- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 08-08-2022

- GBP/USD fades the previous day’s corrective pullback but 200-SMA defends buyers.

- 38.2% Fibonacci retracement level adds to the downside filters.

- Bulls to remain cautious unless crossing 1.2175 hurdle.

GBP/USD retreats to 1.2085 after a mildly positive start to the week, sidelined during Tuesday’s initial Asian session. In doing so, the Cable pair pokes the 200-SMA support while fading the bounce off the 38.2% Fibonacci retracement of June 16 to July 14 downturn.

Given the bearish MACD signals and the recently downward sloping RSI (14), the GBP/USD pair is likely to remain pressured.

However, the aforementioned key SMA and the Fibonacci retracement levels, respectively neat 1.2060 and 1.2000, will be tough nuts to crack for the bears before retaking control.

Following that, a downward trajectory towards the multi-month low marked in July, around 1.1760, can’t be ruled out.

On the flip side, a convergence of the one-week-old descending trend line and the 61.8% Fibonacci retracement level near 1.2160 could restrict the short-term recovery of the GBP/USD pair.

Even if the Cable pair rises past 1.2160, the buyers need validation from the previous support line from mid-July, around 1.2175 to remain on the throne.

To sum up, GBP/USD remains on the seller’s radar but the downside remains sluggish.

GBP/USD: Four-hour chart

Trend: Pullback expected

Silver price (XAG/USD) steadies around $20.70 during Tuesday’s initial Asian session, after refreshing the monthly high the previous day.

In doing so, the bright metal tracks the cautious optimism in the options market as bulls retreat of late.

That said, the one-month risk reversal (RR) of silver prices, the difference between the call options and the put options, appear to retreat of late. The weekly RR prints 0.0000 figures after easing to 0.420 in the last week, from 0.950. It’s worth noting that the daily options market gauge remains indecisive at 0.000 by the press time.

Given the receding bullish bias in the options market, coupled with the anxiety ahead of the US Consumer Price Index (CPI) for July, up for publishing on Wednesday, XAG/USD prices may find it difficult to extend the latest run-up.

Also read: Silver Price Analysis: XAG/USD jumps back above $20.00, 50 DMA/50% Fibo. holds the key

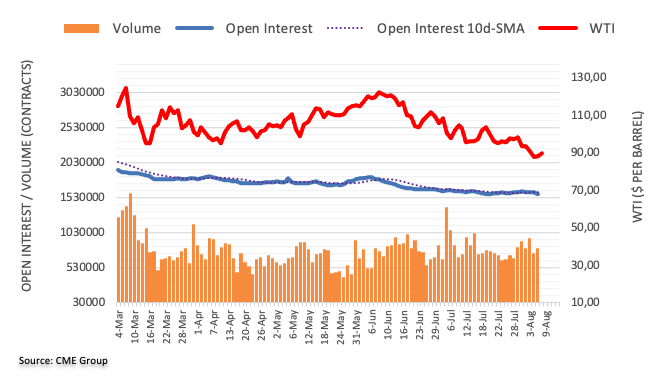

- WTI grinds higher after bouncing off the key Fibonacci retracement support.

- Sluggish RSI, MACD challenge further upside momentum but 61.8% golden ratio probes bears.

- Convergence of 200-DMA, two-month-old resistance line and 50% Fibonacci retracement level restricts short-term upside.

WTI crude oil prices struggle to extend the latest rebound at around $90.00 during Tuesday’s initial Asian session.

The black gold began the week on a positive side while extending Friday’s recovery from the 61.8% Fibonacci retracement level of December 2021 to the March 2022 upside, near $86.90.

However, downbeat RSI and sluggish MACD seem to challenge the WTI crude oil’s further recovery, which in turn restricts the quote’s latest moves below $90.00.

It’s worth noting that the commodity’s further upside past the $90.00 immediate hurdle needs validation from the $94.30-50 resistance area comprising the 50-DMA, 50% Fibonacci retracement level and a downward sloping trend line from early July.

During the quote’s pullback, the 61.8% Fibonacci retracement level near $86.90 could restrict immediate downside ahead of the late January swing low around $81.70.

Should WTI price remain weak past $81.70, the $80.00 round figure and early December 2021 swing high around $73.70 should lure the oil bears.

WTI: Daily chart

Trend: Limited upside expected

- A symmetrical triangle formation after a juggernaut rally hints continuation of an upside.

- Overlapping 50-EMA and asset’s price indicates short-term consolidation ahead.

- Aussie bulls will recapture a seven-year high at 96.88 on triangle breakout.

The AUD/JPY pair has picked bids around 94.20 after a soft decline from 94.37 in the early Asian session. Broadly, the cross has turned sideways in a 93.97-94.42 range after a vertical upside move on Monday. Aussie bulls have not exhausted yet and are expected to extend their gains further.

On a daily chart, the asset is oscillating in a Symmetrical Triangle chart pattern that signals an extreme slippage in the standard deviation. The upward-sloping trendline of the above-mentioned chart pattern is placed from May 12 low at 87.31 while the downward-sloping trendline is plotted from June 8 high at 96.88.

The 50-period Exponential Moving Average (EMA) at 93.35 is overlapping with the asset prices, which signals a consolidation ahead.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range. The prolonged upside bias is hinting for the continuation of an upside after a symmetrical breakout. And, a break above 60.00 will trigger the upside momentum.

Should the asset oversteps July 27 high at 95.70, the aussie bulls will drive the risk barometer towards a seven-year high at 96.88. A breach of the latter will send the cross towards May 2015 high at 97.30.

On the flip side, a decisive drop below Friday’s low at 92.24 will drag the asset towards Wednesday’s low at 91.72, followed by August low at 90.52.

AUD/JPY daily chart

-637955977820943348.png)

- NZD/USD remains sidelined after rising the most in three weeks the previous day.

- New Zealand Electronic Card Retail Sales improved MoM, dropped on YoY during July.

- Softer US Treasury yields weighed DXY, China trade numbers favored Antipodeans.

- Kiwi bears ignored softer prints of Q3 RBNZ Inflation Expectations with eyes on US CPI for July.

NZD/USD bulls struggle amid mixed retail sales data at home, as well as an absence of major catalysts, after rising the most in three weeks the previous day. That said, the Kiwi pair seesaws around 0.6280-85 during the initial hour of Tuesday’s Asian session.

New Zealand Electronic Card Retail Sales for July rose to -0.2% MoM versus -1.3% market forecasts and downwardly revised 0.0% prior. The yearly figure, however, slumped to -0.5% versus 6.9% expected and 1.9% prior.

It’s worth noting that the Reserve Bank of New Zealand’s (RBNZ) third quarter (Q3) Inflation Expectations eased to 3.07% versus 3.29% prior.

Even so, the Kiwi pair began the key week comprising the US inflation on a front foot amid a softer US dollar, as well as hopes of economic recovery from China.

That said, US Dollar Index (DXY) traced Treasury yields to consolidate Friday’s heavy gains that offered the greenback gauge the first weekly positive in three. That said, the DXY registered a 0.19% daily loss to 106.37 by the end of Monday whereas the US 10-year Treasury yields dropped nearly seven basis points (bps) to 2.75% at the latest, following a 14-bps run-up the previous day.

On the other hand, optimism surrounding China could be witnessed in the July month trade numbers from the dragon nation, as well as the market’s lack of interest in the Sino-American tussles over Taiwan. The dragon nation continues its military drills near the Taiwan border but the US recently signaled no major escalation in the geopolitical risks likely from Beijing. Elsewhere, China’s trade numbers for July. The headline Trade Balance rose to $101.26B versus $90B forecasts and $97.94B. Further details suggest that Exports increased by 18% compared to 15% expected and 17.9% prior whereas the Imports eased to 2.3% compared to 3.7% expected and 1.0% prior.

Amid these plays, Wall Street began Monday’s trading on a firmer footing before closing mixed, which in turn should have challenged the NZD/USD buyers amid hawkish Fed bets.

Given the recently cautious mood in the market, the Kiwi pair may remain sidelined and can witness a pullback should the scheduled second-tier US job numbers print strong outcomes. Forecasts suggest that the second quarter (Q2) US Nonfarm Productivity could improve to -4.6% from -7.3% prior while Unit Labor Costs may ease to 9.5% during the stated period versus 12.6% in previous readings. Furthermore, headlines surrounding Taiwan and Russia will also be important for clear directions.

Technical analysis

Although 20-DMA puts a floor under the short-term NZD/USD downside around 0.6240, a downward sloping resistance line from June 16, close to 0.6335-40 challenges the pair buyers.

