- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 27-01-2022

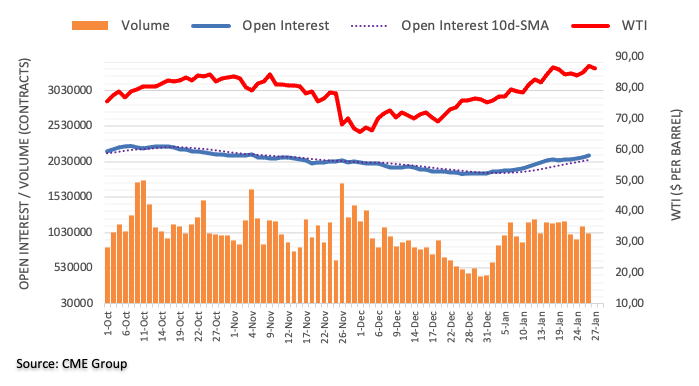

- WTI grinds higher around seven-year peak during four-day uptrend.

- US President Biden calls UN Security Council meeting to discuss risk of the Russian invasion to Ukraine.

- US dollar rallied after Fed emphasized inflation concerns to hint at rate hikes.

- US PCE Inflation figures are important, risk catalysts are the key.

WTI crude oil bulls take a breather around $86.90 during Friday’s Asian session, after refreshing the seven-year high the previous day. In doing so, the oil benchmark awaits clear direction amid a mixed play of catalysts and an absence of major data/events.

The black gold rallied to the highest levels since late 2014 the previous day before easing from $88.00. The pullback moves, however, were recently reversed from $85.73.

That said, looming fears of Russia’s invasion of Ukraine contrasts with the US Federal Reserve’s (Fed) hawkish message to entertain the oil traders. However, given the higher emphasis on the immediate geopolitical fears and receding negative concerns over the coronavirus seem to have underpinned the commodity’s latest advances.

“Russia, the world's second-largest oil producer, and the West have been at loggerheads over Ukraine, fanning fears that energy supplies to Europe could be disrupted, although concerns are focused on gas supplies rather than crude,” said Reuters. On the same line were US President Joe Biden’s comments during the CNN interview, citing the escalating risks of Russia's invasion of Ukraine and looking to additional macroeconomic assistance for Kyiv.

Also helping the WTI crude oil could be likely preparations for the next week’s meeting of the Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, a group known as OPEC+. Ahead of the meeting, Reuters learns from several sources that OPEC+ is likely to stick with a planned rise in its oil output target for March.

Elsewhere, the US Dollar Index (DXY) rallied to the highest levels last seen during July 2020 as the Federal Reserve (Fed) indirectly confirmed the March rate hike and cited room for more lift-offs.

Talking about the data, Advance Q4 US GDP rose 6.9% annualized versus 5.5% market consensus and 2.3% prior. On the same line was the US Initial Jobless Claims for the week ended in January 21that came in 206K compared to 260K expected and 290K previous. It should be noted, however, that the US Durable Goods Orders for December dropped by -0.9% for December, below -0.5% market consensus.

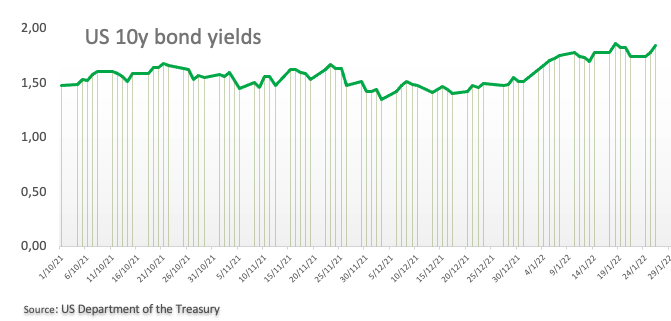

Against this backdrop, equities reversed initial gains and closed with losses while the US 10-year Treasury yields ended Thursday’s North American trading session with four basis points (bps) of a downside to 1.80%.

Moving on, to the US Core PCE Price Index figures for December, expected 4.8% YoY versus 4.7% prior, will be important for oil traders to watch. However, major attention will be given to the geopolitical concerns as Russia is the world’s second-largest crude producer.

Read: US PCE Inflation Preview: Dollar rally has more legs to run

Technical analysis

A clear upside break of the two-month-old ascending trend line, near $88.20 by the press time, becomes necessary for the WTI bulls to keep reins. In absence of this, a pullback towards a six-week-long support line around $84.30 can’t be ruled out considering the overbought RSI conditions.

- USD/CAD pauses two-day uptrend near the highest levels in three weeks.

- Bullish MACD signals, sustained break of 200-SMA keep buyers hopeful.

- Weekly ascending trend line acts as the key short-term support.

USD/CAD retreats from a three-week high to 1.2736 during a quiet Asian session on Friday. In doing so, the Loonie pair drops for the first time in three days while stepping back from a one-month-old descending resistance line.

Even so, the quote’s successful trading above the 1.2695-2710 support zone, comprising 200-SMA and 50% Fibonacci retracement (Fibo.) of December-January declines, keeps USD/CAD buyers hopeful amid bullish MACD signals.

It’s worth noting that 61.8% Fibo. level near 1.2770 acts as an additional upside hurdle, should the quote manage to cross the immediate trend line barrier around 1.2750.

In a case where USD/CAD manages to stay firmer past 1.2770, the monthly high of 1.2813 and the late December tops close to 1.2850 will test the further advances before directing the quote towards the last month’s peak of 1.2964.

On the flip side, short-term sellers will gain momentum on the break of 1.2695. However, an ascending support line from January 20, near 1.2595, will challenge the USD/CAD sellers afterward.

If at all the USD/CAD bears conquer the 1.2595 support, the 23.6% Fibonacci retracement level of 1.2571 may offer an intermediate halt during the anticipated fall towards the monthly low of 1.2450.

USD/CAD: Four-hour chart

Trend: Further upside expected

With the Fed’s hint of March rate-hike, global markets keep their eyes on the upcoming key inflation gauge for the US Federal Reserve (Fed), namely US Core Personal Consumption Expenditure Price Index, for fresh impulse.

Early signal for the same, namely the US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, recovered from the weekly low of 2.38% to 2.40% by the end of Thursday’s North American trading session.

It’s worth noting that the inflation gauge dropped to the lowest level last seen during last September during the previous week before bouncing off 2.33%.

That said, the US Core PCE Price Index figure for December is expected to rise to 4.8% YoY from 4.7% previous reading during today’s US session. The same is likely to bolster the Fed’s hawkish view and can help the US dollar to extend the latest run-up.

Read: US PCE Inflation Preview: Dollar rally has more legs to run

US President Joe Biden and his Ukrainian counterpart Volodymyr Oleksandrovych Zelenskyy talked about Russia on Thursday, per CNN. The news stated that Biden told Zelenskyy that a Russian invasion is now highly certain.

US President Biden also said that the US is looking into additional macroeconomic assistance for Ukraine.

Elsewhere, Biden pushes for a United Nations (UN) Security Council meeting on Monday to discuss the Russia-Ukraine issues. The US leader also reiterated his warning to Russia if it invades Ukraine.

FX implications

The news weighs on the riskier assets while keeping WTI crude oil prices afloat, around $86.80 at the latest.

Read: AUD/USD bears eye sub-0.7000 zone on strong USD ahead of US PCE Inflation

- On Thursday, the NZD/USD plunged to levels not seen since November 2, 2020.

- Risk-aversion in the financial market spurred demand for safe-havens like the USD, weighed on the NZD.

- US Stocks finished in the red, led by the S&P, the less damaged was the Dow Jones Industrial.

- The NZD/USD is downward biased, and a break below 0.6500-11 might send the pair tumbling to 0.6478.

The New Zealand dollar extends its free fall for the sixth consecutive day against the US dollar, plunging close to 300-pips from 0.6850 down under the 0.6600 figure. As the New York session winds down and the Asian session begins, the NZD/USD is trading at 0.6583 at the time of writing.

Risk aversion hurts the prospects of risk-sensitive peers like the NZD

The market sentiment is downbeat. Factors like the hawkish Federal Reserve, which said that might raise interest rates “soon,” in the monetary policy statement, did not have an impact. However, when US central bank Chair Jerome Powell said at the presser that “the committee is of a mind to raise the federal funds rate at the March meeting assuming that the conditions are appropriate for doing so,” those were the words that caused volatility in the market.

Cash stock indices in the US ended with losses. The S&P 500 fell in the session 1.4%, finished at 4326.51, while technology stocks, reflected by the Nasdaq Composite, fell for the second straight day 0.54%, down to 13,352.78, while the less damaged Dow Jones, was almost flat a 0.02% loss, finishing at 34,169.78.

Sector-wise, the leading gainers were energy, utilities, and consumer staple, up some 1.24%, 0.78%, and 0.58% each. Contrarily, the hardest hit by the sell-off were consumer discretionary, real estate, and industrials, falling 2.27%, 1.75%, and 0.93%, respectively.

In the meantime, the US Dollar Index finished up 1.272%, sitting at 97.220, while the 10-year US T-bond yield ended at 1.803%, down five basis points.

A light Asian economic docket, referring to New Zealand data, featured the ANZ NZ consumer confidence, which came at 98, in line with the previous reading. Meanwhile, Japan’s Consumer Price Index (CPI) and Australia Producer Price Index (PPI) will be featured at 23:00 and 23:30 GMT, respectively.

NZD/USD Price Forecast: Technical outlook

The NZD/USD broke a downslope trendline of a descending channel (probably a bullish flag). The result of that emphasized the pair as downward biased, exposing September 24, 2020, a daily low at 0.6511. The closeness of the aforementioned price level to the 0.6500 figure would make the 0.6500-11 region the NZD/USD first support. A breach of it would open the door for further losses. The following demand zone would be August 20, 2020, 0.6487, followed by June 20, 2020, cycle low at 0.6478.

