021 top near 1.1385 and the 1.1400 threshold will act as intermediate halts.

EUR/USD: Daily chart

Trend: Further upside expected

“New Zealanders in Australia will be allowed to return without having to isolate in MIQ from February 28, and those in the rest of world from March 14,” said New Zealand (NZ) Prime Minister (PM) Jacinda Ardern as she releases a five-step plan of easing the covid-linked border controls during early Thursday morning in Asia, per ABC News.

Additional quotes

Instead of MIQ, those who are vaccinated will be allowed to self-isolate elsewhere.

We are well on our way to reaching that destination. But we are not quite there yet.

Fully vaccinated Kiwis and other currently eligible travellers from Australia will be able to travel to New Zealand from 11.59 pm Sunday 27 February, and instead of going into MIQ, will be able to self-isolate.

In step 2, two weeks later on Sunday 13 March, fully vaccinated New Zealanders and other currently eligible travellers from the rest of the world will also be able to travel into New Zealand without going through MIQ.

Step 3 begins from 11.59 pm 12 April. Here we further extend our border extension to include a large international student cohort of up to 5,000 students for entry ahead of semester 2 and temporary visa holders who still meet relevant visa requirements.

Step 4 sees the biggest expansion yet, and includes our Australian cousins and all other visitors and other visitors and business travellers who can normally enter New Zealand without a visa. This stage is likely to begin when we have much larger case numbers than we have now. For planning, we anticipate this stage will begin no later than July.

Step 5 begins in October and includes all other visitors and students who require a visa to enter New Zealand, with normal visa processing resuming.

NZD/USD renews intraday high but stays pressured…

Following the news, NZD/USD prices refreshed daily high to 0.6645 but remain depressed as markets turn cautious ahead of the key central bank meetings, namely the ECB and the BOE.

Read: NZD/USD bulls take a breather in pursuit of 0.67 the figure for days ahead

- AUD/USD bears are stalling at a critical daily resistance block.

- The bears are monitoring for bearish structures on lower time frames.

From a daily perspective, the AUD/USD has reached a potential resistance bloc which is guarding the M-formation's neckline near 0.7170. The price on Wednesday is forming a Bearish Doji.

AUD/USD daily chart

The bears will be looking for confirmation that this bullish correction may have ended from Thursday's candle's close. An ideal and textbook outcome would be a bearish engulfing candle such as this:

Bears will be monitoring price action from a 4-hour time frame in hope of a bearish structure over the coming days from which to engage and target a daily downside extension as illustrated above.

AUD/USD H4 chart

The moving averages are showing the price remains in bullish territory but bears wl be on the lookout for a bearish crossover with the 10 moving below the 21 EMA in the sessions ahead. In doing so, a newly formed resistance structure below 0.7120 could be the basis for the downside bias if it holds on subsequent bullish retests.

