- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 01-02-2022

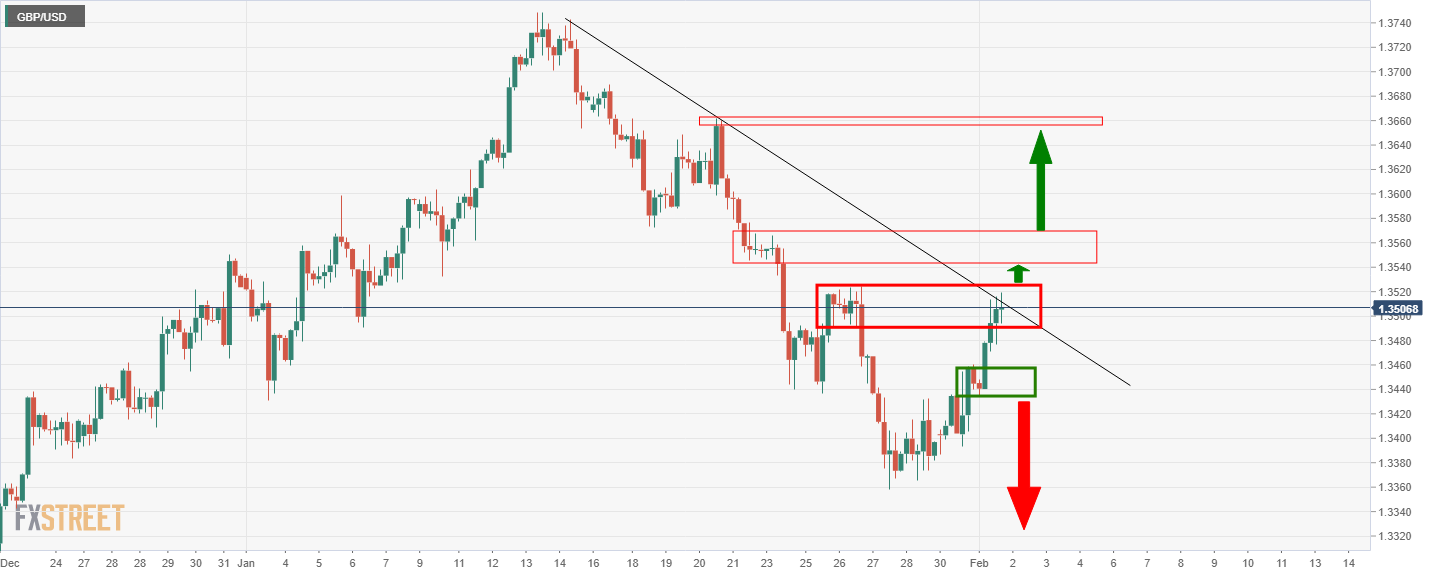

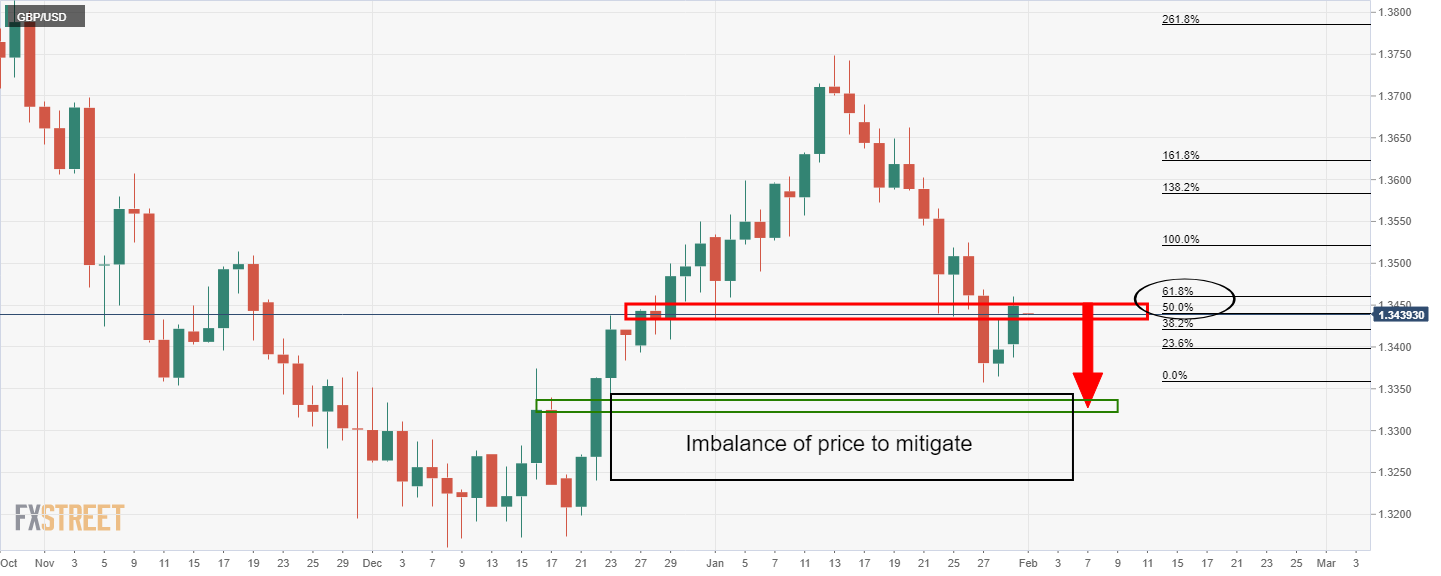

- GBP/USD grinds higher around weekly top following three-day uptrend.

- A three-week-old resistance line tests buyers ahead of 100-SMA.

- Bullish MACD, sustained break of 50-SMA favor buyers.

- Sellers need validation from 61.8% Fibonacci retracement to take fresh entries.

GBP/USD bulls attack nearby resistance line around the weekly high of 1.3528 during Wednesday’s Asian session.

In doing so, the pair buyers take a breather following a three-day rebound from the 61.8% Fibonacci retracement (Fibo.) of December 2021 to early January 2022 upside.

Other than the bounce from the key Fibo. level, firmer MACD and the cable pair’s ability to stay beyond the 50-SMA level also keeps buyers hopeful to overcome the immediate trend line resistance, stretched from January 13, around 1.3530.

Even so, the 100-SMA level near 1.3560 will act as an extra filter to the north before fueling the GBP/USD prices towards the previous month’s peak of 1.3748.

Alternatively, pullback moves may aim for the 50-SMA level of 1.3470 ahead of highlighting a convergence of the previous resistance line from January 20 and 61.8% Fibonacci retracement level surrounding 1.3385.

It’s worth noting that January’s low of 1.3357 could also test the GBP/USD bears before giving them controls to aim for the sub-1.3300 area.

GBP/USD: Four-hour chart

Trend: Further upside expected

US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, fade the gradual recovery from September lows tested on January 20, per the FRED website.

In doing so, the inflation gauge eases from the highest level in a fortnight to 2.43% by the end of Tuesday’s North American session.

The easing in inflation expectations could be combined with the recently mixed signals from the Fed to justify the US dollar’s latest weakness. That said, the market’s shift in attention from the Fed ahead of Friday’s US jobs report could also be considered as weighing on the US dollar prices.

However, firmer US ISM Manufacturing PMI for January, 57.6 versus 57.5 expected, joins the Fed’s hawkish halt test the greenback bears.

Moving on, Fedspeak and risk catalysts are important to determine short-term market moves ahead of the US employment report for January.

Read: The US employment report may lose some of its market-moving ability

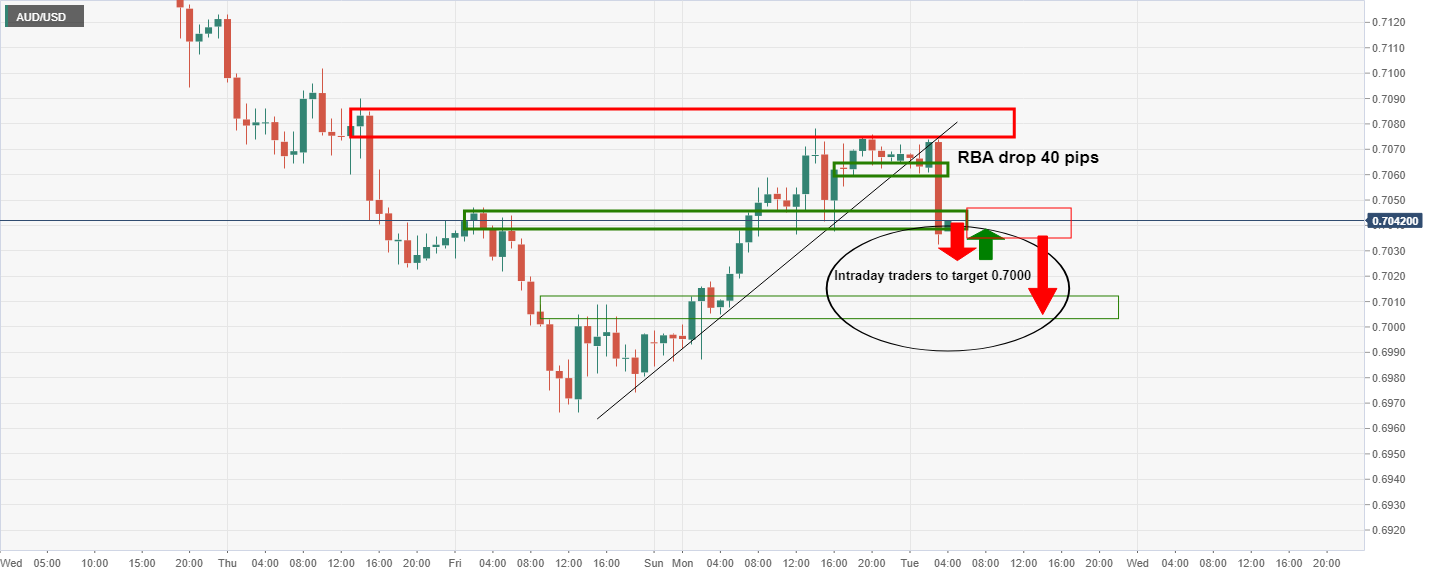

- On Tuesday, the Australian dollar prolongs its weekly gains.

- A positive market mood kept the AUD in the bid while the USD fell.

- AUD/USD Technical Outlook: in the long-term is downward biased but might print a leg-up before resuming the prevailing trend.

The Australian dollar extends its rally to two straight days during the week, so far up 2.15% vs. the greenback. At press time is trading at 0.7129 during the Asian session.

Wall Street finished Tuesday’s session in the green, while Asian equity futures are set to open in the green. Meanwhile, the greenback keeps dropping, with the US Dollar Index down 0.28%, sitting around 96.26, a tailwind for the AUD/USD as the buck is down 1.09% in the week.

On Tuesday, the AUD shrugged off the initial sell-off, post-Reserve Bank of Australia (RBA) monetary policy decision. Worth noting that the RBA ended the Quantitative Easing (QE) but failed short of hawkish expectations, as market participants waited for hints of a possible rate hike shortly.

Meanwhile, according to the ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve, dated February 1, 2022, market participants are not expecting any rate hikes until the May meeting.

Analysts at Westpac commented that “it was a clearly dovish message. The Governor has certainly gone out of his way to dissuade pricing for a hike in the first half of the year.”

On Wednesday, the Australian economic docket would feature the RBA Chart Pack, and RBA’s Governor Philip Lowe will cross the wires at 01:30 GMT

AUD/USD Price Forecast: Technical outlook

The AUD/USD is downward biased, as depicted by the daily moving averages (DMAs) residing above the spot price. Nevertheless, a leg-up might not be discounted in the near term after the RBA dropped the monetary stimulus, perceived as a hawkish signal.