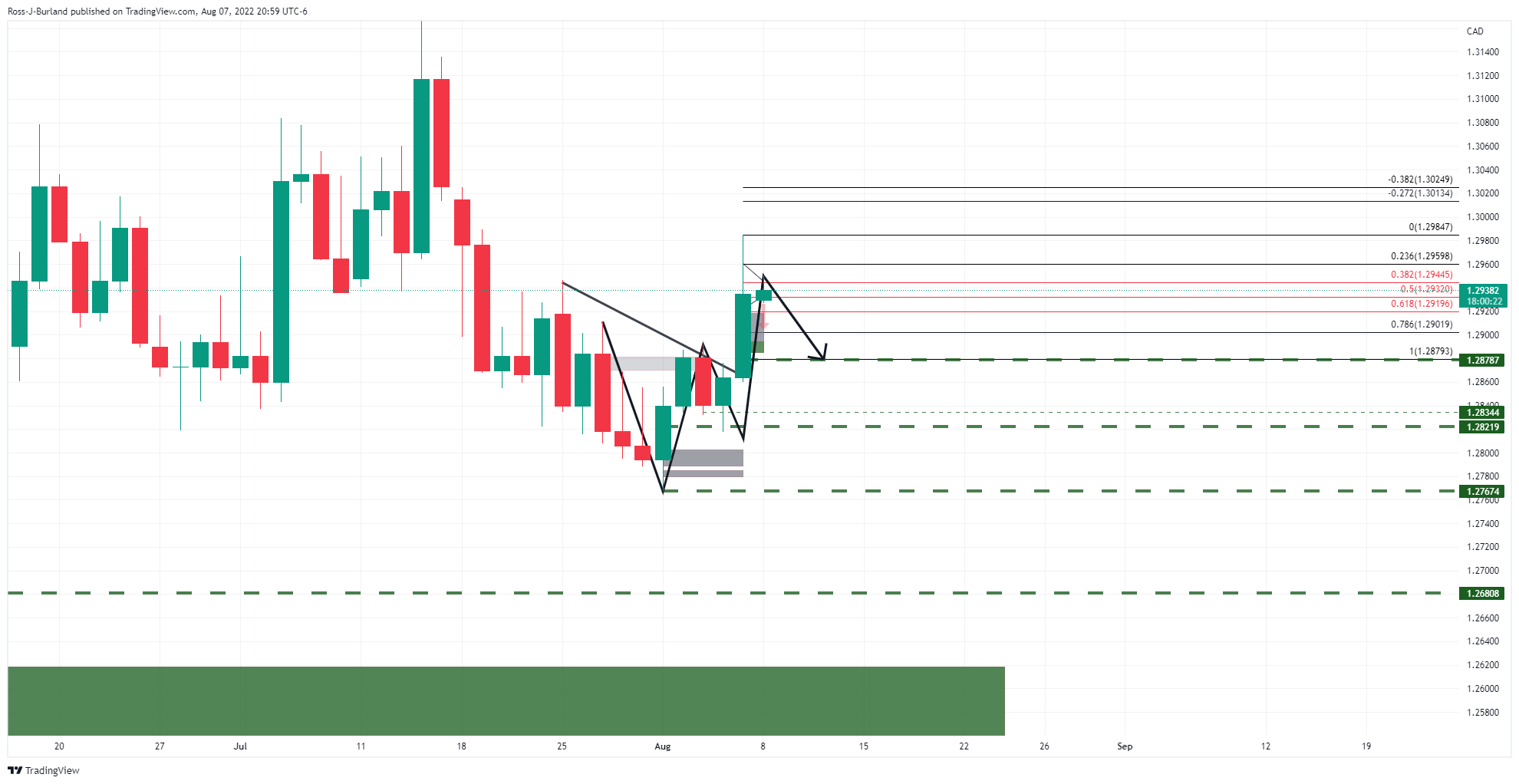

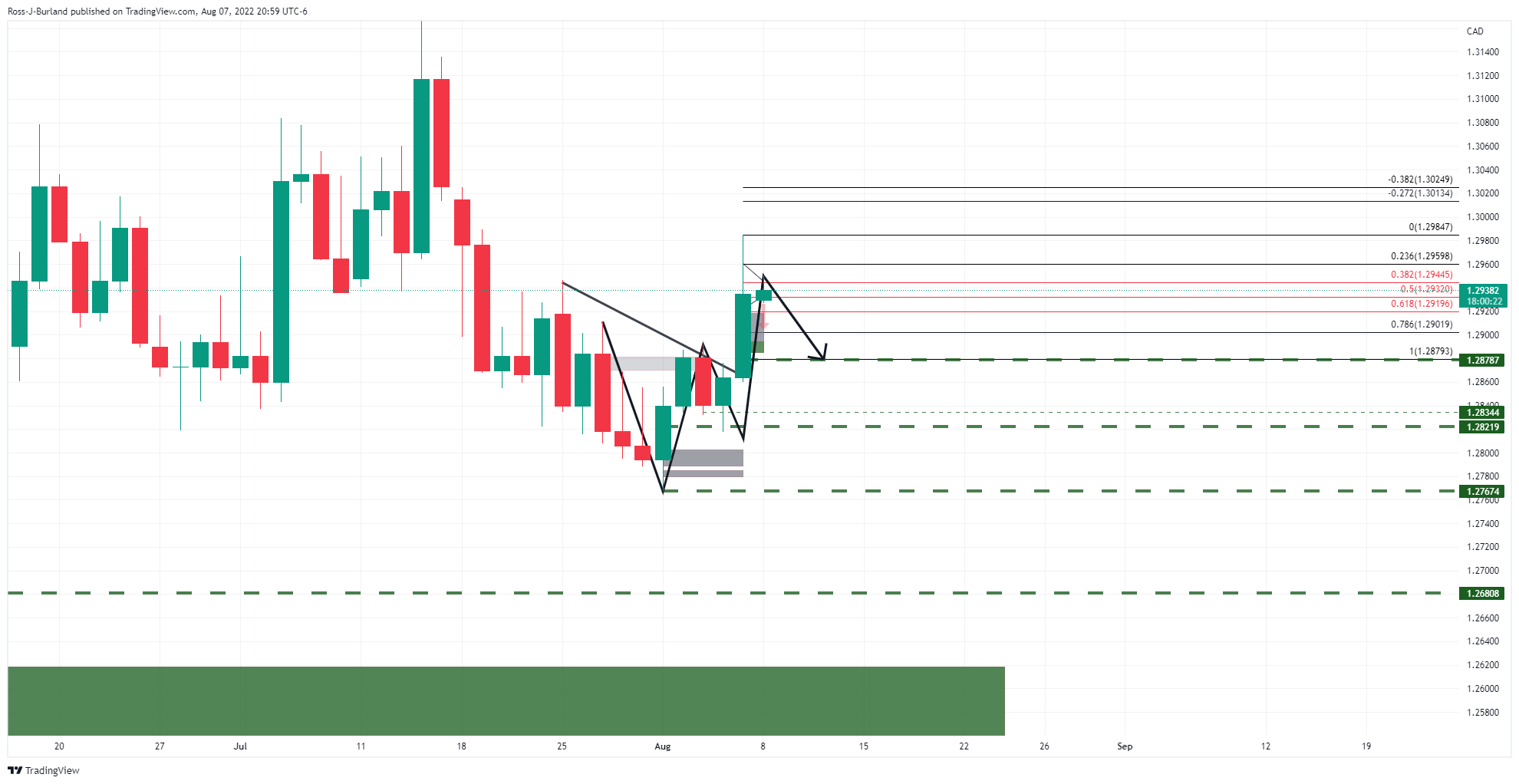

- USD/CAD is trapped between key hourly support and resistance.

- USD/CAD breakout prospects diminished with US CPI ahead.

As per the start of the week's analysis, USD/CAD Price Analysis: Bears lurking with eyes on a deeper correction, USD/CAD indeed fell into the hands of the bears as the following illustrates:

USD/CAD prior analysis

For the hourly time frame, it was explained that ''a break to the downside opens the probability of a move into the area of price imbalance. 1.2880 is a potentially key structure that if broken may give way to a deeper correction towards 1.2820 and 1.2770.''

(USD/CAD H1 chart, above, daily chart below)

It was explained that ''the daily chart's W-formation is a bearish feature with price anticipated to correct the daily bullish impulse towards the neckline. ''

USD/CAD live chart

As illustrated, the price has indeed dropped, respecting the prior analysis of the W-formation and the subsequent pull into the neckline.

As for the 1-hour chart, the price fell out of the coil and besides a brief spell of price discovery in the 1.2880s, the bears stayed in control to test below 1.2850:

The price is coiling again and a break of the corrective highs will likely see the bulls mitigate the price imbalance above. However, resistance could hold and see the price reverse in a continuation of the downside and in an extension of the prior bearish impulse to test towards 1.2820 and potentially beyond with daily structure eyed at 1.2767.

Alternatively, we could simply see the price bounded between 1.2900 and 1.2820 as we head into key US inflation data mid-week:

- The GBP/JPY daily chart portrays the pair as neutral-to-downwards, pierce of 163.00, to send the pair towards the 163.10s area.

- From a short-term perspective, the GBP/JPY is range bound, but the higher-time frame could lean the pair neutral-to-downwards.

The GBP/JPS is almost flat as Tuesday’s Asian Pacific session begins, seesawing around the 100-day EMA after hitting the weekly high at 163.84 on Monday. At the time of writing, the GBP/JPY is trading at 163.06, amid a risk-off mood as shown by Asian futures preparing to open lower.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart shows the pound remains heavy, albeit finishing Monday’s session with gains. Nevertheless, buyers’ inability to breach the 20-day EMA at 136.64 opened the door for sellers, who stepped in, sending the cross-currency diving towards the 163.00 figure. All that said, the pair is neutral-to-bearish biased.

Therefore, the GBP/JPY’s first support would be the August 8 low at 162.56. Break below will expose the August 5 low at 161.11, followed by the August 2 swing low at 159.44. Otherwise, if buyers reclaim the 20-day EMA at 163.64, that would open the door for a test of the 50-day EMA at 164.21.

GBP/JPY Daily chart

GBP/JPY Daily chart

The cross-currency pair is neutral biased from a short-term perspective, capped by the August 5 low and the August 8 high, at 161.11-163.84, respectively. Additionally, the Relative Strength Index (RSI), is almost flat, just above the 50-midline, but directionless. Therefore, a break above 163.84 could send the pair towards the August 4 high at 163.97, which, once cleared, could open the door for further gains. On the flip side, the GBP/JPY first support would be a busy support area, with the intersection of the 50, 200, and 100-hour EMAs around the 162.49-162.65. Once cleared, the next support would be the S2 pivot point at 161.86, followed by the S3 daily pivot at 161.16.

GBP/JPY Hourly chart

GBP/JPY Hourly chart

GBP/JPY Key Technical Levels

- USD/CHF is eyeing the 0.9550 figure, critical support ahead of the US Inflation.

- Declining oil prices are responsible for lower consensus for US CPI.

- SNB’s hawkish stance is still fresh despite the unchanged inflation rate at 3.5% released last week.

The USD/CHF pair has turned sideways after catching bids around 0.9550 in the early Tokyo session. On Monday, the asset defended the two-day support of 0.9540 and a responsive buying action pushed the asset higher. The major is likely to display action as per the positions adjusting ahead of the US Inflation.

As per the market consensus, the US Consumer Price Index (CPI) is likely to trim to 8.7% from the prior release of 9.1%. A drop by 40 basis points in the consensus is backed by declining oil prices over the past few weeks. The black gold lost its mojo on accelerating recession fears and trimming supply worries. This may delight the Federal Reserve (Fed) to head a little soft this time on interest rates.

Apart from that, the upbeat US Nonfarm Payrolls have shrugged off higher unemployment fears. The job additions in the labor market at 528k were more than doubled the expectations of 250k despite a halt in the recruitment process by various US corporate players.

Well, the economic condition is not fixed yet as the US CPI is still to release. Also, a continuous slowdown in the price pressures is crucial to determine a decline in the price rise index. Therefore, a wait-and-watch game will continue to persist.

On the Swiss franc front, the unchanged inflation rate released last week at 3.5% doesn’t trim the odds of a rate hike by the Swiss National Bank (SNB) ahead, but hawkish guidance could get mild. A light Swiss economic calendar this week will remain more dependent on the greenback.

US inflation expectations, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose for the second consecutive day by the end of Monday’s North American session. That said, the inflation gauge recently flashed the 2.48% mark, reversing the previous week’s losses of late.

The recovery in the long-term inflation expectations should ideally help the US dollar as traders brace for this week’s US Consumer Price Index (CPI) for July, up for publishing on Wednesday.

Also likely to have underpinned the data could be the recently firmer US jobs report for July and the hawkish Fedspeak. On Friday, the headline Nonfarm Payrolls (NFP) rose to 528K versus 250K expected and 398K upwardly revised prior. Further, the Unemployment Rate also inched lower to 3.5% compared to 3.6% expected and previous readings. Following the data, San Francisco Fed President Mary Daly said during the weekend that the Fed is far from done in combating inflation. The policymaker also added, “50 bps increase is definitely in play. We need to keep an open mind.” On the same line was Fed Governor Michelle Bowman who said, “Fed should consider more 75 basis-point interest rate hikes at coming meetings to bring high inflation back down to the central bank's goal.”