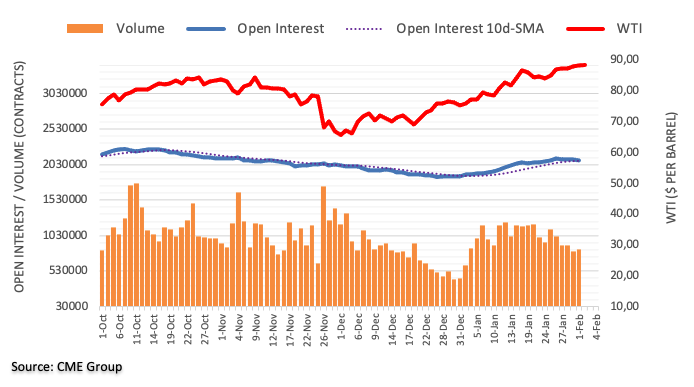

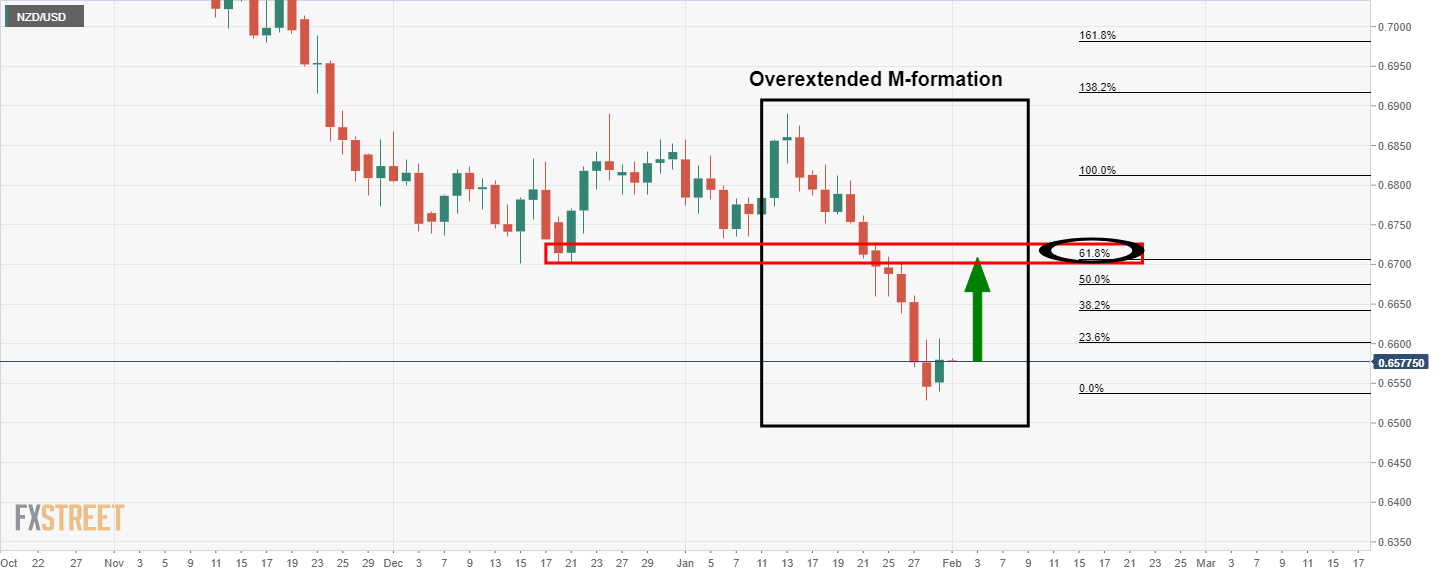

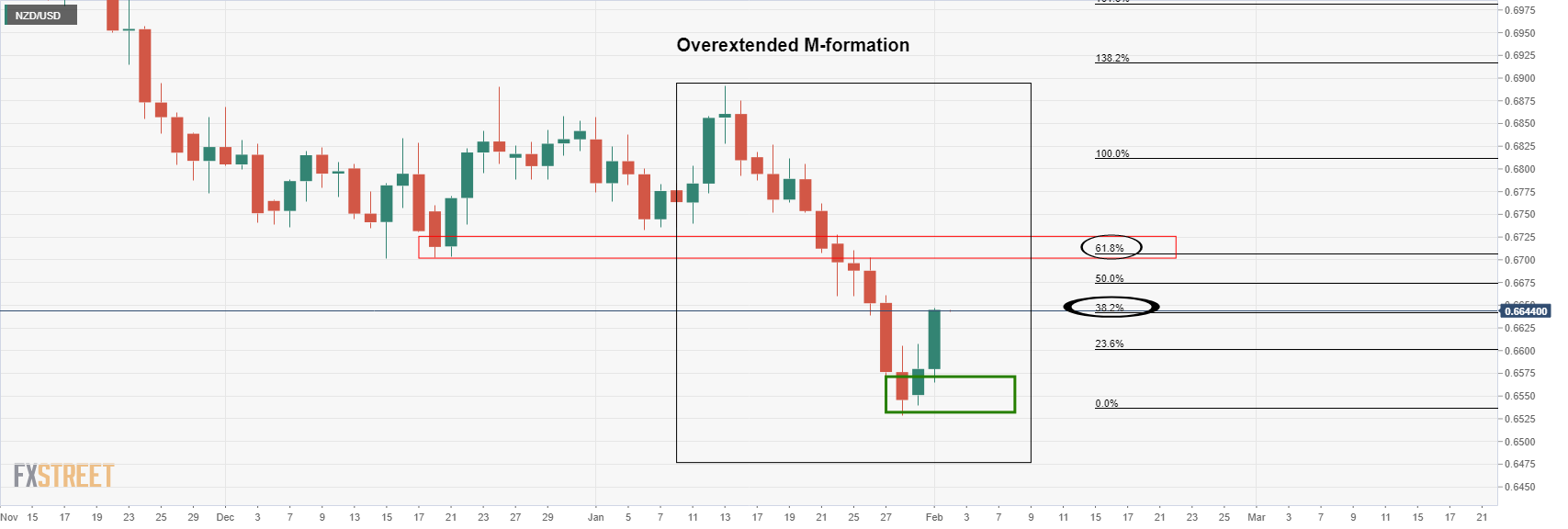

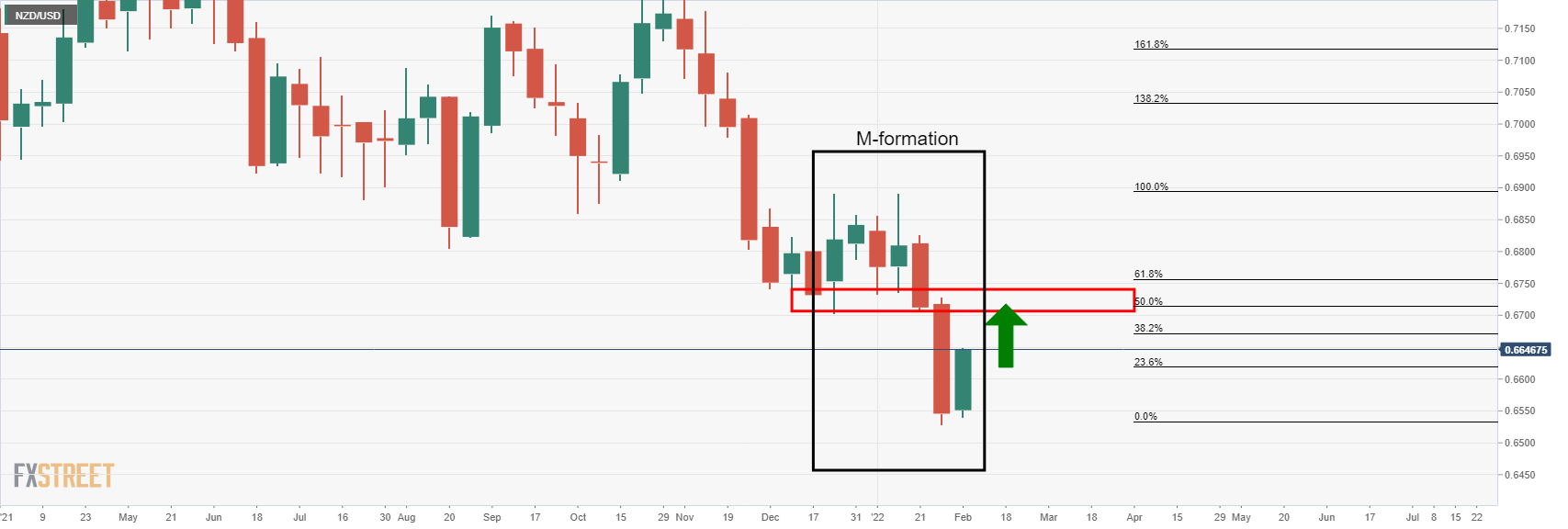

- NZD/USD stalls in the daily correction despite further weakness in the greenback.

- NZD/USD bulls still might not be throwing in the towel just yet.

NZD/USD stalled midweek as the correction met a prior low on the daily time frame. At 0.6635, the price is flat at the end of the North America session and is set to leave a Doji candle on the daily time frame.

As analysts at ANZ Bank said, ''the Kiwi had a whippy sort of a night, rallying up to around 0.6660 before coming back early this morning as the USD DXY put in a very mild recovery off lows and the AUD lost momentum following Lowe’s still measured tone in his speech yesterday.''

Recalling the Reserve Bank of Australia event earlier in the week, the Aussie dragged the kiwi along for a ride to the upside, despite the dovish tone set at the central bank. The markets appear to be setting aside the interest rate differentials for the time being and are enjoying a burst of life in risk appetite that has returned this week. The dollar bloc currencies have benefitted from ongoing weakness in the greenback as a consequence.

''While price action has been a bit whippy (which isn’t unusual), dips have tended to be shallow and it has been well supported on pull-backs,'' the analysts at ANZ bank argued.

''The data backdrop remains very strong, but at the moment, markets are thinking more about commodity prices and the post-Omicron outlook, and so in that regard, higher oil prices, which have spilt over (no pun intended) onto higher milk prices, and today’s NZ government border announcements bear watching.''

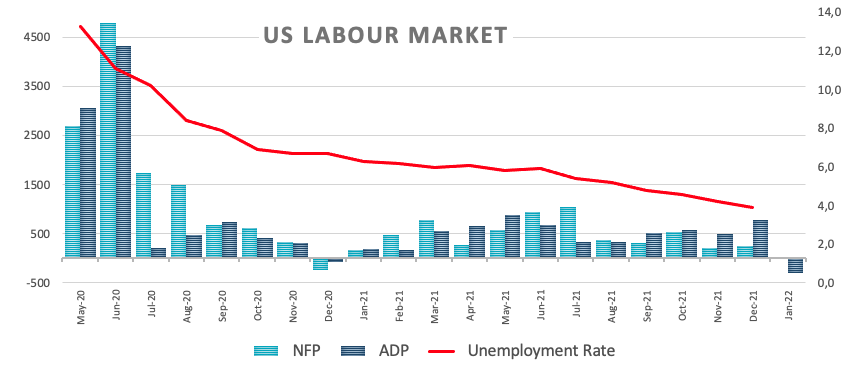

US jobs market in vouge

Meanwhile, the US dollar was once again on the back foot owing to a bearish prelude to this week's main event in US Nonfarm Payrolls on Friday. The dollar declined to a more than a one-week low on Wednesday after data showed a drop in US private sector employment in January due to the increase in COVID-19 infections. ADP private payrolls, which showed a 301,000 drop, was missing an estimate of 207k.

Also, the January decline followed a downwardly revised 776,000 increase in December, compared with the 807,000 gain initially reported. By sector, goods-producing jobs fell by 27,000, while service-providing jobs plunged by 274,000, with leisure and hospitality jobs down 154,000.

The chorus of less hawkish Fedspeak this week coupled with disappointing data has led to a decrease in pricing of Fed rate hikes in the futures markets. In late afternoon trading, US rate futures priced in about 4.7 hikes this year, or 118.6 basis points of policy tightening, down from the five rate increases seen over the last two days, Reuters reported. ''Futures also showed the probability of a 50-basis-point hike in March has settled at 12.5%, from as high as 32% late last week.''

NZD/USD technical analysis

The weekly outlook is bullish as per the M-formation neckline target.

The daily chart's deceleration could lead to a test of prior daily highs near 0.66 the figure first before the price finds more demand from there. This could lead to a continuation of the correction into a 61.8% ratio target near 0.67 the figure.

- GBP/JPY continued to advance on Wednesday as risk appetite improved the BoE’s policy decision day eve, remaining supported above 155.00.

- GBP/JPY has been trending higher, alongside equities, as of late within the confines of a bullish trend channel.

GBP/JPY continued to trend higher on Wednesday, gaining 0.2% on the day to hit fresh near-two-week highs whilst remaining well supported above the 155.00 level as global risk appetite continued to improve. The pair has been trending higher over the last week or so within the confines of a bullish trend channel, and has now rallied more than 1.5% from sub-153.00 January lows, in fitting with the recent recovery seen in global equity markets. The more risk-sensitive sterling tends to perform better versus the safe-haven yen in times when global equities are advancing.

Ahead of Thursday’s BoE meeting, where the bank is expected to hike interest rates by 25bps to 0.5% and outline quantitative tightening plans, GBP/JPY has been unable to push beyond resistance in the 155.40 area from mid-January. Should there be either a hawkish BoE surprise or a continued improvement in risk appetite, or both, on Thursday, the pair may well break above this level and have a run at the next resistance area at 157.00. Ahead of Thursday’s BoE meeting, however, trading conditions are likely to remain subdued as traders keep their powder dry and remain in wait-and-see mode.

Bank of Canada Governor Tiff Macklem on Wednesday said that there is some uncertainty about how quickly inflation will come down, according to Reuters. However, Macklem added that the bank is confident that inflation will eventually come down, and that the latest GDP data reinforced the view that Q4 2021 growth was strong. With labour markets tightening and evidence of capacity pressures increasing, he added, the BoC expects higher interest rates will be needed to bring inflation back to the 2.0% target. Finally, he noted that there is some evidence that Canadians have not been dipping into excess savings as of late.

Market Reaction

CAD has not seen any notable reaction to the latest remarks from Macklem, which were broadly in line with the tone of last week's meeting.

- The AUD/JPY advances despite a risk-off mood in the FX complex, up 0.01%.

- AUD/JPY Technical Outlook: Downward biased as long as it remains below 82.60.

On Wednesday, the Australian dollar pares losses against the low-yielder Japanese yen during the North American session. At the time of writing, the AUD/JPY is trading at 81.77.

The market sentiment in the FX complex is risk-off. The Japanese yen has strengthened as the New York session progressed. In the meantime, risk-sensitive currencies like the AUD, the NZD, and the CAD fall vs. the abovementioned.

AUD/JPY Price Forecast: Technical outlook

During the overnight session for American traders, the AUD/JPY meandered close to the 82.00 figure not reached since January 26 but failed to reclaim the abovementioned. From that point, broad safe-haven flows to the JPY, weighed on the AUD/JPY, dipping to the 200-hour simple moving average (SMA) at 81.38.

The AUD/JPY is downward biased, as depicted by the daily moving averages (DMAs), which lie above the spot price in orderly bearish form. Downwards, the first support would be February 1 daily low at 80.90. A breach of the latter would expose January 24 daily low at 80.69, followed by the YTD low at 80.36.

Contrarily, in the event of an AUD/JPY shift upwards, the first resistance would be the 50-DMA at 81.89. If the previous-mentioned level gives way for AUD bulls, the next resistance would be 82.00, followed by the confluence of the 100 and the 200-DMA lying within the 82.40-46 range.