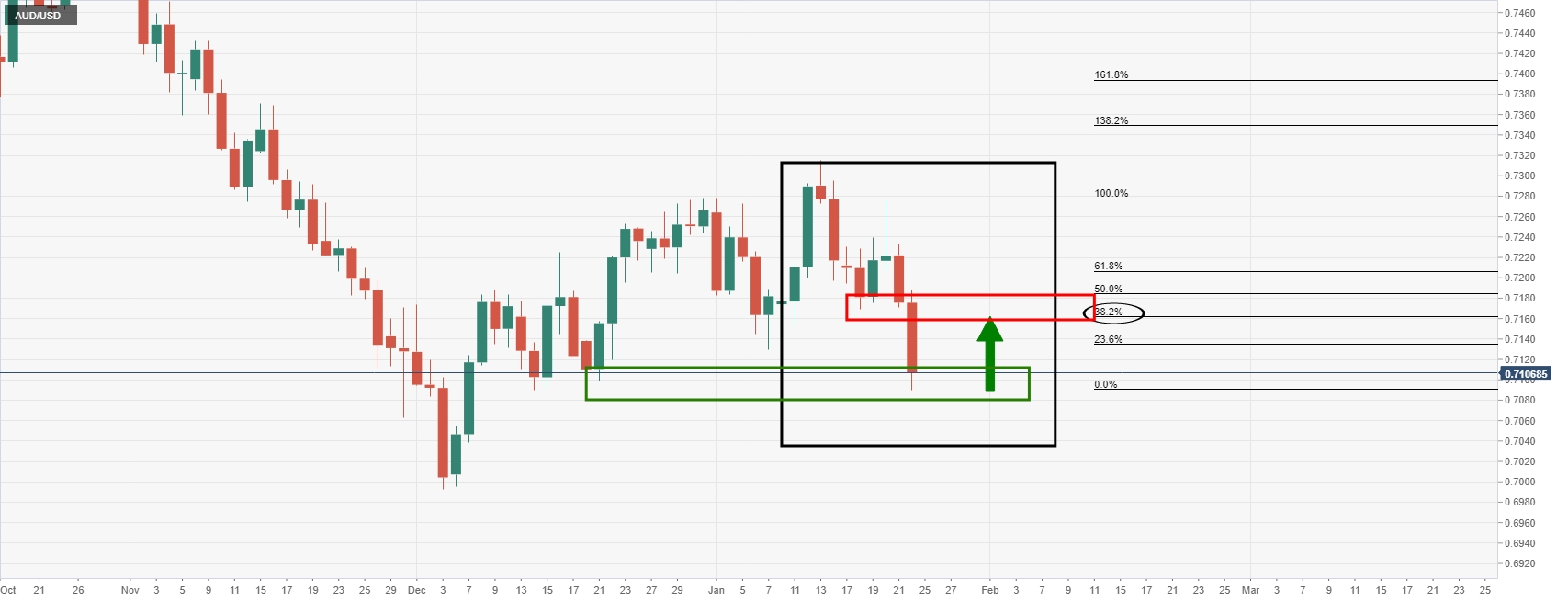

- AUD/USD braces for the biggest weekly fall since August, recently stabilizing near two-month low.

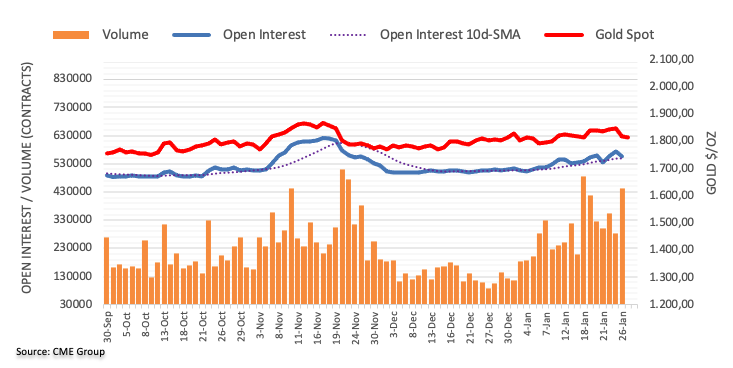

- Markets tried to digest hawkish Fed signals, yields eased but couldn’t help equities, gold.

- US Q4 Advance GDP, Jobless Claims came in stronger to fuel USD, Durable Goods Orders couldn’t harm the buck

- Aussie PPI, risk catalysts to entertain traders with eyes on US Core PCE Inflation.

AUD/USD stays on the way to post the biggest weekly loss in five months, taking rounds to 0.7030-35 during early Friday morning in Asia.

The Aussie pair dropped to December 2021 bottom following the heaviest daily fall in a month the previous day as the US dollar cheered the hawkish Fed verdict. The upside momentum gained support from a slump in gold prices while ignoring mixed equities and a pullback in the US Treasury yields.

Global traders matched expectations of favoring the US dollar against almost everything after the Federal Reserve (Fed) indirectly confirmed the March rate hike and cited room for more lift-offs.

The hawkish expectations gained support from the Advance Q4 US GDP, up 6.9% annualized versus 5.5% market consensus and 2.3% prior. On the same line was the US Initial Jobless Claims for the week ended in January 21that came in 206K compared to 260K expected and 290K previous. It should be noted, however, that the US Durable Goods Orders for December dropped by -0.9% for December, below -0.5% market consensus.

Elsewhere, China's slowest industrial profit growth in nine months and softer Westpac Leading Index for Australia also weighed on the AUD/USD prices. On the same line were softer-than-previous readings of the Aussie Export Price Index and Import Price Index for Q4.

Other than the data and Fed, escalating geopolitical fears concerning the Russia-Ukraine issue also drown the risk barometer AUD/USD prices. Recently, US President Joe Biden told Ukrainian President Volodymyr Oleksandrovych Zelenskyy that a Russian invasion is now highly certain, per CNN. Also backing the risk-off mood was news from China’s Evergrande as the struggled real-estate firm said it is targeting a restructuring proposal within six months.

Amid these plays, equities reversed initial gains and closed with losses while the US 10-year Treasury yields ended Thursday’s North American trading session with four basis points (bps) of a downside to 1.80%. Further, gold prices slumped over 1.0% to below $1,800 whereas the US Dollar Index (DXY) rose to the highest levels last seen during July 2020.

Looking forward, Australia’s Q4 Producer Price Index, expected 0.3% QoQ versus 1.1% prior, will decorate the calendar in Asia but major attention will be given to the US Core PCE Price Index figures for December as they’re considered the Fed’s preferred version of inflation. Markets expect a 4.8% YoY figure versus 4.7% prior.

Read: US PCE Inflation Preview: Dollar rally has more legs to run

Technical analysis

A clear downside break of a horizontal area from August, surrounding 0.7100, directs AUD/USD towards 2021 bottom of 0.6993. However, any further weakness will not hesitate to challenge the 61.8% Fibonacci Expansion (FE) of the pair’s declines from late June 2021 to January 2022, around 0.6920.

Apple (AAPL) reported earnings after the close on Thursday. Earnings per share (EPS) came in at $2.10 versus the estimate of $1.89. Revenue was $123.9 billion versus the estimate for $118.66 billion.

Apple (AAPL) stock forecast

Apple (AAPL) stock is trading at $162.40 in Thursday's aftermarket, a change of 2% versus the regular session close of $159.16.

Apple chart, daily

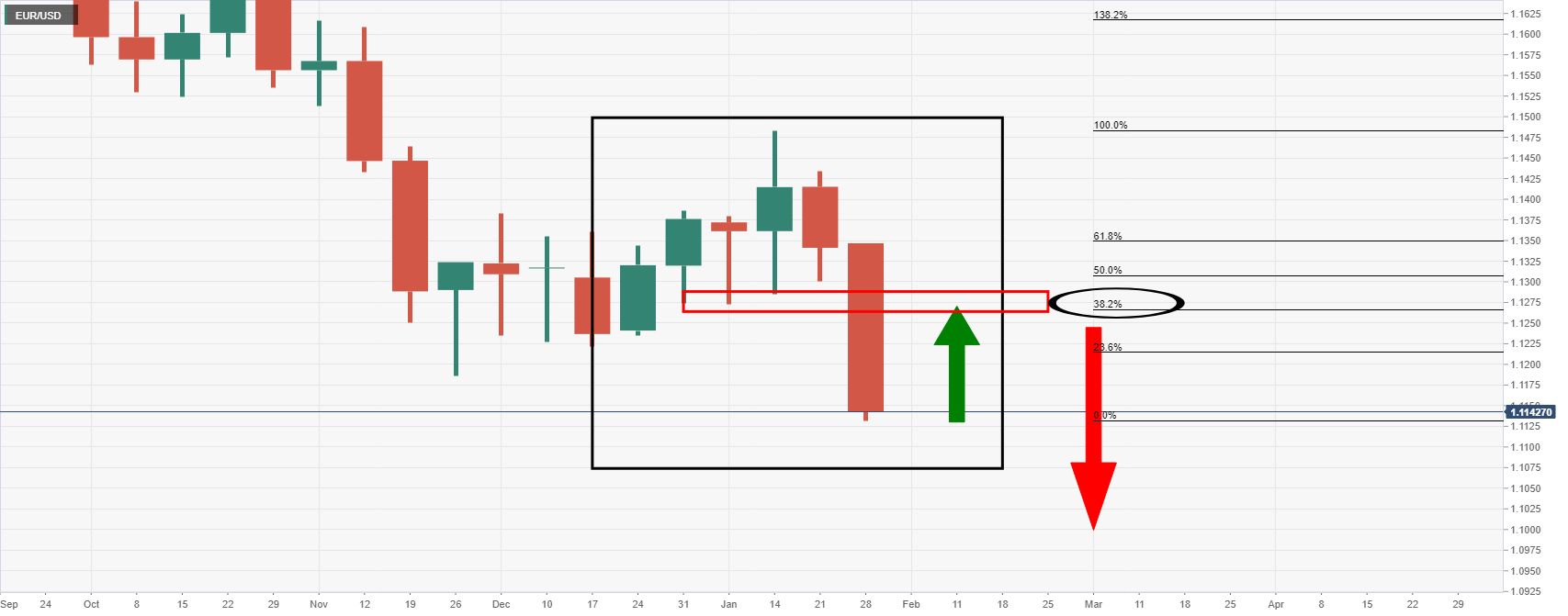

- EUR/USD bulls moving in at the lows for the day.

- Bulls have an eye on the weekly M-formation and prospects of a significant correction.

EUR/USD is set to close off a bearish week towards a test of 1.11 the figure after breaking out of the bearish weekly wedge to the downside. The following illustrates the potential for a downside continuation on the lower time frames while keeping note of the potential for a significant correction to the upside medium term.

EUR/USD weekly chart

The weekly chart has imprinted an M-formation. This is a reversion pattern and could be a significant theme for the technical outlook in the medium term. The 38.2% Fibonacci retracement level has a confluence with the prior lows that would be expected to at together as a firm resistance structure. Meanwhile, there is still room for a run to test 1.11 the figure, however.

EUR/USD H1 chart

The price has left a bottoming formation given the wicks and subsequent upside correction. The irregularity of the price action is also bullish.

However, we have seen more commitments from the bears since the lows which leave prospects of a downside continuaiton towards 1.11 the figure for the sessions ahead. With that being said, the combination of month-end flows and the choppy price action, the risk-reward is hardly attractive at this stage of the bearish flow.

- GBP/USD is consolidating in the 1.3380 level after dipping under 1.3400 for the first time in over a month.

- Hawkish BoE expectations may be supporting sterling, which outperformed most of its G10 peers even though it succumbed to the dollar.

GBP/USD fell to one-month lows on Thursday underneath the 1.3400 level after slumping below resistance in the 1.3450 area earlier in the session, weighed by a buoyant dollar in wake of Wednesday’s hawkish Fed meeting and strong US GDP data. The pair is now consolidating in the 1.3380 area, practically bang on a level of resistance turned support from back in mid-December, where it trades lower by about 0.6% on the day. Those losses, though extensive, are modest compared to many of sterling’s G10 peers; AUD is down 1.2%, SEK and NZD are down 1.1%, EUR and CHF are down around 0.9%. Sterling’s performance puts it roughly in line with that of the loonie and yen, both of which are also down about 0.6% on the day versus the buck.

