- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 17-05-2023

- US Dollar Index fades upside momentum after rising to late March highs.

- US policymakers appear hopeful of getting a deal to avoid default ahead of debt-ceiling expiry.

- Fewer details on the US debt limit negotiations, doubts on retail sales raised by Target Corp prod DXY bulls.

- Light calendar may allow US Dollar Index to pare recent gains at multi-day top.

US Dollar Index (DXY) buyers struggle to keep the reins at the highest levels in seven weeks during early Thursday in Asia. That said, the greenback’s gauge versus the six major currencies grinds near 102.90 while reversing the late Wednesday’s pullback from a multi-day high.

The DXY previously cheered optimism surrounding no US default, as well as hawkish comments from the Federal Reserve (Fed) officials, to rise to nearly two-month top. However, the latest doubt on the policymakers’ ability to agree on a wide range of details, as well as fears of easing US retail sales, seem to prod the US Dollar Index buyers.

Global markets turned optimism after a brief meeting between US President Joe Biden and House Speaker Kevin McCarthy conveyed that the policymakers are ready to compromise for a greater benefit. While portraying the same, US House Speaker Kevin McCarthy said in an interview on CNBC, "Now we have an opportunity to find common ground but only a few days to get the job done." Further, US President Joe Biden said that he is confident that they will be able to reach a budget agreement and noted that it would be catastrophic if the US failed to pay bills, per Reuters. "Will have a news conference on Sunday on the debt issue,” added US President Joe Biden.

However, the clock it ticking and the US Treasury Department has already signaled early June expiry of the debt-limit, as well as cited ‘catastrophic’ default of the US, if policymakers fail to strike a deal of multiple issues that can help solve the debt-limit problem. With this, markets reassess the previous optimism and prod the DXY bulls.

On the other hand, Reuters said that US retail sales have remained resilient despite higher prices but consumers have been careful about their spending, hurting companies such as Target and Home Depot, whose merchandise largely consists of discretionary products.

Previously, upbeat US data allowed the Federal Reserve (Fed) officials to reconfirm their hawkish bias about the monetary policy. On Wednesday, US Housing Starts came out as unimpressive with 1.401M figures for April versus 1.4M expected and 1.371M prior (revised). Alternatively, the Building Permits for the said month eased to 1.416M from 1.437M edited previous readings and market forecasts. Before that, upbeat US Retail Sales and Industrial Production details for April allowed the Federal Reserve (Fed) officials to remain hawkish and prod the risk-on mood. The latest among them were Federal Reserve Bank of Chicago President Austan Goolsbee and Atlanta Fed President Raphael Bostic who reiterate inflation fears and favored the US Dollar Index bulls.

Amid these plays, S&P 500 Futures print mild losses despite the upbeat Wall Street close whereas the US Treasury bond yields also remain sidelined at the multi-day top.

With this, the DXY may witness hardships in extending the latest run-up amid a light calendar. However, risk catalysts are the key to watch for clear directions.

Technical analysis

A daily close beyond the six-week-old horizontal resistance, around 102.75, struggles with the 100-DMA hurdle, near 102.90, to convince the DXY bulls. That said, nearly overbought RSI, however, suggest a pullback in prices.

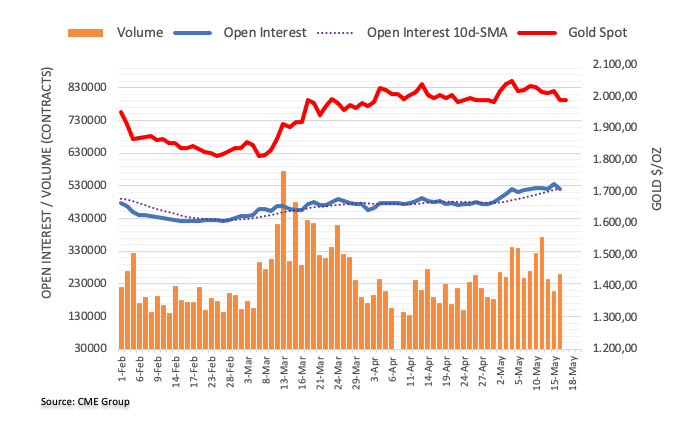

- Gold price remains weak despite recent rebound from the lowest level in three weeks.

- United States debt ceiling drama, hawkish Federal Reserve talks underpin US Treasury bond yields, USD and weigh on XAU/USD.

- Second-tier US data, risk catalysts eyed for clear direction of the Gold price.

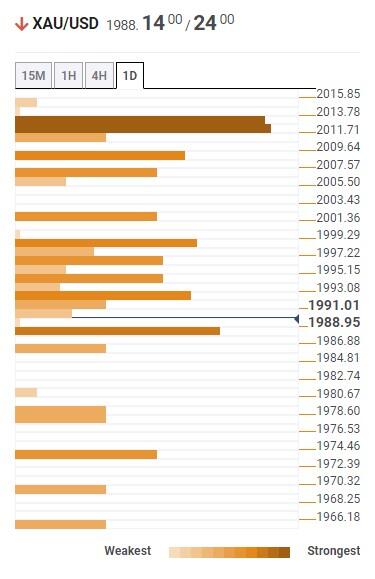

Gold price (XAU/USD) licks its wounds at a three-week low, picking up bids to print mild gains around $1,985 amid the early hours of Thursday’s Asian session. In doing so, the XAU/USD bears take a breather after declining in the last two consecutive days amid a lack of major data/events. Even so, expectations that the United States will be able to stretch its debt limit and join the hawkish Federal Reserve (Fed) talks to weigh on the Gold price.

Gold price bears burden of United States Treasury bond yields, US Dollar

Gold price broke short-term triangle support earlier in the week and dropped further afterward to refresh the multi-day low amid the firmer United States Treasury bond yields and the US Dollar.

That said, the US 10-year and two-year Treasury bond yields rose to the highest levels since May 01 and April 24 while portraying a four-day uptrend near 3.57% and 4.16% respectively, remaining unchanged by the press time. The same allows the US Dollar Index (DYX) to stay upbeat despite the latest retreat from a seven-week high to 102.85.

With this, the Gold price remains pressured as the markets cheer the firmer US Dollar amid upbeat expectations.

US debt ceiling drama, hawkish Federal Reserve talks favor US T-bond yields, USD

In addition to the United States debt ceiling jitters, the Federal Reserve officials’ hawkish bias also favors the US Treasury bond yields and the US Dollar, which in turn weighs on the Gold price.

Although markets doubt a brief meeting between US President Joe Biden and House Speaker Kevin McCarthy and portray the latest corrective bounce off the Gold price, comments from both key diplomats propel hopes of no US debt ceiling expiry and challenge the XAU/USD bulls. On Wednesday, US House Speaker Kevin McCarthy said in an interview on CNBC, "Now we have an opportunity to find common ground but only a few days to get the job done." Further, US President Joe Biden said that he is confident that they will be able to reach a budget agreement and noted that it would be catastrophic if the US failed to pay bills, per Reuters. "Will have a news conference on Sunday on the debt issue,” added US President Joe Biden.

On the other hand, recently upbeat US data allow the Federal Reserve (Fed) officials to reconfirm their hawkish bias about the monetary policy and exert additional downside pressure on the Gold price. On Wednesday, US Housing Starts came out as unimpressive with 1.401M figures for April versus 1.4M expected and 1.371M prior (revised). Alternatively, the Building Permits for the said month eased to 1.416M from 1.437M edited previous readings and market forecasts. Previously, upbeat US Retail Sales and Industrial Production details for April allowed the Federal Reserve (Fed) officials to remain hawkish and prod the risk-on mood. The latest among them were Federal Reserve Bank of Chicago President Austan Goolsbee and Atlanta Fed President Raphael Bostic who reiterate inflation fears and pleased the Gold sellers.

Qualitative catalysts are the key for XAU/USD watchers

Moving on, a light calendar with only second-tier United States jobs and activity data may not be able to entertain the Gold price traders. As a result, headlines surrounding the US default and comments from the global central bankers, mainly from the Federal Reserve (Fed) officials will be watched carefully for clear XAU/USD directions.

Gold price technical analysis

Confirmation of a two-month-old bearish triangle joins the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator to favor the Gold price downside at the lowest levels in a month.

However, the below 50 level of the Relative Strength Index (RSI) line, placed at 14, suggests the XAU/USD bears wait for sustained trading beneath the 50-DMA, around $1,985 by the press time, before adding more short positions.

Following that, the yellow metal could drop to the 50% Fibonacci retracement of its March-May upside, around $1,945, ahead of testing the 100-DMA support of $1,925 and the golden Fibonacci ratio, the 61.8% mark, of around $1,910.

In a case where the Gold price remains bearish past $1,910, the odds of witnessing a slump in the XAU/USD can’t be ruled out.

Alternatively, the Gold price recovery needs to sustain beyond the stated triangle’s bottom line, $1,995, quickly followed by the $2,000 round figure hurdle.

Even so, the 23.6% Fibonacci retracement level and the aforementioned triangle’s top, respectively near $2,015 and $2,050 will be in the spotlight.

To sum up, the Gold price remains on the bear’s radar even as the road towards the south is long and bumpy.

Gold price: Daily chart

Trend: Further downside expected

- AUD/JPY is looking to re-test the 10-day high around 92.00 as the focus has shifted to Australian Employment.

- The stubborn labor cost index could keep the overall demand elevated and eventually the Australian inflation.

- Japan’s economy is likely to continue moderate pickup ahead due to wage hikes, and a strong corporate appetite for investment.

The AUD/JPY pair is looking to reclaim the 10-day high around 92.00 in the early Tokyo session. The risk barometer showed a significant jump on Wednesday as investors are worried that the Reserve Bank of Australia (RBA) could raise interest rates further to tame Australian inflation.

On Wednesday, the Australian Bureau of Statistics reported mixed Q1 Wage Price Index data. The quarterly labor cost index remained steady at 0.8% but lower than the estimate of 0.9%. On an annual basis, the economic data accelerated to 3.7% vs. the consensus of 3.6% and the former release of 3.3%. A stubborn labor cost index could keep the overall demand elevated and eventually, the Australian inflation, which could force RBA Governor Philip Lowe to tighten monetary policy further.