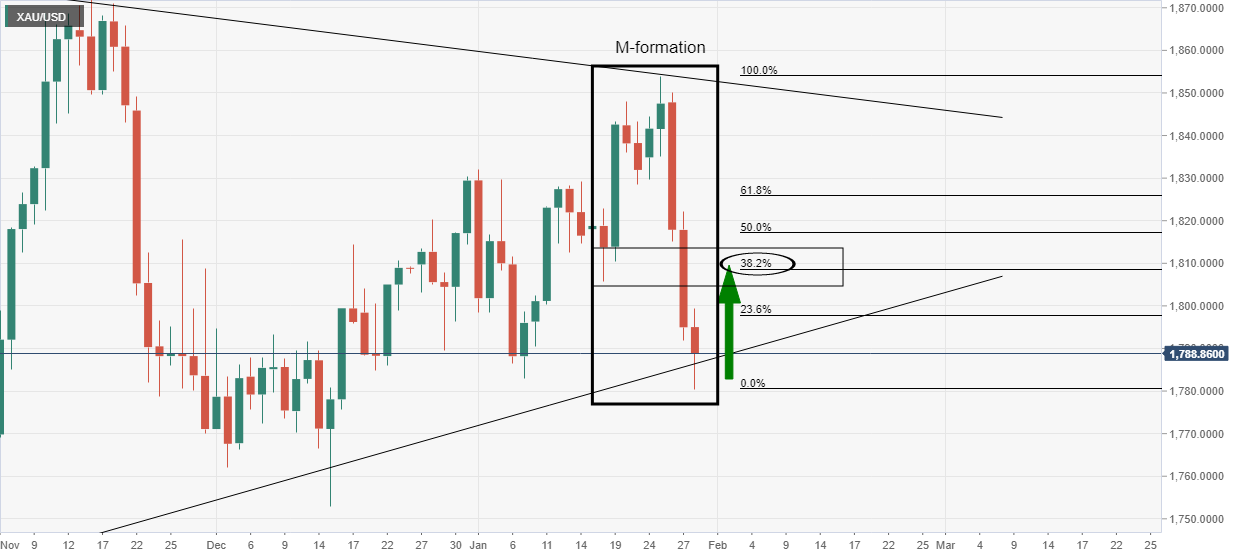

- Gold bears are monitoring for a deceleration in the bullish correction, now at critical resistance.

- The 4-hour time frame offers a compelling picture of the market structure.

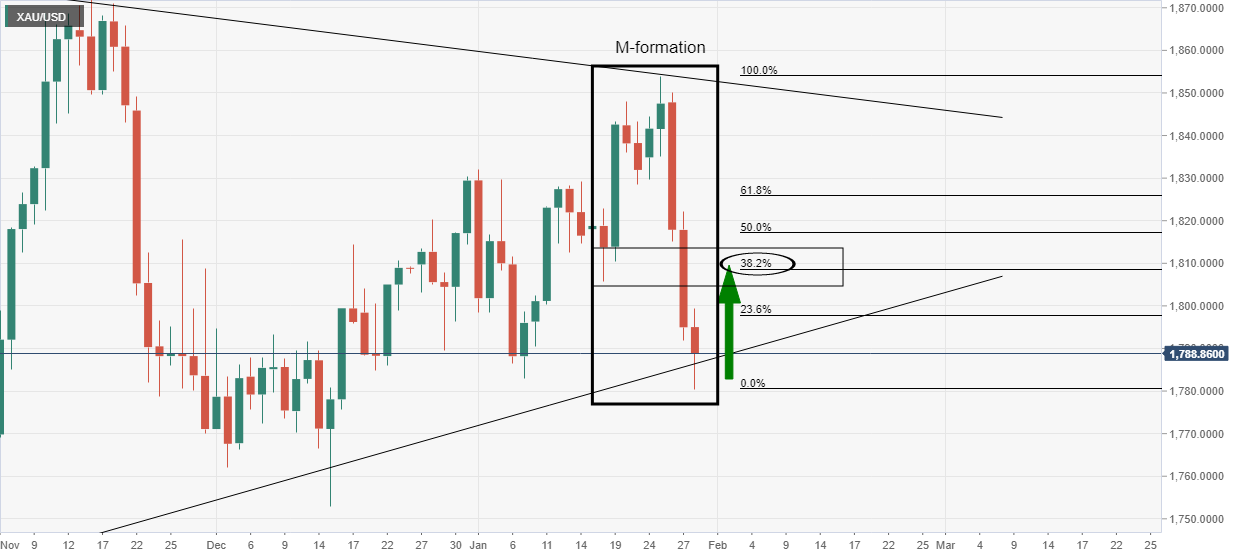

As per the Chart of the Week analysis, the daily M-formation that was noted has played out as follows.

It was stated that ''considering the trendline support and the daily M-formation, the technicians would argue that a significant correction of the bearish impulse could be in play...''

Gold, daily chart prior analysis

In the case above, the 38.2% Fibonacci retracement level near $1,810 was the initial target area that had a confluence with prior structure as illustrated.

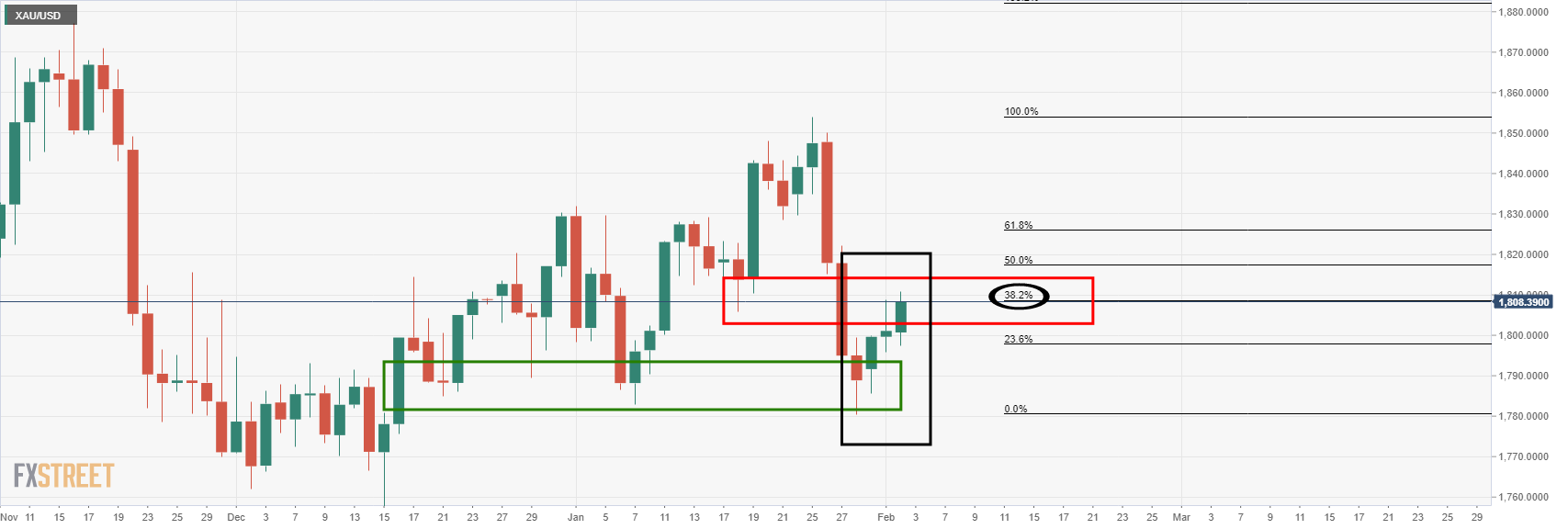

Gold, live market

So far so good.

What bears will now want to see is a deceleration in the price action. This can be monitored from a lower time frame, such as the 4-hour chart:

In the above chart, we can see a number of interesting structures that leave a bearish bias below the $1,820's. The price would be expected to move lower to test the W-formation's neckline near $1,802 as follows:

As stated at the start of the week's analysis in the Chart of the Week, ''should this playout, and if the bears commit ... additional supply could be the straw that breaks the camel's back for a sizeable continuation to crack the trendline support as follows:

On the other hand, if the US dollar gives way again, then the neckline of the M would be the last defence for a restest of the wedge resistance the $1,850's once again:

- The S&P 500 is pushing towards 4500, up around 0.8% on the day and spurred by strong Google earnings.

- That puts the index on course for a fourth successive positive session as equities continue their strong start to February.

- Focus has turned to upcoming Facebook and Amazon earnings ahead of Friday’s official US jobs report.

US equity markets enjoyed a broad-based rally for a fourth successive session on Wednesday, with the latest leg in the rebound from January’s lows driven by strong earnings from tech giant Alphabet (Google’s parent company). GOOG shares surged as much as 10% on Wednesday after the company posted record quarterly sales following Tuesday’s market close and announced a new 20 to one stock split. Analysts said this would make investing in the company more appealing to the retail crowd. After the closing bell, focus then switches to earnings from Meta Platforms (Facebook) ahead of Amazon results on Thursday.

Strong Google earnings helped lift the S&P 500 0.8% to the 4580s, with the bulls eyeing a challenge of the 4600 level. Equity analysts reasoned that strong tech earnings could catalyze a recovery back towards early January levels, as long as upcoming economic data releases don’t provoke further Fed tightening fears. The Nasdaq 100 index was 0.7% higher and managed to break back above the 15K level, while the Dow was up 0.6% to back above 35.5K. Compared to January lows, the S&P 500 trades 8.7% higher, the Nasdaq 100 10.2% higher and the Dow 7.3% higher.

However, the three indices are still 4.9%, 9.7% and 3.7% below recent record highs. Whilst a more cautious tone to Fed rhetoric this week has aided recent gains, for equities to return back to record levels, more certainty that the Fed isn’t going to tighten “too” aggressively is needed. Policymakers this week suggested that a 50bps rate hike in March is highly unlikely and emphasised that the timing and pace of upcoming tightening remain uncertain and data dependent. That means equity markets will be closely scrutinising upcoming data releases, the most important of which this week include Friday’s labour market report.

Wednesday’s weak ADP figures will strengthen the market’s conviction that Friday’s headline payrolls number is likely going to be poor. But Fed members have said they expect this and flagged wage growth and labour slack metrics as more important to monitor. If Average Hourly Earnings growth surprises to the downside like last Friday’s Q4 Employment Cost Index figures did (recall that helped equities at the time), that could spur a strong finish to the week for equities. More broadly, bad jobs data is good jobs data as far as the US stock market is concerned, with investors hoping to see numbers that will keep the Fed cautious and tightening monetary policy at a more measured pace in 2022.

What you need to know on Thursday, February 3:

The American dollar kept falling on Wednesday to reach fresh weekly lows against its high-yielding rivals. The EUR/USD pair reached 1.1329 as the EU annual Consumer Price Index jumped to 5.1% in January, largely surpassing the 4.4% expected and above the 5% previous. The reading came one day ahead of the European Central Bank monetary policy announcement, putting pressure on the central bank to respond with a tighter monetary policy.

