- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-05-2023

Japanese economic growth came in as 0.4% versus 0.1% expected and 0.0% prior, per the preliminary reading of the first quarter (Q1) 2023 Gross Domestic Product (GDP) figures.

More to come

- US Dollar Index grinds higher after reversing week-start retreat from monthly top.

- US Retail Sales, Industrial Production offered positive surprise for April, Fed policymakers defend hawkish play.

- US President Biden, House Speaker McCarthy’s debt ceiling negotiations ended too soon, cited hopes of a deal by this weekend.

- Second-tier US housing data, risk catalysts eyed for clear directions.

US Dollar Index (DXY) seesaws around 102.60 amid early Wednesday, following a run-up to reverse the early week pullback from the highest levels in five weeks. With this, the greenback’s gauge versus six major currencies justify upbeat US data and hawkish Federal Reserve (Fed) comments while also making note of the latest positive development about the US debt ceiling issue.

US President Joe Biden and top congressional Republican Kevin McCarthy’s meeting ended within an hour and raised expectations of a positive development as congressional leaders, said, "It is possible to get a deal by the end of the week." Following the news, Reuters quotes the S&P Global Market Intelligence data while marking a fall in the one-year US Credit Default Swap (CDS) spreads from 164 basis points (bps) to 155 bps. “Spreads on five-year CDS decreased to 69 basis points from 72 bps on Monday,” reported the news.

That said, Federal Reserve Bank of Chicago President Austan Goolsbee and Atlanta Fed President Raphael Bostic recently defended the US central bank’s hawkish moves by citing inflation woes as they spoke at a conference hosted by the Federal Reserve Bank of Atlanta. Previously, Richmond Fed Thomas Barkin said in an interview with the Financial Times (FT) that if inflation persists, or God forbid accelerates, there’s no barrier in my mind to further increases in rates. On the same line, Cleveland Fed President Loretta Mester said, “I don’t think we're at that hold rate yet.”

It’s worth noting that US Retail Sales improved to 0.4% MoM for April, from -0.7% prior (revised) versus 0.7% expected. More importantly, Retail Sales Control Group for the said month crossed market forecasts of 0.0% and -0.4% prior with 0.7% actual figure whereas Retail Sales ex Autos matches 0.4% MoM estimations for April¸ surpassing the -0.5% prior. Further, the US Industrial Production MoM rose to 0.5% for April versus expectations of printing a 0.0% figure.

Amid these plays, the US Treasury bond yields remained firmer and Wall Street witnessed losses on Tuesday. However, the S&P500 Futures print mild gains by the press time.

Moving on, US Building Permits and Housing Starts for April will decorate today’s calendar and can entertain the DXY traders. However, major attention will be given to US debt ceiling updates and Fed talks for clear directions.

Technical analysis

Although 50-DMA puts a floor under the US Dollar Index (DXY) price near 102.35, a five-week-old horizontal resistance area around 102.75-80, followed by the 100-DMA hurdle of 102.90, can prod the bulls.

“Fear with rising unemployment is that once joblessness starts to rise it ‘goes way up’,” said Federal Reserve Bank of Chicago President Austan Goolsbee while participating in a conference hosted by the Federal Reserve Bank of Atlanta, together with Atlanta Fed President Raphael Bostic.

Also read: Fed's Bostic: Pressure on Fed will be “enormous” if unemployment starts to rise, inflation remains sticky

Key comments

Wages are not a leading indicator of inflation.

'A chance' can get rid of inflation without a recession.

Market reaction

Even if Fed’s Goolsbee fails to amplify hawkish comments from Atlanta Fed President Bostic, the tone of the statements appears positive for the US Dollar. However, the US Dollar Index (DXY) remains unimpressive as bulls take a breather around 102.70 after reversing the week-start gains.

Also read: Forex Today: Higher US yields, risk aversion lead to a stronger US Dollar

- USD/CHF is looking to stretch its upside move above 0.8970 amid a cautious market mood.

- The US debt-ceiling issues are expected to get a constructive outcome by the end of the week.

- Fed Barkin has opened room for more rate hikes while the street is anticipating a steady interest rate policy ahead.

The USD/CHF pair is looking to stretch its recovery above the immediate resistance of 0.8970 in the Asian session. The Swiss franc asset has rebounded firmly as the US debt-ceiling negotiations for raising the same to avoid the situation of default in augmenting obligated payments by the US treasury have been postponed.

S&P500 futures have added significant gains in early Asia after a bearish Tuesday. Market sentiment is still quite nervous as an absence of a constructive outcome from US debt-ceiling talks has pushed the United States economy further towards recession.

The White House and Republican leaders have admitted that a default that contains approval of a higher borrowing limit without cutting spending cannot be approved. Also, Reuters reported that the meeting ended on an upbeat and unexpected note as McCarthy, coming out of the meeting with Biden and other congressional leaders, said, "It is possible to get a deal by the end of the week."

The US Dollar Index (DXY) has sensed pressure in extending its recovery above 102.70, however, the upside seems favored after commentary from Federal Reserve (Fed) policymakers. Richmond Fed Bank President Thomas Barkin, cited on Tuesday that he would be comfortable with more interest rate hikes if needed to bring inflation down. The commentary from Fed Barkin has opened room for more rate hikes while the street is anticipating a steady interest rate policy ahead.

Meanwhile, markets in the Swiss economy will remain closed on Wednesday on account of Ascension Day.

“Fed will have to stay ‘super strong’ in its inflation commitment,” said Federal Reserve (Fed) Bank of Atlanta President Raphael Bostic while participating in a conference hosted by the Federal Reserve Bank of Atlanta.

Additional comments

Fed is ‘far beyond success’ on its employment mandate, a ‘bit of pulling back’ in the aid of lowering inflation is ‘justifiable and appropriate’.

Wages didn't fully catch up to inflation in 2022.

This year another round of raises, less than the previous year.

Still some way to go until inflation is beaten.

Market reaction

Given the unimpressive statements and the early hours of the Asian session, market players fail to react to the statements. Even so, the US Dollar grinds higher after reversing the week-start losses.

Also read: Forex Today: Higher US yields, risk aversion lead to a stronger US Dollar

- EUR/USD stays pressured towards monthly low after breaking immediate bullish channel formation.

- Nearly oversold RSI, multiple supports near 1.0845-35 challenge Euro sellers.

- Downbeat MACD signals, jungle of resistances keep EUR/USD bears hopeful.

EUR/USD holds lower grounds near 1.0860 amid the early hours of Wednesday’s Asian session, after reversing the week-start rebound on Tuesday.

In doing so, the Euro pair justifies the previous day’s downside break of a weekly bullish channel, as well as the bearish MACD signals, amid a nearly oversold RSI (14) line.

Apart from the RSI (14) line that suggests limited room for the Euro pair towards the south, multiple lows marked since April 10 around 1.0837-45 also challenge the EUR/USD bears.

Hence, the pair sellers may retreat after hitting the aforementioned immediate support, maybe around that, failing to do so won’t hesitate to challenge the previous monthly low of around 1.0785. That said, the 1.0800 round figure may act as an intermediate halt during the likely fall.

On the contrary, the stated channel’s bottom line, near 1.0885 by the press time, guards the immediate recovery of the EUR/USD pair.

Following that, the 100-Hour Moving Average (HMA) and a fortnight-old descending trend line, respectively near 1.0900 and 1.0925, may prod the Euro pair buyers.

It’s worth noting that a horizontal area comprising multiple levels marked since May 02 and the 200-HMA, close to 1.0935-45 and 1.0950 in that order, appear as the last defense of the EUR/USD bears.