Going forward, Australia’s Employment data (April) will provide more clarity. As per the consensus, the Australian economy added 25K fresh jobs in April, lower than the additions of 53K made in March. The Unemployment Rate is seen unchanged at 3.8%. Lower additions of fresh payrolls would be a comfort for the agenda of bringing inflation down ahead.

Economists at Commerzbank believe that “The main risk remains that the labor market data might surprise to the upside. A surprise of that nature would further fuel recent hopes of a further rate step and would no doubt be positive for the Aussie.”

On the Japanese Yen front, Japan’s Gross Domestic Product (GDP) showed a decent rise in Q1 numbers. Preliminary Q1 GDP accelerated by 0.4% vs. the estimates of 0.1%. In the last quarter, the GDP growth remained stagnant. Japan’s Economy Minister Shigeyuki Goto cited “Economy likely to continue moderate pickup ahead due to improving sentiment, wage hikes and strong corporate appetite for investment.

- AUD/NZD picks up bids to snap two-day downtrend but remains indecisive ahead of the key data/events.

- Upbeat sentiment, softer New Zealand data allow bears to take a breather.

- Strong Aussie jobs report necessary to justify RBA’s hawkish surprise, New Zealand’s “no frill” budget needs validation from rating agencies.

AUD/NZD renews its intraday high near 1.0670 as it prints the first daily gains in three ahead of the all-important Australian employment report and New Zealand’s annual budget, scheduled for publishing on Thursday.

The exotic pair’s latest rebound from a 1.5-month-old ascending support line could be linked to the market’s cautious optimism, as well as downbeat New Zealand (NZ) inflation clues.

That said, New Zealand’s first quarter (Q1) Producer Price Index Input and Output numbers ease to 0.2% and 0.3% respectively versus 0.5% and 0.9% priors in that order. It’s worth noting that these figures are way below the market forecasts of 1.5% and 1.3% for Input and Output respectively.

Adding to the pair’s recovery moves could be the latest hopes of the US policymakers’ ability to avoid the ‘catastrophic’ default. Although markets doubt a brief meeting between US President Joe Biden and House Speaker Kevin McCarthy, comments from both key diplomats propel hopes of no US debt ceiling expiry.

On Wednesday, US House Speaker Kevin McCarthy said in an interview on CNBC, "Now we have an opportunity to find common ground but only a few days to get the job done." Further, US President Joe Biden said that he is confident that they will be able to reach a budget agreement and noted that it would be catastrophic if the US failed to pay bills, per Reuters. "Will have a news conference on Sunday on the debt issue,” added US President Joe Biden.

In addition to the US-inspired run-up, hopes of more investment from China also underpinned the AUD/NZD recovery as China’s State Planner National Development and Reform Commission of the People's Republic of China (NDRC) mentioned on Wednesday that it'll take measures to unleash consumption potential and to make continuous efforts in stabilizing and expanding manufacturing investment.

To portray the risk-on scenario, Wall Street closed with gains while Treasury bond yields remain firmer at a two-week high.

Moving on, AUD/NZD pair traders should close attention to today’s Australia Employment data for April as the headline Employment Change is expected to ease to 25K, versus 53K prior, whereas the Unemployment Rate and Participation Rate may stay unchanged at 3.5% and 66.7% respectively. Should the data match downbeat forecasts, or show a further easing of the jobs market, the RBA will have a tough time justifying the latest hawkish surprise, which in turn can weigh on the pair prices.

Additionally, New Zealand’s “no frill” budget needs acceptance from the rating agencies and bond markets to favor the New Zealand Dollar (NZD) buyers. With this in mind, ANZ said, “Despite the ‘no frills’ label being attached to Budget 2023 ahead of its release, we expect it to add a little more stimulus to an already capacity-constrained economy.”

Technical analysis

AUD/NZD pair’s recovery from a six-week-old ascending support line, close to 1.0640 at the latest, remains elusive unless crossing a convergence of the 50-DMA and 21-DMA, near 1.0735 by the press time. That said, easing the bearish bias of the MACD and steady RSI favors the pair’s latest corrective bounce.

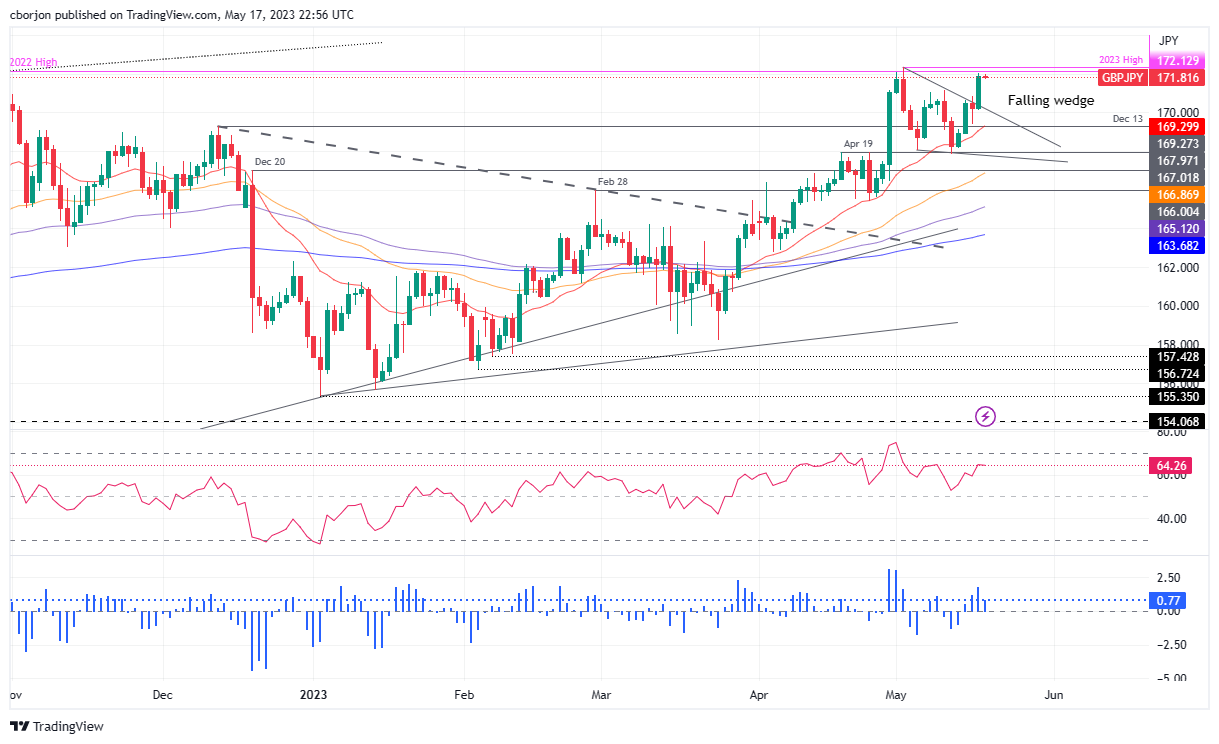

- GBP/JPY breaks falling wedge approaches YTD high of 172.33; currently trading at 171.86, down 0.01%.

- The technical outlook turns bullish, but resistance at 173.00 and 175.00 could pose challenges for further gains.

- Negative divergence on the RSI indicator suggests a possible pullback; downside risks emerge below the 170.00 psychological figure.

The GBP/JPY rallied sharply as a falling wedge, usually a bullish chart pattern, has been broken decisively to the upside, and the GBP/JPY approaches the year-to-date (YTD) high of 172.33 as the Asian session begins. At the time of writing, the GBP/JPY is trading at 171.86, down 0.01%.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY uptrend remains intact from a daily chart perspective, but solid resistance levels will be tested in the short term. If the GBP/JPY breaks 172.33, that could open the door for further gains, supported by momentum oscillators, turning bullish.

Although bullish, the Relative Strength Index (RSI) indicator printed a lower peak than the previous one, while price action is reaching higher highs. That means a negative divergence could emerge, meaning that a pullback might be on the cards.

But if GBP/JPY breaks above 173.00, the next resistance to challenge would be the 175.00 figure. Once cleared, the GBP/JPY could rally towards the 2016 year high of 177.37. A breach of the latter, and the next supply zone, would be the 180.00 figure, which could open the door for a test of 2015 high of 195.88.

Conversely, a failure at 172.00, the GBP/JPY could retreat towards the May 16 high of 170.83. Break below will expose the May 17 daily low of 170.11 before cracking the 170.00 psychological figure.

GBP/JPY Price Action – Daily chart

- GBP/USD is aiming to reclaim the 1.2500 resistance as the USD index is expected to correct further.

- The Fed is widely anticipated to pause its policy-tightening process in June.

- The risk impulse is positive as investors are expecting that the US debt-ceiling will get raised this week.

The GBP/USD pair has gauged an intermediate support around 1.2480 after a mild correction and is looking to reclaim the psychological resistance of 1.2500. The Cable is expected to get stronger due to a correction in the US Dollar Index (DXY) and an absence of evidence of United Kingdom inflation softening ahead.

S&P500 futures are showing nominal losses in early Asia followed by a meaningful bullish Wednesday as the White House and Republican leaders are expected to approve the deal of raising the US debt ceiling. However, spending initiatives for the budget will get compromised as each member who attended US debt-ceiling talks admitted that a raise in the US borrowing cap along with a higher spending budget will be a disaster for the economy. The overall market mood is indicating that investors have underpinned the risk-appetite theme.

The US Dollar Index (DXY) witnessed an extreme selling pressure around 103.10 and dropped to near 102.80. Further downside in the USD index seems possible as investors are shifting their focus to June’s monetary policy meeting by the Federal Reserve (Fed) in which a neutral stance on interest rates is widely anticipated.

On the Pound Sterling front, higher inflationary pressures are causing worry for the Bank of England (BoE) policymakers. On Wednesday, BoE Governor Andrew Bailey cited that easing of United Kingdom labor market tightness is happening at a slower pace than we expected in February and the labor market remains very tight.

Also, UK Finance Minister Jeremy Hunt said on Wednesday, there is “nothing automatic about bringing down inflation.” He further added the administration supports the BoE fully and is focusing on getting taxes down.

