- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 12-03-2023

- EUR/USD picks up bids to refresh intraday high amid firmer sentiment.

- US regulators unveil action plan to tame risks emanating from Silicon Valley Bank, Signature Bank.

- Hidden bearish RSI divergence teases another pullback from 200-SMA but 100-SMA defends bulls.

EUR/USD grinds near an intraday high of around 1.0700 during a three-day uptrend to Monday morning in Asia. In doing so, the major currency pair pokes the 200-SMA as the market’s upbeat sentiment weighs on the US Dollar’s haven demand. It should be noted, however, that the hidden bearish RSI divergence challenges the Euro buyers ahead of the European Central Bank (ECB) monetary policy meeting, up for Thursday.

Also read: AUD/USD marches towards 0.6650 as fears from SVB abate, Aussie employment, US inflation eyed

That said, the EUR/USD’s higher highs on price fail to gain support from the Relative Strength Index (RSI) 14 as it forms a lower high, which in turn suggests a lack of enough bullish momentum to cross the immediate key hurdle, namely the 200-SMA level surrounding 1.0710.

Even if the EUR/USD manages to surpass the 1.0710 resistance, the 50% Fibonacci retracement level of its early February-March downside, near 1.0780, will precede the mid-February swing high near 1.0810 to challenge the bulls.

On the flip side, EUR/USD pullback remains elusive unless the quote stays beyond the 100-SMA support of 1.0620. Following that, an upward-sloping trend line from the last Wednesday, close to 1.0585 at the latest, will be in focus.

In a case where the EUR/USD pair remains bearish past 1.0585, the odds of witnessing a fresh monthly low, currently around 1.0525, can’t be ruled out.