EUR/USD: Hourly chart

Trend: Limited downside expected

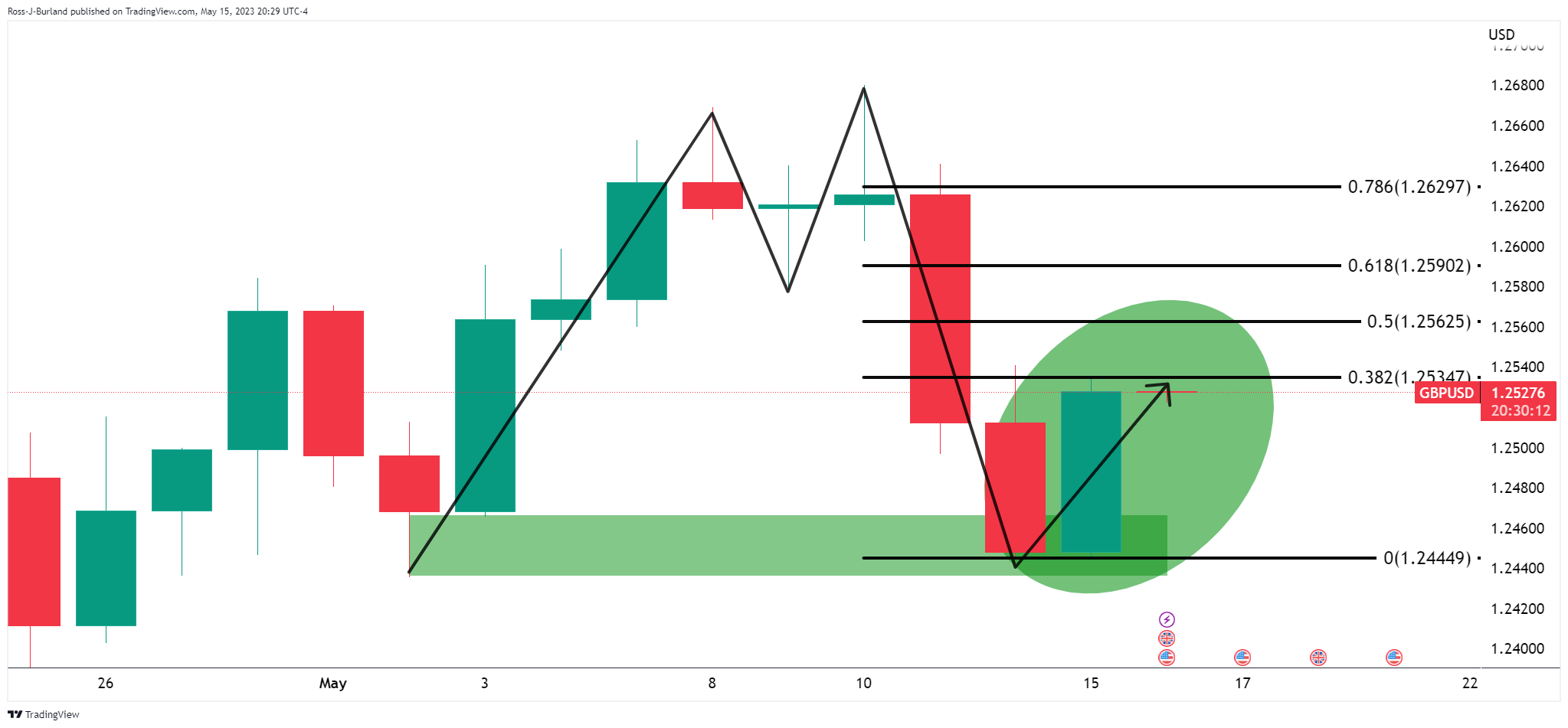

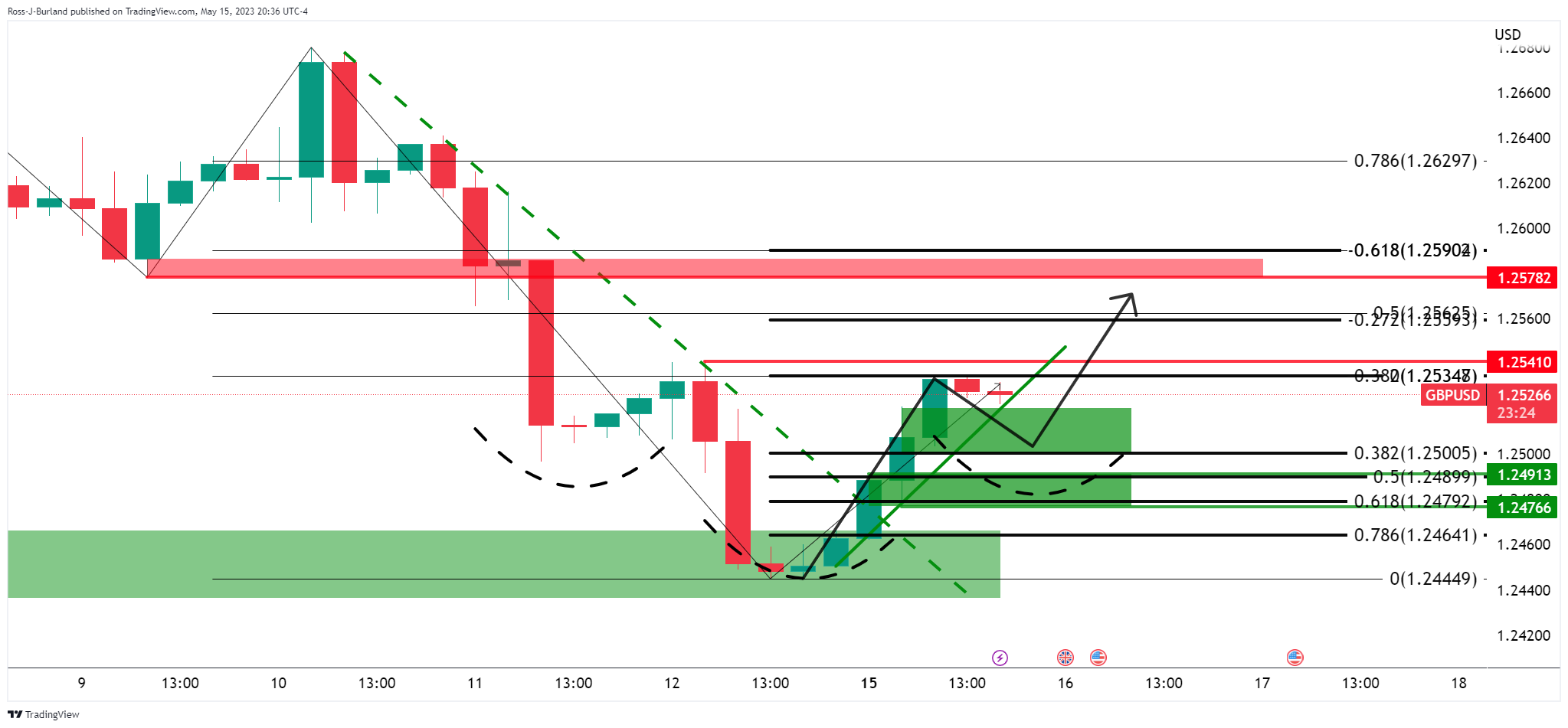

- GBP/USD has turned sideways after a sell-off move below 1.2500 as approval for raising the US debt-ceiling limit has been delayed.

- The Pound Sterling remained in action on Tuesday after the release of the downbeat UK Employment data.

- GBP/USD is at a make or a break level near the lower portion of the Rising Channel chart pattern plotted from 1.2276.

The GBP/USD pair is demonstrating a sideways auction above 1.2480 after a downside move below the psychological support of 1.2500 in the early Asian session. The Cable witnessed a steep fall after the White House reported that the decision for the approval of a higher US borrowing cap limit has been postponed till the end of the week.

Market mood is expected to remain cautious as each day spent without a concrete decision on the US debt-ceiling is pushing the United States economy into a position of default. The US Dollar Index (DXY) rebounded to near 102.60 as all parties familiar with US debt-ceiling negotiations have admitted disagreement for the approval of a higher US debt-ceiling limit without cutting the spending budget.

The Pound Sterling rebounded sharply on Tuesday after the release of the downbeat United Kingdom Employment data. However, those gains have faded now. Three-month Unemployment Rate jumped to 3.9% vs. the estimates and the former release of 3.8%. Claimant Count Change (April) soared to 46.7K while the street was anticipating a decline of 10.8K. Also, Average Earnings excluding bonuses landed at 6.7%, missing estimates of 6.8%.

GBP/USD is at a make or a break level near the lower portion of the Rising Channel chart pattern plotted from April 03 low at 1.2276. The 50-period Exponential Moving Average (EMA) has restricted the upside of the Pound Sterling.

A confident break of the Relative Strength Index (RSI) (14) below 40.00 will trigger the downside momentum.

A downside move below May 12 low at 1.2440 will trigger a breakdown of the Rising Channel pattern and will expose the Cable to April 21 low at 1.2367 followed by April 03 low at 1.2276.

On the flip side, a recovery move above May 09 high at 1.2640 will drive the major toward the round-level resistance at 1.2700 and 26 April 2022 high at 1.2772.

GBP/USD four-hour chart

- AUD/USD stays depressed after welcoming bears the previous day.

- Aussie bears previously cheered US debt ceiling concerns, strong US data and downbeat Australia job numbers.

- Disappointment from China data, dicey markets supersede receding fears of US default to exert more downside pressure on AUD/USD.

- Australia’s Q1 Wage Price Index, risk catalysts eyed for clear directions.

AUD/USD justifies its risk barometer status as it remains pressured near 0.6650 amid early Wednesday morning in Asia, after reversing the week-start gains the previous day. The Aussie pair’s latest inaction may also be linked to the cautious mood ahead of the key Aussie wage data, as well as receding fears of the US default. However, hawkish Fed talks and strong US data, as well as an absence of a strong message suggesting a US debt ceiling extension prod the Aussie bulls.

That said, Reuters reported that the Democratic President Joe Biden and top congressional Republican Kevin McCarthy's US debt ceiling negotiations ended on Tuesday after less than an hour, as the looming fear of an unprecedented American debt default prompted Biden to cut short an upcoming Asia trip. The news also mentioned that the meeting ended on an upbeat and unexpected note as McCarthy, coming out of the meeting with Biden and other congressional leaders, said, "It is possible to get a deal by the end of the week."

Following the news, Reuters quotes the S&P Global Market Intelligence data while marking a fall in the one-year US Credit Default Swap (CDS) spreads from 164 basis points (bps) to 155 bps. “Spreads on five-year CDS decreased to 69 basis points from 72 bps on Monday,” reported the news.

Elsewhere, US Retail Sales improved to 0.4% MoM for April, from -0.7% prior (revised) versus 0.7% expected. More importantly, Retail Sales Control Group for the said month crossed market forecasts of 0.0% and -0.4% prior with 0.7% actual figure whereas Retail Sales ex Autos matches 0.4% MoM estimations for April¸ surpassing the -0.5% prior. Further, the US Industrial Production MoM rose to 0.5% for April versus expectations of printing a 0.0% figure.

Talking about the Fed comments, Richmond Fed Thomas Barkin said in an interview with the Financial Times (FT) that if inflation persists, or God forbid accelerates, there’s no barrier in my mind to further increases in rates. On the same line, Cleveland Fed President Loretta Mester said, “I don’t think we're at that hold rate yet.”

It should be noted that the Reserve Bank of Australia’s (RBA) Monetary Policy Meeting Minutes showed the policymakers’ accord to the hawkish surprise even as some of the floors cited easing inflation fears and discussed policy pivot. Furthermore, downbeat data from China, Australia’s biggest consumer, also weigh on the AUD/USD price. Additionally, fears of more West versus Russia tension and the US-China tussles exert more downside pressure on the AUD/USD price. It should be noted that the recession woes are an extra load on the Aussie price.

Against this backdrop, the US Treasury bond yields remained firmer and Wall Street witnessed losses on Tuesday, which in turn allowed the US Dollar to cheer the haven demand. As a result, the AUD/USD price remained pressured.

Looking ahead, the RBA Meeting Minutes defend the policymakers’ hawkish bias and hence upbeat signal from today’s Aussie Q1 Wage Price Index, expected to increase to 3.6% YoY versus 3.3% prior, could allow the AUD/USD pair to pare recent losses. However, a light calendar elsewhere and mixed sentiment may keep the Aussie sellers hopeful.

Technical analysis

Sustained trading below the 200-DMA hurdle of around 0.6720 joins the firmer US Dollar to push the AUD/USD prices toward an upward-sloping support line from March 10, close to 0.6620 at the latest.

“A measure of the cost to insure exposure to U.S. government debt declined on Tuesday as Democratic President Joe Biden and top congressional Republican Kevin McCarthy edged closer to a deal to avoid a debt default,” said Reuters early Wednesday morning in Asia.

The news quotes the S&P Global Market Intelligence data while marking a fall in the one-year US Credit Default Swap (CDS) spreads from 164 basis points (bps) to 155 bps. “Spreads on five-year CDS decreased to 69 basis points from 72 bps on Monday,” reported the news.

While providing details, Reuters also states that a closely-watched meeting on Tuesday between President Biden and McCarthy, the speaker of the House of Representatives, ended on an upbeat note, with the White House describing the meetings as "productive and direct."

Also read: Forex Today: Higher US yields, risk aversion lead to a stronger US Dollar

- USD/CAD is aiming to recapture the critical resistance of 1.3500 amid a delay in the approval of a higher US debt-ceiling limit.

- The USD index rebounded strongly despite weaker-than-anticipated monthly US Retail Sales data.

- A rebound in Canada’s inflation might force the Bank of Canada (BoC) to reconsider its neutral interest rate policy stance ahead.

The USD/CAD pair has shown a V-shape recovery from near the round-level support of 1.3400 as negotiations between White House and Republican leaders concluded without a constructive outcome. Reuters reported that the meeting ended on an upbeat and unexpected note as McCarthy, coming out of the meeting with Biden and other congressional leaders, said, "It is possible to get a deal by the end of the week."

