- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 31-01-2022

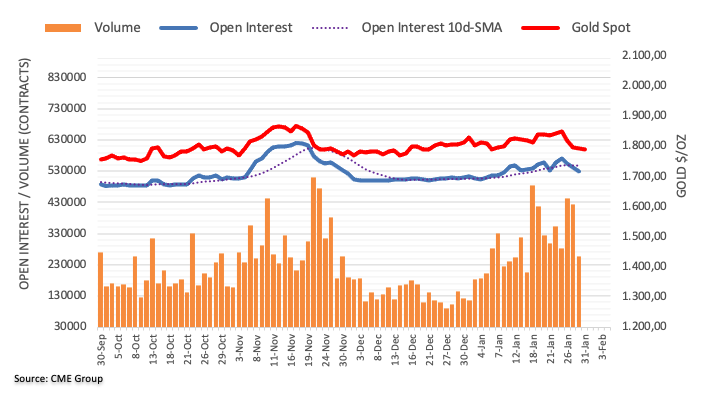

- Gold prices grind higher after a positive start to the key week.

- S&P 500 Futures fail to extend Wall Street gains, yields struggle for clear direction amid unimpressive Fedspeak, Russia-Ukraine updates.

- DXY licks its wounds after declining the most in a month as traders shift attention from Fed.

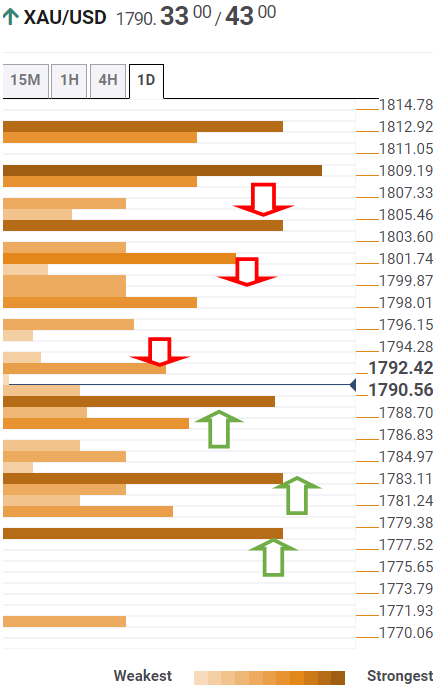

- Gold Price Forecast: Corrective advance capped by selling interest aligned at around $1,800

Gold (XAU/USD) buyers flirt with the $1,800 threshold, keeping the previous day’s bounce off a seven-week low during a quiet Asian session on Tuesday.

In doing so, the precious metal ignores downbeat US stock futures, as well as sluggish Treasury yields, after mixed updates from the Fed and positive news over the Russia-Ukraine tussles seem to have recalled the buyers.

Having witnessed the Fed’s hawkish halt the last week, various Fed policymakers conveyed their dissatisfaction with the higher inflation and favored rate hikes in March. However, a lack of clarity on the pace of rate lift seems to have weighed on the US Dollar Index (DXY), which in turn favored gold, the previous day. Among the key Fed speakers were Atlanta Fed President Raphael Bostic and Kansas City Fed President Esther George, not to forget Federal Reserve Bank of San Francisco President Mary Daly.

Elsewhere, the Washington Post (WaPo) conveyed the news of Russian response to the US proposal over Ukraine, citing an anonymous Senior Diplomat. “The Russian government has delivered a written response to a U.S. proposal aimed at de-escalating the Ukraine crisis.” It’s worth noting that UK PM Boris Johnson is also scheduled to visit Ukraine on Tuesday whereas US Secretary of State Antony Blinken and Russian Foreign Minister Sergei Lavrov will also hold meetings today.

In addition to the mixed Fed updates and receding pressure on the Russia-Ukraine issue, a light calendar and the market’s attention off the Fed’s hawkish communication also favored the Wall Street benchmarks to post an upbeat start to the week. The same challenged the US 10-year Treasury yields while the US Dollar Index (DXY) dropped the most in a month, which in turn backed gold buyers.

Looking forward, gold traders will keep their eyes on the US ISM Manufacturing PMI for January, expected 57.5 versus 58.7 prior, for immediate direction. However, major attention will be given to the Fedspeak and developments concerning Russia.

Read: ISM Manufacturing PMI January Preview: Fed policy counts on a continuing US expansion

Technical analysis

Gold prices hold onto the week-start bounce off 50% Fibonacci retracement (Fibo.) of August-November 2021.

Given the steady RSI and bearish MACD signals, the gold sellers are yet to convince markets before retaking controls.

This highlights a convergence of the 50-DMA and previous support line from August, near $1,802, as the nearby key resistance.

Following that, a confluence of the 200-DMA and 38.2% (Fibo.) near $1,806 will also challenge gold buyers before directing them to the December 2021 peak surrounding $1,831.

On the contrary, the aforementioned 50% Fibonacci retracement level near $1,782 restricts the quote’s immediate pullback.

Gold: Daily chart

Following that, 78.6% Fibo. on the four-hour (4H) chart near $1,773 will challenge the gold sellers before directing them to December’s low of $1,753.

It’s worth noting that the RSI and MACD conditions do favor XAU/USD buyers on the 4H, suggesting an extension of the latest recovery moves.

Gold: Four-hour chart

To sum up, gold prices are up for consolidating the Fed-led losses but the bulls have strong challenges to justify their strength.

- The USD/JPY pair begin on the wrong foot in the Asian session.

- Unchanged US T-bond yields boosted the Japanese yen, the USD fell.

- USD/JPY is upward biased, but it would need a daily close above 115.50-70.

As the Asian Pacific session kicks in, the USD/JPY is trading at 115.11 at the time of writing. The US cash equity markets closed in the green, while the US 10-year T-bond yield, which correlates positively with the USD/JPY, is flat at 1.784% at press time.

The market sentiment is upbeat. Asian equity futures are mixed, led by the Hang-Seng rising, while the biggest loser is the Australian ASX7200.

In the New York session, Fed speaking was in the spotlight. Most of them agreed that a hike rate in the March meeting is on the cards. Nevertheless, some divergences in the balance sheet loom. So any chances of the Quantitative Tightening (QT) starting in the March meeting seems unexpected.

Over the weekend, Atlanta’s Fed President Raphael Bostic crossed the wires. He stated that a 50 basis points hike is possible, but it would depend on economic data. Meanwhile, San Francisco Fed President Mary Daly said that she is uncomfortable with inflation this high and sees rate hikes as early as March. Daly further noted that if the Federal Funds Rate (FFR) hits 1.25% by the end of the year, it would still be supportive despite being a lot of tightening.

Later on, Kansas City Fed President Esther George noted that a more aggressive reduction of the balance sheet, coupled with hiking rates, would alter the yield curve, so she backpedaled some of her “hawkish” monetary policy stance.

Therefore, USD/JPY traders would lean on Japanese economic data crossing the wires at 23:30 GMT. Japanese Unemployment Rate for December came at 2.7%, below the 2.8% foreseen, in line with the previous reading. Later at 00:30 GMT, the Jibun Bank Manufacturing PMI for January could offer some cues to give direction to the pair.

USD/JPY Price Forecast: Technical outlook

On Monday, early in the Asian session, the USD/JPY peaked around 115.59, at the R1 daily pivot point, to then retreat towards the daily pivot point at 115.35 in the European session. However, when the North American session began, the pair slid under the 50-hour simple moving average (SMA), pushing the pair towards the 100-hour SMA at 114.90. As the session progressed, the US T-bond yield recovered the 1.78% threshold, and the pair jumped above the 115.00 figure.

That said, the USD/JPY is upward biased. The daily moving averages (DMAs) reside above the spot price, confirming the bias, but an upslope trendline around the 115.50-70 would be challenging to overcome for USD bulls. If the USD/JPY break above the previous mentioned, that would open the door towards 116.00. A breach of the latter would expose the YTD high at 116.35.

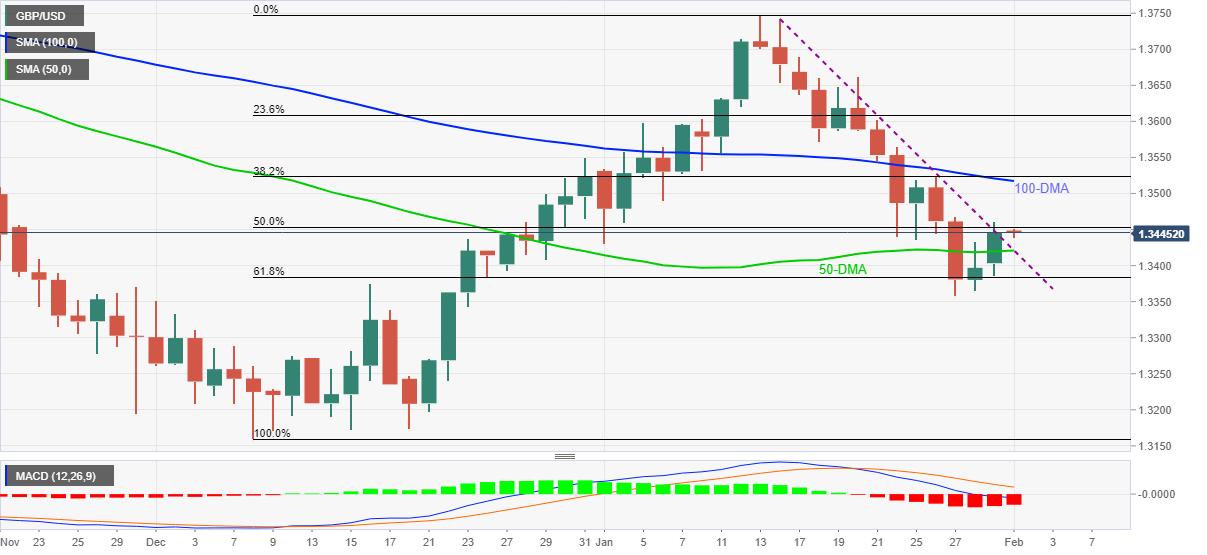

- GBP/USD grinds higher after posting the biggest daily gains in a month.

- A confluence of 50-DMA, fortnight-old descending trend line restricts short-term downside.

- 50% Fibonacci retracement guards immediate upside ahead of 100-DMA.

GBP/USD holds onto the previous day’s resistance break around 1.3440-45 during a quiet start to Tuesday’s Asian session.