While then yen’s comparatively strong on the day performance compared to most of its G10 peers can likely be attributed to choppy US equity market conditions and US yield curve flattening, GBP and CAD may be finding central bank support. Recall that the BoC on Wednesday, while disappointing some calls for a 25bps hike, signaled a rate hike would soon be coming in March (as the Fed did). Meanwhile, investors expect the BoE to lift interest rates by 25bps to 0.25% next Thursday following strong labour market and inflation data for December. While the likes of the euro, Aussie and kiwi have recently broken out to multi-month/year lows, sterling still remains some way above its December 2021 lows just under the 1.3200 area.

Looking ahead, it seems likely that the US dollar’s broad post-Fed rally may have some legs with the Fed seemingly the most intent on monetary policy tightening for some time (i.e. since 2018). Friday’s Core PCE inflation data for December is likely to reinforce that. That keeps GBP/USD downside risks alive, even in the face of BoE hawkishness. Traders should remember to keep an eye on the UK political situation as a UK PM Boris Johnson resignation remains a strong possibility as the partygate scandal drags on. Whilst analysts have so far mostly shrugged off the impact of this political noise on GBP, it surely can’t be helping sterlings cause. Short/medium-term bears will likely be targetting a test of the aforementioned December lows at some point in Q1 2022.

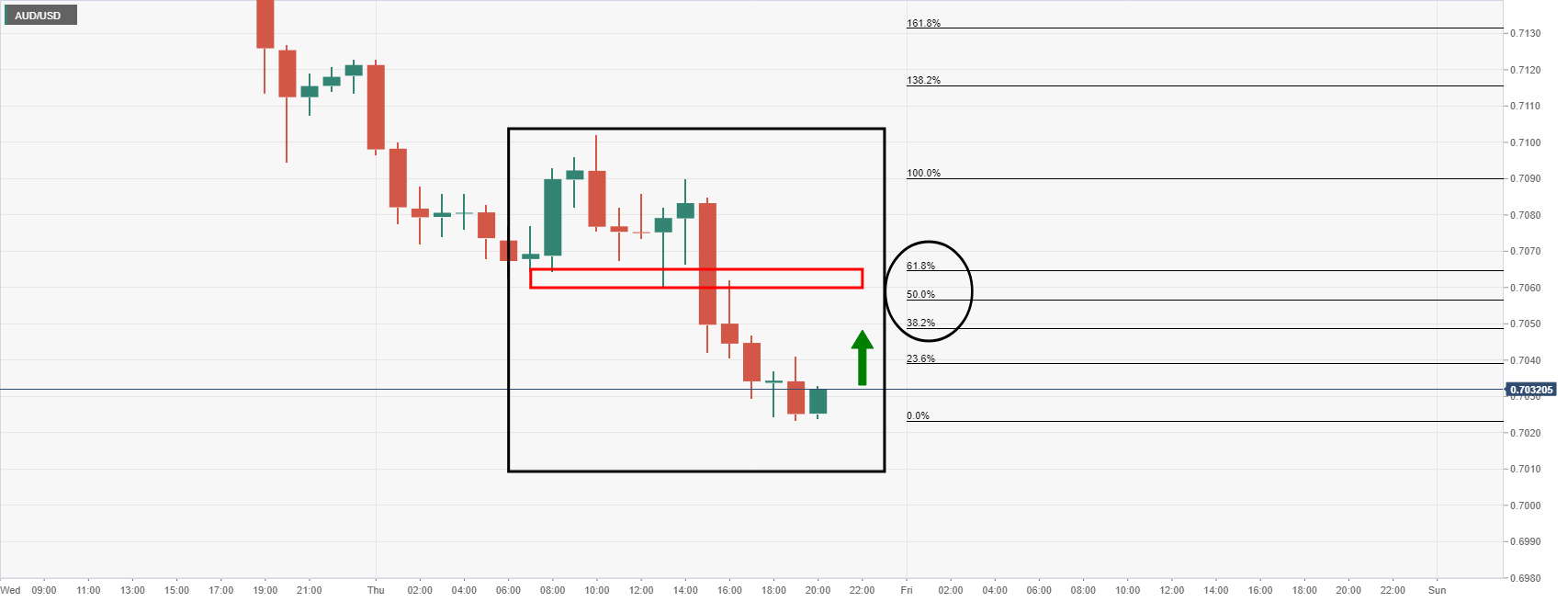

- AUD/USD is in the hands of the bears, but a meanwhile correction can not be ruled out.

- 0.7000 is calling the bears while the 0.7050/'60s could be re-tested first.

Following a break of daily trendline support, AUD/USD has been in the hands of the bears in a sharp and decisive impulse on the daily chart which could be destined to test the December swing lows:

AUD/USD daily chart

Since the break of the trendline support, the price retested the old support area and was subsequently resisted which led to a downside continuation as follows:

The bears are well and truly in control and a daily close below the midpoint of the 0.70 area could indicate that the path of least resistance will continue to be to the downside for the rest of the week.

With that being said, a bullish correction on the lower time frames could be in order first:

The M-formation is a risk for bears considering the high probability that the price will revert back to, or towards the neckline of the pattern. The 38.2% Fibonacci could come under pressure in this regard before the next wave of selling occurs at a discount from current levels. This puts the 0.7050/'60s on the map for the remaining sessions ahead for the week in the first instance. On the other hand, should the bears commit prior to there, then 0.7000 could be seen first.

- The shared currency slides against the Japanese yen, down 0.26%.

- The EUR/JPY is neutral-downward biased, though a break under 128.24 would add further downward pressure on the pair.

During the New York session, the EUR/JPY slides 0.40%. At the time of writing, the EUR/JPY is trading at 128.43. A mixed market mood surrounds the financial markets, as depicted by US equity indices trading in the red, except for the Dow Jones, gaining 0.23%.

EUR/JPY Price Forecast: Technical outlook

In the overnight session, the EUR/JPY was subdued around the 50 and the 100-hour simple moving average (SMA), lying at 128.75 and 128.77, respectively. In the overlap of the European and North American session, faced resistance at the abovementioned, followed by a fall towards the daily low at 128.35.

The EUR/JPY daily chart depicts a neutral-downward bias. Although almost flat, the daily moving averages (DMAs) reside above the spot price.

On the downside, the EUR/JPY first support would be January 25 daily low at 128.24. A breach of the latter would expose December 2021, daily lows at 127.51. It is worth noting that a downslope trendline below the latter, part of a falling wedge, might be tested, but it is in the early stages of the pattern.

To the upside, the EUR/JPY first resistance level would be the 50-DMA at 129.27. A test of that level would expose the 100-DMA at 129.89, followed by the 200-DMA at 130.49.

What you need to know on Friday, January 28:

The market was all about the dollar and the Fed after the US central bank pretty much confirmed a rate hike coming in March, fueling speculation of at least four hikes this year. The greenback got additional support from upbeat growth figures, as Q4 GDP came in at 6.9%, much better than the 5.5% expected. Meanwhile, unemployment claims in the week ended January 14 met expectations by printing at 260K.

The American currency extended its post-Fed rally to reach a multi-month high vs the shared currency, as EUR/USD plunged to 1.1130. GBP/USD fell to 1.3354, a one-month low, with both pairs settling nearby.

Commodity-linked currencies also fell, with AUD/USD currently trading at around 0.7030 and USD/CAD at 1.2730. Gold prices collapsed, with the bright metal falling below $1,800 a troy ounce. Crude oil prices advanced to fresh multi-year highs but lost momentum ahead of the daily close and finished the day little changed, with WTI settling at $86.80 a barrel.

Wall Street started the day with a firm footing, posting substantial intraday gains. However, it changed course in the final hours of trading, with indexes falling into the red. US Treasury yields retreated from Wednesday’s peak, with the yield on the 10-year note down to 1.78%. The greenback held on to gains despite the changing direction in equities and yields.

Dogecoin price to break weekly high and tag $0.16

Like this article? Help us with some feedback by answering this survey:

- USD/CAD is at three-week highs around 1.2740, having cleared some key resistance levels on the way.

- The buck has been given a broad boost in wake of Wednesday’s more hawkish than expected remarks from Powell.

- Short-term bulls will be betting that technical buying carries the pair to resistance in the 1.2800 area.

USD/CAD rallied above the 1.2700 level in recent hours to hit a new three-week high around 1.2740, the pair having broken to the north of its 50-day moving average close to 1.2710. USD/CAD now trades about 0.6% higher on the session near 1.2740, having rallied around 90 pips from earlier session lows at 1.2650. At these earlier session lows, it seems that the short-term bulls took the opportunity to add to long positions with the pair retesting a downtrend it broke above in wake of Wednesday’s hawkish Fed meeting.

Indeed, the more hawkish than expected tone of Fed Chair Jerome Powell’s remarks in the post-meeting press conference are the main reason why the US dollar has strengthened across the board, including versus the loonie, on Thursday. Arguably, stronger than expected US GDP growth figures for Q4 2021 are helping sustain the broad USD rally on Thursday. Wednesday’s BoC meeting, where, like the Fed, the central bank also gave the nod to a rate hike in March, has been largely forgotten at this point. Although looking at the daily G10 performance table, with CAD holding up better than most of its G10 peers, it may be offering some relative support (versus the likes of AUD, NZD and NOK for example).

US equity markets have been choppy, as have global crude oil markets, with both asset classes swinging from the green back into the red over the course of the session and not offering the risk/commodity-sensitive loonie much support. With USD/CAD above the downtrend that had prevailed since mid-December and above key resistance in the 1.2700 area, it seems likely that technical buying can carry the pair higher towards resistance around 1.2800 in the short term. If Friday’s US Core PCE inflation data for December comes in higher than expected, this will likely help this move via a boost to the buck amid renewed Fed tightening bets.

- Gold slid to trendline support as US equities lost ground late in the session.

- US Q4 GDP rose 6.9% saar in December, versus 5.5% expected.

- US dollar remains in bullish territory despite the slump in US yields.

Gold, (XAU/USD), was lower in midday markets on Wall Street, losing some 1.4% at $1,795. The price of gold fell from a high of $1,822.18 and had reached a low of $1,791.86. Equity markets initially bounced in the aftermath of the FOMC driven sell-off yesterday. However, they started to slide again and the US dollar edged higher, hitting a one-and-a-half-year high, weighing on the yellow metal.

''The market ran short of optimists as it weighed up the pros and cons of a Fed belatedly determined to tame rampant inflation,'' analysts at ANZ Bank explained.

At the time of writing, the Dow Jones Industrial Average is down 0.25% and has marked a low of 34,034.08 so far, giving up earlier gains of as much as 1.4%. The Nasdaq Composite fell 0.5% to 14,002.58 after trading in the green at market open. The S&P 500 is down 0.37% and hit a low of 4,315.20 after trading up 1.2% earlier in the session. The yield on the US 10-yr note fell to 1.783% and is down 4%.