S&P500 futures are showing some gains in the Asian session as the Federal Reserve (Fed) is highly likely to hold the interest rate policy steady in June. The overall market mood has turned cautious amid further delay for an urgent outcome from the US debt ceiling negotiations.

The US Dollar Index (DXY) is showing signs of volatility contraction around 102.70 and is expected to add more gains ahead. On Tuesday, the USD index rebounded strongly despite weaker-than-anticipated monthly US Retail Sales data (April). The economic data expanded at a slower pace at 0.4% against the estimate of 0.7%. A mild expansion is insufficient to impact expectations for a steady monetary policy but is also not strongly supportive of holding interest rates ahead.

On the Canadian Dollar front, inflation figures have turned out persistent. Annual headline Consumer Price Index (CPI) (April) landed at 4.4%, higher than the consensus of 4.1% and the former release of 4.3%. While the core inflation landed between the estimates of 3.9% and the prior release of 4.3% at 4.1%. This might force the Bank of Canada (BoC) to reconsider its neutral interest rate policy stance ahead.

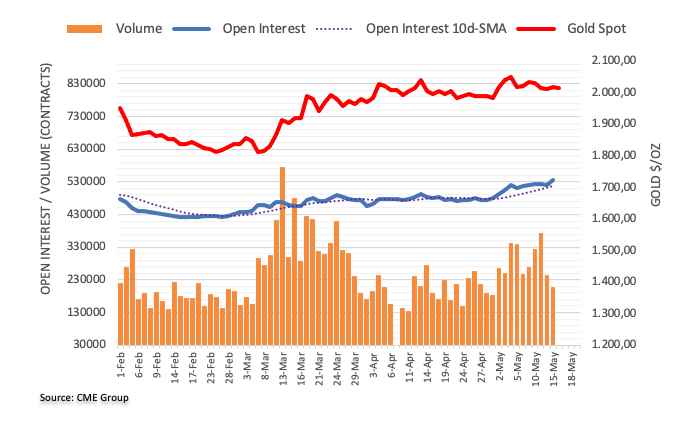

- Gold Price breaks short-term key supports as bears cheer firmer US Dollar.

- Hopes of United States debt limit extension, upbeat US data and hawkish Federal Reserve talks weigh on XAU/USD.

- S&P500 Futures remain depressed tracing downbeat Wall Street performance, Treasury bond yields rise amid risk-off mood.

- Risk catalysts will be the key to follow for the Gold price predictions.

Gold Price (XAU/USD) holds lower grounds at a two-week bottom surrounding $1,990 early Wednesday, after breaking the key short-term support lines during the previous day’s fall. That said, the yellow metal bears the burden of the strong US Dollar, as well as upbeat United States data, while failing to justify the optimism surrounding the US debt limit extension.

Gold price drops on firmer US Dollar, fails to cheer debt limit hopes

Gold price broke important supports and marked the biggest daily loss in nearly a fortnight as the US Dollar Index (DXY) remains firmer despite the recent relief in the risk markets due to the receding fears of the United States default. The reason for the DXY run-up could be linked to the strong US data and the hawkish Federal Reserve (Fed) commentary.

Recently, Reuters reported that the Democratic President Joe Biden and top congressional Republican Kevin McCarthy's US debt ceiling negotiations ended on Tuesday after less than an hour, as the looming fear of an unprecedented American debt default prompted Biden to cut short an upcoming Asia trip. The news also mentioned that the meeting ended on an upbeat and unexpected note as McCarthy, coming out of the meeting with Biden and other congressional leaders, said, "It is possible to get a deal by the end of the week."

On Tuesday, US Retail Sales improved to 0.4% MoM for April, from -0.7% prior (revised) versus 0.7% expected. More importantly, Retail Sales Control Group for the said month crossed market forecasts of 0.0% and -0.4% prior with 0.7% actual figure whereas Retail Sales ex Autos matches 0.4% MoM estimations for April¸ surpassing the -0.5% prior. Further, the US Industrial Production MoM rose to 0.5% for April versus expectations of printing a 0.0% figure.

It should be noted that Richmond Fed Thomas Barkin said in an interview with the Financial Times (FT) that if inflation persists, or God forbid accelerates, there’s no barrier in my mind to further increases in rates. On the same line, Cleveland Fed President Loretta Mester said, “I don’t think we're at that hold rate yet.”

Amid these plays, the US Treasury bond yields remained firmer and Wall Street witnessed losses on Tuesday, which in turn allowed the US Dollar to cheer the haven demand. As a result, the Gold price remained pressured.

China data, geopolitical fears also weigh on XAU/USD

Apart from what’s already mentioned above, downbeat data from China, one of the world’s biggest Gold consumers, also weigh on the XAU/USD price. Additionally, fears of more West versus Russia tension and the US-China tussles exert more downside pressure on the Gold price. It should be noted that the recession woes are an extra load on the Gold price.

Moving on, Wednesday’s light calendar may allow the Gold price to consolidate recent losses in a case where the sentiment improves. As a result, the risk catalysts will be eyed for clear directions of the XAU/USD.

Gold price technical analysis

Gold price remains well below an eight-day-old horizontal support of around $2,000, as well as an upward-sloping support line from late March, close to $1,993 by the press time, suggesting the bear’s dominance.

It’s worth noting that the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator teases sellers but the lower lows on the Relative Strength Index (RSI), placed at 14, hint at limited downside room.

As a result, the XAU/USD sellers might want to wait for a clear downside break of the 50-DMA support of $1,982 for conviction.

Meanwhile, the Gold price corrective bounce needs validation from the aforementioned support-turned-resistances around $1,993 and $2,000 before recalling the XAU/USD bulls targeting a five-week-old horizontal resistance area surrounding $2,050.

Following that, the latest all-time high of around $2,080 and the $2,100 round figure will be on the radars of the XAU/USD bulls.

Overall, the Gold price remains on the seller’s desk but a sustained downside break of $1,982 becomes necessary to convince bears.

