- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 12-05-2023

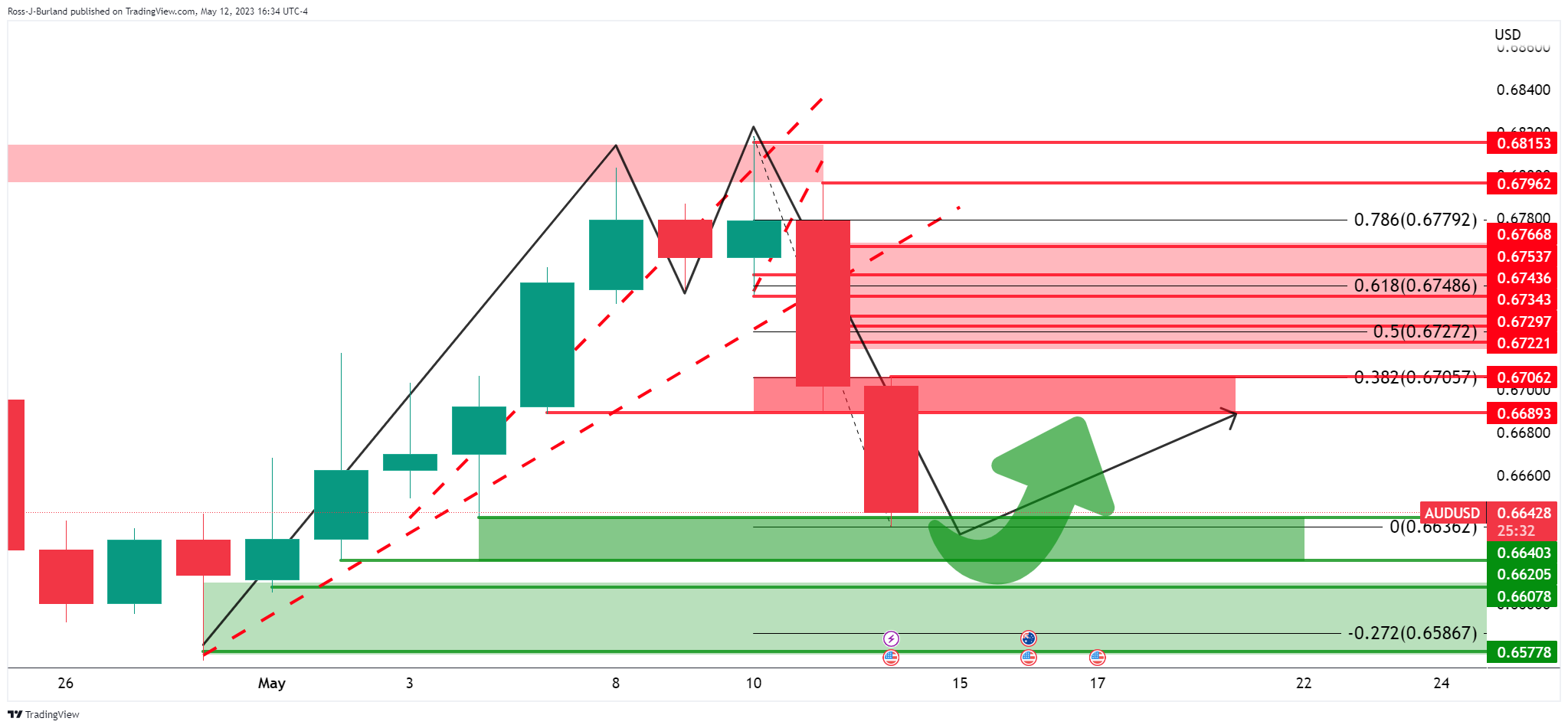

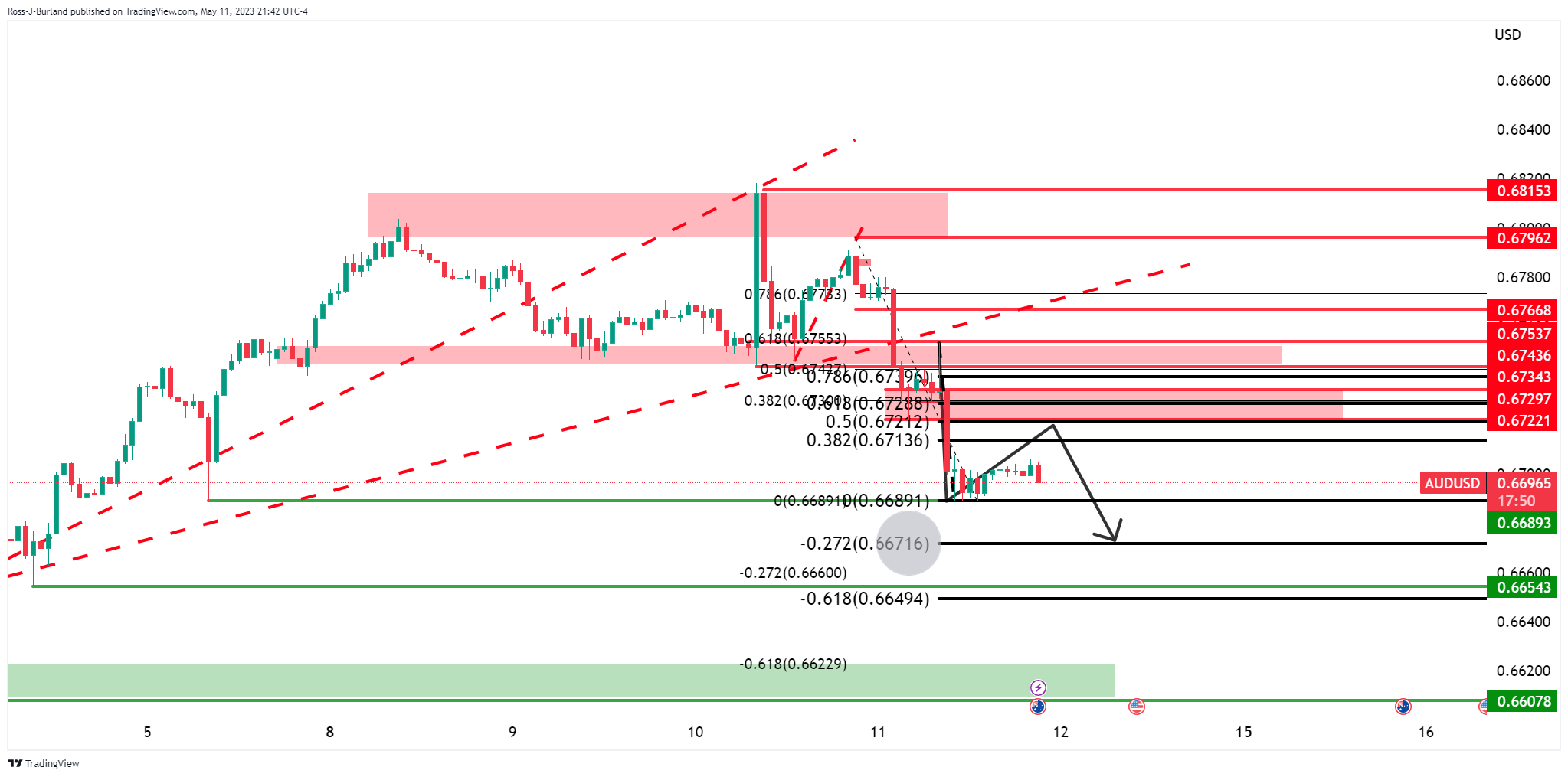

- AUD/USD bears are in the money but bulls are lurking from daily support.

- A move back to challenge channel resistance could be on the cards for the initial balance at the start of the week.

AUD/USD could be on the verge of moving back inside of the sell-off range. The M-formation is a reversion pattern and a deceleration of the sell-off would be expected as the market moves in on support. The following illustrates this on the daily charts and also looks at the prospects on the hourly chart for the open next week.

AUD/USD daily charts

Zooming in, we have the 0.6640s and 0.6620s and space in between that is highlighted as the first support zone. There could be a correction from this point. However, as per the hourly chart, there are prospects of a downside continuation:

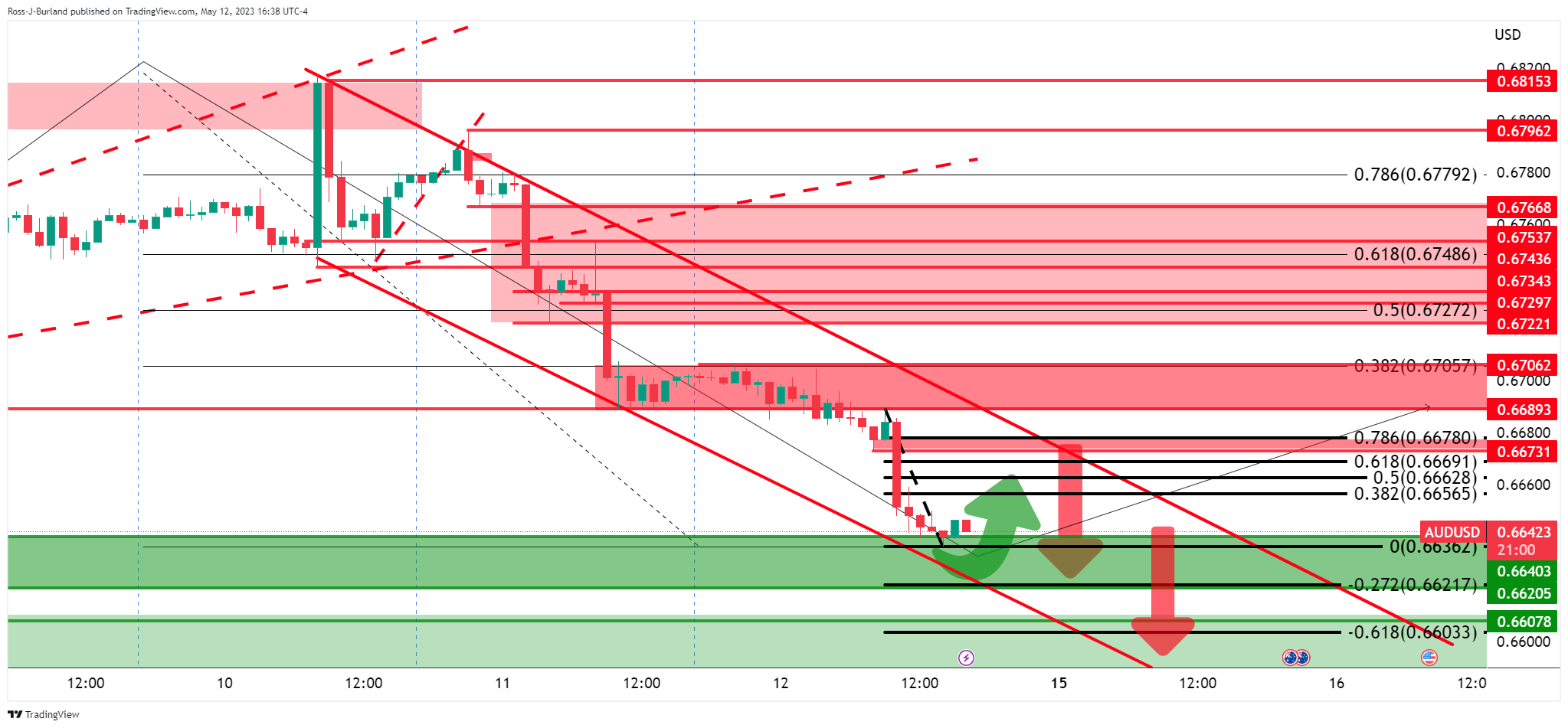

AUD/USD H1 chart

The bias is bearish while inside of the bearish channel. However, the bulls seem to be moving in from support which could be a theme for the open. There are prospects of a move into the trendline resistance prior to the next bear continuation for the forthcoming initial balance next week. To the contrary, a move above 0.6670 and outside of teh channel would put the bias in favour of the bulls.

