- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 05-08-2022

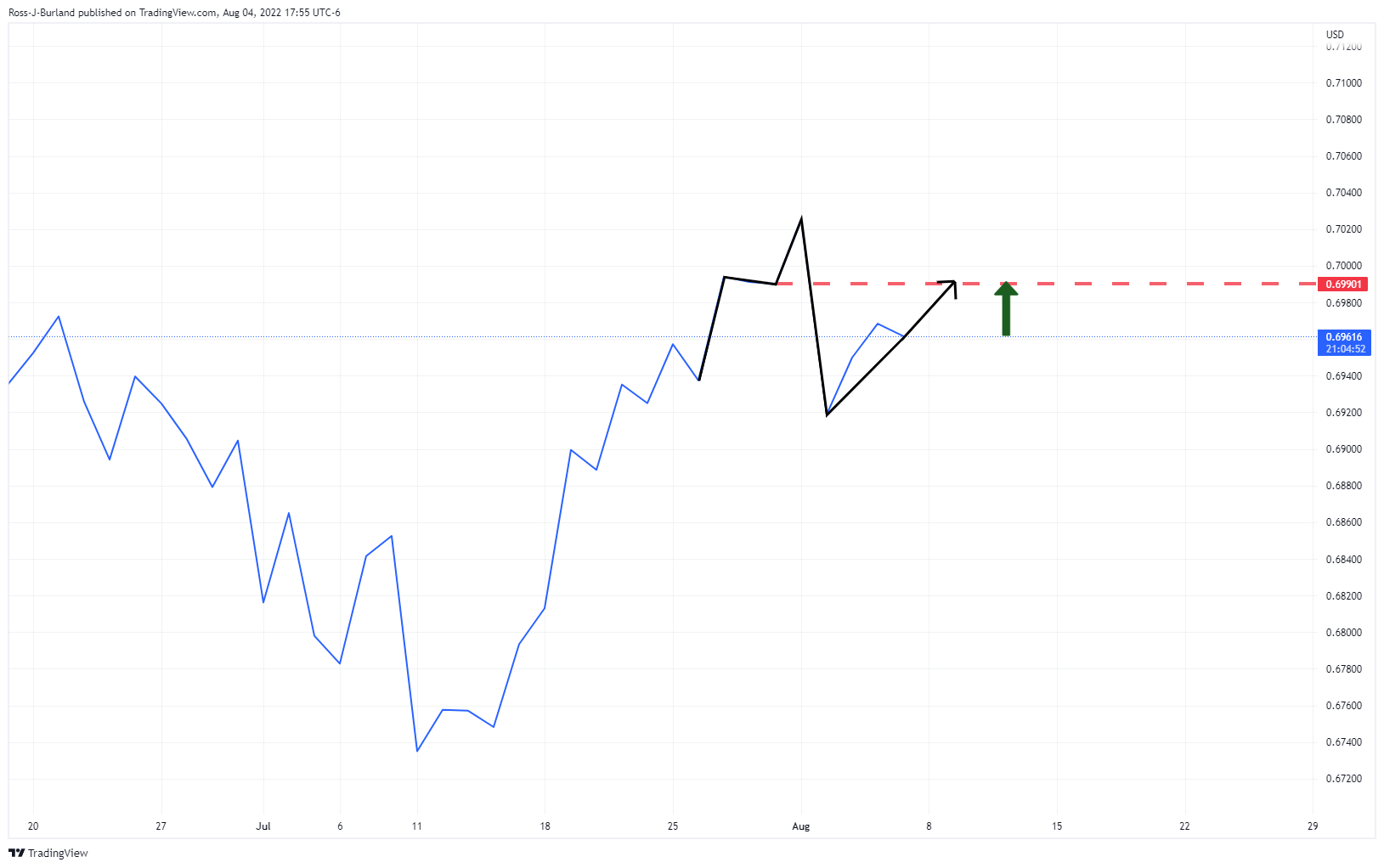

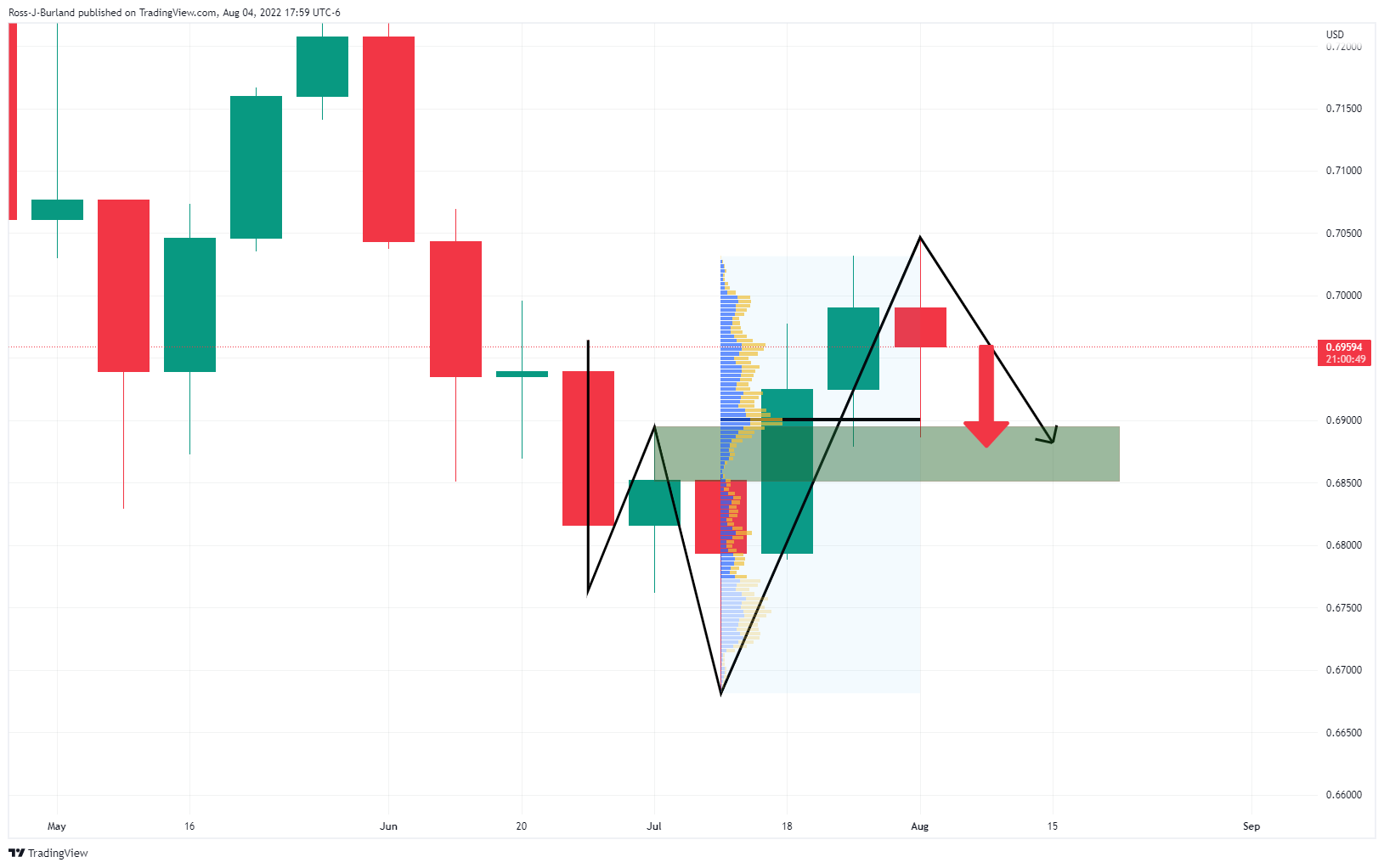

- AUD/USD is about to finish the week with losses of 1.10%.

- A bearish-engulfing candle pattern and the RSI’s crossing below 50 are two reasons that could tumble the AUD/USD.

- AUD/USD sellers eye a break below 0.6900, on its way towards 0.6800.

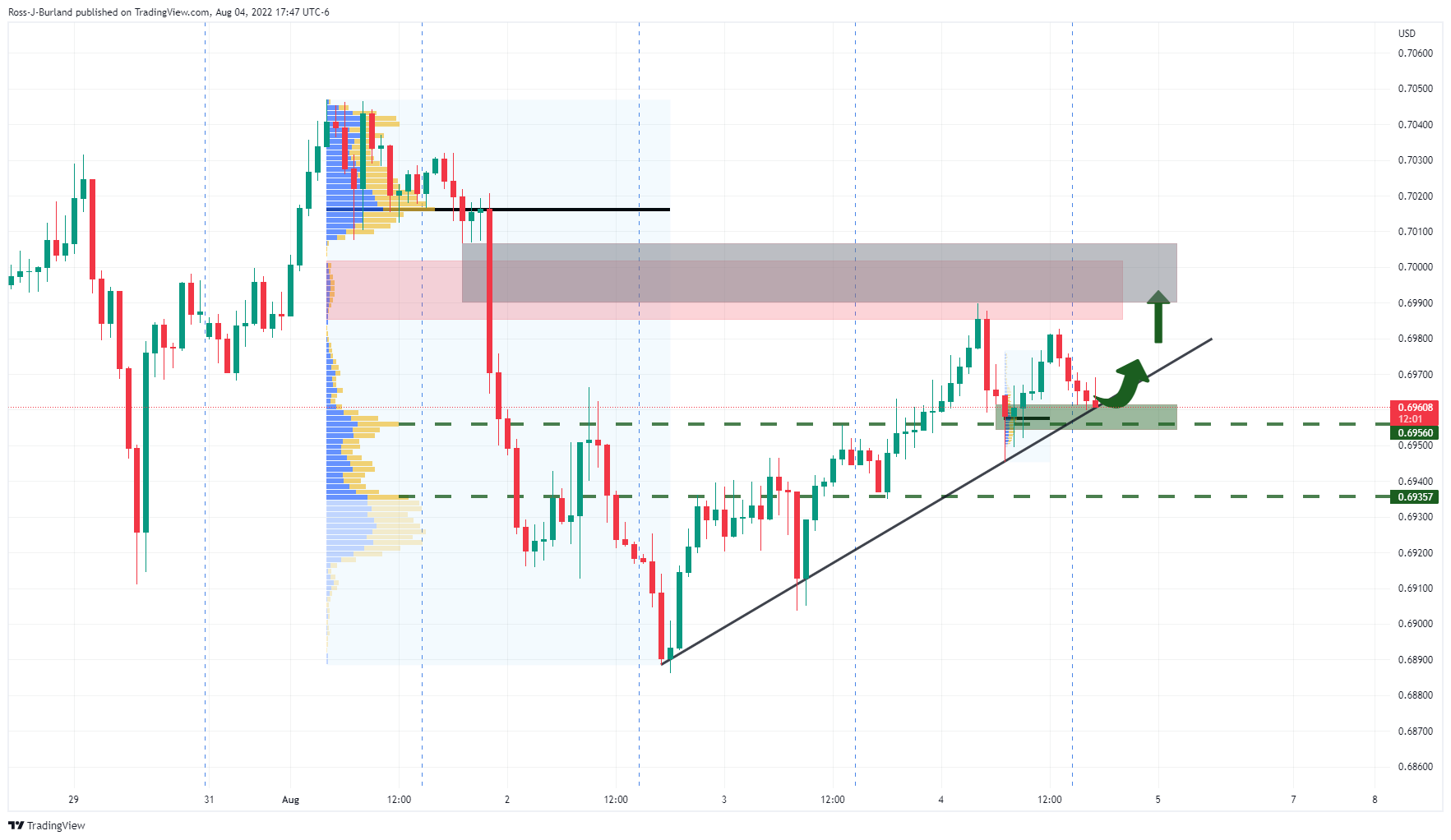

The AUD/USD drops substantially, courtesy of upbeat US economic data, which sent the major plunging from daily highs around 0.6974 towards the day’s lows at 0.6869, though as Wall Street closed, the Aussie trimmed some of those losses. At the time of writing, the AUD/USD is trading at 0.6910, down 0.82%.