Gold price: Daily chart

Trend: Recovery expected

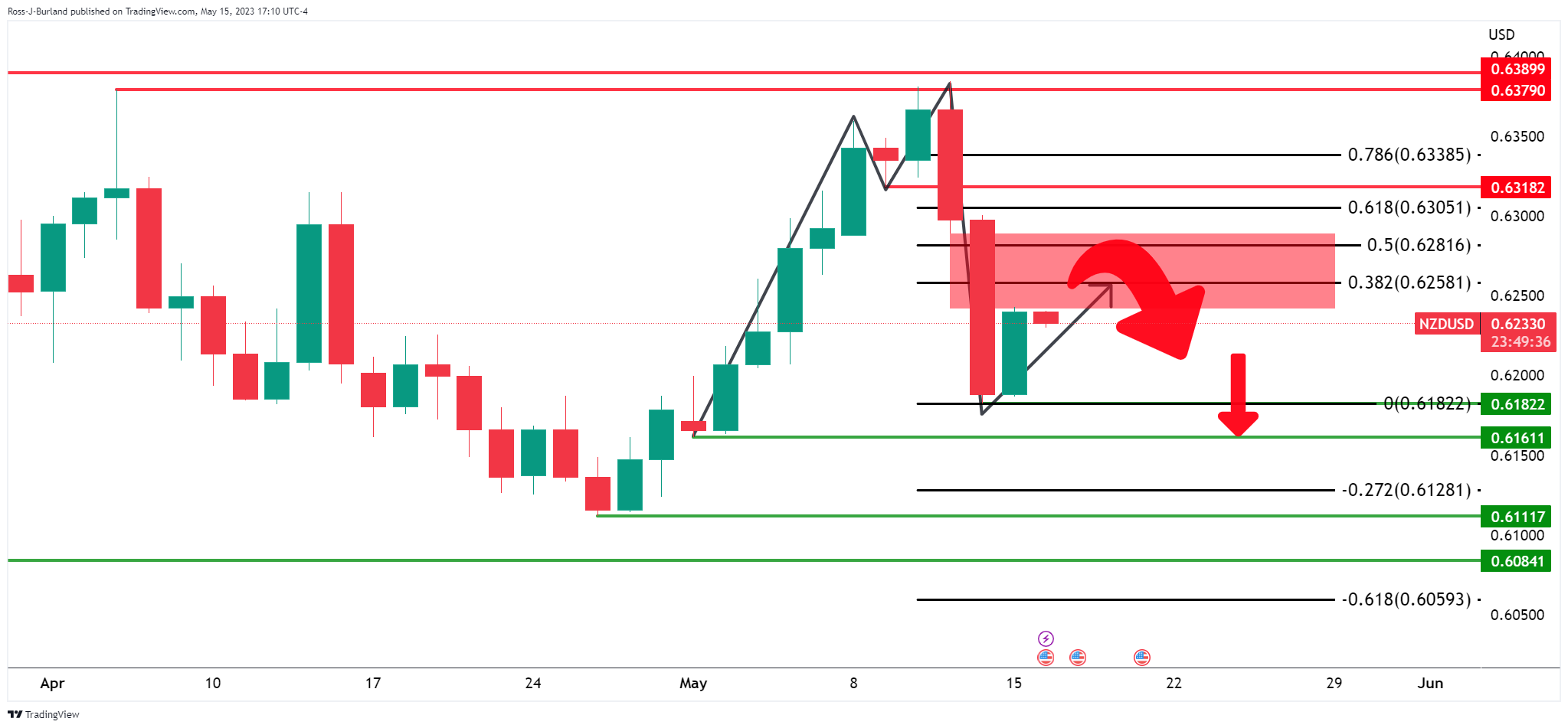

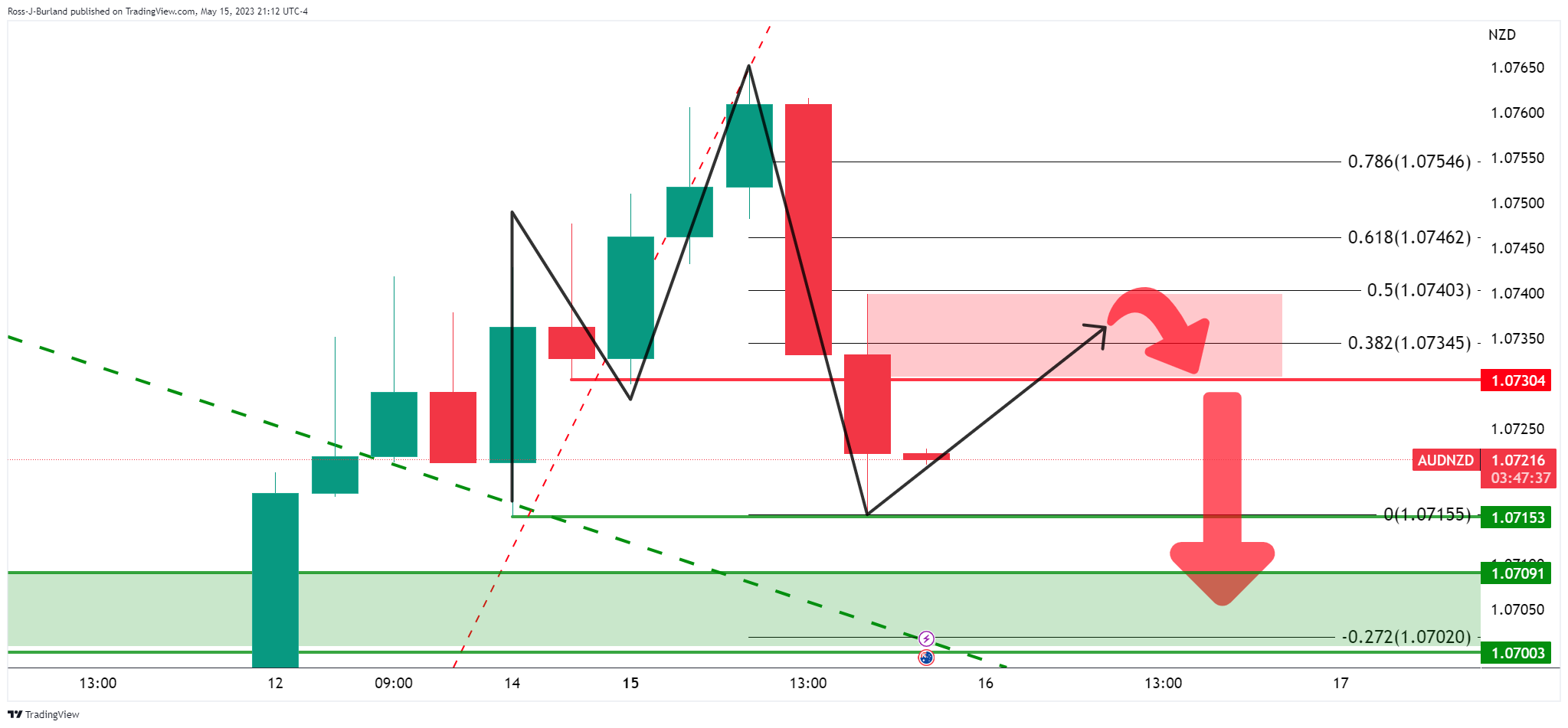

- NZD/USD bulls were pressured following a fresh high in the daily chart´s correction.

- Uncertainty over the US debt ceiling and hawkish Fedspeak may fuel USD safe-haven demand.

NZD/USD is down by some 0.16% as the forex markets head towards a close on Tuesday. The pair traveled from a high of 0.6259 and made a low of 0.6223.

´´The Kiwi lost a little of yesterday’s shine and is down a touch as we get underway today, but moves have been orderly and contained, mostly reflecting a slight uptick in the USD DXY as bond yields rose, data and Fedspeak surprised to the up/hawkish side,´´ analysts at ANZ Bank explained.

The analysts also explained that 1) ´´local participants are starting to size up the Budget, with the bond markets nervous about bond supply and FX markets worried about how credit rating agencies will perceive the Budget, hoping for a tick, but fearing the opposite,´´and 2) ´´More bonds pose an upside risk to bond yields, but not in a “good” way, as it’s supply, not demand driven. But going the other way, uncertainty over the US debt ceiling and hawkish Fedspeak may fuel USD safe-haven demand and it seems reasonable to expect more volatility.´´

NZD/USD technical analysis

As per the prior day´s analysis, NZD/USD bulls in the market and eye a firm correction, the pair moved up into the 38.2% Fibonacci resistance:

Prior analysis:

Update:

There are prospects of a move lower although the 4-hour and 1-hour charts can be used to gauge as to whether there is going to be a deceleration in the bullish correction and so far, it is early days still.

Japan's growth data for the first quarter and the Australian Wage Price Index will be the highlights of the Asian session on Wednesday. Despite mixed data and the ongoing debt ceiling drama, the US Dollar has gained momentum.

Here is what you need to know on Wednesday, May 17:

The US Dollar strengthened across the board on Tuesday, driven by higher US yields and mixed US data. The Dow Jones index experienced a 1% loss, while the Nasdaq slid by 0.18%. Investor sentiment remained cautious. The US Dollar Index gained 0.20% and was last observed above 102.60.

“The president changed the scope of who is negotiating,” said Kevin McCarthy, the top congressional Republican, during his talks regarding the debt ceiling. He sounded more optimistic about a deal to avoid a US default.

US Retail Sales rose by 0.4% in April, falling short of the market consensus of 0.7%. However, March figures were revised higher from -1% to -0.7%. Industrial Production expanded by 0.5% in April, surpassing the market consensus of 0%. On Wednesday, the US will report Building Permits and Housing Starts.

Fed’s Mester sounded hawkish on Tuesday. She mentioned she would like to get to a point where it could equally be a potential increase or decrease in interest rates. “I don’t think we’re at that hold rate yet”. More Fed speakers are scheduled on Wednesday. Earlier, Fed’s Barking said that if inflation persists or accelerates “there’s no barrier in my mind to further increases”.

The US 10-year Treasury yield rose to 3.57%, reaching its highest level in two weeks before retracing slightly. The 2-year yield reached 4.12%. European yields also rose, weighing on the Japanese Yen. USD/JPY reached fresh weekly highs above 136.60 before pulling back modestly. Japan will release preliminary Q1 GDP and March Industrial Production data.

EUR/USD was rejected from above 1.0900 and dropped towards 1.0850. It continues to maintain a bearish tone, trading near the weekly low area. Final inflation data is due in the Eurozone on Wednesday.

GBP/USD failed to hold above 1.2500 and pulled back due to a strong US Dollar. The Pound was also influenced by UK data. The ILO Unemployment rate unexpectedly edged higher from 3.8% to 3.9% in the three months to March, reaching the highest level in over a year. The claimant count change also showed an unexpected increase of 46.7K in April, compared to an expected decline of 10.8K.

USD/CAD finished modestly higher, above 1.3470. The Canadian Dollar strengthened across the board following higher-than-expected Canadian inflation data. The annual Consumer Price Index (CPI) unexpectedly accelerated for the first time since June 2022, reaching 4.4%.

Analysts at RBC wrote:

“Inflation in Canada accelerated in April, but has still on balance been easing since peaking in summer 2022. Early signs that the lagged impact of higher interest rates are weighing on economic growth suggest underlying price pressures should continue to ease. The BoC is expected to stay on the sideline for the remainder of the year.”

NZD/USD attempted a recovery but retreated to 0.6230 after reaching 0.6258. AUD/USD fell from above 0.6700 to 0.6655. The Australian Dollar lagged due to weaker Chinese data, the RBA minutes and a larger-than-expected decline in the Westpac Consumer Confidence report for May. Australia will release the Wage Price Index on Wednesday and the Employment report on Thursday.

Gold experienced a sharp drop below $2,000, remaining under pressure and potentially testing the crucial support level of $1,970. Silver also lost ground, falling to $23.60. Crude oil prices retraced some of Monday's gains, with WTI ending around $70.55. Cryptocurrencies also experienced losses; BTC/USD falling below $27,000 by 1.40%.

Like this article? Help us with some feedback by answering this survey:

- EUR/USD stays in negative territory, down 0.06%, as solid US economic data triggers a jump in US Treasury bond yields and strengthens the US Dollar.

- Eurozone data largely aligned with estimates, while ZEW Economic Sentiment Index dropped sharply, reflecting increasing recession fears in the bloc.

- Upcoming speeches from regional Fed Presidents could provide further insight into US monetary policy, with some officials stating it’s too early to discuss rate cuts.

EUR/USD trims some of its earlier losses though it remains in negative territory, sponsored by solid economic data from the United States (US), triggering a jump in US Treasury bond yields. Therefore, the US Dollar (USD) rose, helped by US bond yields, while Eurozone’s (EU) data was aligned with estimates. The EUR/USD is trading at 1.0868, down 0.06%.

US Dollar strengthens as Eurozone data aligns with estimates, ZEW sentiment index plunges

US equities are slightly mixed, except for the Nasdaq 100. US Retail Sales for April improved, with some figures missing estimates, but overall, the month-over-month (MoM) numbers beat March’s data, except for Retail Sales on an annual basis. Later, the US Federal Reserve (Fed) reported that Industrial Production for April rose by 0.5% MoM, above estimates, while year-over-year (YoY) stood at 0.2% above March’s 0.1%.

Although the EUR/USD’s initial reaction headed towards 1.0880s, overall US Dollar strength dragged the exchange rates toward the day’s lows at 1.0855. The US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, trimmed some of Monday’s losses, edging up 0.17% at 102.597.

The EU’s agenda revealed the Balance of Trader printed a surplus of 25.6 billion of Euro’s, above the prior’s month 4.6 Billion. Furthermore, the Gross Domestic Product (GDP) for Q1 was aligned with estimates at 1.3%, while the Employment Change QoQ rose 0.6% in Q1. The ZEW Economic Sentiment Index plunged to -9.4 as recession fears mount, despite the ongoing tightening cycle by the European Central Bank (ECB).

Aside from this, US debt ceiling discussions finished in the White House, and initial reports prompted that US Congress leaders agreed that a deal is possible by the end of the week while emphasizing that a default “is a horrible option.”

Late Fed speakers like Aaron Golsbee and Lorie Logan, Presidents of the Chicago and Dallas Fed Regional Banks, commented that it’s early to discuss interest rate cuts. Logan added that when conditions are uncertain, the Fed may need to move more slowly and added that we need to move slowly.

EUR/USD Technical Levels

Reuters reported that the Democratic President Joe Biden and top congressional Republican Kevin McCarthy's U.S. debt ceiling negotiations ended on Tuesday after less than an hour, as the looming fear of an unprecedented American debt default prompted Biden to cut short an upcoming Asia trip.

Reuters reported that the meeting ended on an upbeat and unexpected note as McCarthy, coming out of the meeting with Biden and other congressional leaders, said, "It is possible to get a deal by the end of the week."

US Senate majority leader Schumer's comments

Debt meeting was good, productive.

We all agreed default is a horrible option.

Hopefully we can come to an agreement.

Everyone in the room understood what a disaster default would be.

Everyone agreed we need to be bipartisan.

Bipartisan negotiations will continue, with a few added players.

- USD/JPY is meeting support on the front side of the bullish trend,

- If the trendline breaks, then the bears will be encouraged to move in.

USD/JPY has been in the hands of the bulls. However, there is the possibility of a significant correction to the downside if support near 136.20 fails. 135.50 would then be eyed as the following video illustrates.

USD/JPY daily chart

The price is running into resistance as illustrated within the W-formation. This is a reversion pattern that opens risk towards the neckline and trendline support.