Powered by bets the US Federal Reserve could deliver faster and larger interest rate hikes in the months ahead, the greenback holds near the highest levels since July 2020 against other major currencies on Thursday, as measured by the DXY index. At the time of writing, it is trading 0.7% up near 97.20 as money markets move in to price in as many as five quarter-point increases by year-end.

The greenback was also supported on the fourth-quarter Gross Domestic Product that rose 6.9% saar vs expectations of a 5.5% rise. The GDP price index also beat expectations, rising 6.9% saar, while Q4 core inflation rose to 4.9% vs 4.6%. Personal consumption expenditures rose 3.3% vs 2.0% in Q3.

Is the Fed jawboning?

Analysts at TD Securities tackle the questions as to whether the Fed is jawboning, or whether they are on a quest to pummel inflation?

''The answer to this question is key to recognizing the regime that lies ahead. By not pushing back against the notion of hikes at consecutive meetings or even against a potential 50bp rate hike, Chair Powell's tone was undeniably hawkish at yesterday's FOMC,'' the analysts argued.

Key points

''The market has already priced-in a 25bp hike in March but the possibility of a 50bp hike is also seeping into market pricing. Given global macro's elevated sensitivity to liquidity, evidence that quantitative tightening might be more impactful for asset prices suggests that this axis could be particularly relevant.''

''We expect that the precious metals complex will struggle to attract capital in the face of a hawkish Fed.''

''We should not discount the possibility that the Fed's tone is also being used as a policy tool — jawboning might also help crush the momentum in inflation expectations that ultimately threatens the Fed's control on inflation itself.''

''In this scenario, the Fed could potentially use the pace of quantitative tightening as a tool to manage the strike on its put, without necessarily causing undue harm to its primary objective of keeping inflation expectations bounded.''

''We have initiated a short gold position and expect a low threshold for CTA trend follower liquidations to support our position.''

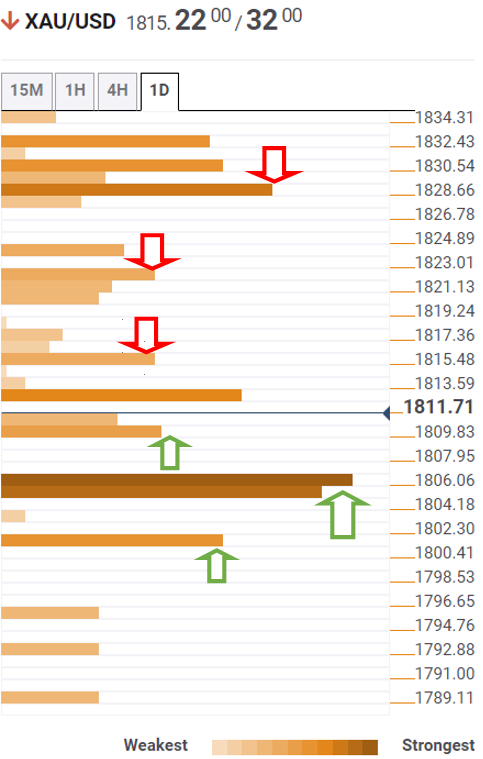

Gold technical analysis

The price, however, is meeting dynamic trendline support. While the momentum is with the bears, profit-taking into month-end could see the bulls move in for the kill. This could be expected to see the price revert back towards liquidity where the 38.2% ratio is currently aligned, towards $1,820. With that being said, a break below the trendline and then $1,780 horizontal support would open the doors to lower levels for the foreseeable future.

- All three major US bourses have reversed earlier gains and are now trading in negative territory.

- The S&P 500 was at one point above 4400 but is now in the low 4300s.

- Sentiment remains mixed and conditions choppy as investors digest this week’s Fed meeting and the latest strong US GDP numbers.

Having been as much as 1.8% higher in earlier trade and above the 4400 level, the S&P 500 has reversed lower in choppy trade and is back to trading in the red in the low 4300s. At current levels around 4320, the index trades lower by about 0.6% on the day. The Nasdaq 100 and Dow indices have seen similarly choppy trading conditions, with both also reversing sizeable gains earlier in the session to slip into the red. The Nasdaq 100 index is now down about 1.0% on the day and probing the 14K level again for a third successive session, while the Dow has reversed from earlier highs in the 34.75K area to just above 34K where it trades lower by about 0.3% on the session. Sentiment remains mixed and conditions choppy as investors digest this week’s Fed meeting and the latest strong US GDP numbers.

Looking at the S&P 500 GICS sector performance, there is a clear defensive bias, with Utilities (+0.4%) and Consumer Staples (+0.3%) leading. Most other sectors are either flat or in the red, aside from the big tech-dominated Communication Services sector, which is about 0.25% higher. The comparatively decent performance of this sector versus the likes of the Information Technology (-1.0%) and Consumer Discretionary (-1.8%) sectors highlights some interesting rotation going on under the surface. The first thing to note is that Tesla has seen a massive 9.0% decline post earnings (the carmaker warned of lasting supply chain issues) and this is weighing on the Consumer Discretionary sector. Meanwhile, Netflix has rocketed nearly 7.0% higher after billionaire investors Bill Ackman hailed the share’s recent post-earnings drop as a great buy-the-dip opportunity.

Elsewhere, the semiconductor subindex within the Information Technology sector is getting battered in wake of poor Intel (-7.5%) earnings, with the co. also warning about supply chain issues. The PHLX Semiconductor Index is down nearly 5.0% on the day. Elsewhere, despite the downbeat tone in most non-defensive equity sectors, large-cap tech stocks have been doing well (Microsoft +1.0%, Amazon +1.0%, Apple -0.4%, Google flat, Meta (Facebook) +0.4%). One equity analyst said, “we believe the biggest opportunity in markets right now is in dividend growth stocks (like the aforementioned large-cap tech names) that have strong balance sheets and cash flows, and can thrive in an environment no matter what the Fed does”.

- The USD dollar marches firmly in the North American session, with the DXY surging 1.34%, above 97.00.

- The greenback gains lie on the back that the US central bank might hike rates in the March meeting.

- USD/JPY is upward biased, though a break above the 115.30-45 region would open the door for a test of YTD highs.

The US dollar extends its rally against the Japanese yen, trading at 115.23, a gain of 0.55% at the time of writing. The investor’s mood has been swinging throughout the day. In the last hour, US equity indices fluctuated between wins and losses, but the USD has been able to hold its ground vs. the safe-haven Japanese yen.

The dollar surge is attributed to Fed hawkishness. On Wednesday, the US central bank kept the Federal Funds Rate (FFR) unchanged around the 0-0.25% range while mentioned that they would hike rates “soon.” Following the release of the monetary policy statement, Fed’s Chairman Jerome Powell said that “the committee is of a mind to raise the federal funds rate at the March meeting assuming that the conditions are appropriate for doing so.”

In the meantime, the US dollar index, which measures the dollar value against a basket of its rivals, advances 1.34%, up to 97.231. Contrarily to the positive performance of the greenback, the US 10-year Treasury yield slides six basis points, from 1.851% to 1,792%

Before Wall Street opened, the US economic docket featured Initial Jobless Claims for the week ending on January 22, fell to 260K from 286K, better than expected after two consecutive weeks of increases. Meanwhile, the Gross Domestic Product (GDP) for Q4 rose by 6.9%, crushing 5.5% expectations, helped by the fiscal policy and Fed accommodative monetary policy.

Later in the day, USD/JPY traders focus would turn to the release of the Consumer Price Index (CPI) in Japan,

USD/JPY Price Forecast: Technical analysis

The USD/JPY is upward biased, as depicted by the daily moving averages (DMAs) residing well below the spot price. At press time, the pair is approaching an upslope trendline drawn from October 2021 swing lows to December ones, broken to the downside on January 13, that will be resistance around 115.30-45 area.

A breach of the latte would expose the YTD high at 116.35, which, once broken, will be followed by January 2017 cycle highs at 118.61, a space of approximately 235-pips.

Contrarily, the USD/JPY first support would be the January 18 daily high, previous resistance-turned-support at 115.00, followed by 114.47, and the 50-DMA at 114.31.

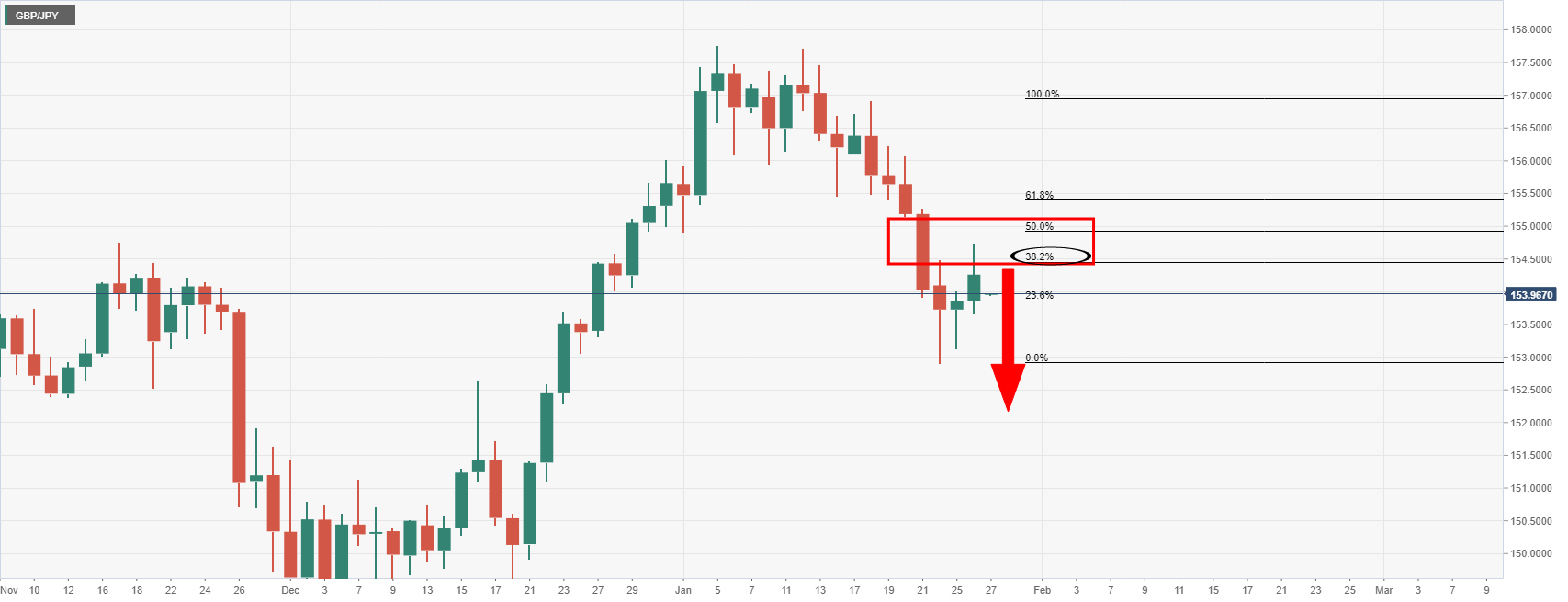

- GBP/USD offers something for both the bulls and bears until the 4-hour support structure breaks.