The cable pair rose past a downward sloping trend line from January 14 following its bounce off the 61.8% Fibonacci retracement (Fibo) of December 2021 to January 2022 upside.

However, the 50% Fibo. level guards the quote’s further advances around 1.3450, a break of which will direct the GBP/USD prices towards the 100-DMA level of 1.3517.

It’s worth noting that the 1.3500 threshold will act as an intermediate halt whereas the 1.3600 round figure may lure GBP/USD bulls past 1.3517.

Meanwhile, a convergence of the 50-DMA and resistance-turned-support line near 1.3420 becomes the key nearby support to watch during the quote’s pullback moves.

Following that, the 61.8% Fibonacci retracement level and the recent swing low, respectively around 1.3385 and 1.3355, will challenge the GBP/USD sellers.

Overall, GBP/USD prices have recently crossed a short-term key hurdle and hence may witness further recovery.

GBP/USD: Daily chart

Trend: Further upside expected

Early Tuesday morning in Asia, the Washington Post (WaPo) quotes an anonymous US Official saying, “The Russian government has delivered a written response to a U.S. proposal aimed at de-escalating the Ukraine crisis.”

“It would be unproductive to negotiate in public, so we’ll leave it up to Russia if they want to discuss their response,” adds the US diplomat.

The news also stated, “The official declined to provide details about the proposal, delivered ahead of an upcoming phone call between Secretary of State Antony Blinken and Russian Foreign Minister Sergei Lavrov on Tuesday.”

“We remain fully committed to dialogue to address these issues and will continue to consult closely with our allies and partners, including Ukraine,” adds the US official per WaPo.

It’s worth noting that UK PM Boris Johnson is also scheduled to visit Ukraine on Tuesday.

Market reaction

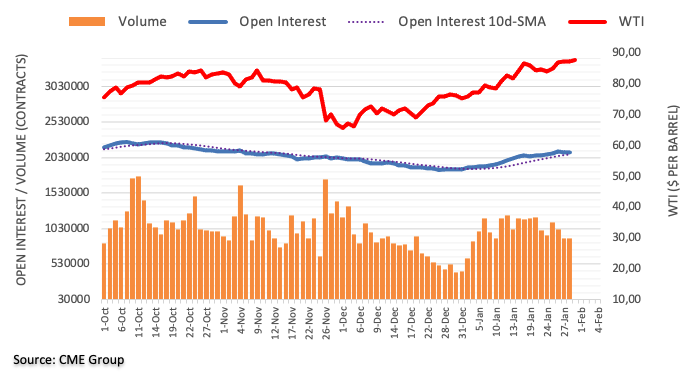

The news eases the pressure from the oil traders and hence WTI crude oil prices begin Tuesday’s Asian session on a back foot, down 0.20% around $87.40 at the latest.

“Indirect talks between the United States and Iran on returning to the 2015 nuclear agreement are entering the “final stretch,” with all sides having to make tough political decisions,” per a Senior US State Department Official, said Reuters during late Monday.

During a telephonic updates from Vienna, the official also mentioned, “Iran may choose not to go down the road of compliance with the agreement, and Washington is ready to deal with that contingency.”

FX implications

The news should have ideally helped the riskier assets but the risk-barometer AUD/JPY remains pressured ahead of the key Reserve Bank of Australia (RBA) meeting.

Read: AUD/JPY stays above 81.00 amid firmer sentiment ahead of RBA

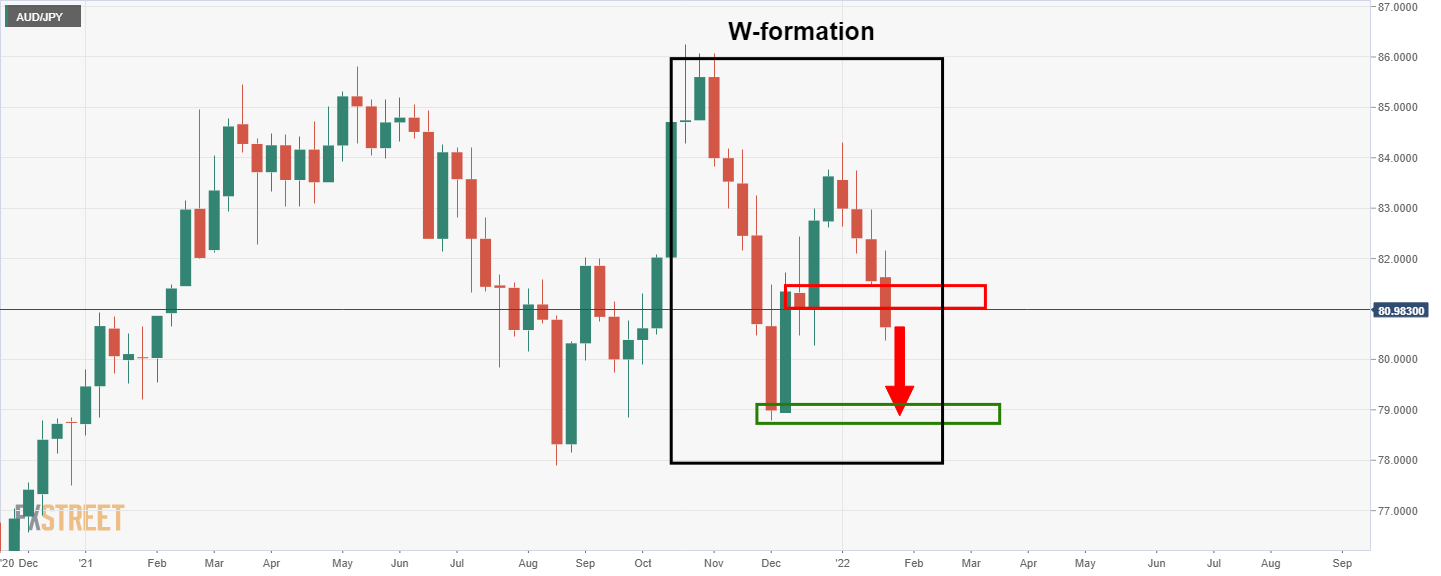

- AUD/JPY consolidates the heaviest daily in rise, battles 13-day-old resistance line.

- Risk appetite improves at the week’s start without major positives.

- Aussie data came in positive, China PMIs signaled downbeat start of 2022 ahead of Lunar New Year holidays.

- Hawkish expectations from RBA tests bulls ahead of the event, Japan’s Omicron updates, jobs report important as well.

AUD/JPY struggles to extend the heaviest daily jump in over a month by grinding around 81.30-40 amid the pre-RBA caution on early Tuesday.

The risk barometer pair rose the most since January 13 before a fortnight-old resistance line challenged the bulls ahead of the key monetary policy meeting of the Reserve Bank of Australia (RBA). Additionally, the softer-than-forecast Commonwealth Bank of Australia Manufacturing PMI for January, 55.1 versus 55.3, also probes the AUD/JPY buyers of late.

AUD/JPY began the week on a positive note, tracking the general market mood, as traders licked the Fed-led moves amid a light calendar. Also favored the riskier assets were Japanese PM Fumio Kishida’s rejection to call another virus-led state of emergency and softer prints of Japan’s Retail Trade, as well as Industrial Production, figures for January.

It’s worth observing that China’s official activity numbers for January came in softer while the Caixin Manufacturing PMI marked a contraction in activities with 49.1 figures.

On a broader front, the US 10-year Treasury yields hovered around 1.78% but a positive performance of the Wall Street benchmarks favored the AUD/JPY to print daily gains.

Looking forward, pre-RBA caution may keep the AUD/JPY prices below the aforementioned short-term resistance. However, hawkish expectations from the Aussie central bank can become a reason for the currency pair to remain weak afterward.

Market consensus favors a formation end to the A$350 billion bond-buying program and signals hints for the rate hikes. “We expect the RBA to forecast trimmed mean inflation of 3% by mid-2022, with unemployment falling below 4% by the end of the year. Despite this we expect the RBA Board to say it will wait until wages growth accelerates further before it lifts the cash rate,” said ANZ.

Ahead of the RBA, Australia Retail Sales for January and Japan’s job numbers will entertain the AUD/JPY traders. However, nothing matters more than the Aussie monetary policymakers’ verdict.

Read: Reserve Bank of Australia Preview: A hawkish surprise from Lowe & Co?

Technical analysis

A downward sloping trend line from January 13 restricts immediate AUD/JPY upside around 81.45, a break of which will direct the pair towards the 200-DMA hurdle of 82.51. Meanwhile, 23.6% Fibonacci retracement (Fibo.) of October-December 2021 downside, near 80.55, precedes the 80.00 threshold to keep AUD/JPY buyers hopeful.

- AUD/USD bulls move in on the 50% mean reversion zone.

- The RBA will be the critical event where volatility is likely to occur.

As per the start of the week's analysis, AUD/USD Price Analysis: Bulls accumulating, mark-up could be on the cards, traders move din on the bid and took the price higher to test the 0.7080s.

AUD/USD live market

The price has started to stall here and is carving out dynamic support that could come under pressure again in the session ahead as traders get set for the Reserve bank of Australia tomorrow.

In the start of the week's analysis, AUD/USD: It's a big week for the Aussie, a come back could be on the cards, it was stated, from a daily perspective that a correction would be the most typical course for the pair at this juncture prior to further downside:

AUD/USD live market

As illustrated, the price has moved in on the forecasted target zone, but there could be more to come from the bulls in the days to come prior to the next test of the 0.6950s.

- Indecision in the NZD/JPY pair keeps the cross-currency range-bound.

- A risk-on market mood keeps the NZD in the bid, weighed on the safe-haven JPY.

- NZD/JPY is downward biased, but in the event of a daily close above 76.00 would open the door for further gains.

The NZD/JPY snaps two days of losses, steady around 75.70 at the time of writing. US equity indices print gains as the New York session finishes. Alongside that, commodity currencies like the NZD, the AUD, and the CAD, rose by 0.76%, 1.03%, and 0.45%, respectively. Contrarily, safe-haven peers led by the USD and the JPY

NZD/JPY Price Forecast: Technical outlook

On Monday, in the Asian session, the NZD/JPY rose higher up to 76.01, to then retreat some towards 75.71. Following the retracement, American traders got to their desks reached a daily high around 76.11, following the path of US equities, but failed to break above that resistance area, sending the pair tumbling towards the daily lows around 75.50s.