USD/JPY H4 chart

There is firm resistance as seen on the 4-hour chart and we are now testing support.

A break of the support and the trendline opens risk of a move to the downside as illustrated above.

USD/JPY H1 chart

From an hourly perspective, the price is meeting support but while still on the front side of the bullish trend, there will be prospects of a continuation for the sessions ahead. If, however, the trendline breaks, the bears will be encouraged to move in.

- Silver prices slide as US retail sales data spur a jump in US Treasury bond yields, driving XAG/USD down to six-week lows around $23.64.

- Technical outlook shows a double-top chart pattern with XAG/USD between 50 and 100-day EMAs, while a bearish RSI suggests further declines may be imminent.

- XAG/USD could target the $22.90 level if the 100-day EMA is breached, while reclaiming the $24.00 figure could pave the way for a rally toward the 50-day EMA and potentially $25.00.

Silver price continues to validate a double-top formation, falls to fresh six-week lows around $23.64, shy of testing the 100-day Exponential Moving Average (EMA) at $23.48. Factors like US Retails Sales improving in April spurred a jump in US Treasury bond yields, a headwind for the white metal. Therefore, the XAG/USD is trading at $23.73 after reaching a daily high of $24.10.

XAG/USD Price Analysis: Technical outlook

A double-top chart pattern remains as the XAG/USD continued to slide, sitting between the 50 and 100-day EMAs, each at $24.24 and $23.48, respectively. The Relative Strength Index (RSI) indicator at bearish territory suggests Silver’s fall could continue in the near term, but the 3-day Rate of Change (RoC) has begun to show that sellers are losing momentum.

If XAG/USD cracks the 100-day EMA, that will exacerbate a fall toward the $23.00 a troy ounce figure before sellers can reach the double-top’s objective to fall toward $22.90, shy of testing the 200-day EMA at $22.77.

On the other hand, if XAG/USD reclaims the $24.00 figure, that could exert upward pressure on the XAG/USD and open the door to test the 50-day EMA. A breach of the latter will expose the February 2 high at $24.63 before challenging the $25.00 psychological figure.

XAG/USD Price Action – Daily chart

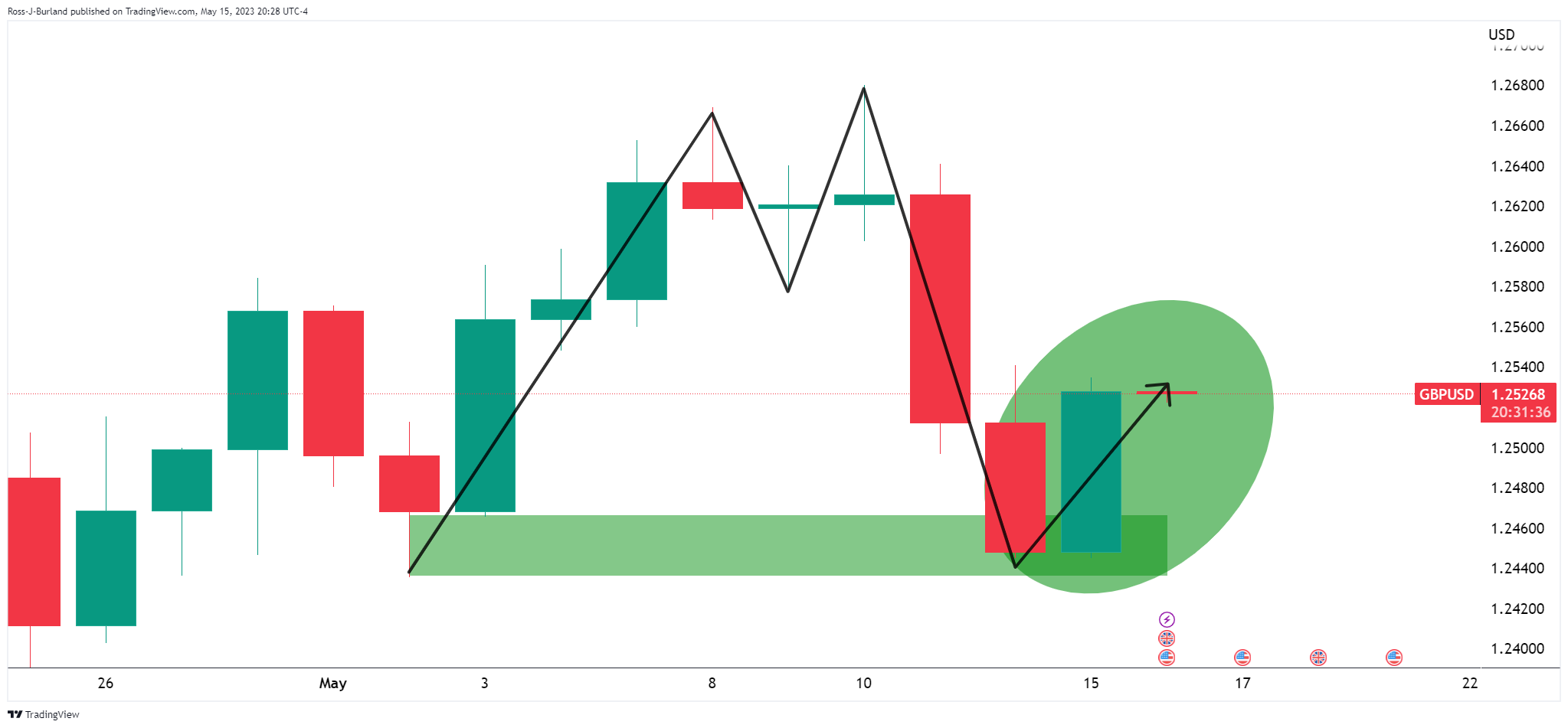

- GBP/USD bears are in the market testing daily support.

- Sterling bulls eye a move towards 1.2550s.

GBP/USD is trading at around 1.2480 and has traveled between a low of 1.2465 and a high of 1.2546 so far on the day. The British Pound was in trouble at the start of the London day with the rise in Britain's jobless numbers.

Markets have started to re-price the Bank of England as they expect the central bank to pause its rate-increasing path over the coming months that would otherwise be needed to bring down inflation. Current market pricing indicates potentially just one more 25 basis point rate increase from the Bank of England

The Pound fell by as much as 0.5% against the Dollar to 1.2465 and the lows of the day. The United Kingdom´s Unemployment Rate unexpectedly climbed to 3.9% in the three months to March as more people sought to get back into the jobs market.

Meanwhile, there is an eye being kept on Congress and the delays in raising the US debt ceiling. Tighter credit conditions caused by the recent banking crisis in the US and elsewhere have increased the likelihood that the US economy will slip into a recession, leading to Federal Reserve rate cuts and a weaker US Dollar.

´´With time running out to strike a deal to raise the debt limit, President Biden and congressional leaders are set to meet on Tuesday for pivotal face-to-face negotiations at the White House to avoid a default that economists say could eliminate jobs and cause a recession,´´ the New York Times wrote

´´The meeting, at 3 pm, comes a day after Treasury Secretary Janet L. Yellen reiterated that the United States could run out of money to pay its bills by June 1 if Congress does not raise or suspend the debt limit, the statutory cap on how much the government can borrow to finance its obligations.´´

´´Ms. Yellen warned on Tuesday that the United States faced ´an economic and financial catastrophe´ if it defaulted and said the standoff over the debt limit was already affecting financial markets and households.´´

GBP/USD technical analysis

The M-formation is homing in the 1.2550s in a bullish correction, although the bears are in the market on Tuesday but support is holding.

- AUD/USD falls 0.62% as US economic data remains strong, while weaker-than-expected Chinese data weighs on the Australian Dollar.

- Hawkish remarks from Federal Reserve officials and concerns over “unacceptably high inflation” keep the US Dollar well-supported in the North American session.

- Reserve Bank of Australia minutes show potential for future rate hikes, depending on economic and inflation developments, while Consumer Confidence in Australia declines.

AUD/USD retraces from daily highs of 0.6709 and drops 0.62% after a slew of economic data from the United States (US) showed that the economy remains resilient amidst 500 bps of rate hikes implemented by the US Federal Reserve (Fed). Additionally, weaker data than foreseen data from China weighed on the Australian Dollar (AUD). At the time of writing, the AUD/USD is trading at 0.6653, below its opening price.

AUD/USD drops as US economic data outshines expectations amidst disappointing Chinese figures

Wall Street is treading water, except for the Nasdaq, which is up 0.21%. Data-wise, the US economic docket revealed that Retails Sales in April missed estimates but improved compared to March figures. Monthly, sales grew 0.4%, aligned with forecasts, while excluding autos, rose 0.4%, above March’s -0.5% contraction. Annually based, Retail Sales expanded at a 1.6% pace below the last month’s 2.4% growth.

Meanwhile, April’s Industrial Production in the US improved to 0.5% MoM, above estimates and prior’s month 0% expansion, and on an annually based, rose by 0.2% above March’s 0.1%.

After the US data was released, the AUD/USD spiked towards 0.6690 before making a U-turn and diving toward the day’s lows of 0.6651. Additionally, hawkish remarks by Federal Reserve (Fed) officials kept the US Dollar (USD) bid in the North American session.

Loretta Mester, the President of Cleveland’s Fed, revealed that the Fed couldn’t do much about slowing the economy but could “do its part” to curb inflation. Later, Richmond’s Fed President Thomas Barkin commented that if more rate hikes are needed, he’s “comfortable with that.”

As of writing, the New York Fed President John Williams stressed that the economy is facing “unacceptably high inflation,” though it’s gradually moving in the right direction.

Aside from this, the US debt ceiling discussions would continue throughout the day. However, US Treasury Secretary Janet Yellen warned that “time is running out” to avert a catastrophe by not raising the debt ceiling.

On the Australian front, Consumer Confidence dropped compared to April’s 85.8 figure, reaching 79.0 in May. The Reserve Bank of Australia’s (RBA) minutes showed that the central bank discussed pausing or raising rates at the May meeting. The RBA left the door open for further increases, but it would depend on “how the economy and inflation evolve.”

The AUD/USD took a hit as China’s Industrial Production and Retail Sales in April improved but missed estimates suggesting that growth is slowing down. Industrial Production rose by 5.6%, below the 10.9% forecast, while Retails Sales jumped 18.4%, beneath the 21% forecast.

AUD/USD Price Analysis: Technical outlook

The AUD/USD show three candlesticks, depicting a 50 pip range within the 0.6650-0.6700 area, unable to crack the 20-day EMA at 06694 on the upside. On the downside, a six-month-old support trendline keeps buyers supported around the bottom of the range, suggesting that a catalyst is needed to give clear direction in the pair. On the upside, AUD/USD buyers must crack 0.6700 to challenge the 100-day EMA at 0.6732 and the 200-day EMA at 0.6784. Conversely, a drop below 0.6650, the AUD/USD could pose a challenge to test 0.6600, ahead of the April low of 0.6573

- Gold prices fall 0.80% as US economic data showcases resilience, led by strong retail sales and industrial production figures.