That said, following the path of least resistance, the AUD/USD first resistance would be the 50-DMA at 0.7163. A breach of the latter would expose 0.7200, followed by the 100-DMA at 0.7254, which, if it gives way, could signal a significant trend shift lying ahead.

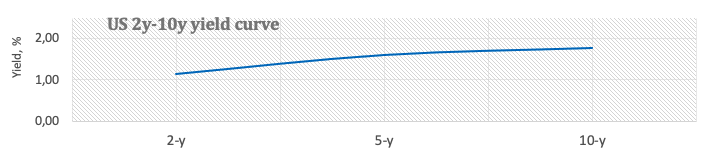

“A reduction in the size of the Federal Reserve’s balance sheet could hurt liquidity within the Treasury market, boost volatility and affect how different parts of the U.S. rates market are valued relative to one another, according to Goldman Sachs Group Inc,” per Bloomberg’s latest analytical piece published during Wednesday’s Asian session.

The descriptive reading also quotes Praveen Korapaty follows remarks from Citigroup Inc. who previously said that the process of so-called quantitative tightening -- which is widely expected to follow on the heels of the central bank’s first interest rate increases later this year -- could spark a return of arbitrage opportunities for traders within U.S. interest-rate markets.

“QT is likely to widen the gap between pricing of the most-traded benchmark securities and other, older securities,” Goldman Sachs (GS) adds, “and also to tighten the gap between Treasury yields and swap rates at the shorter-end of the yield curve.”

Bloomberg also said, “The bank’s strategists also expect bigger yield gaps between futures and cash securities and “higher yield dispersion metrics,” they said in a note to clients Tuesday.”

Additional quotes from Bloomberg

Meanwhile, the depletion of excess reserves within the system that stems from a reduction in the Fed’s bond holdings could result in upward pressure on short-term rates, such as the effective fed funds rate and Treasury bill yields, although those moves could be more pronounced in 2023 than in 2022.

The Fed is planning to wind down its buying of Treasuries by March, completing a process that market observers refer to as tapering, and could start shedding its holdings by attrition later this year.

Fed officials, who are currently paving the way for a widely expected interest-rate hike in March, have yet to announce specific plans for balance-sheet reduction, but they did release a set of principles alongside the authority’s most policy decision indicating that it is looking to embrace the broad model it used last time it engaged in QT back in 2017-2019.

Projections are most sensitive to the assumption that ‘levered investors will, over time, replace the Fed as the marginal buyer of USTs.’ Strategists don’t expect QT to ‘materially affect’ cross-currency bases.

Their projections are based on an assumption that the Fed will announce runoff plans in June, quickly ramp it up to a pace of around $100 billion per month and ultimately shrink the balance sheet by between $2.2 trillion to $2.7 trillion over a period of two to two-and-a-half years.

- EUR/USD remains on the front foot, carrying the early breakout of short-term descending trend line.

- Upbeat MACD, firmer RSI adds to the bullish bias but a convergence of 200-SMA, 100-SMA will be the key.

- Sellers will wait for downside break of 1.1200 for fresh entries.

EUR/USD grinds higher around the weekly top near 1.1270 following a three-day uptrend during the initial Asian session on Wednesday.

The major currency pair gained upside momentum after Monday’s upside break of a three-week-old descending resistance line, now support around 1.1205.

The bullish bias then gained support from MACD and RSI to flirt with the 38.2% Fibonacci retracement (Fibo.) level of January 14-28 downside.

It’s worth noting that the EUR/USD buyers aim for 50% Fibo. around 1.1300 as an immediate target during the further advances. However, a confluence of the 100-SMA and 200-SMA around 1.1315-20 will be a tough nut to crack for the pair bulls afterward.

Meanwhile, pullback moves remain elusive until staying beyond the resistance-turned-support and 23.6% Fibonacci retracement level near 1.1200.

Following that, the yearly low around 1.1120 and the 1.1100 threshold may lure EUR/USD bears ahead of the April 2020 peak surrounding 1.1020.

EUR/USD: Four-hour chart

Trend: Further upside expected

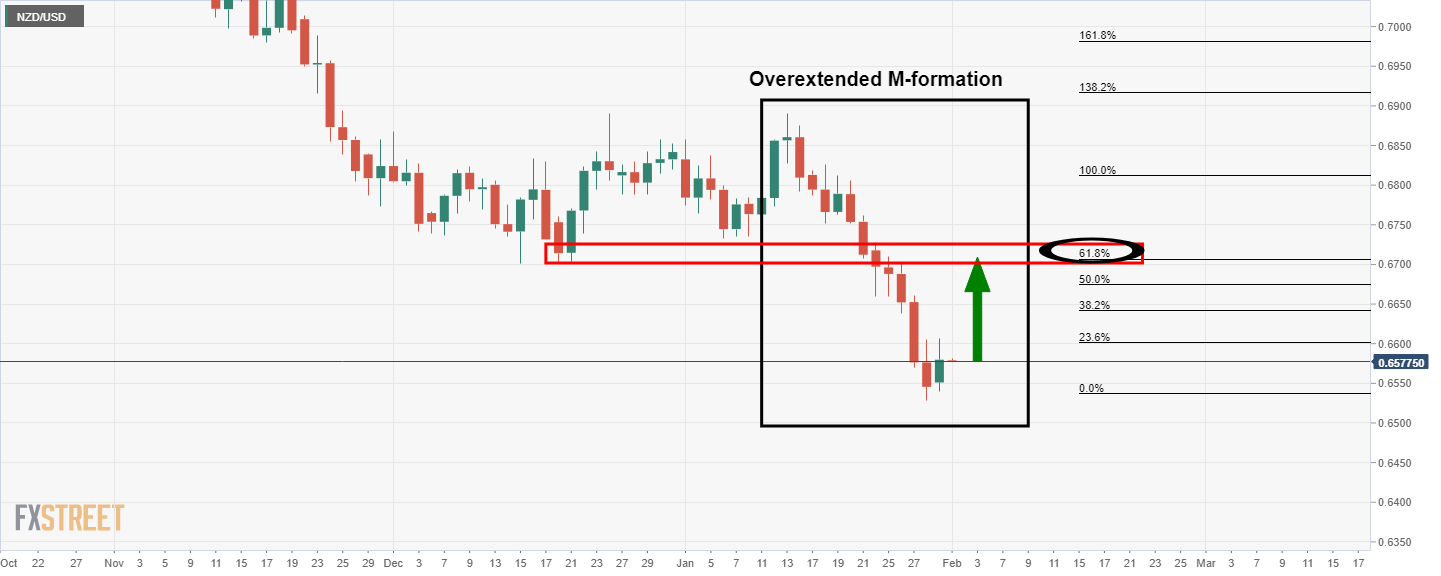

- NZD/USD eases from weekly high, probes two-day rebound after New Zealand jobs report.

- NZ Employment Change, Unemployment Rate eased in Q4, Participation Rate softened too.

- NZ Government unveils an unemployment insurance scheme worth $3.54 billion.

- Kiwi bulls tracked Aussie higher post-RBA while softer USD added to the upside momentum, market’s mood stays unclear.

NZD/USD bulls take a breather following the mixed prints of Q4 employment details from New Zealand during early Wednesday morning in Asia. In doing so, the kiwi pair consolidates the recent gains around the weekly top, easing to 0.6635 by the press time. However, the government’s recent assurance to those who lost their jobs during the pandemic times seems to have kept the bulls hopeful of late.

As per the latest New Zealand (NZ) jobs report for the fourth quarter (Q4) of 2021, the Unemployment Rate continues to ease but the softer-than-expected figures of Employment Change, Labour Cost Index and Participation Rate seem to have tested NZD/USD bulls. “We’re “strongest” in the market, expecting unemployment to fall to a historic low of 3.0%. If we’re right, we’d expect the NZD to benefit,” said ANZ bank ahead of the data.

Read: NZ Unemployment Rate beats, but disappointments elsewhere hamsting NZD

A few minutes before the NZ employment data, New Zealand Finance Minister Grant Robertson released employment benefits worth around $3.54 billion, including $1.81b for displacement and $1.73 billion for health condition and disability claims, per NZ Herald. The news reads, “People who are laid off may soon be able to claim support worth as much as 80 percent of their former income, under a Government unemployment insurance plan unveiled today.”

That said, the Kiwi pair tracked the Australia Dollar towards the north the previous day while being on the top-tier of the G10 currency pair winners. The AUD cheered the Reserve Bank of Australia’s (RBA) end to the Quantitative Easing (QE) and revised up the inflation forecasts. Though, the Aussie central bank’s rejection of the immediate rate hike concerns and comments like, “Inflation has picked up, it is too early to conclude that it is sustainably within the target band,” initially weighed on the AUD/USD.

It should be noted that a generally positive risk appetite, upbeat US equities and downbeat US Dollar, despite firmer US Treasury yields, added to the NZD/USD strength earlier.

Moving on, markets remain on the sidelined while waiting for the key data/events, starting from today’s Eurozone Consumer Price Index (CPI) and ending on Friday’s US NFP. However, mixed concerns over Russia-Ukraine may offer intermediate moves. It should be noted that the Fedspeak will be important as well.

Technical analysis

Although oversold RSI conditions triggered NZD/USD bounce during the early week, a three-week-old descending trend line joins the 10-DMA, around 0.6650, to challenge the pair’s immediate upside. Following that, the December 2021 low near 0.6700 will be in focus.

Alternatively, the recently flashed multi-month low near 0.6530 will lure the NZD/USD bears once they conquer the 0.6600 round figure.

- The NZD/JPY advances 0.49% as the North American session ends.

- Mixed NZ macroeconomic data kept the exchange rates unchanged.

- The NZD/JPY path of least resistance is downwards, though the daily close above 76.00 opened the door for a leg-up towards 77.00.

The NZD/JPY climbs as the Asian Pacific session begins, though it faces strong resistance around the 76.00-20 area. At the time of writing, the NZD/JPY is trading at 76.13. Tuesday’s market sentiment was upbeat, as portrayed by US equities finishing in the green. In the Asian Pacific region, equity futures point to a higher open.

NZD/JPY Price Forecast: Technical outlook

On Tuesday, in the Asian session, the NZD/JPY seesawed around the 75.50-75 range. However, in the North American session, a positive market mood spurred a rally towards 76.20. However, positive New Zealand macroeconomic data crossing the wires caused a dip to 76.08 on the pair.

The NZD/JPY remains downward biased. The daily moving averages (DMAs) stay above the spot price, with a downslope, in the case of the 50-DMA. That said, the first support level would be 76.00. A breach of the latter would expose July 20, 2021, daily low at 75.27, followed by August 19, 2021 daily low at 74.56.

Contrarily, in the event of the cross-currency pair holding its ground against JPY bulls, the first resistance would be 76.24. A break above that level could pave the way for further gains. The next resistance would be January 26 daily high at 76.67, followed by January 21 cycle high at 77.05.

The key quarterly labour market data roundup for New Zealand has been released as follows.

The Unemployment Tate fell to 3.2 per cent in the fourth quarter, according to data released by Statistics New Zealand on Wednesday. While this beat expectation, it's not moved the needle on the NZD because the rest of the data was disappointing.

- NEW ZEALAND Q4 S/ADJ UNEMPLOYMENT RATE 3.2 PCT (REUTERS POLL 3.4 PCT)

- NEW ZEALAND Q4 S/ADJ JOBS GROWTH +0.1 PCT Q/Q (REUTERS POLL +0.3 PCT)

- NZ Q4 PARTICIPATION RATE 71.1 PCT (REUTERS POLL 71.2 PCT)

- NZ Q4 LCI PRIVATE SECTOR WAGES (EX-O'TIME) +0.7 PCT ON PVS QTR (REUTERS POLL +0.9 PCT)

- NZ Q4 LCI PRIVATE SECTOR WAGES (EX-O'TIME) +2.8 PCT ON YEAR AGO (REUTERS POLL +2.9 PCT)

Monetary policy implications

The Reserve Bank of New Zealand had viewed the labour market as beyond maximum sustainable employment back in the November MPS. Despite the disappointments today, this is still a highly inflationary labour market, with workers now a scarce commodity, and employers having to pay big bucks to fill vacancies, as analysts at ANZ Bank explained.