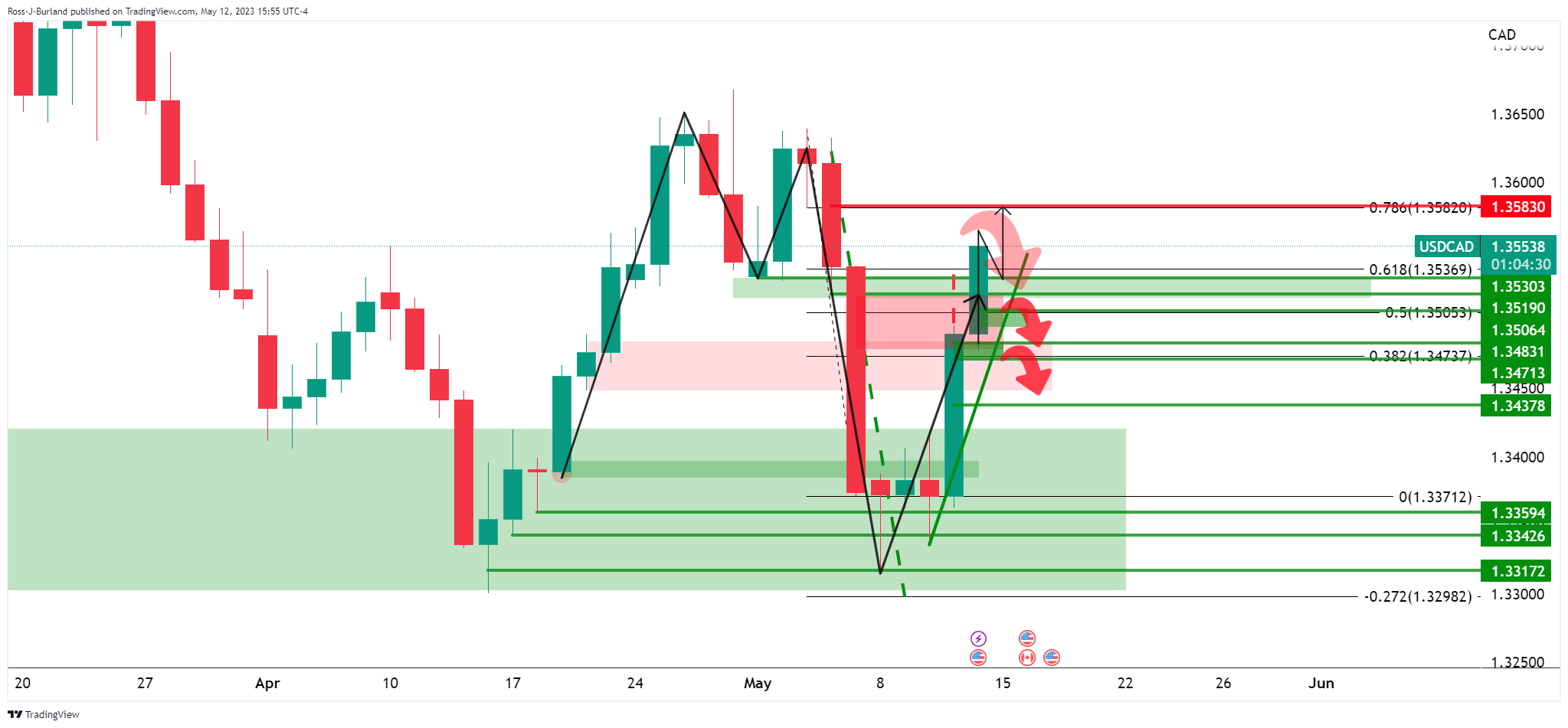

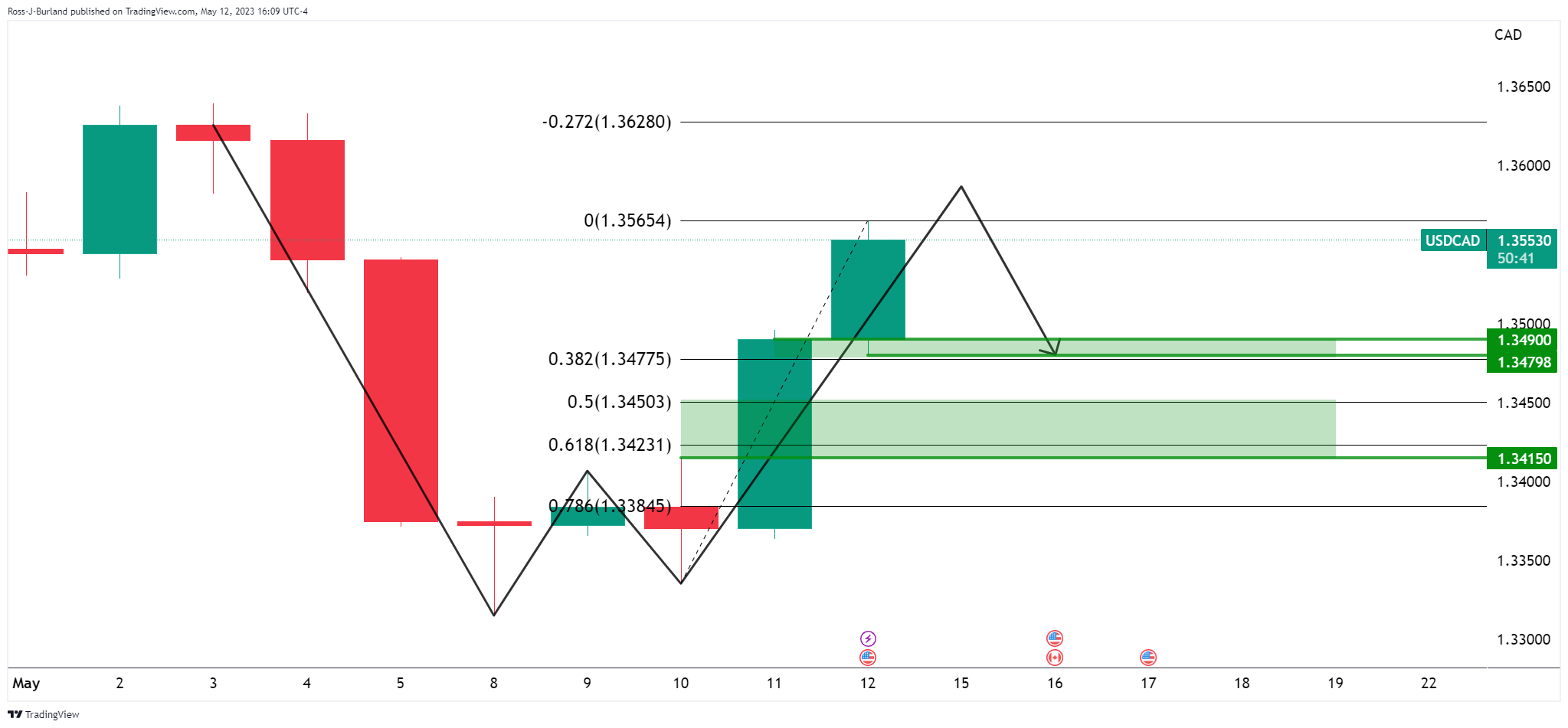

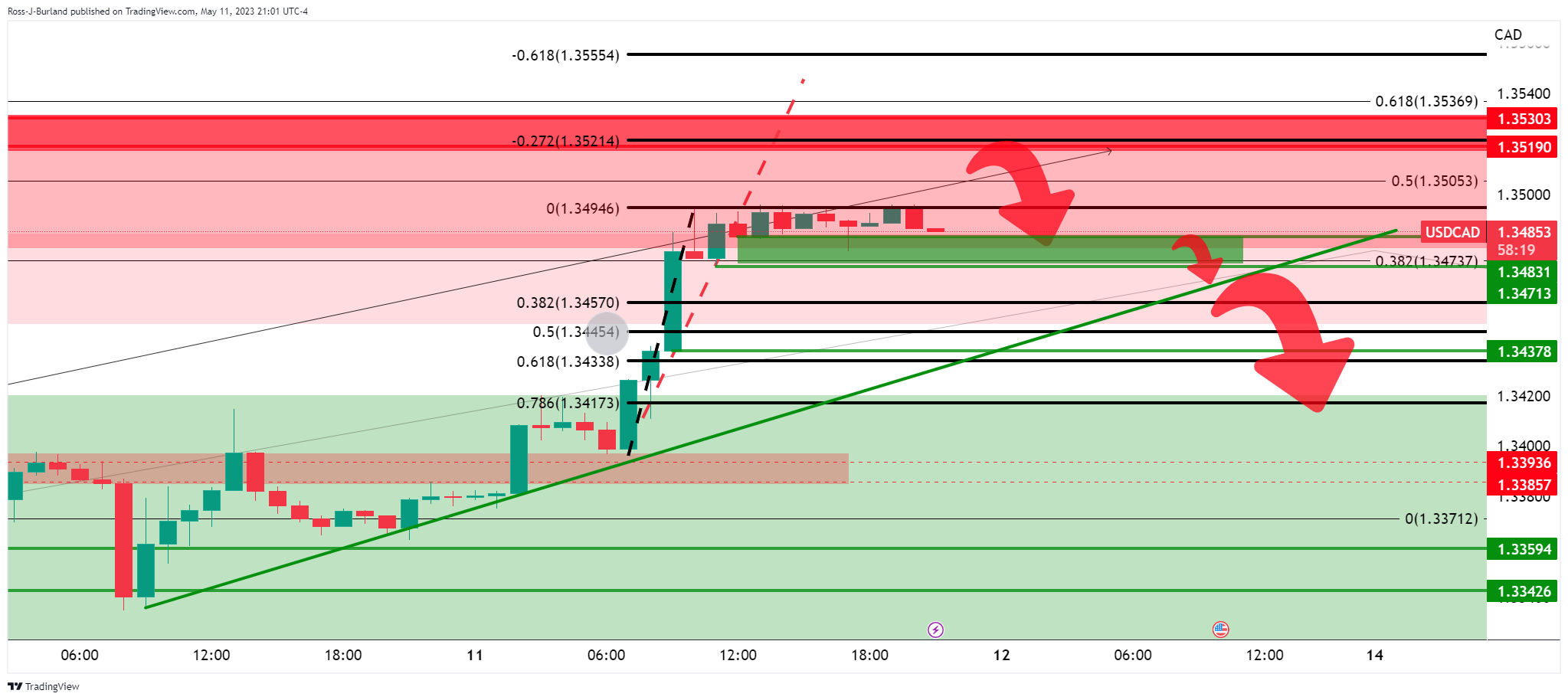

- USD/CAD bulls tear through prior resistance with eyes on the 1.3580s.