- EUR/USD remains sidelined after bouncing off six-week low.

- Downbeat RSI (14) line, 100-DMA favors underpin recovery move.

- Convergence of 50-DMA, previous support line from September 2022 highlights 1.0900 hurdle.

- Euro buyers can remain hopeful beyond 1.0480, multiple levels prod bulls past 1.1000.

EUR/USD seesaws around 1.0840 as the previous day’s corrective bounce from 1.5-month low fades during the early hours of Thursday.

That said, the downbeat RSI (14) conditions and the 100-DMA support triggered the Euro pair’s rebound from the 1.0800 mark on Wednesday. However, a bearish MACD signal and cautious mood ahead of a speech from European Central Bank (ECB) President Christine Lagarde, as well as amid US default jitters, check the pair buyers.

Hence, the EUR/USD recovery needs validation and highlights a convergence of the 50-DMA and the support-turned-resistance line stretched from September 2022, close to 1.0900 by the press time, as the key for the pair’s further advances.

Following that, the early May low of near 1.0940 and February’s high surrounding 1.1035 can challenge the buyers.

Adding to the upside filters are multiple tops marked during April and May around 1.1090 and 1.1100.

On the flip side, a daily closing below the 100-DMA level of near 1.0800 will be enough to recall the EUR/USD sellers.

In that case, the 23.6% Fibonacci retracement level of the pair’s run-up from September 2022 to April 2023, around 1.0725, can act as an extra filter to the south.

It’s worth noting that a broad support zone comprising multiple levels marked since November 2022, around 1.0520-480, becomes a tough nut to crack for the EUR/USD sellers.

To sum up, EUR/USD is likely to remain bearish despite the latest corrective bounce.

EUR/USD: Daily chart

Trend: Limited recovery expected

- USD/CHF trades below the weekly high, failing to conquer the 50-day EMA; currently trading at 0.8984, up 0.05%.

- The technical outlook remains neutral unless the pair can reclaim the 50-day EMA at 0.9027 and the 100-day EMA at 0.9144.

- RSI indicator suggests buyers are moving in, but key resistance levels lie ahead; downside risks emerge below the 20-day EMA.

USD/CHF holds to its earlier gains achieved after three days of consecutive gains. However, it’s trading well below the weekly high, which tested the 50-day Exponential Moving Average (EMA) at 0.9027 but failed to conquer the latter. Hence, the USD/CHF retreated beneath the 0.9000 figure, and as the Asian session begins is trading at 0.8984, up 0.05%.

USD/CHF Price Analysis: Technical outlook

Wednesday’s price action formed an inverted hammer candlestick that fell shy of cracking the 50-day EMA, though it retreated and stood above the 20-day EMA at 0.8951. However, the USD/CHF bias remains neutrally biased unless buyers reclaim the 50-day EMA at 0.902, followed by the 100-day EMA at 0.9144.

The Relative Strength Index (RSI) indicator entered the bullish territory, suggesting buyers are moving in, while the 3-day Rate of Change (RoC) jumped above the neutral line.

Therefore, the path of least resistance is upward biased in the near term. The USD/CHF first resistance would be the 0.9000 figure, followed by the 50-day EMA at 0.9027. Once cleared, ad upside risks lie at 0.9120, the April 10 high, followed by the April 3 daily high of 0.9196.

Conversely, downside risks for the USD/CHF emerge below the 20-day EMA at 0.8951, followed by the psychological 0.8900 mark.

USD/CHF Price Action – Daily chart

- USD/CAD has sensed some buying interest near 1.3440 as the focus shifts to Canadian Retail Sales data.

- S&P500 ended Wednesday’s session on a bullish note on hopes that US Treasury will get raise in debt-ceiling.

- Rising expectations of US debt ceiling raise approval have eased demand for US Treasury bonds.

The USD/CAD pair has attempted a recovery after gauging bids near 1.3440 in the early Asian session. The Loonie asset has rebounded as the US Dollar Index (DXY) has also picked bids near 102.80. Earlier, the USD index witnessed selling pressure after failing to sustain above the critical resistance of 103.00 as Republican House of Representatives Joseph McCarthy announced that negotiations with the White House will reach a deal of raising the US borrowing limit.

S&P500 ended Wednesday’s session on a bullish note on hopes that US Treasury will get raised in debt-ceiling and will be able to pay its obligated bills on time. Also, the expectations for a pause in the policy-tightening process are solid as tight credit conditions by the Federal Reserve (Fed) have resulted in lower credit disbursals by regional banks to small-scale firms. The overall issue is easing labor market conditions and firms are underutilizing their overall capacity due to lower working capital credit.

US delegates don’t have another option than to allow raising the US debt ceiling to avoid default in obligated payments by the Federal, however, spending initiatives will definitely cut ahead. Rising expectations of US debt ceiling raise approval have eased demand for US Treasury bonds. This has led to a jump in the 10-year US Treasury yields above 3.57%.

On the Canadian Dollar front, after recording some persistence in inflationary figures, investors are shifting their focus toward Friday’s Retail Sales (March) data. Monthly Retail Sales data is seen contracting by 1.4% vs. a contraction of 0.2% recorded earlier. A decline in households' demand would offset the impact of a rebound in inflation and will allow the Bank of Canada (BoC) to keep its interest rate policy steady further.

- AUD/USD grinds higher ahead of the key Aussie jobs report after bouncing off two-week low.

- US policymakers’ statements weigh on pessimism surrounding US debt ceiling expiry.

- Mixed Australia Wage Price Index, US housing numbers fail to impress traders.

- Upbeat Aussie employment report can validation RBA’s hawkish surprise and propel AUD/USD further towards the north.

AUD/USD portrays a typical pre-data anxiety around 0.6660 amid the early hours of Thursday’s trading in Asia, after posting a notable rebound from a fortnight low. That said, the Aussie pair initially dropped on Wednesday amid mixed sentiment and downbeat Aussie data but the upbeat sentiment allowed the risk-barometer pair to recover ahead of the key Aussie data.

After quick debt ceiling negotiations, the US policymakers appear quite optimistic as US President Joe Biden and House Speaker Kevin McCarthy both conveyed hopes of reaching an agreement over avoiding the default.

That said, US House Speaker Kevin McCarthy said in an interview with CNBC on Wednesday, "Now we have an opportunity to find common ground but only a few days to get the job done." Further, US President Joe Biden said that he is confident that they will be able to reach a budget agreement and noted that it would be catastrophic if the US failed to pay bills, per Reuters. "Will have a news conference on Sunday on the debt issue,” added US President Joe Biden.

Apart from the US-inspired run-up, hopes of more investment from China also underpinned the AUD/USD recovery as China’s State Planner National Development and Reform Commission of the People's Republic of China (NDRC) mentioned on Wednesday that it'll take measures to unleash consumption potential and to make continuous efforts in stabilizing and expanding manufacturing investment.

While portraying the mood, Wall Street closed with gains while Treasury bond yields remain firmer at a two-week high. It’s worth noting, however, that the US Dollar also stays upbeat despite the latest retreat from a seven-week high, which in turn prods the AUD/USD bulls.

On the other hand, the US data came in mixed while the Aussie Wage Price Index for the first quarter (Q1) of 2023 also arrived as unimpressive. That said, Australia’s Wage Price Index repeated 0.8% QoQ figures for the first quarter (Q1) of 2023, below the 0.9% market consensus, whereas the YoY numbers improved to 3.7% versus 3.6% expected and 3.3% previous readings. Further, US Housing Starts came out as unimpressive with 1.401M figures for April versus 1.4M expected and 1.371M prior (revised). Alternatively, the Building Permits for the said month eased to 1.416M from 1.437M edited previous readings and market forecasts.

Moving on, AUD/USD pair traders should close attention to today’s Australia Employment data for April as the headline Employment Change is expected to ease to 25K, versus 53K prior, whereas the Unemployment Rate and Participation Rate may stay unchanged at 3.5% and 66.7% respectively. Should the data match downbeat forecasts, or show a further easing of the jobs market, the RBA will have a tough time justifying the latest hawkish surprise, which in turn can weigh on the pair prices.

Also read: Australian Employment Change Preview: Another strong report?

More importantly, headlines surrounding the US debt ceiling and second-tier US data can direct the AUD/USD moves amid a likely busy day.

Technical analysis

A daily closing beyond a convergence of the 21-DMA and 10-DMA, near 0.6685 at the latest, becomes necessary for the AUD/USD bulls to keep the reins. That said, repeated failures to cross 0.6700 keeps the pair sellers hopeful of visiting an upward-sloping support line from early March, close to 0.6610 at the latest.