''And that’s only going to reinforce the upwards trend in domestic inflation pressures. Inflation is a challenge for household budgets –and it’s particularly hard for lower-income households, for whom essential spending on food, shelter, and transport takes up the bulk of their disposable income. Real wages were likely still falling in Q4 –putting further cash-flow pressure on households, who now need to work longer to be able to afford the same standard of living as one year ago.''

''Higher interest rates are needed to put a lid on surging domestic inflation pressures. And we think that means the RBNZ will lift the OCRin 25bp increments to 3% in April 2023 (assuming no unforecastable shocks knock the economy off course).''

About the employment data

Statistics New Zealand releases employment data on a quarterly basis. The statistics shed a light on New Zealand’s labor market, including unemployment and employment rates, demand for labor and changes in wages and salaries. These employment indicators tend to have an impact on the country’s inflation and Reserve Bank of New Zealand’s (RBNZ) interest rate decision, eventually affecting the NZD. A better-than-expected print could turn out to be NZD bullish.

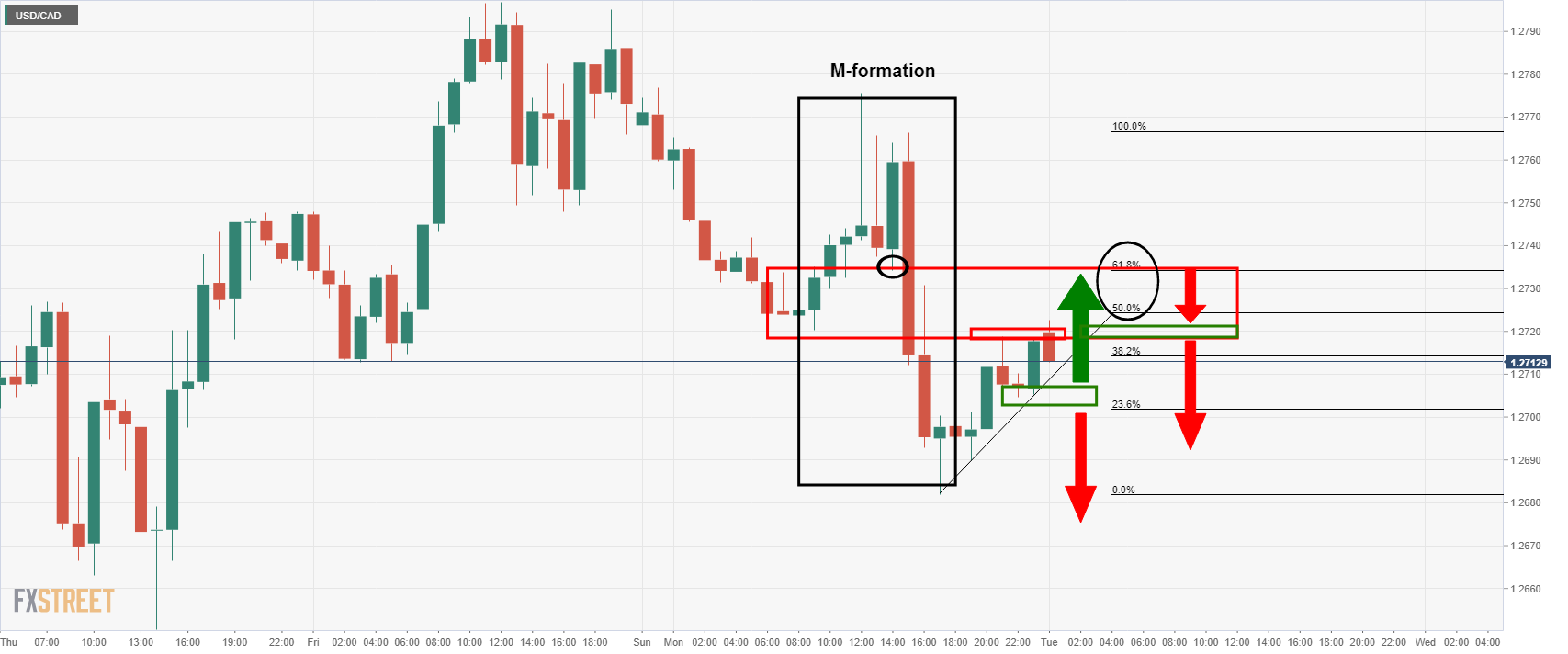

- USD/CAD bulls could be about to step in again at critical support.

- The 61.8% golden ratio is in view near 1.2650.

As per the prior analysis, USD/CAD Price Analysis: Bears have eyes on 61.8% golden ratio, the bears sank their teeth into the bullish rally and hit the 61.8% target. Since then, the bears gave way to the bulls and a fresh corrective high has been scored. This leaves prospects for a fresh surge to the upside depending on a number of conditions, as illustrated in the analysis below.

USD/CAD, prior analysis

The W-formation's neckline near the 61.8% Fibonacci level was a target area for the imbalance in price which has since been mitigated as follows:

As illustrated, the price tested the area near the neckline and rallied to score a fresh recovery high. The pair is now correcting that rally and is on the verge of making another 61.8% ratio retracement towards 1.2650. If this zone holds, then there will be prospects for an upside extension in the coming days.

- AUD/JPY has reversed sharply higher from its post-RBA lows beneath the 81.00 level to trade in the 81.75 area.

- Attention now turns to an upcoming speech from RBA Governor Philip Lowe at 0130GMT on Wednesday.

AUD/JPY has reversed sharply higher from its post-RBA lows beneath the 81.00 level to trade in the 81.75 area, up roughly 0.5% on the day. The central bank meeting was initially interpreted as dovish given the RBA stuck to its pledge that it would be patient with regard to rate hikes. But a sizeable upwards revision to the bank’s inflation forecasts and a dropping of the reference to rates remaining on hold to at least late 2023 suggests the door has been opened to rate hikes later this year if necessary. As a result, a few local Aussie banks stuck with the H2 2022 first-rate hike calls in wake of the meeting.

Attention now turns to an upcoming speech from RBA Governor Philip Lowe at 0130GMT on Wednesday. If AUD/JPY can rally beyond last Thursday’s highs in the 81.70 area, a move towards the 82.00 level and last week’s highs is on the cards. Against the backdrop of a continued recovery in global equity markets with torrid January trading conditions in the rear-view mirror, the stage may even be set for a more protracted AUD/JPY rebound back towards the 200-day moving average in the mid-82.00s.

Whether that recovery in equities can continue in the coming weeks will depend to a large extent on US data, with the Fed emphasising its data-dependent approach to determining the speed of policy tightening in 2022. The AUD/JPY bulls will be hoping for Friday’s US labour market data and January inflation data out later in the month to ease concerns about wage and cost of living pressures, thus reducing the likelihood of a 50bps March rate hike. A slower pace of Fed tightening in 2022 is seen as better for broad macro risk appetite.

- The AUD/NZD retreated from YTD highs on a dovish RBA monetary policy decision.

- AUD/NZD Technical Outlook: Upward biased but facing strong resistance around 1.0750s.

On Tuesday, the AUD/NZD pare some of its Monday’s gains, during the North American session, after a “dovish” than expected monetary policy statement released by the Reserve Bank of Australia. (RBA). At the time of writing is trading at 1.0722, barely down 0.15%. The market sentiment has improved, with US equity indices recording gains, except for the Nasdaq Composite.

AUD/NZD Price Forecast: Technical outlook

In the overnight session, the AUD/NZD plunged from 1.0750 to 1.0696, courtesy of a dovish RBA monetary policy decision. Even though it came in line with forecasts finalizing their QE program, the central bank’s language was not as hawkish as estimated. However, the downward move stalled at the confluence of the 50 and the 100-hour simple moving averages (SMAs) around the 1.0702-05 region.

That said, the AUD/NZD is upward biased. The daily moving averages (DMAs) reside below the spot price. Furthermore, the price action of the last nine days depicts that the spot price has been seesawing in the mid-point between the top and the central line of Pitchfork’s channel, which traces the price action from November 2021.

To the upside, the AUD/NZD first resistance would be the YTD high at 1.0757. A breach of the latter would expose the top trendline of Pitchfork’s channel around 1.0760-70 area, followed by 1.0800.

Contrarily, the first support would be the mid-point, between the top and the central Pitchfork’s channel around 1.0690. A break under the aforementioned would expose the central trendline of the channel around 1.0630-50, followed by the January 10 daily low at 1.0575.

- Tuesday has thus far been choppy but, as the session’s end approaches, indices have swung back into positive territory.

- The S&P 500 has rallied into the 4530s, up 0.4% on the day, versus previous session lows near 4480.

- Analysts attributed a combination of dip-buying and short-covering as driving the day’s gains.

Tuesday has thus far been a choppy session for US equity markets, but as the end of the session approaches, the major indices have swung back into positive/neutral territory. The S&P 500 has rebounded from 4480ish lows where it was trading 0.7% lower on the day and has pushed into the 4530 area, where it trades around 0.4% up on the day. Having been as much as 1.2% lower earlier in the day, the Nasdaq 100 index is back to flat, though remains unable to crack back above the psychologically important 15K mark. Finally, the Dow is the outperformer on the day, up just over 0.5% and back above the 35K level.

Analysts attributed a combination of dip-buying and short-covering as driving the day’s gains. “A part of the rally is explained by dip-buying from those who believe stocks hit a bottom as a result of aggressive hawkish Fed pricing across the market,” analysts at Swissquote explained. “Part of it is explained by some short covering, which got traders to buy back shares they initially bet against to close their positions,” they continued. Tuesday’s gains mean that the S&P 500 is now more than 7.0% up from last Monday’s lows near 4200, meaning the index has gained back nearly half of the drop from its record highs printed at the start of the year.

But "this will be the year when Fed will pull back support ... the markets will not be on steroids anymore and may go through a phase of detox” cautioned one analyst at Commonwealth Financial Network. Some might argue US equities are currently in the midst of this “detox” phase and that the road ahead remains bumpy amid uncertainty about future Fed policy. On which note, a barrage of Fed speakers this weak have had left markets with the broadly consistent message that, while it is practically guaranteed that tightening will begin soon, the pace and extent of it depends on economic developments.

That means markets (including equities) will be even more sensitive to economic data than usual. The most important US data to look at this week is thus Friday’s January jobs report. Fed policymakers and economists expect a weak headline NFP number as Omicron disrupted usual labour market churn. They (and markets) will be looking most intently at measures of wage growth (average hourly earnings) and labour market slack (unemployment rate, participation rate). As Fed policymakers leave open the possibility of more aggressive tightening in H2 this year, further tightening of the labour market and build-up of wage pressures might encourage markets to add to Fed tightening bets.

This presents the most downside risk to duration-sensitive big tech and growth stocks which are heavily concentrated in the Nasdaq 100. Data on Tuesday (ISM Manufacturing and JOLTs), while making for interesting reading, did not move markets. The former showed the PMI index falling to its lowest level since November 2020 as the spread of Omicron hampered manufacturing output growth, while the latter showed that labour demand remains very robust, with nearly 11M job opening at the end of 2021.

Other risk events to consider this week relate to earnings; Google’s parent company Alphabet is posting earnings after the closing bell ahead of earnings from fellow tech giants Apple and Meta Platforms (Facebook) later in the week. So far, S&P 500 earnings have been broadly positive and supportive of market sentiment. According to Reuters, of the 184 S&P 500 companies to report thus far, 78.8% have beaten analyst earnings forecasts.