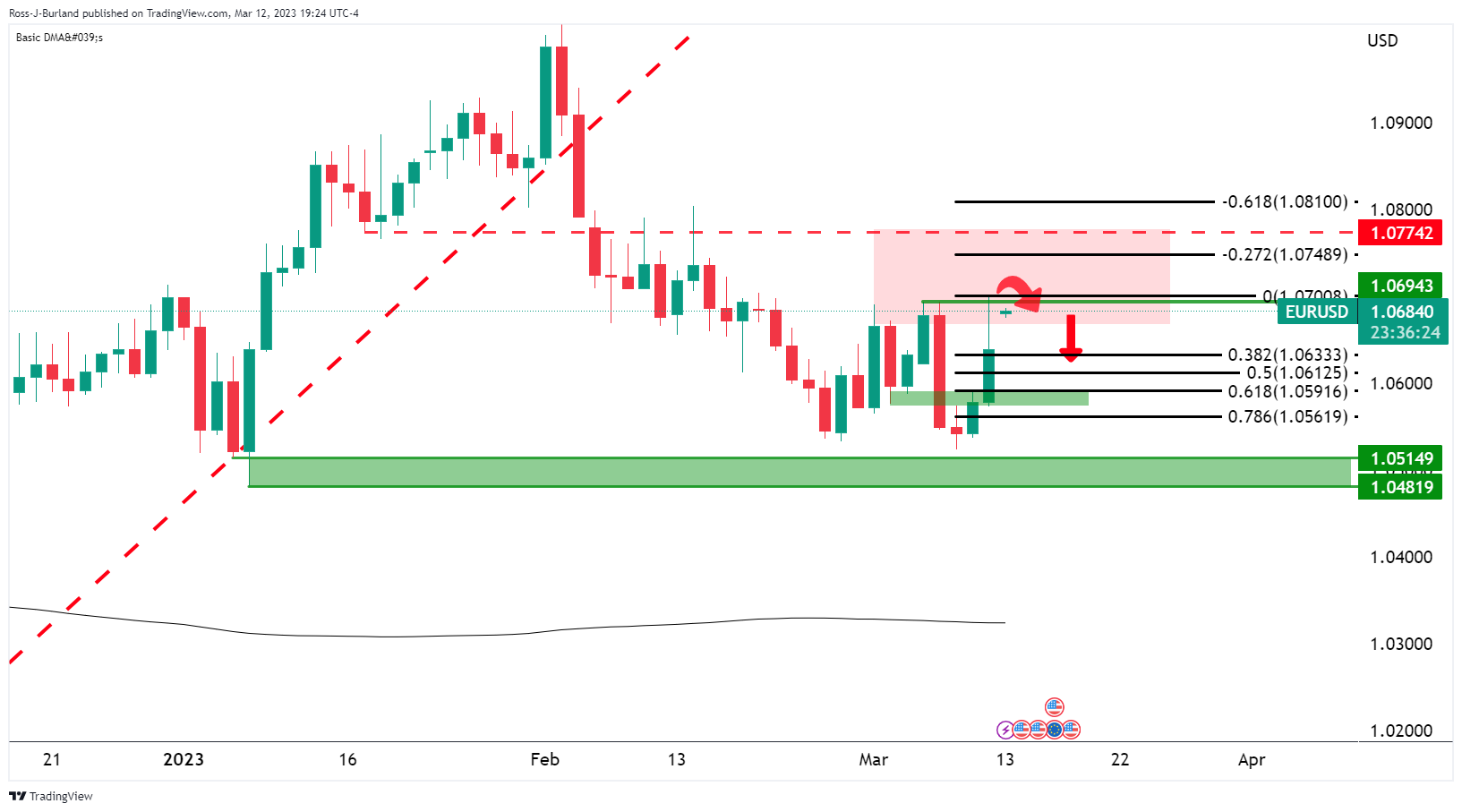

EUR/USD: Four-hour chart

Trend: Pullback expected

- AUD/USD picks up bids to refresh intraday high amid broad risk-on mood.

- US regulators take action and tame fears emanating from Silicon Valley Bank, Signature Bank.

- Upbeat US employment data may weigh on Aussie prices once initial reaction to SVB plan fades.

- Aussie jobs report, RBA Bulleting and US inflation will be in focus for clear directions.

AUD/USD portrays the market’s risk-on mood as it prints the biggest daily gains in more than a month, rising 0.90% intraday to refresh daily tops near 0.6635 during early Monday morning in Asia. In doing so, the risk-barometer pair cheers the US authorities’ actions to tame the risks emanating from the Silicon Valley Bank (SVB) and Signature Bank.

Also read: US Treasury Department, Fed unveil action plan on Silicon Valley Bank fallout

That said, US Treasury Department, Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) took joint actions to tame the risks emanating from the SVB and Signature Bank. “All depositors of Silicon Valley Bank and Signature Bank will be fully protected,” said the authorities in a joint statement released a few minutes back. S&P 500 Futures and US Treasury bond yields consolidate the previous day’s losses after the late plan for the US authorities to tame the financial crisis.

Also read: Regulators close Signature bank, announce plan to make depositors whole

It should be noted, however, that the fears of the Aussie pair’s pullback are high amid the fading of the risks emanating from SVB and Signature Bank. The reason could be linked to Friday’s US jobs report. On Friday, United States Nonfarm Payrolls (NFP) grew more than 205K expected to 311K in February, versus 504K (revised), while the Unemployment Rate rose to 3.6% for the said month compared to 3.4% expected and prior. Further, the Average Hourly Earnings rose on YoY but eased on monthly basis for February whereas the Labor Force Participation increased during the stated month.

Although the fears of the Fed hawks’ return and downbeat AUD/USD are high, the Federal Reserve (Fed) officials’ two-week ahead of the monetary policy meeting may probe the bears.

Though, the US Consumer Price Index (CPI) for February, up for publishing on Tuesday, will precede the Retail Sales and preliminary readings of the Michigan Consumer Sentiment Index for March, up for publishing on Wednesday and Friday, will be crucial for traders to watch.