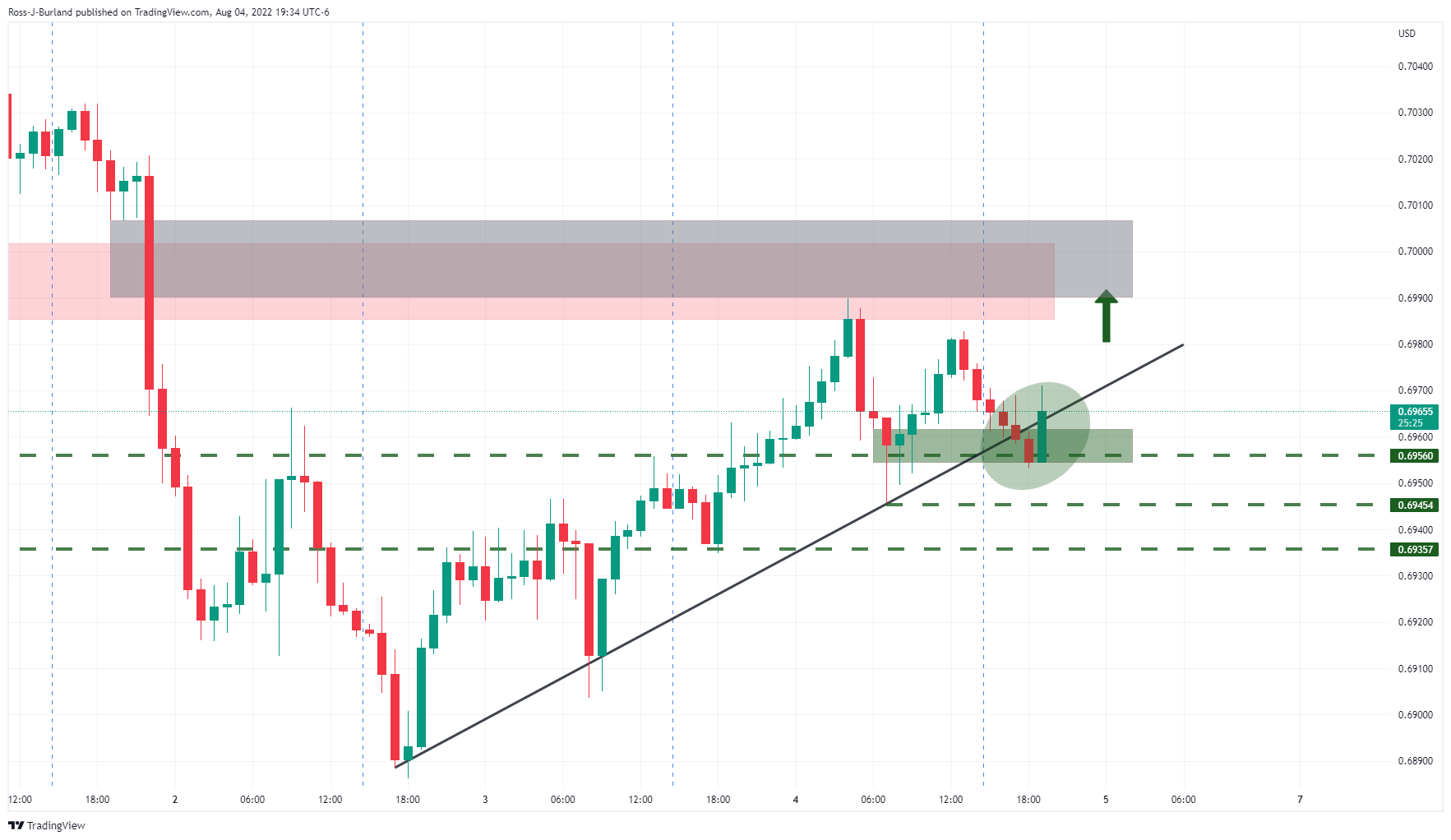

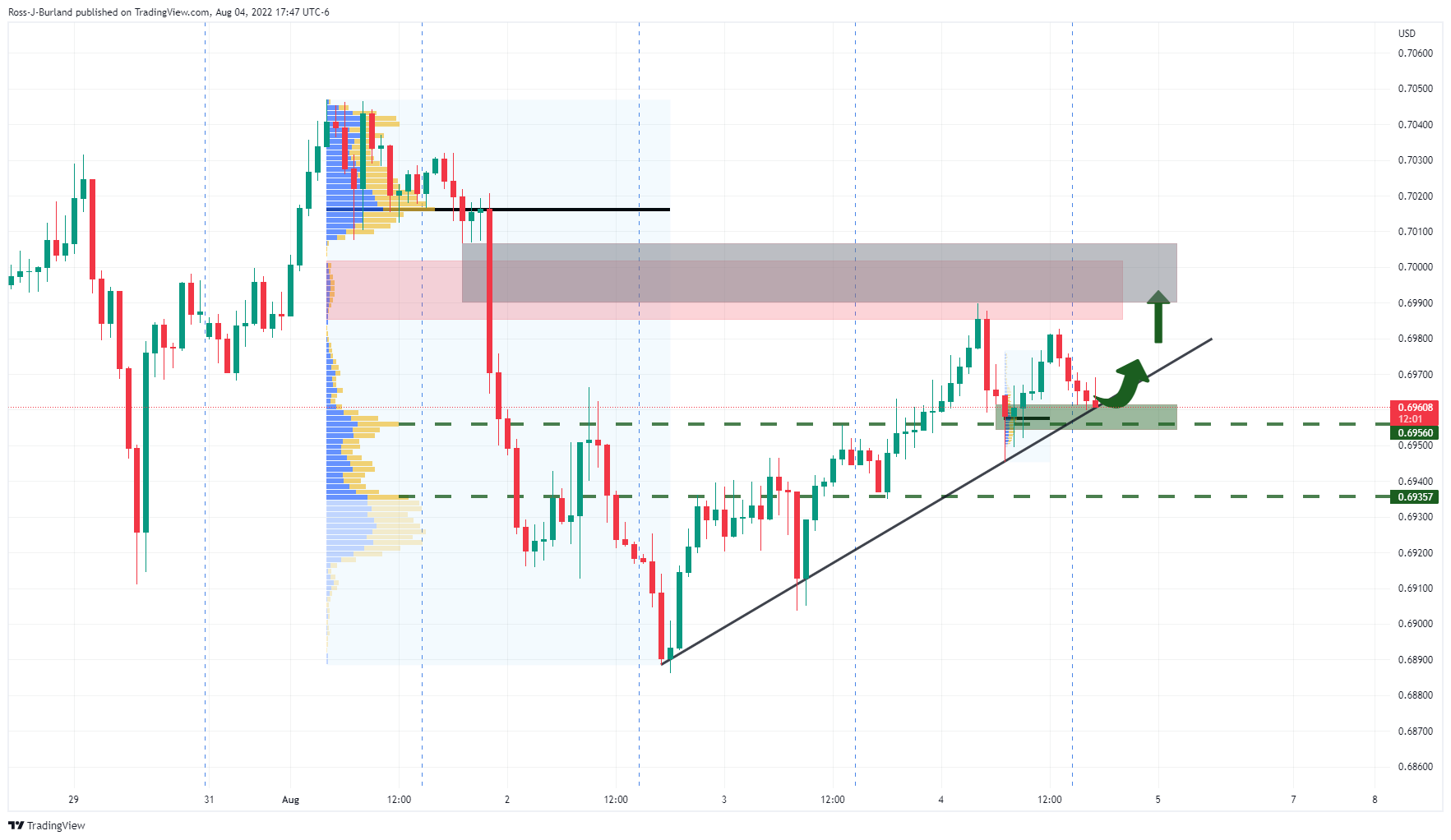

AUD/USD Price Analysis: Technical outlook

The AUD/USD daily chart portrays the pair below the confluence of the August 4 low and the 50-day EMA around 0.6952. It’s worth noting that earlier, the major dived below the intersection of a five-month-old downslope trendline and the 20-day EMA, around 0.6892, but it was short-lived and bounced toward current exchange rates.

Still, the AUD/USD is downward biased for some reasons: first, the Relative Strength Index (RSI) just crossed below the 50-midline, indicating sellers are gathering momentum. And the second reason would be that the last two-daily candles formed a bearish-engulfing candle pattern, implying that sellers outweighed buyers.

Therefore, the AUD/USD path of least resistance is downwards, and the pair’s first support would be the 0.6900 figure. Once cleared, the next stop will be the 20-day EMA at 0.6892, followed by the 0.6800 mark.

AUD/USD Key Technical Levels

- The EUR/USD snaps two straight weeks of gains, drops 0.42%.

- The common currency is trendless, within the boundaries of 1.0096-1.0278.

- From a daily chart perspective, the EUR/USD might probe the 1.0096 low before a re-test of YTD lows below the parity.

The EUR/USD slumps late as Wall Street close looms, down by 0.62%, battered by an upbeat US employment report that bolstered the greenback while increasing the odds of another “jumbo” rate hike by the Fed in the September meeting. Meanwhile, the EUR/USD Is trading at 1.0180 at the time of writing.

EUR/USD Price Analysis: Technical outlook

The shared currency daily chart illustrates the pair consolidating within the 1.0096-1.0278 area. Although the US Nonfarm payrolls report underpinned the greenback, the EUR/USD stood tall and bounced off the daily low of 1.0141, reclaiming the 20-day EMA. Still, the major is subject to selling pressure, as the RSI shifted gears, aiming downwards, and crossed below its 7-day SMA, opening the door for further downside.

Hence, the EUR/USD first support would be the 20-day EMA at 1.0158. Break below will expose the bottom of the abovementioned trading range at 1.0096, which, once cleared, opens the way to refresh YTD lows below parity.

On the flip side, the EUR/USD first resistance is the 1.0200 figure. A breach of the latter will send the euro towards August’s 2 daily high at 1.0293 before probing the 1.0300 figure.