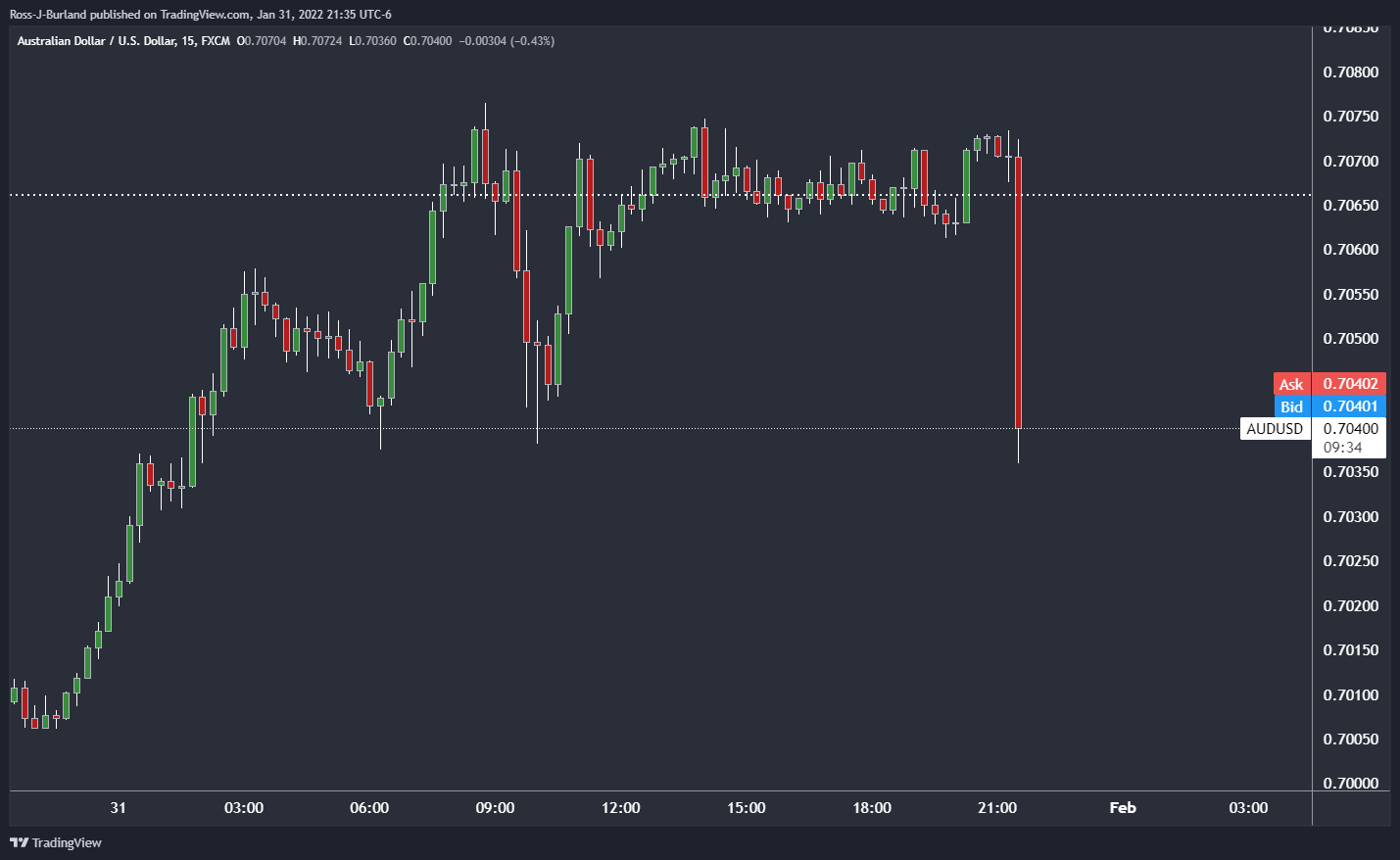

- AUD/USD looks like it could have some staying power around 0.71 the fgure.

- The bulls are in control despite a dovish stance at the RBA.

At 0.7114, AUD/USD is 0.68% higher on the day after rallying from a low of 0.7033 to a high of 0.7117 so far which was recently hit as in New York late afternoon trade as the greenback remains on the backfoot.

The Aussie failed to appease the bulls despite yesterday’s Reserve Bank of Australia's dovish outcome. There was some volatility, but no fresh direction for the pair which continues to correct the daily bearish impulse, as illustrated below.

The RBA ended QE but sounded patient on rate increases. What was telling in the muted impact on AUD/USD is that rate differentials are a secondary driver for the pair. Trapped shorts will have added to the upside as well in the aftermath of the event while traders await the full suite of forecasts that will follow in the RBA’s Statement on Monetary Policy this Friday. before then in Asia today, we will hear from the RBA's governor, Philip Lowe.

''The Governor has certainly gone out of his way to dissuade pricing for a hike in 1H2022, which leaves the evolution of the data for the market to assess which meetings are “live,” analysts at Westpac explained.

''Westpac’s August meeting expectation appears well placed in that regard. The forward cash profile will still remain steep, especially given the hawkish Fed backdrop, so while yields at the front end and out to 3yrs will be lower, they will only be marginally so and we remain better sellers into strength, despite the RBA message.''

The US dollar may still prevail

Positioning could be the key when it is all boiled down. AUD should emerge as an outperformer on the back of US dollar weakness and improved risk sentiment for its higher beta staus to global equity performance. From a positioning standpoint, it is highly stretched on the net short side as well. This can support the Aussie for the time being. However, looking forward, the US dollar is going to be supported by the Fed's stance on tightening for most of 2022. Therefore, the resistance on the daily chart should hold initial tests under the status quo.

AUD/USD technical analysis

The price has penetrated into resistance territory and is testing above the 61.8% Fibonacci ratio of the prior bearish impulse. The move has been strong which gives rise to the prospects of some staying power near to 0.7100 before the bears might reemerge again.

St Louis Fed President James Bullard on Tuesday said that he thinks it an open question whether the Fed will have to become more restrictive (i.e. raise rates above the "neutral" 2.0%-2.5% zone).

Additional Remarks:

"We will be able to assess our position in a few months' time."

"I think it's premature to be concerned about the yield curve."

"I don't think the market so far thinks we will let inflation get out of control."

"I do consider the slope of the yield curve though."

"I think the unemployment rate will go below 3% this year."

"Firms are scrounging around for workers."

"I think labor force participation has been affected by retirements... and those people are unlikely to return."

"I think the upcoming monthly jobs report will not be good."

What you need to know on Wednesday, February 2:

The greenback remained on the backfoot on Tuesday, although losses were limited across the FX board. The EUR/USD pair is ending the day pretty much unchanged in the 1.1240/50 area after dismal EU data put a cap to the shared currency.

GBP/USD shrugged off UK's political turmoil and retained gains at the end of the day, trading at around 1.3510. The AUD/USD pair also holds near intraday highs in the 0.7110 region despite the RBA refusing to hint at a sooner rate hike. The USD/CAD pair ended the day unchanged amid the weaker tone of oil prices.

Asian and European indexes got to close with gains, but Wall Street spent the day struggling around its opening level, trading mixed but directionless.

Government bond yields started the day on the backfoot, recovering during US trading hours amid generally positive local data. The yield on the 10-year US Treasury note bottomed at 1.73% and currently stands at 1.80%.

US Federal Reserve officials were on the wires, giving mixed signals to those speculating on rate hikes' dates. Bullard said that we would support a hike in March, although he prefers to delay it to May. Earlier in the day, Atlanta's Bostic noted that there is a "real danger" of expectations drifting from the Fed's 2% to 4% or higher. Overall, officials are paving the way to lessen the impact of hikes in stocks.

Gold is hovering around the $1,800 level, incapable of extending gains. Crude oil prices seesawed between gains and losses, ending the day marginally lower. WTI currently trades at $87.90 a barrel.

New Zealand employment figures will bring some action during the Asian session as investors get ready for Thursday's ECB and BOE announcements.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Cryptos eyes new uptrend in February

Like this article? Help us with some feedback by answering this survey:

St Louis Fed President James Bullard said on Tuesday that he would support a rate increase at the March meeting and would also raise rates at the May meeting if he was to make that decision today. A 50bps rate hike doesn't really help up right now, he added, saying that we are doing a lot here even though we haven't yet raised rates.

Additional Remarks:

"Inflation is quite high right now."

"I am thinking of the March meeting and second quarter for potential rate hikes, and then getting going on balance sheet reduction."

"In July and August, we'll be able to assess how robust inflation seems for the rest of the year and adjust accordingly."

"If inflation ebbs as expected, we may not have to be as aggressive in the second half of the year."

"I think markets pricing in five hikes this year is not too bad a bet."

"I don't think inflation will moderate much before mid-year."

"I am a little pessimistic on inflation compared to the market."

"I see rest of world having more geopolitical risk than in recent years in 2022."

"China's Covid zero policy for Omicron is also a risk."

"I see strong US demand and growth at 4% for 2022."

"But that will meet with continued supply chain disruption."

"That is not too good for inflation numbers this year."

"I would like to guard against that case."

"If we take steps now, we can in the middle of the year see where we are on uncertainties."

"The Fed is data-dependent and this is a fast-moving environment."

"We don't want to disrupt markets but we also need to keep inflation under control."

"Our previous forward guidance suited a different era."

"We are going to have to be more nimble, faster, better at reacting to inflation and other developments this year."

"We are going to be more data-dependent than in the past."

"I could see real returns in the US being higher owing to our success on dealing with the pandemic."

"But it's a global marketplace and it's not nearly so clear for other countries."

"The rest of the world will drag on real rates."

"I'd like to start reducing the balance sheet in Q2."

"Runoff can be faster than last time."

"I think we can get significant balance sheet reduction pretty soon."

"The Fed is not that far from reaching neutral if you consider both rates and balance sheet together."

"If we had to, we could go above the neutral rate."

"I am confident we are not behind the curve."

- Despite US equities recording losses, the NZD rises courtesy of improved market sentiment.

- The USD remains offered across the pond, and the DXY sheds 0.15%.

- The NZD/USD is downward biased but, once 0.6600 was reclaimed, a move towards 0.6700 is on the cards.

The New Zealand dollar advances sharply during the North American session, amid European stocks closing in the red, while US equity indices record losses. At the time of writing, the NZD/USD is trading at 0.6633.

During the day, the greenback has been under intense selling pressure. The US Dollar Index, a gauge of the buck’s value against a basket of six rivals, slides 0.15%, sitting at 96.39, courtesy of a risk-appetite increase in the last couple of days, except for US equities.

The US economy continues in expansion territory

The US economic docket featured the release of the ISM Manufacturing indicators for January on its final reading. The Manufacturing PMI came at 57.6 higher than the 57.5 foreseen by analysts. Although a tenth lower than December’s reading (revised), it showed the resilience of the US economy. Worth noting is the jump in Manufacturing Prices, which crushed expectations and the previous reading, up to 76.1 from 68.1 estimations and 68.2 in December.

That said, it further cements the US central bank hawkish pivot. However, regarding the labor market, Thursday’s Initial Jobless Claims and Friday’s Nonfarm Payrolls could shed light on how it is positioned in the US economy.

On Tuesday, the Philadelphia Fed President Patrick Harker crossed the wires. He commented that he expects a rate hike of 25 basis points in the March meeting, and he foresees at least four increases to the FFR. Harker said that the Fed is not behind the curve and noted that it could begin the Quantitative Tightening (QT) once the Federal Funds Rates (FFR) hit 1% to 1.25%.

Fed speaking continues with St. Louis Fed President Bullard at 19:30 GMT

In the Asian session, the New Zealand economic docket would feature employment figures. HILFS Unemployment Rate is expected at 3.4%, while the Labor Cost Index in a (QoQ) and (YoY) is foreseen at 0.9% and 2.9%, respectively.

NZD/USD Price Forecast: Technical outlook

The NZD/USD is trending downwards, once 0.6700 gave way to USD bulls. The daily moving averages (DMA) show that the downtrend remains intact but, the price action of the last two days might suggest a leg-up is underway and can reach the abovementioned price level.