At home, the latest dovish hike of the Reserve Bank of Australia (RBA) may gain attention if Thursday’s headline Aussie employment data and RBA Bulletin print downbeat outcomes.

Technical analysis

A sustained upside break of the five-week-old descending resistance line, around 0.6665 by the press time, becomes necessary to recall the AUD/USD bulls.

- Gold price retreats from one-month high after rising in the last two consecutive weeks.

- Fears emanating from Silicon Valley Bank drowned United States Treasury bond yields, US Dollar and propel haven demand of XAU/USD.

- Better-than-expected US Nonfarm Payrolls (NFP) failed to impress US Dollar buyers amid Silicon Valley Bank’s fallout.

- US Consumer Price Index, Federal Reserve’s efforts to defend SVB eyed for clearly predicting Gold price.

Gold Price (XAU/USD) pares the daily gains as it retreats from the highest levels in five weeks, marked earlier in the day, to $1,885 by the press time of the early Asian session on Monday. In doing so, the precious metal struggles to extend the previous two-week uptrend as the United States Treasury Department and Federal Reserve (Fed) take action to defend the financial market crisis risk emanating from Silicon Valley Bank. That said, the XAU/USD ignored better than forecast US Nonfarm Payrolls (NFP) to renew the one-month high, before rallying to a five-week top earlier in the day, as the US Dollar traced downbeat Treasury bond yields.

Gold price eases on measures to defend Silicon Valley Bank fallout

United States Treasury Department, Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) took joint actions to tame the risks emanating from the Silicon Valley Bank (SVB) fallout during the weekend and exert downside pressure on Gold prices of late. “Taking decisive actions to protect the US economy by strengthening public confidence in our banking system,” said the US Treasury Department and Federal Reserve (Fed) in joint statements on the action plan to defend the Silicon Valley Bank (SVB). Market sentiment improved after the news release as the US regulators also closed the Signature Bank and announced plans to make depositors whole. While portraying the mood, S&P 500 Futures and the US Treasury bond yields rise after a downbeat close the previous day. It should be noted that the market sentiment roiled on Friday after the SVB spread the risks of another financial crisis.

Also read: US Treasury Department, Fed unveil action plan on Silicon Valley Bank fallout

United States Employment data may weigh on XAU/USD after initial disappointment

On Friday, United States Nonfarm Payrolls (NFP) grew more than 205K expected to 311K in February, versus 504K (revised), while the Unemployment Rate rose to 3.6% for the said month compared to 3.4% expected and prior. Further, the Average Hourly Earnings rose on YoY but eased on monthly basis for February whereas the Labor Force Participation increased during the stated month. Despite mostly upbeat US data, the US Dollar failed to improve as risks from the Silicon Valley Bank (SVB) fallout drowned the US Treasury bond yields. However, the recent US regulators’ actions may redirect the market players towards remembering the upbeat US jobs report and renew the hawkish Fed bets ahead of next week’s Federal Reserve (Fed) monetary policy meeting, which in turn could weigh on the Gold price.

United States Inflation in focus

Looking ahead, the United States Consumer Price Index (CPI) for February, up for publishing on Tuesday, will precede the Retail Sales and preliminary readings of the Michigan Consumer Sentiment Index for March, up for publishing on Wednesday and Friday, to direct Gold price. It’s worth noting that the Federal Reserve (Fed) officials’ two-week ahead of the monetary policy meeting adds importance to the stated data. Should the headline numbers manage to flash inflation risks, the odds of witnessing further XAU/USD declines can’t be ruled out.

Gold price technical analysis

Gold price manages to cheer a sustained bounce off 61.8% Fibonacci retracement level of November 2022 to February 2023 upside of around $1,812, also known as the golden Fibonacci ratio.

Adding strength to the bullish bias surrounding the XAU/USD is a successful upside break of a nine-week-old horizontal hurdle, now immediate support near $1,860, as well as the 50-DMA level surrounding $1,872.