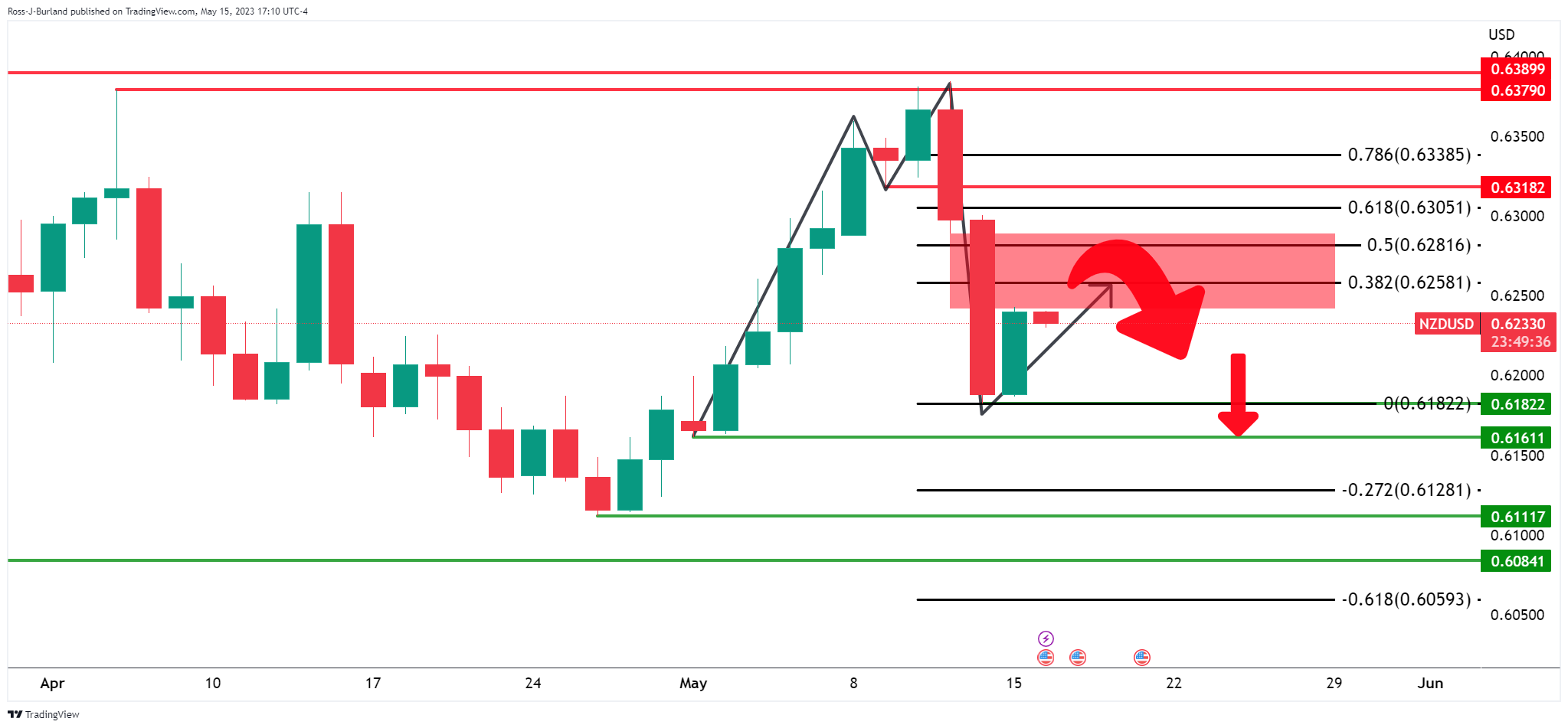

- NZD/USD bulls remain in control riding the trendline support.

- A break of the trendline support opens risk of a move lower.

NZD/USD was moving higher midweek and reached 0.6273 after climbing from a low of 0.6224. At the time of writing, the pair is trading flat at around 0.6243.

´´The Kiwi is at the upper end of the week’s ranges early this morning following a whippy night that also saw a rebound in the USD, which has of course meant that the Kiwi has done well on most crosses,´´ the analysts at ANZ Bank said in a note on Wednesday.

The analysts note that today is Budget day and say that it has been flagged as a no-frills one.

´´Rating agencies are hoping for restraint, and FX markets are in turn hoping that rating agencies give it a tick. But with the tax take slowing, demands on the public purse growing, and deficits expected to persist for longer, FX markets are worried rating agencies might caution us, especially given our record current account deficit.´´

Meanwhile, the US Dollar index, a measure of the greenback's value against six major currencies, climbed as high as 103.11 and to its strongest level since late March. There was the possibility of agreement on the US debt ceiling while US President Joe Biden expressed confidence an agreement will be reached. House Representative Speaker Kevin McCarthy argued that a debt-ceiling agreement by Sunday is doable. Meanwhile, US Vice President Kamala Harris is to brief on preventing a default on Thursday.

NZD/USD technical analysis

As per the prior day´s analysis, NZD/USD bulls in the market and eye a firm correction, the pair moved up into the 38.2% Fibonacci resistance and came close to a 50% mean reversion:

Prior analysis:

Update 1:

Update 2, live market:

There are still prospects of a move lower although the 4-hour and 1-hour charts can be used to gauge as to whether there is going to be a deceleration in the bullish correction and so far, it is early days still. After all, the price is still on the front side of the bullñish dynamic trendline support.

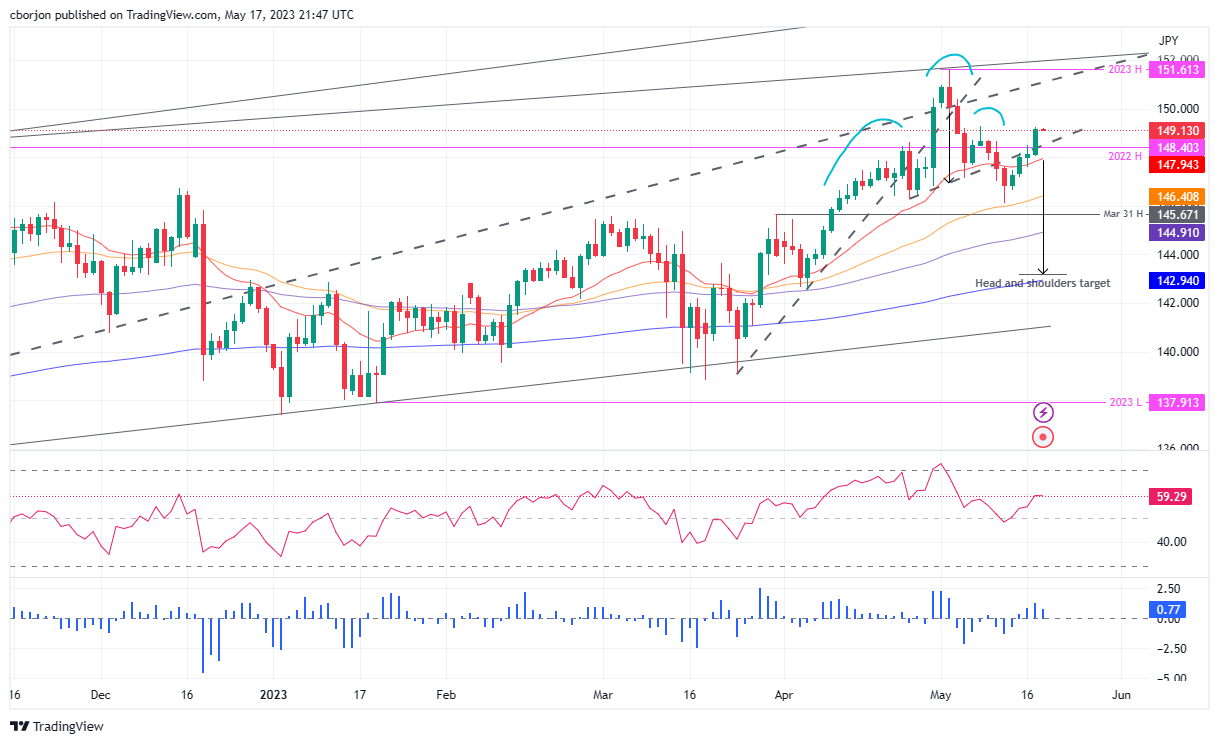

- EUR/JPY breaks head-and-shoulders neckline, bolstered by high EU inflation and hawkish ECB comments.

- The uptrend remains intact as the pair holds above the 20-day EMA, but further gains require a break above the month-to-date high.

EUR/JPY rallied sharply on Wednesday, breaking above a head-and-shoulders chart pattern neckline, invalidating the pattern, as buyers emerged on a high inflation report in the Eurozone (EU). That, alongside European Central Bank’s (ECB) hawkish commentary, opened the door for further gains. As the Asian session begins, the EUR/JPY trades at 149.17, registering a minuscule gain of 0.01%.

EUR/JPY Price Analysis: Technical outlook

After the EUR/JPY struggled to crack the 2022 high of 148.40, the cross-currency pair extended its gains and cleared the neckline of a head-and-shoulders chart pattern. Therefore, the EUR/JPY’s uptrend remains intact in play, as also the pair jumped off the 20-day Exponential Moving Average (EMA) at 147.94. Nevertheless, to further cement its bias, a break above the month-to-date (MTD) high of 149.26 is needed, so the EUR/JPY could threaten to crack the 150.00 figure.

The Relative Strength Index (RSI) indicator shows buyers entered the market but has turned flat as the Asian session begins. The 3-day Rate of Change (RoC) portrays that buying pressure is fading; hence, mixed signals around the pair could prevent traders from opening fresh long positions.

On the upside, if EUR/JPY buyers reclaim 49.26, the psychological 150.00 figure is up for grabs. A breach of the latter will expose the year-to-date (YTD) high of 151.61.

Conversely, the EUR/JPY first support would be the 149.00 mark. Downside risks will emerge below the latter, like the 2022 high turned support at 148.40, ahead of the 20-day EMA at 147.94.

EUR/JPY Price Action – Daily chart

- Gold price is on the front side of the bearish trend.

- Bears eye the bullish trendline for a test as US Dollar firms.

Gold price dropped on Wednesday, pressured for a second day below the psychological $2,000 mark in the face of a firm US dollar and US Treasury yields.

The US Dollar has been in favor with favorable US data and while the debt-ceiling negotiations continue in Washington. The threat of potential defaults has been pushing up treasury yields while the outlook is mixed for the greenback.

However, there was some improvement in the optimism over the possibility of agreement on the US debt ceiling while US President Joe Biden expressed confidence an agreement will be reached. House Representative Speaker Kevin McCarthy argued that a debt-ceiling agreement by Sunday is doable. Meanwhile, US Vice President Kamala Harris is to brief on preventing a default on Thursday.

The US Dollar index was last seen up 0.27% to 102.87, making gold more expensive for international buyers while the US two-year note was last seen paying 4.165%. The 10-year note printed a high of 3.57%.

Analysts at TD Securities have said that ´´the gold price may well be near all-time highs, but the positioning set-up is inconsistent with a cycle top.´´

´´The bar for algorithmic liquidations in gold is high, whereas Shanghai trader length is also nearing year-to-date lows,´´ the analysts added.

´´Dry-powder analysis also highlights that position sizing for gold bulls remains near average levels, and our gauge of discretionary trader positioning continues to suggest that this cohort has yet to participate in the precious metals rally.´´

Lastly, the analysts said, ´´looking forward, we expect a hoard of discretionary capital to flow towards gold, given strong historical linkages with market expectations for a deepening Fed cutting cycle over the next year. In turn, we expect gold to print new cycle highs over the coming months.´´

Gold daily chart

Gold price is pressured on the front side of the bearish trend on the daily charts and is headed toward both horizontal and dynamic support areas.