- Bears are lurking, waiting to pounce on a correction.

USD/CAD is on the front side of the bullish trend and momentum is strong. At the time of writing, USD/CAD is trading higher by some 0.48% and rallied from a low of 1.3477, scoring a high of 1.3565 on the day. The pair is in the hands of the bulls put there are prospects of a correction for next week.

USD/CAD daily chart

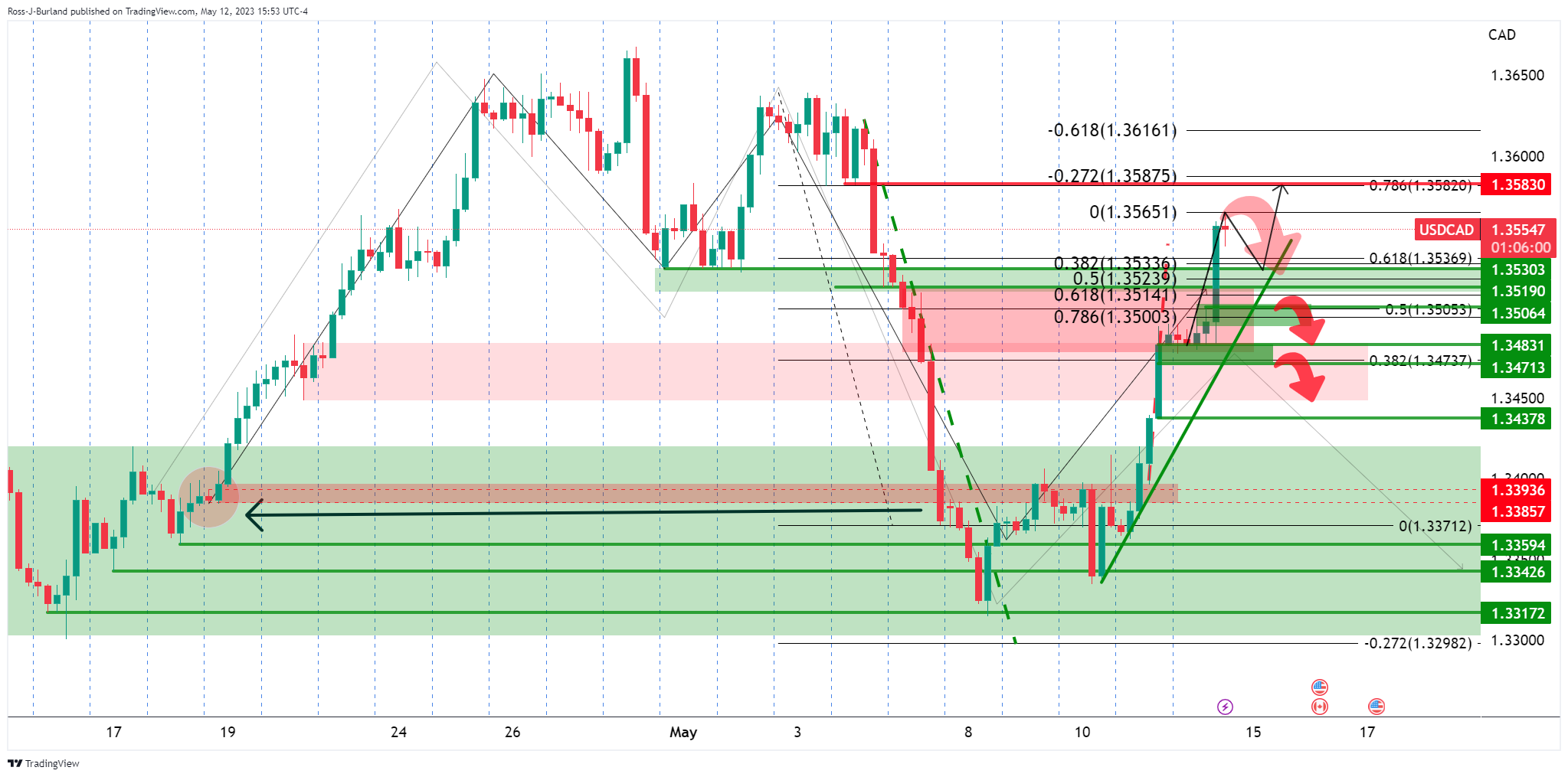

USD/CAD H4 chart

USD/CAD is now making the case for a run to test the 1.3580s whereby the bulls have burst through prior resistance that is now potentially going to act as a support area.

USD/CAD W-formation

Meanwhile, we have a W-formation which is a reversion pattern that might be expected to pull the price back in toward the neckline.

Analysts at Rabobank see the GBP/USD heading lower in the coming month amid USD strength. They consider the pair may drop to 1.22.

Key quotes:

“With the USD on the front foot yesterday, sellers stepped in, technical indicators soured, and cable registered its worst day in 2 months. It is our view that GBP’s gains since early March suggest that a lot of better news regarding UK fundamentals is already baked into the price.”

“Last week’s release of stronger than expected US April labour market data underpinned the stickiness of wages and inflation risks on the other side of the Atlantic. As a result, the market withdrew some of the projected Fed easing that has been anticipated for the end of this year. It is our view that there will be no rate cut from the Fed until next year. We foresee some support for the USD in the coming months as 2023 rate cuts are fully priced out and as the USD picks up some safe haven support from US recession risks. We see scope for GBP/USD to push back to 1.22 on a 3 month view.”

“We expect EUR/GBP to trade mostly around the 0.87-88 area through the summer.”

Here is what you need to know for next week:

After the Dollar's rally on Friday, Monday may not be the usual “quiet Monday”. Tuesday is the busiest day of the week for economic data, with Chinese activity, the Reserve Bank of Australia minutes, inflation in Canada and US Retail Sales. Later in the week, Australia will release labor market data and the Bank of Mexico will decide on interest rates.

The US Dollar finished the week stronger, trading at its weekly highs. Next week, the US calendar is light, with Retail Sales being the highlight on Tuesday. The debt ceiling impasse and banking concerns continue to be relevant developments. There will also be Federal Reserve remarks from Chair Powell and Williams.

The US Dollar Index rose above 102.50, posting its highest daily close in more than a month, surpassing relevant technical levels. The risks now appear to be tilted to the upside in the short term. A factor that boosted the US Dollar was the deterioration in market sentiment. Major stock indices across the globe finished the week with modest losses.

US yields finished the week modestly higher, despite evidence of slowing inflation and easing labor market conditions in the US. The US Treasury 10-year yield settled at 3.44% and the 2-year at 4%. Yields continue to move sideways in a wide range, trapped between volatile expectations for rates by year-end, the short end of the curve being sensitive to the debt ceiling drama, the Fed's expected pause and cautious market sentiment.

EUR/USD suffered its worst weekly decline since September 2022, after breaking a 2-week range on the back of a stronger US Dollar and despite hawkish European Central Bank (ECB) talk. After being unable to rise above 1.1100, the pair corrected to 1.0850, the lowest level in a month.

GBP/USD reversed from monthly highs near 1.2700 and tumbled to levels below 1.2450. In the UK, labor data is due on Tuesday. Many members of the Bank of England's Monetary Policy Committee are due to speak, which could be relevant after the recent 25 basis points rate hike.

USD/JPY surged on Friday, breaking important levels and climbing to 135.70, a one-week high, boosted by the rebound in Treasury yields.

USD/CAD erased last week's losses and rose from 1.3310 to 1.3560. It continues to move sideways in a wide range. Canada will report inflation on Tuesday and on Friday, the Bank of Canada will publish its Financial System Review.

AUD/USD traded above key moving averages in the daily and weekly charts but turned to the downside. It is still moving sideways but now risks are tilted to the downside. The pair could test 0.6600. It is a busy week ahead in Australia with the RBA minutes on Tuesday, of the May meeting that ended with a surprise rate hike; on Wednesday, the Wage Price Index is due and on Thursday April's employment report.

NZD/USD dropped 200 pips from the top, rejected from above the 20-week Simple Moving Average (SMA). The Kiwi was the worst performing currency among G10 currencies.

The worst performer across the board was the South African Rand. USD/ZAR jumped to a record high 19.50 after the US alleged that a Russian ship picked up weapons in South Africa last year.

Latin American currencies outperformed. USD/MXN posted its lowest weekly close since July 2017, near 17.50. The Bank of Mexico will have its monetary policy meeting, and there is potential for a pause after 15 consecutive interest rate hikes.

On Sunday, there will be general elections in Turkey. The Turkish lira accelerated its depreciation during the last days, hitting fresh record lows.

The gloomy global outlook weighed on crude oil prices that posted another weekly loss, the fourth in a row. Metals had mixed luck: Gold finished the week flat, holding above $2,000 while Silver tumbled 6.6% during the week, ending around $24.00.

Like this article? Help us with some feedback by answering this survey:

- USD/JPY is meeting the strat of a resistance area around 135.70/00.

- Bulls remain focused on the 136 area for the next sessions.

USD/JPY has had a good run on the day, bursting up into the 135.70s. The market is trending back up into the start of May´s sell-off and a resistance area while being on the front side of the bullish trendline as the following analysis will show:

USD/JPY daily charts

Bulls are testing the prior bullish trendline that would now be expected to act as counter-trend line resistance.

On closer inspection, we can see there could be room to the 136s.

In any case, we have a support area between 135.20/50.

USD/JPY H4 chart

The rally could be regarded as a touch over-extended so late in the day and this may have run its course into the close.

The Board of Directors of the Bank of Canada (BoC) announced on Friday the appointment of Rhys R. Mendes as Deputy Governor, effective July 17, 2023.

“As Deputy Governor, Mr. Mendes will join the Bank’s Governing Council, which sets the strategic direction of the Bank and is its policy-making body. He will oversee the Bank’s economic and financial research, its analysis of international economic developments, and he will serve as the Bank’s G7 and G20 Deputy”, the BoC said in a statement.

The Governing Council makes the final decision regarding monetary policy.

- GBP/USD bears move into the 1.2450s that are holding up currently.

- 1.2480/2500 is eyed to the upside should the bulls take over.

GBP/USD is down on the day by some 0.45% and has fallen from a high of 1.2540 to a low of 1.2448 on the day as speculators continue to cut their short GBP positions. However, the pair is running into a potential area of support as the following technical analysis will illustrate:

GBP/USD daily chart

We have the last leg of the M-formation playing out on Friday. The M-formation is a reversion pattern and at some point, as the moment decelerates, bulls will be looking to buy in.

GBP/USD H1 chart

On the hourly time frame, we can see prospects of a move into the lows of the month, but the 1.2450s are holding-up currently. 1.2480/2500 is eyed to the upside should the bulls take over.

- US Dollar heads for important weekly gains across the board.

- Higher US yields and weaker sentiment weigh on EUR/USD.

- The pair is having its worst week since September 2022.

The EUR/USD is falling on Friday, the fourth time in the last five days, extending its weekly losses. The pair is hovering near 1.0850, at the lowest level in a month, consolidating a weekly loss of more than 150 pips.

The key driver is a stronger US Dollar across the board. The combination of a cautious tone in equity markets and higher US yields is boosting the Greenback.

The US Dollar Index is up by 0.60% on Friday, trading above 102.50, at the highest level in a month. The Dow Jones is down by 0.31% and the Nasdaq is dropping by 0.53%. The US 10-year stands at 3.44% and the 2-year is approaching 4%.