EUR/USD Daily chart

EUR/USD Key Technical Levels

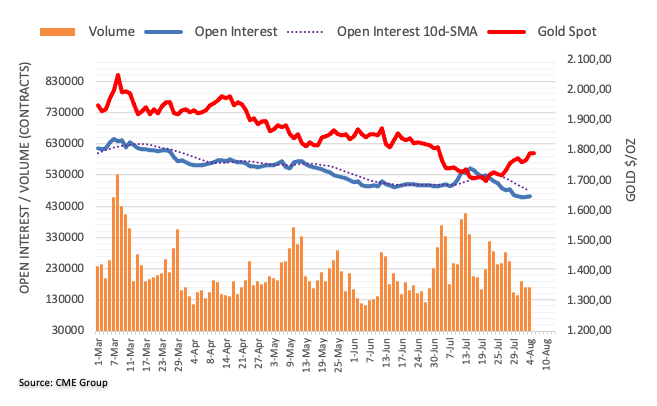

- Gold price extends its gains to three straight weeks, up 0.54%.

- Stellar US jobs data exerts further pressure on the Fed, as next week CPI is eyed.

- US-China tussles add further uncertainty to the global economic outlook.

Gold price remained on the defensive late during the New York session after an early US employment report showed that the Federal Reserve is “right” about pushing back on recession chatter. However, next week’s data, led by the Consumer Price Index (CPI), might signal that probably, Fed tightening is working. Meanwhile, XAUUSD is trading at $1773.33, down by almost 1%.

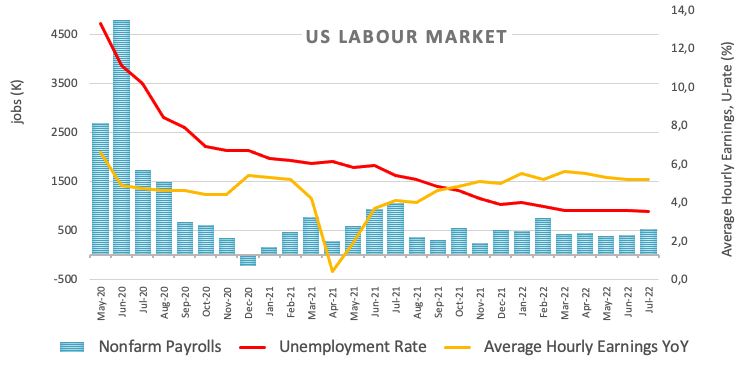

Before Wall Street opened, the US Bureau of Labor Statistics revealed that the July Nonfarm Payrolls report added 528,000 people to the labor market, crushing estimates of 250,000. Even June’s data was upward revised, from 325,000 to 398,000, while the Unemployment rate continued its downward path from 3.6% to 3.5%.

Regarding wages, namely Average Hourly Earnings, an essential component of the employment report and closely watched by the Fed, rose 0.5% MoM, topping 5.1% annually.

The financial market’s reaction saw the greenback jumping, as the US Dollar Index reached a daily high of around 106.930, while the US 10-year bond yield peaked at 2.869%. Additionally, money market futures expect a 75 bps rate hike for the September meeting, while the yellow metal slashed $35, hitting a daily low at $1764 a troy ounce.

Further, Fed officials crossed wires on Thursday. Loretta Mester, Cleveland’s Fed President, said a 75 bps rate hike for September is “not unreasonable.” Earlier in the week, the St. Louis Fed President James Bullard said he favors front-loading rate hikes, further cementing the case for the FOMC September meeting.

Elsewhere, tensions between the US and China, courtesy of US House Speaker Pelosi’s trip to Taiwan, weighed on the market’s mood. Once Pelosi’s visit finished, China conducted aggressive military drills around Taiwan and announced sanctions against Nancy Pelosi and her family on Friday.

Additionally, China announced it would halt cooperation with the US in some areas, including climate change and defense while sending warships across the Taiwan Strait’s median line.

Therefore, the yellow metal price would likely remain pressured. Unless gold buyers decisively lift the price above $1800, the non-yielding metal would be vulnerable to further selling pressure.

What to watch

Next week, the US economic calendar will feature the Inflation data, namely consumer and producer indices, Initial Jobless Claims, and the University of Michigan’s Consumer Sentiment for August.

Gold (XAUUSD) Key Technical Levels

At its latest meeting, the Reserve Bank of Australia (RBA) raised the key interest rate by 50 basis points to 1.85%. According to analysts at Wells Fargo, the RBA will likely raise again in September but with a 25 bps rate hike. They see the rate peak at 3.10% by early next year.

Key Quotes:

“The August announcement dropped previous references to "withdrawal of extraordinary monetary support". Instead, this phrase was replaced with more standard language that "the increase in interest rates is a further step in the normalization of monetary conditions in Australia." This new language hints that the RBA believes it is now a bit further along the monetary tightening path, and perhaps does not need to move at an accelerated 50 bps pace anymore—also a mildly dovish tilt.”

“In its Statement on Monetary Policy, the RBA indicated it is seeking to bring inflation down in a way that keeps the economy on an "even keel". We believe this language is also consistent with a more measured pace of rate hikes. Against this backdrop, we now expect the RBA to revert to a steady pace of consecutive 25 bps rate hikes at its next several meetings in September, October, November, December and February, which would bring the Cash Rate to 3.10% by early 2023.”

Analysts at Rabobank see risks that the GBP/USD pair may trade as low as 1.14 on a 1 to 3 month perspective. They warn that the scenario assumes another break below parity for EUR/USD.

Key Quotes:

“The Bank of England’s forecast of recession underpins the vulnerability of the pound going forward. The warnings on growth over-rode any support for the currency that may otherwise have been derived from the Bank’s 50 bps rate hike, the largest incremental move in 27 years. The UK is facing months of astoundingly high inflation levels faced by a period of disinflation during potentially 5 quarters of negative GDP growth. In politics, Liz Truss, the favourite to win the Tory party leadership race, continues her charm offensive aimed at Tory party members who will choose the next UK PM in September. Her policies, however, are not necessarily in line with investors’ needs. We see risk that cable could print as low at 1.14 on a 1 to 3 month view. This assumes a continued period of broad-based USD strength.”

“We recently reined back our 3 mth forecast for EUR/GBP to 0.84 from 0.86. That said, on the assumption that EUR/USD faces another break below parity on a 1 to 3 month view, we see scope for cable to head to 1.14.”

- The USD/JPY is soaring during the week by almost 1.50%.

- A bullish-engulfing candle pattern in the daily chart opens the door for further gains.

- In the near term, a pullback towards 134.00 is on the cards.

The USD/JPY rises for the third time during the week, reaching a fresh weekly high at 135.50, spurred by positive US jobs data released on Friday, which caused a knee-jerk reaction of almost 200 pips, from around 133.07 to its aforementioned weekly high. At 135.06, the USD/JPY gains 1.66%.

USD/JPY Price Analysis: Technical outlook

USD/JPY’s Friday price action shows that the major formed a huge bullish-engulfing candle pattern, meaning buying pressure is stepping in. At the same time, the exchange rate sits above the 50-day EMA at 134.84, which, decisively broken, could pave the way towards the 20-day EMA at 136.04. Worth noting that buyers are gathering momentum, as shown by the Relative Strength Index (RSI), about to cross the 50-central line, another reason for sellers to get out of the way once buyers have regained control.

Therefore, the USD/JPY’s first resistance would be the 135.00 figure, followed by the 20-day EMA at 136.04, and then the June 22 daily high at 136.71.

USD/JPY Daily Chart

Meanwhile, the USD/JPY hourly chart illustrates the major faced resistance near the R3 pivot at 135.60, dipping towards the R2 daily pivot point at 135.00, where bids keep the pair above the 135.00 figure. Nevertheless, the uptrend appears to be losing steam, as the Relative Strength Index reached overbought territory, meaning that buying pressure is easing, so a pullback towards the R1 daily pivot around 133.94 is on the cards.

USD/JPY Hourly chart

USD/JPY Key Technical Levels

- The GBP/USD prepares to finish the week with hefty losses of 0.78%.

- US labor data poured cold water on recession fears ahead of next week’s CPI.

- BoE’s Pill: The bank will reach its inflation target, but it “will take some time.”

The GBP/USD tanks reached a fresh weekly low at 1.2002 as a reaction to a stellar US employment report which eases US recession fears while increasing the odds for further Federal Reserve aggressive tightening amidst a 9% inflation in the country.

During the day, the GBP/USD peaked at around 1.2169, but as abovementioned, it tumbled. Still, the GBP/USD is trading at 1.2078, down 0.67%, though some 70 pips above the day’s low.

GBP/USD plunged on US data

Sentiment remains mixed, with most EU stocks closing with losses while US equities wobble. On Friday, the Department of Labor revealed that July Nonfarm Payrolls added 528K jobs to the US economy, smashing estimations of 250K. Additional data from the US jobs report illustrates that the labor market remains tight, with the Unemployment rate falling to 3.5% and Average Hourly Earnings increasing 0.5% MoM while, on an annual basis, rose by 5.2%

On Thursday, Cleveland’s Fed President Loretta Mester kept her hawkish stance. She said the rate path outlined by June dot plots is “about right,” while adding that a 75 bps for September is “not unreasonable.”

Elsewhere, the Bank of England Chief Economist Huw Pill crossed wires via Bloomberg. He said that the BoE would return to its 2% inflation target but added that “it’s going to be a process, which is going to take time reflecting the magnitude of shocks we’ve seen,” on Friday. Those remarks came one day after the “old lady” raised rates by 50 bps, the most in 27 years, lifting the Bank’s Rate to 1.75%, and warned that the UK might tap into a recession by the year’s end.

All that said, the GBP/USD prepares to finish the week with losses. The resilience shown by the US economy so far, with ISM PMIs holding the fort in expansionary territory and a solid labor market, paints a positive picture for the greenback. Contrarily, the stagflationary scenario looming in the UK, we can conclude that the Sterling’s weakness could remain towards the next week.

What to watch

Next week, the UK economic docket will feature RICS House Price Balance as the only market mover data. The US docket will feature the Inflation data, namely consumer and producer indices, Initial Jobless Claims, and the University of Michigan’s Consumer Sentiment for August.

GBP/USD Key Technical Levels

- US Dollar holds onto important daily gains after NFP.

- Employment reports boost US dollar and yields.

- EUR/USD heads for a modest weekly loss.

The EUR/USD bottomed on Friday at 1.0140 and then rebounded. The recovery of the euro was not strong enough to regain 1.0200. Near the end of the week, the pair looks vulnerable, on the back of a stronger US dollar.

The July employment report showed the US economy added 528K jobs, much more than expected. US yields jumped after the report boosting the greenback across the board.

After NFP, the key report next week will be US inflation numbers. The July CPI is due on Wednesday and a monthly 0.2% increase is expected. On Thursday the PPI will be released. The numbers will be critical for Fed rate expectations. The employment report left the doors open to aggressive tightening.

Another week in the range

Despite the FOMC and the NFP, the EUR/USD continues to move sideways, as has been the case since mid-July. The euro continues to be rejected from near the 1.0280 zone while at the same time is keeps finding support around 1.0100.

“The weekly chart shows that the long-term bearish stance remains intact. Technical indicators hold within negative levels, the Momentum advancing but the RSI extending its consolidation at around 31. At the same time, the 20 SMA heads south almost vertically, roughly 350 pips above the current level but over 800 pips below the longer ones, a sign of bears’ dominance”, explains Valeria Bednarik, Chief Analysts at FXStreet.

According to Bednarik, a break below 1.0105 will open the door for a retest of parity. On the upside, she argues “EUR/USD would need to accelerate through 1.0280 to shrug off the negative stance and extend its recovery towards 1.0360 first and en route to 1.0440 then.”