Gold H4 chart

From a 4-hour perspective, the price could continue lower to support or it may well correct a little before the next decisive move lower.

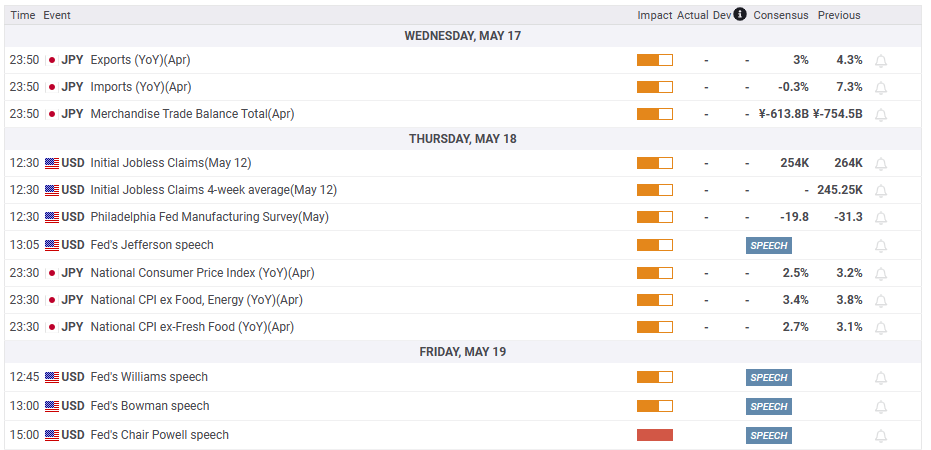

A busy session is ahead in Asia, with several key reports scheduled for release. The most important report will be the Australian employment data. In New Zealand, the government will deliver the Budget 2023, and wholesale inflation data is also due. Japan will report its trade balance figures. The Kiwi has been outperforming, but the Budget and the PPI could challenge its strength. The Aussie has been under pressure, and the jobs numbers could be crucial for its performance.

Here is what you need to know on Thursday, May 18:

Wall Street indexes rose more than 1%, while the US Dollar pulled back amid an improvement in market sentiment. However, higher US yields provided support to the Greenback. Easing bets for year-end rate cuts pared further, and on the contrary, odds of a rate hike in June advanced on US economic data, optimism about a debt ceiling deal, and fewer concerns about the banking sector.

Debt ceiling talks show some progress, but a resolution is not yet on the table. US President Biden shortened his trip to Asia. Housing data from the US came in mixed. On Thursday, the US will report weekly Jobless Claims, the Philly Fed, and Existing Home Sales.

The US Dollar Index (DXY) finished higher near 103.00, but off highs. The US 10-year Treasury yield rose to 3.57%, the highest level in almost a month.

EUR/USD hit monthly lows near 1.0800 before rising to the 1.0850 area. However, the Euro lagged following comments from European Central Bank (ECB) officials with a dovish tilt. EUR/GBP posted the lowest daily close since mid-December around 0.8675.

GBP/USD hit weekly lows at 1.2420 and then rose back to 1.2500. Bank of England (BoE) Governor Bailey sounded hawkish, helping the Pound.

USD/JPY jumped from 136.40 to 137.55, posting the strongest close since December, boosted by higher government bond yields and the better tone in equity markets. Japan reported better-than-expected Q1 GDP data and will release trade data on Thursday.

AUD/USD reached weekly lows at 0.6627 but finished modestly higher, uplifted by a weaker US Dollar. Australia will release the April Employment report on Thursday, and the market consensus is for a 25,000 increase in jobs.

NZD/USD rose on Wednesday and peaked at the 100-day Simple Moving Average (SMA) at 0.6270 before pulling back a bit. New Zealand's Q1 Producer Price Index is due on Thursday, and the government will present the Budget 2023.

The Loonie outperformed among commodity currencies, boosted by a 2.70% rally in crude oil prices. USD/CAD dropped almost a hundred pips from the intraday highs, settling at 1.3445.

On a volatile day, USD/MXN climbed to 17.68 and then eased to 17.55. The Bank of Mexico will announce its decision on Thursday, and it is expected to be a close call.

Gold remains under pressure while silver offered some signs of stabilization. XAU/USD bottomed at $1,974 but is still holding above the crucial support area of $1,970.

Like this article? Help us with some feedback by answering this survey:

- GBP/USD bulls hit a brick wall in the Wall Street risk rally.

- The daily chart offers a bearish scenario for the days ahead.

GBP/USD is back to flat in the day after initial losses that were sparked in the face of the Bank of England Governor Andrew Bailey reiterating that he expected price pressures to ease, as soon as April. Also, data showed Britain's jobless rate rose to 3.9%, while the rate of increase in total pay held steady. At the time of writing, GBP/USD is trading near 1.2490 and is correcting lower from a 4-hour resistance area.

GBP/USD daily chart

The M-formation is a topping pattern that has formed as the potential for the final stage of the prior bullish rally. The price is now on the backside of that trendline, so shorts could be the more favorable playbook for traders:

GBP/USD H4 chart

The price has shot up to test resistance and while there are prospects of an onward continuation, the price can easily head lower as illustrated in the chart above.

- Optimism around US debt ceiling talks and solid economic data push US T-bond yields higher.

- US housing market data shows improvement, with Building Permits and Housing Starts exceeding expectations.

- Eurozone inflation remains high, supporting further ECB tightening, while Fed officials maintain hawkish rhetoric.

EUR/USD continued to trend lower on Wednesday and reached a new six-week low of 1.0810 on optimism around the US debt ceiling talks amidst a tranche of positive economic data in the US. Hence, US T-bond yields jumped, underpinning the US Dollar (USD), a headwind for the Euro (EUR). At the time of writing, the EUR/USD is trading at 1.0838.

US T-bond Yields climb, while Eurozone inflation data supports ECB tightening

Wall Street continues its advance as sentiment improvement keeps traders leaning on riskier assets. US Treasury bond yields had risen, bolstering the US Dollar (USD) to new weekly highs. Negotiations between the White House and the US Congress about the debt ceiling seem to advance, as both sides commented that a default is not an option. The US House Speaker Kevin McCarthy commented that reaching an agreement this week is “doable.”

US data on Wednesday showed the housing market is improving. Building Permits for April dropped -1.5%, less than the expected -3% plunge, while Housing Starts for the same period smashed March’s -4.5% contraction and jumped by 2.2%. That, alongside Tuesday’s Retail Sales and Industrial Production printing positive numbers, paints a solid economic outlook in the United States.

Therefore, speculators trimmed the chances of seeing the US Federal Reserve (Fed) cutting rates three times a year to only two. The CME Fed Watch Tool shows odds of 40.8% for a 50 bps rate cut by the year’s end, higher than Tuesday’s reading.

US Federal Reserve officials crossed newswires. Loretta Mester, Thomas Barkin, and Raphael Bostic continued to push back against rate cuts, though the latter has moderated its stance. On the dovish front, Aaron Golsbee and Lorie Logan took a cautious stance but emphasized that no rate cuts are expected in 2023.

Across the pond, Eurozone (EU) inflation was aligned with estimates, though it remains at around 7% YoY in headline inflation. The core Harmonized Index of Consumer Prices (HICP) rose by 5.6%, aligned with estimates. Given that inflation remains three times the European Central Bank (ECB) objective, further tightening by the ECB is expected.

ECB officials continued to lean towards the hawkish side, but the ECB’s Vice President Luis de Guindos said that the ECB tightening is mostly done but still has a way to go.

EUR/USD Technical Levels

- Wall Street stocks rally on optimism in earnings and the debt ceiling outlook.

- US500 index is tracking higher towards key resistance area.

US stock indexes rose on Wednesday and the S&P 500 was up 43 points, or 1.07%%, at 4,153 at the time of writing. The index made a high of 4,164.67 on the day, rising from a low of 4,113.62.

The index was helped by Tesla and after Western Alliance amid optimism about a potential breakthrough in the deadlock in Washington over the nation's debt limit. The debt ceiling talks continue after top-ranking lawmakers met with President Joe Biden at the White House on Tuesday. House Representative Speaker Kevin McCarthy argued that a debt-ceiling agreement by Sunday is doable. Meanwhile, US Vice President Kamala Harris is to brief on preventing a default on Thursday.

Stocks in Tesla Inc extended gains to rise 3.9% after its annual shareholder meeting on Tuesday. ´´Top boss Elon Musk played down market rumors that he may step down as CEO of Tesla, touched upon two new mass-market models the company is developing, and reaffirmed that deliveries of its long-delayed Cybertruck pickup would start this year,´´ Reuters reported.

Reuters also reported that ´´US regional banks rose, led by a 14.0% rise in Western Alliance Bancorp

as the lender's deposit growth exceeded $2 billion and brokerage Bank of America Global Research resumed coverage of the bank with a "buy" rating.´´

US500 technical analysis

The index has rallied and is now facing a layer of resistance that could lead to a downside correction into the W-formation´s neckline and a test of dynamic support in the sessions ahead.

- AUD/USD recovers from the lows and seeks fresh highs for the day.

- A risk-on rally on Wall Street is supporting AUD ahead of the local key jobs data event.

AUD/USD has come back to life in the midday New York session as it attempts to print a fresh high for Wednesday. The pair has traveled between a low of 0.6629 and a high of 0.6673 so far.

Earlier in the day, the US Dollar rallied to a seven-week high as investors moved in due to its safe-haven allure amid the risk of a US debt default. Additionally, firm US Consumer Spending and Housing data gave the currency a boost as traders anticipated the higher odds of another Federal Reserve interest rate hike.

The US Dollar index, a measure of the greenback's value against six major currencies, climbed as high as 103.11

DXY, its strongest level since late March. It was last up 0.2% at 102.806.

The move in the high beta Aussie was helped by a rise in US indices on Wall Street. The debt ceiling talks continue after top-ranking lawmakers met with President Joe Biden at the White House on Tuesday. House Representative Speaker Kevin McCarthy argued that a debt-ceiling agreement by Sunday is doable. Meanwhile, US Vice President Kamala Harris is to brief on preventing a default on Thursday.