Government bond yields held near the lower end of their weekly range.

GBP/USD heads into the Asian opening, trading near a daily high of 1.3587, as Wall Street recovered from an early knee-jerk and closed in the green. Stocks eased after the release of the US ADP survey, which showed that the private sector lost 301K positions in January, much worse than anticipated and fueling concerns about the economic recovery in the country.

AUD/USD trades in the 0.7140 region, while USD/CAD is down to 1.2660, while safe-haven currencies also advanced against the dollar.

Gold posted a modest intraday advance and trades at $1,808 a troy ounce, while crude oil prices remained steady around Tuesday’s close. WTI settled at $88.10 a barrel.

US indexes managed to post gains after a soft start to the day. The DJIA added over 200 points and was the best performer.

On Thursday, the European Central Bank and the Bank of England will announce their decisions on monetary policy.

Crypto.com price slips despite offer to protect Australian users against hacks

Like this article? Help us with some feedback by answering this survey:

- The Loonie gains 0.07% vs. the greenback in the New York session.

- The FX complex is in a risk-off mood, the JPY, and the CHF rise.

- USD/CAD remains upward biased, despite retreating near 1.2650s.

The Loonie gains ground vs. the greenback for the third consecutive day in the week. At press time, the USD/CAD is trading at 1.2672. The market sentiment is mixed, as some European equity indices recorded losses. Meanwhile, US stock indices advance, except for the Russell 2000, down 1.20% during the day.

In the FX complex, the mood shifted towards a risk-off as portrayed by recent JPY and CHF strength, up some 0.28% and 0.25%, respectively. In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of six peers, losses almost 0.50%, sitting at 95.95.

On Wednesday, the US economic docket featured the ADP employment report for January. Market participants expected an increase of 207K jobs added to the economy but instead witnessed the losses of 301K. That was noticed by some Fed members, like Philadelphia Fed Patrick Harker, who expects that the Nonfarm Payrolls report would be bad due to the spread of the Covid-19 Omicron variant.

In the report, the ADP Chief Economist said, “That the labor market took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth.”

In the commodities market, particularly US crude oil due to its high correlation to the Canadian dollar, the Western Texas Intermediate also known as WTI, rises 0.05% during the North American session, trading at $88.39 per barrel.

USD/CAD Price Forecast: Technical outlook

The USD/CAD retreated from the 50-day moving average (DMA). Nevertheless, the upward bias remains in place as long as the 100 and the 200-DMA remain positioned below the spot price, though almost horizontal.

The retracement witnessed in the last three trading sessions stalled around the February 1 daily low at 1.2654. However, a breach of the latter would expose the 100-DMA at 1.2620, followed by the 1.2600 figure.

Contrarily, if the USD/CAD uptrend resumes, the first resistance would be 1.2700, immediately followed by the 50-DMA at 1.2712. An upside break would open the door towards January 28 highs at 1.2797.

UK Chancellor of the Exchequer (Finance Minister) Rishi Sunak will hold a major press conference on Thursday amid souring UK energy costs, reported The Sun. The UK energy regulator Ofgem will announce the new energy price cap for April on Thursday morning (UK time) and Sunak is expected to announce new financial support measures for low-income Brits.

Market Reaction

GBP does not seem to have reacted much to the latest news, though if Sunak's measures on Thursday are interpreted as amounting to meaningful fiscal stimulus, the impact on sterling could be modestly positive.

- EUR/GBP bears are waiting in the flanks of the central bank meetings.

- Bulls are tiring on the bid which opens prospects of a downside continuation.

EUR/GBP is under the spotlight this week considering the central bank meetings on Thursday. ''The money market has priced in another 125 bps on UK rates on a 12-month view. This compares with around 35 bps on Eurozone rates in the same period,'' analysts at Rabobank explained.

''The guidance provided by the ECB and the BoE tomorrow will provide an opportunity for investors to re-evaluate these policy expectations and this suggests the potential for fresh direction for EUR/GBP.''

As for the technical outlook for the meetings, the following illustrates a bearish bias from an hourly perspective:

EUR/GBP H1 charts

The price is losing traction on the bid as it moves in on the 50% mean reversion point of the prior bearish impulse. If the bears commit here, then there will be prospects of a bearish head & shoulders forming in subsequent sessions and price action as follows:

- EUR/USD continues to remain well supported above 1.1300 after hot Eurozone inflation, having shrugged off weak US ADP data.

- Focus now turns to Thursday’s ECB meeting and whether the bank will adjust its inflation view.

EUR/USD continues to trade well supported to the north of the 1.1300 level as the euro remains well positioned near the top of the daily G10 performance table, having been boosted by post-hot Eurozone inflation data hawkish ECB bets. While the pair had already broken above the key 1.1275 resistance area during Asia Pacific trade amid continued US dollar weakness, it was sent lurching above the big figure after Eurozone HICP inflation unexpectedly hit fresh record highs in January.

Weak US ADP National Employment data, which showed a surprise more than 300K drop in employment last month, was broadly shrugged off by FX markets. That’s because market participants don’t trust ADP to accurately predict the official NFP number and Fed members have recently been emphasising the importance of wage growth data. Thus, EUR/USD has spent the last few hours going sideways in the 1.1310 area, where it currently trades with gains of about 0.4% on the day. Subdued trade is likely to persist ahead of Thursday’s ECB policy decision.

In wake of the latest Eurozone inflation surprise, some analysts are calling for the ECB to adjust its inflation view. At its last meeting, the central bank said that it still viewed inflation as transitory and likely to fall back under the 2.0% target by the end of 2022, but that this view could shift on persistent inflation surprises. The ECB won’t be posting new forecasts but could hint towards an upgrade at the coming meeting that might validate current market pricing for a hiking cycle to begin in the final quarter of 2022. A hawkish surprise at Thursday’s meeting would likely lift EUR/USD further towards the upper 1.1300s.

- GBP/USD bulls in good stead for a run towards the 1.3660's.

- The BoE is now the main focus ahead of Friday's US NFP.

At 1.3570, GBP/USD is around 0.40% higher on the day as it tracks down the start of the New York sessions highs of 1.3587 again during midday trade. Sterling is climbing on Wednesday for the fourth session in a row, reaching a 1-1/2-week high against the dollar.

Trader's expectations that the Bank of England will raise interest rates on Thursday, a disappointment in US jobs data, a softer US dollar and rebounding US stocks, is supporting cable higher.

Bearish prelude for NFP

The US dollar depreciated to a low of 95.806 at the start of the day as measured by the DXY index as what might be regarded as a prelude to Friday's January Nonfarm Payrolls employment report disappointed. ADP private payrolls, which showed a 301,000 drop, was missing an estimate of 207k.

Also, the January decline followed a downwardly revised 776,000 increase in December, compared with the 807,000 gain initially reported. By sector, goods-producing jobs fell by 27,000, while service-providing jobs plunged by 274,000, with leisure and hospitality jobs down 154,000.

Meanwhile, domestic data for sterling since December has shown that the economy was in much better shape than expected heading into Omicron, and high inflation is lifting inflation expectations. Encouragingly for cable bulls this week, a survey has shown British manufacturing output grew at the fastest pace in six months in January. This is supporting the view that the British economy is still handsomely rebounding from the COVID-19 recession.

Moving into the key event, the BoE, which was among the first off the blocks among its developed market peers to raise interest rates in December, the money markets are now expecting a total of 125 bps in rate hikes from the central bank this year.

This has been priced into the pound, so traders will be keen to see if policymakers strike a more hawkish tone to curb inflation in Thursday's meeting.

Reuters reported on Wednesday that most economists polled by the news agency believe the BoE will also signal its approach to start unwinding its 895 billion pound ($1.2 trillion) quantitative easing programme.

''Investors have now fully priced a 25-basis-point rise in the BoE's main interest rate to 0.50% on Feb. 3 and economists polled by Reuters also expect that outcome from the meeting.''

A bearish outlook for GBP on BoE

Based on their base case scenario for Thursday's BoE meeting, analysts at TD Securities said, ''we think the profile skews more negatively for GBP on the day, especially as positioning looks relatively long. That said, external drivers, like risk and the USD, feature prominently in the price action.''

Their base case view, published on Wednesday in the same notes is as follows:

''The MPC hikes Bank Rate, but echoing its recent messaging, offers few hints at future rate hikes beyond the big-picture acknowledgement that rates need to continue rising. The yield curve is implicitly backed by the MPC over the medium-term with 2024 inflation likely to be revised just a touch higher (though still under 2%).''

GBP vulnerable to a tax hike

Meanwhile, at the start of the week press reports indicated that the planned April increase in UK National Insurance Tax will go ahead despite calls from some Tory MPs for this to be reviewed in light of the rise in the cost of living.

''On the assumption that the government does proceed with its tax hike in April, we see the risk that the market will unwind some of its assumptions on BoE rates and this could leave the pound vulnerable in the spring and early summer,'' analysts at Rabobank argued. '' Given our view that the USD will be buoyed as Fed tightening commences, we see a risk that cable could dip below the 1.30 level in the middle of the year.''

As for politics, currency markets have simply ignored the latest developments of the political crisis in Britain over lockdown parties at Downing Street. This is despite the fact that six Conservative members of parliament now publicly saying they are seeking a vote of confidence on Prime Minister Boris Johnson's leadership on Wednesday.

GBP/USD technical analysis

The price has burst through what might have been expected to be a firmer resistance on the 4-hour charts near 1.3525. A break of 1.3580 could set the stage for a rally through to the 1.3660s to mitigate an old imbalance of price between here and there.

- The AUD/USD climbs some 0.07% in the North American session.

- AUD/USD Technical Outlook: Downward biased as shown by the confluence of resistance levels and DMAs depicting a downslope.