- Hawkish tones from Fed officials Mester and Barkin contribute to rising US Treasury bond yields, further pressuring gold prices.

- Upcoming speeches from New York Fed John Williams, Dallas Fed Lorie Logan, and Atlanta’s Fed Raphael Bostic may provide more insight into the economic outlook.

Gold price is erasing Monday’s gains, plunging 0.80%, as data from the United States (US) showed signs of resilience amidst a solid retail sales report. Industrial Production recovered in April, though manufacturing production stood at contractionary territory. The factors mentioned above and the US bond yields rising were a headwind for XAU/USD prices. At the time of writing, the XAU/USD is trading at $2000.91 after hitting a daily high of $2018.28.

Solid Retail Sales and Industrial Production data strengthen the greenback and XAU/USD dips

The US economic agenda revealed that Retail Sales rose by 0.4% MoM, below estimates of 0.8%, while excluding autos rose by 0.4% MoM, aligned with estimates. It should be said that both figures surpass March’s readings, which showed sales plunging. Annually based figures rose by 1.6% below the prior’s month 2.4% rise, suggesting an ongoing deceleration of the United States (US) economy.

In another data, the US Federal Reserve (Fed) reported that Industrial Production in April rose by 0.5% MoM, above estimates of 0%, while annually based, uptick to 0.2% from 0.1% in March. The same report showed that Manufacturing Production expanded at a 1% MoM pace, crushing forecasts of 0.1%, with motor vehicle production underpinning the figures.

On the data release, XAU/USD extended its losses and reached a two-day new low of $1998.17 before trimming some of its losses. US Treasury bond yields continued to rise as Federal Reserve officials led by San Francisco Fed President Loretta Mester and Richmond’s President Thomas Barkin sounded hawkish.

Mester said that the Fed cannot do much about slowing long-term economic growth but can “do its part” by tackling inflation. She emphasized the Fed’s commitment to getting inflation to the 2% target. In the meantime, Thomas Barkin said that if more increases are needed to bring down, he’s “comfortable with that.”

Upcoming events

Further Fed speaking is expected with New York Fed John Williams, Dallas Fed Lorie Logan and Atlanta’s Fed Raphael Bostic.

Gold Price Analysis: Technical outlook

XAU/USD remains in a neutral bias, albeit exchanging hands above the 50, 100, and 200-day Exponential Moving Averages (EMAs), each at $1978.42. Nevertheless, since reaching a year-to-date (YTD) high of $2081.82, XAU/USD retraced sharply, below the April 13 high of $2048.79, which opened the door for a deeper pullback. Since then, XAU/USD has fallen more than 3.5%, with sellers eyeing to extend its losses past the $2000 mark. Once cleared, the next support for XAU/USD would be the 50-day EMA at $1978.43 before Gold tests the April 19 swing low of $1969.34.

The US debt ceiling farce continues. Economists at Commerzbank analyze the implications for Gold price.

Gold to decline if the US debt ceiling conflict were to be resolved

“In view of the ongoing dispute over the US debt ceiling, the Gold price will probably hold its own above the $2,000 mark for the time being, living up to its reputation as a safe haven.”

“Any debt default by Washington, even if only temporary, would doubtless have serious negative repercussions for the US economy, which makes it more likely that monetary policy will be loosened – to a greater extent than is already priced in on the market – and make Gold more attractive in relative terms as a non-interest-bearing investment.”

“According to Treasury Secretary Janet Yellen, the deadline is 1 June. If the parties fail to reach agreement by then, the treasury risks running out of money on that day. Equally, the precious metal can be expected to decline if the conflict were to be resolved.”

Thomas Barkin, president of the Federal Reserve Bank of Richmond, told Bloomberg on Tuesday that he would be comfortable with more rate increases if that's what is needed to bring inflation down, per Reuters.

Key takeaways

"I like the optionality implied in the statement from last meeting."

"Deposit flows are stable at banks in my district, encouraged by the resilience I've seen."

"Commercial office sector is where you hear the most concern."

"Most people I talk to anticipate a downturn over coming quarters."

"When it comes to downsizing, businesses are quite cautious, reluctant to let staff go."

"Businesses will not give up pricing power unless they're forced to do it."

Market reaction

The US Dollar Index clings to modest recovery gains slightly above 102.50 following these comments.

As the Fed nears the end of its tightening cycle and interest rate volatility reduces, the USD has been grinding weaker. Waves of uncertainty remain, particularly around the US debt ceiling and a resolution should see the tide shift against the USD anew, in the view of economists at HSBC.

The ongoing US debt ceiling discussions could increase volatility

“We still expect the USD to decline, but we remain mindful of possible risks, with the most obvious prevailing source of concern being the US debt ceiling. In fact, the US debt ceiling is not a new issue for the FX market to navigate.”

“To be clear, we are not expecting a technical default. But the debt ceiling issue has the potential to spark a rapid increase in FX volatility. Increasing fear of ‘hard landing’ risks and the subsequent rise in FX volatility could see the ‘safe haven’ USD attempting to rally, before falling. That being said, we think the more probable outcome is still one of a resolution. This would likely keep FX volatility relatively subdued while risk sentiment improves, allowing the USD to weaken going forward.”

EUR/USD has recently faced renewed headwinds, pushing the cross back below 1.10. Economists at Danske Bank maintain their strategic case for a lower EUR/USD.

USD strength in store

“In line with market expectations, we think the Fed has delivered its last rate hike for this hiking cycle. However, we think the current 3x25 bps rate cuts priced for the rest of the year seem too aggressive. If we are right in this call, that will add some USD support in H2. For the ECB, we think there are three 25 bps rate hikes left, bringing the policy rate up to 4%.”

“We maintain the strategic case for a lower EUR/USD based on relative terms of trade, real rates and relative unit labour costs. Despite the impending Fed pause, we see the prospect of the USD finding further near-term support as we expect the Fed to hold rates steady into 2024. Furthermore, we think the outlook of the US economy looks less gloomy.”

“We continue to forecast the EUR/USD cross at 1.03 in 6-12M.”

US Treasury Secretary Janet Yellen warned on Tuesday a United States default would result in an "unprecedented economic and financial storm" that could trigger an income shock and lead to recession, per Reuters.

Yellen further elaborated by saying that default could disrupt government operations such as air traffic control, law enforcement, national defense and telecommunications and lead to a financial markets 'break' with worldwide panic triggering margin calls, runs and fire sales.

Market reaction

Markets remain cautious on Tuesday and the Dow Jones Industrial Average was last seen losing 0.55% on a daily basis.

ZAR is fracturing along geopolitical lines. Economists at ING expect the USD/ZAR pair to test 20.00 in the near term.

Broad Dollar bear trend will carry USD/ZAR lower later this year

“The US ambassador to South Africa accused the country of shipping arms (or allowing the shipment of arms) to Russia last December. USD/ZAR traded to a new record high on the news. The US ambassador has since backtracked on those comments – although it is unclear whether the accusation still stands. It will probably be hard to put this particular genie back in the bottle anytime soon.”

“Even though we think a broad Dollar bear trend will carry USD/ZAR lower later this year, in the nearer term – a febrile environment suggests USD/ZAR may challenge 20.00.”

- EUR/USD adds to Monday’s advance and flirts with 1.0900.

- If the rebound picks up pace, the pair should retarget the 1.1000 mark.

EUR/USD manages to grab extra impulse and trades closer to the key barrier at 1.0900 on Tuesday.

The surpass of the 1.0900 region in a convincing fashion should prompt the pair to embark on a potential visit to the psychological 1.1000 hurdle. Further upside could see the 2023 peak at 1.1095 (April 26) revisited in the not-so-distant future.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0457.

EUR/USD daily chart

- The index navigates within a narrow range on Tuesday.

- US yields made a U-turn and now extend the weekly rebound.

- US Retail Sales disappointed expectations in April.

The USD Index (DXY), which measures the greenback vs. a basket of its main competitors, keeps the irresolute price action around the 102.40/30 zone on Tuesday.

USD Index keeps looking at data, yields

The index remains under pressure amidst a tepid bias towards the appetite for the riskier assets, although the still unresolved debt ceiling issue is expected to put a floor on occasional bouts of weakness in the buck.

The ongoing price action in DXY comes along the reversal in US yields across the curve, which rapidly changed course in the wake of lower-than-expected US Retail Sales for the month of April.

In the US docket, Industrial Production expanded 0.5% MoM in April and 0.2% vs. the same month of 2022. In addition, Manufacturing Production rose 1.0% MoM and contracted 0.9% YoY.

What to look for around USD

The index abandons the area of 5-week highs in the 102.75/80 band amidst some inconclusive risk appetite trends and ahead of the release of key results in the docket.

The index seems to be facing downward pressure in light of the recent indication that the Fed will probably pause its normalization process in the near future. That said, the future direction of monetary policy will be determined by the performance of key fundamentals (employment and prices mainly).

Favouring an impasse by the Fed appears the persevering disinflation – despite consumer prices remain well above the target – incipient cracks in the labour market, the loss of momentum in the economy and rising uncertainty surrounding the US banking sector.

Key events in the US this week: NY Empire State Index, TIC Flows (Monday) – Retail Sales, Business Inventories, Industrial Production, NAHB Housing Market Index (Tuesday) – MBA Mortgage Applications, Building Permits, Housing Starts (Wednesday) – Philly Fed Index, Initial Jobless Claims, CB Leading Index, Existing Home Sales (Thursday) – Fed J. Powel (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 20223. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is down 0.03% at 102.39 and faces the next support at 101.01 (weekly low April 26) prior to 100.78 (2023 low April 14) and finally 100.00 (psychological level). On the other hand, the break above 102.75 (monthly high May 15) would open the door to 102.80 (weekly high April 10) and then 103.05 (monthly high April 3).

Economists at Commerzbank see further limited CAD recovery potential against the USD.

Hawkish BoC supports the CAD

“The CAD is benefiting from the hawkish BoC rhetoric, especially since the Fed also appears to be at the end of the rate hike cycle. We see further limited CAD recovery potential against the USD given the robust economy. In this context, the CAD should benefit if the gap in interest rate expectations for the Fed and BoC narrows further or sustainably turns positive.”

“In a risk-averse environment, however, the CAD should find it difficult to hold its ground against the USD, which is favored as a safe haven. A risk to our forecasts therefore remains a further smoldering uncertainty after the financial market turmoil in March.”

Source: Commerzbank Research

- USD/JPY reverses an intraday dip amid the emergence of some USD dip-buying on Tuesday.