All eyes on Aussie jobs

Meanwhile, domestically, net AUD short positions had moved up to their highest levels since November as the Reserve Bank of Australia moves towards a perceived peak in the policy rate. With that being said, however, we have key data out later today in the Employment report.

´´After the strong jobs report last month, we expect Employment to expand at a still-firm pace of +20k in April (cons: 25k, Mar: 53k) though the risk is biased to the upside given favorable seasonals,´´ analysts at TD Securities said.

´´We think labour demand is still outstripping supply and expect the tightness in the labour market to only ease gradually. We look for the participation rate to stay unchanged at 66.6% and the unemployment rate to rise to 3.6% (last: 3.5%) due to higher working-age population growth,´´ the analysts explained. ´´Overall, we think another strong jobs report may pressure the RBA to retain a hawkish tone and the June meeting could be another live decision.´´

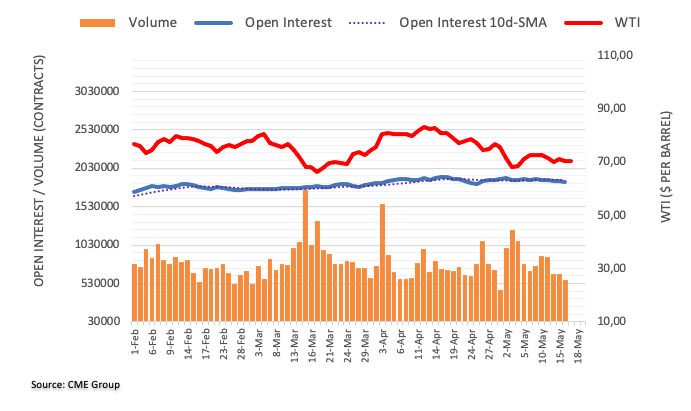

- International Energy Agency predicts supply to fall behind demand by 2 million bpd in H2.

- Positive developments in US debt ceiling talks boost market sentiment, lifting oil prices.

- US crude oil prices rise despite increased inventories as China’s economic growth tempers.

Western Texas Intermediate (WTI) advanced more than 3% in the late New York session, exchanging hands at around the $72.90 area due to renewed optimism after UD debt ceiling negotiations pointed to an agreement. At the same time, the International Energy Agency (IEA) revealed that demand would outpace supply, bolstering oil prices.

Oil demand is set to outpace supply, while China accounts for 60% of the demand increase in 2023

The IEA revealed that supply would surpass demand by 2 million barrels per day (bpd) in the second half of the year, with China’s making up 60% of the oil demand increase in 2023.

In the meantime, US President Joe Biden commented that he’s confident about reaching a debt ceiling as he embarks on a trip to Japan. The US House Speaker Kevin McCarthy commented that he planned to be engaged in negotiations, while Biden said he planned to remain in close contact with the speaker and negotiators.

US crude oil prices defy the increase in US inventories, according to the US Energy Information Administration (EIA). Stockpiles rose 5 million barrels in the last week to 467.6 million barrels, compared to analysts’ expectations for a drop of 900K.

Aside from this, China’s recent economic data revealed that the economy is tempering its growth. According to sources cited by Reuters, “A bunch of Chinese macro-economic data for April released on Tuesday confirmed the narrative of a patchy and slow recovery in the country and continue to weigh on oil market sentiment.”

WTI Price Analysis: Technical outlook

WTI has recovered some ground after dipping below the last year’s low of $70.10, reaching a two-week low of $69.44. However, WTI buyers moved in, lifting the price toward the 20-day Exponential Moving Average (EMA), which, once cleared, could pave the way to test the 50-day EMA at $74.91. Once cleared and up next would be the 100-day EMA at $76.78. Nevertheless, the Relative Strength Index (RSI) indicator continues at bearish territory, suggesting that sellers remain in charge. Therefore, WTI’s failure to crack the $73.00 PB area and a dip towards the $69.00 area is on the cards.

- Solid US housing market data and upbeat sentiment in US equities weaken the Japanese Yen.

- Improved US debt ceiling negotiations and hawkish Fed speakers keep the US Dollar climbing.

- Japanese economy surprises with better-than-expected Q1 GDP and consumption figures.

USD/JPY rises to fresh two-week highs of 137.57, propelled by higher US Treasury bond yields due to solid US data reported on Tuesday and Wednesday. In addition, an improvement in US debt ceiling negotiations between the White House and the US Congress keeps the US Dollar (USD) rising. Therefore, the USD/JPY is trading at 137.49 after hitting a daily low of 136.30.

Rising US Treasury bond yields and upbeat sentiment weaken the safe-haven Yen

US equities portray an upbeat sentiment in the financial markets, to the detriment of safe-haven peers, like the Japanese Yen (JPY). The US housing market shows signs of improvement, as April’s Building Permits dropped to -1.5%, better than the expected -3% plunge, as permits improved from 1.437M to 1.416M. Housing Starts for the same period jumped 2.2%, smashing the prior month’s data of -4.5%, growing at a 1.401M pace.

That data, alongside the latest Retail Sales and Industrial Production figures, showed that the US economy is pointing to a soft landing. The Atlanta Fed GDP Now for Q2 rose from a previous 2.6% to 2.9%.

Therefore, traders had begun to slash their bets of three rate cuts by the US Federal Reserve in 2023 amidst the ongoing hawkish rhetoric by some officials. Loretta Mester, Thomas Barkin, and Raphael Bostic continued to push back against rate cuts, though the latter has moderated its stance. On the dovish front, Aaron Golsbee and Lorie Logan took a cautious stance but emphasized that no rate cuts are expected in 2023.

Odds that the Fed would cut rates by 50 bps toward year’s end lie at 40.8%, compared to Tuesday’s 39%, according to the CME FedWatch Tool.

The US debt ceiling theme continues to grab USD/JPY traders’ attention, though a negotiation improvement calmed investors’ nerves. The US House Speaker McCarthy stated the two sides remain apart. Nevertheless, he acknowledged that a deal could be done by the week’s end. Wall Street cheered Tuesday’s results, as the three major indices posted gains above the 0.30% threshold.

Given the backdrop, US Treasury bond yields advanced, with the 10-year benchmark note rate at 3.570%, gaining three basis points. Consequently, the US Dollar Index (DXY), which tracks the US Dollar performance against a basket of six currencies, advanced 0.23%, up at 102.830.

In the meantime, the Japanese agenda revealed a surprise in Gross Domestic Product in Q1, at 0.4%, exceeding estimates of 0.1%. On a year-over-year (YoY), figures rose by 201%, above the prior’s 1.2%, while Consumption rose by 0.6%, above estimates of 0.4%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart portrays a strong uptrend facing solid resistance at around the year-to-date (YTD) highs of 137.91. Additionally, if surpassed, a six-month-old resistance trendline passes around that area, which could pave the way for the USD/JPY to test the November 30 high at 139.89 before testing 140.00. On the downside, failure to crack 138.00, a pullback towards the 137.00 mark is on the cards.

Upcoming events

- US housing market data shows the recovery, bolstering the US Dollar and limiting NZD/USD gains.

- Improving US debt ceiling discussions boost Wall Street and investor sentiment.

- Despite some dovish-leaning Fed speakers, no rate cuts are expected by year’s end.

NZD/USD holds to its earlier gains but retraces after piercing the 200-day Exponential Moving Average (EMA) at 0.6256, as data from the United States (US) shows the housing market seems to recover. Therefore, the US Dollar (USD) is appreciating and putting a lid on the NZD/USD rise. The NZD/USD is trading at 0.6238 after hitting a daily low of 0.6224.

US debt ceiling talks progress; Fed speakers maintain the hawkish tone

The NZD/USD remains underpinned by an upbeat sentiment, though at the brisk that a sudden shift could turn into losses. US debt ceiling discussions would continue today after Tuesday’s talks improved, although US House Speaker McCarthy said the two sides remain apart. Nevertheless, he acknowledged that a deal could be done by the week’s end. Wall Street cheered Tuesday’s results, as the three major indices post gains above the 0.30% threshold.

The United States (US) data showed the housing market’s recovery. April’s Building Permits improved from a -3% plunge to a -1.5% contraction, as permits improved to 1.416M, lower than March’s 1.437M. Surprisingly, Housing Starts rose by 2.2%, crushing March’s figures of -4.5% contraction, expanding at a 1.401M annualized pace.

That, alongside solid US Retail Sales and Industrial Production, revealed on Tuesday, keeps the US Dollar (USD) in the driver’s seat, cushioning the NZD/USD’s rally. The US Dollar Index (DXY), a gauge that tracks the performance of six currencies vs. the USD, climbs 0.33%, up at 102.937, a headwind for the NZD/USD.

Given the backdrop, US Treasury bond yields advanced, while bets that the Federal Reserve would cut rates in 2023 diminished. On Tuesday, odds for 75bps of rate cuts were 33.5%, while as of writing, diminished under 27%, as shown by the CME FedWatch Tool. Most investors are still pricing 50 bps of cuts by December 2023.

In the meantime, Federal Reserve speakers maintained their hawkish stance. However, the newly appointed Chicago Fed President Aaron Golsbee and Dallas Fed President Lorie Logan are leaning towards a dovish posture. Nevertheless, both commented that no rate cuts are expected by the year’s end.

On the New Zealand front, the economic calendar was empty. Nevertheless, a strong jobs report at the beginning of the month increased the likelihood of another rate hike, as the Overnight Cash Rate (OCR) sits at 5.25%. Swaps are pricing for the Reserve Bank of New Zealand (RBNZ) to raise rates to 5.50% in the upcoming May meeting.

NZD/USD Price Analysis: Technical outlook

US President Joe Biden said on Wednesday that he is confident that they will be able to reach an agreement on budget and noted that it would be catastrophic if the US failed to bay bills, per Reuters.

Additional takeaways

"We're going to come together because there is no alternative."

"This negotiation is about the outlines of what the budget will look like."

"Leaders all agree, we will not default."

"Group of negotiators met Tuesday night, will meet again Wednesday."

"Will be in close touch with negotiators during the trip."

"Will continue discussions until we reach agreement."

"Will have a news conference on Sunday on debt issue."