The AUD/USD retreats from weekly highs, right around the 50-day moving average (DMA) at 0.7163, edges lower some 0.07%. At the time of writing, the AUD/USD is trading at 0.7134. Market conditions are mixed, as European and US equity indices fluctuate between gainers and losers in the middle of the North American session.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of six rivals, is losing 0.38% in the day but reclaimed the 96.00 figure as investors flow towards safe-haven peers.

AUD/USD Price Forecast: Technical outlook

The AUD/USD seesawed around the 0.7130-60 range during the overnight session until Wall Street opened. However, as American traders got to their desks, the release of US macroeconomic data influenced the dip from weekly highs around 0.7158 to 0.7125.

The Aussie is downward biased, based on the daily moving averages (DMAs) residing above the spot price, with a downslope. Furthermore, an eight-month-old downslope trendline, drawn from 2021 yearly highs, confluences with the 200-DMA, around 0.7384, 130-pips above the 100-DMA at 0.7254.

The AUD/USD first support would be the January 7 daily low at 0.7129. A breach of the latter would expose the January 24 daily low at 0.7090, followed by January 28 at 0.6967.

To the upside, the AUD/USD first resistance would be the 50-DMA at 0.7163. If it gives way for AUD bulls, the next resistance would be 0.7200, followed by the confluence of a three-month-old downslope trendline and the 100-DMA at 0.7254.

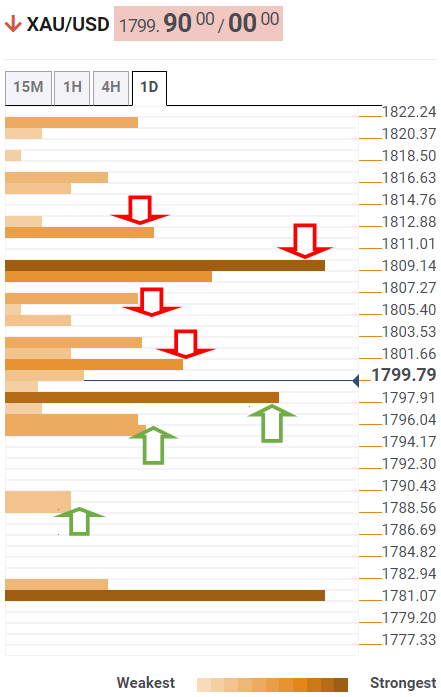

- The non-yielding metal is trading above $1805, the trendsetter 200-DMA.

- The US ADP data was worse than expected; it could be a prelude to the Nonfarm Payrolls (NFP).

- XAU/USD Technical Outlook: A daily close above the 200-DMA could signal a shift in gold’s trend.

Gold (XAU/USD) climbs in the North American session as US T-bond yields led by the 10-year benchmark note fall three basis points, undermining the greenback. At the time of writing, XAU/USD is trading at $1808, up 0.44%.

The market sentiment is mixed, as European bourses remain in the green, while US equity indices fluctuate between gains/losses. Meanwhile, the US Dollar Index extends its losses throughout the week to three straight days, down 0.20%, sitting at 96.07.

ADP worse than foreseen report a prelude of Friday’s Nonfarm payrolls?

Before Wall Street opened, the ADP Jobs report for January was released. The print came awful, showing that the US economy lost more than 301K, private employees when analysts estimated it would add 207K new jobs.

The ADP Chief Economist said that “The labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact on job growth.” Nevertheless, officials in the White House and Fed members warned that the January employment report would be disappointing, subject to the impact of the Omicron variant.

On Tuesday, Fed speakers with the likes of Philadelphia Fed President Patrick Harker and St. Louis James Bullard crossed the wires.

Philadelphia’s Fed Harker said that the Fed could begin unwinding its balance sheet once Federal Funds Rates (FFR) hit 1 – 1,25%. Worth noting that Harker said that the employment report would probably be bad due to the Omicron variant. Regarding hiking rates, he does not foresee a 50 bps hike.

Meanwhile, St. Louis Fed Bullard said that he estimates two hikes, one in March followed by May. Bullard said that at the beginning of the H2, the US central bank would be able to assess how robust inflation seems for the rest of 2022 and expects to adjust accordingly. Concerning Quantitative Tightening (QT), Bullard noted that he would like to start in Q2 and emphasized that the runoff could be faster.

XAU/USD Price Forecast: Technical outlook

On Wednesday, the yellow metal, so far, reclaimed the 200-day moving average (DMA), which lies at $1,805. However, it faces resistance at the mid-line between the central/bottom trendlines of Pitchfork’s channel, around $1,808-12 area.

The break above ALL the DMAs appears to put the greenback under pressure. Nevertheless, to further cement gold’s trend shift to the upside, XAU bulls would need a daily close above $1,815. In that event, the first resistance would be the central trendline of Pitchfork’s channel around $1824-26. A breach of the latter would expose July 15, 2021, high at $1,834, followed by the mid-line within the central/top trendline of the channel around $1,844.

- Spot silver prices continue to struggle to benefit from the latest USD slump, amid selling pressure in the $23.00 area.

- That despite a massive miss on expectations in the latest US ADP figures, which come ahead of Friday’s jobs report.

- Perhaps what XAG/USD needs is to clear the resistance area around $23.00 before a more substantial rebound can take place.

Spot silver (XAG/USD) prices continue to struggle to benefit from the latest US dollar slump, as spot prices continue to face selling pressure ahead of the $23.00 per troy ounce level. Indeed, since pulling back from earlier session highs in the $22.80s after failing to rally above the 50-day moving average at $22.86, the precious metal has traded in choppy fashion, even dipping below $22.50 at one point. At current levels in the $22.60s, it trades about 0.2% higher on the session. That despite a massive miss on expectations in the latest US ADP National Employment report, which showed private payrolls dropping by more than 300K in January versus forecasts for a 207K rise.

Though ADP hasn’t had the best track record as of late in predicting the official US payroll change number (out on Friday), it will push already very low expectations even lower. The rapid spread of Omicron over the past six weeks or so in the US has disrupted the usual labour market churn and slowed the pace of hiring. In light of this, markets have broadly ignored the latest ADP report and will likely ignore the headline NFP number on Friday (so long as it doesn’t deviate to massively from the roughly 150K expected job gain). Fed officials have flagged wage cost pressures as more important in the near-term to policymaking decisions, so Friday’s Average Hourly Earnings (AHE) growth metric will be the most closely followed aspect of the report.

If AHE follows in the footsteps of last week’s Q4 Employment Cost Index data by underwhelming expectations, the US dollar may gather fresh momentum. Spot silver’s failure to capitalise on the USD weakness that has already ensued this week raises questions about whether the aforementioned scenario would ultimately be a XAG/USD positive. Perhaps what XAG/USD needs is to clear the resistance area around $23.00 before a more substantial rebound can take place. Certainly, a rally above $23.00 would open the door to a run back towards $24.00. However, in the longer-run, in an environment where the Fed is moving towards tighter policy, the 200DMA may continue to provide a long-term ceiling, as has been the case since last August.

- Mexican peso lost strength after being unable to break 20.50.

- USD/MXN rebounded after hitting a fresh weekly low at 20.47.

- Rebound likely to weaken near 20.70.

The USD/MXN is rising on Wednesday after falling sharply during the previous two trading days when it corrected from levels near 21.00 to 20.47. The Mexican peso was rejected twice from under 20.50, showing difficulties in extending the rally.

The key support area is 20.50 and a daily close below would point to more losses, targeting 20.35. A decline below 20.35 should clear the way for a new test of the critical area of 20.25/20.30 that includes the 200-day simple moving average.

The current move to the upside will likely face resistance near 20.70. The mentioned level is a critical short-term resistance. A break above would expose the next obstacle seen at 20.85/90.

On the weekly chart, the USD/MXN is still in negative despite Wednesday’s gains. The weekly chart shows the 20-week simple moving average at 20.60; a close above would keep the doors open for 21.00.

USD/MXN Daily chart

-637794153852198555.png)

- USD/CHF fell under 0.9200 on Wednesday, down another 0.2% and taking weekly losses to about 1.3%.

- US dollar weakness continued for a third day, amid better risk appetite, position squaring and easing Fed tightening bets.

US dollar weakness has continued for a third day on Wednesday, with the buck weighed by the continued improvement in global equity market sentiment, long-position squaring and a paring back of Fed tightening bets. More recently, weak ADP national employment change figures for January have further dented USD sentiment. As a result, USD/CHF dropped back under 0.9200 on Wednesday and is now below both its 21 and 50-day moving averages at the 0.9192 and 0.9198 levels respectively. At current levels close to 0.9190, USD/CHF is off earlier session lows in the 0.9170s, but still trades with on the day losses of about 0.2%.

USD/CHF is now trading roughly 1.3% lower on the week and about 1.6% down versus its Monday highs in the mid-0.9300s. FX market focus has predominantly been on US data, Fed expectations and risk appetite so far this week, but will on Thursday switch to central banks, with the BoE and ECB both reporting. If the ECB sticks to its “transitory” inflation narrative and shrug off upside inflation risks despite Wednesday’s hot Eurozone HICP inflation figures, that could bolster the European safe-haven CHF, which has in the past benefitted from ECB dovishness. Short-term bears may look for USD/CHF to test support in the form of its 200DMA at 0.9164.

Focus will switch back to US data and Fed expectations on Friday when the official US labour market report for January will be released. The headline number is expected to be weak but this shouldn’t faze markets (just as Wednesday’s weak ADP numbers didn’t), with focus instead on wage inflation pressures and measures of labour market slack. If those also show signs of easing in January, then that would be interpreted as easing the pressure on the Fed to tighten so fast in 2022 and would hit the US dollar. Such a scenario could conceivably see USD/CHF hit support in the form of 2022 lows in the 0.9100 area, although some might see the dollar’s drop already this week as somewhat overdone, which may reduce downside risks.