Short-term outlook

The Euro is having its worst week against the US Dollar since September 2022 so far. The short-term bias for EUR/USD is bearish. “The 1.0800 level is the natural immediate support, en route to 1.0745, the 61.8% retracement of the 2022 yearly decline. A break below the latter should open the door for a long-term USD rally. The 1.0980/1.1000 area will be a tough bone to break now, although if the pair manages to recover above it, 1.1100 is a possible target”, said Valeria Bednarik, Chief Analysts at FXStreet.

Technical levels

The Congressional Budget Office (CBO) projects that if the debt limit remains unchanged, “there is a significant risk that at some point in the first two weeks of June, the government will no longer be able to pay all of its obligations”. The CBO updated its budget outlook.

Key takeaways from the report:

“CBO estimates that if the limit is not raised or suspended, there is a significant risk that the Treasury will run out of funds at some point in the first two weeks of June.”

“CBO projects that if the debt limit remains unchanged, there is a significant risk that at some point in the first two weeks of June, the government will no longer be able to pay all of its obligations.”

“CBO’s updated baseline projections show a federal budget deficit of $1.5 trillion in 2023. Those projections reflect the assumption that current laws generally remain unchanged and that no further legislation affecting the federal budget is enacted this year.”

“Deficits generally increase over the coming years in CBO’s projections, totaling about $20 trillion over the 2024–2033 period. As a result of those deficits, debt held by the public grows significantly in CBO’s projections, rising from 98 percent of gross domestic product (GDP) this year to 119 percent in 2033—which would be the highest level of U.S debt ever recorded. Debt would continue to grow beyond 2033 if current laws generally remained unchanged.”

“The projected cumulative deficit for the 2024– 2033 period is now $51 billion greater than CBO estimated in February.”

The White House announced that President Biden has nominated Philip Jefferson for Vice Chair and Adriana Kugler as a Member on the Board of Governors of the Federal Reserve System. Biden has also announced that he will renominate Lisa Cook for an additional full term as a member.

The US Senate has to approve nominees for the Fed before they can take office.

- Australian Dollar under pressure due to risk aversion and lower commodity prices.

- US Dollar extends weekly gains despite weaker-than-expected US Consumer Sentiment data.

- The AUD/USD has lost another key support level after falling below 0.6680.

The AUD/USD accelerated to the downside after Wall Street's opening bell, as the US dollar strengthened and equity and commodity prices declined. The pair dropped to 0.6650, the lowest level in more than a week.

US data

The US Import and Export Price Index declined as expected, but less than forecast. The significant decrease in annual rates will help bring inflation closer to the Federal Reserve's target.

A separate report showed that the University of Michigan's Consumer Sentiment Index fell to 57.7 in May from 63 in April, below the 63.5 expected by market consensus.

The US Dollar briefly weakened after the Consumer Sentiment data, only to regain strength. The Greenback is trading at daily highs across the board, extending its weekly gains, supported by risk aversion. Commodity prices are weakening again, adding pressure to the Australian Dollar.

Extending the reversal

The AUD/USD peaked during the week at 0.6817, the highest level since February, before reversing its course. Over the last two days, it has lost more than a hundred pips, slipping below the 20-day Simple Moving Average (SMA).

On Friday, it broke below the 0.6680 support area. The next relevant support zone is around 0.6635; below this, attention will turn to 0.6600. To alleviate the bearish pressure, the Aussie needs to regain 0.6680 initially.

Next week's US data includes Retail Sales on Tuesday. In Australia, it will be a busy week with the release of the Reserve Bank of Australia minutes (Tuesday), the Wage Price Index (Wednesday) and Employment Change (Thursday).

Technical levels

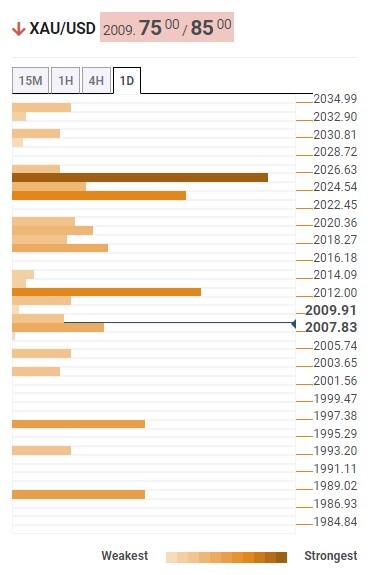

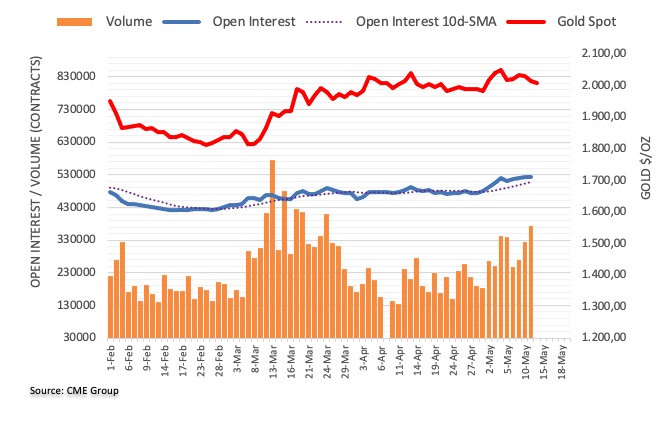

After the strong rise over the last few months, the Gold price is close to its all-time high. But Gold is likely to come under pressure yet again, economists at Commerzbank report.

Gold to climb again towards the end of the year

“Gold is likely to come under pressure yet once again, as the expectations of interest rate cuts in the second half of the year should be disappointing. But since the rate cuts are probably only postponed, the price decline should be limited.”

“Towards the end of the year and next year, the Gold price is likely to rise again.”

“For the end of the year, we foresee a price of $2,050 and a further rise to $2,100 by the middle of next year.”

Strategists at ANZ Bank discuss Silver's (XAG/USD) outlook.

Institutional investors to come back this year

“Strong fundamental backdrop and macroeconomic challenges should see institutional investors coming back this year.”

“While some demand is likely to level-off, we estimate supply will fall short by 140moz (12% of demand).”

“We continue to hold our bullish view and expect Silver prices to reach $26 by the end of this year.”

“A break of $24 could turn market sentiment bearish.”

See – Gold Price Forecast: XAU/USD could trade in the unchartered territory of $2,100 – ANZ

The negotiations to avert the US default were postponed to next week at short notice. Economists at Commerzbank note that this issue is not a concern for FX markets at the moment.

Sentiment could change at any moment

“The fact that the Dollar appreciated yesterday proves that the USD reaction to a hypothetical US default would be anything but trivial, as the Dollar benefitted yesterday as a result of resurging fears about the stability of regional US banks, which underlines the significance of the USD as a safe haven currency.”

“This should not, however, lead to the conclusion that the subject of the US debt ceiling will remain of no concern to the FX market. Sentiment could change at any moment, and the likelihood of that happening increases the more the time of a possible default approaches. That means the currently low vol levels could constitute an attractive hedging possibility.”

- Long-run inflation expectations rose to their highest reading since 2011.

- US Dollar loses momentum, but remains in positive ground for the day.

Consumer sentiment in the US deteriorated in early May with the University of Michigan's (UoM) Consumer Confidence Index falling to 57.7 (preliminary) from 63.5 in April. This reading came in below the market expectation of 63.

“Consumer sentiment tumbled 9% amid renewed concerns about the trajectory of the economy, erasing over half of the gains achieved after the all-time historic low from last June,” the UoM noted in its report. “While current incoming macroeconomic data show no sign of recession, consumers’ worries about the economy escalated in May alongside the proliferation of negative news about the economy, including the debt crisis standoff.”

Inflation expectations for one year dropped from 4.6% to 4.5% in May. On the contrary, 5-year inflation expectations rose from 3.0% to 3.2%, the highest reading since 2011.

Market reaction

The US Dollar pulled back across the board after the report but remained in positive territory for the day. The DXY was up by 0.15%, trading at one-week highs.

- GBP/USD struggles to capitalize on its intraday uptick and meets with a fresh supply on Friday.

- The BoE’s less hawkish tilt overshadows slightly better UK macro data and undermines the GBP.

- The USD climbs to a nearly two-week high and further exerts downward pressure on the major.

The GBP/USD pair attracts fresh sellers following an early uptick to the 1.2540 region on Friday and drops to a one-and-half-week low during the early North American session. Spot prices slip below the 1.2500 psychological mark, with bears now awaiting a break below through the lower end of an ascending trend channel extending from the April swing low before placing fresh bets.

The British Pound continues to be undermined by the Bank of England (BoE) Governor Andrew Bailey's less hawkish comments on Thursday, indicating the possibility of a sharp fall in UK inflation. This, to a larger extent, overshadows mostly in-line UK GDP print for the first quarter of 2023 and the better-than-expected UK Manufacturing/Industrial Production figures for March. Apart from this, some follow-through US Dollar (USD) buying for the second straight day prompts some intraday selling around the GBP/USD pair.

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, hits a one-and-half-week high amid fears about a global economic slowdown. The market worries resurfaced following the mixed release of Chinese inflation figures and the US labor market report on Thursday. That said, concerns about the US debt ceiling, along with a generally positive tone around the equity markets, keeps a lid on any further gains for the safe-haven Greenback and lends support to the GBP/USD pair, at least for now.

The USD bulls also seem reluctant amid the uncertainty over the Federal Reserve's (Fed) next policy move. In fact, the US CPI report released earlier this week pointed to signs of easing inflationary pressures, which could allow the US central bank to pause its rate-hiking cycle. Investors, however, remain divided over the possibility of rate cuts later this year. This makes it prudent to wait for strong follow-through selling before positioning for an extension of the GBP/USD pair's pullback from over a one-year high, around the 1.2680 region touched earlier this week.

Technical levels to watch

Economist at the National Bank of Canada discard to invest in equities.

Sell in May and go away

“As the economic impact of the most aggressive monetary tightening cycle in a generation becomes more apparent in the second half of 2023, we believe equity prices are vulnerable to negative earnings surprises.”

“If history is any guide, a deeply inverted yield curve does not bode well for the economy. At this stage, we also don’t think that the Fed will meet current market expectations for rate cuts as early as this summer. That could be problematic for the S&P 500 given that it is already trading at a lofty level. This month, we are further reducing our equity allocation in favor of cash. This increase comes at the expense of US equities as we adopt a ‘sell in May and go away’ strategy.”

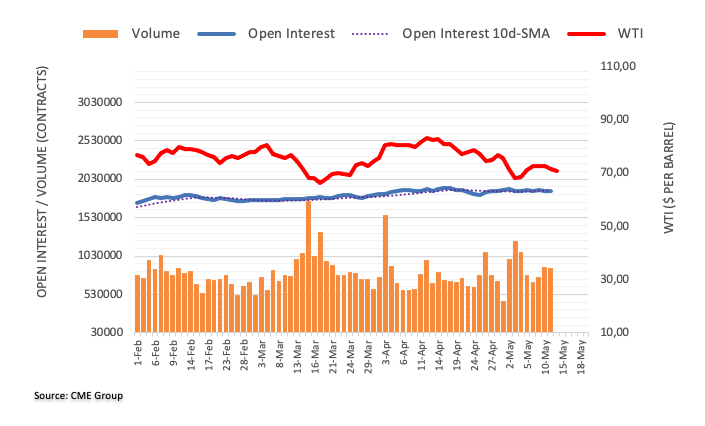

- WTI bounces off multi-day lows near $70.00.