The NZD/JPY daily chart depicts a downward bias. The daily moving averages (DMAs) reside above the spot price, providing the direction of the trend. Furthermore, failure to break the resistance above 76.00 keeps the cross-currency pair trading near the tops of the 75.27-75.96 range.

If the NZD/JPY pair prints a daily close above 76.00, that would open the door for further gains. The next resistance would be the January 20 daily low, previous support-turned-resistance at 77.05, followed by the 50-DMA at 77.46.

On the flip side, the first support would be the July 2021 lows at 75.27, followed by 2021 yearly lows at 74.56.

- NZD/USD bulls step in as the US slides at the start of the week.

- The central bank meetings will start off with the RBA.

NZD/USD is firm into the closing part of the New York session having rallied from a low of 0.6538 to a high of 0.6597. At 0.6582, the cross is 0.67% higher on Monday as the US dollar slides on the back of prospects of a centralised effort to contain inflation by global central banks, bridging the divergence between the Federal Reserve.

The dollar index (DXY) was down 0.63% at 96.56 putting it on track for its largest daily fall since Jan. 12 as central banks’ focus this week will be on securing a sustainable business cycle. ''That means emergency monetary policy accommodation will need to be unwound in most geographies in the foreseeable future,'' analysts at ANZ bank explained.

This has led to a rebound of global risk appetite. The three main benchmarks on Wall Street all traded higher. By 20:37 the Dow Jones Industrial Average rose 0.83% the S&P 500 1.49% and the Nasdaq Composite 2.61%.

Meanwhile, the Reserve bank of Australia is going to be taking the spotlight in Asia tomorrow.''While no hike is expected, we do expect the RBA to formally end QE, and to signal that QT will start from next month as the bonds it owns start to mature, and it’s the market’s take on this that has and will influence the AUD,'' analysts at ANZ bank said. ''Commodities continue to boom, with the broad CRB Index up just under 1% to a 7yr high. All of this has potential to support the NZD down here, or limit the downside.''

- EUR/JPY rallied to one-week highs in the 129.30s on Monday amid a broad uptick in macro risk appetite.

- The real test, from a technical perspective, will come when the pair hits the 129.50 balance area.

EUR/JPY saw a decent rebound on Monday, a function of a broad improvement in global risk appetite rather than broadly in line with expected Eurozone Q4 GDP and flash January inflation data. The pair rebounded from under 128.50 to jump back to the north of the 129.00 level and proceed to hit a one-week high in the 129.30s and also move above the 50-day moving average at 129.28. At current levels around 129.30, the pair trades with gains of 0.7% on the day, the best such one-day performance since early December.

From a technical perspective, the recent push into the 129.30s and to fresh one-week highs is a good sign for momentum this week, but the real test will come when EUR/JPY challenges the 129.50 area. This zone has been a key area of both resistance and support in the last few months. If traders expect the risk-off flows that dominated throughout most of January to be the dominant force in the coming months, then a retest of 129.50 might be seen an attractive entry point to reload on short positions.

Fundamentally speaking, one problem for that outlook is the fact that Eurozone/Japan rate differentials continue to move in the former’s favour as ever more ECB tightening is priced into the long-end of the Eurozone rate curve. The German 10-year on Monday hit its highest level since May 2019 at 0.03%, while the German 2-year broke out to its highest level since April 2019 at -0.525%. Focus this week will be on Thursday’s ECB meeting, which is not expected to deliver any policy changes.

Traders will be eagerly assessing whether the bank can add further fuel to the recent rise in Eurozone bond yields which has, so far, been primarily driven by the spillover impact of rising US yields. If so, that could EUR/JPY back towards 130. If this week’s US data and Fed speak spurs fresh hawkish Fed bets and further US bond yield upside, that might also help, as long as it doesn’t also trigger a sell-off in equities that spurs safe-haven yen demand.

Federal Reserve Bank of Richmond President Thomas Barkin said that he would like the Fed to get better positioned, speaking in an interview with CNBC on Monday. How fast we go depends on how the economy develops, he added, saying also that the pace of rate hikes will depend on the pace of inflation. I'd like us to be closer to neutral than we are now, he said, before reiterating that he expects goods prices to ease.

Moving on to discuss the labour market, he said what he is really watching is labour wage pressure and that we are at "interim" full employment, but there is still some upside ahead. Barkin added that he is expecting a strong job market to continue into the spring and summer. Moving on to the economy, there is no question we saw a demand issue in January, he added, but he has his fingers crossed for a stronger spring. The Fed is still a long way from triggering any recession, he added, saying that he is not seeing any weakening in core demand, and that it is not the focus of the Fed to worry about a recession when demand is still strong.

Market Reaction

FX markets do not seem to have reacted to the latest remarks from Barkin.

- GBP/JPY building up the base for a significant downside breakout.

- Bearish wedge formation is potentially at an extreme and the market could be due for a shakeout of longs.

As per the prior analysis, GBP/JPY bulls are on the move early doors, eyes on central bank divergences, GBP/JPY moved in on the liquidity pool target and subsequently sold off aggressively.

GBP/JPY prior analysis

GBP/JPY live market

The price is now back into the old wedge formation following a spike through resistance in what could be termed as a fake-out that simply went to grab more liquidity from an area that was previously marked as a target for the open.

At this juncture, there is a bias to the downside and a break of 154.40 opens the risk of a test to 154 the figure as the last defence of a potentially significant downside breakout of the bearish wedge formaton.

What you need to know on Tuesday, February 1:

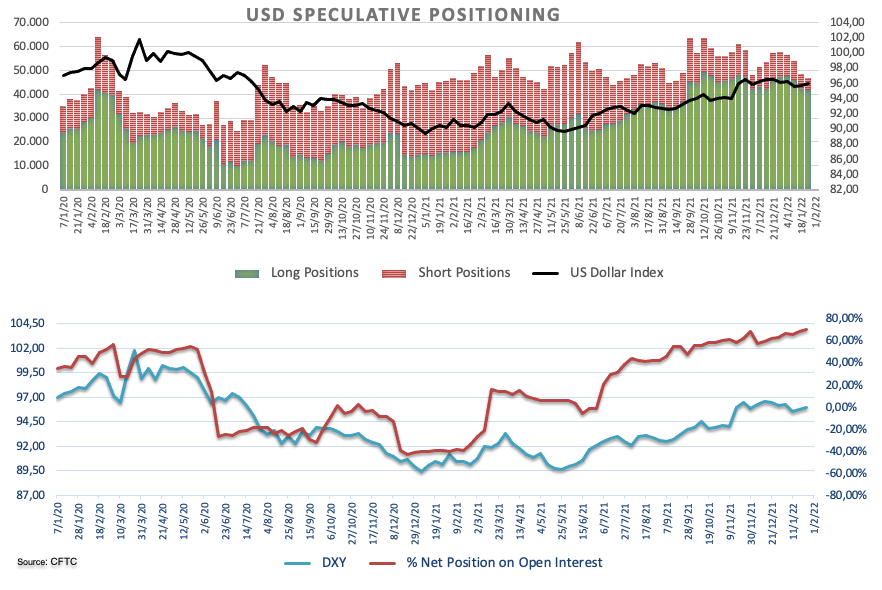

The greenback edged lower against most major rivals, as speculative interest completely digested the US Federal Reserve’s aggressive tightening pat and as attention shifts to other central banks and US employment figures.

The Reserve Bank of Australia will announce its monetary policy decision early on Tuesday, with market participants anticipating the end of the pandemic-related QE and a possible announcement of sooner-than-planned rate hikes amid mounting inflationary pressures.

Later in the week, the European Central Bank and the Bank of England will have monetary policy decisions. Finally, on Friday, the US will publish the January Nonfarm Payrolls report.

Stocks staged a nice comeback, with Wall Street holding on to substantial gains heading into the daily close, adding pressure on the American currency. US government bond yields, in the meantime, ticked lower with that on the 10-year Treasury note settling at around 1.77%.

The EUR/USD pair trades in the 1.1230 region, while GBP/USD stands at 1.3460. Commodity-linked currencies posted intraday gains, with AUD/USD now trading at around 0.7070 and the USD/CAD pair just below the 1.2700 figure. Safe-haven currencies also advanced vs their American rival.

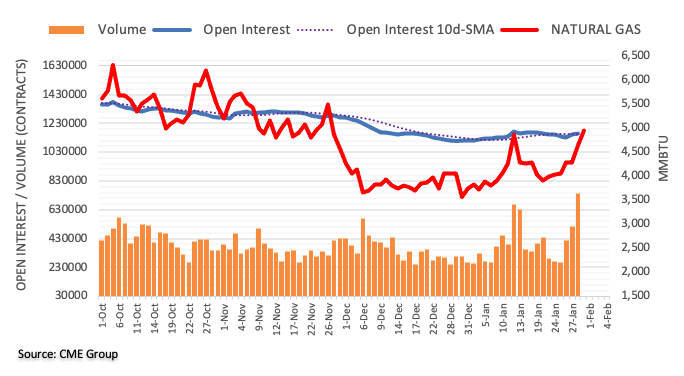

Spot gold struggles to overcome the $1,800 threshold, holing nearby. Crude oil prices are marginally higher, helped by Wall Street’s strength, with WTI trading at $88.12 a barrel.

British Prime Minister Boris Johnson still risk his premiership after a report by senior civil servant Sue Gray, uncovered multiple parties, some of which the PM attended, and a failure of leadership in his government in the early stages of coronavirus lockdowns. According to the report, gatherings were "difficult to justify."

Binance creates $1 billion insurance funds against hackers, benefiting BNB price

Like this article? Help us with some feedback by answering this survey:

Swiss National Bank Chairman Thomas Jordan said on State TV on Monday that he sees no sign of a Swiss wage-price spiral and that inflation is more or less at its peak and will recede. The strength of the Swiss franc limits Swiss inflation, he added, but remarked that stubbornly high inflation above 2.0% elsewhere in the world would lead to policy tightening. Finally, Jordan said that the Swiss franc had remained stable in real terms.

Market Reaction

The Swiss franc was unreactive to Jordan's latest remarks, which stuck to the bank's usual script.

- Silver is flat after reaching a week of losses, though as the New York session end approaches, silver is flat.

- The US 10-year T-bond yield is flat at 1.777%, despite Fed policymakers piling to raise rates in March.

- XAG/USD Technical Outlook: Downward biased, but upside risks remain, as shown by the bullish harami.