If the NZD/USD challenges the 0.6700, the next target for NZD bulls would be January 6 low previous support-turned-resistance at 0.6733, immediately followed by the 50-DMA at 0.6768.

Contrarily, and the path of least resistance as the NZD/USD current trend is to the downside, the first support would be 0.6600. A breach of the latter would expose January 28 high, previous resistance-turned-support at 0.6588, followed by the YTD low at 0.6529.

- GBP/JPY continued to trade with a positive bias on Tuesday, though was unable to hold above 155.00.

- GBP/JPY continues to move higher within a short-term bullish trend channel.

- If risk appetite is able to improve in February, yen weakness could propel the pair towards recent highs near 158.00.

GBP/JPY continues to trade with an upside bias on Tuesday against a backdrop of favourable risk appetite, though the pair has been unable to hold above the 155.00 level and in recent trade slipped back below it. A strong start to the year for house price growth according to data from British lender Nationwide, coupled with confirmation that manufacturing PMI had risen to its highest since in six months in January helped keep sterling underpinned. Meanwhile, market commentators also cited investor speculation that the BoE might announce its quantitative tightening plans alongside a 25bps rate hike on Thursday as supportive for the pound.

Ahead of Thursday’s key monetary policy announcement, GBP/JPY continues to move higher within a short-term bullish trend channel that has been guiding the price action for nearly the last week. If the pair can surpass the 155.00 level, its faces solid resistance in the 155.40s area, and the area it failed to get above at the end of last week. A break above this area (perhaps as a result of BoE tightening bets) would open the door to a move above 156.00 and on towards resistance in the 157.00 area. Meanwhile, if February proves to be a better month for risk appetite than last, yen weakness as investor demand for more risk-sensitive assets rises could propel the pair back towards January and Q4 2021 highs in the 158.00 area.

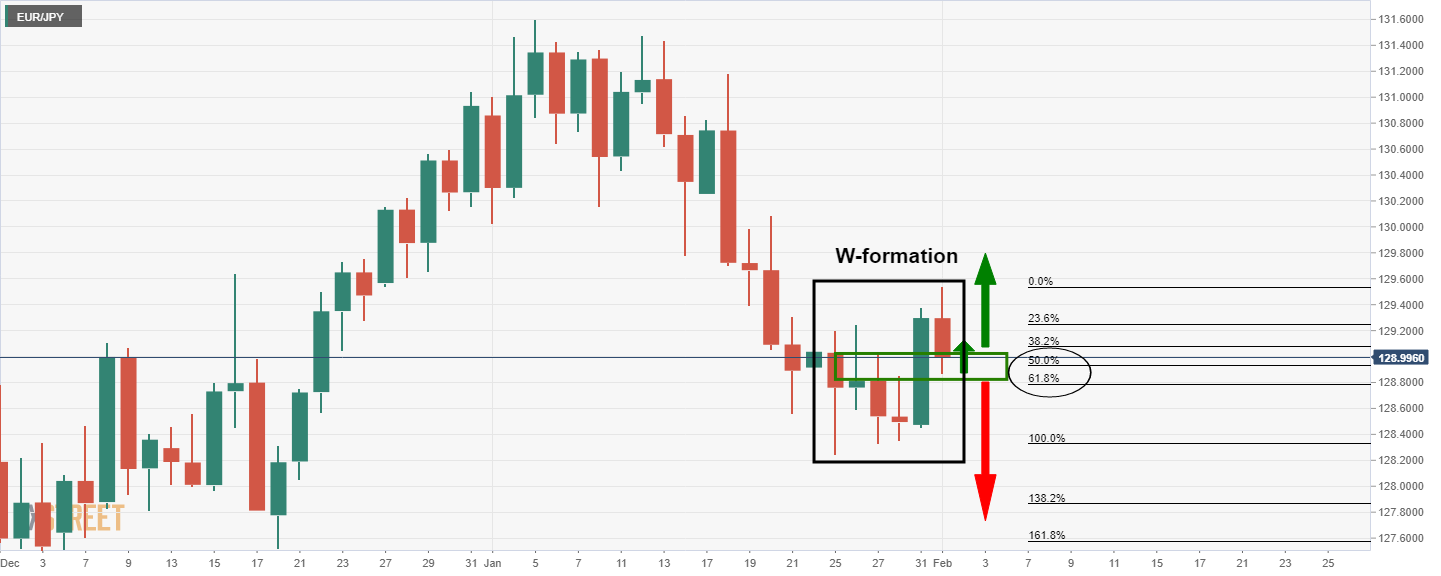

- EUR/JPY bears are moving in on critical support.

- A breakout could be on the cards in the coming sessions.

EUR/JPY bulls are correcting on the ower time frame, but the bears are moving on a critical longer-term support level. The price from a daily perspective has completed a restest of the W-formation's neckline as illustrated below:

EUR/JPY daily chart

This would be expected to act as support on initial tests where the 50% and 61.8% ratios align with the structure above 128.80. A break of there, however, would open the risk of a downside continuation to test back into the 127.80s

EUR/JPY H1 charts

From a bearish perspective, the hourly market structure is as follows:

The bullish outlook, on the other hand, requires a break of the 129.30s.

- EUR/USD has eased back under 1.1250 from earlier highs in the 1.1270s, having rejected resistance.

- FX markets are digesting the latest Eurozone and US data releases and Fed speak.

- After upside Eurozone inflation surprises, some analysts have been flagging a risk of a more hawkish ECB on Thursday.

After rejecting resistance in the 1.1270s and reversing back from session highs to underneath the 1.1250 level, it looks as though the EUR/USD bears are making a comeback. Having been as much as 0.4% higher earlier in the session, EUR/USD is back to trading flat in the 1.1240 area, as traders continue to digest the latest Eurozone and US data releases and Fed speak. Recently released US ISM manufacturing PMI survey data for January showed manufacturing activity growth at its weakest since November 2020, with pandemic-related problems such as labour shortages and supply chain holdups worsening last month with the spread of Omicron.

Stronger than expected December JOLTs data showed job openings rising back towards 11M in December, however, seemingly negative any negative impact the ISM survey might have had on the buck. Net-net, Tuesday’s US data has not changed the narrative surrounding the US economy right now; that it is experiencing temporary Omicron-related weakness and that labour markets remain very tigth and inflationary pressures very high. With Tuesday’s data dump out of the way, FX markets turn their focus to the ADP national employment change estimate on Tuesday, ahead of the ISM Services report on Thursday and the official jobs report on Friday.

As usual, the Friday jobs report will be the most important data of the week; the headline NFP number is expected to be weak with Omicron slowing labour market churn. Fed policymakers have this week flagging wage growth and measures of labour market slack as the more important metrics to keep an eye on. Speaking of Fed speak, the message from policymakers this week has been consistent; a March rate hike enjoys wide support, but there is less certainty about the pace of tightening for the rest of 2022. Fed members have expressed a desire to maintain optionality to go slower or faster depending on economic developments and most said a 50bps move in March was possible, but not the expected scenario.

While Fed speak, US data and how these impact Fed tightening expectations will continue to be a key driver of EUR/USD for the remainder of the week, traders should not ignore Eurozone fundamentals. After upside inflation surprises from France, Germany and Spain this week (implying an upside surprise in the Eurozone aggregative inflation figures on Wednesday), some analysts have been flagging a risk of a more hawkish ECB on Thursday. Eurozone money markets were pricing an 80% chance of a 25bps rate hike from the bank as soon as October. Any hint towards the conditions for a rate hike being met in 2022 could light a fire under EUR/USD and send it back towards the 1.1300s.

- GBP/USD is higher on US dollar weakness and improved risk apatite.

- The BoE is the focus for this week and traders will be looking for clues from the MPC.

GBP/USD has printed a fresh high in New York trade. At 1.3519, the price is 0.56% on the day after rallying from a low of 1.3433. Cable is up for a third straight session as strong domestic economic data and hawkish sentiment surrounding the Bank of England coupled with a weak US dollar leaves bulls in control.

Thursday will see a UK Monetary Policy Committee meeting, where a rate hike is likely. Investors have now fully priced a 25-basis-point rise in the BoE's main interest rate to 0.50% on Feb. 3. Therefore, the focus ought to be on what's said, more than what's done.

Pricing for UK rate hikes this year is the same as for the US - 5 in total. The Bank of England is expected to start running down its bond holdings on 7 March. However, amid fears the central bank might be behind the curve when it comes to tackling inflation, there is uncertainty over the pace at which it will raise rates and the level at which they will peak. Traders are also wondering how soon and how fast the bank will start reducing its balance sheet and stop reinvesting maturing gilts.

Encouragingly for sterling bulls, a survey showed British manufacturing output grew at the fastest pace in six months in January. This is supporting the view that the British economy is still handsomely rebounding from the COVID-19 recession. Additionally, the political crisis in Britain over lockdown parties at Downing Street has not had a significant impact on investors appetite for the pound. However, opinion polls showing a majority of voters felt Prime Minister Boris Johnson should resign, so this could come back to bite the bulls once the BoE premium is eventually discounted; The pound might not be able to stay strong on the BoE indefinitely.

''On the assumption that the government does proceed with its tax hike in April, we see the risk that the market will unwind some of its assumptions on BoE rates and this could leave the pound vulnerable in the spring and early summer,'' analysts at Rabobank argued. '' Given our view that the USD will be buoyed as Fed tightening commences, we see a risk that cable could dip below the 1.30 level in the middle of the year.''

US dollar under pressure

Meanwhile, the US dollar is under pressure and has fallen for a second consecutive session on Tuesday. Weaker-than-expected US economic data and less hawkish Federal Reserve officials who have pushed back against aggressive rate hikes this year have weighed. This too has helped the British pound to gain ground as risk appetite returns. Wall Street shares are also higher.

A series of Federal Reserve officials said on Monday that they would raise interest rates in March, but they have spoken cautiously about what might follow. That has taken the sting out of Fed's Powell's more hawkish tone from the recent Fed, meeting and presser that followed.

GBP/USD technical analysis

The price has shot into 4-hour liquidity where resistance could see the bulls struggle from here around the descending trendline. Having said that, a break of 1.3525 could open the doors to 1.3575 as the last defence for a significant move high towards 1.3680.

According to analysts at MUFG Bank, the Turkish lira will remain weak against the US dollar during the first half of the year. They forecast USD/TRY at 14.500 by the first quarter and at 16.000 by the second quarter.

Key quotes:

“The lira has been notably more stable at the start of the new year with USD/TRY trading within a relatively narrow range between 12.803 and 13.940. It follows the extreme price action towards the end of last year when USD/TRY traded between 10.251 and 18.363 in December. However, we still believe that the current period of stability is built on shaky foundations.”

“There is no indication yet of shift to more orthodox policy settings in Turkey that would help to restore confidence in the lira on a more sustained basis. To the contrary, President Erdogan has recently called for interest rates to be lowered further. He still believes that lower interest rate will help to bring down inflation that is expected to have reached close to 50% in December. At the same time producer price inflation is expected to have reached close to 100%. The CBRT is still relatively optimistic that inflation will fall back sharply to around 23% by the end of this year.”

“Last month’s decision to transfer FX risk-linked to holding lira deposits from individuals to the government may help to temporarily slow the pace of dollarization in Turkey but does not solve the underlying problems and risks undermining the health of public finances which has been one of the solid domestic fundamentals. At the same time, policymakers in Turkey have stepped up intervention to provide more support the lira in the near-term.”

Data released on Tuesday showed the ISM Manufacturing Index dropped 1.2 to 57.6 in January, below 57.5 of market consensus. Analysts at Wells Fargo point out that despite these headwinds, the ISM manufacturing report continued to signal incremental thawing of supply problems. They expect activity to remain strong.