Technical levels

- The USD/CHF is snapping two consecutive weeks of losses, gaining 1.37%.

- From the daily chart perspective, the major is headed upwards and will test resistance around 0.9669-75.

- If USD/CHF buyers conquer 0.9642-50, a move towards 0.9703 is on the cards.

The USD/CHF is surging during the North American session after hitting a daily low early in the Asian session at 0.9538. Still, positive US economic data spurred a jump towards the daily high at 0.9644, shy of the weekly high at 0.9651. At the time of writing, the USD/CHF is trading at 0.9638.

USDCHF Price Analysis: Technical outlook

The USD/CHF daily chart illustrates the pair as upward biased, further reinforced by the Relative Strength Index, crossing above the 50-midline, displaying that buyers are gathering momentum as the exchange rate approaches a substantial resistance area at the confluence of the 20 and 50-day EMAs, in the 0.9660-75. A decisive break would clear the way towards the July 14 daily high at 0.9886.

In the 4-hour scale, the USD/CHF tests the confluence of the 100, 200-EMAs and the R2 daily pivot point, in the 0.9642-52 area, which ounce cleared, could pave the way for the USD/CHF towards the July 22 high at 0.9703. Even though it’s a clouded area, the Relative Strength Index reading at 64 still has some room to spare if buyers step in to push prices higher.

On the other hand, if USD/CHF resistance holds, the major could dip towards the R1 pivot point at 0.9600.

USDCHF Key Technical Level

The Canadian employment reports showed an unexpected negative change in July. Analysts at CIBC point out that while the figures muddied the waters further for policymakers, the Bank of Canada will likely focus on the historic low unemployment rate and still strong wage growth to justify another non-standard rate hike at its next meeting.

Key Quotes:

“The jobs tally fell (-31K) for a second consecutive month in July, although with labour force participation also declining the jobless rate held steady at a historic low of 4.9%. The drop in employment was roughly evenly distributed between part-time and full-time, and was driven in large part by a decline in public sector paid employment. Self-employment rose on the month, although not by enough to offset the big decline seen in June.”

“Employment fell for the second successive month in July, in what would typically be a sign of a slowing economy and potential easing of future inflationary pressure. However, at the same time labour market participation has fallen, the unemployment rate remains at a historic low and wage growth is still well above its pre-pandemic norms. Those trends would add to inflationary concerns. We suspect that for now the Bank of Canada will focus mainly on the record low unemployment rate, and deliver a further non-standard interest rate hike at its next meeting.”

The July US official employment report showed better-than-expected numbers and triggered a rally of the US dollar on Friday. According to analysts at Wells Fargo, at least a 50 bps rate hike at the September 20-21 FOMC meeting seems likely at this point in time, and yet another 75 bps hike could be in store if inflation over the next two inflation reports shows no signs of trending lower.

Key Quotes:

“If the U.S. economy is in a recession, no one seems to have told employers. Nonfarm payroll growth in July was more than double the Bloomberg consensus, registering a 528K monthly gain. This marked the second fastest pace of job growth in 2022. Employment growth was broad-based with nearly all major sectors adding jobs in the month. Average hourly earnings data added further fuel to the fire, increasing 0.5% in the month and 5.2% over the past year. The unemployment rate fell a tenth of a percentage point to 3.5%, which matches the 50-year low reached in 2019.”

“The economic data are sending mixed messages at present, and the white-hot payroll numbers look increasingly out-of-line with other data points. That said, employment growth of more than half a million jobs per month and a falling unemployment rate are hard to ignore, and we suspect this data will give the FOMC the confidence it needs to push ahead aggressively with its fight against inflation. At least a 50 bps rate hike at the September 20-21 FOMC meeting seems likely at this point in time, and yet another 75 bps hike could be in store if inflation over the next two CPI reports shows no signs of trending lower.

- US Payrolls rise above expectations in July.

- Japanese yen drops sharply as US yields soar.

- EUR/JPY rebound more than 400 pips from the weekly lows.

The EUR/JPY jumped following the release of a better-than-expected US employment report. The cross rose to 137.75, reaching the highest level in a week. It is hovering around 137.50, holding onto strong daily gains.

From the weekly low EUR/JPY has gained more than 400 pips. The sharp rebound weakened the negative outlook for the pair. On the upside, the next key resistance is at 137.90, the 20-week Simple Moving Average. A weekly close above that level should open the doors to more gains.

On Friday, EUR/JPY is rising for the fourth consecutive day boosted after the release of US employment data. Non-farm payrolls rose by 528K above the 250K expected. The numbers triggered a decline in Treasuries that weighed on the yen.

The Japanese currency tumbled across the board even as equity prices in Wall Street declined hit by higher US yields. The US 10-year yield rose from 2.70% to 2.84%.

EUR/JPY’s rally on Friday is being driven by a weaker yen. EUR/USD tumbled following NFP, falling from 1.0220 to levels under 1.0150. At the same time, USD/JPY jumped from 133.20 to 135.35.

Technical levels

- Silver price hits a daily low of $19.55 in a knee-jerk reaction to the US employment report.

- The US economy added 528K new jobs, so US bond yield surged, a headwind for precious metals.

- Silver Price Forecast (XAGUSD): Failure to break above $20.40 will keep silver exposed to sellers.

Silver price dives after US labor data crushed expectations, as traders scaled back their bets that a Fed pivot was a done deal while pouring cold water to recession fears. The greenback is rising, with the US Dollar Index, up almost 0.80% at 106.579, while the US 10-year bond yield soars 15 bps, up at 2.834%. Consequently, XAGUSD is trading at $19.91, losing 1.19%.

US and European equities shifted gears, recording losses following the US employment report. US Nonfarm Payrolls for July increased by 528K, topping expectations of just 250K. Furthermore, the prior month’s data was revised upwards to 398K, while the Unemployment Rate tick lower to 3.5%. Financial analysts chatter, put a Fed’s 75 bps rate hike on the table for the September meeting, reinforced by Average Hourly Earnings rising 0.5% MoM while on an annual basis, rose by 5.2%.

Still, the US 2s-10s yield curve inversion is a theme around financial markets desks, further deepening to -0.370%, as the US 2-year bond rate is yielding 3.211%.

In the meantime, Cleveland’s Fed President Loretta Mester spoke on Thursday and stayed hawkish. She said the rate path outlined by June dot plots is “about right,” though it should be taken with a pinch of salt after a great jobs report. She added that a 75 bps for September is “not unreasonable.”

Elsewhere, geopolitical risks keep lingering in investors’ heads. Tensions between the US and China, courtesy of US House Speaker Pelosi’s trip to Taiwan, left some scars and consequences, with China conducting aggressive military drills around Taiwan and announcing sanctions against Nancy Pelosi and her family.

What to watch

Next week, the US economic calendar will feature the Inflation data, namely consumer and producer indices, Initial Jobless Claims, and the University of Michigan’s Consumer Sentiment for August.

Silver Price Analysis (XAGUSD): Technical outlook

The XAGUSD daily chart illustrates the pair is still facing solid resistance around the $20.00-$20.40 area, with buyers unable to crack it. Traders should note that the 50-day EMA, around $20.35, is where sellers had been leaning to, but news propelling higher US bond yields would likely keep buyers at bay. Therefore, the XAGUSD next support to test will be $19.50, followed by the 20-day EMA at $19.23.

- NZD/USD drops hard following the US NFP report.

- The price is left testing a familiar cluster of daily support.

NZD/USD has dropped on the back of a rally in the US dollar on Friday due to an astonishing outcome in the US labour market data. Nonfarm Payrolls in the US rose by 528,000 in July, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed June's increase of 398,000 (revised from 372,000) and came in better than the market expectation of 250,000. The Unemployment Rate edged lower to 3.5%.

Meanwhile, from a technical perspective, they are no clearer to the eye while the price remains bound by a cluster of daily support and resistance. The pair has been trading in a wide range since breaking out of the daily trendline resistance, failing to maintain a directional bias over the past two weeks of choppiness. The following illustrates the current structure and potential scenarios for the coming days.

NZD/USD daily chart

The price is testing a cluster of support on the daily chart with 0.6190 a potential key structure that if broken will open the risk of a significant sell-off towards a test of 0.61 the figure. Below there, 0.5900 will be eyed. However, should the bulls somehow manage to fend off the bears, then there will be prospects of a move into the recent highs that guard a breakout to the upside.

Economists at Commerzbank provide their afterthoughts on the stellar US monthly jobs report, which showed that the economy added a whopping 528K jobs in July and the unemployment rate fell to 3.5%. The upbeat employment details now seem to have revived hopes for a larger Fed rate hike move at the September policy meeting.

Key Quotes:

“With the U.S. economy having contracted in the first two quarters of 2022, the definition of a "technical recession" popular in financial markets is fulfilled. However, the labor market, which has been very robust so far, should in the end determine whether the economy is headed for a real recession with rising unemployment and falling consumer spending.”

“At the press conference after the July meeting, Fed Chairman Powell explicitly referred to the two employment reports due before the September meeting. These would help determine whether the Fed would have to continue to apply the brakes forcefully. The first of these two data points has now been published – and shows that the labor market continues to run hot. The cooling hoped for by the Fed to lower inflationary pressure has failed to materialize. As a result, calls for another 75 basis points rate hike are likely to grow louder in the FOMC.”

- The index gathers extra pace following July’s NFP.

- The US economy created more jobs than expected last month.

- The US jobless rate ticked lower to 3.5% in July.

The greenback, in terms of the US Dollar Index (DXY), accelerates the upside to new monthly tops around 107.00 on Friday.

US Dollar Index boosted by Payrolls figures

The index rebounds sharply and already flirt with the 107.00 zone following the solid prints from the US Nonfarm Payrolls for the month of July.

Indeed, the upside momentum in the buck picked up extra pace after the US economy added 528K jobs during last month vs. markets’ consensus for a 250K increase. In addition, the jobless rate ticked lower to 3.5% while Average Hourly Earnings also surprised to the upside rising 0.5% MoM and 5.2% over the last twelve months.

The sharp bounce in the index comes reinforced by the equally strong rebound in US yields across the curve. In fact, the short end revisits the multi-week highs past 3.25%, as speculation of a now faster normalization by the Fed has started to run high among investors.

What to look for around USD

Higher-than-expected Payrolls results for the month of July appear to have reignited the perception of a more aggressive Fed’s rate path in the next months, lending extra support to both the dollar and yields.

Also bolstering the constructive outlook for the buck emerges the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Non-Farm Payrolls, Unemployment Rate, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is gaining 0.93% at 106.73 and a break above 107.42 (weekly high post-FOMC July 27) would expose 109.29 (2022 high July 15) and then 109.77 (monthly high September 2002). On the other hand, the next support emerges at 105.04 (monthly low August 2) seconded by 104.96 (55-day SMA) and finally 103.67 (weekly low June 27).

- Gold witnesses aggressive selling and tumbles to the daily low amid the post-NFP strong USD buying.

- The upbeat report lifts bets for a 75 bps Fed rate hike in September, which further weighs on the metal.

- The risk-off impulse could offer some support to the safe-haven XAU/USD and help limit further losses.