- Traders remain divided between recession fears and Chinese recovery.

- Baker Hughes will publish its oil rig count later in the session.

Prices of the barrel of the West Texas Intermediate (WTI) cling to daily gains above the $71.00 mark following an earlier pullback to multi-session lows near the key $70.00 mark on Friday.

WTI looks at China, recession jitters

Crude oil prices now alternate gains with losses above the $71.00 mark and remain on track to close the first week with gains after three consecutive pullbacks.

In the meantime, the debate among traders remains well in place amidst the perception of an incipient US recession and dark clouds over the prospects for a Chinese recovery post-pandemic, while the still unresolved debt ceiling issue and unabated banking jitters also collaborate with the cautious scenario around the commodity for the time being.

A couple of news limiting the daily decline came from the announcement that the US government will start re-filling its SPR and the decrease to multi-month lows in Nigerian oil output during April.

Later in the NA session, Baker Hughes will publish its weekly report on the US drilling activity.

WTI significant levels

At the moment the barrel of WTI is up 0.11% at $71.47 and faces the next resistance at $73.83 (weekly high May 10) seconded by $76.92 (high April 28) and finally $79.14 (weekly high April 24). On the other hand, the breach of $63.97 (monthly low May 3) would open the door to $64.41 (2023 low March 20) and then $61.76 (monthly low August 23 2021).

- Gold rebounds despite stronger US Dollar.

- XAU/USD find support above $2,000 and rises erasing daily losses.

Gold prices rose significantly during the last hour, turning positive for the day. XAU/USD bottomed at $2,000, the lowest level in a week, before quickly rising to the $2,020 zone, where it remains at its daily highs with a bullish sentiment.

The move higher followed the release of the US Import and Export Price Index, which, as expected, showed notable declines from a year ago. These figures will help bring US inflation closer to the Federal Reserve's target. The next report to be released will be the US Consumer Confidence Index.

The move higher in Gold is taking place even as the US Dollar trades at daily and weekly highs against its main rivals. EUR/USD is below 1.0900, the lowest since mid-April, while AUD/USD holds below 0.6700, at one-week lows.

If XAU/USD continues to rise, the next resistance level is seen at $2,025, followed by the $2,045 area. A retreat below $2,010 would weaken the intraday outlook, exposing the $2,000 mark again.

Gold is headed toward a small weekly gain, the second in a row. The trend is up, but the fact that it is far from the weekly high and from the recent top indicates that the momentum is waning.

Technical levels

Day-to-day moves are fine, but the Dollar’s valuation is not, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

A Yen recovery is only a matter of waiting for the BoJ to act

“The current state of the global economy, or the state of global geopolitics, doesn’t, in our view, come anywhere close to justifying the USD holding on to so much of its 2021-2022 gains.”

“On a day-to-day basis, positioning, yield moves, geopolitical uncertainty and economic data trends all suggest we may be stuck in narrow ranges for a while. But the sense that the Dollar is simply too highly-valued here, isn’t going to be easy to shrug off. Nor is the sense that a Yen recovery is only a matter of waiting for the BoJ to act.”

Senior Economist at UOB Group Alvin Liew comments on the latest US inflation figures released on May 10.

Key Takeaways

“US headline consumer price index (CPI) increased by 0.4% m/m, 4.9% y/y in Apr (from 0.1% m/m, 5.0% y/y in Mar), the lowest headline reading, and the first below 5% inflation print since Apr 2021 (4.2%). However, core CPI (which excludes food and energy) proved to be stickier, as it rose sequentially at 0.4% m/m, (same as Mar), and compared to one year ago, it eased slightly to 5.5% y/y in Apr (from 5.6% in Mar).”

“US Inflation Outlook – For 2023, we still expect both headline and core inflation to ease to an average of 3.0%, and above the Fed’s 2% objective. Even as the shelter costs rose at a slower pace and food prices stayed flat for two months in a row, the latest CPI data showed that the balance of risk for US inflation remains far from being one-sided disinflation as reflected by surprise return of goods inflation and higher gasoline prices. Core and services inflation remain elevated (y/y) and rising (m/m), while the re-acceleration in Apr wage growth may still add to services cost pressure.”

Economists at Commerzbank expect the USD/BRL to move back higher amid Brazil's political issues.

BCB's hawkish stance remains under fire

“The BCB's hawkish stance is already fully priced into the USD/BRL exchange rate, which is why we see little further appreciation potential for the BRL. Rather, we are concerned that the FX market risks underestimating the consequences of increased government influence on monetary policy.”

“The BCB will find it increasingly difficult to provide a credible counterweight to a presumably more expansionary government, especially when BCB president Roberto Campos Neto's term ends at the end of 2024. This could affect the BCB's credibility in terms of sustainable inflation control, which is the main argument for our forecast of higher USD/BRL prices next year.”

“At present, the BRL is still benefiting from the still attractive real interest rate outlook, but we see increasing risks that the USD/BRL could turn faster than we expect.”

- USD/CAD touches a fresh weekly high on Friday, though remains below the 100-day SMA.

- Sliding Oil prices undermines the Loonie and lends support amid a modest USD strength.

- A positive risk tone caps the safe-haven buck and caps any further gains for the major.

The USD/CAD pair attracts some buying near the 1.3475 region on Friday and climbs to a fresh weekly high heading into the North American session. The pair is currently placed around the 1.3500 round-figure mark, up for the second straight day, with bulls now awaiting a move beyond the 100-day Simple Moving Average (SMA) before placing fresh bets.

Crude Oil prices remain under some selling pressure for the third successive day amid doubts over fuel demand this year, led by concerns about a global economic slowdown. The worries resurfaced following the release of the mixed Chinese inflation figures and weaker US labor market data on Thursday, which continue to weigh on the black liquid. This, in turn, is seen undermining the commodity-linked Loonie, which, along with some follow-through US Dollar (USD) buying, acts as a tailwind for the USD/CAD pair.

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, hits a nearly two-week high in the wake of a modest uptick in the US Treasury bond yields. That said, the uncertainty about the Federal Reserve's (Fed) next policy move might hold back the USD bulls from placing aggressive bets and cap gains for the USD/CAD pair. In fact, the US CPI report released earlier this week pointed to signs of easing inflationary pressures and might allow the Fed to pause its year-long rate-hiking cycle.

Investors, however, remain divided over the possibility of rate cuts later this year. Apart from this, concerns about the US debt ceiling and a generally positive risk tone might further contribute to keeping a lid on the safe-haven buck. This makes it prudent to wait for a sustained move beyond a technically significant 100-day SMA before positioning for an extension of the USD/CAD pair’s weekly rise from the 1.3315 region. Traders now look to the release of the Preliminary Michigan US Consumer Sentiment Index for a fresh impetus.

Technical levels to watch

- EUR/USD accelerates the decline and drops to 1.0890.

- The following contention area appears around 1.0830.

The pessimism around EUR/USD gathers further traction in the second half of the week and drags the pair back to the 1.0890 region, or multi-week lows, on Friday.

If bears remain in control, spot could initially revisit the interim 55-day SMA at 1.0847 ahead of the weekly low at 1.0831 (April 10).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0451.

EUR/USD daily chart

- Pound Sterling vs US Dollar falls by over 100 pips on “Super Thursday”.

- BoE Governor Bailey suggests inflation may show a sharp fall in April data, UK growth data paints a more optimistic picture.

- US Dollar strengthens on safe-haven flows after PacWest records large deposit outflows, renewing banking jitters.

The Pound Sterling (GBP) finds a floor after dropping off a cliff against the US Dollar (USD) on Thursday, following the Bank of England (BoE) monetary policy meeting. GBP/USD is currently trading in the lower 1.25s, trading slightly higher after UK GDP data confirms the country has averted a feared recession.

The pair fell on Thursday after the Bank of England published its decision, and deepened its decline following BoE Chairman Andrew Bailey’s dovish opening comments. Although it recovered later in the press conference as Bailey moderated his tone, GBP/USD ended the day just above 1.2500, as a further factor – renewed banking crisis woes – took its toll.

From a technical perspective, GBP/USD is showing short-term bearish signs but overall remains in a long-term uptrend, advantaging long over short holders.

GBP/USD market movers

- The Pound Sterling finds its feet after a sharp downswing following the release of UK GDP data, which it had been feared would show the UK falling into a recession.

- Quarterly GDP, however, came out positive at 0.1%, in line with estimates. GDP YoY showed a 0.2% rise, also in line with forecasts. The month-on-month figure, however, showed a below-expectations decline of -0.3% when a 0.1% rise had been expected.

- On Thursday, a combination of dovish commentary at the BoE meeting and renewed banking crisis fears, supporting safe-haven flows to the US Dollar, led to a sharp decline in GBP/USD on Thursday.

- GBP/USD initially fell following the BoE’s announcement of its decision by a vote of 7-2 (the same ratio as last meeting) to raise interest rates by 0.25% bringing the Bank Rate to 4.50%.

- The pair continued lower after BoE Chairman Andrew Bailey said, “The committee had good reason to believe headline inflation would fall considerably from April onwards”.

- Although the Pound Sterling recovered later when Bailey emphasized secondary effects and how “risks to inflation continue to be skewed to the upside as secondary effects persist”.

- GBP/USD renewed its sell-off after the US Dollar strengthened on safe-haven demand following the release of a securities filing by struggling US lender PacWest renewed US banking crisis fears. The filing revealed that the bank’s deposits had dropped nearly 10%, leading to a 20% sell-off in the bank's shares.

- Headline inflation in the UK is at 10.1% which is more than double the 4.9% reading in the US. US and UK Core inflation are more similar, however, with US at 6.2% versus 5.5% in the UK. Nevertheless it suggests the UK will have to continue raising rates after the Federal Reserve (Fed) has stopped. This should benefit GBP over USD as global investors favor currencies with higher interest rates to park their money.

- The CME Group FedWatch Tool is showing a 90% probability of no further interest rate hikes by the Fed.

- In addition, the Fed removed wording from its last statement saying that further monetary tightening would be appropriate if conditions warranted. The BoE, on the other hand, kept similar wording in its statement.

- The US Dollar is at risk from US debt ceiling default risk. US Treasury Secretary Janet Yellen warned on Thursday that a US default on a failure to raise the debt ceiling would produce an "economic and financial catastrophe." Most analysts believe this would be USD-negative.

- The main release for the US Dollar on Friday is Michigan Consumer Sentiment Index which is forecast to fall to 63.0 in May for its preliminary reading.

GBP/USD technical analysis: Shooting star reversal receives confirmation

GBP/USD sells off to 1.2500 and shows signs it may extend lower, however, this does not change the broadly bullish long-term picture. The uptrend remains intact as long as the 1.2435 May lows hold, and thus still favors Pound Sterling longs over shorts, for now.

-638194906504815376.png)

GBP/USD: Daily Chart

On Wednesday, the market formed a shooting star Japanese candlestick reversal pattern on GBP/USD, indicating the possibility of a short-term bearish reversal. The pattern gained confirmation after Thursday’s bearish close. The expectation is for more downside in the short-term, probably to support at the base of the rising channel/wedge, located at around 1.2475.