- Hawkish remarks by Fed’s Mester lift bets for additional rate hikes and boosts the Greenback.

- A softer risk tone could underpin the safe-haven JPY and cap any further gains for the major.

The USD/JPY pair attracts some dip-buying on Tuesday and move back above the 136.00 mark during the early North American session, closer to a one-and-half-week high touched the previous day.

The US Dollar (USD) recovers its intraday losses in reaction to hawkish remarks by Cleveland Federal Reserve President Loretta Mester and turns out to be a key factor lending support to the USD/JPY pair. Mester said that interest rates are not at a sufficiently restrictive level and that the central bank isn't at the spot to hold rates yet. This, in turn, triggers a sharp intraday rise in the US Treasury bond yields and acts as a tailwind for the Greenback, overshadowing the mixed US Retail Sales figures.

The US Census Bureau reported that the headline US Retail Sales rose 0.4% MoM in April as compared to consensus estimates for a reading of 0.8%. Meanwhile, sales excluding automobiles registered a modest 0.4% growth during the reported month, as anticipated. The positive surprise came from Retail Sales Control Group, which recorded a solid rebound from the previous month's 0.4% downfall and increased by 0.7% during the reported month, surpassing market expectations for a flat reading.

This, along with a more dovish stance adopted by the Bank of Japan (BoJ), continues to undermine the Japanese Yen (JPY) and further contributes to the USD/JPY pair's intraday bounce. It is worth recalling that BoJ Governor Kazuo Ueda said last week that it was too early to discuss specific plans for an exit from the massive stimulus program. That said, a generally weaker toen around the equity markets could benefit the JPY's relative safe-haven status and cap any meaningful gains for the major.

Against the backdrop of concerns about the US debt ceiling, weaker-than-expected Chinese macro data fuels recession fears and tempers investors' appetite for riskier assets. Nevertheless, the fundamental backdrop seems tilted in favour of bullish traders and suggests that the path of least resistance for the USD/JPY pair is to the upside. Hence, a subsequent move up towards testing the 200-day Simple Moving Average (SMA), currently around the 137.00 round-figure mark, looks like a distinct possibility.

Technical levels to watch

- Loonie rises across the board after Canadian inflation data.

- US Retail Sales rise below expectations in April.

- USD/CAD drops to lowest since Thursday, under 1.3430.

The USD/CAD dropped from 1.3455 to the 1.3410 area following the release of US and Canadian economic data. The Loonie is among the top performers of the day in the currency market.

Inflation rebounds unexpectedly in Canada

In Canada, data released on Thursday showed the Consumer Price Index (CPI) rose to 4.4% on a yearly basis in April from the 19-month low of 4.3% in March, and against expectations of a decline to 4.1%.

“Inflation now lies well above the April MPR's implied forecast of 4.0% y/y, and while the top-line story on core inflation may provide some reassurances to the BoC, the underlying story is one of further evidence that policy may not be tight enough to bring inflation down to its 2% target over a reasonable horizon. The risks continue to build for a BoC hike later this year, especially if Q1 growth figures surprise sharply to the upside”, commented analysts at TD Securities.

The Loonie rose across the board after the CPI, hitting fresh daily highs. At the same time, data from the US triggered a mixed reaction to the Greenback. US Retail Sales rose 0.4% in April, below the 0.7% market consensus, but March figures were revised upward from -1% to -0.7%.

USD/CAD erases most of last week’s gains

The USD/CAD is falling sharply for the second day in a row and is approaching the 1.3400 level. A break below this level could expose the next support area seen around 1.3360/70. A daily close below this area could open the door for a test of the monthly low at 1.3310/15.

The immediate resistance for the pair is the 1.3455 area. If the it rallies above this level, it would alleviate the current bearish pressure.

Technical levels

The US Dollar is likely to strengthen, in the view of economists at Rabobank.

USD – safe haven of choice

“It is our view that the USD remains a primary safe haven and that it will retain this status for many years to come.”

“It is our view that Fed rates will be higher for longer than the market currently expects. We also see risk of higher for longer rates from a number of other G10 central banks. This can only serve to enhance the risk of other financial related crisis in the coming months, which could trigger further safe haven USD demand.”

“We retain our six-month forecast of EUR/USD 1.06.”

Cleveland Federal Reserve President Loretta Mester said on Tuesday that she would like the policy rate to get to a point where it could equally be a potential increase or decrease, per Reuters.

Additional takeaways

"I don't put it in terms of a pause, I put it in terms of a hold."

"I don't think we're at that hold rate yet. However, there is four weeks to go until next meeting, need to see more data."

"Whether banking turmoil is adding to pull back in credit, we're monitoring."

"At this point given, how stubborn inflation is, can't say I'm at a level where it's equally probable that the next thing would be an increase or a decrease."

"We know part of total rate increase has not affect the economy yet."

"Seeing some slowdown in labor market conditions, still think the labor market is quite tight."

"I need to see more evidence that inflation is coming down."

"Inflation is still high, we have to stick to what we're doing."

Market reaction

The US Dollar stays under modest bearish pressure in the early American session on Thursday and the US Dollar Index was last seen losing 0.05% on a daily basis at 102.38.

- GBP/USD struggles to capitalize on its intraday bounce from the post-UK jobs data low.

- The US Retail Sales fail to impress the USD bulls or provide any meaningful impetus.

- The fundamental/technical setup warrants some caution for aggressive bullish traders.

The GBP/USD pair witnessed good two-way price swings on Tuesday and now seems to have stabilized around the 1.2500 psychological mark, nearly unchanged for the day. Spot prices hold steady during the early North American session and move little following the release of the US macro data.

The US Census Bureau reported that the headline US Retail Sales rose 0.4% MoM in April as compared to consensus estimates for a reading of 0.8%. Meanwhile, sales excluding automobiles registered a modest 0.4% growth during the reported month. The data does little to impress the US Dollar (USD) bulls or provide any meaningful impetus to the GBP/USD pair. Against the backdrop of concerns about the US debt ceiling, reviving safe-haven demand leads to a modest downtick in the US Treasury bond yields and undermines the Greenback, which, in turn, lends support to the major.

That said, the overnight hawkish remarks by several Federal Reserve (Fed) officials warned on Monday that interest rates could still rise further amid relatively high inflation and a robust labor market. This could act as a tailwind for the US bond yields and limit the downside for the USD. This, along with expectations that fewer rate increases by the Bank of England (BoE) will be needed in coming months to bring down inflation, caps the upside for the GBP/USD pair. The speculations were fueled by the rather unimpressive UK monthly employment details released earlier this Tuesday.

In fact, the UK Office for National Statistics (ONS) reported that the number of people claiming unemployment-related benefits rose by 46.7K in April, more than the 26.5K seen in March and well above estimates for a fall of 10.8 K. Furthermore, the jobless rate ticked higher to 3.9% from 3.8%, suggesting that the flatlining economy has started to take a toll of Britain’s labour market. Additional details of the report showed that UK Average Earnings excluding bonuses rose by 6.7% in the quarter to March, softer than the 6.8% expected, though slightly higher than February's 6.6%.

The aforementioned fundamental backdrop warrants some caution for aggressive bullish traders and before positioning for an extension of the GBP/USD pair's overnight goodish rebound from the 1.2445-1.2440 region, or a three-week low. Even from a technical perspective, last week's break below a short-term ascending trend channel suggests that the path of least resistance for spot prices is to the downside.

Technical levels to watch

- EUR/USD gives away initial gains and revisits 1.0860.

- EMU, Germany Economic Sentiment surprised to the downside.

- US Retail Sales increased less than expected last month.

EUR/USD rapidly abandons the area of daily highs around 1.0900 in response to the sudden bout of strength in the dollar following the release of US Retail Sales.

EUR/USD: Daily upside seems capped just above 1.0900

EUR/USD deflates to the 1.0860 region and rebounds afterwards following a quick uptick in the greenback, all in response to lower-than-expected results from the US docket.

Indeed, US Retail Sales expanded at a monthly 0.4% in April, coming in short of initial expectations.

Following the release of Retail Sales, US yields made a U-turn and now trade with marked gains across the curve, while the German 10-year Bund yields also leap to the 2.30% region, eroding initial losses.

Later in the NA session, Industrial Production comes next ahead of the NAHB index and Business Inventories. Additionally, Fed’s Mester, Bostic, Williams, Logan and Barr are also due to speak

Closer to home, another revision of the Q1 GDP Growth Rate saw the economy expand 0.1% QoQ and 1.3% YoY. In addition, the ZEW’s Economic Sentiment in Germany and the broader euro bloc unexpectedly dropped to -9.4 and -10.7 for the current month. Finally, ECB’s Tuominen and Lagarde will also speak later on Tuesday.

What to look for around EUR

EUR/USD extends the weekly rebound and adds to Monday’s promising price action, always with the immediate target at the 1.0900 barrier.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: ECOFIN Meeting, EMU Flash Q1 GDP Growth Rate, ZEW Economic Sentiment, Germany ZEW Economic Sentiment (Tuesday) – EMU Final Inflation Rate (Wednesday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle in June and July (September?). Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.02% at 1.0877 and the surpass of 1.1095 (2023 high April 26) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022). Conversely, the next contention level emerges at 1.0844 (monthly low May 15) seconded by 1.0831 (monthly low April 10) and finally 1.0802 (100-day SMA).

Economists at Commerzbank see limited upside potential for the GBP.

Downside risks

“As the rate hike expectations are already quite high, it is difficult to imagine that it will rise further over the coming weeks – even if the economic data were to improve somewhat. Instead, we see an increased risk of market expectations being disappointed if the economic data comes in weaker.”

“We see hardly any appreciation potential for Sterling following the positive development over the past months, instead, we see downside risks.”

- Annual CPI inflation in Canada rebounded to 4.4% in April.

- USD/CAD hits fresh daily low after data as Loonie rises across the board.

Inflation in Canada, as measured by the Consumer Price Index (CPI), rose to 4.4% on a yearly basis in April from the 19-month low of 4.3% in March, Statistics Canada (StatCan) reported on Tuesday. This reading came in against market forecast of a decline to 4.1%. “This was the first acceleration in headline consumer inflation since June 2022. On a year-over-year basis, higher rent prices and mortgage interest costs contributed the most to the all-items CPI increase in April 2023”, said StatCan.

On a monthly basis, the CPI rose by 0.7% as expected, above the 0.4% of consensus, and accelerating from the 0.5% of March. “Prices for gasoline (+6.3%) contributed the most to the headline month-over-month movement. Excluding gasoline, the monthly CPI rose 0.5%.”

Additionally, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, dropped to 4.1% on a yearly basis from 4.3% in March, compared to analysts' estimate of 3.9%.

Market reaction

The USD/CAD dropped from 1.3455 to levels under 1.3430, reaching fresh daily lows. The decline took palace even as the US Dollar strengthened following the US Retail Sales report. The Loonie rose across the board boosted by higher-than-expected Canadian CPI.