Key quotes:

“While current activity was weaker amid a 1.2 point drop in the production component, the 3.1 point decline in new orders suggests some pullback in demand as well. The declines in January brought both of these components to their lowest levels in over a year and a half, signaling weaker activity in the sector.”

“The third consecutive monthly decline in the ISM manufacturing index in January signals weaker but still-strong activity in the sector. But, we believe this weakness will partly be temporary. The Omicron variant has shown some signs of subsiding just as fast as it appeared. New daily cases seem to have peaked and the national hospitalization rate looks to have rolled over. Further, even if demand continues to subside in the near-term as the service sector gains more considerable momentum, the expansive backlog of orders means manufacturers will be busy with plenty of product to still deliver on.”

- US dollar stabilizes during the American session, DXY trims losses.

- XAU/USD fails to breaks $1810, remains above $1800.

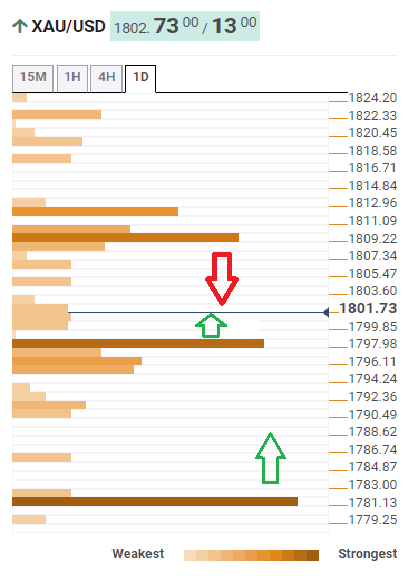

Gold peaked on European hours at $1809 and then lost strength. It pulled back following the release of US economic data to $1797 and then rose back above $1800. XAU/USD is moving sideways on American hours, capped by $1810 while holding above $1800.

The dollar recovers some strength amid rising US bond yields that rebounded from weekly lows. The DAY is falling for the second day in a row and it stands around 96.50, down 0.18% off lows. The combination of a rebound in yields and also in the DXY weakened XAU/USD that is still in positive ground for the day.

Short-term outlook

Gold’s price recovery found resistance at $1809 and pulled back. If XAU/USD fails to break the $1810 area, the upside would remain limited and a break higher could clear the way for a rally initially to the 20-day moving average at $1816; above the next key barrier is the $1830 area.

A slide back under $1800 would increase the bearish pressure. A daily close under $1790 is needed to suggest more losses ahead. Key support levels are seen at $1780 and $1770.

Technical levels

- The USD continues losing against the safe-haven status of the Japanese yen, 0.26%.

- US ISM PMI Manufacturing Price Index jumped to 78.1 from 68.1.

- USD/JPY is upward biased, despite the 1% drop since last week’s Friday.

During the New York session, the USD/JPY extends to three days its losses, dips 0.26%. At press time, the pair is trading at 114.78, up from 114.56, after a better than expected US ISM Manufacturing report. Market sentiment is mixed. European equity indices rise, while US stock indices fall post-ISM.

In the meantime, the US 10-year Treasury yield edges up two basis points sits at 1.804% post-US ISM.

US ISM Manufacturing came better than expected

On Tuesday, the Institute for Supply Management (ISM) reported the Manufacturing PMI Index for January. The figures at 57.6, better than the 57.5 foreseen, showed that the US economy continues expanding. However, the Manufacturing Prices Index smashed forecasts, climbing to 76.1 from 68.1 estimated, further cementing Fed rate hikes in 2022.

Some minutes before the ISM PMI, the IHS Markit Manufacturing PMI came at 55.5, slightly up than the 55.0 estimated.

Fed speaking continues with regional Presidents, led by Philadelphia’s Harker, followed by St. Louis Bullard at 19:30 GMT

In the meantime, before the North American session began, the Philadelphia Fed President Patrick Harker crossed the wires. Harker commented that the Fed is not behind the curve, and he expects a rate hike of 25 basis points, four in the year. Concerning the balance sheet reduction, he said that the US central bank could begin the Quantitative Tightening (QT) once the Federal Funds Rates (FFR) hit 1% to 1.25%.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased despite solid resistance around the 115.50-70 area, courtesy of a five-month-old upslope trendline previous support-turned-resistance. A breach of the latter would expose the YTD high at 116.35, followed by January 3, 2017, high at 118.61.

On the flip side, the USD/JPY first support level would be January 27 daily low at 114.47, followed by the 50-day moving average (DMA) at 114.33 and then 114.00.

The Korean won lost ground in January versus a stronger US dollar across the board, explained analysts at MUFG Bank. They see the USD/KRW moving to the downside over the rest of the year and forecast it at 1150.0 by the third quarter and at 1145.0 by year-end.

Key quotes:

South Korea has been facing an elevated number of new daily confirmed Covid-19 cases since mid-January, the country reported a record high 14,518 new cases on 27th January, exceeding the previous peak in mid-December last year of 7,850. The Covid-19 situation pushed the KOSPI to decline by 11% and financial market sentiment was low in January.

“Despite the worsened pandemic situation, South Korea’s economy showed its resilience in exports and construction activities. South Korea’s exports grew strongly by 22%yoy in the first 20 days of January, up from 20% in December. Growth of exports to the US accelerated by 8.9ppts to 28% yoy. Product-wise, semiconductor, a key export, grew by 29.5%yoy. Korean consumers’ sentiment picked up.”

“The government has enforced new containment measures including expanded rapid testing which will help to mitigate the spread of highly transmissible Omicron variant. Also, on January 21st, South Korea proposed an additional budget of 14 trillion won to support small and micro merchants hit by extended Covid-19 management measures caused by the protracted pandemic.”

“We expect USD/KRW to decline to 1,175.0 by Q1 2022.”

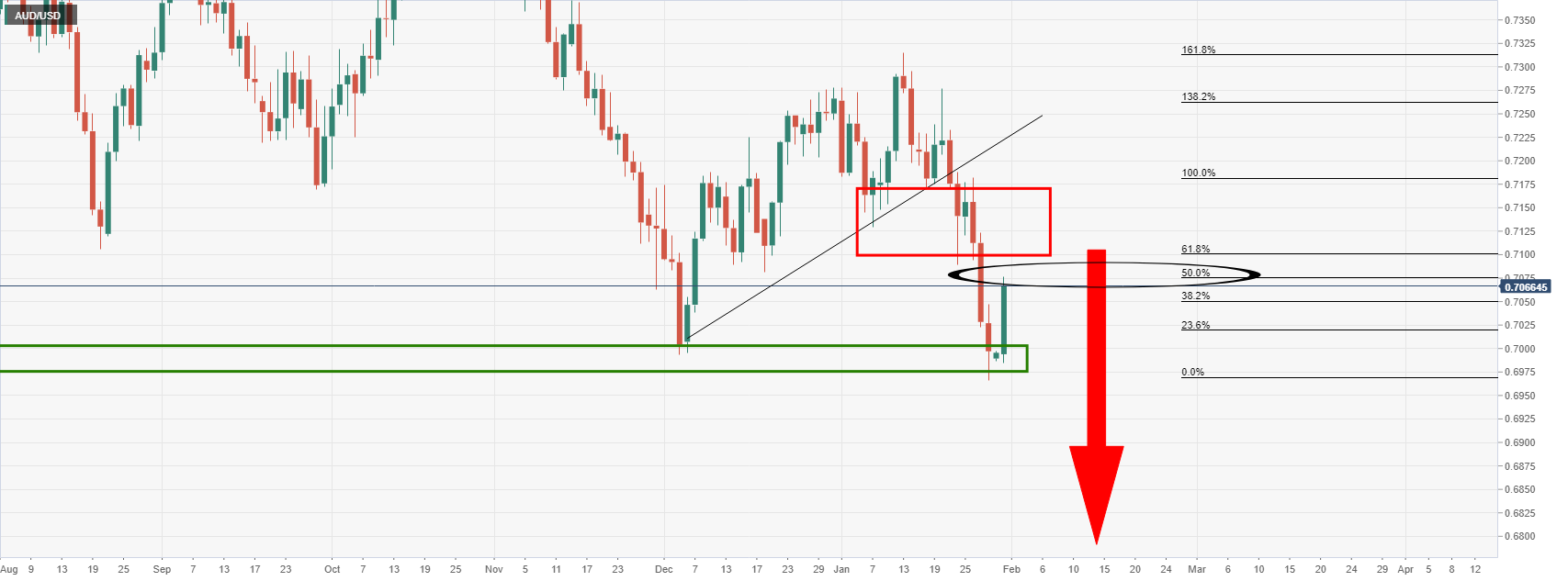

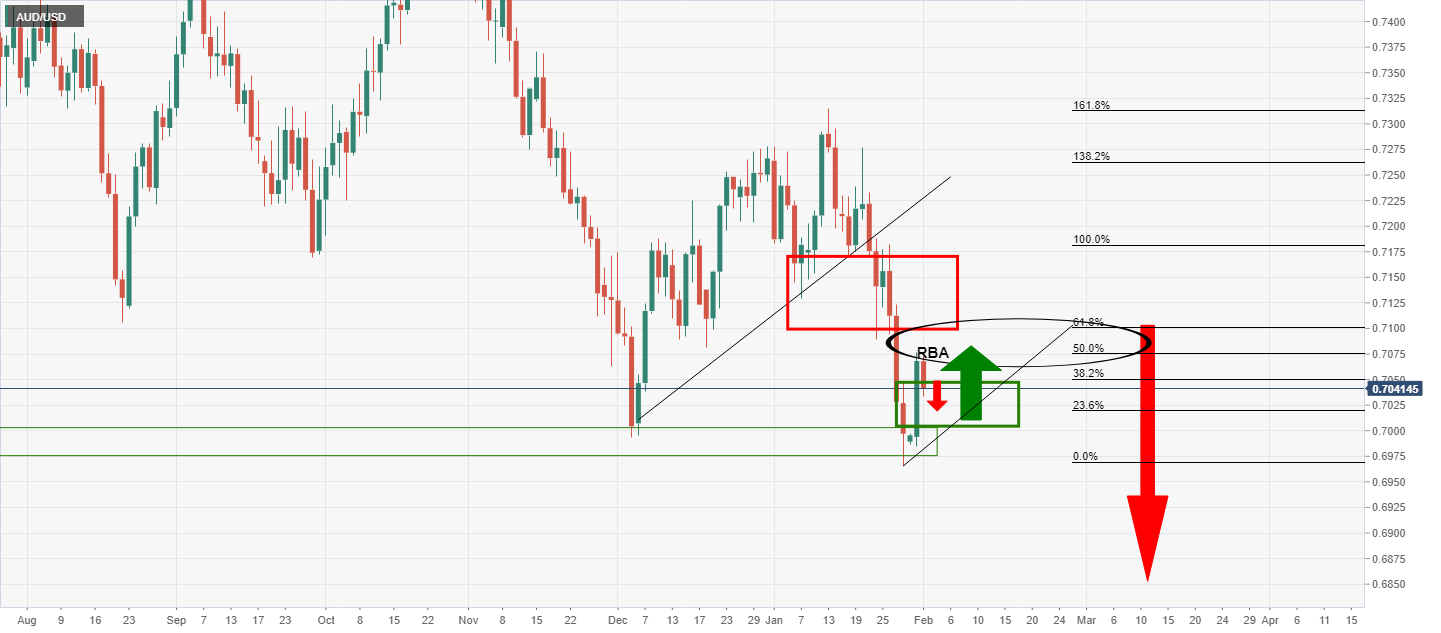

- AUD/USD pushed back above 0.7100 on Tuesday despite what analysts said was a “dovish” RBA meeting.

- The US dollar has been falling, risk appetite improving and base metal/energy prices rising, all contributing to AUD’s outperformance.