"Will not accept work requirements that will affect medical needs of people."

"There is a possibility of some work requirements."

Market reaction

The market mood remains relatively upbeat following these comments and the S&P 500 Index was last seen rising 0.4% on the day at 4,126.

Gold is still stalling, but strategists at Credit Suisse stay biased towards an eventual move to new record highs above $2,070/75.

Support aligns at $1,969/66

“We look for the $2,070/2,075 record highs posted in 2020 and 2022 to remain a formidable barrier for now for further sideways consolidation.”

“Post the current ranging phase, we believe the market will eventually move to new record highs, supported by lower US Real Yields. With this in mind, above $2,075 on a weekly closing basis would be seen to mark a significant break higher, opening up a move to our first core upside objective at $2,330/2360.”

“Support is seen at $1,969/66, which includes the 55-DMA, below which would point to a more decisive rejection of the $2,075/70 highs.”

- US economic data reinforces robust growth, diminishing odds for rate cuts by year-end.

- Hawkish Fed speakers bolster the US Dollar, pushing USD/MXN past critical resistance levels.

- The market awaits the Bank of Mexico’s rate decision amid anticipation of a pause in the tightening cycle.

USD/MXN rallies sharply by more than 0.50%, cracking critical resistance levels like the 17.5000 figure and the 17.6000 area, amidst a light economic calendar on the Mexican front, ahead of the Bank of Mexico’s (Banxico) decision. The latest round of economic data from the United States (US) proved that the economy is robust, while Fed speakers continued to favor rate hikes. The USD/MXN is trading at around 17.6710 after hitting a low of 17.4809.

Bank of Mexico decision looms, US data support Fed hawkish narrative

Upward pressure on the USD/MXN has been sponsored by the above reasons. Retail Sales in the US showed the consumer’s resilience, while Industrial Production showed signs of a recovery on Tuesday. Wednesday’s data showed that Building Permits in April missed estimates by 1.437M to 1.416M, while Housing Starts improved from March’s plunge of -4.5%, to 2.2% in April, to a 1.401M annualized rate.

Given that the latest data still shows signs that the economy is solid, expectations that the Federal Reserve (Fed) would cut rates by the year’s end had been pushed back. Odds for two rate cuts by December lie at 40.4%, while for three rate cuts, they diminished to 26.9%, as shown by the CME FedWatch Tool.

Hence, US Treasury bond yields reflect the above-mentioned recovering ground and underpin the US Dollar (USD), a tailwind for the USD/MXN. The USD Dollar Index (DXY) is advancing 0.38%, up at 102.989, and about to test the 100-day Exponential Moving Average (EMA) at 103.187.

On the Fed speaking front, Fed officials maintained their hawkish rhetoric, led by Loretta Mester, Thomas Barkin, and John Williams. On the more neutral spectrum remains the newly appointed Aaron Golsbee, and Lorie Logan, though both reiterated that no rate cuts are expected.

Aside from this, the debt ceiling discussions showed some improvement, despite US House Speaker McCarthy continuing to say the two sides remain apart. He acknowledged that a deal could be done by the week’s end. President Biden announced that there was “consensus, I think, among the congressional leaders that defaulting on the debt is simply not an option.”

Before the meeting even started, there was news that President Biden was going to shorten his upcoming trip to Asia and return to Washington on Sunday after the G-7 summit in Japan.

On the Mexican front, USD/MXN traders’ eyes are on Banxico’s decision on Thursday, with most analysts estimating that the central bank will pause on its tightening cycle.

USD/MXN Price Analysis: Technical outlook

Even though the USD/MXN achieved back-to-back bullish sessions, the bias remains downwards. However, today’s jump in the spot price puts into play a test of the 20-day Exponential Moving Average (EMA), which, if broken, it would open the door to test the April 2018 swing low-turned-resistance at 17.9388. A breach of the latter will expose the 18.0000 as the USD/MXN pair recovers from early-year losses. Conversely, a retracement below 17.5000 would open the door to re-test the year’s lows around 17.40s.

ING’s year-end target for EUR/USD now sits at 1.20.

The bumpy path to a higher EUR/USD

“Based on our view that the Fed tightening cycle is over and that a credit crunch makes a US recession more likely, we believe the Dollar is about to embark on a multi-quarter (if not multi-year) decline. The bulk of that Dollar decline may come in 2H23 as the US disinflation story builds and the Fed front-loads easing with 100 bps of cuts in 4Q23. That could see EUR/USD at 1.20 end year.”

“The road to a Dollar decline will not be smooth, however. The most pressing risks are the US banking crisis and the risk of a US Treasury default in the June/July window. Historically, stress in US money markets has triggered a temporary surge in the Dollar.”

“Any flash crash below 1.05 should be temporary, however.”

Did Banxico end its rate hike cycle at 11.25% in March, or will it hike again tomorrow? Economists at Commerzbank expect the Peso to struggle if Banxico remains on hold.

Finished or not? Banxico's exciting interest rate decision

“The majority of analysts surveyed by Bloomberg and Reuters expect a pause tomorrow. This could put some pressure on the Peso, as a minority still seems to expect another rate hike.”

“Fundamentally, however, we see the MXN as well supported and expect it to trade sideways around current levels. With core inflation at 7.7%, Mexico offers an attractive real interest rate in a stable political environment. Moreover, we expect Banxico to leave no doubt that it will promptly address any upside risks to inflation.”

- The index pierces 103.00 and prints new multi-week tops.

- Markets’ attention remains on the debt ceiling issue.

- US housing data came in mixed in April.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main rival currencies, keeps the buying pressure well and sound near the 103.00 region on Wednesday.

USD Index looks at debt ceiling discussions

DXY pushes higher and revisits the area just above the 103.00 barrier for the first time since early April on the back of the persistent risk aversion, while the recovery in US yields across the curve also lend wings to the dollar.

According to the bipartisan discussions that took place on Tuesday, there appears to be a glimmer of optimism regarding the resolution of the debt ceiling issue in the upcoming days despite the fact that investors' feelings of risk aversion continue to dominate.

Despite the persistent hawkish narrative from policymakers, particularly when it comes to the inflation that has remained stubbornly elevated, expectations of an impasse in the hiking cycle at the June event appear to be steady from the Fed's perspective. In this regard, R. Bostic of the Atlanta Fed stated late on Tuesday that the Fed is anticipated to face significant pressure in the event of higher unemployment and persistent inflation.

In the US calendar, Mortgage Applications decreased by 5.7% in the week ending May 12, while Housing Starts increased by 2.2% MoM (1.401 million units) and Building Permits dropped 1.5% MoM (1.416 million units) in April's housing sector data.

What to look for around USD

The index returns to the area of multi-week highs in the 103.00 zone amidst the marked resurgence of the risk-off mood among market participants.

The index seems to be facing downward pressure in light of the recent indication that the Fed will probably pause its normalization process in the near future. That said, the future direction of monetary policy will be determined by the performance of key fundamentals (employment and prices mainly).

Favouring an impasse by the Fed appears the persevering disinflation – despite consumer prices remain well above the target – incipient cracks in the labour market, the loss of momentum in the economy and rising uncertainty surrounding the US banking sector.

Key events in the US this week: MBA Mortgage Applications, Building Permits, Housing Starts (Wednesday) – Philly Fed Index, Initial Jobless Claims, CB Leading Index, Existing Home Sales (Thursday) – Fed J. Powel (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 20223. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.39% at 103.01 and the break above 103.05 (monthly high April 3) could open the door to 105.80 (200-day SMA) and then 105.88 (2023 high March 8). On the downside, the next support emerges at 101.01 (weekly low April 26) prior to 100.78 (2023 low April 14) and finally 100.00 (psychological level).

S&P 500 remains trapped in a very tight range above its 63-Day Moving Average at 4052/48, with a break below here needed to confirm a rejection of key resistance at 4195 and a renewed fall, analysts at Credit Suisse report.

Looking for a top to form beneath the 4195 YTD high

“With daily MACD momentum having turned lower, we still think the broader risk is shifting towards a ‘risk off’ phase and our bias stays lower for an eventual break below 4052/48 to confirm a near-term top for a fall to test the 200-DMA, now at 3975.”

“Above 4195 YTD high would now be seen to mark an important break higher, especially give the extreme net short in positioning to clear the way for a test of the summer 2022 high and 61.8% retracement of the entire 2022 fall at 4312/4325.”

- GBP/USD rebounds from a multi-week low, albeit lacks follow-through buying.

- Hawkish remarks by the BoE Governor Bailey boost the GBP and lend support.

- Sustained USD buying caps any further recovery and warrants caution for bulls.

The GBP/USD pair stages a goodish intraday bounce from the 1.2420 area, or over a three-week low touched this Wednesday and climbs to the top end of its daily trading range during the early North American session. The pair, however, remains in the negative territory for the second straight day and is currently placed around the 1.2470-1.2475 region, down over 0.10% for the day.

The British Pound finds some support in reaction to Bank of England (BoE) Governor Andrew Bailey's hawkish remarks and assists the GBP/USD pair to attract some buyers at lower levels. Speaking at the British Chambers of Commerce, Bailey said that inflation is much too high and we need to bring it back sustainably to our 2% target. Bailey added that the easing of labour market tightness is happening at a slower pace than expected in February and the labour market remains very tight.

The upside for the GBP/USD pair, however, remains capped, at least for the time being, amid strong follow-through US Dollar (USD) buying for the second successive day. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, hits a six-week high amid speculations that the Federal Reserve (Fed) will keep rates higher for longer, bolstered by the recent hawkish remarks by several FOMC members. That said, a combination of factors could cap gains for the buck.

US President Joe Biden and Republican leaders have expressed cautious optimism that a deal to raise the US debt ceiling is within reach. This, in turn, boosts investors' confidence and leads to a modest recovery in the global risk sentiment, which is evident from a generally positive tone around the equity markets and undermines the safe-haven Greenback. Apart from this, a modest downtick in the US Treasury bond yields is further holding back the USD bulls from placing aggressive bets.