- DXY falls for the third consecutive day, hits lowest since January 24.

- Employment data from the US came sharply below expectations.

- USD/JPY finds support above 114.00, holds negative bias.

The USD/JPY is falling on Wednesday for the fourth consecutive day. It bottomed at 114.14 after the release of the US ADP employment report. During the American session, it has been trading in range between 114.20 and 114.45, consolidating daily losses.

The decline of USD/JPY takes place as the DXY continues to correct lower and while US yields remain rangebound. The Index is falling 0.23%; it bottomed at 95.82, the weakest in almost two weeks before bouncing back above 96.00. The 10-year stands at 1.77%, down 1.05% for the day.

The yen is posting mixed results across the board. The improvement in risk sentiment weighs on the Japanese currency. The worse-than-expected economic numbers from the US did not push the yen sharply higher. The ADP employment report showed a decline in private payrolls of 301K, against expectations of a 200K increase. Attention now turns to Friday’s NFP.

Strong barrier ahead

The negative bias in USD/JPY remains in place. The yen appears to have reached a strong barrier above 114.00/10. A break under the area should clear the way for a test of 113.45 (January low).

On the upside, the immediate resistance is seen at 114.45 followed by 114.60 and then 114.95. A daily close back above 115.00 would alleviate the bearish pressure.

Technical levels

- The NZD/USD snaps two consecutive days of gains, down 0.15%, amid a positive market mood.

- The US ADP employment report was dismal, though it barely influenced the US dollar.

- NZD/USD is downward biased, and failure to break above a downslope trendline opened the door for the YTD low.

The New Zealand dollar climbs but retreats from weekly highs around 0.6662 after mixed than foreseen NZ jobs report released in the Asian session. At the time of writing, the NZD/USD is trading at 0.6637.

The US ADP Employment report was ignored by investors as they prepare for Friday's NFP

An hour and a half before Wall Street’s opened, the ADP Jobs report was released. The figures were dismal, showing the losses of more than 301K employments when polled economists expected at least 207K private jobs added to the economy.

The ADP Chief Economist said that “The labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth.” Nevertheless, officials in the White House and Fed members warned that the January employment report would be disappointing, subject to the impact of the Omicron variant.

Meanwhile, in the Asian session, New Zealand’s employment report showed that the unemployment rate fell from 3.3% to 3.2%, while the Labor Cost Index jumped two tenths from the previous month to 2.6%., but short of the 2.9% foreseen.

The RBNZ is expected to hike rates 25 basis points to the Overnight Cash Rate (OCR) at the February meeting. Nevertheless, wage growth is lagging widely, so the NZ central bank could decide to slow rate hike increases in 2022, allowing inflation to shoot up.

NZD/USD Price Forecast: Technical outlook

The NZD/USD is downward biased, as shown by the daily moving averages (DMAs) residing above the spot price, despite the recent jump from YTD lows, at 0.6529. All the DMAs have a downward slope, suggesting the downtrend could be accelerating. Furthermore, a bottom downslope trendline of a descending channel, broken to the downside on January 26, located around the 0.6650-60 range, was challenged through the day.

Failure to break the abovementioned opened the door for further losses. The NZD/USD first support would be the figure at 0.6600. A breach of it, then the NZD/USD would face January 28 high, previous resistance-turned-support at 0.6588, followed by the YTD low at 0.6529.

- One day out from an anticipated second successive BoE rate hike, pound sterling has been trading on the front foot.

- GBP/USD recently surpassed its 21DMA at 1.3557 before running into resistance ahead of the 1.3600 level

- The pair wasn’t much moved by the latest weak US ADP figures, with USD traders more focused on wage growth.

One day out from an anticipated second successive BoE rate hike, pound sterling has been trading on the front foot, with GBP/USD recently surpassing its 21-day moving average at 1.3557 before running into resistance ahead of the 1.3600 level. At current levels in the 1.3560s, the pair trades with on-the-day gains of about 0.3%, taking its on-the-week gains to about 1.3% and the rebound from last week’s sub-1.3400 lows to roughly 1.5%. While hawkish BoE bets ahead of Thursday’s meeting are one factor supporting GBP/USD on Wednesday, with the latest BRC Shop Price inflation figures jumping to near-decade highs and adding to inflation fears, dollar factors are also in play.

Market commentators are citing a combination of 1) a paring back of long positions and 2) a paring back on hawkish Fed bets following recent policymaker communications as the major driver of recent US dollar weakness. Regarding positioning; MUFG noted on Wednesday that their 2yr z-score measure of Leveraged Funds’ long USD positioning is “at an extreme”, with USD longs at a level not seen since 2011. However, ING says that “if position-squaring is indeed behind this week’s dollar weakness… we expect the dollar’s positioning now to have reached a somewhat more balanced level which can allow for some stabilisation,” the bank says. “After all”, they continue, “a market that is quite freely speculating on the pace and size of Fed tightening is unlikely to turn much less bullish on the dollar anytime soon”.

Regarding recent Fed speak, policymakers played down the prospect of a 50bps rate hike in March. Meanwhile, though policymakers speaking this week have unanimously expressed support for the start of a rate hiking cycle next month, most emphasised a data-dependent approach when it comes to determining its timing, pace and extent. That implies that US economic data in the coming months will take on even more important than usual, starting with this Friday’s official January labour market report. The latest weak ADP national employment change figures have solidified expectations for a weak headline NFP number but didn’t impact FX markets or GBP/USD too much given Fed members have said they are more focused on wage growth.

- DXY drops as low as the 95.80 region on Monday.

- Consolidation remains the name of the game around US yields.

- The ADP report surprised to the downside in January.

The greenback remains on the defensive although it managed to bounce off daily lows near 95.80 when measured by the US Dollar Index (DXY).

US Dollar Index stays supported near 95.80

Following fresh multi-day lows around 95.80, the index now regained some composure and looks to reclaim the key 96.00 zone in a context where US yields remain depressed amidst the broad side-lined theme.

The rebound in the dollar came soon after the ADP report showed the US private sector lost 301K jobs during last month, missing consensus although matching previous speculation that the labour market could have suffered the impact of the rapid spread of the omicron variant in past weeks. The drop in the ADP print was the biggest since April 2020, the onset of the pandemic.

What to look for around USD

The dollar’s corrective downside remains well in place, although some decent support seems to have turned up around 95.80. Reasons behind the strong correction in the buck can be found in the improved mood in the risk-associated universe and dormant US yields (despite navigating the upper end of the recent range). However, the constructive outlook for the greenback is expected to remain unchanged in the longer run on the back of rising yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery.

Key events in the US this week:) ADP Employment Change (Wednesday) – Initial Jobless Claims, ISM Non-Manufacturing PMI, Factory Orders (Thursday) – Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issues. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.30% at 95.97 and a break above 97.44 (2022 high Jan.28) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 95.80 (weekly low Feb.2) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).

In January, the Mexican peso weakened modestly from 20.496 to 20.655 against the US dollar. As economists at MUFG Bank note, the USD/MXN is set to inch higher amid expected tightening from the Federal Reserve.

MXN tends to gradually depreciate amid Fed policy and local policies

“Even though it seems highly priced in by the market, we assess that the effective monetary policy tightening in the US might further strengthen the US dollar leading to our call of MXN weakening this year.”

“We expect a moderate pace of depreciation once Banxico tends to continue increasing its key policy rate in order to control inflation expectations, which might partially offset the drivers that push MXN to weaker levels.”

“We need to keep monitoring Lopez Obrador protectionist policies, especially in the energy sector. US President Joe Biden’s trade chief is reviewing these policies to see how they relate to the country’s commitments to their 2020 USMCA trade deal.”

The S&P 500 maintains a strong tone. Analysts at Credit Suisse see scope for further strength yet to the 61.8% retracement of the January collapse at 4591, potentially the 63-day average at 4639, but with this then ideally capping.

Initial support seen at 4526/24

“We see scope for the recovery to extend further yet with resistance seen next at the 61.8% retracement of the January sell-off at 4591, then the potential downtrend from the beginning of January and price resistance at 4602/12. With the 63-day average seen not far above at 4639, we look for a cap in this 4602/39 zone to define the top of a broader sideways range.”

“Support is seen at 4526/24 initially, then 4504, with a break below 4494/84 needed to ease the immediate upside bias for a retreat back to 4453, then a retest of the 200-day average at 4439.”

- EUR/USD remains bid and surpasses the 1.1300 mark.

- Above 1.1300 the pair targets the 1.1369 level.

EUR/USD keeps the bid bias unchanged for yet another session, this time finally leaving behind the key 1.1300 barrier to click new multi-day highs.

While the ongoing strength is deemed as corrective only, it seems it still has the legs to go further on. Against such a scenario, extra gains could extend to the January 20 high at 1.1369 ahead of the 1.1430 region, where the 100-day SMA and the 4-month resistance line coincide.

In the longer run, the negative outlook is seen unchanged below the key 200-day SMA at 1.1683.

EUR/USD daily chart

GBP/USD is firming up its drive above 1.35 ahead of expected Bank of Enland (BoE) hike on Thursday. Economists at Scotiabank believe that the “Old Lady” will not meet market expectations of further rate hikes, pounding the pound.

Near-term ceiling for the cable at 1.36

“We await the BoE’s announcement tomorrow – where we see a 25bps hike but some pushback against market pricing (GBP downside risk).”

“Market pricing for the BoE has held steady at a 95-100% chance of a hike tomorrow and a total of five 25bps hikes by end-2023. We think it’s more likely that the bank delivers only 100bps in rate increases this year, which should eventually act as a headwind for the GBP as markets reprice expectations.”

“We see the 1.36 mark as a near-term ceiling for the GBP.”

“It would take a clear sign from the BoE that it is willing to go above its neutral rate for the pound to test 1.38.”