Silver (XAG/USD) grinds higher during the North American session, trading at $22.48 at the time of writing. The market sentiment remains upbeat, with US equity markets trading in the green, while the US dollar remains under heavy downward pressure. The US Dollar Index, a measurement of the greenback’s versus a basket of six rivals, drops near 0.70% sits at 96.61.

Meanwhile, the US 10-year Treasury yield, which when It raises weighs on non-yielding assets, is flat at 1.777%.

Regional Federal Reserve Presidents favor rate hikes

An absent US economic docket kept precious metals investors glued to their screen as Fed speakers crossed the wires. Over the weekend, Atlanta’s Fed President Raphael Bostic (voter 2024) said that he foresees three rate hikes by the end of 2022 and would not discount a 50 basis points increase to the Federal Funds Rate (FFR).

On Monday, earlier in the day, San Francisco Fed President Mary Daly (voter 2024) said that “inflation is too high” and added that the US central bank is “not behind the curve at all.” Worth noting that if the FFR ends at 1.25% in 2022, Daly said that “that is quite a bit of tightening, but still supporting the economy.”

An hour later, Kansas City Fed President Esther George (voter 2022), who leaned to the hawkish tilt in the FOMC board, noted that the risks of a “large” balance sheet should not be ignored. Furthermore, She said it could be “appropriate to move earlier on the balance sheet relative to the Fed’s last tightening cycle.” Worth noting that a steep path for rate hikes coupled with “modest” reductions of the balance sheet could lead to more financial risk.

The US economic docket will feature the JOLTS Openings report for December on Tuesday. That, alongside the ISM Manufacturing Prices and the Dallas Fed Index for January, could give XAG/USD traders some cues about the US Dollar.

XAG/USD Price Forecast: Technical outlook

From a technical perspective, XAG/USD is downward biased. Nevertheless, the last couple of trading sessions failed to break below a one month-upslope trendline, which provided support, around $22-3545 region.

To the upside, the first resistance would be the 50-day moving average (DMA) at $22.91. A breach of the latter would expose the 100-DMA at $23.22. A break above it would open the door for a January 3 daily high test at $23.40.

The S&P 500 surged towards a key area of resistance at the 4500 level on Monday, though was unable to surpass the big figure for now. Nonetheless, the indice's on-the-day gains currently stand at roughly 1.4%, taking the two-day run of gains to more than 3.5%. The tech-heavy Nasdaq 100 index is seeing even more impressive gains of over 2.5% on the session and is now up more than 5.0% in the last two sessions. The Dow is up 0.8% and probing its 200-day moving average at the 35K level, up about 2.5% in the last two sessions. The S&P 500 CBOE Volatility Index or VIX saw a sharp 2.5 point drop to around 25, taking it to now more than 13 points below last week’s highs near 39.

Some analysts put the strong gains, particularly in the hard-hit tech sector, down to month-end factors. “Today's and Friday's bounce is just some of the institutional guys saying Nasdaq was due for end of the month rebalancing… It is simply a little bit of a relief rally after such a sharp sell-off," said an analyst at Ally Invest. But the Nasdaq 100 index was also helped by a more than 9.0% jump in Tesla’s share price after being upgraded to “outperform” at Credit Suisse, and amid a nearly 10.0% jump in Netflix after shares were labeled as “buy” at Citigroup.

Nonetheless, the Nasdaq 100 looks set to close out the month 9.1% lower, the S&P 500 5.6% lower and the Dow 3.7% lower. Fed tightening fears have been the major driver of the downside, with markets now expecting five 25bps rate hikes in 2022 and with Fed speakers so far this weak doing nothing to dampen this speculation. Fed speakers have also done nothing to dampen speculation that the first move, expected in March, could be a 50bps rate hike. Fed’s Raphael Bostic, speaking over the weekend and again on Monday, explicitly outlined a 50bps as a possibility (though not his base case assumption).

Looking ahead this week, the Fed tightening story will receive further inputs in the form of plenty more Fed speak, as well as key US data releases, most important of which is Friday’s January labour market report. The report will be closely scrutinised for signs of wage inflation and a further tightening of the labour market, given that this is what the Fed is mostly focused on right now. The headline NFP number won’t be as important, with economists and the Fed expecting a weaker number compared to recent months given the impact of Omicron.

Another important equity market theme this week is the ongoing Q4 earnings season. Following last week’s decent results from Apple and Microsoft last week, Alphabet (Google), Amazon and Meta Platforms (Facebook) will be reporting. According to Refinitiv data cited by Reuters, 77.4% of S&P 500 companies who have reported earnings thus far (about one-third of the index) have beaten analyst expectations. To shield equity markets from further Fed tightening fears induced downside, this strong run of earnings will need to continue.

- GBP/USD bulls are moving in for an attack on critical resistance.

- The US dollar is weak and the pound is benefitting from BoE sentiment.

At 1.3448, GBP/USD is firming in mid-day New York trade and moves in towards the highs of Monday near 1.3455. The US dollar has come under further pressure in recent trade and the US dollar index DXY was down 0.61% 96.624, putting it on track for its largest daily fall since January 12.

Investors have consolidated gains in the US dollar ahead of the closely-watched monthly employment report later this week and the pound is bid as traders expect the Bank of England to be raising interest rates for the second time in as many months.

The BoE meets on Thursday

Most economists polled by Reuters expect the BoE to raise rates to 0.5% on Feb. 3 from 0.25%. Reaching the 0.5% threshold would also see the bank stop reinvesting maturing gilts and start to reduce its 875 billion-pound government bond holdings.

However, there are some analysts that are calling for a far more aggressive move from the central bank. Goldman Sachs is calling for interest rates at 1% in May and 1.25% in November to show "the MPC (Monetary Policy Committee) is serious about the inflation target, and will act to ensure the UK does not face the risk of a wage-price spiral."

Analysts at Rabobank said that ''the money market has been positioned for a fair amount of tightening this year. That said, fears of a spike in the cost of living in the UK question whether the BoE be able to match these expectations.''

In the lead into this week's meeting, we heard from several BoE policymakers who have commented on inflation risks in recent weeks. The governor of The Old Lady, Andrew Bailey, was suggesting the risk of second-round inflation effects was a source of concern and that the bank would do "everything we can do".

GBP/USD technical analysis

As per the start of the week's analysis, GBP/USD Price Analysis: Bears lurking at critical daily resistance near 1.3440, the price is moving in on the critical resistance.

GBP/USD, prior analysis

GBP/USD live market

The price has penetrated into resistance and there are prospects of a continuation into the 1.3520's on a break of the 1.3470.

- AUD/USD is on course for its best one-day rally since June 2021 and is more than 1.5% above Friday lows.

- The pair is trading in 0.7060s, up about 1.1% ahead of a highly anticipated RBA policy announcement.

- The focus will then switch to US data for the rest of the week, culminating in Friday’s official jobs report.

A positive start to the week, as far as global equity markets are concerned, and profit-taking following last week’s hawkish Fed policy announcement induced surge have seen the US dollar turn sharply lower on Monday. Stronger than expected January Chicago PMI figures and commentary from Fed policymakers which broadly stuck to the bank’s new hawkish script was unable to turn the tide for the US dollar. The Aussie has been the major G10 beneficiary of buck weakness as focus turns to Tuesday’s RBA monetary policy announcement.

AUD/USD has rallied more than 1.1% on Monday to the 0.7060s and is on course for its best one-day performance since June 2021, putting the pair now nearly 1.5% above the sub-0.6970 19-month lows it hit last Friday. Aussie traders will be closely scrutinized the upcoming RBA meeting with regards to 1) its decision on QE and 2) its interest rate guidance. Regarding the former, consensus expectations are for the bank to ax bond-buying in its entirety and regarding the rate guidance, markets expect some pivot towards admitting that the conditions for a rate hike could be met in 2022. However, the scope for the RBA to hawkishly surprise the market, which is pricing in a full 25bps rate hike by the end of H2 2022, is somewhat limited.

That may limit any post-“hawkish RBA policy shift” gains in AUD/USD to underneath resistance in the 0.7100 area. Indeed, any rally past these levels might be seen by US dollar bulls anticipating inflationary and tight US labour market numbers on Friday as a good short entry point. As the threat of a 50bps move by the Fed in March hangs over the market’s head, FX markets are likely to be even more volatile to US employment and labour market data in the coming weeks than usual.

Federal Reserve Bank of Atlanta President Raphael Bostic on Monday told Yahoo Finance that he expects three rate hikes in 2022, in a reiteration of remarks made over the weekend. He clarified that a 50bps move in March was not the Fed's preferred policy action and that the Fed is not fixed on a set policy progression. Bostic continued that he is "laser-focused" on the Fed's next meeting and how data on inflation and jobs are evolving, before saying that, at this point, it is hard to anticipate too much what the "long arc" of policy will be.

Bostic continued that he had penciled in 3.0% inflation for the full year 2022, adding that he anticipates labour and supply-side disruptions to ease. If inflation responds more quickly, the Fed could go slower, he added, though noting that this is not his base case assumption give that businesses appear to have built in price increases already. Regarding the coming official US jobs report, Bostic said he expects the headline number to be a little lower than recent months to reflect the influence of Omicron, before saying that he is hopeful that job growth will rebound in February and March.

Market Reaction

FX markets do not seem to have paid much attention to the latest remarks from Fed's Bostic.