- DXY comes under pressure following recent tops near 102.80.

- The surpass of 102.80 exposes a move to the April high at 103.05.

DXY comes under renewed downside pressure and revisits the low-102.00s amidst the debate between risk appetite trends and debt ceiling unease.

The continuation of the bearish move, however, appears not favoured for the time being. That said, the resumption of the uptrend is expected to clear the weekly high at 102.80 (April 10) to allow for a potential challenge of the April top at 103.05 (April 3).

On the downside, there is a formidable contention around the 101.00 neighbourhood for the time being.

Looking at the broader picture, while below the 200-day SMA, today at 105.81, the outlook for the index is expected to remain negative.

DXY daily chart

Economists at ING are keeping a close eye on AUD this week. The Aussie could rise if wage data surprise to the upside.

Markets are not expecting any more hikes

“The Reserve Bank of Australia (RBA) minutes opened the door to more tightening if necessary, and tomorrow we’ll see the first quarter wage price index in Australia, which is expected to rise from 3.3% to 3.6% YoY. Any upside surprise may prompt some bets on further tightening by the RBA, and offer some support to AUD: at the moment, markets are not expecting any more hikes.”

“On Thursday, April employment figures will also be released and could confirm a still very tight jobs market.”

The financial markets continue to monitor developments on the debt ceiling dispute. You-Na Park-Heger, FX Analyst at Commerzbank, expects the US Dollar to weaken as the deadline approaches.

Solution to the debt dispute?

“It is questionable whether the USD will be able to benefit if an agreement between the two parties is postponed again.”

“Will the USD then still be able to gain in its function as a safe haven or will concerns about an imminent default by the US dominate at some point, so that the USD will come under depreciation pressure? The closer the presumed deadline approaches, the more likely the latter seems to me.”

Canada CPI Overview

Statistics Canada is scheduled to release the consumer inflation figures for April later during the early North American session this Tuesday, at 12:30 GMT. The headline CPI is expected to have risen by 0.4% during the reported month as compared to the 0.5% increase in March. The yearly rate, meanwhile, is expected to inch down from 4.3% to 4.1% in April - marking the lowest since August 2021. However, the Bank of Canada's (BoC) Core CPI, which excludes volatile food and energy prices, is estimated to edge up to 0.7% in April and decelerate to 3.9% on a yearly basis as compared to 0.6% and 4.3%, respectively, in March.

Analysts at NBF offer a brief preview of the crucial CPI report and write: “A rebound in gasoline prices could have been only partially offset by further moderation in the food segment and resulted in a 0.4% increase of the consumer price index in April (before seasonal adjustment). If we’re right, the 12-month rate of inflation should come down from 4.3% to a two-and-a-half-year low of 4.1%. The core measures preferred by the BoC should decrease as well; we see both the CPI-Trim (4.0% vs. 4.4%) and the CPI-Median (4.2% vs. 4.6%) declining four ticks on an annual basis.”

How Could It Affect USD/CAD?

Heading into the key release, the USD/CAD pair struggles to capitalize on its modest intraday uptick and seesawed between tepid gains/minor losses just above mid-1.3400s. Given that the Bank of Canada (BoC) has shown readiness to resume the rate-hiking cycle, if necessary to press inflation to the target, a surprisingly strong CPI print should provide a fresh boost to the domestic currency. This, in turn, will set the stage for an extension of the pair's previous day's retracement slide from the 1.3665-1.3670 region, or over a one-week high.

Conversely, softer Canadian consumer inflation figures could weigh on the Canadian Dollar, though the immediate market reaction is likely to be limited amid a modest US Dollar (USD) weakness. This might do little to provide any meaningful impetus to the USD/CAD pair. That government's borrowing limit, could infuse some volatility and produce short-term trading opportunities. said, the simultaneous release of the US monthly Retail Sales figures, along with developments surrounding a standoff to raise the federal

Key Notes

• Canadian CPI Preview: Forecasts from five major banks, inflation likely to ease again

• USD/CAD Forecast: Bulls look to seize back control ahead of Canadian CPI, US Retail Sales

• USD/CAD: Loonie to benefit if Canadian inflation were to surprise on the upper end – Commerzbank

About Canadian CPI

The Consumer Price Index (CPI) released by Statistics Canada is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of CAD is dragged down by inflation. The Bank of Canada aims at an inflation range (1%-3%). Generally speaking, a high reading is seen as anticipatory of a rate hike and is positive (or bullish) for the CAD.

- EUR/JPY’s recovery appears to have met initial hurdle near 148.00.

- The continuation of the rebound targets the weekly high near 149.30.

The ongoing upside momentum in EUR/JPY struggles to surpass the 148.00 region with conviction on Tuesday.

Once the 148.00 area is surpassed, the cross should be able to challenge the weekly peak at 149.26 (May 8). The surpass of this level could pave the way for a potential test of the YTD high at 151.61 (May 2).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 143.11.

EUR/JPY daily chart

Economists at Société Générale discuss GBP/USD and EUR/GBP outlook.

Hawkish 25 bps increase by the BoE and outlook for Fed pause should augur well for further GBP/USD upside

“The rebound in the Dollar checked the advance of GBP/USD last week but the hawkish 25 bps increase by the BoE and outlook for Fed pause (tither spread) in theory should augur well for further upside in the coming weeks.”

“For EUR/GBP, the technical break below the 200-DMA and underperformance of EUR/USD could nudge the cross closer towards 0.86. The cross is in the process of trying to retrace the 1.6% intra-day gain of 15 December which coincided with the hawkish policy reset by the ECB.”

Latest Q1 GDP figures in Malaysia surprised to the upside, note Senior Economist Julia Goh and Economist Loke Siew Ting at UOB Group.

Key Takeaways

“Malaysia’s economy chalked up a robust growth of 5.6% y/y in 1Q23, which was better than our estimate (5.0%) and Bloomberg consensus (5.1%). Nevertheless, growth momentum moderated further compared to 4Q22’s 7.1% y/y. On a seasonally adjusted basis, real GDP expanded 0.9% q/q (4Q22: -1.7% q/q).”

“Growth was anchored by domestic demand particularly private consumption and investments, while net exports added 2.1ppts to headline growth in 1Q23. All sectors expanded last quarter, led by services, manufacturing, and construction industries. The current account surplus narrowed to MYR4.3bn (or 1.0% of GDP) in 1Q23, from MYR27.5bn (5.9% of GDP) in 4Q22.”

“The better-than-expected 1Q23 GDP outturn has lifted our full year GDP outlook even though we are keeping an average GDP expansion of ~4.0% for the rest of the year. We remain cautious on the external outlook while domestic drivers are seeing signs of normalisation and moderation. Hence, we raise our full year GDP growth forecast to 4.4% for 2023 (from 4.0% previously, 2022: 8.7%). Brighter avenues in 2H23 include stronger investment recovery, higher tourism activity, lower unemployment rate, and supportive policy measures particularly gradual removal of price controls and subsidies that help to contain inflation pressures.”

- Gold price meets with a fresh supply on Thursday, though the downside remains limited

- Hawkish Federal Reserve expectations drive some flow away from the non-yielding metal.

- Looming recession fears lend support to the XAU/USD amid a modest US Dollar weakness.

Gold price struggles to capitalize on the previous day's modest uptick and comes under some renewed selling pressure on Tuesday. The XAU/USD, however, manages to bounce off the daily low and hold above the $2,000 psychological mark through the first half of the European session.

Looming recession risks lend support to Gold price

The market sentiment remains fragile in the wake of a standoff to raise the federal government's borrowing limit, which, along with weaker-than-expected Chinese macro data, fuel recession fears and benefit the safe-haven Gold price. In fact, US President Joe Biden expressed confidence that a deal could be done in time ahead of an expected meeting with congressional leaders later this Tuesday. Republican House of Representatives Speaker Kevin McCarthy, however, said the two sides were still far apart. Apart from this, signs that the post-COVID recovery in China - the world's second-largest economy - is losing steam temper investors' appetite for perceived riskier assets.

A weaker US Dollar contributes to limiting losses for XAU/USD

The anti-risk flow, along with concerns about the US debt ceiling, trigger a fresh leg down in the US Treasury bond yields, which is seen weighing on the US Dollar (USD) for the second successive day. A weaker Greenback lends additional support to the US Dollar-denominated Gold price. However, fresh speculations that the Federal Reserve (Fed) will stick to its hawkish stance in the wake of a rise in consumer inflation expectations contribute to the offered tone surrounding the non-yielding yellow metal. it is worth recalling that the Michigan survey showed last Friday that consumers see prices over the next five years climbing at an annual rate of 3.2% - the highest level since 2011.

Hawkish Fed expectations could cap the upside for Gold price

Adding to this, a slew of Fed officials warned on Monday that interest rates could still rise further amid relatively high inflation and a robust labor market. This could act as a tailwind for the US bond yields and the USD, supporting prospects for a further near-term downside for Gold price. Market participants now look forward to the US economic docket, featuring the release of monthly Retail Sales figures and industrial production data, due later during the early North American session. Apart from this, Fedspeaks could produce short-term trading opportunities around the XAU/USD. The focus, however, will remain glued to Fed Chair Jerome Powell's speech on Friday.

Gold price technical outlook

From a technical perspective, acceptance below the $2,000 mark will expose the $1,980 horizontal zone. This is closely followed by support near the $1,970 region, which if broken decisively might shift the near-term bias in favour of bearish traders and make the Gold price vulnerable to prolong its recent corrective pullback from the all-time high, around the $2,078-$2,079 area touched earlier this month. On the flip side, the $2,020-$2,021 region now seems to have emerged as an immediate hurdle. The next relevant resistance is pegged near the $2,035-$2,040 region. Some follow-through should allow Gold to climb back towards the all-time high and extend the momentum further towards conquering the $2,100 round-figure mark.

Key levels to watch

Antje Praefcke, FX Analyst at Commerzbank, expects the Swedish Krona to strengthen against the Euro latter in the year.

EUR/SEK should have peaked when it moved towards 11.40-50 this year

“As long as the ECB is perceived as the more restrictive central bank, with the market expecting two further rate steps, the Krona is struggling to record sustainable gains against the Euro. I am nonetheless of the view that EUR/SEK should have peaked when it moved towards 11.40-50 this year”.

“In the Eurozone too inflation will fall, economic and inflation data will weaken as a result of past rate hikes and the market might have to get used to the idea that the ECB will only hike the key rate one more time rather than twice.”

“It might take a little while yet, but I think that SEK stands a good chance to gain ground against the Euro over the course of the year.”

- US Dollar stays on the back foot for the second straight day on Tuesday.

- US Dollar Index manages to hold above 102.00 following Monday's slide.

- US Retail Sales data and headlines surrounding debt ceiling talks could impact USD valuation.