Gold comes under intense selling pressure during the early North American session and plummets to a fresh daily low, around the $1,765 area in the last hour.

The US dollar strengthens across the board on a stronger-than-expected employment report and turns out to be a key factor weighing heavily on the dollar-denominated gold. The headline NFP print showed that the US economy added a whopping 528K jobs in July, smashing expectations by a huge margin. Furthermore, the previous month's reading was also revised higher to 398K from the 372K, while the unemployment rate also surprisingly edged down to 3.5% from 3.6% in June.

The upbeat macro data lifts market bets for a larger Fed rate hike move at the September meeting, which further contributes to driving flows away from the non-yielding yellow metal. The odds of a 75 bps hike jump to 70% from 40% before the jobs report and trigger a sharp spike in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond climbs back closer to the weekly high and exerts additional downward pressure on gold.

The prospects for more aggressive policy tightening by the Fed, meanwhile, tempered investors' appetite for riskier assets. This is evident from a fresh leg down in the equity markets, which could lend some support to the safe-haven gold and help limit any deeper losses, at least for the time being. Hence, any subsequent downfall is more likely to find decent support near the weekly low, around the $1,754 area, which coincides with a strong hurdle cleared last week.

Technical levels to watch

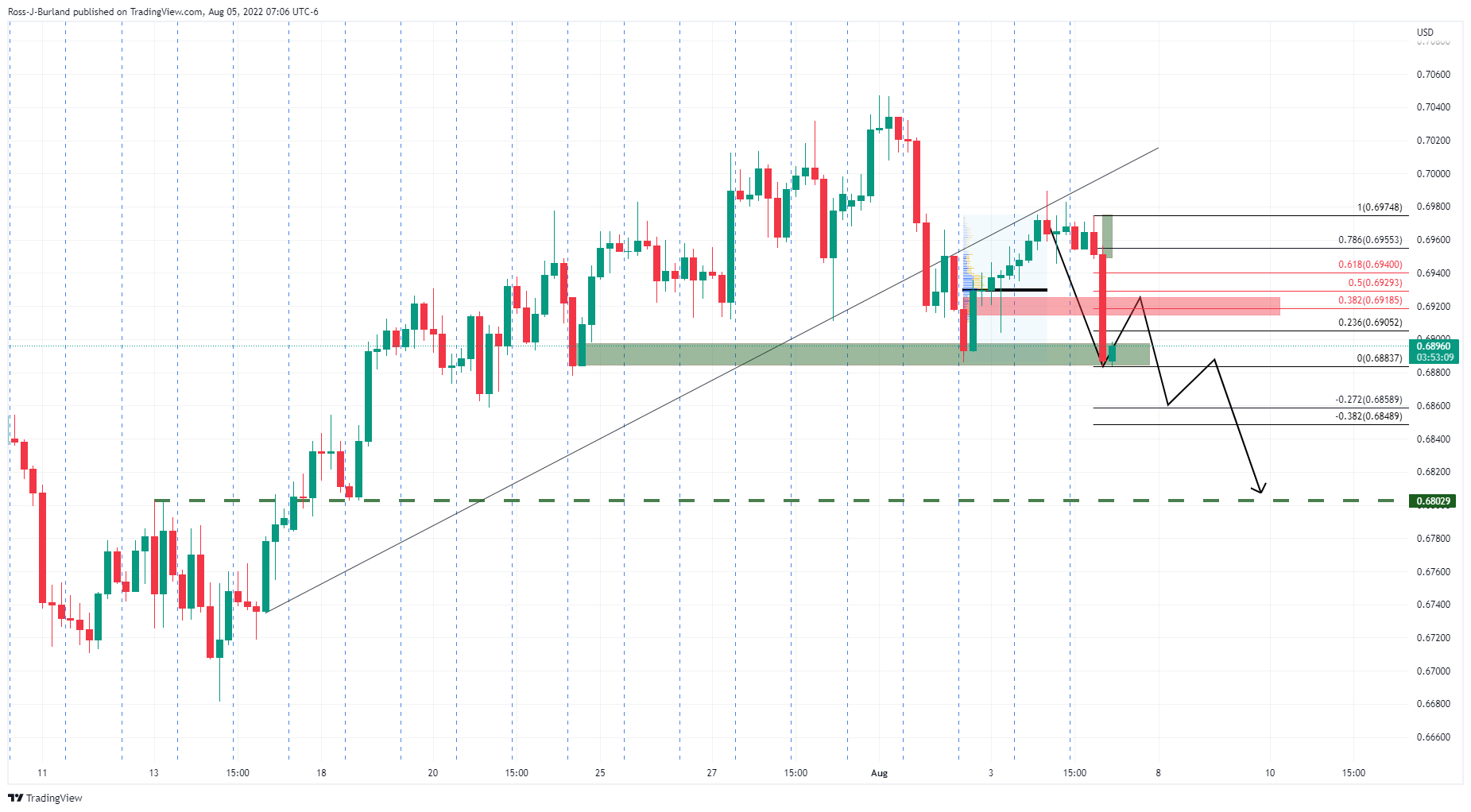

- AUD/USD is knocked for six on the strong NFP headline.

- The price is taking on 4-hour support, a break of that opens the risk of a deeper run below the countertrend line to test 0.68 the figure.

AUD, sensitive to risk tones in financial markets, has been battered by a doubling of market expectations in the Nonfarm Payrolls outcome. AUD/USD has fallen to 0.6882, dropping three pips below the August 2 lows. This move could be carving out a technical bearish breakout towards 0.6900 as illustrated below.

NFP doubles market expectations

- Breaking: US Nonfarm Payrolls rise by 528,000 in July vs. 250,000 expected

Nonfarm Payrolls in the US rose by 528,000 in July, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed June's increase of 398,000 (revised from 372,000) and came in better than the market expectation of 250,000. The Unemployment Rate edged lower to 3.5%.

Further details of the publication revealed that the annual wage inflation, as measured by the Average Hourly Earnings, remained unchanged at 5.2%, compared to analysts' estimate of 4.9%. Finally, the Labor Force Participation Rate declined to 62.1% from 62.%.

Investors had been in anticipation of the report for further hints of how the US economy is faring considering a data-dependent Federal Reserve. The data now raises the prospects of a 75 bp hike from the Federal Reserve which is not going to be favourable for risk sentiment or the Aussie that tends to track the performance of global stock markets. The odds of a 75 bps hike have leapt to 61% from 40% on the release.

US dollar tears higher on NFP

Meanwhile, ahead of the jobs data, the US dollar edged higher on Friday in a correction of some of the sharpest daily drop in more than two weeks, sliding 0.68% on Thursday, the largest fall since July 19. The US dollar index (DXY), which measures the greenback against a basket of currencies, was up 0.15% to 105.90 just ahead of the data release, a touch below the day's high of 106.00. While the data is being digested, the index is rallying to a high of 106.808 so far, up over 1% on the day so far.

AUD/USD technical analysis

The price is taking on 4-hour support. There are prospects of a correction following this knee-jerk sell-off as the markets continue to position themselves around the data. There is scope for the price to correct to a higher area of volume to the upside near 0.6920/0.6940, but given the strength of the sentiment surrounding the Fed, a break below the lows printed today opens the risk of a deeper run below the countertrend line to test 0.68 the figure and a prior resistance structure.

- USD/JPY rallies to over a one-week high in reaction to stellar US employment details.

- The US economy added 528K jobs in July and the unemployment rate fell to 3.5%.

- The risk-off impulse fails to benefit the safe-haven JPY or hinder the strong move up.

The USD/JPY pair catches aggressive bids during the early North American session and jumps to over a one-week high, around the 134.85 region in reaction to the stellar US jobs report.

The headline NFP print smashed consensus estimates and showed that the US economy added a whopping 528K jobs in July, more than doubling the 250K anticipated. Adding to this, the previous month's reading was also revised higher from 372K to 398K. Furthermore, the unemployment rate surprisingly fell to a pre-pandemic low of 3.5% from 3.6% in June.

Against the backdrop of more hawkish comments by several Fed officials this week, the upbeat employment details revive bets for a larger interest rate hike at the September FOMC policy meeting. In fact, the odds for a 75 bps hike have jumped to 61% from the 40% ahead of the release, which triggers a sharp spike in the US Treasury bond yields.

This, in turn, results in the widening of the US-Japan rate differential, which, along with a strong pickup in the US dollar demand, provides a solid boost to the USD/JPY pair. The combination of supporting factors helps offset the risk-off impulse, which does little to benefit the safe-haven Japanese yen or cap gains for the major.

With the latest leg up, spot prices confirm a near-term breakout through the 134.50-134.55 intermediate hurdle, suggesting that any pullback could be seen as a buying opportunity. Some follow-through buying beyond the 135.00 psychological mark would reaffirm the positive outlook and pave the way for a further appreciating move for the USD/JPY pair.

Technical levels to watch

- Unemployment Rate in Canada stayed unchanged at 4.9% in July.

- USD/CAD posts strong daily gains above 1.2950 after the data.

The Unemployment Rate in Canada was virtually unchanged at 4.9% in July, Statistics Canada reported on Friday. This reading came in slightly better than the market expectation of 5%.

On a negative note, Net Change in Employment arrived at -30.6K, missing analysts' estimate for an increase of 20,000 by a wide margin.

"The average hourly wages of employees were up 5.2% (+$1.55 to $31.14) on a year-over-year basis in July, matching the pace of wage growth recorded in June," the publication further read.

Market reaction

The USD/CAD pair rose sharply in the early American session but this move seems to have been fueled by the renewed dollar strength on the upbeat US July jobs report. As of writing, the pair was up 0.75% on the day at 1.2960.

- NFP beats market expectations and sends the US dollar higher.

- GBP/USD bulls pushed back to the London open and session lows.

On the back of the US Nonfarm Payrolls that have come in at the hotter end of expectations, the US dollar has rallied, weighing heavily on its peers, including sterling.

GBP/USD has dropped to test the lows of the day on the knee-jerk. GBP/USD had been trading between a 45 pip box during the London morning between 1.2170 and 1.2125 ahead of the data, setting a meanwhile range for the day ahead, but bears are penetrating this box to the downside with a potential bearish breakout below 1.2050 now on the cards.

NFP doubles market expectations

- Breaking: US Nonfarm Payrolls rise by 528,000 in July vs. 250,000 expected

Nonfarm Payrolls in the US rose by 528,000 in July, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed June's increase of 398,000 (revised from 372,000) and came in better than the market expectation of 250,000. The Unemployment Rate edged lower to 3.5%.

Further details of the publication revealed that the annual wage inflation, as measured by the Average Hourly Earnings, remained unchanged at 5.2%, compared to analysts' estimate of 4.9%. Finally, the Labor Force Participation Rate declined to 62.1% from 62.%.

Investors had been in anticipation of the report for further hints of how the US economy is faring. The jobs report is a relief for the greenback when taking into consideration the data on Thursday showed that the number of Americans filing new claims for unemployment benefits increased last week. However, the data now raises the prospects of a 75 bp hike from the Federal Reserve which is not going to be favourable for risk sentiment nor the pound. The odds of a 75 bps hike have leaped to 61% from 40% on the release.