-638194906991617937.png)

GBP/USD: Daily Chart

The Relative Strength Index (RSI) is falling sharply after showing mild bearish divergence between price at the May peaks and RSI. This is indicative of underlying weakness, and further suggests more short-term downside.

That said, given the overall trend is bullish, the GBP/USD exchange rate will probably recover and continue rallying. The May 2022 highs at 1.2665 provide the first resistance level, but once breached they open the way to the 100-week Simple Moving Average (SMA) situated at 1.2713, and finally at the 61.8% Fibonacci retracement of the 2021-22 bear market, at 1.2758. All provide potential upside targets for the pair. Each level will need to be decisively breached to open the door to the next. Likewise for the bull trend to reverse, the 1.2435 lows will need to be decisively breached.

Decisive breaks are characterized by long daily candles that break through key resistance levels in question and close near their highs or lows of the day (depending on whether the break is bullish or bearish). Alternatively, three consecutive candles that break through the level can also be decisive. Such insignia provide confirmation that the break is not a ‘false break’ or bull/bear trap.

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, aka ‘Cable’, which < href="https://fxssi.com/the-most-traded-currency-pairs">accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

The NOK has reclaimed some ground vs. the EUR since the start of the month. A more hawkish Norges Bank should allow this month's recovery in the NOK vs. the EUR to extend a little further, economists at Rabobank report.

Risks of further Norges Bank rate hikes

“The market is currently priced for a peak in the policy rate of 3.53% suggesting that just one more 25 bps rate hike is fully priced in. By contrast market pricing suggests that the peak in ECB rates will be 44 bps above current levels.”

“A more hawkish Norges Bank could allow for EUR/NOK to push back towards the 11.40 level on a three-month view.”

The Dollar rebounded yesterday. Markets are set to remain very sensitive to US debt ceiling news into the weekend, and the Dollar’s support may linger barring positive developments.

Washington holds the key to the Dollar’s correction

“We still think investors are worryingly eyeing a scenario where it would ultimately take an adverse market reaction to break the impasse, and lack of any progress towards a deal can definitely continue to offer some support to the Dollar.”

“On the other hand, a benign scenario where a bipartisan deal has a positive impact on sentiment can leave the Dollar quite vulnerable given the quite aggressive rate cuts being priced into the USD curve, which the Dollar is not currently negatively discounting thanks to safe-haven demand.”

- DXY extends the advance further north of 102.00.

- Further upside should target the monthly high at 102.40.

DXY adds to the weekly recovery past the 102.00 mark on Friday.

A more serious bullish attempt should clear the monthly high at 102.40 (May 2) to mitigate the downside pressure and allow for a potential advance to the provisional 55- and 100-day SMAs at 102.70 and 102.93, respectively.

On the downside, there is a formidable contention around the 101.00 neighbourhood for the time being.

Looking at the broader picture, while below the 200-day SMA, today at 105.84, the outlook for the index is expected to remain negative.

DXY daily chart

Technically, Gold prices are consolidating near $2,020. If prices breach recent highs, strategists at ANZ bank expect Gold to advance towards $2,100.

Bullish trend remains intact

“The technical chart shows sustained bullish momentum, as the upward channel suggests a broad range of $1,900-2,100.”

“Prices face a key resistance at $2,062. A break above this level could trigger fresh technical buying, and prices could trade in the unchartered territory of $2,100.”

“On the downside, any disappointment on the rate hike front could pull prices back to the trend line support of $1,900.”

UOB Group’s Lee Sue Ann reviews the recently unveiled 2023/24 Federal Budget.

Key Takeaways

“The Labor government unveiled its Federal Budget 2023-24 late Tue (9 May) – the second budget since winning power in May 2022. These cost of living measures include AUD3bn of energy bill relief, AUD3.5bn on Medicare bulk billing incentives, AUD4.9bn for an across-the-board Jobseeker increase and increasing rent assistance by 15%. Other areas of focus include Medicare, improving aged care services and supporting the energy transition through incentives to small business for green investments and a AUD2bn Hydrogen Head Start program to develop the industry.”

“Australia’s GDP is expected to grow below trend over each of the next two years at 1.5% in 2023-24 and 2.25% in 2023-24. Inflation, which is currently at 7%, is forecast to fall to 3.25% next year. This inflation level returns to the Reserve Bank of Australia (RBA)’s target band for 2024-25. Real wage growth of 0.75% is expected for the year to Jun 2024, which is up half a point since the Oct budget. Unemployment is expected to rise from current lows to 4.25% by 202324 and 4.5% by 2024-25.”

“The AUD14.6bn suite of measures to help with the high cost of living are over four years. Threatening to eclipse the cost-of-living relief package was the surprising fact of the budget surplus, coming in at AUD4.2bn this financial year. This is the first surplus in 15 years, and the first since the 2007-08 Global Financial Crisis. The small surplus is a vast improvement from the AUD36.9bn deficit that the government predicted in its mini-Budget 2022-23 in Oct.”

- NZD/USD adds to the previous day’s heavy losses and drifts lower for the second straight day.

- Break below the 200-day SMA and the 50% Fibo. level could be seen as a fresh trigger for bears.

- An oversold RSI (14) on the hourly chart warrants caution before positioning for further losses.

The NZD/USD pair remains under intense selling pressure for the second successive day on Friday and retreats further from a nearly three-month top, around the 0.6380 region touched the previous day. Spot prices continue losing ground through the mid-European session and dive to over a one-week low, around the 0.6230 region in the last hour.

The New Zealand Dollar (NZD) is weighed down heavily by the Reserve Bank of New Zealand's (RBNZ) survey, which showed that inflation expectations for the first quarter eased to 2.79% from 3.30% in the previous quarter. This, in turn, lessens the need for further rate hikes by the RBNZ and prompts aggressive selling around the NZD/USD pair. Bulls, meanwhile, seem rather unimpressed by subdued US Dollar (USD) price action and a generally positive tone around the equity markets, which tends to benefit the risk-sensitive Kiwi.

From a technical perspective, a convincing break through the very important 200-day Exponential Moving Average (EMA), which coincides with the 50% Fibonacci retracement level of the April-May rally, could be seen as a fresh trigger for bearish traders. Adding to this, oscillators on the daily chart have just started drifting into negative territory and support prospects for a further depreciating move. That said, the Relative Strength (RSI) on the 1-hour chart is flashing extremely oversold conditions and warrants some caution for bears.

Hence, it will be prudent to wait for some intraday consolidation or a modest rebound before traders start positioning for any further depreciating move. Nevertheless, the aforementioned setup suggests that the path of least resistance for the NZD/USD pair is to the downside and any attempted recovery back above the 50% Fibo. level, around mid-0.6200s, might still be seen as a selling opportunity. This, in turn, should cap spot prices near a technically significant 200-day SMA, which should act as a pivotal for short-term traders.

On the flip side, any further downfall could find some support near the 61.8% Fibo. level, around the 0.6215 region. This is closely followed by the 0.6200 mark, below which the NZD/USD pair is likely to accelerate the fall towards the 0.6170-0.6165 intermediate support. Spot prices could drop further to the 0.6135 intermediate support before aiming to challenge the 0.6100 round figure or the April swing low.

NZD/USD daily chart

-638194866114914720.png)

Key levels to watch

USD has proven more resilient this week. The US Dollar Index (DXY) faces the next crucial resistance level at 102.40, economists at MUFG Bankr report.

More resilient price action as US debt ceiling comes into focus

“The DXY is rising back up to the 102.00 level as it moves further above the intra-day low from 4th May at 101.03. The next important resistance level comes in at 102.40 which is the intra-day high from 2nd May which is the top of its recent tight trading range.”

“The resilience of the US Dollar over the past week could reflect in part more investor unease over the global growth outlook.”

“The USD could be deriving more support in the near-term from more unease amongst market participants over risks to financial stability and growth posed by the ongoing loss of confidence in US regional banks and looming US debt ceiling stand-off that could be helping to temporarily disrupt the weakening US Dollar trend that has been in place driven by expectations of looser Fed policy.”

- GBP/USD bounce off a one-month-old ascending channel support, though lacks follow-through.

- The technical setup warrants some caution before positioning for any further near-term decline.

- A convincing break below the ascending channel support is needed to confirm a bearish break.

The GBP/USD pair attracts some buying near the 1.2500 psychological mark, which coincides with the lower end of a short-term ascending trend line extending from early April and recovers a part of the previous day's slump to over a one-week low. The pair sticks to its mildly positive tone, around the 1.2525-1.2530 region through the first half of the European session and for now, seems to have stalled a pullback from its highest level since April 2022 touched on Wednesday.

The US Dollar (USD) struggles to gain any meaningful traction and is seen consolidating the previous day's strong move up, which, in turn, is seen as a key factor lending some support to the GBP/USD pair. The upside, however, remains capped in the wake of the Bank of England (BoE) Governor Andrew Bailey's less hawkish remarks on Thursday, indicating the possibility of a sharp fall in UK inflation. This, to a larger extent, overshadows mostly in line UK GDP print for the first quarter of 2023 and the better-than-expected UK Manufacturing/Industrial Production figures for March.

From a technical perspective, the recent failure near the aforementioned trend-channel resistance and the subsequent downfall might have already shifted the near-term bias in favour of bearish traders. That said, oscillators on the daily chart - though have been losing positive traction - are still holding in the bullish territory. This, in turn, makes it prudent to wait for a convincing break below the 1.2500 mark, or the ascending trend-channel support, before positioning for any further depreciating move. The GBP/USD pair might then accelerate the slide towards the 1.2440-1.2435 region.

This is followed by the 1.2400 round figure, below which the downward trajectory could get extended further towards the next relevant support near the 1.2370-1.2465 region en route to the mid-1.2300s. The GBP/USD pair could eventually weaken further below the 1.2300 round-figure mark and test the 1.2275-1.2270 horizontal support.

On the flip side, any subsequent move-up is likely to confront stiff resistance near the 1.2550-1.2560 region. A sustained strength beyond will reaffirm the trend-channel support and trigger a near-term short-covering move. The GBP/USD pair might then aim to reclaim the 1.2600 round figure and test the 1.2635-1.2640 supply zone. The upward trajectory has the potential to push spot prices towards the 1.2700 mark, which coincides with the top end of the ascending channel. The latter should act as a pivotal point, which if cleared will be seen as a fresh trigger for bullish traders.

GBP/USD 4-hour chart

Key levels to watch

- EUR/JPY rebounds from earlier monthly lows near 146.00.

- Extra losses should not be ruled out of the time being.

EUR/JPY so far reverses three consecutive daily pullbacks and reclaims the area above the 147.00 mark on Friday.

The monthly leg lower looks unchallenged so far. Against that, the cross could now put the May low of 146.13 (May 11) to the test prior to the provisional 55-day SMA at 145.29.

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 143.00.

EUR/JPY daily chart

Economists at Commerzbank discuss ECB and Fed outlook and its implications for the EUR/USD pair.

The ECB appears to be more hawkish than the Fed

“Even if the ECB (as our ECB watcher expects) will only raise its key rate once more (in June), the EUR is likely to appreciate in the second half of the year if (as we expect) it becomes foreseeable that the Fed will cut its key rate, but the ECB will remain rock-solid on its ‘terminal rate’.”

“In the long run, however, EUR strength is unlikely to be sustainable. According to our economists, the ECB is likely to succeed in controlling inflation to a lesser extent than the Fed in the long term. Regardless of which of the two central banks offers the highest real interest rate on its respective currency, this is likely to result in the Euro suffering from an increased inflation risk premium.”