That said, the bullish signals from the Moving Average Convergence and Divergence (MACD) indicator join the upbeat but not overbought appearance of the Relative Strength Index (RSI) line, placed at 14.

With this, the XAU/USD run-up towards the 23.6% Fibonacci retracement level surrounding $1,904, as well as a challenge to the previous monthly top of near $1,960, can’t be ruled out.

On the contrary, Gold sellers may return to the table if the quote struggles to remain beyond the aforementioned horizontal resistance-turned-support of around $1,860. It should be noted that the 50-DMA can restrict the immediate downside near $1,872.

Adding to the downside filters are 50% and 61.8% Fibonacci retracement levels near $1,840 and $1,812. It’s worth noting that the 100-DMA level of $1,810 appears the last defense of the Gold buyers.

To sum up, Gold price gains buyers’ attention ahead of the key United States data but sustained trading beyond $1,871 could help strengthen the bullish bias.

Gold Price: Daily chart

Trend: Further upside expected

“New York state's Department of Financial Services said on Sunday it has taken possession of New York-based Signature Bank and appointed the U.S. Federal Deposit Insurance Corp as receiver, the second bank failure in a matter of days,” reported Reuters.

“Signature Bank had deposits totaling approximately $88.59 billion as of December 31,” adds the news.

The news also mentioned that the US Treasury Department along with other bank regulators said in a joint statement on Sunday that all depositors of Signature Bank will be made whole, and that "no losses will be borne by the taxpayer."

Also read: US Treasury Department, Fed unveil action plan on Silicon Valley Bank fallout

Risk appetite improves

The news allows traders to begin the week on a positive footing after a downbeat close on Friday. The same propels S&P 500 Futures after a negative close the previous day.

“Taking decisive actions to protect the US economy by strengthening public confidence in our banking system,” said the US Treasury Department and Federal Reserve (Fed) in joint statements on the action plan to defend the Silicon Valley Bank (SVB).

Key quotes

Boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the fdic to complete its resolution of Silicon Valley Bank.

No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for signature bank, New York, which was closed today by its state chartering authority.

All depositors of this institution will be made whole.

Signature shareholders and certain unsecured debt holders will not be protected.

Signature senior management has been removed.

The Federal Reserve board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

Banking system remains resilient and on a solid foundation.

Any signature bank losses to the deposit insurance fund to support uninsured depositors will be recovered by a special assessment on banks.

Fed will make available additional funding to eligible depository institutions to help assure banks can meet depositors' needs.

To provide liquidity to US depository institutions, each Federal Reserve Bank would make advances to eligible borrowers, taking as collateral certain types of securities

Treasury department, using the exchange stabilization fund, would provide $25 billion as credit protection to the federal reserve banks in connection with bank term funding program.

Today's actions demonstrate US commitment to take 'necessary steps' to ensure that depositors' savings remain safe.

Eligible collateral includes any collateral eligible for purchase by the federal reservebanks in open market operations.

Rate for term advances will be the one-year overnight index swap rate plus 10 basis points; The rate will be fixed for the term of the advance on the day the advance is made.

Collateral valuation will be par value; margin will be 100% of par value.

Advances can be requested under the program until at least March 11, 2024.

Advances made under the program are made with recourse beyond the pledged collateral to the eligible borrower.

Market sentiment improves

With the US authorities are in action mode to defend the world’s largest economy from another financial crisis, the market’s risk appetite improved after a disappointment on Friday.

Also read: Source: US marshalling 'material action' to stem SVB fallout – Reuters

US authorities were preparing "material action" on Sunday to shore up deposits in Silicon Valley Bank (SVB) and try to stem any broader financial fallout from the sudden collapse of the tech startup-focused lender, mentioned Reuters while relying on anonymous sources familiar with the matter.

Elsewhere, Bloomberg also cites people familiar with the matter to mention that the US Federal Reserve is considering easing the terms for banks to access its discount window to prevent another collapse similar to Silicon Valley Bank.