The data coincides with stark warming from the Bank of England earlier this week which raised rates by the most in 27 years to fight surging inflation in a dovish 50 bp hike to 1.75%. The central bank followed up by saying that a long recession was coming, beginning in the fourth quarter of this year, highlighting the bleak outlook for the UK economy and the pound. ''

The central bank clearly believes a deep recession is not only inevitable but also necessary to bring down inflation. This will put it on a collision course with 10 Downing Street,'' analysts at Rabobank said.

US dollar rallies on NFP

Meanwhile, ahead of the jobs data, the US dollar edged higher on Friday in a correction of some of the sharpest daily drop in more than two weeks, sliding 0.68% on Thursday, the largest fall since July 19. The US dollar index (DXY), which measures the greenback against a basket of currencies, was up 0.15% to 105.90 just ahead of the data release, a touch below the day's high of 106.00. While the data is being digested, the index is rallying to a high of 106.5510 so far, now up over 0.68% on the day so far.

GBP/USD technical analysis

The price has moved out of a 4-hour rising channel with 1.2063 as a potentially key level on the downside. A break of there could open the avenue for a significant sell-off in the coming week with 1.1950 daily trendline support eyed:

GBP/USD daily chart

- USD/CAD catches fresh bids following the release of upbeat US monthly employment details.

- The US economy added 528K jobs in July, and the unemployment rate ticked lower to 3.5%.

- The dismal Canadian jobs report overshadows an uptick in oil prices and fails to benefit the loonie.

The USD/CAD pair builds on the overnight positive move and gains some follow-through traction for the second straight day on Friday. The intraday buying picks up pace in reaction to the upbeat US monthly jobs report and lifts spot prices to a nearly two-week high, closer to mid-1.2900s during the early North American session.

The headline NFP showed that the US economy added 528K jobs in July, surpassing the most optimistic estimates and market expectations for a rise of 250K. Furthermore, the previous month's reading was also revised higher to 398K from the 372K, while the unemployment rate also surprisingly edged down to 3.5% from 3.6% in June.

Additional details revealed that the Average Hourly Earnings rose 5.2% YoY and pointed to a further rise in inflationary pressures. The stronger data revives bets for a large Fed rate hike move at the September meeting and pushes the US Treasury bond yields higher, which, in turn, is providing a goodish boost to the US dollar.

Apart from this, weaker Canadian employment details weigh on the domestic currency and turn out to be another factor that contributes to the USD/CAD pair's sudden spike over the past hour or so. Statistics Canada reported that the number of employed people fell by 30.6K in July against estimates for an additional 20K jobs.

The combination of aforementioned factors overshadows a modest uptick in crude oil prices, which fail to lend support to the commodity-linked loonie or hinder the USD/CAD pair's positive move. This, in turn, supports prospects for a further intraday appreciating move, which should allow bulls to reclaim the 1.3000 psychological mark.

Technical levels to watch

- EUR/USD sparks a deeper correction following July’s NFP.

- US Non-farm Payrolls rose by 528K jobs in July.

- The unemployment rate ticked lower to 3.5%.

EUR/USD saw its downside accelerated to the 1.0170 region in the wake of the publication of the US jobs report for the month of July.

EUR/USD weaker on solid US jobs report

EUR/USD remains on the defensive on Friday after US Nonfarm Payrolls showed the US economy added 528K jobs during July, more than doubling the consensus for a gain of 250K jobs. The June’s reading was revised up to 398K (from 384K).

Further data saw the Unemployment Rate improve to 3.5% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.5% MoM and 5.2% vs. the same month of 2021. Additionally, the Participation Rate, eased a tad to 62.1%.

EUR/USD levels to watch

So far, spot is retreating 0.71% at 1.0173 and faces the next contention at 1.0096 (weekly low July 26) followed by 1.0000 (psychological level) and finally 0.9952 (2022 low July 14). On the other hand, the breakout of 1.0293 (monthly high August 2) would target 1.0404 (55-day SMA) en route to 1.0615 (weekly high June 27).

Nonfarm Payrolls in the US rose by 528,000 in July, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed June's increase of 398,000 (revised from 372,000) and came in better than the market expectation of 250,000. The Unemployment Rate edged lower to 3.5%.

Further details of the publication revealed that the annual wage inflation, as measured by the Average Hourly Earnings, remained unchanged at 5.2%, compared to analysts' estimate of 4.9%. Finally, the Labor Force Participation Rate declined to 62.1% from 62.%.

Follow our live coverage of market reaction to the US jobs report.

Market reaction

With the initial market reaction, the greenback gathered strength against its rivals and the US Dollar Index was last seen rising 0.65% on the day at 106.45.

Win Thin, Global Head of Currency Strategy at BBH, offers a brief overview of the US dollar price action on Friday and the closely-watched US monthly jobs data. The popularly known NFP report would play a key role in influencing the near-term USD price dynamics amid the recent hawkish remarks by several Fed officials.

Key Quotes:

“DXY has risen 3 of the past 4 days and is trading near 106 currently. We maintain our strong dollar call as Fed officials are making it clear that markets misread the Fed’s commitment to lowering inflation. The greenback is also getting more traction as data came in stronger than expected. Today’s jobs data will likely be key for the medium-term dollar outlook.”

“Consensus sees 250k jobs added vs. 372k in June, while the unemployment rate is expected to remain steady at 3.6% and average hourly earnings are seen falling two ticks to 4.9% y/y. Fed Chair Powell stressed labor market strength many times in his post-decision press conference, which supports our view that the Fed is not about to pivot while the economy remains at full employment. June consumer credit will be also reported and is expected at $27.0 bln vs. $22.347 bln in May.”

“WIRP suggests a 50 bp hike September 21 is fully priced in, with around 40% odds of a larger 75 bp move. The swaps market is pricing in 100 bp of tightening over the next 6 months that sees the policy rate peak near 3.5%, followed by the start of an easing cycle over the subsequent 6 months. The Fed has made it clear that this is not its expected rate path and so we look for a hawkish shift in market pricing in the coming days and weeks if the U.S. data cooperate.”

- EUR/USD gives away part of Thursday’s advance, stays around 1.0220.

- The pair needs to clear 1.0300 to allow for a more serious recovery.

EUR/USD comes under pressure after faltering once again in the 1.0250/60 region at the end of the week.

The so far August high at 1.0293 (August 2) emerges as the magnet for bulls for the time being. Above this level, spot is expected to see its uptrend reinvigorated and could challenge the temporary 55-day SMA in the near term, today at 1.0404.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0927.

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment details for July later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 20K jobs during the reported month, up sharply from the 43.2K decline reported in June. Meanwhile, the unemployment rate is expected to edge higher to 5.0% in July from the 4.9% previous.

Analysts at TD Securities (TDS) are more optimistic about the report and explain: “We look for job growth of 38k in July, driven by a partial rebound for trade services and natural resources after their sharp decline in June. Full-time hiring should lead the increase, while stronger labour force participation should keep unemployment stable at 4.9%. We also expect to see wage growth firm to 6.0% y/y in July, although AHE (Average Hourly Earnings) should slow on a m/m basis.”

How could the data affect USD/CAD?

The data is likely to be overshadowed by the simultaneous release of the closely-watched US jobs report - popularly known as NFP. That said, a significant divergence from the expected readings should influence the Canadian dollar and provide some meaningful impetus to the USD/CAD pair.

Heading into the key data risks, spot prices climbed back closer to the weekly high amid a goodish pickup in the USD demand. That said, a goodish recovery in crude oil prices could underpin the commodity-linked loonie and cap the upside for the USD/CAD pair.

Any disappointment from the Canadian data would be enough to assist the USD/CAD pair to confirm a near-term bullish breakout through the 1.2900 mark. The subsequent strength would set the stage for a more towards mid-1.2900s en route to the 1.3000 psychological mark and the next relevant hurdle near the 1.3055-1.3060 region.

Conversely, stronger domestic data should lend additional support to the Canadian dollar and prompt fresh selling around the USD/CAD pair. That said, any further decline below the 1.2835-1.2830 region is more likely to find decent support near the 1.2800-1.2790 zone. A convincing break below the latter would be seen as a fresh trigger for bearish traders. Spot prices could then accelerate the fall towards the 1.2700 mark before eventually dropping to the 1.2655-1.2650 region.

Key Notes

• USD/CAD Forecast: Bulls await move beyond 1.2900, US/Canadian jobs report in focus

• USD/CAD buyers approach 1.2900 ahead of US/Canada employment data

• CAD/USD about to move towards the 0.7877 level

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

- DXY keeps the erratic performance unchanged so far this week.

- The resumption of the bearish mood could retest 105.00.

DXY advances modestly following the previous day’s strong pullback on Friday.

The continuation of the selling pressure could facilitate a deeper pullback to, initially, the August low near 105.00 (August 2). This area of initial contention appears reinforced by the 55-day SMA.

The short-term constructive stance is expected to remain supported by the 6-month support line, today near 104.30.

Furthermore, the broader bullish view in the dollar remains in place while above the 200-day SMA at 99.74.

- EUR/JPY advances for the fourth session in a row on Friday.

- Immediately to the upside emerges the monthly high near 137.00.

EUR/JPY extends the recovery for yet another session ahead of key US data releases.

Considering the ongoing price action, further upside in the cross appears likely for the time being. That said, the breakout of the monthly peak at 136.92 (August 4) should open the door to a potential visit to the 100- and 55-day SMAs at 137.88 and 139.50, respectively.

While above the 200-day SMA at 133.75, the outlook for the cross is expected to remain constructive.

UOB Group’s Head of Markets Strategy Heng Koon How, CAIA, Senior FX Strategist Peter Chia, Rates Strategist Victor Yong and Markets Strategist Quek Ser Leang assess the ongoing recession fears and its effect on the long term yield.

Key Takeaways

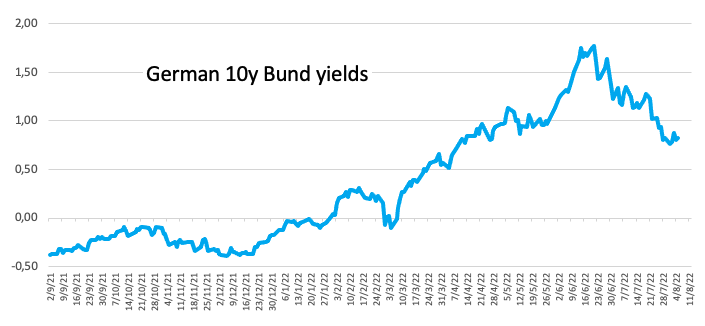

“The Recession vs Inflation debate has intensified and taken an interesting turn. For now, it would appear that Recession fears are dominating amidst increasing signs of growth slowdown. However, it is important to note that Inflation risks are far from over and the US Federal Reserve (Fed) and other global central banks remain committed to continue their aggressive rate hikes in the months ahead.”

“We maintain our positive core view on a stronger USD and note that this latest USD rally still has legs and with USD strength extending further into this current Fed hiking cycle than in previous cycles. Elevated volatility and increasing safe haven needs are supportive of further USD strength.”

“In the Major FX, we lower our EUR/USD forecast and see risk of parity for the remaining months of the year as a worsening energy crisis in Europe and on-going political crisis in Italy nullify the yield support from the start of the ECB’s rate hiking cycle. On the other hand, USD/JPY is finally seeing prospects of topping out after the retreat in 10-year US Treasuries yield.”