- US Dollar holds its ground following Thursday's decisive rebound.

- US Dollar Index stays near 102.00, looks to post strong weekly gains.

- US banking woes and debt ceiling headlines could continue to drive US Dollar's valuation.

The US Dollar benefited from souring risk mood on Thursday and registered strong gains against its major rivals. Markets stay relatively quiet early Friday and the US Dollar Index (DXY) consolidates its weekly gains.

Although there will not be any high-tier macroeconomic data releases from the United States ahead of the weekend, market participants will keep a close eye on headlines surrounding the banking crisis and the debt ceiling. Nevertheless, the US Dollar remains on track to register its best weekly performance since mid-March.

Daily digest market movers: US Dollar stays resilient for now

- Beth Hammack, Chair of the Treasury Borrowing Advisory Committee and Co-Head of Goldman's Global Financing Group, said recently that a political deadlock over the US debt ceiling poses a "real risk" for the USD.

- President Joe Biden and top Republican lawmakers have postponed the next round of negotiations on debt limit to next week.

- Securities filing submitted by PacWest revealed on Thursday that the bank's deposits dropped nearly 10% last week. As the bank's shares lost more than 20% following this development, the financial heavy Dow Jones Industrial Average lost nearly 0.7% on the day.

- Commenting on the Federal Reserve's (Fed) policy outlook, "inflation is coming down, but so far it's been pretty darn persistent, that means we are going to have to keep at it for an extended period of time," said Minneapolis Federal Reserve President Neel Kashkari.

- US Treasury Secretary Janet Yellen warned on Thursday that a US default on a failure to raise the debt ceiling would produce an "economic and financial catastrophe." On Friday, Yellen reassured that she is working full-time with Congress to raise debt ceiling.

- Fed Governor Christopher Waller said that they are worried about things like bank deposit runs, not climate change, when it comes to financial stability.

- The Core CPI inflation, which excludes volatile food and energy prices, edged lower to 5.5% in April from 5.6% in March as expected. On a monthly basis, the CPI and the Core CPI rose 0.4%, matching analysts' estimates.

- The BLS reported on Thursday that the Producer Price Index (PPI) for final demand in the US rose 2.3% on a yearly basis in April, down from the 2.7% increase recorded in March.

- The weekly data published by the US Department of Labor showed that Initial Jobless Claims totaled 264,000 in the week ending May 6. This print followed the previous week’s unrevised 242,000 and came in above the market expectation of 245,000.

- Commenting on the US inflation report, "the CPI report comes on top of the Nonfarm Payrolls (NFP) figures released less than a week ago, and together there is a compelling case for pausing," said FXStreet Analyst Yohay Elam. "Investors already see a growing chance of rate cuts, and that weighs on the Greenback."

- The CME Group FedWatch Tool shows that markets are pricing in a more than 80% probability of the Fed leaving its policy rate unchanged at the next policy meeting.

- The benchmark 10-year US Treasury bond yield fell nearly 2% on Thursday before stabilizing near 3.4% early Friday.

- Earlier in the week, the Fed noted in its Loan Officer Survey for the first quarter that respondents reported tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms. "Banks reported tighter standards and weaker demand for all commercial real estate loan categories," the publication further read.

- On Monday, Federal Reserve Bank of New York President John Williams told the Economic Club of New York on Tuesday that the Fed needs to be data-dependent with monetary policy and reminded that the Fed will raise rates again if needed.

Technical analysis: US Dollar Index holds above key support

The US Dollar Index (DXY) climbed above 102.00 for the first time on Thursday and closed the day above the 20-day Simple Moving Average after having failed to do so earlier this week. 102.50 (50-day SMA) aligns as the next bullish target for the DXY ahead of 103.00 (psychological level, 100-day SMA) and 103.60 (static level from February).

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart rose slightly above 50, pointing to a buildup of bullish momentum.

On the downside, 101.65 (20-day SMA) forms first support. A daily close below that level could attract sellers and open the door for an extended decline toward 101.00 (static level, psychological level) and 100.00.

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.

BoE offered few reasons to turn bearish on the Pound, in the opinion of economists at ING.

EUR/GBP should climb back to 0.9000 in the second half of the year

“The BoE retained its flexibility and kept the door open for more rate hikes if inflation proves persistent. While we don’t exclude one final June hike, our base case is that we have reached the peak of the BoE tightening cycle as inflation will start to rapidly decelerate this year.”

“Still, the Sonia curve continues to price in around 38bp of tightening to the peak, which leaves the pound at risk of a rate-driven negative impact down the stretch. We feel this will materialise in EUR/GBP, which should climb back to 0.9000 in the second half of the year as EUR and GBP rates re-converge, in our projections.”

“For now, however, there aren’t many convincing reasons to call for GBP underperformance against its main peers in the near term.”

- AUD/USD drifts lower for the second successive day and hits a fresh weekly low on Friday.

- Worries about a global economic slowdown drive flow away from the risk-sensitive Aussie.

- A positive risk tone undermines the safe-haven USD and helps limit losses for the major.

The AUD/USD pair adds to the previous day's heavy losses and remains under some selling pressure for the second successive day on Friday. The pair maintains its offered tone through the first half of the European session and is currently placed just below the 0.6700 mark, with bears flirting with the 50-day Simple Moving Average (SMA).

Concerns about a global economic slowdown resurfaced on Thursday following the release of the mixed Chinese inflation figures and weaker US labor market report, which, in turn, is seen as a key factor weighing on the risk-sensitive Aussie. The US Dollar (USD), on the other hand, is seen consolidating the previous day's strong gains to over a one-week high and draws some support from a modest uptick in the US Treasury bond yields. This, in turn, exerts additional downward pressure on the AUD/USD pair, though the downside seems limited.

The uncertainty over the Federal Reserve's (Fed) next policy move is holding back the USD bulls from placing aggressive bets. In fact, the US CPI report released earlier this week pointed to signs of easing inflationary pressure and could allow the US central bank to pause its year-long rate-hiking cycle. Investors, however, remain divided over the possibility of rate cuts later this year. This, along with a generally positive tone around the equity markets, keeps a lid on any further gains for the safe-haven buck and lends support to the AUD/USD pair.

Apart from this, the Reserve Bank of Australia's (RBA) hawkish outlook, indicating that some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time, warrants caution for bearish traders. Hence, it will be prudent to wait for strong follow-through selling before positioning for an extension of this week's rejection slide from the 100-day SMA. Nevertheless, the AUD/USD pair remains on track to end the week in the red and reverse a major part of its gains recorded over the past week or so.

Technical levels to watch

According to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, further upside in USD/CNH is likely to meet tough hurdles at 6.9700 prior to 7.0000 in the next few weeks.

Key Quotes

24-hour view: “We did not expect USD to soar to a high of 6.9640 yesterday (we were expecting it trade in a range). The rapid increase in momentum is likely to lead to further USD strength even though the major resistance at 6.9750 is likely out of reach today. Support is at 6.9480; a breach of 6.9400 would indicate that USD is not advancing further.”

Next 1-3 weeks: “Yesterday (11 May, spot at 6.9330), we indicated that ‘there does not appear to be any directional bias and for the time being’ and we expected USD to ‘trade in a range of 6.9100/6.9630’. We did not expect USD to rise so quickly to the top of the expected range (high of 6.9640). Upward momentum is beginning to build and USD is likely to trade with an upward bias. However, it is worth noting the resistance at 6.9750 and the significant level at 7.0000. On the downside, a breach of 6.9250 would suggest USD is not ready to head higher.”

- USD/JPY gains traction for the second straight day, albeit lacks any follow-through.

- A combination of factors undermines the JPY and acts as a tailwind for the major.

- The USD stands tall near a one-week high and remains supportive of the move up.

The USD/JPY pair builds on the overnight goodish rebound from the 133.75 region, or a one-week low. and gains some follow-through traction for the second successive day on Friday. The pair maintains its bid tone through the early part of the European session and is currently placed around the 134.70 region, up over 0.20% for the day.

A generally positive tone around the equity markets, along with the Bank of Japan's (BoJ) dovish outlook, undermines the safe-haven Japanese Yen (JPY) and turns out to be a key factor acting as a tailwind for the USD/JPY pair. It is worth recalling that the BoJ Governor Kazuo Ueda, speaking in parliament earlier this week, said it was too early to discuss specific plans for an exit from the massive stimulus programme.

The US Dollar (USD), on the other hand, reverses a modest intraday dip and stands tall near a one-and-half-week high touched on Thursday, which, in turn, lends additional support to the USD/JPY pair. The uncertainty over the Federal Reserve's (Fed) next policy move, along with a modest uptick in the US Treasury bond yields, continue to underpin the Greenback, though the US debt ceiling concerns act as a headwind.

The US CPI report released earlier this week pointed to signs of easing inflationary pressure and reaffirmed market expectations about an imminent pause in the Fed's year-long rate-hiking cycle. Investors, however, remain divided over the possibility of rate cuts later this year. This, in turn, holds back the USD bulls from placing aggressive bets and might keep a lid on any meaningful upside for the USD/JPY pair, at least for now.

Market participants now look forward to the release of the Preliminary Michigan Consumer Sentiment Index from the US, due later during the early North American session. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the USD/JPY pair. Apart from this, traders will take cues from the broader risk sentiment to grab short-term opportunities on the last day of the week.

Technical levels to watch

During his visit to Beijing on Friday, Australian Trade Minister Don Farrell said that he “can see the benefits for Australian and Chinese businesses and consumers that continue to flow from the China-Australia free trade agreement.”

“We still have some way to go to establish usual trade across the board,” Farrell said.

Market reaction

AUD/USD is a little impressed by the above comments, staying on the back foot just beneath 0.6700, as of writing.

Downward bias continues to pick up pace in USD/JPY comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “While we expected USD to weaken yesterday, we indicated that ‘a clear break of last week’s low near 133.50 is unlikely’. USD dropped briefly to 133.73 in early NY trade and then rebounded. USD appears to have moved into a consolidation phase and it is likely to trade in a range of 134.00/135.00 today.”

Next 1-3 weeks: “There is not much to add to our update from yesterday (11 May, spot at 134.20). As highlighted, while downward momentum is building again, the likelihood of USD dropping to 133.00 has not increased much. On the upside, a break of 135.50 (no change in ‘strong resistance’ level) would indicate 133.00 is not coming into view.”

US Treasury Secretary Janet Yellen said on Friday that “they will be meeting with senior bankers on debt ceiling next week.”

Additional quotes

“Will be meeting with senior bankers on debt ceiling next week.”

“Working full-time to work with Congress to raise debt ceiling.”

“If Congress fails, we face financial and economic catastrophe.”

Related reads

- Forex Today: US Dollar consolidates weekly gains ahead of mid-tier data

- US Treasury yields to rise amid debt ceiling standoff – Reuters poll

FX option expiries for May 12 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.1100 896m

- 1.1050 696m

- 1.1020 567m

- GBP/USD: GBP amounts

- 1.2430 301m

- USD/JPY: USD amounts

- 135.00 1.31b

- 133.00 981m

- 125.00 875m

- AUD/USD: AUD amounts

- 0.6740 742m

- USD/CAD: USD amounts

- 1.3700 821m

- 1.3500 770m

- 1.3250 737m

- USD/CNY: USD amounts

- 6.9447 491m

- 6.9000 438m

Federal Reserve (Fed) Governor Michelle Bowman said Friday, “policy rate will need to remain sufficiently restrictive for some time.”