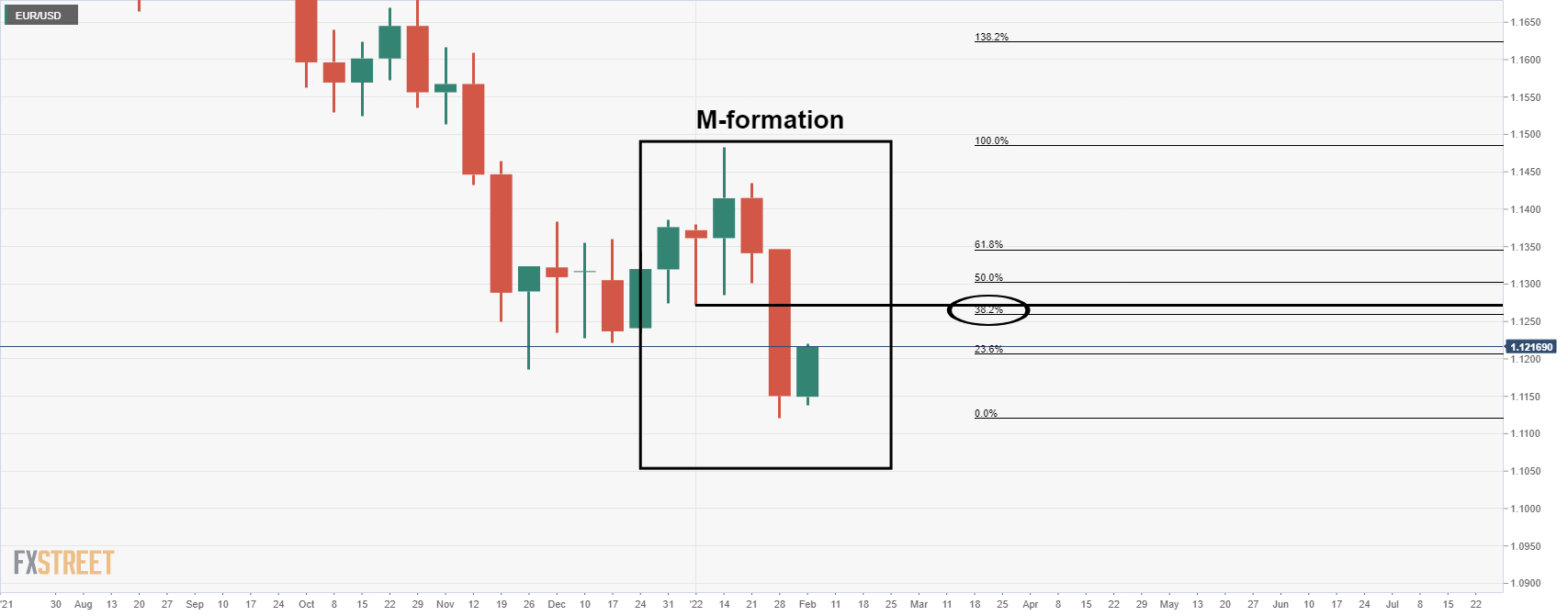

- EUR/USD bulls are correcting last week's bearish closing candle.

- Bears are moving aside at critical hourly resistance.

EUR/USD is on the verge of an important upside break on the hourly charts. Bulls have their eyes set on a significant correction of last week's bearish close and eye the 61.8% retracement level of the daily bearish impulse.

EUR/USD weekly chart

The M-formation is compelling. This is a reversion pattern with a high completion rate whereby the price would be expected to head back towards the neckline of the formation, in this case, this is located near 1.1270 and the 38.2% Fibonacci level as additional confluence.

The price, as illustrated has already started to make a move into the prior lows near 1.1220. A bullish weekly close this week will cement the probability of a deeper correction to follow.

EUR/USD daily chart

The daily chart shows that the price has rallied sharply into the prior lows following Friday's doji candle. This is a bullish candlestick scenario and is encouraging for the bulls and countertrend traders. The 61.8% Fibonacci retracement of the prior bearish impulse is located at 1.1270 also, cementing the target down for the week ahead.

EUR/USD H1 chart

From a near term perspective, the bulls continue to press on in the New York trade. However. there are now up against a wall of resistance near 1.1230 that could be expected to reject the price in initial tests. However, the market is bullish while above 1.1210. 1.1240 should give way to 1.1270 targets in coming sessions. On the flip side, a break below 1.1180 would leave the price in consolidation once again.

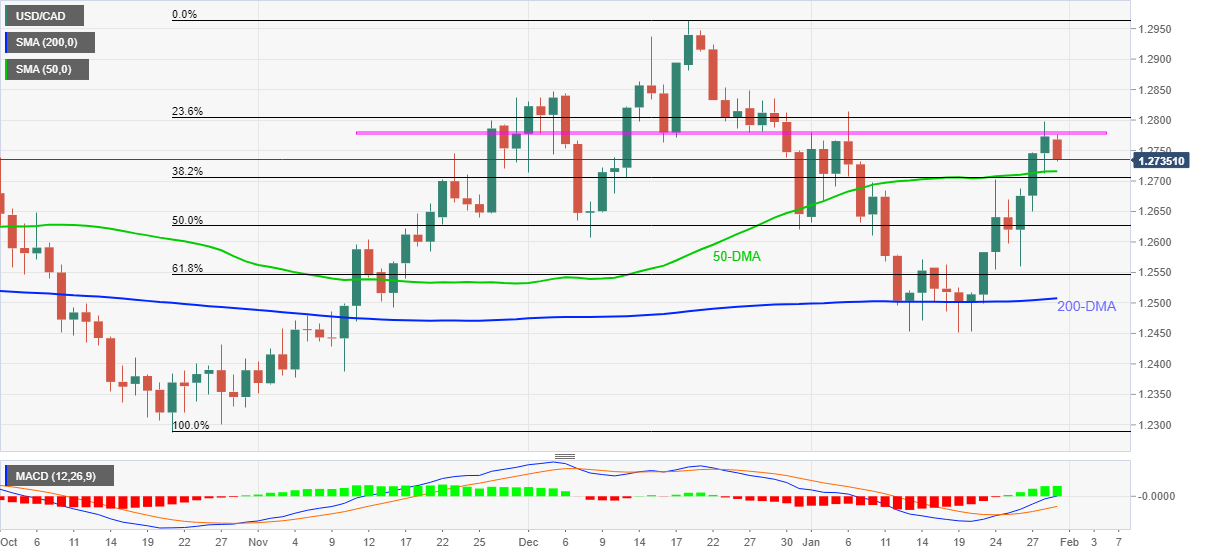

- The USD/CAD strengthens despite flat US crude oil prices, as the greenback remains offered.

- Fed speakers crossing the wires failed to lift the US dollar.

- USD/CAD Technical Outlook: Upward biased, but if bears break below the 100-DMA, would expose the 200-DMA.

In the North American sesión, the USD/CAD falls for the first time in four straight trading days, losses 0.60%. At press time, the USD/CAD is trading at 1.2697. European and US cash equity indices gain, except for the Dow Jones, barely down 0.02%. In the FX complex, the commodity currencies led by the AUD, the NZD, and the CAD, are gaining between 0.60% and 1%, to the detriment of the USD and the JPY.

In the meantime, the Western Texas Intermediate (WTI) US crude oil benchmark is trading at $86.71, barely up 0.02%, a tailwind for the Loonie. The US Dollar Index, a gauge of the greenback’s value versus a basket of six rivals, falls sharply more than 0.50%, sitting at 96.75.

Fed speakers crossing the wires fail to boost the greenback

During the weekend, Atlanta’s Fed President Raphael Bostic expressed that he foresees at least three rate hikes, beginning in March, but further noted that the Federal Reserve would increase 50 basis points if inflations remain “stubbornly high,” according to the FT.

Meanwhile, crossing the wires, Fed’s Daily said that “inflation is too high,” but at the same time noted that labor market recovery is uneven. Regarding monetary policy, she noted that the Fed is “not behind the curve at all.” Furthermore said that she “does not want to ratchet up the rates so quickly that it bridles growth to mouch.” Daly further added that if the US central bank gets to 1.25% in the Federal Funds Rate (FFR) by the end of the year, “that is quite a bit of tightening, but still supporting the economy.”

The Canadian economic docket features the Producer Price Index (PPI) for December, which came at 0.7% on its monthly reading, higher than the 0.1% in November. Regarding the annually based figure, it rose by 16.1%, lower than the 17.1%.

Meanwhile, Esther George, and Raphael Bostic, Federal Reserve Presidents, would cross the wires around 17:40GMT, and 18:30 GMT, respectively. Any hints regarding balance sheet reduction and rate hikes could be taken from their words.

USD/CAD Price Forecast: Technical outlook

The USD/CAD daily chart is upward biased at press time, as depicted by the daily moving averages (DMAs) residing above the spot price. However, the 50-DMA is under heavy pressure, lying at 1.2711 gave way to CAD bulls, which try to reclaim control, but they will need to break under the 100-DMA at 1.2620 to have a shot at the 200-DMA at 1.2503.

On the flip side, if USD bulls reclaim the 1.2700 figure, that would expose the USD/CAD to upward pressure. The first resistance would be January 28, a daily high at 1.2797, followed by December 3, 2021, a high at .12854, and then 1.2900.

Reuters has reported that Kansas City Fed President Esther George said on Monday that the Federal Reserve can move sooner to start reducing its bond holdings than in the past and aggressive action to shrink the US central bank's portfolio.

"What we do on the balance sheet will likely affect the path of policy rates and vice versa," George said in remarks prepared for an event organized by the Economic Club of Indiana. "For example, more aggressive action on the balance sheet could allow for a shallower path for the policy rate."

The news agency reported that George said a different approach in which the central bank pairs a "steep path" for rate increases with more modest reductions to the balance sheet could lead to more financial risks.

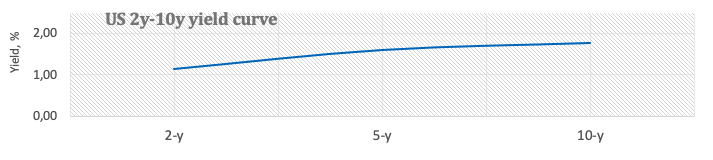

She said such a scenario where the Fed is raising short-term interest rates while putting downward pressure on long-term yields through its bond holdings "could flatten the yield curve." That could, in turn, lead to "reach-for-yield behaviour from long-duration investors."

"All in all, it could be appropriate to move earlier on the balance sheet relative to the last tightening cycle," George said.

Market reaction

There has been no reaction to the comments in the market and the US dollar remains pressured on Monday, as investors consolidated gains ahead of the closely-watched monthly employment report later this week, Nonfarm Payrolls.

The currency has rallied to a 1-1/2-year high on Friday as investors take stock of the hawkishness at the Fed.

The dollar index DXY was down 0.48% after George's comments at 96.758, putting it on track for its largest daily fall since January 12.

- USD/CHF is trading flat just above 0.9300 after ignoring Fed’s Daly and SNB’s Jordan ahead of more Fed speak.

- Fed speak, alongside US data, will be a key theme for USD/CHF this week.

- Bulls are eyeing a test of H2 2021 highs in the 0.9370 area.

USD/CHF flatlined on Monday, as the safe-haven Swiss franc and US dollar both underperformer their other more risk-sensitive G10 peers amid a broad pick up in the market’s appetite for risk. The pair did manage to squeeze out a fresh 10-week high in the 0.9340s but has since ebbed back to trading flat on the day just above the 0.9300 level, with the December high in the 0.9290s offering decent support. The pair was unreactive to the latest weekly domestic Swiss sight deposits which showed a sharp rise (indicative of an uptick in SNB intervention) or remarks from SNB Chairman Thomas Jordan. Jordan did not say anything new or interesting on central bank policy, though did praise recent moves by the Fed to signal upcoming rate hikes.