Further, Mint reports that the US Federal Reserve will hold a closed-door emergency meeting on Monday of the Board of Governors amid the fallout of the Silicon Valley Bank. The news also adds, “According to a statement released by Fed it will review and determine the advance and discount rates to be charged by the Federal Reserve Banks during the meeting.”

Key quotes

Biden administration officials worked through the weekend to assess the impact of SVB Financial Group's Friday failure, with a particular eye on the venture capital sector and regional banks, the sources said.

Details of an announcement expected on Sunday were not immediately available, but one of the sources said the Federal Reserve could take action similar to what it did to keep banks operating during the COVID-19 pandemic.

U.S. authorities are considering safeguarding all uninsured deposits at SVB, weighing an intervention to prevent what they fear would be panic in the country's financial system, the Washington Post reported, citing three people with knowledge of the matter.

Officials at the Treasury Department, Federal Reserve and Federal Deposit Insurance Corporation discussed the idea this weekend, the report said.

CNBC reported that the Fed and the FDIC are discussing two different facilities to manage the fallout from the closure of SVB if no buyer materializes.

US Treasury Secretary Janet Yellen said she was working with banking regulators to respond after SVB became the largest bank to fail since the 2008 financial crisis.

As fears deepened of a broader fallout across the U.S. regional banking sector and beyond, Yellen said she was working to protect depositors, but ruled out a bailout.

Market implications

The SVB fallout shocked global markets and propelled risk-off mood on Friday, drowning the US Treasury bond yields and weighing on the US Dollar. Hence, any positive development on the front can help the US Dollar to regain its upside bias.

Also read: Forex Today: DXY ends week flat after Powell and NFP, ahead of US CPI; Wall Street plunges

- EUR/USD bulls in the market at the open.

- EUR/USD jumps in a gap to start the week after NFP.

EUR/USD 1.0590 target in a 61.8% Fibonacci retracement for the day ahead. On the other hand, a continuation towards 1.0770s could just as easily play out.

EUR/USD has opened with a large gap in the open and is trading around 1.0680 after closing on Friday at 1.0639 after a mixed Nonfarm Payrolls report triggered a sell-off in the US Dollar.

However, as analysts at ANZ Bank said in a note before the open, ´´after so much anticipation it was ironic that it got lost in the noise, but non-farm payrolls rose 311k in February, indicating very strong momentum in jobs growth continues.´´

Additionally, the analysts explained that ´´the January data was barely revised, and the 3-month average of jobs growth is now 355k vs 321k in the prior three months. The unemployment rate edged higher to 3.6% as the participation rate rose 0.1% to 62.5%. Average hourly earnings slowed to 0.2% MoM (4.6% YoY). That will be of some comfort to the Fed, but the weaker monthly rise owed much to strong gains in low-paying jobs: leisure and hospitality and retail, suggesting firms expect discretionary consumer spending to remain strong,´´ they said.

Nevertheless, a significant repricing across the curve and in the terminal rate weighed on the US Dollar due to weaker-than-expected wages. The Fed funds rate implied upper bound fell from 5.89% to 5.5% and the probability of a 50bp hike in March declined substantially.

EUR/USD technical analysis

The price is reaching a liquidity area that could see the bears move in with eyes on a 1.0590 target in a 61.8% Fibonacci retracement for the day ahead. On the other hand, a continuation towards 1.0770s could just as easily play out.