- The bulls will want to see the 61.8% Fibo give on the 4-hour time frame.

As per the prior day's analysis, GBP/JPY Price Analysis: Bears sinking their teeth into what could be a fresh daily impulse, the price has moved accordingly within the corrective stage of the bearish trend.

The Fibonacci levels are in focus and for now, the space between the 38.2% ratio and the 50% mean reversion mark is offering resistance:

GBP/JPY daily chart

The wicks of the 28 December and 3 January daily candlesticks align and offer values of liquidity below the 21-day EMA, reinforcing the resistance potential.

GBP/JPY H4 chart

The 4-hour chart shows that the price needs to get below 153.83 where the dynamic support of the counter-trendline and horizontal support meet. On the flip side, if the bulls commit and should the 50% mean reversion give way, then the 61.8% will be the last defence to a potential bullish daily and weekly continuaiton:

GBP/JPY weekly chart

The weekly chart is bullish and the price s testing the critical Fibonaccis. If the price holds the 21-week EMA, and the 4-hour chart's 61.8% gives, then this will be bullish for the outlook in weeks ahead.

- On Thursday, the Swiss franc collapsed almost 1%, as Fed policymakers eye the first rate hike in the March meeting.

- The US Dollar Index marches firmly above 97.00 for the first time since 2020.

- USD/CHF is upward biased, though a retracement before resuming the uptrend is on the cards.

During the North American session, the USD/CHF advances close to 1%, trading above 0.9300 for the first time since November 2021 highs. At the time of writing, the USD/CHF exchanges hands at 0.9312.

A risk-on market mood dented the prospects of the Swiss franc, which usually rallies on risk aversion. In the meantime, the US Dollar marches firmly throughout the session, with the US Dollar Index (DXY) advancing 1.23%, sitting at 97.131.

USD/CHF Price Forecast: Technical outlook

The USD/CHF is upward biased. On Wednesday, the pair broke resistance levels on its way towards 0.9300, like the 50 and 100-day moving averages (DMAs), lying at 0.9204 and 0.9212. Furthermore, it broke a downslope resistance trendline drawn from April – September 2021 cycle highs that pass around the 0.9300-05 area. However, due to the nature of the movement, a pullback towards the figure, or December 15, 2021, a daily high at 0.9294, is on the cards.

That said, the USD/CHF first support is 0.9300. A break of that level immediately suggests a test of December 15, 2021, high at 0.9294, followed by a January 26 daily high at 0.9246.

Contrarily, to the upside, the first resistance is November 2021 cycle high at 0.9373. A breach of the latter would expose the 0.9400 figure, followed by April 2021, swing highs at 0.9472.

- NZD/USD recently dipped below 0.6600 for the first time since early November 2020 as the pair maintains bearish momentum.

- It is now down more than 4.0% from its earlier monthly highs near 0.6900.

- Hawkish Fed vibes and strong US data have been driving the latest downside, with hot NZ CPI figures ignored.

NZD/USD has dipped below the 0.6600 level in recent trade for the first time since early November 2020, as the pair maintains bearish momentum courtesy of renewed USD strength following stronger than expected Q4 US GDP numbers released on Thursday. The latest drop comes after the pair reversed sharply lower from Wednesday highs above 0.6700 when Fed Chair Jerome Powell caught investors off guard with his more hawkish than expected tone in the post-Fed meeting press conference. Since then, the US dollar has strengthened across the board, with the bullish momentum carrying through to a second session. NZD/USD currently trades 0.8% lower on the day after Wednesday’s 0.5% loss, with on-the-week losses now about 1.7%.

Recent losses come following a torrid last few weeks for the kiwi. A reversal lower in global equities (the S&P 500 is roughly 9.0% lower versus monthly highs), a ramping up of Fed tightening bets and technical selling have seen the pair reverse more than 4.0% lower from monthly highs near 0.6900. Indeed, since posting annual highs on January 13, the pair has fallen in nine out of the last ten sessions. The losses really accelerated when NZD/USD broke to the south of its mid-December to mid-January upwards trend channel in the 0.6750 area on January 21. Most short-term bears will be targetting a test of the August/September 2020 lows in the 0.6500 area.

RBNZ hawkishness (the central bank has already hiked rates twice since October 2021, bringing rates to 0.75%) has been unable to shelter the kiwi from losses. That might explain why hotter than expected New Zealand Consumer Price Inflation figures for Q4 2021 (released early during Thursday’s Asia Pacific session) has been unable to offer NZD/USD a lift. For reference, CPI came in at 1.4% QoQ and 5.9% YoY, above the 1.3% and 5.7% expected.

Looking ahead to the rest of the week, though equity market sentiment has taken a turn for the better amid dip-buying, this has not yet come to the aid of risk-sensitive G10 currencies like the kiwi. Equities are likely to remain choppy for the rest of the week as investors digest Wednesday’s Fed meeting, which could keep NZD vulnerable. Otherwise, further bearish NZD/USD could come from Friday’s US Core PCE Inflation data for December, especially if it comes in hot and further pumps Fed tightening bets.

-637788988819980024.png)

Analysts from Rabobank expect no surprises from the European Central Bank at its February meeting. They expect 2022 to bring a reversal of pandemic policies, but not a broader tightening of policy.

Key Quotes:

“The ECB has recovered some policy flexibility in December, but this comes at the cost of some uncertainty and continued market speculation that the ECB will hike rates sooner rather than later. We expect the ECB to stick to its script of transitory inflation, which means that 2022 should only see a reversal of pandemic-related tools, and not a broader withdrawal of monetary accommodation aimed at achieving the inflation goal.”

“While the outlook remains very fluid, we therefore believe that it takes a lot of stars to align before the ECB’s baseline is realised, let alone exceeded, in terms of wage-driven inflationary pressures. And downside risks remain abundant. Most notably, we believe that cost-push inflation could still have a detrimental impact on future consumption and hence medium-term inflation. And the geopolitical environment may further exacerbate the energy price shock, if tensions with Russia escalate.”

“Inflation is still more likely to nip demand in the bud before wage growth gets enough room to accelerate sharply. We therefore maintain our call that 2022 will only see the reversal of pandemic-specific stimulus measures and we do not expect the ECB to turn into a more general inflation hawk.”

Data released on Thursday, showed the US economy grew at a 6.9% annualized rate in the fourth quarter, surpassing gexpectetions. According to analysts at Wells Fargo, the details behind the better-than-expected headline point to a slowing in spending and a back-up in inventories. Without the boost from inventories, GDP would have been just 2.0% in Q4, they explained.

Key Quotes:

“It is tempting to celebrate a better-than-expected outturn with 6.9% GDP growth in the fourth quarter, but due to a confluence of factors we will not likely see that sort of growth again for some time. While to some extent the year-end surge was a function of steady consumer and business spending, both petered out at the end of the year as Omicron cases climbed and hospitalizations followed.”

“In the absence of that stimulus, consumer spending is poised to slow. We do not have a quarterly growth rate north of 3.0% for consumer spending throughout the rest of this year or next year. To the extent that there is good news in that, this will allow supply chains a chance to catch up”.

“The inventory build we saw in Q4 was an unhealthy one, and an argument could be made that it was unintentional. But a slower, sustained build in inventories over the next couple of years will not only underpin growth it will allow for a smoother, if somewhat slower expansion in the business sector.”

“The defining challenge for the economy in the next year or two will be how well we can sustain growth not just in the absence of fiscal policy, but in the face of tightening monetary policy.”

- US dollar holds onto daily gains across the board.

- EUR/USD heads for the lowest daily close since June 2020.

- US Q4 GDP comes above expectations, Jobless Claims slide and Durable Goods Orders decline more than expected.

After a brief recovery, the EUR/USD dropped to 1.1130, hitting a fresh multi-month low. It then rebounded again, finding resistance around 1.1160. The pair remains under pressure amid a broad-based strong US Dollar.

The greenback strengthened sharply after the FOMC meeting. “Fed Chair Jerome Powell was quite hawkish during the press conference, which drove US yields higher, EUR/USD lower and US equities lower. We continue to see EUR/USD at 1.08 and expect dollar strength to broaden against other currencies during H1”, considered analysts at Danske Bank.

Economic data in the US came in mixed on Thursday. The first reading of Q4 US GDP showed activity expanded at a 6.9% annualized rate, above the 5.5% of market consensus. Initial Jobless Claims dropped to 260K in line with expectations. Durable Goods Orders dropped 0.9% in December (vs the 0.6% slide expected). Pending Home Sales fell 3.8% in December.

The economic figures have no impact on price actions as market participants continue to digest the FOMC meeting. The dollar remains firm even as US yields decline and stocks rebound on Thursday.

The EUR/USD is about to post the lowest daily close since June 2020. Despite falling 150 pips during the last 24 hours and showing oversold readings, no signs of a correction or stabilization are seen at the moment. Under 1.1130, the next support might be seen at 1.1105.

Technical levels

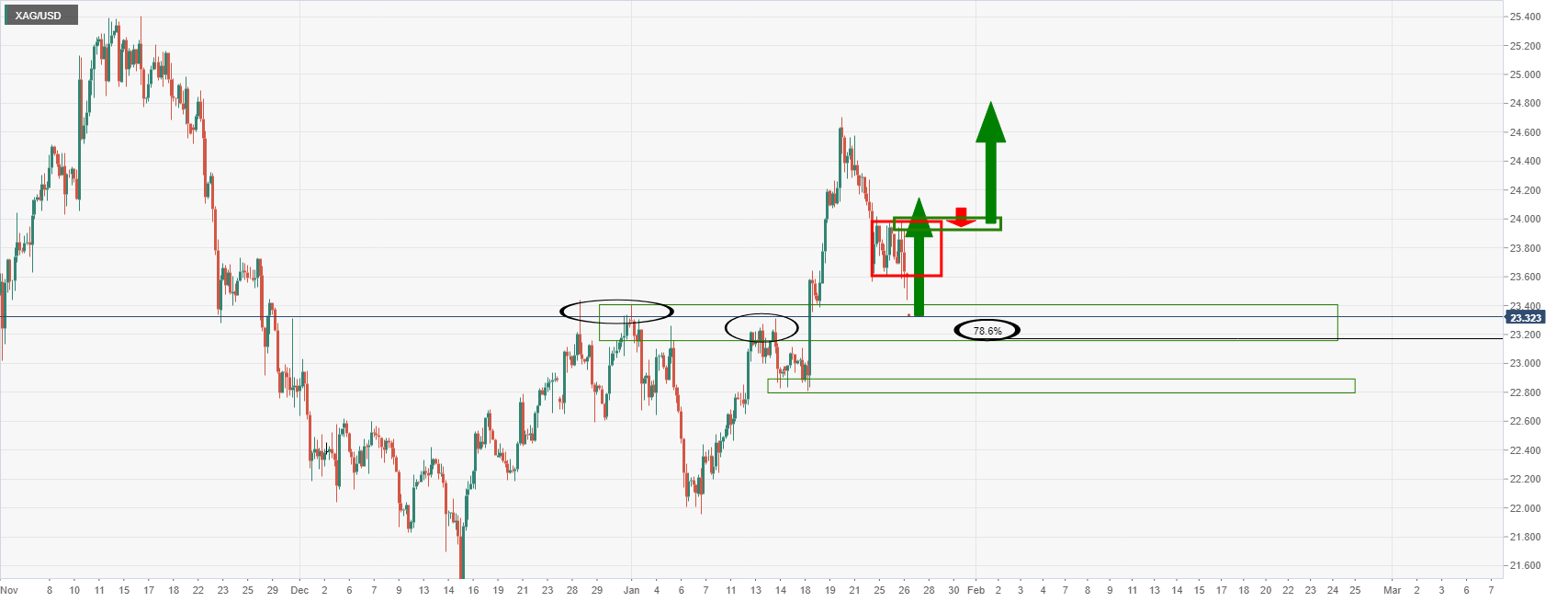

- Silver plummets on the back of Fed’s Chairman Powell, saying that the “committee” could raise rates in the March meeting.