It’s worth noting, however, that a lack of major data/events offered a sluggish start to the key week.

Also read: Forex Today: Adjusting positions ahead of US inflation figures

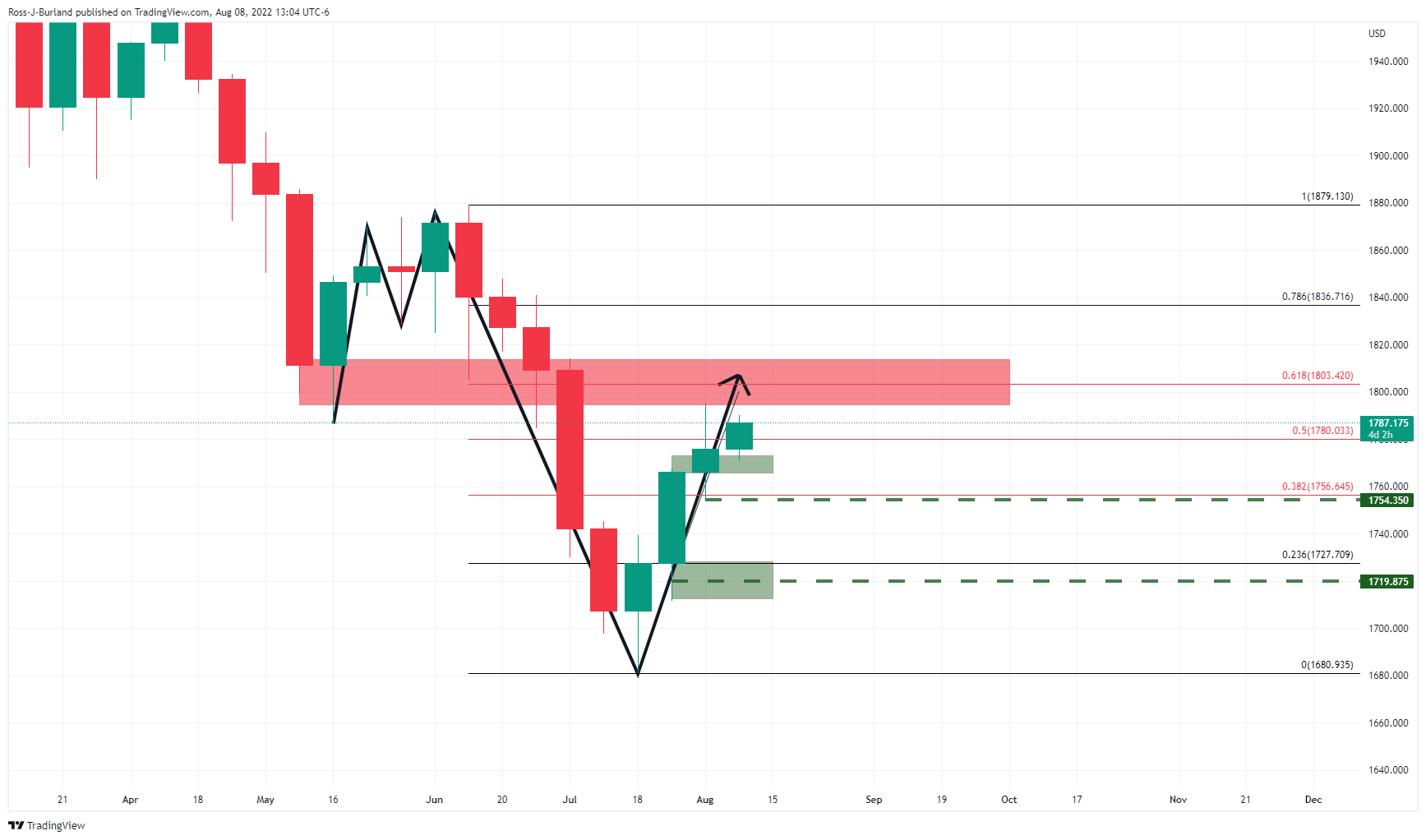

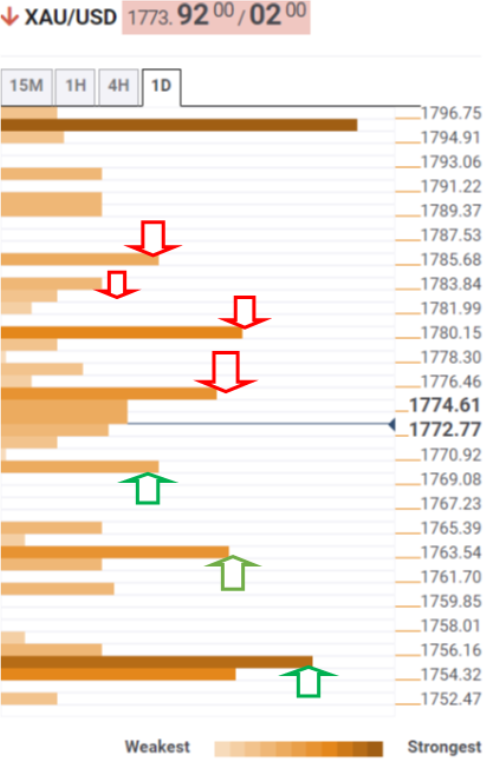

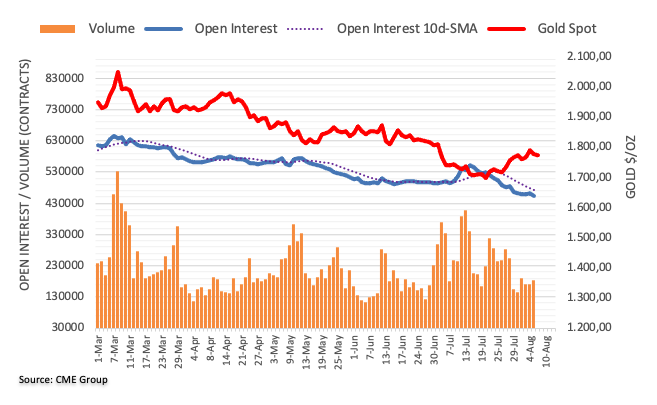

- Gold price bounced off 13-day-old support line amid softer US dollar.

- Market’s preparations for US inflation, pullback in yields and a light calendar favored XAU/USD buyers.

- Second-tier US jobs numbers, risk catalysts can entertain bulls ahead of US CPI for July.

Gold price (XAU/USD) cheered US dollar pullback and softer yields to print the latest gains, before taking rounds to $1,790 during the initial Asian session on Tuesday. The metal’s upward trajectory also took clues from equities as the key began the week’s trading on a positive side but retreated by the end of the day.

US Dollar Index (DXY) traced Treasury yields to consolidate Friday’s heavy gains that offered the greenback gauge the first weekly positive in three. That said, the DXY registered a 0.19% daily loss to 106.37 by the end of Monday whereas the US 10-year Treasury yields dropped nearly seven basis points (bps) to 2.75% at the latest, following a 14-bps run-up the previous day.

Also favoring the gold buyers could be the market’s lack of attention to the US-China tussles over Taiwan and China’s solid trade numbers for July. That said, the dragon nation continues its military drills near the Taiwan border but the US recently signaled no major escalation in the geopolitical risks likely from Beijing. Elsewhere, China’s trade numbers for July. The headline Trade Balance rose to $101.26B versus $90B forecasts and $97.94B. Further details suggest that Exports increased by 18% compared to 15% expected and 17.9% prior whereas the Imports eased to 2.3% compared to 3.7% expected and 1.0% prior.

It’s worth noting, however, that escalating hawkish Fed bets and the Fed policymakers’ favor for the aggressive rate hikes challenged the XAU/USD bulls. That said, the interest rate futures signaled a 73% chance of the Fed’s 75 bps rate hike in September following the strong US jobs report for July. The headline Nonfarm Payrolls (NFP) rose to 528K versus 250K expected and 398K upwardly revised prior. Further, the Unemployment Rate also inched lower to 3.5% compared to 3.6% expected and previous readings.

After the data, San Francisco Fed President Mary Daly said during the weekend that the Fed is far from done in combating inflation. The policymaker also added, “50 bps increase is definitely in play. We need to keep an open mind.” On the same line was Fed Governor Michelle Bowman who said, “Fed should consider more 75 basis-point interest rate hikes at coming meetings in order to bring high inflation back down to the central bank's goal.”

Looking forward, the US dollar weakness may favor gold buyers, together with the technical details mentioned below. Also important to watch will be the US Nonfarm Productivity and Unit Labor Costs for the second quarter (Q2). Forecasts suggest that the US Nonfarm Productivity could improve to -4.6% from -7.3% prior while Unit Labor Costs may ease to 9.5% versus 12.6% previous readings. Furthermore, headlines surrounding Taiwan and Russia will also be important for clear directions.

Technical analysis

Gold price not only bounced off a short-term key support line but also crossed the 50-DMA on a daily closing for the first time since late April. The upside move takes clues from the firmer RSI (14), not overbought, as well as bullish MACD signals to keep buyers hopeful.

That said, the XAU/USD buyers are ready to renew the monthly high near the $1,800 threshold before poking the 38.2% Fibonacci retracement of April-July fall, close to $1,802.

However, a downward sloping resistance line from mid-June, close to $1,827, could challenge the gold bulls afterward.

Meanwhile, the 50-DMA and the aforementioned support line, respectively near $1,786 and $1,780, could restrict the metal’s short-term downside.

Following that, the 23.6% Fibonacci retracement level and the 21-DMA, around $1,755 and $1,741 in that order, should gain the XAU/USD sellers’ attention.

Overall, the gold price is ready to extend the latest gains toward the 1.5-month-old resistance line.

Gold: Daily chart

Trend: Further upside expected

- Volatility contraction escalates on a follow-up Diamond after a consolidation.

- Overlapping 50-EMA with asset prices is hinting at a sideways move ahead.

- The shared currency bulls are continuously facing barricades around 1.0200.

The EUR/USD pair has displayed a gradual decline and has slipped to near 1.0193 after failing to surpass the critical hurdle of 1.0220 in the New York session. On a broader note, the asset is advancing modestly after printing a low of 1.0146 last week. The asset is facing barricades in establishing above the psychological resistance of 1.0200

A formation of a Diamond pattern after a prolonged consolidation indicates that the asset is still inside the woods and will take sufficient time to conclude its volatility contraction. Usually, a breakout of a volatility contraction in an asset is followed by volumes and wide-range ticks.

The 50-period Exponential Moving Average (EMA) at 1.0193 is overlapping with the asset prices, which signals a consolidation ahead.

Also, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which indicates that the market participants are awaiting a fresh trigger for a decisive move.

A decisive move above Thursday’s high at 1.0254 will drive the asset towards the August 2 high at 1.0294, followed by June 15 low at 1.0359.