Meanwhile, the latest remarks from San Francisco Fed President Mary Daly were also broadly ignored by FX markets. Daly threw her support behind the removal of extraordinary monetary stimulus this year. Reading between the lines, she also hinted that she could be open to five 25bps hikes, as she said that ending the year with rates at 1.25% would still mean providing support to the economy. FX markets don’t have much time to dwell of Daly’s latest remarks, with remarks from Fed policymakers Ester George (at 1740GMT) and Raphael Bostic (at 1830GMT) coming up shortly ahead of a smattering of other Fed speakers throughout the week.

Fed speak will of course be one of the key FX market drivers this week after last week’s hawkish Fed policy announcement sent the US dollar surging across the board. Also feeding into the Fed tightening theme will be a barrage of US data, most important of which will be Friday’s January labour market report. Particular focus will be on indicators of wage inflation and labour market tightness, with the headline NFP number expected to be weak (Omicron deterring workers from finding jobs). If this week’s Fed speak and US data does further pump Fed tightening bets, that could be enough to send USD/CHF to test H2 2021’s double top around 0.9370.

Federal Reserve Bank of San Francisco President Mary Daly on Monday noted that if the Federal Funds rate was to reach 1.25% by the end of the year, that would be quite a bit of tightening but still supportive of the economy. Presumably, she is talking about the possibility of five 25bps rate hikes in 2022 to take the Federal funds target range to 1.25-1.50% by the year's end. The fact that she (as one of the Fed's more dovish policymakers) points out that, even after five hikes, the level of interest rates would still be economically supportive could be seen as a nod of approval by Daly to market expectations for five hikes this year.

Additional Takeaways:

"Our two goals feel somewhat in tension."

"Inflation is too high, and labor market for disadvantaged groups is stronger than it has been in a long time."

"It's time to adjust the policy rate to get the economy on a sustainable path."

"I don't want to be too quick to declare victory on full employment."

"I am completely comfortable with making interest rate adjustments in 2022, but open about 2023."

"You could pretty much use any averaging period you want and the Fed would be meeting 2% inflation on average."

"We still have an aging population, slower productivity growth and lower neutral rate of interest that are putting downward pressure on inflation in the medium run."

On Friday, the US official employment report will be released. Market consensus is for an increase in payrolls of 155K while analysts at Wells Fargo expect a decline by 100K. They anticipate average hourly earnings to rise by 0.6% during January.

Key Quotes:

“In recent months, there have been substantial revisions to the payroll data each month, and January will bring annual benchmark revisions to the payroll survey, shedding additional light on the underlying trend in hiring. Looking ahead, the Omicron wave looks to have slowed hiring markedly in the first month of 2022.”

“Aside from causing a surge in worker absenteeism due to illness, the hiring process was likely significantly derailed by the wave of new infections, which reached a peak during the survey week. On the other hand, employers' reluctance to part ways with seasonal workers amid increasingly dire shortages of labor might help offset the drag from the sharp acceleration in case counts.”

“All together, we stand apart from the consensus view of a modest gain and expect payrolls to decline by 100,000 in January. We look for the unemployment rate to hold steady at 3.9%, although we note that new population controls for the household survey will be released with January's report, which could add extra noise to the household numbers. F

Swiss National Bank Chairman Thomas Jordan told Swiss broadcaster SRF on Monday that we have to take inflation developments seriously, and that while some of this inflation is certainly temporary, all central banks have to be careful it doesn't become permanent. Jordan reiterated that inflation is expected to come down and noted that, in the medium and long-term, monetary policy must ensure that inflation is always within the price stability range.

On the Fed moving towards tightening, Jordan noted that the Fed raising rates is a good sign for the US economy and shows that it is working at capacity. Moreover, the Fed raising rates means that interest rates around the world are going up a little, which is a positive for us (Switzerland).

Market Reaction

CHF has not reacted to the latest remarks from SNB Chair Jordan.

Federal Reserve Bank of San Francisco President Mary Daly reiterated on Monday that she is not comfortable with inflation as high as it is and that she does see a rate hike as soon as March.

Additional Takeaways:

"Balancing the Fed's two mandates is always the challenge."

"The US economy is getting to a more self-sustaining path."

"Supply chain bottlenecks are pushing prices up."

"When trying to get the economy to a self-sustaining path have to be gradual, and not disruptive."

"We are not behind the curve at all."

"In December, no Fed policymakers thought rates would go above terminal rate by end of the cycle."

"What we see today is broad-based price pressures."

"Demand and supply imbalance is pushing prices up and the Fed needs to act."

"There is no preset course for Fed policy... there are a lot of risks."

"If the economy progresses as I expect, it is clear it can stand partially on its own two feet."

"The Fed doesn't need to keep providing extraordinary accommodation."

"It's appropriate to remove accommodation."

"You don't want to ratchet up the rates so quickly that it bridles growth too much."

"We hope that supply chains repair and fiscal aid is rolling off."

The Bank of England will announce its decision on monetary policy. Market consensus points to a rate hike of 25bp to 0.50%. Analysts at Danske Bank see the BoE raising rates three times in 2022 (February, May and November) and consider that expectations of five hikes as being to the aggressive side.

Key Quotes:

“We expect the Bank of England to hike the Bank Rate to 0.50% at its upcoming meeting on Thursday. We expect two additional hikes this year (May and November) but risks are skewed towards more rate hikes. Markets are pricing in nearly five rate hikes this year.”

“We expect the BoE to announce “passive QT” (ceasing reinvestments of maturing bonds) in connection with the upcoming meeting. The BoE has previously stated QT would start when the Bank Rate reaches 0.50%. We expect “active QT” (selling bonds to markets) when the Bank Rate reaches 1%. Our base case right now is that happens in November, but since we believe risks are skewed towards more rate hikes, risk is also skewed towards an earlier start for “active QT”.”

“Our base case is three rate hikes in 2022 (February, May and November) but markets are pricing in around 125bp this year, i.e. five rate hikes. We also see risks skewed towards more rate hikes than the three we have pencilled in right now, but we still see five as being to the aggressive side, also given the headwinds the UK economy may face over the course of the year, such as tighter fiscal policy.”

- Gold advances closes to 0.50% in the North American session, amid US dollar weakness and falling US T-bond yields.

- Atlanta’s Federal Reserve President Raphael Bostic eyes three rate hikes.

- The Ukraine – Russia conflict reclaims the spotlight in talks at the UN.

- XAU/USD Technical Outlook: Neutral bias, though upside/downside risks remain.

Gold (XAU/USD) snaps three days of losses, jumping from a support trendline around the daily lows at $1785. At the time of writing, XAU/USD is trading at $1796, slightly short of the 50-day moving average (DMA), which resides at $1801.

So far, an improvement in the market mood has hurt the prospects of a higher greenback, with the USD Dollar Index down some 0.46% in the day, under the 97.00 handle. Furthermore, the US 10-year Treasury yield undermines the buck, down one basis point sitting at 1.787%.

Fed’s Raphael Bostic would not rule a 50 bps hike

During the weekend, Atlanta’s Fed President Raphael Bostic expressed that he foresees at least three rate hikes, beginning in March, but further noted that the Federal Reserve would increase 50 basis points if inflations remain “stubbornly high,” according to the FT.

Meanwhile, the Fed parade began once the US central bank blackout was lifted. Fed’s Daily, George, and Bostic would cross the wires around 16:30 GMT, 17:40GMT, and 18:30 GMT, respectively. Gold traders might turn their attention to all of them, particularly Kansas City Fed Esther George, a voter in 2022. Any hints regarding balance sheet reduction and rate hikes could be taken from their words.

In the meantime, the Ukraine – Russia conflict, which investors put aside for a moment after the Federal Reserve monetary policy meeting, gets into the spotlight. The UN security council voted to hold a public meeting on a build-up of Russian troops on the Ukraine border. Furthermore, China’s ambassador to the UN said that he does not consider Russia’s troop build-up near the Ukraine border a threat, per Reuters.

Meanwhile, US President Joe Biden commented that if Russia chooses to walk away from diplomacy and attack Ukraine, there will be consequences.

XAU/USD Price Forecast: Technical outlook

The XAU/USD daily chart shows a confluence of the daily moving averages (DMAs) around the $1795-$1805 area, which could pave the way for further gains once broken to the upside.

The first support would be $1,800. A breach of the latter would expose Pitchfork’s channel central line around the $1,825-30 area, followed by July 2021 swing high at $1,834 and the YTD high at $1,854.

Contrarily, failure at $1,800 would expose the January 28 daily low at $1,780. Giving way for USD bulls would reveal crucial support levels like November 3, 2021, daily low at $1,759, followed by December 15, 2021, swing low at $1,753.

- Aussie strengthens ahead of the RBA meeting.

- More gains seem likely if AUD/NZD breaks above 1.0730.

The AUD/NZD is rising on Monday, testing the 1.0730 resistance area. It has been trading at the highest level since July. The 1.0725/30 is the upper limit of the current range. The cross is moving sideways, consolidating after strong gains with an upside bias.

A break and a consolidation above 1.0730, would clear the way to more gains with the next target at 1.0800, which should limit the upside.

The bullish bias is likely to remain intact while above 1.0650. A daily close clear below 1.0650 should point to an extension on the downside, with the next strong barrier at 1.0570.

Volatility is likely to remain elevated considering the incoming Reserve Bank of Australia meeting and the fact that AUD/NZD is trading at key technical levels. Also, the RSI is about to reach 70, suggesting some exhaustion to the upside.

AUD/NZD daily chart

-637792418141050428.png)

- NZD/USD is enjoying a modest rebound from the 14-month lows it struck last Friday amid better risk appetite.

- NZD/USD traders will have plenty of US data, Fed speak, and Q4 NZ jobs data to monitor this week.

A more risk-on mood in global equity and FX markets at the start of the week has facilitated a rebound in NZD/USD from last Friday’s 14-month, sub-0.6530 lows, with the pair trading about 0.6% higher on the day around 0.6575. Amid the better tone to risk and ahead of a week packed full of key US data releases, the US dollar is taking a breather following last week’s outsized rally (the biggest one-week move higher in seven months). As far as NZD/USD traders are concerned this week, Friday’s official US labour market report is the main risk event. Any signs of growing wage pressures and further reductions in labour market slack could further pump Fed tightening bets and prompt further USD strength, adding downside risks for NZD/USD.