- On Wednesday, the US central bank kept rates unchanged and mentioned that QT would begin after the bank started its hiking cycle.

- XAG/USD is heavily downward pressured, approaching an upslope trendline that might give way towards $21.94.

Silver (XAG/USD) slides sharply on Thursday, after the Federal Reserve’s first monetary policy meeting, left open the door for a rate hike in March, as Fed’s Chairman Jerome Powell mentioned. At the time of writing, XAG/USD is trading at $22.58, down more than 3.97%.

The market sentiment remains positive, as portrayed by European and US equities climbing. In the meantime, the US Dollar Index, a measurement of the greenback value against six peers, advances 1.33%, sitting at 97.224, its highest level since July 2020.

On Wednesday, the US central bank held its first monetary policy meeting of 2022. Fed policymakers agreed to keep rates unchanged at the 0 to 0.25% range. Policymakers commented that inflation reflects “supply and demand imbalances related to the pandemic and the reopening of the US economy.” Furthermore, the balance sheet reduction will begin as soon as the central bank hikes rates.

Chairman Powell hit the stage following the Fed’s monetary policy statement release. He said that “…the committee is of a mind to raise the federal funds rate at the March meeting assuming that the conditions are appropriate for doing so.”

The US economic docket featured Initial Jobless Claims for the week ending on January 22, fell to 260K from 286K in the previous week, showing the labor market’s resilience after two consecutive weeks of increases. Meanwhile, the Gross Domestic Product (GDP) for Q4 rose by 6.9%, crushing 5.5% expectations.

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) is under “heavy” downward pressure, breaking previous support levels, like the 100 and the 50-day moving averages (DMAs), lying at $23.25 and $23.00, respectively. That exposed an upslope trendline, drawn from December 2021 lows up to January ones, which lies around $22.35-50 area. In the event of a test of the latter, that would send XAG/USD tumbling towards January 7 cycle low at $21.94, followed by December 2021 lows at $21.42.

Economists at Rabobank have significant doubts over market expectations that the Bank of England (BoE) is likely to hike rates at an aggressive pace this year. Therefore, they expect the GBP/USD to dive below the 1.30 level by mid-year.

The BoE will struggle to tighten policy further this year

“On the assumption that the government does proceed with the announced hike in National Insurance tax in April, we see a risk that the market will unwind some of its assumption on BoE rates and this could leave the pound vulnerable in the spring and early summer.”

“Given our view that the USD will be buoyed as Fed tightened commences, we see risk that cable could dip below the 1.30 level in the middle of the year.”

- US dollar remains strong across the board following Fed’s meeting.

- Mexican peso under pressure amid risk aversion.

- USD/MXN bullish, next resistance at 20.85.

The USD/MXN soared to 20.80, reaching the highest level in five weeks earlier on Thursday, boosted by a stronger US dollar across the board. The greenback is rising sharply on the back monetary policy expectations from the US.

On Wednesday, the Fed opened the doors to rate hike in March and more during the next year. The more “hawkish” than expected tone from Chair Powell triggered sharp moves and hit emerging market currencies. So far, the Mexican peso is not the most affected. The positive tone in Wall Street with the Dow Jones up by 0.98% is helping the MXN.

The fundamental perspective supports the dollar with US yields moving to the upside, and a caution tone prevailing in global equity markets. The Bank of Mexico is expected to hike rates again offsetting somewhat Fed’s boost to the USD/MXN.

From a technical perspective, the bias in USD/MXN points to the upside. A break under 20.60 (uptrend line) should alleviate the bullish tone. The next support stands at 20.52, followed by 20.40. The 20.85/90 barrier is a strong area that if broken, would clear the way for a return above 21.00.

Technical levels

- WTI hit fresh multi-year highs above $88.00 per barrel recently, breaking above last week’s highs.

- Profit-taking has since seen WTI drop back into the mid-$86.00s, but oil holds onto decent on the week gains.

- Positive risk appetite and ongoing geopolitical and OPEC+ supply concerns are an ongoing source of support that might limit downside.

Crude oil prices have been on the back foot in recent trade amid profit-taking after they plowed to fresh multi-year highs. Front-month WTI futures surpassed the $88.00 level for the first time since October 2014 in the last few hours, finally managing to surpass last week’s highs just under $88.00 after failing on Wednesday in wake of the hawkish Fed meeting. However, profit-taking in the last few minutes has seen WTI give up its earlier session gains and slip back into the mid-$86.00s, where it trades down by slightly more than 50 cents on the day. At current levels near-$86.50, oil is trading well within recent intra-day ranges and still holds onto gains of about $1.75 on the week and is more than $4.50 up from earlier weekly lows.

Risk appetite has broadly taken a turn for the better on Thursday, with the S&P 500 up about 1.5% on the session, which (prior to the profit-taking) had been offering some support to crude oil prices. Meanwhile, according to market commentators and analysts, ongoing OPEC+ supply concerns and the tense geopolitical backdrop continue to offer support to the oil complex. After the US and NATO issued a formal response to Russian security requests (essentially rejecting demands to rule out Ukraine ever joining NATO and reduce their Eastern European military presence), global markets await Russia’s next move.

According to Reuters, tensions between NATO/Russia/Ukraine have been “fanning fears of disruption of energy supplies to Europe”. “A more pronounced price slide is being prevented by the Ukraine crisis, as there are still concerns that Russian oil and gas deliveries could be hampered in the event of a military escalation,” analysts at Commerzbank said. Meanwhile, oil market analysts remain concerned about the struggles faced by smaller OPEC+ producers in lifting oil output. Sources have indicated the cartel plans to hike output again in March by 400K barrels per day. OPEC+ supply and geopolitical concerns shielded oil prices this week from bearish US inventory data, which showed a surprise 2.4M barrel inventory build last week.

- Pending Home Sales saw a larger than expected 3.8% MoM drop in December.

- There was no discernable immediate market reaction to the data.

Pending Home Sales in the US fell by 3.8% on a monthly basis in December following November's 2.3% decline (revised lower from a 2.2% decline), data published by the US National Association of Realtors showed on Thursday. That was well below expectations for a decline of 0.2% MoM. The Pending Home Sales Index fell to 117.7 in December from 122.3 (downwardly revised from 122.4) in November.

Market Reaction

There was no discernable immediate market reaction to the data.

- DXY comes under some pressure near 97.30.

- US flash Q4 GDP figures came in above estimates.

- Weekly claims rose in line with expectations by 260K.

After climbing as high as the 97.30 region, the greenback now gives away some gains and recedes to the 97.00 neighbourhood when gauged by the US Dollar Index (DXY).

US Dollar Index in fresh cycle tops

The demand for the dollar accelerated on Thursday and propelled the index to levels last visited back in July 2020 further north of the 97.00 barrier.

The hawkish bias from Chairman Powell at his press conference post the FOMC meeting on Wednesday prompted some repricing of the Fed’s rate path among investors and sponsored fresh inflows into the buck on Thursday.

Also collaborating with the intense upside bias in the dollar, preliminary figures of the US GDP now see the economy expanding more than expected 6.9% in Q4. On the not-so-bright side, headline Durable Goods Orders contracted 0.9% from a month earlier in December.

US Dollar Index relevant levels

Now, the index is gaining 0.57% at 97.02 and a break above 97.26 (2022 high Jan.27) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.00 (55-day SMA) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).

- European equities rise, while US futures point to a higher open, reflecting an upbeat market.

- The Loonie holds its ground versus the greenback, which marches firmly with its DXY above 97.00, the first time since July 2020.

- USD/CAD upward biased, as long as the spot remains above the 100 and the 200-DMA.

As the North American session begins, the USD/CAD barely advances after two hawkish holds by the Bank of Canada and the Federal Reserve. At the time of writing, the USD/CAD is trading at 1.2661, up 0.01%. Risk sentiment is upbeat, portrayed by European equity indices trading in the green, while US futures point to a higher open.

The BoC and the Fed delivered a “hawkish” hold

On Wednesday, the Bank of Canada (BoC) and the Federal Reserve (Fed) held their first monetary policy meeting of 2022.

The BoC was the first to hit the stage, which held the overnight rate at 0.25%, as widely expected. However, the Canadian central bank noted that economic slack “has been absorbed,” signaling that a March hike could be possible.

Analysts at TD securities mentioned that “while today’s decision came as a surprise, it does not change our conviction that rates are headed to 1.00% by mid-2022. Furthermore, upcoming meetings are now live for balance sheet runoff with the updated guidance.”

Meanwhile, the Fed kept rates unchanged at the 0 to 0.25% range later in the day. However, it emphasized the need to normalize the economy and noted that the central bank might raise interest rates “soon.” Although the monetary policy statement fell short of hawkishness, Fed’s Chair Powell press conference underpinned the greenback and sent stocks in a free fall.

Powell said that “…the committee is of a mind to raise the federal funds rate at the March meeting assuming that the conditions are appropriate for doing so.”

In the meantime, the US Dollar Index, a gauge of the greenback’s value versus a basket of six rivals, rallies 1.26%, sitting at 97.156, a level last reached on July 7, 2020, underpinned by rising US T-bond yields, with the 10-year note sitting at 1.814%.

Despite broad US dollar strength across the board, the CAD has been able to cap any upwards move, due to higher crude oil prices, with Western Texas Intermediate (WTI) rising 1%, trading at $88.22.

The US economic docket featured Initial Jobless Claims for the week ending on January 22, fell to 260K from 286K in the previous week, showing the labor market’s resilience after two consecutive weeks of increases. Meanwhile, the Gross Domestic Product (GDP) for Q4 rose by 6.9%, crushing 5.5% expectations.