“In terms of short-term rates outlook, we continue to see on-going rate hikes from the US Fed as well as other central banks in the months ahead. As such, the rise in short term rates is not over. We raise our year end forecasts for 3-month compounded SOFR and SORA to 3.30% and 2.60% respectively (from 2.99% and 2.29% previously).”

“As for long term yield outlook, elevated recession fears have started to dampen and weigh on long term yield. We lower our 10-year UST and SGS outlook for end of the year to 3.60% and 3.20% respectively (from 3.80% and 3.40% previously). Consequently, as a result of higher short term rates and the pull back in long term yield, yield curve inversion can persist for longer during high inflation regimes or until evidence that monetary policy tightening has peaked.”

“In terms of technical analysis, we note that after the recent heavy pullback in yield, the risk for 10-year US Treasuries yield is still clearly on the downside; next support levels to monitor are at 2.557% and 2.500%.”

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data for July. The popularly known NFP report is scheduled for release at 12:30 GMT and is expected to show that the economy added 250K jobs during the reported month, down from the 372K in June. The unemployment rate, however, is expected to hold steady at 3.6% in July. Apart from this, investors will take cues from Average Hourly Earnings, which could offer fresh insight into the possibility of a further rise in inflationary pressures.

According to Yohay Elam, Senior Analyst at FXStreet, "real or "whisper" estimates for the NFP stand at around 300,000 or even 350,000. A higher bar means a greater chance for disappointment." Nevertheless, any divergence from the expected readings would infuse some volatility and produce some meaningful trading opportunities in the FX market.

How could the data affect EUR/USD?

Heading into the key release, the US dollar regains some positive traction on Friday and exerts some downward pressure on the EUR/USD pair. Against the backdrop of the hawkish remarks by several Fed officials this week, a stronger NFP print would revive bets for a large rate hike move at the September FOMC meeting and lift the buck.

Conversely, a weaker reading would add to worries about a possible global economic downturn and continue to benefit the safe-haven greenback. This, along with the energy crisis in Europe, which might drag the Eurozone economy faster and deeper into recession, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Eren Sengezer, Editor at FXStreet, outlines important technical levels to trade the EUR/USD pair: “First technical support seems to have formed at 1.0200, where the 20-period and the 50-period SMAs on the four-hour chart align. If the pair drops below that level and starts using it as resistance, 1.0150 (Fibonacci 23.6% retracement of the latest downtrend) and 1.0100 (psychological level, static level) could be seen as the next bearish targets.”

“On the other hand, interim resistance is located at 1.0230 (Fibonacci 38.2% retracement) before 1.0260 (100-period SMA). A four-hour close below the latter could be seen as a significant bullish development and trigger another leg higher toward 1.0300 (psychological level, Fibonacci 50% retracement),” Eren adds further.

Key Notes

• Nonfarm Payrolls Preview: High expectations set deal the dollar a blow, create buying opportunity

• EUR/USD Forecast: Upbeat NFP could drag euro back below 1.0200

• EUR/USD appears offered near 1.0220 prior to Payrolls

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

- EUR/USD loses the grip and slips back to the 1.0220 region.

- Industrial Production in Italy surprised to the downside in June.

- The NFP is expected at 250K jobs in July.

Sellers seem to have regain the initiative around the single currency and drag EUR/USD back to the low-1.0200s at the end of the week.

EUR/USD focuses on US data

EUR/USD resumes the downside and trims part of Thursday’s noticeable advance on the back of the renewed buying interest around the greenback, while yields on both sides of the ocean remain depressed so far.

Indeed, the appetite for the risk-associated assets appears somewhat subdued on Friday, as usual cautiousness pre-NFP dominates the sentiment among market participants.

In the domestic data space, Italian Industrial Production contracted 2.1% MoM in June and 1.2% from a year earlier. In France, the Industrial Production expanded 1.4% MoM also in June and the trade deficit widened to €13.7B in the same month.

Other than the monthly labour market report, the US docket will include the Consumer Credit Change figures for the month of June and the speech by Richmond Fed T.Barkin.

What to look for around EUR

EUR/USD remains within a choppy range this week ahead of the key release of US Nonfarm Payrolls for the month of July.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerges the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment readings among investors and the renewed downtrend in some fundamentals.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is retreating 0.16% at 1.0228 and faces the next contention at 1.0096 (weekly low July 26) followed by 1.0000 (psychological level) and finally 0.9952 (2022 low July 14). On the other hand, the break above 1.0293 (monthly high August 2) would target 1.0404 (55-day SMA) en route to 1.0615 (weekly high June 27).

- Gold edges lower on Friday and erodes a part of the overnight gains to a one-month high.

- A modest USD strength turns out to be a key factor exerting some pressure on the metal.

- Recession fears, geopolitical tensions should limit losses ahead of the key US NFP report.

Gold attracts some sellers on Friday and erodes a part of the previous day's strong move up to the $1,795 region, or a one-month high. The XAU/USD remains depressed around the $1,785 zone through the first half of the European session and for now, seems to have snapped a two-day winning streak.

The US dollar regains some positive traction on the last day of the week, which is turning out to be a key factor exerting some downward pressure on the dollar-denominated gold. The modest USD uptick, meanwhile, could be attributed to some repositioning trade ahead of the closely-watched US monthly jobs data, due for release later during the early North American session.

In the meantime, subdued action around the US bond markets is likely to act as a headwind for the USD and lend support to the non-yielding yellow metal. Despite hawkish remarks by several Fed officials this week, investors continue pushing back against the idea of a larger rate hike at the September FOMC meeting. This, in turn, has been weighing on the US bond yields.

Apart from this, growing recession fears, along with China-Taiwan tensions over US House Speaker Nancy Pelosi's visit to the island, should limit the downside for the safe-haven gold. In fact, China on Thursday conducted missile strikes in the Taiwan Strait. The five missiles landed within Japan's exclusive economic zone and raises tensions in the region.

Investors might also refrain from placing aggressive bets and prefer to wait for a fresh catalyst from the US NFP report. The data will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to gold. This makes it prudent to wait for strong follow-through selling before confirming that the XAU/USD has topped out.

Technical levels to watch

Rates strategist and Senior Economist at ABN Amro offer their take on the August Bank of England (BOE) monetary policy decision.

Key quotes

“The Bank of England (BoE) raised its policy rate by 50bp, which was the biggest increase since 1994 and in line with our and consensus expectations. This brought the bank rate to 1.75% and serves as the sixth consecutive rate hike.”

“The vote split indicates that the MPC committee was almost fully aligned this time with 8-1 MPC members that voted for a 50bp rate increase.”

“During the press conference, BoE Governor Bailey highlighted the exceptional high uncertainty surrounding the BoE’s forecasts and as such, the BoE will follow the ECB and the Fed's path of setting policy ‘’meeting-by-meeting’’. “

“Bailey stated that the BoE has moved from a system of ‘’predictive forward guidance to a framework that is not predictive’’. Therefore, ‘all options are on the table’ for future meetings.”

“The August report offers a much darker economic outlook for the UK compared to the previous report published in May.”

“Inflation is now expected to peak at 13.3% in 2022Q4 and remain elevated for longer than anticipated, with inflation at 9.5% (vs 5.9% prev) in 2023Q3. “

- AUD/USD witnesses some selling on Friday and snaps a two-day winning streak.

- The emergence of some USD selling exerts some downward pressure on the pair.

- Recession fears, geopolitical tensions further weigh on the risk-sensitive aussie.

- The downside seems cushioned as the focus remains glued to the US NFP report.

The AUD/USD pair struggles to capitalize on its two-day-old recovery move from its lowest level since July 25 and edges lower on Friday. The pair remains on the defensive through the first half of the European session and is currently placed near the daily low, around the 0.6950-0.6945 region.

The US dollar regains some positive traction on the last day of the week, which turns out to be a key factor exerting downward pressure on the AUD/USD pair. Against the backdrop of growing recession fears, heightened geopolitical tensions after US House Speaker Nancy Pelosi's Taiwan visit, offer some support to the safe-haven greenback.

In fact, China on Thursday said that it conducted “precision missile strikes” in the Taiwan Strait as part of military exercises. The five missiles fired by China landed within Japan's exclusive economic zone and raises tensions in the region. Furthermore, China said that it will sanction Pelosi and bar her from entering the country.

Apart from this, an uptick in the US Treasury bond yields offers additional support to the buck amid some repositioning trade ahead of the key data risk. The closely-watched US monthly jobs report - popularly known as NFP - is scheduled for release later during the early North American session and would influence the USD price dynamics.

Against the backdrop of more hawkish remarks by several Fed officials this week, stronger US data would revive bets for a large rate hike move at the September FOMC meeting. This would be enough to boost the USD. Conversely, any disappointment would further fuel recession fears and act as a tailwind for the safe-haven buck. This, in turn, suggest that the path of least resistance for the AUD/USD pair is to the downside.

Technical levels to watch

China’s Foreign Ministry announced on Friday, “we will sanction US House of Representative Speaker Nancy Pelosi over the Taiwan visit.”

Key takeaways

"Ms. Pelosi had disregarded China’s concerns and resolute opposition to her visit to the self-ruled island, which Beijing claims."

"Ms. Pelosi was the highest-ranking US official to visit the self-governing island in 25 years. China claims Taiwan as its territory and opposes it having its own engagements with foreign governments."

"Ms. Pelosi’s visit is provocative and said it undermines China’s sovereignty and territorial integrity. Sanctions would be imposed on Pelosi and her immediate family."

Market reaction

The Chinese proxy and high-beta currency, the AUD, has come under moderate selling pressure on escalating US-China tensions. AUD/USD is trading at 0.6952, down 0.23% so far, as of writing. The S&P 500 futures have erased gains and turned slightly negative on the day.

Bank of England (BOE) Chief Economist Huw Pill is making some comments this Friday following the central bank’s policy announcements on ‘Super Thursday’.

Key quotes

You would expect housing market to cool, not expecting dramatic downturn.

We are trying to ensure there is an element of flexibility on interest rates.

We are not behind the curve on inflation.

If we get inflation to target interest rates will be a slightly positive premium to inflation.

Equilibrium level of interest rates is very uncertain.

If we get inflation to 2%, nominal interest rates will be broadly at that level.

We are in a long transition since global financial crisis with low interest rates.

There are risks on both sides.

Quantitative tightening will have a tightening effect.

Market reaction

GBP/USD is back in the red below 1.2150, little affected by the above comments. The spot is currently trading at 1.2140, down 0.12% on the day.

USD/CNH is still predicted to extend the 6.7350-6.8000 consolidation theme for the next week, comment FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang.

Key Quotes

24-hour view: “We expected USD to ‘trade sideways within a range of 6.7470/6.7700’ yesterday. USD subsequently traded between 6.7496 and 6.7678 before closing little changed at 6.7523 (-0.09%). The underlying tone has softened somewhat and USD is likely to edge lower. That said, any weakness is likely limited to a test 6.7400 (minor support is at 6.7450). On the upside, a break of 6.7660 would indicate the current mild downward pressure has eased.”