Against the backdrop of robust risk appetite, favorable moves in base metal and energy prices and a faltering US dollar, the Aussie’s post-“dovish” RBA policy announcement Asia Pacific underperformance is now firmly in the rear-view mirror. The currency has been climbing the G10 rankings throughout the session and is now the second-best on-the-day performer after NZD, with AUD/USD trading about 0.7% back above the 0.7100 level.

The next significant area of resistance for traders to keep an eye on is in the 0.7170 zone, which has acted as both support and resistance since mid-January and also coincides with the 21 and 50-day moving averages. With the RBA policy announcement now old news, AUD/USD is free to focus back on US themes, such as data and Fed speak. There has already been plenty of both this week and will be plenty more in the coming days.

The pair was unfazed by a slightly stronger than expected ISM manufacturing PMI survey that still showed the headline index dropping to its weakest since November 2020 and ignored a surprise rise in monthly job openings in December. While Thursday’s ISM Services PMI survey will also be worth watching, the main event of the week will be Friday’s US jobs report. Fed speakers have been emphasising a new data-dependent approach to determining the pace at which the bank tightens policy in 2022 and beyond.

If Friday’s jobs report contains fresh signs of build wage pressures and of a further tightening of the labour market, that could encourage money markets to start pricing in the chance of a 50bps hike in March again. Of course, this presents downside risks to AUD/USD towards the end of the week and should any Fed-related dollar strength come surging back, traders will be looking for a retest of January lows under 0.7000.

On Tuesday, the Reserve Bank of Australia (RBA) kept rates unchanged and announced the end of its QE program. According to analysts at Well Fargo, the RBA made a modestly hawkish shift. They anticipate modest weakness in the Australian dollar versus the greenback over the medium term.

Key quotes:

“Australia's economy appears to be on a sturdy upturn, with a rebound in activity and quickening of inflation in the final quarter of 2021. Despite some near-term uncertainties, we believe these more solid economic trends can continue in 2022.”

“We believe inflation will remain elevated in the coming quarters and that by late this year the RBA will be confident enough to begin raising rates. Accordingly, we have made a modestly hawkish shift on our own monetary policy outlook, and now forecast an initial 15 bps rate hike in November 2022 and a cumulative 100 bps of rate hikes in 2023.”

“We also forecast an additional 100 bps of rate hikes over the course of 2023. Next year we expect 25 bps rate hikes at each of the RBA's February, May, August, and November meetings, which would take the Cash Rate to 1.25% by the end of 2023. Still, even with a more timely path for monetary tightening, RBA rate hikes should still lag behind those of the Federal Reserve and fall short of monetary tightening currently priced in by market participants. Accordingly, even with an outlook for a solid Australian economy and slightly faster RBA monetary tightening, we still anticipate moderate weakness in the Australian dollar versus the greenback over the medium-term.”

Capital flows may help mitigate downward pressure on the Indian rupee during the next weeks according to analysts at MUFG Bank. They forecast USD/INR at 74.000 by the end of the first quarter and at 73.00 by the second quarter.

Key quotes:

“The magnitude of the Indian rupee’s depreciation against the US dollar in January was the largest since September 2021, mainly driven by US dollar strength on rising market expectations of a more hawkish Fed, higher oil prices, and net equity outflows in part due to a potential delay in the launch of India’s largest IPO beyond March.”

“Downside risks for the rupee have risen as market expectations of more aggressive Fed tightening may result in more capital outflows in the near term, which could be exacerbated by the lack of a substantial pick-up in IPO-related inflows should there be delays in IPO launches. Downward pressure on the rupee can still be mitigated by net inflows into the bond market towards end-Q1 in anticipation of the potential inclusion of Indian sovereign bonds into a few global bond indices, followed by passive inflows following the official announcement.”

“With economic activity affected in the short term, we think it is premature for the RBI to raise the benchmark repo rate as soon as the next meeting on 9th February despite higher levels of inflation. But we think the RBI is likely to take more concrete action to mop up excess liquidity by hiking the reverse repo rate by 20bps to 3.55% in February, thereby narrowing the interest rate corridor.”

Economists at ING think that the European Central Bank (ECB) could disappoint the market’s hawkish expectations and send EUR/USD back to the 1.1200 support.

Downside risks from hawkish expectations

“We think that patience will prevail over panic in the ECB’s message when it comes to inflation, and given the bar for a hawkish surprise is placed quite high after this week’s consumer price index figures, we expect EUR/USD to give up some of its recent gains after the ECB announcement.”

“We expect the pair to pull back to the 1.1200 support, with any recovery in the dollar set to trigger a break below that level.”

Atlanta Fed President Raphael Bostic said on Tuesday that there is a "real danger" of inflation expectations drifting from the Fed's 2.0% target to 4% or higher. If current levels of Fed support are left in place, he added, it could fuel more inflation and thus warrant action "soon" to reduce accommodation.

Additional Remarks:

"The business response to what appeared short-term supply and other problems could change the long-run path of inflation."

"Businesses are now seeking "redundant suppliers" to buffer against future disruptions, adding to their costs."

"The goal of coming policy actions is to ensure expectations about inflation don't become untethered."

"There is a "real danger" of expectations drifting from the Fed's 2% to 4% or higher."

"The pandemic induced price changes could "grind on" long enough to "fundamentally alter" how the public thinks about inflation."

"I will be watching monthly changes in inflation to see if they decline... ready to support more aggressive steps if the pace increases."

- Oil remains supported close to multi-year highs with WTI currently above $88.00 per barrel.

- Speculation about a larger than 400K BPD OPEC+ output hike from March hasn’t weighed on prices.

Oil prices have continued to trade close to multi-year highs and within recently established ranges on Tuesday, with front-month WTI futures undulating between lows in the $86.00s and highs in the $88.00s. At current levels just above $88.00 per barrel, WTI is trading flat on the day and is less than $1.0 below the seven-year highs printed back last Friday at $88.82. Traders were passing round/discussing a note from Goldman Sachs on Tuesday that suggested that OPEC+ could add more supply than expected at the coming meeting amid high oil prices.

OPEC+ meet later in the week to set policy and sources had previously indicated that the group would in March stick to their current policy of increasing oil production quotas by 400K barrels per day each month. However, Goldman Sachs flagged the risk that the group goes further than adding 400K additional daily barrels, saying “we view growing potential for a faster ramp-up at this meeting, given the pace of the recent rally and the likely pressure from importing nations”. They said the outcome of the meeting remained “evenly balanced” between a larger than 400K output hike versus and a continuation of the current policy.

Speculation of a larger supply increase hasn’t dented oil prices. Indeed, OPEC+’s Joint Technical Committee, who always meet the day before the OPEC+ oil ministers, just wrapped up and did not discuss a larger than 400K barrel per day output hike in March, suggesting that a larger hike is unlikely. Meanwhile, even if the group did surprise with a larger than expected output hike announcement later this week, doubts remain about the ability of smaller OPEC+ producers to meet their rising output quotas. A Reuters survey released on Tuesday showed that OPEC+ production in January was 824K barrels per day lower than allowed by the group’s output quotas.

Elsewhere, analysts continue to cite ongoing geopolitical tensions (Ukraine/Russia/NATO), a lack of progress in nuclear negotiations between Western powers and Iran about a potential easing of the latter’s oil export sanctions and robust/recovering global demand as supportive for oil prices. Looking ahead, US weekly private API oil inventory figures are released at 2130GMT and are expected to show another build.

- After several losses held since January 21, the white metal rebound climbs 1.07%.

- A risk-on market mood weighs on the US dollar.

- XAG/USD remains downward biased, which could be cemented by a positive Friday Nonfarm Payrolls report.

Silver (XAG/USD) finally recovered after printing seven straight down days, approaching $23.00, as the North American session begins. At the time of writing, XAG/USD is trading at $22.74. In the meantime, US T-bond yields remain unchanged at 1.78%, while the USD slides 0.21%, sitting at 96.34.

The risk-on market mood keeps investors looking towards riskier assets. Meanwhile, the US dollar has been getting a beating since Monday. The greenback has lost 1.16% after piercing the 97.00 figure for the first time since July 8, 2021.

Fed speakers continue to drive US Dollar

Before Wall Street opened, the Philadelphia Fed President Harker crossed the wires. Harker commented that the Fed is not behind the curve, and he expects a rate hike of 25 basis points, four in the year. Concerning the balance sheet reduction, he said that the US central bank could begin the Quantitative Tightening (QT) once the Federal Funds Rates (FFR) hit 1% to 1.25%.

At 19:30 GMT, St. Louis Federal Reserve President James Bullard (voter 2022) would hit the wires.

Meanwhile, the US economic docket featured the US IHS Markit Manufacturing PMI which came at 55.5 higher than the 55.0 expected. Crossing the wires at press time, the ISM Manufacturing PMI for January came at 57.6, a tick higher than the 57.5 expected. Digging a little deeper on the ISM report, Manufacturing Prices crushed the expectations, rising to 76.1 from 68.1 estimated, while the ISM Manufacturing Employment increased to 54.1 from 53.9 in the previous month.

XAG/USD Price Forecast: Techincal outlook

The XAG/USD remains downward biased, despite the 1,30% jump in the day. The upward move fell short of the $23.00 figure, attributed to the release of US macroeconomic news. Nonetheless, the downward move was capped by a two-month-old upslope support trendline, drawn from December lows, around the $22.50-65 area.

In the event of extending the downtrend, the first support would be the aforementioned trendline, which once breached would expose the January 28, daily low at $22.15. A break below that level would expose the January 7 swing low at $21.94, followed by December 2021 swing low at $21.42.

Contrarily to the upside, XAG/USD first resistance is the 50-DMA at $22.88. If that level gives way for silver bulls, that could send prices towards the 100-DMA at $23.21, followed by the January 3 daily high at $23.40.

- Mexican peso adds to weekly gains versus the US dollar.

- The greenback continues to correct lower, gains strength after US data.

- Key support in USD/MXN seen at 20.50, resistance at 20.70.

The USD/MXN is falling on Tuesday for the second day in a row, although it moved off lows during the American session. The pair bottomed at 20.50, the lowest since January 24 and then bounced to 20.60 following US data.

Price action continues to be driven by the US dollar. The greenback is correcting lower across the board after last week’s rally. The move to the downside lost momentum following the ISM Manufacturing report as US yields rebounded sharply to the upside. On Friday, the NFP report is due.

Emerging market currencies trimmed gains during the last hours but remain in the positive ground taking into account the last five trading sessions, on the back of the recovery in risk appetite. The performance of the Mexican peso has been below average.

Short-term outlook

The area around 20.50 is a strong short-term support that also contains the 20-day simple moving average. A daily close below could clear the way to more losses, with the following support seen at 20.40 followed by 20.30.

On the upside, the key resistance is located at 20.70 which should limit the upside. If the dollar breaks higher, it could recover the positive bias in the short term. The next key level stands at 20.85.

USD/MXN daily chart

Economists at Rabobank maintain the forecast of a grind towards EUR/USD 1.10 by the middle of the year. But they highlight the risk of pullbacks for the greenback due to the prevalence of long positions and the potential pace of Fed rate hikes this year.

USD to be sensitive to any data disappointments

“While we are on the view that EUR/USD can meander to the 1.10 area by the middle of the year as Fed tightening kicks off, we remain of the view that pullbacks may be an inevitable part of the USD outlook in the coming months.”

“If the Fed tightens policy too quickly, the risk of a hard-landing increases. This would not bode well for the medium-term outlook for the USD as the market could again be focussed on policy accommodation from the Fed in the not too distant future.”

“While the current strength of the US economy is ensuring that recession is only considered to be a tail-risk by most commentators, the build-up of long USD positions in recent months suggests that the USD is set to be sensitive to any data disappointments.”

- There were 10.925M job openings in the US at the end of December, more than the 10.3M expected.

- The data strengthens the narrative that labour demand in the US is currently very strong.