Alternatively, the greenback bulls could cripple the upside bias if the asset drops below July 27 low at 1.0097, which will drag the asset towards July 14 high at 1.0050. A breach of the latter will unleash the greenback bulls for more downside towards July 14 low at 0.9952.

EUR/USD hourly chart

-637955936412348412.png)

- AUD/USD grinds higher after the heavy gains amid a lack of major catalysts.

- China trade data, market’s preparations for US CPI appeared to have favored buyers.

- Mixed equities probed upside momentum, yields underpinned the US dollar pullback.

- Australia’s NAB data for July, second-tier US job numbers may entertain intraday traders, Taiwan headlines are important too.

AUD/USD bulls take a breather after the biggest daily jump in three weeks, taking rounds to 0.6880-90 amid the initial hour of Tuesday’s Asian session. In doing so, the Aussie pair cheered the US dollar’s pullback, as well as firmer China data, before portraying a cautious mood ahead of sentiment data from the National Australia Bank (NAB) and the key US Consumer Price Index 9CPI) for July.

The Aussie pair began the week on the front foot as the US Dollar Index (DXY) traced Treasury yields to consolidate the latest gains. That said, the DXY registered a 0.19% daily loss to 106.37 by the end of Monday whereas the US 10-year Treasury yields dropped nearly seven basis points (bps) to 2.75% at the latest, following a 14-bps run-up on Friday.

Also helping the AUD/USD bulls were firmer prints of China’s trade numbers for July. The headline Trade Balance rose to $101.26B versus $90B forecasts and $97.94B. Further details suggest that Exports increased by 18% compared to 15% expected and 17.9% prior whereas the Imports eased to 2.3% compared to 3.7% expected and 1.0% prior.

It’s worth noting, however, that the hawkish Fedspeak and anxiety ahead of the US inflation data capped the AUD/USD prices. The Fed policymakers welcomed Friday’s strong US jobs report while supporting the aggressive rate hikes.

On Friday, the headline Nonfarm Payrolls (NFP) rose to 528K versus 250K expected and 398K upwardly revised prior. Further, the Unemployment Rate also inched lower to 3.5% compared to 3.6% expected and previous readings. Following the data, San Francisco Fed President Mary Daly said during the weekend that the Fed is far from done in combating inflation. The policymaker also added, “50 bps increase is definitely in play. We need to keep an open mind.” On the same line was Fed Governor Michelle Bowman who said, “Fed should consider more 75 basis-point interest rate hikes at coming meetings in order to bring high inflation back down to the central bank's goal.”

Moving on, NAB Business Confidence and NAB Business Conditions for July, expected 15 and 7 versus 13 and 1 in that order, will direct short-term moves of the AUD/USD ahead of the US Nonfarm Productivity and Unit Labor Costs for the second quarter (Q2). Forecasts suggest that the US Nonfarm Productivity coooulddd improve to -4.6% from -7.3% prior while Unit Labor Costs may ease to 9.5% versus 12.6% previous readings. Other than that, headlines surrounding Taiwan and Russia will also be important for clear directions.

Technical analysis

AUD/USD remains firmer above the 50-DMA support of 0.6880 but the upside momentum needs validation from a downward sloping resistance line from mid-June, close to 0.7025 by the press time.

- On Monday, the EUR/JPY registered minimal gains of 0.14%.

- EUR/JPY daily chart depicts the pair as neutral-to-downward biased; however, a break above 137.92 could shift the bias.

- Short term, the EUR/JPY is neutral-to-upwards, but breaks below 137.06, shift the bias to neutral.

The EUR/JPY seesaws as the Asian Pacific session begins, just below the confluence of the 20 and 100-day EMA, around 137.99-138.19 area, amidst fragile sentiment, as shown by Asian equity futures set to open lower, while US equities closed mixed. At the time of writing, the EUR/JPY is trading at 137.62, slightly up 0.02%.

EUR/JPY Price Analysis: Technical outlook

From a daily chart perspective, the EUR/JPY is bearish biased. Successions of lower highs/lows, alongside daily EMAs above the exchange rate, confirm those above. Also, sellers are gathering momentum, per the Relative Strength Index (RSI) shows, at 46.05, with an almost horizontal slope, but still in negative territory. Therefore, the EUR/JPY's first support would be the August 8 daily low at 137.06. A break below could pave the way towards 135.80 August 5 low, exacerbating further downside action. On the flip side, the EUR/JPY's first resistance would be the August 8 high at 137.92.

EUR/JPY Daily chart

EUR/JPY Daily chart

Meanwhile, the EUR/JPY hourly chart portrays an opposite bias to the daily chart, neutral-to-upwards. Factors like the hourly EMAs, below the exchange rate, alongside the Relative Strength Index (RSI) at bullish territory, back up the bias.

Therefore, the EUR/JPY's first resistance would be the confluence of the August 8 high and the R1 pivot around 137.92-138.00. A breach of the latter will expose the R2 daily pivot at 138.40, followed by the R3 pivot point at 138.87. On the other hand, a EUR/JPY break below 137.06 might shift the bias to neutral, opening the door for further losses.

EUR/JPY Hourly chart

EUR/JPY Hourly chart

EUR/JPY Key Technical Levels

- GBP/USD is sensing barricades around 1.2080 as investors await US CPI data.

- Downbeat oil prices have trimmed US CPI forecasts and Fed’s rate hike hopes.

- A lower consensus for BRC Like-for-Like Retail Sales in times of higher inflation indicates vulnerable demand.

The GBP/USD pair is struggling to cross the immediate hurdle of 1.2080 and has marked its territory after a sheer downside move from the critical hurdle of 1.2130. The cable is oscillating in a narrow range of 1.2068-1.2081 from the late New York session and is likely to remain topsy-turvy as investors are awaiting the release of the US Inflation.

Wednesday’s US Consumer Price Index (CPI) is likely to shift lower to 8.7% on an annual basis as oil prices have remained vulnerable in July. Accelerating recession fears in the Western economies and China have trimmed the demand forecasts vigorously, which forced the market participants to dump oil longs.

The investing community is aware of the fact that the volatile oil prices were driving the price rise index higher. Now, downbeat oil prices are clearly diminishing the inflation forecasts and the continuation of a 75 basis point (bps) rate hike odds by the Federal Reserve (Fed). While the core CPI that doesn’t inculcate volatile oil and food products is expected to elevate to 6.1% from the prior release of 5.9%.

On the UK front, investors are awaiting the release of the Gross Domestic Product (GDP), which is due on Friday. The economic data is expected to plummet to 2.8% vs. 8.7% reported earlier on an annual basis. An occurrence of the same will send the pound bulls on the back foot.

But before that, the release of the British Retail Consortium (BRC) Like-For-Like Retail Sales holds significant importance. The economic data may plunge sharply to -8.4% vs. -1.3% reported last month. A significant drop in Retail Sales, in times when the inflation rate is accelerating, displays that the decline is higher than the absolute and relative plunge. Higher inflation should elevate Retail Sales data but a decline vulnerable retail demand in the economy.

- NZD/USD advances despite a lack of catalyst, lifted by the AUD/USD.

- Sentiment remains mixed, tilted positively, as shown by the FX space, with safe-haven peers pressured.

- Fed policymakers are still pushing back against dovish tilt, as money market STIRs odds of a 75 bps hike lie at 90%.

- RBNZ survey of inflation expectations easied, with 2-year inflation at around 3%.

The NZD/USD climbs as the New York session winds down, up 0.72%, as US equities finished mixed, reflecting a fragile mood. Nevertheless, in the FX space, a risk-on impulse underpinned risk-sensitive currencies like the New Zealand dollar, despite increasing odds of further tightening by the Federal Reserve.

The NZD/USD is trading at 0.6285. earlier, the NZD/USD reached a daily low at 0.6230 before rallying sharply and hitting a daily high at 0.6305, around the London fix time.

The sentiment is stills mixed. The greenback ended Monday’s session on the wrong foot, though late trimmed losses, with the US Dollar Index at 106.387, down 0.18%. Contrarily, US bond yields, led by the US 10-year T-bond yield, dropped almost nine bps, at 2.746%.

The financial market narrative hasn’t changed. Strong US jobs report in last Friday, with US Nonfarm Payrolls surprisingly doubling estimation had seen a jump in Fed’s rate hikes expectations. Since money market futures STIRs show a 90% chance of a 75 bps rate hike, further fueled by Fed’s Michelle Bowman, over the weekend. She said, “I supported the FOMC’s decision last week to raise the federal funds rate another 75 basis points,” while adding that the Fed should keep considering significant hikes.

Furthermore, San Francisco’s Fed Mary Daly said that the Fed is nowhere near done with its fight against inflation. Meanwhile, the July New York Fed Consumer survey revealed that inflation expectations dropped to 6.2% YoY from 6.8% for a 1-year horizon.

In the meantime, the Reserve Bank of New Zealand (RBNZ) survey of expectations released on Monday portrays that 2-year inflation expectations tempered to 3.07%. Meanwhile, the 5-year ahead measure slipped to 2.3%, while the 10-year remained stable at 2.1%.

Analysts at Westpac wrote in a note that: “Even so, today’s survey still points to solid inflation pressures in the New Zealand economy and reinforces the case for rate rises. We’re forecasting another 50bp rise at next week’s RBNZ policy meeting. “

What to watch

The New Zealand economic calendar will feature Electronic Card Retail Sales MoM and YoY for July. On the US front, the economic calendar will unveil July’s CPI and PPI data on Wednesday and Thursday, respectively. Further Fed speaking, led by Charles Evans, Neil Kashkari, and Mary Daly, would offer fresh impetus to NZD/USD traders.