Additional quotes

Additional rate hikes 'likely appropriate' if inflation stays high, labor market stays tight.

Policy is now restrictive but uncertain if it is sufficiently restrictive to bring down inflation.

Inflation is still much too high.

Policy action is not on a pre-set course.

Recent data have not provided consistent evidence that inflation is on a downward path.

Market reaction

The US Dollar Index is trading almost unchanged on the day at 102.07, having caught a fresh bid on the above comments.

Speaking on the sidelines of a Group of Seven (G7) meeting in Japan, European Central Bank (ECB) policymaker and Bundesbank Chief Joachim Nagel said on Friday, the latest interest rate hike won't be the last as it needs to ensure the current wave of inflation comes to an end.

Key quotes

“Current data did not indicate that the ECB should change its thinking on the need for further rate hikes.”

"We need to be sure that the latest inflation wave ends.”

Market reaction

Despite the hawkish comments from Nagel, EUR/USD is erasing gains to trade flat at 1.0910, as of writing.

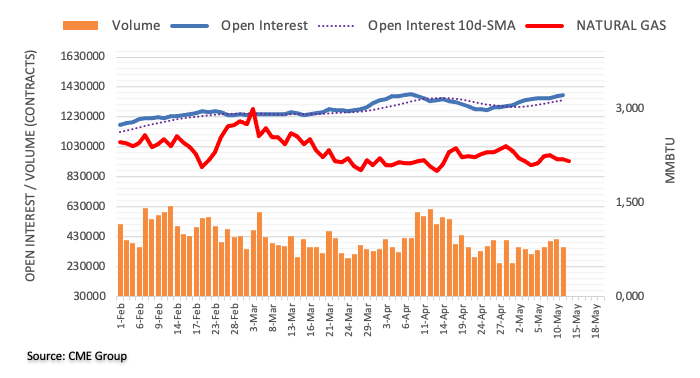

Considering advanced prints from CME Group for natural gas futures markets, open interest rose for the third straight session on Thursday, now by around 3.6K contracts. Volume, on the other hand, dropped by nearly 50K contracts after four daily builds in a row.

Natural Gas: Immediately to the downside emerges $2.00

On Thursday, natural gas prices fell even lower. The move was prompted by growing open interest and dropping volume, which maintains the current broad consolidative theme for the time being. Meanwhile, the important $2.00 mark per MMBtu has been a significant support for the commodity thus far.

- EUR/USD regains some balance and rebounds from 1.0900.

- The greenback appears slightly offered following recent strength.

- Investors’ attention will be on the flash US Consumer Sentiment.

Following fresh multi-week lows in the 1.0900 neighbourhood, EUR/USD now manages to pick up some upside traction and reclaims the 1.0930 zone on Friday.

EUR/USD looks bid on risk-on mood

EUR/USD partially reverses Thursday’s strong decline to the 1.0900 area on the back of the better tone in the risk complex, which in turn forces the Greenback to give away some of its recent strong gains.

The uptick in the pair, as well as the improvement in the risk appetite, appears also reflected in the US and German money markets, where yields reverse part of the recent weakness and attempt a tepid bounce.

Around the ECB, usual hawk Board member J. Nagel reiterated that inflation remains too high and advocated for a faster pace of the quantitative tightening (QT) process from July.

Nothing to write home about from the euro docket on Friday should leave the attention to the release of the advanced Michigan Consumer Sentiment for the current month later in the NA session.

What to look for around EUR

EUR/USD attempts a mild rebound following the reversal to 4-week lows in the 1.0900 neighbourhood recorded on Thursday.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.06% at 1.0921 and the surpass of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022). Conversely, the next contention level emerges at 1.0899 (monthly low May 11) seconded by 1.0831 (monthly low April 10) and finally 1.0798 (100-day SMA).

- NZD/USD drifts lower for the second successive day and dives to over a one-week low on Friday.

- Worries about a global economic slowdown continue to weigh heavily on the risk-sensitive Kiwi.

- A modest USD downtick lends support, though the fundamental backdrop favours bearish traders.

The NZD/USD pair extends the previous day's sharp retracement slide from the 0.6385 region, or a nearly three-month high and remains under heavy selling pressure for the second successive day on Friday. The pair drops to over a one-week low during the early European session, albeit shows some resilience below a technically significant 200-day Simple Moving Average (SMA) and currently trades around the 0.6260-0.6250 area, still down over 0.60% for the day.

The mixed Chinese inflation data and a weaker US labor market report released on Thursday raised concerns about a global economic slowdown, which, in turn, is seen as a key factor driving flows away from the risk-sensitive Kiwi. That said, a modest uptick in the US equity futures and a softer US Dollar hold back traders from placing fresh bearish bets around the NZD/USD pair. Apart from this, expectations for further rate hikes by the Reserve Bank of New Zealand (RBNZ) lend some support to the major, at least for the time being.

The USD downtick, meanwhile, is likely to remain cushioned amid the uncertainty over the Federal Reserve's (Fed) next policy move. The US CPI report released on Wednesday pointed to further signs of easing inflationary pressures and should allow the US central bank to pause its year-long rate-hiking cycle. Investors, however, remain divided over the possibility of a rate cut later this year. This, in turn, acts as a tailwind for the US Treasury bond yields, which should limit the USD losses and cap any intraday recovery for the NZD/USD pair.

The aforementioned fundamental backdrop supports prospects for a further near-term depreciating move, though traders need to wait for a break and acceptance below the 200 DMA is needed before placing fresh bearish bets. Market participants now look to the release of the Preliminary Michigan Consumer Sentiment Index from the US later during the early North American session. This, along with the broader risk sentiment and the US bond yields, will influence the USD price dynamics and provide some impetus to the NZD/USD pair.

Technical levels to watch

In the opinion of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, AUD/USD is now likely to navigate within the 0.6630-0.6780 range in the next few weeks.

Key Quotes

24-hour view: “Yesterday, we highlighted that ‘while upward momentum has not improved much, AUD could retest the 0.6820 level before a more sustained pullback is likely’. However, instead of retesting 0.6820, AUD plunged by 1.13% (0.6702), its biggest 1-day drop since early March. Not surprisingly, the outsized drop is oversold. That said, the weakness has not stabilized and barring a break above 0.6745 (minor resistance is at 0.6725), AUD could drop further to 0.6670 before stabilization is likely. The major support at 0.6635 is not expected to come under threat.”

Next 1-3 weeks: “We have held a positive AUD view since last Wednesday, 03 May (see annotations in the chart below). After AUD rose to 0.6818 and pulled back, we highlighted yesterday (11 May, spot at 0.6780) that ‘while the outlook for AUD is still positive, it remains to be seen if it has enough momentum to advance to the next objective of 0.6860’. We did not expect the sharp reversal as AUD plummeted below our ‘strong support’ level of 0.6720 in NY trade (low of 0.6689). The breach of 0.6720 indicates that AUD strength has ended. Despite the sharp drop, it is too early to expect a major reversal in AUD. For the time being, the bias is tilted to the downside but we view any AUD weakness as part of a 0.6630/0.6780 range. In other words, a sustained drop below 0.6630 is unlikely for now.”

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions for the second session in a row on Thursday, this time by nearly 3K contracts. In the same line, volume shrank by around 9.1K contracts after two daily pullbacks in a row.

WTI: Upside remains capped by $74.00

Thursday’s daily decline in prices of the WTI came along declining open interest and volume, hinting at the idea that a deeper correction seems out of favour for the time being. On the upside, in the meantime, gains remain limited by the $74.00 region per barrel.

- Silver drifts lower for the third successive day and hits over a one-month low on Friday.

- The overnight breakthrough the $24.50-40 horizontal support favours bearish traders.

- Some follow-through selling below the 38.2% Fibo. will set the stage for deeper losses.

Silver remains under some selling pressure for the third successive day on Friday and drops to sub-$24.00 levels, or over a one-month low heading into the European session.

From a technical perspective, the recent repeated failures near the $26.00 round-figure mark and the subsequent steep break through the $24.50-$24.40 strong horizontal support favours bearish traders. Moreover, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone. This might have already set the stage for a further near-term depreciating move for the XAG/USD.

The white metal, however, manages to find some support near the 50-day Simple Moving Average (SMA). This is followed by the 38.2% Fibonacci retracement level of the March-April rally, around the $23.75-$23.70 area, which if broken will reaffirm the negative bias. The XAG/USD might then test the 100-day SMA, currently pegged near the $23.40-$23.45 area, before eventually dropping to the 50% Fibo. level, around the $23.00 mark.

On the flip side, any meaningful recovery attempt might now confront stiff resistance near the $24.40-$24.40 support breakpoint, which coincides with the 23.6% Fibo. level. A sustained strength beyond could negate the bearish outlook and lift the XAG/USD to the $25.00 psychological mark en route to the $25.55-$25.60 resistance. Bulls might then make a fresh attempt to conquer the $26.00 mark and test the YTD peak, around the $26.10-$26.15 area.

Silver daily chart

Key levels to watch

Economists at ING expect the EUR/USD pair to eventually break under the 1.09 level.

No domestic drivers

“EUR/USD continues to follow primarily USD dynamics, and a quiet calendar in the Eurozone means this should continue to be the case today.”

“For now, the USD appreciation was not enough to trigger a break below 1.0900 in the pair, but the lack of some encouraging news on the US debt ceiling story means –in our view – that 1.0900 will hardly prove to be a sturdy support for much longer.”

“ECB speakers have had a limited impact on the Euro after the latest ECB meeting and this should not change for now.”

- Gold price snaps two-week winning streak, slides beneath $2,030 confluence level.

- US debt ceiling talks, banking woes join hawkish Fed bets to propel US Dollar and weigh on XAU/USD.

- US policymakers will gather early next week to overcome default fears, Fed’s Powell also up for a speech.

Gold price (XAU/USD) prints a three-day downtrend to recall the bears, after their fortnight-old recess, as mixed sentiment allows the US Dollar to remain firmer. Adding strength to the XAU/USD bearish bias could be the fears of US debt ceiling expiry after the policymakers pushed back the much-awaited talks of Friday to early next week. On the same line are the fears of witnessing an economic slowdown as US bank deposits slump.

It should be noted, however, that the hopes of recovery in China inflation and the US policymakers’ optimism challenge the Gold bears ahead of some more clues of the US inflation, which in turn can justify the latest hawkish Fed concerns. Apart from the US inflation signals, the next week’s US Retail Sales and a speech from Federal Reserve (Fed) Chairman Jerome Powell will also be important to watch for near-term Gold price moves.

Also read: Gold Price Forecast: For how long can XAU/USD defend 21 DMA support?

Gold Price: Key levels to watch

As per our Technical Confluence Indicator, the Gold price remains bearish below the key $2,025 support confluence comprising the middle band of the Bollinger on the four-hour (4H) play and Fibonacci 23.6% on one month.

That said, the metal recently slipped beneath the $2,010 level and pleased bears to cheer the first weekly loss in three. The said support, now immediate resistance, encompasses Fibonacci 38.2% on one-month, previous daily low and lower band of the Bollinger on the four-hour chart.

It’s worth noting that 5-DMA and Fibonacci 38.2% on one-day together highlight $2,023 as a short-term key upside hurdle.