Next 1-3 weeks: “We continue to hold the same view as Wednesday (03 Aug, spot at 6.7750) where is USD is likely to trade between 6.7350 and 6.8000 for now.”

- The index reclaims part of the ground lost on Thursday near 106.00.

- US yields keep showing lack of traction at the end of the week.

- The US economy is expected to have added 250K jobs in July.

The greenback regains the smile and motivates the US Dollar Index (DXY) to reverse Thursday’s pullback and refocus on the 106.00 neighbourhood ahead of the release of July’s Nonfarm Payrolls later in the session.

US Dollar Index now looks to data

Following Thursday’s deep decline, the index managed to regain some composure and retake the upper hand, revisiting at the same time the 106.00 zone at the end of the week.

The daily rebound in the dollar comes amidst the muted performance of US yields across the curve so far. Yields have been kind of ignoring further hawkish messages from FOMC governors, who hinted at the idea that the normalization process is still far from over and centring the debate at the same time on the size of the September hike. On the latter, CME Group’s FedWatch Tool sees the probability of a 50 bps rate raise at just above 60% vs. nearly 40% when it comes to a 75 bps hike.

Additional data in the US docket will see the Unemployment Rate (3.6% exp.), Average Hourly Earnings (4.9% YoY exp.) and finally June’s Consumer Credit Change.

What to look for around USD

Despite the risk aversion ebbed in past days, the dollar remains bid vs. the risk complex and keeps the index underpinned around 106 on Friday.

The very-near-term outlook for the dollar has deteriorated somewhat in recent sessions, particularly following the latest US GDP figures and the prospects for further tightening by the Fed in the next months, which carry the potential to drag further the economy into the contraction territory.

Among the positives for the buck still emerge the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Non-Farm Payrolls, Unemployment Rate, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is gaining 0.19% at 105.95 and a break above 107.42 (weekly high post-FOMC July 27) would expose 109.29 (2022 high July 15) and then 109.77 (monthly high September 2002). On the other hand, the next support emerges at 105.04 (monthly low August 2) seconded by 104.95 (55-day SMA) and finally 103.67 (weekly low June 27).

Mitul Kotecha, Head of Emerging Markets Strategy at TD Securities (TDS), provides his afterthoughts on the Reserve Bank of India (RBI) policy decision, announced earlier this Friday. The Indian central bank raised its policy repo rate by 50bps to 5.40% in a unanimous decision.

Key Quotes:

“The RBI also maintained its stance to "remain focused on withdrawal of accommodation". We expect the RBI to follow up with more moderate tightening ahead; next hike likely at its meeting at the end of September. We maintain our terminal rate expectation of 6.0% by Q1 2023.”

“There was no revision to the RBI's fiscal year inflation forecast of 6.7% (TD 7.0%) though we see upside risks to this forecast. We concur with the view that CPI will remain above the target range (2-6%) for a few more months, but to drop below the band into next year. RBI maintained its growth forecast of 7.2% for FY 23 (TD 7.5%).”

“Like other Asian currencies INR has benefitted from the recent drop in the USD. Having pulled back from a breach of USDINR 80.0, we continue to expect some consolidation in the near term. We expect IGB yields to drift lower as the RBI shifts to less aggressive tightening in the months ahead though foreign investors continue to remain shy of Indian bonds.”

- Silver oscillates in a narrow trading band above the $20.00 round-figure mark on Friday.

- The technical set-up favour bulls and supports prospects for a further appreciating move.

- A convincing break below the $19.20 area is needed to negate any near-term positive bias.

Silver struggles to gain any meaningful traction on Friday and remains confined in a narrow range through the early European session. The white metal is currently hovering in neutral territory and so far, has managed to hold above the $20.00 psychological mark.

From a technical perspective, any subsequent move up is likely to confront stiff resistance near the mid-$20.00s confluence. The said barrier comprises the 50-day SMA and the 50% Fibonacci retracement level of the $22.52-$18.15 downfall, which should now act as a key pivotal point.

Positive oscillators on hourly/daily charts, meanwhile, support prospects for an eventual breakout through the aforementioned confluence hurdle. Hence, a subsequent positive move could lift the XAG/USD towards the 61.8% Fibo. level, around the $20.85 area, en route to the $21.00 mark.

The momentum could further get extended towards the next relevant hurdle near the $21.40-$21.50 area before the XAG/USD eventually aims to reclaim the $22.00 mark. The latter coincides with the 100-day SMA, which if cleared decisively would be seen as a fresh trigger for bullish traders.

On the flip side, the weekly swing low, around the $19.80-$19.75 region, which coincides with the 38.2% Fibo. level now seems to act as immediate support. Any further decline is more likely to stall and find decent support near the 23.6% Fibo. level, around the $19.20 region.

Some follow-through selling, leading to a subsequent break below the $19.00 mark, would shift the bias back in favour of bearish traders. The XAG/USD could then fall to the $18.40 intermediate support en route to the YTD low, around the $18.15 region touched on July 14.

Silver daily chart

Key levels to watch

US Secretary of State Anthony Blinken is on the wires again, via Reuters, saying that “China's provocative actions a significant escalation.”

Additional quotes

United States has told China repeatedly it does not seek a crisis

Pelosi's visit was peaceful, no justification for China’s extreme response

No justification for China’s "extreme disproportionate and escalatory" response to Pelosi visit

Serious concerns that actions by Beijing will destabilise entire region

United states will stick by allies in region

We will fly, sail, operate wherever international law allows

United states will not be provoked by China’s actions

US will continue to make maritime transits through Taiwan strait

US defense secretary has ordered that USS Reagan will remain on station

We will continue to press the regime to release those unjustly detained in Myanmar

Russia visit to Myanmar flies in the face of Asian’s efforts to achieve peace

We stand in strong solidarity with Japan over China’s dangerous actions

We have open lines of communication with China

Reiterated position that China should not use Pelosi’s visit as pretext for provocative actions

Question of Pelosi’s visit came up when he spoke to China’s foreign minister Wang Yi in Bali last month

No possible justification for what China has done after Pelosi visit to Taiwan, have urged Beijing to cease such actions

Nothing inevitable about crisis, conflict; incumbent upon us and China to act responsibly

We won't take actions to provoke a crisis

We've said all along that the differences between mainland and Taiwan need to be resolved peacefully, not by force

Last thing countries in region want is to see differences resolved by force

What we don't want are efforts by any country including China or Russia to disrupt intl peace and security

Expects other countries will join US Indo-pacific economic framework

Market reaction

Markets remain cautiously optimistic so far this Friday, reflective of the 0.14% gains in the S&P 500 futures. Meanwhile, the US dollar index clings onto its recovery gains near 105.85, adding 0.15% on the day.

USD/JPY remains side-lined for the time being, note FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang.

Key Quotes

24-hour view: “Yesterday, we highlighted that ‘upward momentum has slowed and USD is unlikely to advance further’ and we expected USD to ‘trade between 133.10 and 134.50’. USD subsequently rose to 134.42 before staging a surprisingly sharp pullback (low of 132.75). Despite the sharp pullback, downward momentum has not improved by much. That said, there is room for USD to dip to 132.30. The next support at 131.80 is not expected to come under threat. On the upside, a breach of 134.10 (minor resistance is at 133.65) would indicate that the current mild downward pressure has eased.”

Next 1-3 weeks: “There is no change in our view from Wednesday (03 Aug, spot at 133.50). As highlighted, the recent USD weakness has ended. The current price actions are likely the early stages of a broad consolidation phase and USD is expected to trade between 131.30 and 135.60 for now.”

- GBP/USD attracts some dip-buying on Friday, though lacks bullish conviction.

- The BoE’s bleak economic outlook continues to act as a headwind for sterling.

- Modest USD strength also contributes to capping ahead of the US NFP report.

The GBP/USD pair reverses modest intraday losses and climbs back closer to the daily high during the early European session. The pair is currently trading just above the mid-1.2100s and might now be looking to build on the overnight bounce from the weekly low touched in reaction to the Bank of England's bleak economic outlook.

In fact, the UK central bank warned that a recession will begin in the fourth quarter and the economic downturn could last five quarters. Adding to this, the BoE said that the monetary policy is not on a pre-set path, suggesting that it might slow down the pace of the policy tightening. That said, the lack of any meaningful buying around the US dollar offers some support to the GBP/USD pair.

Despite more hawkish remarks by several Fed officials this week, investors have been pushing back against the idea of a larger interest rate hike at the September FOMC meeting. Apart from this, a positive tone around the equity markets undermines the safe-haven buck and assists the GBP/USD pair to attract some buying near the 1.2130 area, though the uptick lacks follow-through.

Traders now seem reluctant to place aggressive bets and prefer to wait on the sidelines ahead of the closely-watched US monthly jobs data, due later during the early North American session. The popularly known NFP report is expected to show that the economy added 250K jobs in July, down sharply from 372K in the previous month, and the unemployment rate remained steady at 3.6%.

Apart from this, investors will take cues from Average Hourly Earnings growth data. This will play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for the GBP/USD pair. In the meantime, spot prices seem more likely to remain confined in a range below the 1.2200-1.2210 strong resistance zone.

Technical levels to watch

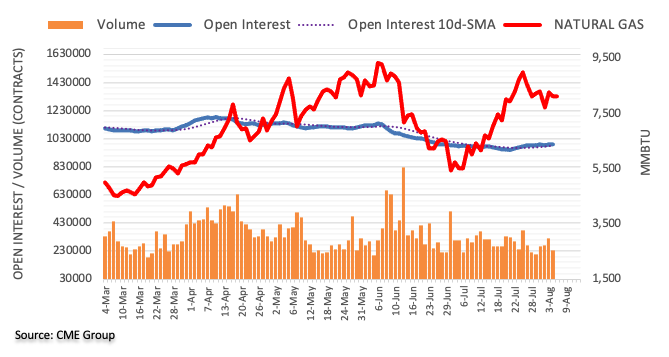

Considering preliminary readings from CME Group for natural gas futures markets, traders scaled back their open interest positions by around 1.2K contracts on Thursday. In the same line, volume reversed three consecutive daily builds and dropped by around 84.3K contracts.

Natural Gas keeps targeting $9.75

The upside bias in prices of natural gas faltered once again around the $8.50 mark on Thursday and ended the session with moderate losses amidst declining open interest and volume. Against that, further losses look unlikely and leaves the door open for the continuation of the rebound with the immediate target at the 2022 high at the $9.75 mark per MMBtu (July 26).

“Interest rates are not going back to where they were a pre-financial crisis,” Bank of England (BOE) Governor Andrew Bailey said on Friday.

Key quotes

We don't know what normal interest rates will be in future.

We don't think selling QE assets will have a big impact on market interest rates.

We are going to be dealing with impact of high inflation for some time.

Market reaction

GBP/USD is almost unfazed by the dovish remarks from BOE Governor Bailey. At the press time, cable is trading flat at 1.2160.

FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang now expect AUD/USD to trade between 0.6885 and 0.7035 in the near term.

Key Quotes

24-hour view: “We expected AUD to ‘trade sideways within a range of 0.6920/0.6970 yesterday’. AUD subsequently traded within a higher range than expected (0.6936/0.6988). The price actions still appear to be part of a consolidation and we expect AUD to trade between 0.6930 and 0.6985 for today.”