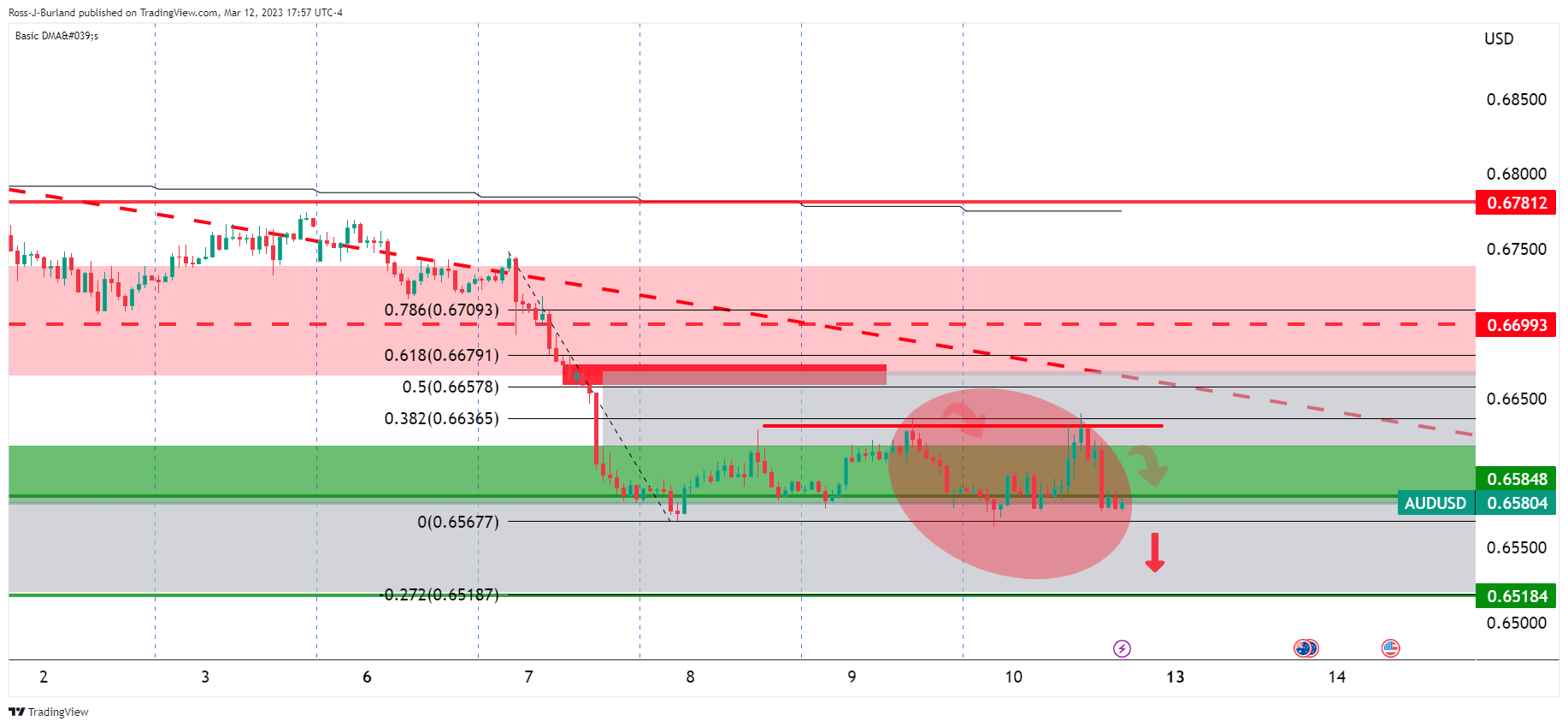

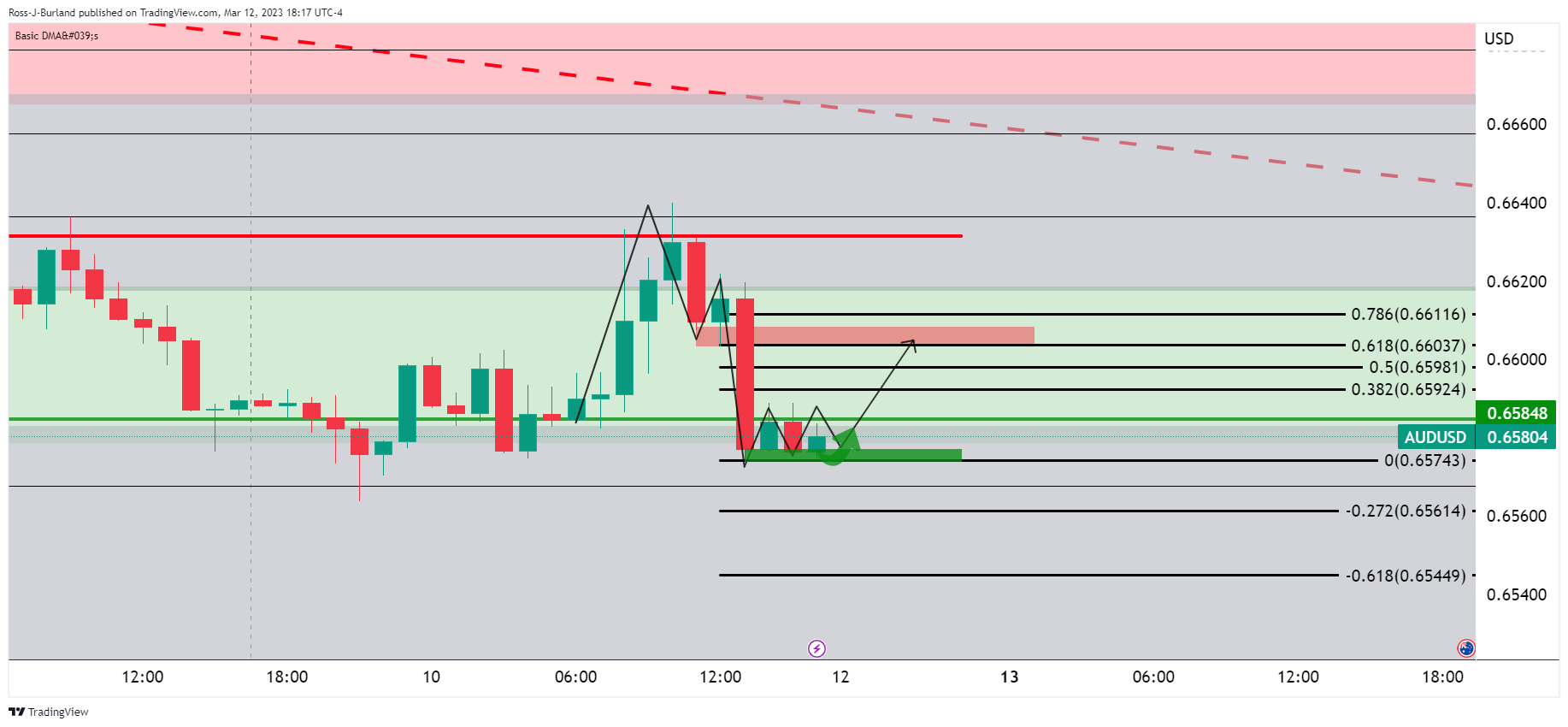

- AUD/USD´s H1 M-formation, a reversion pattern, holds 0.6600 as a target for the open.

- AUD/USD bears need to get below a consolidative pattern and support near 0.6570.

As per the prior analysis and before the Nonfarm Payrolls event on Friday that sent the US Dollar substantially lower, AUD-USD remains in the realms of a geometrical bearish formation:

AUD/USD prior analysis

It was stated that the price was carving out a geometrical box, an ascending triangle, in a downtrend which is considered a bearish chart pattern.

´´Two-way price action can be expected from here with a bearish bias while on the front-side of the bear trend and below the 200 DMA,´´ the analysis stated with 0.6520 being key in this regard as it guarded a move towards 0.6380.

AUD/USD update

The triangle formation has morphed into a sideways consolidation. Of note, an M-formation has formed on this hourly chart:

The M-formation is a reversion pattern and the price can be pulled into the neckline for a restest which is yet to play out, so far. However, it is worth noting for the open this week with 0.6600 being a key level in this regard.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.