NZD/USD Key Technical Levels

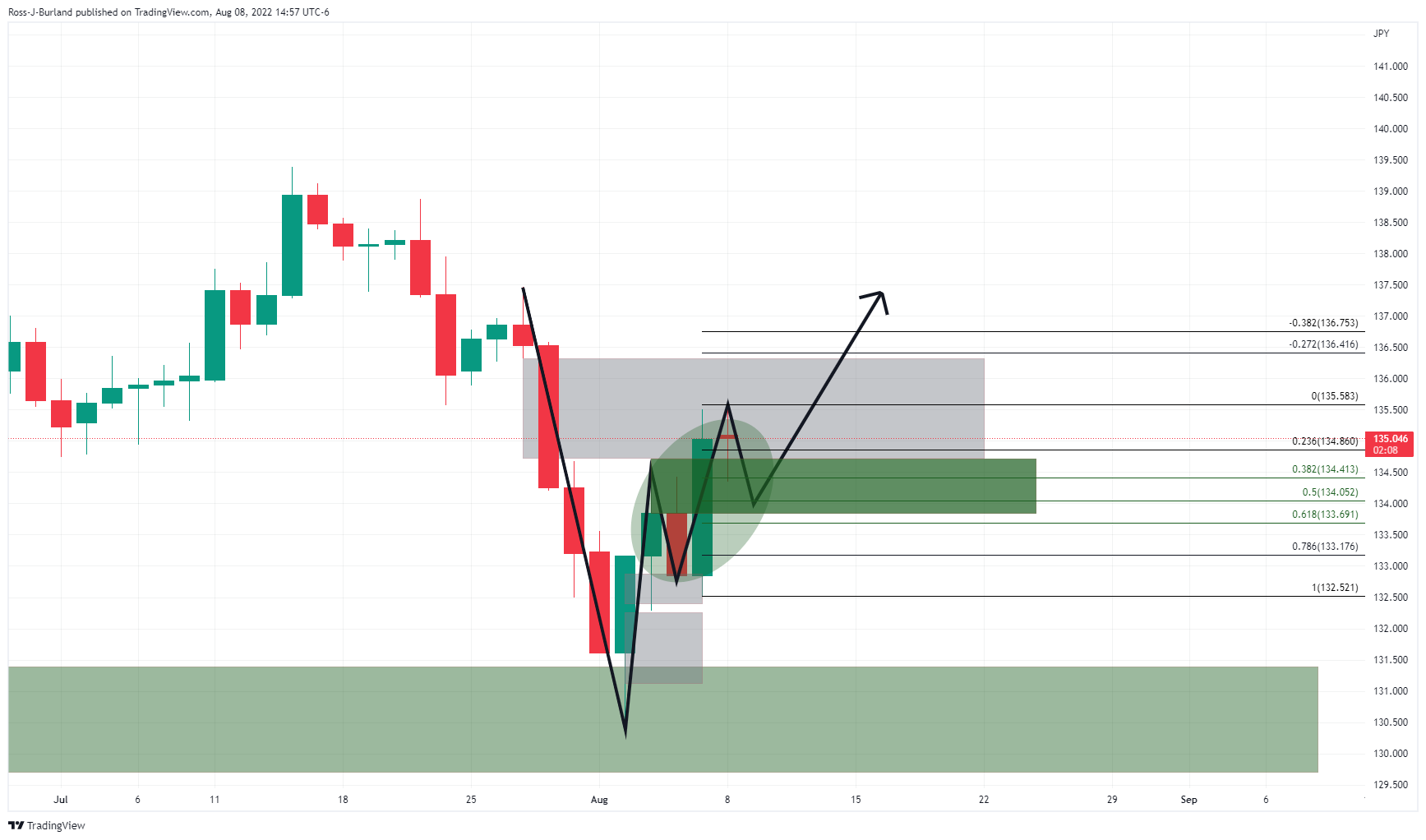

- USD/JPY bulls could be about to move back in on the daily chart.

- US CPI will be key this week, with eyes on US yields.

USD/JPY has been in recovery mode for the best part of a week, but it came up against resistance following last week’s strong July labour market data in the US. On Monday, the pair is ending the New York session flat for the day at around 135 the figure having ranged between 134.34 and 135.58.

Analysts at ANZ Bank said that despite clear signs of a moderation in Gross Domestic Product growth globally, ''the slower growth and less accommodative monetary environment have yet to show up in increased labour market slack. Until clear evidence emerges that both labour markets and core inflation are moderating, central banks will remain dedicated to getting inflation down, a bias that points to the potential for further large incremental rate hikes.''

The focus for the week ahead will be the July US inflation data in Consumer Price Index that is expected to confirm core inflation (ex-food & energy) rose 0.5% MoM, up 6.1% YoY (5.9%). ''That is way too high for the Fed amid a tightening labour market. The priority of reducing inflation in order to underpin the expansion in domestic demand and sustainable jobs growth will ring loud and clear from the August 25-27 Jackson Hole symposium,'' analysts at ANZ Bank explained.

The analysts at ANZ Bank also said that before the Federal Open Market Committee meets again in September, it will also have the August CPI and labour market data. ''Unless that moderates meaningfully from July’s strong gains, the risks are significant that the Fed may need to hike rates by another 75bps at the 20-21 September meeting.''

Meanwhile, from a positioning perspective, JPY net short positions fell according to the latest CFTC data. In the spot market the JPY had recovered some ground vs the USD as US yields dropped back. ''The stronger than expected US July payrolls report, however, has subsequently caused US 2-year yields to push higher and this has lent fresh support to USD/JPY in the spot market,'' analysts at Rabobank explained.

USD/JPY technical analysis

As per the prior analysis, USD/JPY Price Analysis: Bears are lurking within a strong bullish trend, the price moved in to correct the bearish impulse:

(Prior daily chart, above, prior H4 chart, below)

USD/JPY live market

As illustrated, the price indeed moved in towards the targetted area of mitigation as per the prior analysis forecasted and explained. At this juncture, there are prospects of a correction of Friday's bullish candle into the neckline of the W-formation as follows:

The upside prospects will send on the performance of US yields, but there are stacking up for a bullish continuation in the 10-year yields according to the recovery attempts within the broadening formation as follows:

The yield has corrected towards the neckline of the W-formation on the daily chart within the lower boundary of the broadening formation.

In turn, should the price hold above the flagged levels on the chart above, then a break of the trendline resistance could result in a rally in yields, a weight for gold prices.

What you need to take care of on Tuesday, August 9:

The dollar eased on Monday as government bond yields retreated, providing support to stock markets. Still, the absence of relevant news maintained US indexes seesawing within familiar levels. European indexes posted modest intraday gains, but Wall Street closed mixed.

Market players hold their breath ahead of the US Consumer Price Index to be released next Wednesday. Concerns about economic growth and aggressive tightening in the US re-surged on Friday after a strong job report. Investors will make a reassessment of the situation after the release of inflation figures.

Tensions between Germany and Russia over natural gas delivery undermined demand for the shared currency. The EUR/USD pair flirted with the 1.0200 level and settled at around 1.0190.

GBP/USD ended the day pretty much unchanged at 1.2075. Commodity-lined currencies surged against their American rival, shedding some ground ahead of the close but holding to intraday gains. AUD/USD trades at around 0.6980, while USD/CAD is down to 1.2860.

The USD/JPY pair hovers around 135.00, while USD/CHF trades at 0.9560.

Spot gold retained gains at the end of the day at settled at $1,788 a troy ounce. Crude oil prices posted a modest advance, with WTI currently trading at $90.50 a barrel.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Are your bags packed for FOMO Season?

Like this article? Help us with some feedback by answering this survey:

- Gold price is attempting a move higher but faces headwinds, both technically and fundamentally.

- The US CPI data on Wednesday could be pivotal for the gold price.

At $1,787.86, the gold price is firm at the start of the week, trading 0.7% higher having climbed from a low of $1,771.22 to a high of $1,790.04. However, the $1,800 psychological level remains elusive ahead of a critical inflation report due on Wednesday from the US calendar which could be pivotal for the yellow metal, US dollar and US yields.

Meanwhile, the US dollar has given back some of the gains made after last week's blockbuster Nonfarm Payrolls data that has soothed some of the fears about an economic slowdown.

Nevertheless, investors remained cautious as the payrolls data added to expectations of a hawkish US Federal Reserve. US rate futures have priced in a 67.5% chance of a 75-basis-point hike at the Fed's September meeting, up from about 41% before payrolls data on Friday beat market expectations.

However, US 10-year yields remain below the recent highs of 2.869% so far. There is daily support in Monday's lows near 2.7610% at this juncture which could mean the relief is temporary with the focus now on consumer prices data on Wednesday. The inflation data will help to confirm if the Fed's tightening efforts have been successful in starting to tame inflation or if continued Fed tightening is needed and could be a critical milestone for forex markets and indeed the euro.

-

US CPI Preview: It is the hard core that counts, five scenarios for critical inflation data

''While market pricing has shifted more toward another 75bp hike in September, it is far from locked in and with CPI data set for release midweek, the yellow metal has been able to hold firm,'' analysts at TD Securities noted.

However, ''alternatively,'' the analysts warned, ''prop traders in particular still hold a significant amount of long positions, and a continuation of strong economic data could be the catalyst needed to see an unwind. In this sense, we have yet to see capitulation in gold, suggesting the pain trade is still to the downside, and we expect the recent rally will ultimately fade.''

Gold technical analysis

It is worth noting the broadening formation in the US 10-year yield as follows:

The yield has corrected towards the neckline of the W-formation on the daily chart within the lower boundary of the broadening formation.

In turn, should the price hold above the flagged levels on the chart above, then a break of the trendline resistance could result in a rally in yields, a weight for gold prices.

On the other hand, the weekly chart's correction is yet to reach a 61.8% golden ratio as follows:

With that being said, should the bears move in this week, a close below $1,754.35 could be pivotal in opening the prospects of a significant downside continuation beyond $1,720.

- AUD/USD edges up by 1%, boosted by a soft greenback.

- China’s Trade Balance surplus increased the appetite for the risk-sensitive AUD.

- The AUD/USD got bolstered by last week’s RBA’s tightening expectations.

The AUD/USD rallied during the North American session as the market mood turned mixed, with US equities fluctuating, while the greenback tumbles on the back of falling US Treasury bond yields after a strong US jobs report.

The AUD/USD is trading at 0.6980, shy of the day’s highs, reached late in the New York session. During the Asian session, the major gapped down and printed the daily low at 0.6897, but since never looked back, advancing sharply, towards 0.7009, before retracing to current price levels.

AUD/USD bolstered by China’s Trade Balance data, as the US dollar weakened

Last Friday’s US Nonfarm Payrolls report showed that the US economy added 528K employees, further cementing the case for the US Federal Reserve to continue its “aggressive” tightening path. That spurred a jump in US bond yields. Meanwhile, money market future STIRs expectations of a 75 bps rate hike for the FOMC’s September meeting, topping 90%.

Over-the-weekend, Fed’s board member Michelle Bowman crossed newswires. She said, “I supported the FOMC’s decision last week to raise the federal funds rate another 75 basis points,” and added that “similarly-sized” hikes should be on the table until we (the Fed) see inflation declining consistently.

Even though that’s positive for the greenback, the US Dollar Index is falling 0.20% at 106.370, undermined by diving US T-bond yields. Therefore, the AUD/USD is recording its largest gain since July 19.

During the Asian session, an absent Australian economic docket left traders leaning toward China’s data. Chinese exports grew at an 18% YoY pace, vs. 14.1% YoY estimations, up from June’s figures. Imports slowed to 2.3% YoY vs. 4.0% estimated. Consequently, the Trade Balance recorded a surplus of $101 B vs. $89 B foreseen.

That said, alongside last week’s Reserve Bank of Australia (RBA) signaling more tightening in the upcoming months, it was a tailwind for the Aussie. The AUD/USD rebounded near the 20-day EMA at 0.6904 and, on its way towards the daily high, reclaimed the 50-day EMA.