Traders may not have to wait for Friday for a pumping of tightening bets; a smattering of Fed policymakers will be publically orating this week, starting with Fed’s Ester George, Mary Daly and Raphael Bostic later on Monday. The latter already hinted over the weekend that, should the data warrant it (i.e. inflation not subside), he would be open to a 50bps move or more than the three rate hikes he currently expects in his base case. Other US data is less likely to shift the dial. The latest Chicago PMI for January was stronger than expected but didn’t seem to faze FX markets and it may be a similar story for the ISM PMI surveys on Tuesday and Thursday.

While risks do seem tilted towards a stronger US dollar from a fundamentals standpoint, technicals, particularly with regards to NZD/USD, may be pointing in the opposite direction. Admittedly, the pair didn’t quite hit the 0.6500 level (support from August 2020) which many medium-term bears will still be targetting, suggesting further downside remains on the table. But the 14-day Relative Strength Index (RSI) on Friday fell to its lowest since early December at just above 24.00, signaling the currency pair had become oversold (in the short-term, at least). Looking at the performance of the pair in the post-pandemic period, every time the RSI has fallen to the 30 area or below, this has been a leading indicator of near-term consolidation.

Couple with the above with hawkish calls from NZ-based Kiwibank for the RBNZ’s Official Cash Rate to hit 2.5% by November 2020 (a total of seven 175bps of tightening) and the case for a further large drop is substantially weakened. Q4 2021 New Zealand Labour Market data on Wednesday, if it shows an even greater tightening of the country’s labour market, could thus offer the beleaguered kiwi some much-needed support via RBNZ tightening bets. Note that at 3.4% in Q3, the New Zealand unemployment rate was already substantially lower than levels seen (by economists and the RBNZ) as consistent with long-term price stability.

- Japanese yen recovers versus dollar but drops against most G10 currencies.

- DXY drops after five-day rally, down 0.38%.

- USD/JPY heads for the third consecutive daily close near 115.30.

The USD/JPY pair is trading in neutral territory on Monday during the American session. Earlier it peaked at 115.59 but failed again to hold above 115.50 and lost momentum. The US dollar is pulling back after rising sharply last week.

US yields are modestly higher on Monday, with the 10-dayer at 1.79% after making a spike to 1.81% while the 30-year stands at 2.10%, down from 2.13%. In Wall Street, equity prices are rising. The Nasdaq gains 1.65% and the Dow Jones 0.04%.

Economic data released on Monday showed the Chicago PMI rose in January from 64.3 to 65.2 against expectations of a decline to 61.7. The Dallas Fed Manufacturing Business Index dropped from 7.8 to 2, versus market consensus of 9.9. The key report of the week is the official employment report due on Friday.

The greenback opened the week under pressure, correcting lower after the rally following the FOMC meeting that triggered expectations of four to five rate hikes from the Fed during 2022.

The positive momentum of the USD/JPY is easing as it remains unable to hold firm above 115.50. If the dollar manages to confirm levels above the mentioned area, it would point to further gains a possible test of 116.00. On the flip side, the correction could extend to 114.80/85 (20-day moving average) if it breaks below 115.00.

Technical levels

The Reserve Bank of Australia (RBA) will meet on Tuesday, February 1 at 03:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of eight major banks regarding the upcoming central bank's decision. The RBA is expected to end its pandemic-related bond-buying program while market participants speculate policymakers will bring forward rate hikes’ guidance.

ING

“The RBA will probably say they'll keep rates as they are until all, not just most, of the evidence points to a hike. But we might not have too long to wait for that and asset purchases may soon be on the way out. Even if we get a hawkish tilt, the market's already hawkish pricing along with external woes should limit AUD/USD upside”

ANZ

“We expect the RBA to forecast trimmed mean inflation of 3% by mid-2022 with unemployment falling below 4% by the end of year. Despite this we expect the RBA Board to say it will wait until wages growth accelerates further before it lifts the cash rate. This will be a complicated message for the market to absorb. But it will be a clear signal the RBA is serious about wanting to see sustainably faster wages growth before it moves. Its forecast for wages growth will likely point to a rate hike in the first half of 2023 as being its central case, but Lowe will also admit for the first time that a move in 2022 is a possibility if wages growth comes through faster than forecast. This will likely reinforce the market’s belief a rate hike will happen this year.”

Westpac

“The RBA will announce that the QE government bond-buying program will come to an end in February. The cash rate will be held at the record low of 0.1% at this meeting. However, some shift in language is likely in the decision statement. Westpac expects the RBA to begin a tightening cycle this August. The RBA will acknowledge that inflation is now back in the target band and that the unemployment rate is nearing full employment. The RBA expects wages growth to lift – but will highlight uncertainty around the speed and timing of that likely acceleration.”

Standard Chartered

“We maintain our call for the RBA to end QE in February. The bigger question will be how RBA responds to recent labour and inflation data. Notably, Q4 trimmed mean CPI rose 2.6% YoY, moving above the mid of RBA’s target range of 2-3%. In addition, the print is higher than the end-2022 projection of 2.25% in the November Statement on Monetary Policy. While one print does not mean that underlying inflation is now sustainably within the 2-3% range, RBA may need to acknowledge upside risk to inflation. We will watch for any removal of reference to wages and inflation to take some time to reach its target or the RBA “being prepared to be patient”. We will also watch for any changes to the reference on materially high wage growth being needed to generate higher inflation. We currently expect the RBA to start hiking rates in November this year; however, the risk is increasing for the first hike to be earlier.”

Danske Bank

“The RBA is widely expected to end QE purchases. We do, however, think RBA is unlikely to take a hawkish stance as markets are currently pricing.”

TDS

“The Target Cash rate is likely to remain at 0.10% but the Bank's central scenario for the u/e rate, trimmed mean and wages growth is likely to be consistent with the Bank lifting the cash rate this year. The economic forecasts and the Bank formally announcing an end to QE provide room for the removal of state-based forward guidance. The Aus front end should underperform.”

SocGen

“We expect the RBA to maintain the cash rate target of 0.10% and to announce that the government bond purchase programme will end from mid-February. The question is whether they will revise the forward guidance on the timing of the first policy rate hike. We think the RBA is likely to introduce a subtle change; maintaining the conditions for a rate hike, but removing the qualifications of ‘likely to take some time’ and ‘the Board is prepared to be patient’.”

Citibank

“The RBA’s first meeting for 2022 is likely to see it end its QE program and upwardly revise its underlying inflation forecasts following the Q4 CPI upside surprise. But although we now believe the RBA is poised to hike rates twice in H2’22, it’s probably still early for the RBA to turn hawkish. But hawkish risks could arise this week if the Bank softens its language around the requirement for wages growth, though unlikely.”

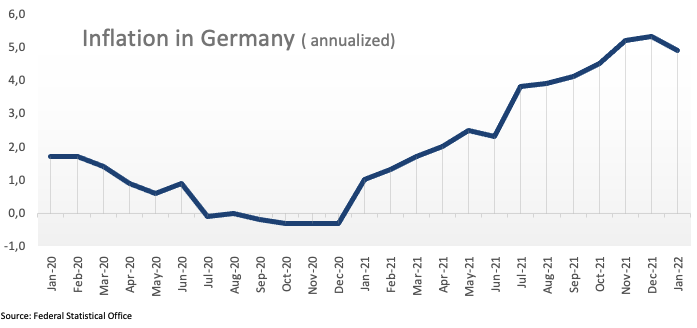

- EUR/USD approaches the key barrier at 1.1200.

- German 10y Bund yields advance past 0.03%.

- EMU flash Q4 GDP rose 4.6% YoY, 0.3% QoQ.

The buying interest around the European currency keeps growing on Monday and pushes EUR/USD to the very boundaries of 1.1200 the figure.

EUR/USD bid on risk-on trade, data

EUR/USD posts gains for the second session in a row on Monday, bolstered by the generalized risk-on sentiment, positive data releases and investors’ repricing of a potential interest rate hike by the ECB at some point by year end.

In addition, yields of the key German 10y Bund advance to levels last seen in May 2019 past 0.03%, while yields of the US 10y benchmark navigate above 1.80%.

In the euro docket, advanced EMU Q4 GDP figures showed the economy is expected to have expanded 0.3% QoQ and 4.6% YoY. In Germany, preliminary inflation figures now see the CPI rising 0.4% MoM in December and 4.9% from a year earlier.

EUR/USD levels to watch

So far, spot is gaining 0.38% at 1.1190 and faces the next up barrier at 1.1198 (weekly high January 31) seconded by 1.1304 (55-day SMA) and finally 1.1369 (high Jan.20). On the other hand, a break below 1.1121 (2022 low Jan.28) would target 1.1100 (round level) en route to 1.1000 (psychological level).

- WTI recently dipped below $87.00 back towards session lows, but remains broadly well supported close to recent highs.

- Strategists cite geopolitics (Russia/Ukraine/Nato), OPEC+ supply concerns and robust/recovering demand as sources of oil market support.

Oil markets have seen a subdued start to the week, with front-month WTI futures spending most of Monday’s session thus far consolidating within an $87.00-$88.00 range, not far below last week’s multi-year highs at $88.82 per barrel. More recently, WTI has dipped under the $87.00 level and is trading in the red by about 50 cents and at session lows. However, WTI remains well within recent ranges and there is plenty of support in the form of recent bottoms in the low $86.00s.

Analysts/market commentators continue to cite uncertainty relating to future Russian oil supply in case the country takes military action against Ukraine, which the UK warned was “highly likely” over the weekend, as supportive to crude oil prices. The head of NATO has subsequently called for the military alliance to “diversify” its energy supply (i.e. the EU becoming less reliant on Russia for oil and gas). Moreover, the US government has been engaging the UAE and other Middle Eastern nations to make up for the shortfall if Russian energy exports are barred as a result of sanctions for military action against Ukraine.

Meanwhile, ahead of this week’s OPEC+ meeting, where the group is expected to stick to its policy of gradual 400K barrels per day in output hikes each month, analysts continue to cite concerns about the inability of smaller producers to keep up with production quota hikes. The latest OPEC Monthly Oil Market Report from two weeks ago highlighted Nigeria and Angola as facing the worst production struggles, though Libya has also been a culprit of low supply recently. Elsewhere, one oil market strategist said that an outage of a major pipeline in Ecuador after a spill was also providing support.