The number of job openings on the last business day of December rose to 10.925 million, the US Bureau of Labor Statistics announced in its latest Job Openings and Labor Turnover Summary (JOLTS) on Tuesday. This reading came in above market expectations for a drop to 10.3 million from November's 10.775 million reading, which had been revised up from 10.562 million.

Market Reaction

The dollar seems to have seen a modestly positive reaction to the latest stronger than expected JOLTs data, with the DXY jumping from the 96.30s to the 96.40s. The data strengthens the narrative that labour demand in the US is currently very strong.

- ISM Manufacturing PMI fell to its weakest since November 2020 in January at 57.6.

- The Employment subindex hit its highest since last March.

According to a survey compiled by the Institute of Supply Management, US Manufacturing PMI fell to 57.6 in January from 58.7 in December. That was a little higher than the expected reading of 57.5, but nonetheless and marked the weakest reading since November 2020.

Subindices:

- Prices Paid rose to 76.1 from 68.2.

- New Orders fell to 57.9 from 61.0, its lowest since June 2020.

- Employment rose to 54.5 from 53.9, its highest since March 2021.

Market Reaction

FX markets did not seemingly react too much to the latest ISM figures.

- DXY remains well on the defensive in the low-96.00s.

- US yields remain largely range bound on Tuesday.

- Markit’s final Manufacturing PMI came at 55.5 in January.

Sellers remain well in control of the sentiment around the greenback and drag the US Dollar Index (DXY) to new 4-day lows in the 96.25/20 band.

US Dollar Index offered ahead of key data

The index extends the rejection from last week’s fresh cycle tops near 97.50, although the downside appears to have met some decent contention in the proximity of 96.20 on Tuesday.

In the US money markets, yields seem to be picking up some pace across the curve and manage to leave behind part of the recent pessimism. Indeed, the short end keep the upper bound of the range intact near 1.18%, while the belly flirt with the 1.80% yardstick.

In the US docket, the final Markit’s Manufacturing PMI came a tad better than estimates at 55.5 for the month of January, all ahead of the key ISM Manufacturing PMI to be released soon.

US Dollar Index relevant levels

Now, the index is losing 0.30% at 96.36 and a break above 97.44 (2022 high Jan.28) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.09 (55-day SMA) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).

- EUR/USD keeps the trade in the upper end of the range.

- German 10y Bund yields return to the positive territory near 0.02%.

- US ISM Manufacturing PMI next of note in the US docket.

The single currency keeps the upbeat note intact so far in the session and motivates EUR/USD to navigate near recent peaks in the 1.1270/80 band on Tuesday.

EUR/USD now looks to US data

The persevering offered stance in the dollar continues to sustain the quite strong upside momentum in EUR/USD, which already trades in 4-day highs near 1.1280, an area coincident with the 10-day SMA.

The decline in the buck comes amidst another negative session in US yields vs. the mixed performance in the German money market, where yields of the key 10y Bund alternates gains with losses near 0.02%.

Furthermore, positive releases in the domestic docket also lend legs to the pair ahead of the key US ISM Manufacturing PMI and the final Markit’s Manufacturing PMI due later in the NA session.

EUR/USD levels to watch

So far, spot is gaining 0.32% at 1.1268 and faces the next up barrier at 1.1278 (weekly high Feb.1) seconded by 1.1304 (55-day SMA) and finally 1.1369 (high Jan.20). On the other hand, a break below 1.1121 (2022 low Jan.28) would target 1.1100 (round level) en route to 1.1000 (psychological level).

- Canada Manufacturing PMI fell slightly to 56.2 in January, remaining in robust territory.

- The loonie did not react to the broadly in line with expected data.

Canadian Manufacturing PMI fell to 56.2 in January, indicating continued robust growth in the manufacturing sector. That marked a slight drop from December's 56.5 reading and was a little below expectations for 56.9.

IHS Markit Economic Commentary:

- "Another robust improvement in operating conditions was recorded in Canada's manufacturing sector with the PMI at 56.2 at the start of the year. The headline figure reflected favourable demand conditions, rising employment levels and growth in inventories.

- "Additionally, price pressures showed further signs of easing, with rates of output and input price inflation moderating to ten- and 11-months lows, respectively.

- "That said, COVID-19 yet again hit performance with output growth slowing notably. Tighter restrictions, among other issues, led to weak input availability and poor transportation conditions.

- "Nevertheless, there is a further indication that restrictions will start to ease across the provinces in the months ahead. Fortunately, Canada boasts a high vaccination rate, which has allowed for growth to continue in the manufacturing sector despite a resurgence in cases.”

Market Reaction

The loonie does not appear to have reacted to the latest broadly in line with expected PMI results.

EUR/USD keeps advancing on Tuesday. The pair could keep advancing in the near-term, but the longer-term perspective favors the downside, in the view of economists at Scotiabank.

EUR/USD set to remain in a 1.12-1.14 range

“The EUR’s recovery from the low 1.11s on Friday now seems on track to test its 50-day MA of 1.1307 that stands as resistance alongside the figure zone; 1.1335/50 follows.”

“The relatively quick recovery of the 1.12 handle for the EUR over the past two sessions averts, for now, a move to 1.10 but the broader technical picture remains negative.

“EUR/USD looks set to remain in a 1.12-1.14 range.”

“Support is 1.1250 and 1.1225 ahead of the figure.”

Cable’s three-day positive streak has taken it to near a test of its 100-day moving average (DMA) of 1.3518. A break above here and a subsequent test of the 1.36 level is crucial to see further gains, economists at Scotiabank report.

Failure to break past the 1.35 figure zone to lead to a test of 1.3450

“Buying pressure on the drop under 1.34 has lifted the GBP but a break above the 100-DMA at 1.3518 and then a test of 1.36 will be key to judge whether the pound may reverse its broadly bearish trend since last summer.”

“A failure to break past the 1.35 figure zone could see the GBP head to a test of support at 1.3450 followed by the 1.34 area.”

“Resistance past the figure and the 100-day MA follows at the 1.3550/65 zone and then 1.36.”

- The British pound climbs in the North American session, 0.34%.

- The market sentiment is mixed as European stocks rise while US futures point towards a lower open.

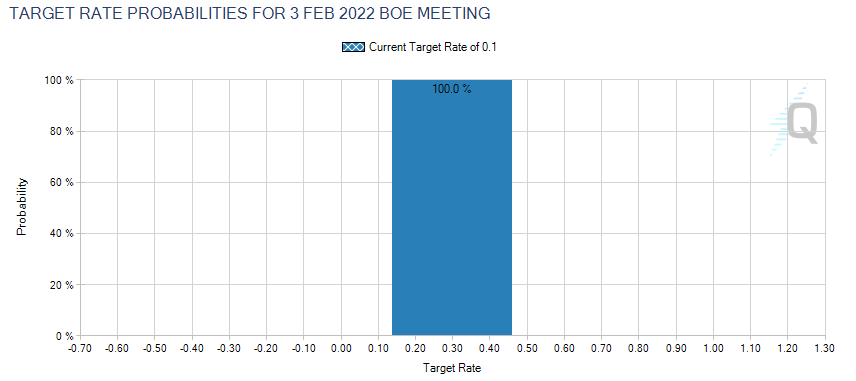

- BoE’s 25 basis points rate hike is fully priced in by investors.

- The GBP/USD remains downward biased, as it failed to breach above the 100-DMA.

After ending January with losses of 0.65%, the British pound snaps three-day losses, climbing 0.31%. At the time of writing, the GBP/USD is trading at 1.3495, though retreating from the 100-day moving average (DMA) lying at 1.3514. As depicted by European stock indices rising, the market sentiment is mixed, but US equity futures underpins the cash market towards a lower open.

Bank of England (BoE) expected to post back-to-back rate hikes

In the meantime, money market futures, as shown per the CME Group BOEWATCH tool, 100% of market participants expect an increase of 25 basis points, from 0.25% to 0.50%. Sources cited by CNBC said that “With the Bank Rate reaching 0.5%, we expect the MPC to confirm that all APF (asset purchase facility) reinvestments will cease following the February decision.”

Source: CME Group

Meanwhile, the Philadelphia Fed President Harker crossed the wires. He commented that the Fed is not behind the curve, and he expects a rate hike of 25 basis points, four in the year. Concerning the balance sheet reduction, he said that the US central bank could begin the Quantitative Tightening (QT) once the Federal Funds Rates (FFR) hit 1% to 1.25%.

The UK economic docket featured the BoE Consumer Credit, Mortgage Approvals for December. The former came at £0.8B in line with expectations, while the latter rose to 71.051K, higher than the 66K foreseen. Concerning the Market Manufacturing PMI Final for January, increased to 57.3, a tick more elevated than the 56.9 estimated, though trailed the previous month 57.9, showing some slowing, due to the Omicron hit.

Across the pond, Manufacturing PMI released by IHS Markit and the ISM for January will be closely watched by GBP/USD traders. That alongside the JOLTs Job Opening for December could shed some light, in anticipation of Thursday’s Jobless Claims and Friday’s Nonfarm Payrolls report.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is downward biased. During the European session, the pair retreated at the 100-day moving average (DMA) at 1.3514, but any downward moves might be capped by the 50-DMA lying at 1.3418.

To the upside, the GBP/USD will face resistance at 1.3500, followed by the 100-DMA at 1.3514 and an eight-month-old downslope trendline around the 1.3530-40 region. On the flip side, the 50-DMA at 1.3418 is the first support level, followed by the 1.3400 figure, and then the YTD low at 1.3357.

The loonie recovers ground after strong close Monday sets up a test of the 1.2650 mark, economists at Scotiabank report.

Resistance intraday now seen around 1.2700/15

“The low close on the day for the USD/CAD Monday formed a bearish ‘engulfing line’ on the daily chart; additional losses today will ‘confirm’ the reversal and put a little more pressure on the mid-1.26 support zone.”

“We expect resistance intraday now around 1.2700/15.”

“A break under 1.2650 targets 1.2570.”

- NZD/USD pushed above 0.6600 on Tuesday as the kiwi outperformed in wake of strong NZ trade data and USD weakness.

- Upcoming US data and Fed speak is in focus ahead of key Q4 NZ labour market metrics.

Decent trade figures, which saw New Zealand’s monthly trade deficit post a significantly larger than expected decline in December to under N$ 500M (versus forecasts for N$ 700M) from previously above N$ 1B, are helping NZD to outperform on Tuesday. Up around 0.6% on the day versus the struggling US dollar, the kiwi is one of the best performing G10 currencies alongside NOK and CHF, enough to catapult NZD/USD back above the 0.6600 level.

The dollar, meanwhile, is suffering from a combination of factors including better risk appetite, profit-taking following last week’s surge and a modest paring back on hawkish Fed bets. Fed speakers this week have so far all backed rate hike in March and while none have ruled out a 50bps move, all said a 25bps hike was their base case. Meanwhile, Fed policymakers have been cautious in their remarks about further tightening later in the year. Most expressed a desire to keep their options open to accelerate or decelerate the pace of tightening dependent on economic conditions.

NZD/USD traders did not seem particularly fussed by Fed policymaker Patrick Harker’s latest remarks, which broadly fit into the above categorization. Focus now shifts to US data in the form of the January ISM Manufacturing survey out at 1500GMT ahead of more Fed speak in the form of remarks from St Louis Fed President James Bullard at 1930GMT. Then, at the start of Wednesday Asia Pacific trade at 2145GMT, Q4 2021 New Zealand Employment Change, Unemployment Rate and Labour Cost Index figures will be released. Strong figures could fuel NZD strength if RBNZ tightening bets get a boost. One local NZ bank recently predicted the RBNZ hiking rates to 2.5% by November.

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 15:00 GMT this Tuesday. The index is anticipated to decline further from 58.7 in the previous month to 57.5 in January – marking the third successive month of fall. Nevertheless, the gauge will provide a fresh insight into the manufacturing sector activity and the performance of the economy as a whole.