EUR/USD has broken through 1.13 trading on a strong four-day streak from the low 1.11s last Friday. Economists at Scotiabank expect the world’s most popular currency pair to challenge the 1.14 level.

Below 1.13 support is seen around the 1.1280 mark

“The EUR is testing its 50-day MA of 1.1310, which alongside the figure stand as key levels to watch on a closing basis. Resistance ahead stands at 1.1335 and the mid-figure zone – with the 1.14 area roughly marking trendline resistance from the losses since June.”

“Support is ~1.1280 if the EUR fails to hold around the figure, followed by 1.1250 and 1.1235.”

- Weak ADP data has failed to push EUR/USD higher, though the pair continues to trade well supported above 1.1300.

- The euro was boosted earlier in the day after hotter than expected Eurozone inflation spurred hawkish ECB bets.

- The central bank announces policy on Thursday ahead of the official January US labour market report on Friday.

Significantly weaker than expected US ADP national employment change figures for January, which showed a surprise 301K drop versus forecasts for a 207K rise, has failed to push EUR/USD to fresh session highs in the 1.1330s. Nonetheless, the pair continues to trade higher by close to 0.3% on the day and is well supported above 1.1300, taking its three-day rebound from last Friday’s 18-month lows around 1.1120 to around than 1.5%. The latest soft US labour market data will likely help keep Fed tightening bets, which have been pared back in recent days following cautious commentary from Fed policymakers, in check ahead of Friday’s official January labour market report. This, combined with an ongoing further bout of dollar-long position squaring, may keep the pair supported above 1.1300 for now.

Though ADP’s national employment change estimate has a poor post-pandemic track record of predicting the official payroll number each month, some economists may be inclined to revise lower their forecasts. Prior to the ADP report, the consensus estimate for Friday’s NFP number was 150K. The weak ADP data’s failure to have a lasting market impact is not just indicative of poor NFP predictive power, but also because the headline official payroll number on Friday won’t be the most closely followed labour market metric. Fed officials have stated that, given their belief the US labour market is pretty much back to near-term full employment, metrics pertaining to wage cost pressures are more important to policy-making decisions right now.

ECB meeting looms

Ahead of Friday’s important official US labour market report, EUR/USD traders will be focused on the ECB’s monetary policy announcement on Thursday. Record high Eurozone HICP inflation data released on Wednesday, which surprisingly rose to 5.1% YoY in January versus expectations for a drop to 4.4%, has complicated things for the bank. Up until now, the ECB has reffered to inflation as transitoy and had said it thought YoY inflation rates would have peaked in December.

The hotter than expected data helped boost the euro on Wednesday amid bets that the ECB will be forced into changing its tone on inflation and acknowledge upside risks to its forecasts. “The ECB will have to adjust its inflation forecast upwards from the current 3.2% for 2022 and 1.8% for 2023” analysts at Berenberg noted. “As soon as the ECB raises its inflation forecast, it must also discuss interest rate steps” the bank added, warning that “perhaps the ECB will surprise us on Thursday.” A hawkish ECB surprise could push EUR/USD back towards 1.1400.

- DXY breaks decisively below the key 96.00 support.

- Next on the downside comes a minor support at 95.41.

DXY adds to the weekly leg lower and clinches fresh lows in the 95.80 region on Wednesday.

The downside extends for the third session in a row and after breaking below the 96.00 yardstick it has now opened the door to a deeper pullback in the short-term horizon. That said, the index faces the next minor support at 95.41 (low January 20) ahead of the 100-day SMA, today at 95.13.

In the near term, the upside pressure remains intact while above the 4-month line around 95.00. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.43.

DXY daily chart

- A combination of factors dragged USD/CAD lower for the third successive day on Wednesday.

- Bullish oil prices underpinned the loonie and exerted pressure amid sustained USD selling bias.

- The disappointing release of the US ADP report did little to provide any respite to the USD bulls.

The USD/CAD pair witnessed fresh selling during the early North American session and dropped to a fresh weekly low, around mid-1.2600s in reaction to the dismal US ADP report.

Following an early uptick to the 1.2700 mark, the USD/CAD pair turned lower for the third successive day on Wednesday and was pressured by a combination of factors. Crude oil prices jumped to a fresh seven-year high, which continued underpinning the commodity-linked loonie. This, along with the heavily offered tone surrounding the US dollar, exerted downward pressure on the major.

Oil prices broke out of a one-week-old consolidative trading range and shot to a fresh seven-year high after the OPEC+ announced to increase March oil production by 400K barrels per day. This, along with the post-pandemic recovery in fuel demand, should keep a tight supply condition. Apart from this, the conflict between Russia and the West over Ukraine acted as a tailwind for the black gold.

On the other hand, the greenback was weighed down by diminishing odds for a 50 bps Fed rate hike in March and lost additional ground following the release of disappointing US macro data, Automatic Data Processing (ADP) reported this Wednesday that the US private-sector employment declined by 301K in January as against market expectations for an addition of 207K jobs and the 807K previous.

This, along with weaker US Treasury bond yields and a generally positive tone around the equity markets, further undermined the greenback's relative safe-haven status. The fundamental backdrop supports prospects for a further near-term depreciating move for the USD/CAD pair, though the lack of any follow-through selling warrants some caution for aggressive bearish traders.

Technical levels to watch

- EUR/JPY resumes the downside following Tuesday’s downtick.

- Next on the upside comes the 200-day SMA near 130.50.

EUR/JPY trades in the upper end of the weekly range further north of the key 129.00 hurdle midweek.

In light of the recent price action, further recovery in the cross could be in the pipeline in the short term. Against this, there is an interim hurdle at the 100-day SMA at 129.88, just ahead of 130.08 (high January 20). The surpass of the latter should put a move to the 200-day SMA, today at 130.45, back on the radar.

While below the 200-day SMA, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

- The prevalent USD selling bias pushed AUD/USD higher for the third straight day.

- The disappointing US ADP report did little to provide any respite to the USD bulls.

- The RBA’s dovish stance seemed to be the only factor capping gains for the major.

The AUD/USD pair maintained its bid tone through the early European session and held steady near the weekly high, just above mid-0.7100s post-US ADP report.

Automatic Data Processing (ADP) reported this Wednesday that the US private-sector employment declined by 301K in January as against market expectations for an addition of 207K jobs and the 807K previous. The awful data exerted additional pressure on the already weaker US dollar, which continues to be weighed down by less hawkish comments by Fed officials.

In fact, St. Louis Fed President James Bullard (a noted hawk) and Philadelphia Fed President Patrick Harker pushed back against market bets and downplayed the prospect of a 50bps hike in March. Apart from this, a softer tone around the US Treasury bond yields further undermined the safe-haven buck and benefitted the perceived riskier aussie.

The combination of supporting factors largely offset the Reserve Bank of Australia's dovish stance and assisted the AUD/USD pair to capitalize on this week's upward trajectory. This marked the third straight day of an uptick, summing up to a strong rally of nearly 200 pips from the lowest level since July 2020, around the 0.6965 area touched last Friday.

It, however, remains to be seen if bulls are able to maintain their near-term dominant position or opt to lighten their bets ahead of the closely-watched US monthly jobs report (NFP) on Friday. Hence, any subsequent move up might confront resistance near the 0.7175 area, which if cleared will suggest that the AUD/USD pair has bottomed out.

Technical levels to watch

- ADP data showed private US employment falling 301K in January versus expectations for a 207K gain.

- The DXY continues to trade at session lows in the 95.80s with the latest data not doing anything to help it rebound.

Employment in the US private sector fell by 301,000 in January, monthly data published by the Automatic Data Processing (ADP) Research Institute revealed on Wednesday, marking only the second month-on-month drop in employment since April 2020 when the US first went into lockdown. That was a huge miss on consensus economist forecasts for an employment gain of 207,000 and marked a more than 1,000,000 turnaround from December's 776,000 job gain (which ADP had revised lower from 807,000).

“The labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth,” said Nela Richardson, chief economist, ADP. “The majority of industry sectors experienced job loss, marking the most recent decline since December 2020. Leisure and hospitality saw the largest setback after substantial gains in fourth-quarter 2021, while small businesses were hit hardest by losses, erasing most of the job gains made in December 2021.”

Market Reaction

The DXY continues to trade close to session lows in the 95.80s area in wake of the latest, much weaker than expected ADP jobs report. The report will likely see economists revising down their forecasts for Friday's official payroll number for January, which is unlikely to help the US dollar, which had already been suffering from position squaring and a paring of Fed tightening bets, rebound. That said, the main focus on Friday is on measures of wage cost pressures and labour market slack rather than the headline NFP number, with Fed officials this week already noting they expect a weak headline number.

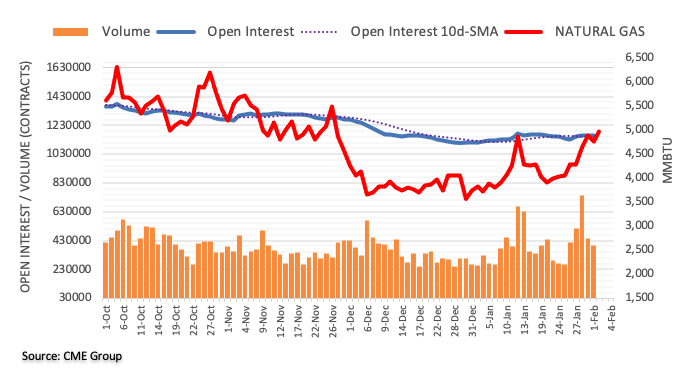

- WTI rallied above $89.00 to hit fresh seven-year highs as OPEC+’s JMMC recommended a 400K BPD output hike in March.

- The OPEC+ meeting is now underway and expected to confirm this recommendation.

- Oil price upside reflects a pricing out of bets that the group would hike output by more than 400K BPD.