What to watch

The Australian economic docket will feature July’s NAB Business Conditions and Business Confidence. On the US front, the US calendar will feature July’s CPI, and PPI data on Wednesday and Thursday, respectively. That, alongside further Fed commentary led by Charles Evans, Neil Kashkari, and Mary Daly, would shed some light regarding the posture of the central bank.

AUD/USD Key Technical Levels

- EUR/USD bulls moved in for the kill at the start of the week in a risk-on environment,

- Given the bullish environment surrounding US yield and the greenback, the floodgates could open up below 1.0150.

EUR/USD is treading water in the green at the start of the week and holding up by 0.20% in the midday New York session. The pair has ranged between a low of 1.0159 and 1.0221 so far and is currently trying to hold onto 1.0200 but is pressured. The US dollar has given back some of the gains made after last week's blockbuster Nonfarm Payrolls data that has soothed some of the fears about an economic slowdown.

Nevertheless, investors remained cautious as the payrolls data added to expectations of a hawkish US Federal Reserve. US rate futures have priced in a 67.5% chance of a 75-basis-point hike at the Fed's September meeting, up from about 41% before payrolls data on Friday beat market expectations.

However, US 10-year yields are anchored below 2.869% so far, ducking below those recently made highs. However, there is daily support in Monday's lows near 2.7610% at this juncture which could mean the relief is temporary with the focus now on consumer prices data on Wednesday. The inflation data will help to confirm if the Fed's tightening efforts have been successful in starting to tame inflation or if continued Fed tightening is needed and could be a critical milestone for forex markets and indeed the euro.

''Insofar as the strong payrolls release was unable to push EUR/USD outside of the range that has been maintained since late July, the market will now be looking for fresh direction,'' analysts at Rabobank argued. ''Although we would expect the EUR/USD 1.01 area to act as solid support going forward, we retain the view that EUR/USD is likely to drop back below parity again on a 1 to 3-month view. However, for this to happen USD strength will likely have to be complemented with another bout of fresh EUR negative news.''

Meanwhile, domestically, the analysts at Rabobank see the odds of a recession in the Eurozone as ''strong'', though also note, that recent reports have played down the prospects of energy rationing for the industry.

''While the news on gas storage has been reassuring, a cold winter and the possibility that gas through Nord Stream 1 is totally shut off are among the risks that are faced by Europe in the months ahead.''''FX positioning data suggest that the market has already built up substantial short EUR positions.

This will de-sensitise the single currency to bad news to some degree. That said, faced with uncertainties connected to energy supply, recession and Italian politics we continue to see further downside potential for the EUR on a 1 to 3-month view. Coincidentally, we expect the USD to remain well supported in this period.''

EUR/USD technical analysis

Firstly, it is worth noting that the US 10-year yield's support zone could see the price rejected higher again in the coming days:

Meanwhile, as per the EUR/USD prior analysis, the H1 M-formation pulled in the price and there was a follow-through beyond the neckline resistance which gave way to a stronger correction into the 78.6% Fibonacci retracement level as follows:

It was stated that the M-formation that was developing was a reversion pattern ''that would be expected to see the price attracted to the neckline again in due course.''

The bulls have run away with it but given the bullish environment surrounding US yield and the greenback, the floodgates could open up below 1.0150.

- GBP/USD trims some of last Friday’s losses but remains trapped between the 20 and 50-DMA.

- The daily chart depicts the pair trending between a descending channel as sellers eye the 20-day EMA.

- The GBP/USD 4-hour scale depicts the pair as neutral-downward biased and might test the 1.2000 figure, short term.

The GBP/USD records minimal gains after hitting a daily high at 1.2137, shy of the 50-day EMA at 1.2166, which has proven to be solid resistance in the last four days. However, the British pound retreated under 1.2100 but remained above the opening price, recording gains of 0.12%. At the time of writing, the GBP/USD is trading at 1.2081.

GBP/USD Price Analysis: Technical outlook

The GBP/USD daily chart illustrates the major as neutral-to-downward biased. Further confirmation of the previously mentioned is that sellers are gathering momentum, as shown by the Relative Strength Index (RSI), aiming lower, residing below the 50-midline. Also, the major trades within a descending channel and the spot price is 50 pips shy of the 20-day EMA at 1.2039. Once cleared, it would exacerbate a fall towards the bottom of the channel, near the YTD low at 1.1759.

GBP/USD Daily chart

GBP/USD Daily chart

Meanwhile, the GBP/USD 4-hour chart shows that an ascending channel was broken to the downside last Friday, adding further selling pressure on the pair. Worth noting that GBP/USD buyers lifted the pair from the confluence of the 100 and 200-EMAs, near the 1.2040s lows of the day. However, sellers piling around the 20-EMA at 1.2113 weighed on the pair, which slid below the 1.2100 mark.

Hence, the GBP/USD 4-hour chart is still neutral-to-downward biased. Therefore, the GBP/USD first support would be the confluence of the 100 and 200-EMA around 1.2065-68. The break below will send the pair tumbling towards the S1 pivot at 1.1990, followed by the S2 at 1.1910.

GBP/USD 4-hour chart

GBP/USD 4-hour chart

GBP/USD Key Technical Levels

The USD/CAD pair will likely decline toward 1.22 in the coming quarters with the oil/loonie correlation turning positive again, point out analysts at National Bank of Canada. They see the WTI oil price stabilizing at 90$ per barrel.

Key Quotes:

“July was a roller coaster ride for the Canadian dollar. The loonie started the month at 1.29 before losing several feathers, with USD/CAD even reaching our Q3 target of 1.32 on July 14, faster than we had envisioned in our previous Forex piece and despite an unexpected jumbo rate hike from the Bank of Canada. After rallying 4 cents through August 1, the loonie has returned to 1.29 against the greenback on disappointing jobs data.”

“Unforced retirements, not layoffs, seem to be the main cause of recent job losses. We still see USD/CAD converging to 1.22 in the coming quarters.”

- Risk appetite on Monday favors the kiwi.

- US dollar erases NFP gains, DXY falls toward 106.00.

- NZD/USD supported by the 20-day SMA.

The NZD/USD is rising on Monday, although it trimmed gains during the last hours. The pair peaked at 0.6303 and then pulled back to 0.6280. It is positive ground for the day, supported by a weaker US dollar and risk appetite.

The greenback is falling across the board as US yields move to the downside. The US 10-year stands at 2.76%, far from Friday’s top of 2.88%. The DXY falls 0.25% and trades below 106.30.

A report from the Reserve Bank of New Zealand showed a decline in inflation expectations. “The outcome provides some relief but does little to alter the bigger picture - short-term inflation expectations (2y) remain well above the 1-3% target band, Q2 headline CPI and non-tradeable inflation handily exceeded the RBNZ's May MPS forecasts while core inflation measures are edging higher. Along with accelerating wages growth, the data suggest that the RBNZ's job is still not done and look for a 4th straight 50bps hike at the upcoming Aug meeting”, explained analysts at TD Securities.

In the US the key number of the week is the CPI on Wednesday. The NFP report opened again the doors to a more aggressive Federal Reserve. Inflation figures (also the PPI on Thursday) will likely impact on Fed rate expectations.

Technical outlook

The NZD/USD remains supported by the 0.6210/20 area and the 20-day Simple Moving Average (SMA), today at 0.6230. A consolidation below those levels should point to more losses in the short-term.

On the upside, NZD/USD is testing the 0.6300 area that contains the 55-day SMA. A break higher could lead to a test of the August high at 0.6332.

Technical levels

- Gold price edges higher on Monday, up by 0.72%, as US bond yields fall.

- Broad US dollar weakness keeps the non-yielding metal buoyant, underpinned by the US-China conflict in Taiwan.

- Fed’s Bowman: Backs a 75 bps in September and supports “similar-size” moves in subsequent meetings.

- Gold Price Forecast (XAUUSD): Neutral-to-bearish below $1800; otherwise, a correction to $1738.91.

Gold price rises to fresh week highs around $1790 in the mid-New York session, as the greenback gets battered, down by 0.34%, per the US Dollar Index at 106.217, as traders brace for July’s US Consumer Price Index, amidst a light US calendar on Monday and Tuesday. However, the NY Fed revealed consumer inflation expectations at 6.2%, from 6.8% in June. At the time of writing, XAUUSD is trading at $1787.62.

XAUUSD rises on falling US bond yields as US-China tensions elevate

The market mood is positive, as European bourses are about to close while US equities rise. US bond yields pare some of last Friday’s gains following a stellar US jobs report that added 528,000 employees to the working force, fueling expectations that the US Federal Reserve might not step out of the pedal. It should be noted that the Unemployment Rate fell to 3.5%, so expectations of a dovish tilt by the US central bank faded.

Therefore, XAUUSD traders scaled back their gold longs as US bond yields jumped, while the US 10-year TIPS, a proxy for real yields, edged higher towards 0.370%.

Amidst those plays, geopolitical concerns around Taiwan, and US-China tussles, are also adding uncertainty to the global economic outlook. That said, precious metals witnessed augmented demand, with investors seeking safety in the yellow metal.

Elsewhere, Fed speaking continued during the weekend, with Michell Bowman crossing newswires. She said, “I supported the FOMC’s decision last week to raise the federal funds rate another 75 basis points,” and added that “similarly-sized” hikes should be on the table until we (the Fed) see inflation declining consistently.

In the meantime, the US 10-year bond yield is falling almost six bps, sitting at 2.775%, while US 10-year TIPS is yielding 0.306%, seven bps less than last Friday’s peak. All that said, a tailwind for XAUUSD,

What to watch

The US economic docket will feature July’s CPI, and PPI data on Wednesday and Thursday, respectively. That, alongside further Fed commentary led by Charles Evans, Neil Kashkari, and Mary Daly, would shed some light regarding the posture of the central bank.

Gold Price Forecast (XAUUSD): Technical outlook

XAUUSD is neutral-to-upward biased, though facing solid resistance at the 50-day EMA at $1787.19. Gold traders should be attentive that unless buyers reclaim the $1800 figure, a correction towards the 20-day EMA at $1738.91 is on the cards. However, in the near term, the gold price could test higher prices, supported by the Relative Strength Index (RSI) at 58, gathering upside momentum.

- USD/JPY tumbles, due to its high correlation with the US 10-year bond yield, dropping below 2.80%.

- Fed’s Bowman: The Fed should consider 75 bps in future meetings.

- US CPI and PPI for July, both inflations readings are eyed.

The USD/JPY begins the week on the wrong foot, slides below the 50-day EMA, on a soft US dollar, undermined by falling US Treasury yields, amidst an upbeat sentiment, despite worries of an aggressive Fed and China-US jittery on Taiwan.

At the time of writing, the USD/JPY is trading at 134.63 after hitting a daily high at 135.58. Nevertheless, the appetite for US Treasuries keeps the US 10-year bond yield down five bps at 2.778%, so the USD/JPY pierced below the 50-day EMA at 134.98.