USD/CAD Price Forecast: Technical outlook

The USD/CAD daily chart depicts the upward bias of the pair. The longer time-frame daily moving averages (DMAs) reside below the spot price, while the 50-DMA is at 1.2708, acting as resistance. The Relative Strength Index (RSI), an oscillator that marks overbought/sold conditions, is at 51, aiming higher, supporting the bullish bias.

To the upside, the first resistance would be the aforementioned 50-DMA at 1.2708. A breach of the latter would expose the January 6 cycle high at 1.2813.

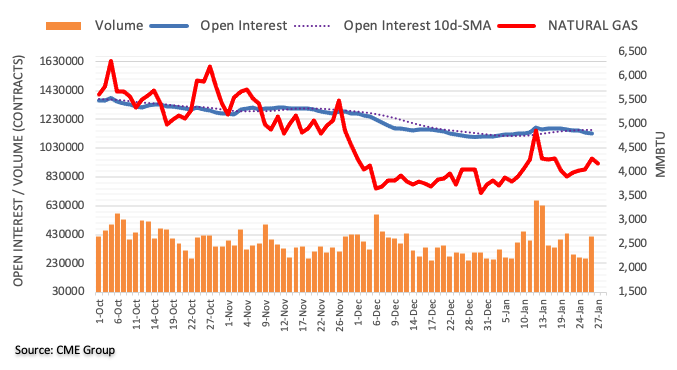

Tensions between Russia, on the one hand, and Ukraine and the US and Europe on the other hand, are building. Strategists at ABN Amro have identified four different scenarios, with the most negative assuming a halt of Russian exports of energy products such as natural gas, liquified natural gas (LNG) and/or oil.

The status quo (75% likelihood)

“We expect the situation in the energy markets to remain unchanged. Nevertheless, in this scenario, natural gas prices stay elevated for a longer period of time as the markets continue to be tight, at least until the spring of 2023. In the event of a harsh winter, either in Europe or in Asia or both, pressure would increase on the LNG markets. However, these extra price gains will probably disappear as soon as the cold period is over.”

A de-escalation leading to normalisation of markets (15% likelihood)

“Energy markets would start to normalise. There will be enough gas supply available for consumers in Europe in the course of 2022. Natural gas prices would normalize towards the pre-2021 levels of the low EUR 20s/MWh or even lower as soon as the ongoing tight market conditions for this winter are over.”

Tensions worsen, Russia halts gas exports to Europe (5-10% likelihood)

“With no short-term alternatives to fully replace Russian gas exports towards Europe, energy supply would need to be rationed, in particular for industry. In addition, prices of natural gas would jump significantly higher, and reach new record highs for a large part of the forward curve. The TTF monthly contracts could trade above EUR 200/MWh for an extended period, with peak prices significantly higher. As an indirect effect, prices of electricity would jump higher throughout the whole of Europe.”

An even bigger escalation would also affect oil markets (<5% likelihood)

“Russia would decide to halt oil exports towards Europe. Such a shift in the oil markets would lead to higher oil prices. Oil prices would be trading above $100/bbl and in case of serious supply worries even head for a new test of the all-time high ($149/bbl). Due to tighter market conditions, this situation could hold for the rest of the year.”

- AUD/USD is trading just above its lowest levels since early December near 0.7070 as the dollar remains firm.

- The buck has been boosted across the board by Wednesday’s hawkish Fed and Thursday’s strong US Q4 GDP numbers.

- With major technical support having been cleared, bears will be eyeing a test of 2021 lows near 0.7000.

After hitting its lowest levels since early December just above the 0.7060 mark in recent trade, AUD/USD has continued to trade heavy and at current levels close to 0.7070, trades lower by about 0.6% on the day. The Aussie’s losses are broadly in line with the losses being experienced by most of its non-USD G10 peers, with the major theme driving FX markets on Thursday being post-hawkish Fed dollar strength. Adding to the US dollar’s tailwinds in recent trade was a substantially firmer than expected first estimate of Q4 2021 GDP growth of 6.9% annualised during the quarter, well above the median forecast for 5.5%.

A new poll showing a hawkish shift in investor expectations for RBA policy was unable to shift AUD or distract from post-hawkish Fed US dollar flows. According to the poll, the median economist expectation for when the RBA will implement its first post-pandemic rate hike will be in November of this year, significantly earlier than the central bank’s current guidance for late-2023/2024. Meanwhile, 17 of 22 economists also predicted that the RBA would axe its bond-buying programme in its entirety on its February first meeting next week.

Looking ahead to the rest of the week, with the Fed meeting, US GDP figures, and Australia Consumer Price Inflation data in the rear-view mirror, things should be calmer for the rest of the week from an economic standpoint. AUD/USD should still keep an eye on Friday’s US December Core PCE inflation data, but the main theme for the rest of the week will be USD flows as investors digest the latest Fed meeting and risk appetite. The latter has shown signs of improvement on Thursday, not least helped by more conciliatory rhetoric from the Russians on Ukraine. Nonetheless, with AUD/USD having cleared the last major area of support ahead of sub-0.7000 2021 lows in the 0.7080s, the bears may have the upper hand going into the weekend.

The GBP/USD picture is again looking firmly bearish after the early-week break below the mid 1.34 area. Economists at Scotiabank spot support for the cable at the mid-1.33s before the figure mark.

Resistance is located at the 1.34 area

“A continued decline should find support at the mid-1.33s before the figure mark.”

“GBP/USD is rushing from overbought as recently as two weeks ago toward oversold in the next few days if the current trend continues.”

“Resistance is the 1.34 area followed by 1.3435/50.”

Gold is already down more than 1% on a daily basis and trades below $1,800 for the first time since January 10.

Developing story...

EUR/USD edges under 1.12 after the Federal Reserve hawkish message. Economists at Scotiabank note that the world’s most popular currency pair could slide below 1.11 towards the 1.10 level.

Escalating tensions with Russia will remain a headwind

“Wednesday’s decision by the Fed that probably tees up more rate hikes than markets are expecting reinforces our expectation that the EUR will aim for a test of 1.10 soon.”

“Escalating tensions with Russia will remain a headwind as will the near-term uncertainty in Italian politics.”

“The EUR now faces very limited support markers until 1.11 (psychological) and then firmer support at 1.10.”

- EUR/USD accelerates losses to the 1.1130 area.

- US flash GDP surprised to the upside in the fourth quarter.

- Claims rose by 260K, Durable Goods Orders down 0.9% MoM.

The selling pressure around the single currency picks up extra pace and drags EUR/USD to fresh lows in the proximity of 1.1130 on Thursday.

EUR/USD weaker on upbeat US data

EUR/USD remains well entrenched into the negative territory on Thursday, as the leg lower intensified pari passu with investors’ readjustment to the recent hawkish message from the FOMC and Chair Powell.

In the meantime, the dollar remains well bid and trading in fresh cycle highs when measured by the US Dollar Index (DXY) despite the mixed performance in US yields so far.

Further legs to the buck came after flash GDP figures showed the US economy is seen expanding at an annualized 6.9% in the October-December period. Additional releases saw headline Durable Goods Orders contracting at a monthly 0.9% in December and Initial Claims increasing by 260K in the week to January 22.

EUR/USD levels to watch

So far, spot is losing 0.79% at 1.1152 and faces the next up barrier at 1.1313 (55-day SMA) seconded by 1.1369 (high Jan.20) and finally 1.1456 (100-day SMA). On the other hand, a break below 1.1134 (2022 low Jan.27) would target 1.1100 (round level) en route to 1.1000 (psychological level).

The Canadian dollar lags despite hawkish Bank of Canada (BoC) prospects. But economists at Scotiabank do not expect the loonie to suffer significant losses.

Scope for decent CAD gains over the rest of the year

“We still rather see limited downside for the CAD versus the USD and scope for decent gains over the rest of the year on the basis of monetary policy prospects.”

“The USD’s close above the 1.2640/45 area yesterday nullifies the near-term, technically bearish outlook for funds now, we think, but weak trend momentum argues against an extended move up in the USD – for now, at least.”

“We spot support now at 1.2645/50 and resistance at 1.2725.”

- GBP/USD witnessed aggressive selling on Thursday and dropped to over a one-month low.

- The post-FOMC strong USD rally remained uninterrupted after mixed US macro releases.

- The bias seems tilted in favour of bearish traders and supports prospects for further losses.

The GBP/USD pair maintained its heavily offered tone around the 1.3365 area, or the lowest level since December 23 and had a rather muted reaction to mixed US macro data.

According to the first estimate released by the US Bureau of Economic Analysis this Thursday, growth in the world's largest economy accelerated to a 6.9% annualized pace during Q4 2021. This was well above consensus estimates pointing to a reading of 5.5% and overshadowed weaker than expected US Durable Goods Orders.

This comes after the Fed on Wednesday reaffirmed market expectations for an eventual lift-off in March and did little to dent the strong bullish sentiment surrounding the US dollar. Apart from this, the UK political turmoil undermined the British pound and continued exerting heavy downward pressure on the GBP/USD pair.

Meanwhile, Thursday's fall below the 1.3400 mark validated this week's bearish break through the 100-day SMA and might have already set the stage for a further depreciating move. The negative outlook is reinforced by bearish technical indicators on the daily chart, which are stall far from being in the oversold territory.

Nevertheless, the fundamental backdrop and the technical set-up supports prospects for an extension of the recent sharp pullback from the vicinity of mid-1.3700s. Hence, a subsequent slide towards testing the next relevant support, around the 1.3320-1.3315 region, remains a distinct possibility amid sustained USD buying.

Technical levels to watch

- There were 260K initial claims in the week ending on January 25, in line with expected.

- The dollar rallied, though that was more to do with strong GDP figures.

There were 260,000 initial claims for unemployment benefits in the US during the week ending January 22, data published by the US Department of Labor (DoL) revealed on Thursday. This reading followed last week's print of 290,000 (revised up from 260,000) and was in line with consensus market expectations for 260,000. Continued Claims rose slightly more than expected to 1.675M in the week ending on January 15 from 1.624M the week prior (revised lower from 1.635M) and was slightly above the 1.65M expected. The insured unemployment rate remained unchanged at 1.2%.

Market Reaction

In wake of the latest US data dump that saw GDP growth for Q4 come in much stronger than anticipated, the US dollar has been kicking higher, with the DXY recently crossing into fresh daily/multi-month highs in the 97.20s.

- Core Durable Goods grew at 0.4% MoM in December, in line with expected.

- The dollar rallied, though that was more to do with strong GDP figures released at the same time.

According to the latest release by the US Census Bureau, US Durable Goods Orders fell by 0.9% MoM in December compared to market expectations for a 0.5% decline in sales. The MoM pace of growth in Core Durable Goods Orders was in line with expectations at 0.4%, marking a deceleration from last month's 1.1% reading (revised up from 0.8%).

Market Reaction

In wake of the latest US data dump that saw GDP growth for Q4 come in much stronger than anticipated, the US dollar has been kicking higher, with the DXY recently crossing into fresh daily/multi-month highs in the 97.20s.

- US Real GDP grew at 6.9% annualised in Q4, well above the expected 5.5% pace.