To put it bluntly, there are plenty of supply-side factors supporting crude oil at multi-year highs right now. Analysts at Reuters pointed out that the Brent futures curve is in its steepest backwardation since 2013 when oil prices were at the time about $100 per barrel. Last Friday, the Brent future for March delivery was $6.75 more expensive than the Brent future for September delivery, suggestive of expectations that market conditions are expected to be significantly tighter in the near-term than the medium-term. That tightness, said some analysts, is being exacerbated by economic reopening in Europe as Omicron, with much of it having been under some sort of lockdown in late-2021.

- The GBP/USD advances 0.28% during the North American session.

- An improved market mood and increasing bets of the BoE hiking five times keep the GBP bid.

- GBP/USD is downward biased in the long-term but, in the near-term, is under upward pressure.

The British pound extends its recovery, amid on Friday snapping two days in a row loss. At the time of writing, the GBP/USD is trading at 1.3434 in the North American session. As shown by the cash markets in Europe, the market sentiment is positive but, US equity futures point to a lower open. Nevertheless, risk-sensitive currencies, led by the antipodeans and the GBP, rise in the day to the detriment of the greenback.

Risk appetite and money markets expecting five rates hikes by the BoE underpins the GBP

Since the Asian session, the pair remained buoyant, rising to the daily high around 1.3450, as market mood carried the New York appetite throughout the weekend. It appears the lift in the GBP is attributed to the Bank of England monetary policy meeting, to be held on February 3, where market participants expect a rate hike towards 0.50%. Furthermore, In the last couple of hours, money markets expect five rates of the Bank of England, expecting the bank’s rate to finish around 1.50%, according to Reuters.

In the meantime, some headlines throughout the weekend, the UK’s PM Boris Johnson and Chancellor Rishi Sunak aim to finalize a package of measures to support low-income households. Regarding domestic political issues, UK’s Foreign Secretary Liz Truss said that PM Boris Johnson is the best person to lead the Tories to the next election.

Atlanta’s Fed President does not rule out a 50 bps rate hike

Over the weekend, Atlanta’s Fed President Raphael Bostic expressed that he foresees at least three rate hikes, beginning in March, but emphasized that the US central bank would increase 50 basis points if inflations remain “stubbornly high,” according to the FT.

An absent UK economic docket left the pair lying in the dynamics of the BoE’s monetary policy meeting ahead. In contrast, the US economic docket on Monday would feature the Chicago PMI and the Dallas Fed Manufacturing Index, both for January. The readings for the former is expected at 61.7, while Dallas Mfg. Index for December was 8.1.

GBP/USD Price Forecast: Technical outlook

The GBP/USD remains downward biased. The daily moving averages (DMAs) stay above the spot price, except for the 50-DMA, underneath at 1.3416, acting as support. Nevertheless, the 100-DMA at 1.3517 is at the reach of the GBP/USD spot price, though a daily close above is required to open the door for higher prices.

That said, the GBP/USD first resistance would be 1.3500. A breach of the latter would expose the former 100-DMA at 1.3517.

Contrarily, the GBP/USD first support would be the 50-DMA at 1.3416. A break of that level would open the door towards 1.3400 that if it gives way to USD bulls (let’s not count them out, as month-end flows loom), that would pave the way towards the 2022 YTD low at 1.3357.

- USD/TRY adds to Friday’s losses and retests 13.3000.

- The softer dollar collaborates with the downside in spot.

- Turkey’s trade deficit widened in December.

The Turkish lira extends Friday’s renewed upside bias and drags USD/TRY to the area of multi-day lows near 13.3000 on Monday.

USD/TRY weaker on USD selling, risk-on

USD/TRY trades on the defensive for the second session in a row at the beginning of the week following the broad-based risk-on environment as well as the offered stance in the US Dollar.

Indeed, better-than-expected Manufacturing PMI in China for the current month and published over the weekend lent support to the risk-associated universe at the beginning of the week, supporting the demand for lira as well as the rest of the EM FX space.

In the meantime, the pair continues to move within a consolidative mood, which kicked in with the new year and after investors seem to have digested the government’s FX-protected lira deposits scheme (announced in late December).

In the domestic docket, December’s trade deficit widened to $6.79B, with exports rising 22.2% and imports expanding 23.2%. Further data saw tourism income increasing 95% to $7.631B during the October-December period.

What to look for around TRY

The pair keeps the multi-session consolidative theme well in place, always within the 13.00-14.00 range. The range bound stance appears reinforced by the recent steady hand by the Turkish central bank, while skepticism keeps running high over the effectiveness of the recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: Manufacturing PMI (Tuesday) - January CPI, Producer Prices (Thursday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is retreating 1.11% at 13.3991 and a drop below 12.7523 (2022 low Jan.3) would expose 10.2027 (monthly low Dec.23) and finally 9.9082 (200-day SMA). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

A number of lockdown gatherings should not have been allowed to take place or develop in the way that they did, the Sue Gray inquiry into No10. Downing Street lockdown breaches said, according to a government update. The full report has not been released due to an ongoing police enquiry, but the UK government has released an update on its contents.

The S&P 500 held near-term support at 4287/76 on Friday and the subsequent strong recovery has turned the spotlight back on resistance at 4434/50 – the key 200-day average and 38.2% Fibonacci retracement of the January collapse. Analysts at Credit Suisse think the pressure is now for a close above here for a deeper corrective recovery to 4495, potentially 4521/31.

S&P 500 Index to reassert a bearish tone again beneath 4292/76

“A close above 4450 should see resistance next at the 13-day exponential average at 4481, then 4495, which we would look to cap at first. Should strength extend, we would see scope for the recovery to extend to 4521/31.”

“Near-term support moves to 4388, then 4374, with a break below 4332 needed for a retest of 4292/76. Beneath here can quickly reassert a bearish tone again for a retest of support at 4223/4199 – the recent low, the 23.6% retracement of the entire 2020/2021 uptrend and the 38.2% retracement of the rally from October 2020.”

See: S&P 500 Index to tank towards a 3,400-3,700 range on escalation of Ukraine-Russia crisis – UBS

GBP/USD rises to mid-1.34s. This move leaves the pair technical picture looking less bearish but economists at Scotiabank still expect the cable to suffer further losses towards the 1.33/32 region.

First real test of momentum is 1.3450 resistance zone

“The overall trend in the pound remains bearish, but the recovery from the break under 1.34 on Thursday leaves the shorter-term GBP picture looking a touch less negative.”

“The first real test of momentum is 1.3450 resistance zone. Beyond the mid-figure zone, the GBP faces resistance around 1.3500 and the 100-day MA of 1.3521.”

“Support is 1.3390/400 followed by 1.3355/75. Below this area, the pound risks losses to 1.33/1.32.”

EUR/USD is making a weak attempt to recover from the lows on Friday, remaining short of a test of 1.12. A break above here would be the first sign of a possible reversal in the EUR’s losses, economists at Scotiabank report.

Price trends point to an imminent test of 1.11

“The currency’s quick drop from the high 1.14s through the low 1.10s over the course of two weeks has maybe briefly stalled as it nears oversold conditions. However, price trends point to an imminent test of 1.11, with little in the EUR’s way to prevent then a test of 1.10.”

“A topside break of 1.12 would be the first sign to watch for a possible reversal in the EUR’s losses.”

The Norwegian krone has been supported by higher petroleum prices through the latest market turbulence. Economists at Nordea see EUR/NOK trading in a range around 10.00 and USD/NOK slightly above 9.00 this year, however, with significant volatility.

High oil and gas prices to support the NOK

“As long as oil and gas prices remain elevated, the NOK will continue to benefit from high oil and gas prices and high purchases of NOK from oil companies to cover taxes paid in NOK.”

“Any negative impact on the NOK will be dampened by Norges Bank hiking the key rate to 1.5% this year – making it more expensive to bet against the NOK.”

“We see EUR/NOK trading around 10.00 – however with significant volatility.”

“We see USD/NOK slightly above 9.00 this year. The pair has potential on the upside as we continue to believe that higher US rates will drive the USD stronger.”

- EUR/GBP squeezed out a fresh 23 month low under 0.8305 but has since rebounded to around 0.8330.

- A barrage of Eurozone GDP and inflation data has done little ot shift the dial for EUR/GBP thus far.

- The pair is likely to trade in rangebound fashion ahead of Thursday’s BoE and ECB rate decisions.

A barrage of Eurozone GDP and inflation data has done little ot shift the dial for EUR/GBP thus far on the session, with the pair just about squeezing out a fresh 23-month low earlier in the session just under 0.8305. The pair has since rebounded to trade around the 0.8330 mark, up a modest 0.1% on the day, as euro traders mull what the latest Eurozone data will mean for the ECB and sterling traders await a statement from the PM on the Sue Gray report. Regarding the latter, “partygate” as it has been coined (referring to multiple accusations of lockdown breaches in Downing Street over the past years), while fuelling rampant speculation that UK PM Boris Johnson might be ousted, has not impacted sterling yet.

The latest batch of Eurozone data, meanwhile, confirmed a robust 2021 GDP growth rate of 4.6% (a tad under the expected 4.7%). According to flash estimates, the headline YoY HICP inflation rates in both Spain and Germany fell in January (though not quite as much as expected). Investors do not seem to have interpreted the data as changing much from the perspective of the ECB. The central bank is issuing its latest monetary policy announcement on Thursday, an event ahead of which euro traders are likely to keep their powder dry/refrain from placing any big bets.

The same can be said for sterling traders ahead of the upcoming BoE rate decision, also on Thursday. That suggests trading conditions for the pair is likely to be rangebound in the coming days. The ECB announcement is not expected to yield any policy/policy guidance changes, thus will likely not be too much of a market mover. The same cannot be said for the BoE, who are expected to implement a 25bps rate hike (to 0.5%) and kick off quantitative tightening by ending balance sheet reinvestments.

Sterling will likely be most sensitive to guidance on the future of the rate path, with money markets currently pricing a terminal BoE rate of around 1.25%. The consensus amongst analysts is that as the BoE brings expected monetary tightening into reality, thus widening the BoE/ECB policy divergence, this will likely keep EUR/GBP under pressure. Medium-term bears continue to target a test of the late-2019/early-2020 lows in the 0.8280 area.

- AUD/USD staged a solid rebound on Monday and was supported by modest USD weakness.

- Any meaningful recovery still seems elusive as the focus remains on the RBA on Tuesday.

- Bears might now wait for some follow-through selling below the 0.6970-0.6965 swing low.