USD/JPY drops on lower US bond yields, even though the narrative supports the US dollar

A light US calendar keeps investors reassessing last week’s employment report, pouring cold water on recession fears while fueling expectations of a Federal Reserve 75 bps rate hike. Nevertheless, with the US Consumer Price Index (CPI) for July looming, focus shifted to expectations that a lower reading might deter the US central bank from tightening aggressively. In the meantime, Fed’s money market futures STIRs odds of a 75 bps hike are at 90%, up from last week’s 76.5%.

That said, Federal Reserve speakers in the last week had been hawkish since the dovish reaction after the FOMC’s meeting. Also, policymakers reiterated the Fed’s commitment to bringing inflation down. Over the weekend, Fed’s board member Michell Bowman reiterated that the Fed should consider 75 bps rate hikes at future meetings to get inflation back down to the central bank target. She added that she would be data-dependent for the following meetings.

Elsewhere, the Japanese calendar featured Bank Lending for July, which increased 1.8% YoY, doubling estimations. At the same time, the current account shrank the deficit from ¥-703 billion to ¥-132.4 billion.

However, the USD/JPY remains irrespective of the current economic environment during the day. Even though the pair pushed below the 50-day EMA unless sellers achieve a daily close below the August 4 daily high at 134.42, buyers remain in charge.

What to watch

The Japanese economic docket will feature Preelimnary Machine Tool Orders. On the US front, the calendar will reveal the NFIB Small Business Optimism Index, Consumer Inflation Expectations, and the US IBD/TIPP Economic Optimism for July, estimated at 38.6.

USD/JPY Key Technical Levels

- Swiss franc among top performers on Monday, despite risk appetite.

- US Dollar weakens amid lower US yields.

- USD/CHF suffers the worst decline in weeks, down almost a hundred pips.

The USD/CHF dropped further after the beginning of the American session and bottomed at 0.9521, reaching the lowest level since Tuesday. It is hovering around 0.9530, with a negative tone, down a hundred pips for the day.

The Swiss franc is among the strongest currencies of the day. EUR/CHF fell from near 0.9800 to 0.9717 (1-week low) and GBP/CHF tumbled to 1.1543 (lowest since July 26). CHF/JPY rose back above the 20-day Simple Moving Average and the 141.00 area.

The US dollar is falling across the board. The DXY is down 0.37%, approaching 106.00. The US 10-year yield stands at 2.78% and the 30-year at 3.00%, both far from Friday’s top.

On Friday, the US dollar rallied following the release of the US employment report that came in above expectations. On Monday it lost most of those gains. Regarding data, attention now turns to the July CPI due on Wednesday.

The bias in USD/CHF is tilted to the downside. A consolidation below 0.9540 would keep the door open for a test of 0.9500. Below the next support is the August low at 0.9469. If the USD dollar break above 0.9660 it would negate the bearish bias: it would be back above critical supports and surpass the 20, 55 and 100-day Simple Moving Averages.

Technical levels

The Federal Reserve Bank of New York's monthly Survey of Consumer Expectations showed on Monday that the US Consumers' one-year inflation expectations declined to 6.2% in July from 6.2% in June. The three-year inflation expectations edged lower to 3.2% from 3.6%.

Key takeaways as summarized by Reuters

"Consumers' median 5-year inflation outlook declined to 2.3% from 2.8% in June."

"Consumers see home prices up 3.5% in the next year, down from 4.4% in June."

"Consumers' year-ahead earnings growth expectation was unchanged in July at 3%."

"Consumers' median 1-year household income growth expectation rises to 3.4% in July, a new series high, from 3.2% in June."

"Consumers in July on average see 40.2% probability of higher unemployment rate in a year, down from 40.4% in June."

"Consumers' median 1-year household spending growth expectation fell 1.5 percentage point to 6.9%."

"Rising share of consumers say credit has been harder to get in the last year and will be in the year ahead."

"Fewer consumers surveyed in July said their household financial situation had deteriorated from a year ago and fewer expect it to deteriorate in the year ahead compared to June."

Market reaction

The greenback stays on the backfoot following this report and the US Dollar Index was last seen losing 0.45% on the day at 106.12.

- Gold regains positive traction on Monday amid retreating US bond yields, a weaker USD.

- The risk-on impulse, along with hawkish Fed expectations, should cap any further gains.

- The market focus would remain glued to the US consumer inflation data on Wednesday.

Gold manages to attract fresh buying on Monday and builds on its steady intraday ascent through the early North American session. The XAU/USD climbs to a fresh daily high, around the $1,786-$1,787 region in the last hour and has now reversed a major part of Friday's post-NFP losses.

The US dollar comes under some renewed selling pressure on the first day of a new week and turns out to be a key factor lending support to the dollar-denominated gold. The market reaction to the upbeat US monthly jobs data released on Friday fades rather quickly amid a fresh leg down in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond slips back below the 2.80% mark, which keeps the USD bulls on the defensive and further seems to benefit the non-yielding yellow metal.

That said, a combination of factors might hold back bulls from placing fresh bets around gold and cap any further gains. The risk-on impulse could act as a headwind for the safe-haven XAU/USD amid speculations that the Fed would stick to its aggressive policy tightening path. The bets were lifted by the blockbuster headline US NFP print, showing that the economy added 528K jobs in July. Adding to this, higher-than-expected wage growth data suggested a further rise in inflationary pressures.

Hence, the market focus now shifts to the latest US consumer inflation figures, scheduled for release on Wednesday. The data would influence Fed rate hike expectations and play a key role in driving the near-term USD demand, which, in turn, should help determine the next leg of a directional move for gold. In the meantime, the US bond yields, the USD price dynamics and the broader risk sentiment would be looked upon for some impetus amid absent relevant market-moving economic releases from the US.

Technical levels to watch

Head of Research at UOB Group Suan Teck Kin, CFA, assesses the latest RBI monetary policy decision.

Key Takeaways

“The Reserve Bank of India (RBI) lifted its benchmark repo rate by 50 bps to 5.40% from 4.90% in its Aug monetary policy meeting in a unanimous decision. The move was more aggressive than Bloomberg survey of a 25bps hike but matched our expectation. The Monetary Policy Committee (MPC) will remain focused on the withdrawal of accommodation to ensure that inflation stays within the target going forward, while supporting growth.”

“The MPC noted that despite a challenging global environment, domestic economic activity is showing signs of broader recovery, while inflationary pressures appear to be in an inflection point with ‘incipient signs of a confluence of factors’ that could lead to further softening of domestic inflationary pressures. Inflation is expected to remain above the upper tolerance band of 6% in 2Q and 3Q. With the crude oil price assumed at an average of US$105/bbl and a normal monsoon, RBI kept its inflation rate projection at 6.7% in 2022-23 (which was last raised from previous forecast of 5.7% at the Jun MPC).”

“RBI remains sanguine on its growth outlook, with both consumer and business sentiment improving and the rebound in contact-intensive services is expected to sustain urban consumption. GDP growth forecast for 2022-23 is kept at 7.2% (after having downgraded it from 7.8% in Apr), with ‘risks broadly balanced’. RBI noted headwinds from global forces - protracted geopolitical tensions, rising global financial market volatility, tightening global financial conditions; and global recession risks.”

“With the policy priority on containing inflationary pressures from second-round effects of supply side shocks and anchoring long term inflation expectations, there is still room for the RBI in its rate hike trajectory. After kicking off with the surprise unscheduled 40bps move on 4 May and the 50bps hikes in Jun and Aug, we think that the RBI will add on another 50bps rate increases in the two remaining MPCs in 2022 to bring the repo rate to 5.90% by the end of the year.”

- EUR/USD looks to advance further north of the 1.0200 mark.

- Extra gains are in store once 1.0300 is cleared.

EUR/USD embarks on a decent recovery following Friday’s marked retracement at the beginning of the week.

The so far August high at 1.0293 (August 2) emerges as the magnet for bulls for the time being. Above this level, spot is expected to see its uptrend reinvigorated and could challenge the temporary 55-day SMA in the near term, today at 1.0394.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0920.

EUR/USD daily chart

Alvin Liew, Senior Economist at UOB Group, comments on the release of Retail Sales figures in Singapore.

Key Takeaways

“Singapore’s retail sales declined by -1.4% m/m, following 1.8% increase in May, breaking the streak of 3 consecutive months of m/m increase. That translated to a weaker-than-expected 14.8% y/y expansion in Jun (from 17.8% in May), against Bloomberg median forecast of a 18.3% y/y growth. That said, this was still the third consecutive month of double-digit growth. Excluding motor vehicle sales, the m/m decrease was more pronounced at -1.9%, (from 2.7% in May), translating to a +19.8% y/y increase (from 22.6% y/y in May).”

“While the growth fell short of forecast, Jun retail sales growth still added to a solid foundation for domestic demand in the 2Q22, it should be noted that according to the Department of Statistics Singapore, the y/y increase was again distorted by the low base effect of the prior year (Jun 2021) when COVID-19 restriction measures were in place, such as international travel restrictions. The weaker m/m print could also be due to more households on overseas holidays during the school break, leading to lower on-shore expenditure during Jun.”

“Year-to-date, retail sales grew by 10.4% y/y. We believe domestic retailers will likely see domestic and external support, complemented by the return of major events such as the F1 formula night race in Sep. On the flipside, we believe that the elevated commodity price pressures, especially on energy and food prices, will feed into higher retail prices in the next few months and eat into the average household’s disposable income, thereby reducing their spending on discretionary items. Barring the re-emergence of fresh COVID-19 or other health-related risks in Singapore and around the region (leading to re-imposition of social and travel restrictions, which is not our base case), we still project retail sales to expand by 9.0% in 2022 (implying a more conservative forecast of 7.6% growth in 2H 2022). The primary driver is still low base effect which is likely to continue to uplift retail sales growth prints in the coming months.”

- DXY fades part of the Friday’s strong advance and returns to 106.30.

- Further weakness could see recent lows near 105.00 revisited.

DXY comes under pressure on Monday and partially reverses Friday’s gains to the proximity of 107.00.

The continuation of the selling pressure could facilitate a deeper pullback to, initially, the August low near 105.00 (August 2). This area of initial contention appears reinforced by the 55-day SMA.

The short-term constructive stance is expected to remain supported by the 6-month support line, today near 104.30.

Furthermore, the broader bullish view in the dollar remains in place while above the 200-day SMA at 99.81.

Economist at UOB Group Enrico Tanuwidjaja reviews the latest FX reserves figures in Indonesia.

Key Takeaways

“Indonesia’s foreign exchange reserves fell to USD132.2bn in July 2022, the lowest since June 2020 and a decrease of USD4.2bn from a 3-month high of USD136.4bn the previous month.”

“The latest reserve level was equivalent to finance 6.2 months of import or 6.1 months of imports and servicing the government’s external debt, well above the international adequacy standard of 3 months of imports.”

“Bank Indonesia (BI) maintains their view that the official reserve assets will remain adequate, supported by the stability and solid domestic economic outlook in line with several responsive policies to support long-term economic recovery.”