- The US dollar is pushing to fresh multi-month highs as a result, with the data underpinning hawkish Fed bets.

US Real GDP grew at an annualised pace of 6.9% in Q4 2021, well above the median economist forecast for a pace of growth of 5.5%, according to the first estimate released by the US Bureau of Economic Analysis on Thursday. That marked a sharp acceleration from Q3's 2.3% QoQ pace of growth. The GDP Price Index, which measures the annualised change in the price of all goods and services included in the GDP calculations, rose at a pace of 7.0% in Q4, above market expectations for a 6.0% reading. For the full year 2021, real US GDP growth was 5.7%, the strongest since 1984.

Market Reaction

In wake of the latest US data dump that saw GDP growth for Q4 come in much stronger than anticipated, the US dollar has been kicking higher, with the DXY recently crossing into fresh daily/multi-month highs in the 97.20s. The latest GDP figures will likely underpin hawkish Fed bets.

- USD/JPY gained strong follow-through traction on Thursday and shot to over a two-week high.

- The post-FOMC strong USD rally remained uninterrupted and remained supportive of the move.

- Technical buying above the key 115.00 mark further contributed to the ongoing bullish run-up.

The USD/JPY pair continued scaling higher heading into the North American session and shot to over a two-week high, around the 115.25 region in the last hour.

The post-FOMC strong US dollar buying interest remained unabated on Thursday, which, in turn, pushed the USD/JPY pair higher for the second successive day on Thursday. In fact, the key USD Index jumped to the highest level since July 2020 and remained well supported by the prospects for a faster policy tightening by the Fed.

It is worth recalling that the Fed on Wednesday indicated that it would likely begin hiking interest rates in March. In the post-meeting press conference, Fed Chair Jerome Powell kept the door open for a 50 basis-points rate hike move in March. This was seen as a key factor that continued acting as a tailwind for the greenback.

Apart from this, the widening of the US-Japanese government bond yield differential, along with a goodish rebound in the equity markets drove flows away from the safe-haven Japanese yen. This further contributed to the strong intraday move up for the USD/JPY pair, taking along some trading stops placed near the 115.00 mark.

Hence, the ongoing positive momentum could further be attributed to some technical buying, though overbought RSI (14) on hourly charts warrants caution for bullish traders. Market participants now look forward to the US macro releases – Advance US Q4 GDP and Durable Goods Orders – for a fresh trading impetus.

The US economic docket also features the release of the Weekly Initial Jobless Claims and Pending Home Sales data, which along with the US bond yields, will influence the USD price dynamics. Apart from this, traders will take cues from the broader market risk sentiment for some short-term opportunities around the USD/JPY pair.

Technical levels to watch

- EUR/USD collapses to levels last seen in June 2020 near 1.1150.

- Further downside could well see 1.10 retested in the near/medium term.

EUR/USD sinks to the mid-1.1100s, area last visited back in June 2020, on the back of the relentless move higher in the US dollar.

Further downside appears likely in light of the ongoing price action. Against this, the next support could turn up at the round levels at 1.1100 and 1.1000, all ahead of May 2020 low at 1.0766 (May 7).

Extra losses in the pair remains well on the cards as long as it remains capped by the 4-month resistance line, today around 1.1340.

In the longer run, the negative outlook is seen unchanged below the key 200-day SMA at 1.1700.

EUR/USD daily chart

Do changes in gold and Bitcoin prices contain useful information? Analysts at Natixis seek to determine whether changes in gold or Bitcoin prices provide information on investors’ perception of future monetary policy, future inflation, future share price movements and dollar’s exchange rate.

Gold and Bitcoin price have a stable correlation only with monetary policy

“We find for the gold price a significant correlation with long-term interest rates (negative) in the US and the OECD, the monetary base (positive) in the US and the OECD, dollar’s exchange rate, to a lesser degree (a depreciation drives up the gold price) but not the stock market index or inflation.”

“For the Bitcoin price, we find a significant correlation with long-term interest rates (negative) in the US and the OECD, rhe monetary base (positive) in the US and the OECD but not with the stock market index, inflation or the dollar’s exchange rate.”

- EUR/GBP has slipped back to the 0.8330s with bears eyeing a retest of recent multi-year lows under 0.8310.

- FX markets are trading on central bank divergence post-hawkish Fed meeting, hence GBP outperformance versus the euro.

EUR/GBP fell to fresh weekly lows in the 0.8330s on Thursday, with bears eyeing a retest of recent multi-year lows printed last week just under 0.8310 and a push lower towards the late-2019/early-2020 lows in the 0.8280 area. Risk appetite took a knock on Wednesday after a hawkish Fed policy meeting where the bank teed up the prospect of multiple rate hikes in 2022 and Fed Chair Jerome Powell refused to rule out a 50bps move in March. Normally, that might push EUR/GBP higher given sterling’s higher beta to broad risk appetite, but the Fed meeting appears to have encouraged FX markets to trade more on central bank policy divergence.

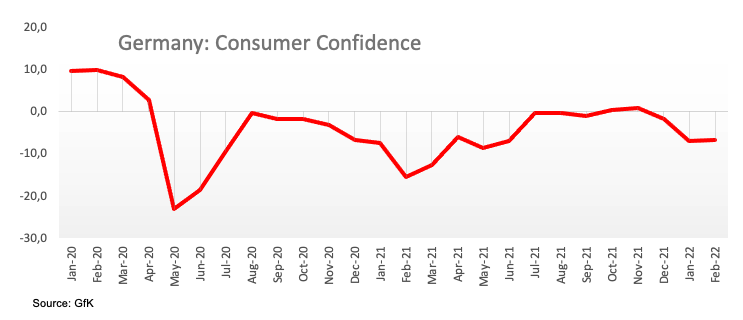

That might explain why EUR/GBP has continued to push lower. The BoE is expected to remain ahead of the Fed in terms of policy normalisation with a second post-pandemic rate hike in February, while the ECB is still yet to substantially taper its QE buying, let alone hike rates. Better than expected retail sector survey data for January from the Confederation of British Industry on Thursday may also be helping sterling outperform the euro. At the very least, the positive UK data appears to have negated a not as bad as forecast German GfK Consumer Sentiment reading for February.

Looking ahead, the much-anticipated Sue Gray report on alleged parties in Downing Street which at the time broke lockdown rules will be released later this week and could further ramp up pressure on UK PM Boris Johnson to resign. Most analysts continue not to expect any follow-through on the pound. Otherwise, other key events to watch this week include flash German, Spanish and French Q4 2021 GDP growth readings on Friday, which could have a moderate impact on ECB policy expectations.

- DXY pushes higher and clinches new tops past the 97.00 mark.

- The June 2020 high at 97.80 should come next for dollar bulls.

DXY extends the advance for yet another session and records new peaks in levels last seen in the summer 2020 further north of the 97.00 barrier on Thursday.

The intense upside in the dollar left behind the previous tops and surpassed the 97.00 yardstick, allowing for the continuation of the rebound for the time being. That said, the door now remains open to a potential move to the June 2020 peak at 97.80 (June 30) ahead of the round level at 98.00.

In the short-term horizon, the upside pressure remains intact while above the 4-month line around 95.45. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.32.

DXY daily chart

- Gold has pulled back to around $1810 from Wednesday’s highs above $1850 as markets price in a more hawkish Fed.

- Traders should watch for a break of a recent upwards trend channel that could trigger a drop towards the $1780s.

After pulling back sharply on Wednesday from the $1850 highs to a sub-$1820 close amid hawkish post-Fed meeting vibes, spot gold (XAU/USD) prices have continued to decline, albeit at a steadier pace on Thursday. XAU/USD is currently trading close to the $1810 level, down a further 0.5% and now down about 2.3% from Tuesday’s highs above $1850. Gold was pressured by the DXY broking out to fresh 19-month highs above the 97.00 level, and as major US front-end yields (2s, 5s) broke out to fresh cycle highs as markets moved to price in more aggressive Fed hikes.

The Fed’s monetary policy statement, which indicated a likely March hike, and decision to hold rates was in line with expectations and didn’t move markets, but Fed Chair Jerome Powell’s press conference was deemed hawkish. Traders noted that Powell did not rule out a significantly faster pace of hikes than currently indicated in the dotplot and did not rule out a 50bps hike in March. Powell also said that, if the Fed had been releasing new forecasts at Wednesday’s meeting, he would have upped his inflation outlook.

As a result, the implied yield on the three-month eurodollar future for December 2022 (a proxy for market expectations for where the Fed funds rate will be) has jumped more than 15bps to close not far below 1.45% from previously under 1.30%. In other words, markets are now pricing five rate hikes in 2022. This shift in pricing seems inline with updated Fed calls from major banks, including Nomura, who see a 50bps hike in March followed by a further four before the end of the year.

Recent breakouts in short-end yields and the DXY suggest a shift in momentum that may see further dollar and yield gains. This may continue to pressure spot gold prices; the safe-haven metal has been in a bullish uptrend in recent weeks and is now probing the lower bounds in the. A break below the $1800 area, which would also mean a break back below the 200 and 50-day moving averages, both of which sit just above $1800, would likely trigger technical selling that might push XAU/USD all the way back to annual lows in the $1780s area. Ahead on Thursday, US data worth watching include the first estimate of Q4 GDP growth and December Durable Goods Orders figures, both out at 1330GMT, as well as some more housing data at 1500GMT. Geopolitics is also worth watching as this has arguably been giving gold a lift in recent weeks.

US Q4 GDP Overview

Thursday's economic docket highlights the release of the Advance fourth-quarter US GDP report, or the first estimate, scheduled at 12:30 GMT. Growth in the world's largest economy is expected to have accelerated to a 5.5% annualized pace during the October-December period, up sharply from 2.3% recorded in the third quarter. Although backwards-looking, the report will provide an insight into how much effect the current wave of Omicron COVID-19 variant had on the US economy.

As Yohay Elam, FXStreet's own Analyst explains: “The US economy is set to complete an impressive recovery in 2021 on a high note. The Delta COVID-19 variant held back America's expansion in the third quarter, and the bounce-back was robust in almost all of the quarter. Omicron came in late, and had a negative impact in December, as retail sales data showed for the final month of 2021.”

How Could it Affect EUR/USD?

Heading into the key release, the US dollar shot to the highest level since July 2020 and remained well supported by the fact that the Fed reaffirmed expectations for an eventual lift-off in March. A stronger-than-expected reading will further fuel speculations about a faster policy tightening cycle and provide an additional boost to the greenback. Conversely, any disappointment is more likely to be overshadowed by rising geopolitical tensions between Russia and Ukraine. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Meanwhile, Eren Sengezer, Editor FXStreet, offered a brief technical outlook for the major: “EUR/USD is trading within a touching distance of the 1.1200 psychological level. In case this support turns into resistance, the pair could face additional bearish pressure and touch its weakest level in 18 months near 1.1180. Below that level, 1.1170 (static support from Jul. 2020) aligns as the next support before sellers can target 1.1100 (psychological level).”