Oil prices popped higher in recent trade, with front-month WTI futures surpassing the $89.00 level to hit fresh seven-year highs as OPEC+’s Joint Ministerial Monitoring Committee (JMMC) recommended a 400K barrel per day (BPD) output hike in March. WTI even managed to briefly advance above the $89.50 level and eye a test of the $90 per barrel mark for the first time since October 2014, though has since dropped back a little. The recommendation from the JMMC, which always meet (though don’t always make a policy recommendation) ahead of OPEC+ meetings, suggests the group will stick to its policy of increasing output by 400K BPD each month.

The positive market reaction likely reflects a pricing out of bets that the group would agree to lift output by more than 400K BPD due to higher prices and strong demand. Attention now turns to the meeting of OPEC+ oil ministers, which just started, who will be expected to take the JMMC’s recommendation. A principal concern that has helped to lift oil prices in recent weeks, noted analysts at UniCredit, “is that many (OPEC+) members are unable to deliver on their quotas due to a lack of spare capacity as a result of years of underinvestment”. “If Saudi and Russia show any signs of raising their production to shoulder shortfalls of some members who cannot meet their output targets, oil prices will likely fall” warned another analyst. “But if there are no such surprises” they continued, “the market is expected to keep a bullish trend as demand is recovering and geopolitical tensions linger”.

Elsewhere in relevant oil market news, weekly private API inventories on Tuesday revealed a surprise drawdown of oil inventories of 1.6M barrels versus expectations for a 1.5M barrel build. Analysts said this has also contributed to recent WTI upside, though, notably the same data also showed a much larger than expected build of 5.8M barrels (versus 1.6M expected) in US gasoline inventories. Oil traders now look ahead to official weekly US EIA numbers out at 1530GMT for confirmation. Separately, another theme worth monitoring is US weather. The centre and Northeast of the US is expected to be hit by a major winter storm this week which is predicted to bring heavy snow and freezing temperatures – analysts have noted this is likely to boost near-term energy demand.

EUR/GBP has regained positive traction on Wednesday. The Bank of England (BoE) policy decision and the European Central Bank (ECB) meeting on Thursday will provide an opportunity for investors to re-evaluate policy expectations. Meanwhile, economists at Rabobank expect EUR/GBP to inch higher towards the 0.85 zone by mid-2022.

Little scope for further BoE moves after spring

“The BoE could follow a 25 bps rate hike this week with another move in May. After that, we see little scope for further moves this cycle. Consequently, we view GBP as being vulnerable in the spring and beyond as the market backtracks on current expectations regarding interest rate settings.”

“The need for flexibility may lessen the amount of conviction with which ECB President Lagarde pushes back against market expectations for 2022 rate hikes at tomorrow’s post council meeting press conference.”

“We expect EUR/GBP to be creeping higher on a three to six-month view towards the 0.85 area in the middle of the year.”

- XAU/USD is consolidating near its 200DMA at $1806 ahead of the release of ADP’s estimate of US January employment change.

- Gold remains decently underpinned as USD continues to decline due to repositioning and a paring back of Fed tightening bets.

As the sharp US dollar downturn continues for a third successive session and with the DXY having shed another 0.5% on the day to drop back below the 96.00 level, spot gold (XAU/USD) prices are trading in the green. Note that a cheaper US dollar makes USD-denominated gold cheaper for purchase by holders of international currencies, thus boosting its demand. Market commentators are citing a combination of 1) a paring back of long positions and 2) a paring back on hawkish Fed bets following recent policymaker communications as the major driver of recent US dollar weakness.

Regarding positioning; MUFG noted on Wednesday that their 2yr z-score measure of Leveraged Funds’ long USD positioning is “at an extreme”, with USD longs at a level not seen since 2011. However, ING says that “if position-squaring is indeed behind this week’s dollar weakness… we expect the dollar’s positioning now to have reached a somewhat more balanced level which can allow for some stabilisation,” the bank says. “After all”, they continue, “a market that is quite freely speculating on the pace and size of Fed tightening is unlikely to turn much less bullish on the dollar anytime soon”.

Regarding recent Fed speak, policymakers played down the prospect of a 50bps rate hike in March. Meanwhile, though policymakers speaking this week have unanimously expressed support for the start of a rate hiking cycle next month, most emphasised a data-dependent approach when it comes to determining its timing, pace and extent. Not only has such rhetoric helped take the wind out of the US dollar, but it has also helped keep a lid on US bond yields, another positive for spot gold.

Ahead of the release of payroll company ADP’s estimate of US employment change in January at 1315GMT, spot gold prices have nudged back above the $1800 level. Analysts have said that due to the data’s poor predictive power of the official NFP number (which is released on Friday) plus the fact that Friday’s number is expected to be pretty poor and larger ignored anyway, markets won’t react much to the ADP release. For now, the XAU/USD price action remains capped by the 200-day moving average at just under $1806, with prices having failed to get above this level on Tuesday. Otherwise, its expected to be a quiet session with no major other US data releases or scheduled Fed speakers.

- USD/JPY prolonged its bearish trend for the fourth straight day amid sustained USD selling.

- Break below the 200-hour SMA, around the 114.55 area, aggravated the bearish pressure.

- Investors now look forward to the US ADP report for some short-term trading opportunities.

The USD/JPY pair continued losing ground through the mid-European session and dropped to over a one-week low, around the 114.25 region in the last hour.

The pair witnessed heavy selling for the fourth successive day on Wednesday and has now retreated nearly 150 pips from the 115.70 area, or a three-week high touched last Friday. Less hawkish comments by Fed officials accelerated the recent US dollar retracement slide from the post-FOMC swing high to the 18-month peak, which, in turn, exerted pressure on the USD/JPY pair.

In fact, St. Louis Fed President James Bullard (a noted hawk) and Philadelphia Fed President Patrick Harker pushed back against market bets and downplayed the prospect of a 50bps hike in March. Bearish traders further took cues from a softer tone surrounding the US Treasury bond yields, which further undermined the greenback and contributed to the USD/JPY pair's ongoing decline.

Apart from this, the downfall could further be attributed to some technical selling below the 200-hour SMA support near the 114.55 area. The USD/JPY pair's inability to attract any buying at lower levels favours bearish traders. This, along with the conflict between Russia and the West over Ukraine, which tends to benefit the safe-haven Japanese yen, supports prospects for further losses.

Market participants now look forward to the US economic docket, highlighting the release of the ADP report on private-sector employment. Apart from this, the US bond yields will influence the USD price dynamics and provide some impetus to the USD/JPY pair. The focus, however, will remain on the closely-watched US monthly jobs report – popularly known as NFP due on Friday.

Technical levels to watch

US ADP jobs report overview

Wednesday's US economic docket highlights the release of the ADP report on private-sector employment, scheduled at 13:15 GMT. Consensus estimates suggest that the US private-sector employers added 207K jobs in January, marking a sharp decelerating from the 807K reported in the previous month. The report might influence expectations from the official Nonfarm Payrolls (NFP) report and help predict how things could move on Friday.

How could it affect EUR/USD?

Ahead of the key release, a stronger Eurozone CPI print pushed the EUR/USD pair back above the 1.1300 mark amid the prevalent US dollar selling bias. Given that Fed officials have downplayed the prospects for a 50 bps rate hike in March, a weaker ADP report would keep the USD bulls on the defensive and provide an additional lift to the pair. Conversely, a stronger print might do little to influence the Fed's policy outlook or provide any meaningful respite to the buck. This, in turn, suggests that the path of least resistance for the pair is to the upside, though traders might refrain from placing aggressive bets ahead of the ECB meeting on Thursday.

Meanwhile, Eren Sengezer, Editor at FXStreet, outlined important technical levels to trade the EUR/USD pair: “ the 200-period and the 100-period SMAs on the four-hour chart form stiff resistance at 1.1320 before the pair could target 1.1340 (Fibonacci 61.8% retracement).”

“On the downside, 1.1260 (Fibonacci 38.2% retracement) aligns as first support. If this level turns into resistance, additional losses toward the 1.1210/1.1200 area (Fibonacci 23.6% retracement, psychological level) could be witnessed,” Eren added further.

Key Notes

• EUR/USD: Options market turns most bullish in 10 weeks

• EUR/USD Forecast: Unconvinced bulls may soon give up

• US Dollar Index extends the downside to 96.10 ahead of data

About the US ADP jobs report

The Employment Change released by the Automatic Data Processing, Inc, Inc is a measure of the change in the number of employed people in the US. Generally speaking, a rise in this indicator has positive implications for consumer spending, stimulating economic growth. So a high reading is traditionally seen as positive, or bullish for the USD, while a low reading is seen as negative, or bearish.

Eurozone money markets now price in 30 basis points of the European Central Bank (ECB) rate hikes by December 2022, according to Reuters.

Earlier in the session, the data published by Eurostat showed that the annual inflation in the euro area, as measured by the Harmonised Index of Consumer Prices (HICP), rose to 5.1% in January from 5% in December. This print came in higher than the market expectation of 4.4%.

Market reaction

EUR/USD preserves its bullish momentum during the European trading hours and the pair was last seen rising 0.35% on the day at 1.1309.

- EUR/GBP regained positive traction on Wednesday, though the uptick lacked follow-through.

- Weaker USD, stronger Eurozone CPI figures underpinned the euro and remained supportive.

- BoE rate hike bets continued acting as a tailwind for sterling and capped any meaningful gains.

The EUR/GBP cross maintained its bid tone through the first half of the European session and refreshed daily high, around the 0.8345 region post-Eurozone CPI.

The cross attracted some buying on Wednesday and reversed a part of the previous day's losses, though bulls seemed struggling to capitalize on this week's bounce from the 0.8300 mark, or the two-year low. The prevalent US dollar selling bias was seen as a key factor that extended some support to the shared currency, which was further underpinned by the stronger Eurozone consumer inflation figures.