- AUD/USD gains strong positive traction on Monday and is supported by a combination of factors.

- Sliding US bond yields undermine the USD and offer support to the aussie amid the risk-on impulse.

- Hawkish Fed expectations could limit losses for the USD ahead of the US CPI report on Wednesday.

The AUD/USD pair climbs to a four-day high during the early North American session, with bulls now eyeing a move towards reclaiming the 0.7000 psychological mark.

The US dollar meets with a fresh supply on the first day of a new week and erodes a part of Friday's post-NFP strong gains, which, in turn, acts as a tailwind for the AUD/USD pair. The USD weakness could be attributed to a fresh leg down in the US Treasury bond yields. Apart from this, the risk-on impulse further seems to undermine the safe-haven greenback and benefit the risk-sensitive aussie.

That said, growing worries about a global economic downturn, along with the US-China tensions over Taiwan, could keep a lid on any optimistic move in the markets. Furthermore, speculations for a larger Fed rate hike move in September should act as a tailwind for the US bond yields and lend support to the USD. This, in turn, could cap any meaningful upside for the AUD/USD pair, at least for now.

Investors might also prefer to move on the sidelines ahead of the latest US consumer inflation figures, scheduled for release on Wednesday. Against the backdrop of the upbeat US monthly jobs report, a stronger CPI print would reaffirm hawkish Fed expectations and provide a fresh lift to the USD. The fundamental backdrop warrants caution before placing aggressive bullish bets around the AUD/USD pair.

In the meantime, the US bond yields would play a key role in influencing the USD price dynamics amid absent relevant market-moving economic releases on Monday. Apart from this, traders would take cues from the broader market risk sentiment to grab short-term opportunities around the AUD/USD pair.

Technical levels to watch

Sterling has been one of the weakest currencies among the majors over the past week. Economists at Scotiabank expect the GBP/USD to drop back under the 1.20 level.

GBP prone to a bit more softness

“GBP price action last week overall pushed cable below the rising trend in place since mid-Jul and leaves spot at clear risk of a return to sub-1.20 levels.”

“Support is 1.2040 and 1.2000/05.”

“Resistance is 1.2125.”

A blockbuster jobs report sparked a brief repricing in gold, but prices have bounced back firmly. Nevertheless, strategists at TD Securities expect the yellow metal's rally to be largely reversed.

Market continues to grapple with expectations for the Fed's next move

“While market pricing has shifted more toward another 75 bps hike in September, it is far from locked in and with CPI data set for release midweek, the yellow metal has been able to hold firm. Nonetheless, the post-FOMC short covering has likely run out of steam, particularly amid the stronger data and continued pushback against a pivot in Fedspeak.”

“After briefly hitting CTA triggers to spark another round of short covering, the jobs report has quickly put a cap on the move and the buying flow has turned to modest selling.”

“Prop traders still hold a significant amount of long positions, and a continuation of strong economic data could be the catalyst needed to see an unwind. In this sense, we have yet to see capitulation in gold, suggesting the pain trade is still to the downside, and we expect the recent rally will ultimately fade.”

EUR/USD is little changed from Friday’s close as early spot gains above 1.02 in European trade were quickly erased. Economists at Scotiabank look for more range trading in the short run, with the EUR retaining a soft undertone.

EUR/USD needs to erode 1.2035/45 to enjoy further gains

“A look at the short-term EUR chart shows spot moving sideways in a broad 1.0125/1.0275 range over the past three weeks, leaving spot at levels which are enticing neither for buyers nor sellers in the short run.”

“Short-term gains will need to push through and hold above 1.0235/45 to have any chance of extending.”

“Support is 1.0155/65 intraday.”

- EUR/JPY extends the recovery to the vicinity of 138.00 on Monday.

- Further up now emerges the interim 55-day SMA around 139.50.

EUR/JPY remains on recovery-mode and already flirts with the 138.00 area at the beginning of the week.

Considering the ongoing price action, further upside in the cross appears likely for the time being. That said, the next temporary target aligns at the 55-day SMAs, today at 139.54.

While above the 200-day SMA at 133.79, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- USD/CAD witnesses fresh selling on Monday amid modest USD weakness.

- Retreating US bond yields, the risk-on impulse weighs on the safe-haven USD.

- Bearish oil prices could undermine the loonie and help limit any further losses.

The USD/CAD pair attracts fresh selling on the first day of a new week and retreats further from a nearly three-week high, around the 1.2985 area touched on Friday. The intraday downtick extends through the mid-European session and drags spot prices to a fresh daily low, around the 1.2870 region in the last hour.

The US dollar struggles to capitalize on the post-NFP strong move up and edges lower on Monday, which turns out to be a key factor exerting downward pressure on the USD/CAD pair. Retreating US Treasury bond yields, along with a generally positive tone around the equity markets, temper the greenback's relative safe-haven status. The downside, however, seems cushioned, warranting some caution before placing aggressive bearish bets.

The upbeat US monthly jobs report released on Friday lifted bets for a larger, 75 Fed rate hike move at the September policy meeting. This should act as a tailwind for the US bond yields and help revive the USD demand. Crude oil prices, meanwhile, languished near a multi-month low, which should undermine the commodity-linked loonie and further contribute to limiting any meaningful downside for the USD/CAD pair, at least for the time being.

In the absence of any major market-moving economic releases, the US bond yields and the broader market risk sentiment would play a key role in driving the USD demand. Apart from this, traders will take cues from oil price dynamics to grab short-term opportunities around the USD/CAD pair. The focus, however, would remain on the release of the US consumer inflation figures on Wednesday, which might provide a fresh directional impetus to spot prices.

Technical levels to watch

EUR/USD has traded fairly choppily this morning around the 1.02 level. Looking ahead, economists at Rabobank continue to see further downside potential for the EUR on a one to three-month view.

USD to remain well supported

“Although we would expect the EUR/USD 1.01 area to act as solid support going forward, we retain the view that EUR/USD is likely to drop back below parity again on a one to three-month view. However, for this to happen USD strength will likely have to be complemented with another bout of fresh EUR negative news.”

“In our view the value of the USD is likely to remain firm until the environment for risky currencies improves. This suggests scope for a firm USD well into 2023.”

In the view of FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research, USD/IDR is likely to trade within the 14,825-14,900 range for the time being.

Key Quotes

“Our expectation for USD/IDR to dip below 55-day exponential moving average support last week was incorrect as it popped briefly to 14,900 before pulling back.”

“The outlook for this week is mixed and USD/IDR is likely to trade sideways, expected to be within a range of 14,825/14,990.”

Oscar Munoz, Macro Strategist at TD Securities, notes that the July Consumer Price Index (CPI) report will be the key highlight of the US data calendar this week.

Fed officials to double down on inflation concerns

"We are looking for core prices to have stayed strong on a m/m basis despite our expectation of slowing vs June."

"Apart from the inflation data, market participants are likely to focus on the preliminary release of the University of Michigan survey for August. We expect the recent improvement in gasoline and equity prices to lead to a new gain in sentiment."

"Separately, turning to Fedspeak, we look for Fed officials this week to double down on concerns about inflation and a tight labor market, and that they remain top of mind over those for growth."

GBP/USD has stabilized after its post-BoE sell-off but remains heavy. Economists at BBH expect the pair to drop under July 29 low around 1.2065.

BoE is set to continue tightening

“A move above 1.21 earlier today failed to trigger any follow-through buying. We believe GBP/USD is still on track to break below the July 29 low near 1.2065.”

“Despite the gloomy outlook, the Bank of England is set to continue tightening as inflation spirals ever higher.”

Economists at BBH note that they maintain their strong dollar call as Fed officials are making it clear that markets misread the Fed’s commitment to lowering inflation.

Fed tightening expectations continue to adjust

"Markets are still digesting last week’s blockbuster jobs report. Nearly a million jobs were added in the past two months, driving the unemployment down to a new cycle low of 3.5%. More importantly, wages continue to grow nicely and should help support consumption. While a strong labor market does not preclude a recession, it does drive home the point that the Fed will have more confidence to continue tightening policy in order to bring inflation down. "

Fed tightening expectations continue to adjust. WIRP is now showing over 75% odds of a 75 bp hike at the September 20-21 FOMC meeting. Looking ahead, the swaps market is now pricing in a 3.75% terminal rate vs. 3.5% at the start of last week."

" We think this is the correct read and if the market gives the Fed 75 bp next month, the Fed will take it. However, the market is still pricing in a quick turnaround by the Fed to move into an easing cycle in H1 2023. It's pretty clear that the Fed doesn't see it that way and the data bear that out, at least for now. Markets should also reprice these easing expectations in the coming days and weeks."

A spokesperson for the German government told reports on Monday that they have ruled out the approval of the shelved Nord Stream 2 gas pipeline, as reported by Reuters.

"We face difficult months ahead," the spokesperson added. "But it is clear that we stand firmly on the side of Ukraine and we stand behind the sanctions that we agreed together with the European Union and the international community."

Market reaction

These comments don't seem to be having a noticeable impact on risk perception. As of writing, Germany's DAX 30 Index was up 0.6% on a daily basis at 13,654.

USD/MYR faces prospects for extra upside in the near term. according to FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We highlighted last Monday (01 Aug, spot at 4.4480) that USD/MYR ‘could drift lower but is unlikely to threaten the rising trend-line support at 4.4300’. USD/MYR dropped briefly to 4.4450 on Friday before rebounding. While USD/MYR extended its advance during Asian hours today, upward momentum is not strong.”

“That said, there is scope for USD/MYR to edge higher but for this week, a break of 4.4700 is unlikely (there is another resistance at 4.4650). Support is at 4.4450 followed by the rising trend-line support at 4.4350. The rising trendline support is unlikely to come under threat this week.”

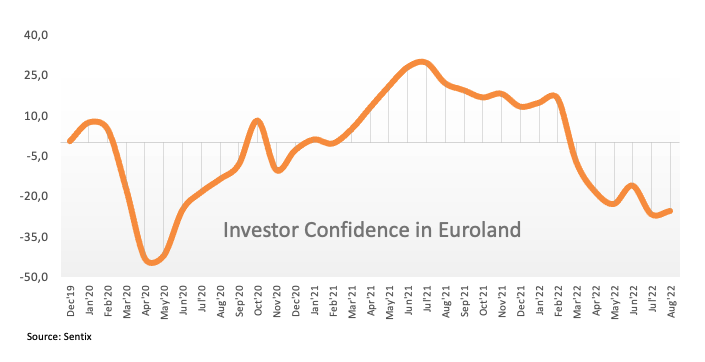

- EUR/USD regains marginal upside traction around 1.0200.

- EMU Sentix index improves a tad for the current month.

- Next risk event in the pair will be the release of the US CPI.

The single currency manages to regain some traction in an uneventful start of the week, lifting EUR/USD briefly above the 1.0200 mark although losing momentum afterwards.