On the economic data front, the mixed US housing market data did little to impress traders or provide any meaningful impetus to the GBP/USD pair. Nevertheless, the aforementioned fundamental backdrop suggests that the path of least resistance for the buck is to the upside. This makes it prudent to wait for strong follow-through buying before positioning for any further recovery for the major ahead of the BoE's Monetary Policy Report Hearings, scheduled on Thursday.

Technical levels to watch

USD/CNH has popped its head above 7 for the first time year. Does USD/CNH point to a broader Dollar bounce? Kit Juckes, Chief Global FX Strategist at Société Générale, believes that the USD could maintain its bid tone.

If the Yuan’s a canary, the Dollar’s bounce has further to go

“We are now likely to see USD/CNY head higher – to 7.3 by the end of this year.”

“If USD/CNH consolidates above 7 in the next few days, that may well open the way for further downside tests of USD/GBP and EUR/USD (and AUD/USD, for that matter). Meanwhile though, our USD/CNH forecast change also implies a solid gain ahead for CAD/CNH.”

- EUR/USD loses further ground and trades closer to 1.0800.

- The loss of this level exposes a move to April low at 1.0788.

EUR/USD maintains the bearish price action and slips back to the vicinity of the 1.0800 neighbourhood on Wednesday.

The 1.0800 area appears supported by the temporary 100-day SMA (1.0804) and the loss of this region could trigger a deeper drop to, initially, the April low at 1.0788 (April 3). Further south emerges the March bottom of 1.0516 (March 15).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0460.

EUR/USD daily chart

- USD/CAD surrenders its modest intraday gains and drops to a fresh daily low in the last hour.

- A modest uptick in Oil prices underpins the Loonie and exerts downward pressure on the pair.

- Sustained USD buying might hold back bearish traders from placing fresh bets and limit losses.

The USD/CAD pair struggles to capitalize on its modest intraday gains and meets with a fresh supply near the 1.3535 region on Wednesday. Spot prices drop to a fresh daily low, around the 1.3470 region during the North American session, though the downside seems cushioned amid strong follow-through US Dollar (USD) buying.

In fact, the USD Index (DYX), which tracks the Greenback against a basket of currencies, sticks to its gains just below its highest level since March 27 touched today amid speculations that the Federal Reserve (Fed) will keep rates higher for longer. In fact, the recent hawkish comments by several FOMC members pushed back against market expectations for interest rate cuts later this year. This, in turn, continues to boost the buck and lends some support to the USD/CAD pair.

That said, the emergence of some buying around Crude Oil prices, along with hotter-than-expected Canadian consumer inflation figures released on Tuesday, underpin the commodity-linked Loonie. This, in turn, attracts some sellers around the USD/CAD pair and contributes to the intraday pullback of over 50 pips. Hence, it will be prudent to wait for strong follow-through buying and acceptance above the 100-day Simple Moving Average (SMA) before placing fresh bullish bets.

On the economic data front, the mixed US housing market data did little to provide any meaningful impetus to the USD/CAD pair.

The US Census Bureau reported that Housing Starts climbed 2.2% on a monthly basis in April as compared to the 1.9% rise anticipated and the 4.5% decline registered in the previous month. Building Permits, however, fell by 1.5% last month against consensus estimates pointing to a 3% increase and the 3% fall recorded in March.

Technical levels to watch

- Building Permits in the US declined unexpectedly in April.

- US Dollar Index clings to strong daily gains near 103.00.

The monthly data published by the US Census Bureau revealed on Wednesday that Housing Starts rose by 2.2% on a monthly basis in April following March 4.5% decline. This reading came in better than the market expectation for an increase of 1.9%.

In the same period, Building Permits fell 1.5%, compared to analysts' estimate for a 3% growth.

Market reaction

The US Dollar Index preserves its bullish momentum after these data and was last seen rising 0.4% on the day at 103.00.

- DXY extends the upside and pierces the 103.00 barrier.

- A convincing break above 103.05 exposes further gains.

DXY adds to Tuesday’s advance and climbs to multi-week peaks just beyond the 103.00 barrier on Wednesday.

Further upside seems like the most probable scenario for the index so far. Against that, a sustained surpassing of the April top at 103.05 (April 3) is expected to mitigate the downside pressure and encourage DXY to extend its march north further.

The index is seen facing the next resistance level of significance not before the 2023 top of 105.88 (March 8).

Looking at the broader picture, while below the 200-day SMA today at 105.80, the outlook for the index is expected to remain negative.

DXY daily chart

In an interview with CNBC on Wednesday, US House Speaker Kevin McCarthy defended Republicans' call for greater spending limits, as reported by Reuters.

Additional takeaways

"Work requirements help people get jobs, help the economy and that's what we should be doing."

"The problem is the spending level."

"There will not be tax discussion in debt ceiling talks."

"Now we have an opportunity to find common ground but only a few days to get the job done."

"I'm going to spend all my effort to make sure we get the job done."

"The only thing I'm confident about is now we have a structure to find a way to come to a conclusion."

Market reaction

These comments don't seem to be having a significant impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was up 0.3% on the day at 102.90.

Economists at TD Securities believe that discretionary trades have yet to buy into the Gold rally.

Positioning in Gold is far from bloated

“The bar for algorithmic liquidations in Gold to pressure prices is elevated, whereas Shanghai trader length is nearing year-to-date lows. Further, dry-powder analysis highlights that position sizing for gold bulls remains near average levels, which points to less pain associated with the recent pullback. Our gauge of discretionary trader positioning continues to suggest that this cohort has yet to participate in the precious metals rally.”

“Looking forward, we expect discretionary capital to flow towards Gold given strong historical linkages with market expectations for a deepening Fed cutting cycle over the next year.”

In a speech to the British Chambers of Commerce on Wednesday, Bank of England (BoE) Governor Andrew Bailey said there are signs that the labour market is loosening a little, per Reuters.

Additional takeaways

"Inflation is much too high and we need to bring it back sustainably to our 2% target."

"After the initial recovery in 2020, the level of economic activity, measured by monthly GDP, has failed to grow beyond its pre-pandemic level on a sustained basis."

"We know that higher interest rates make things hard for many people but we’re conscious that high inflation always hits the least well-off the hardest."

"I’d like to push back strongly against one argument you sometimes hear, which is that inflation is high because monetary policy was too loose in the past."

"Things are looking a bit brighter than they did a couple of months ago."

"We have good reasons to expect inflation to fall sharply over the coming months, beginning with the April number."

"As headline inflation falls, second-round effects are unlikely to go away as quickly as they appeared."

"The easing of labour market tightness is happening at a slower pace than we expected in February and the labour market remains very tight."

Market reaction

GBP/USD managed to rebound from the multi-week low it set near 1.2420 after these comments. As of writing, the pair was trading at 1.2463, losing 0.2% on a daily basis.

Economists at ING expect the US Dollar to remain supported amid the crisis over raising the debt ceiling.

Tentative debt-limit progress not enough to lift sentiment

“Debt-limit negotiations in Washington yielded a more conciliatory tone, but not enough tangible progress to keep markets away from their defensive Dollar positions. This may not change for now.”

“The Dollar is seeing a new round of strengthening and we think that there is still room for appreciation until we get clearer indications that the two sides have gotten closer on core issues when it comes to debt-limit negotiations.”

“We still suspect the lingering uncertainty will prompt markets to favour defensive trades, and DXY could extend its rebound to the 103.50/104.00 area by the end of the week.”

- EUR/JPY extends the weekly leg higher and surpasses 148.00.

- Extra strength could see the weekly high near 149.30 revisited.

EUR/JPY advances for the fourth session in a row and clinches multi-day highs further north of the 148.00 barrier on Wednesday.

Extra gains beyond the latter could encourage the cross to challenge the weekly peak at 149.26 (May 8), while the surpass of this level could pave the way for a potential test of the YTD high at 151.61 (May 2).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 143.19.

EUR/JPY daily chart

- Gold price languishes near a two-week low amid sustained US Dollar buying on Wednesday.

- Hawkish Federal Reserve expectations contribute to capping the upside for the XAU/USD.

- Concerns about the US debt ceiling lend some support and help limit further losses, for now.

Gold price enters a bearish consolidation phase and oscillates in a narrow trading band just above a two-week low touched earlier this Wednesday. The XAU/USD remains on the defensive through the first half of the European session and currently trades around the $1,987-$1,988 region, down less than 0.10% for the day.

Stronger US Dollar acts as headwind for Gold price

The US Dollar (USD) gains positive traction for the second straight day and climbs to a nearly two-month high, which turns out to be a key factor undermining Gold price. The recent hawkish comments from several Federal Reserve (Fed) officials pushed back against speculations for interest rate cuts later this year and continue to underpin the Greenback. In fact, Cleveland Fed President Loretta Mester said on Tuesday that interest rates are not at a sufficiently restrictive level and that the central bank isn't at the spot to hold rates yet.

Hawkish Federal Reserve expectations contribute to cap XAU/USD

Separately, Chicago Fed President Austan Goolsbee said that it was premature to be discussing interest rate cuts. Furthermore, Atlanta Fed president Raphael Bostic noted that the central bank would need to stay super strong in fighting inflation, even if the unemployment rate starts to rise later in the year. This comes on the back of a rise in consumer inflation expectations and lifts market bets that the Fed will keep interest rates higher for longer, which is seen as another factor acting as a headwind for the non-yielding Gold price.

US debt ceiling concerns lend some support to Gold price

The CME FedWatch tool, however, indicates a greater chance that the Fed will stand pat on rates in June. This, along with a standoff to raise the federal government's borrowing limit, lends some support to the safe-haven Gold price and helps limit the downside, at least for the time being. House of Representatives Speaker Kevin McCarthy told reporters that the two sides were still far apart. US President Joe Biden and Republican leaders, meanwhile, have expressed cautious optimism that a deal to raise the US debt ceiling is within reach.

Bias seems tilted in favour of XAU/USD bears

This leads to a modest recovery in the global risk sentiment, which is evident from a generally positive tone around the equity markets and might hold back traders from placing aggressive bullish bets around the Gold price. Moreover, the lack of any buying interest suggests that the path of least resistance for the XAU is to the downside and any attempted recovery runs the risk of fizzling out rather quickly. Market participants now look to the US housing market data and developments surrounding the US debt-limit negotiations for a fresh impetus.

Gold price technical outlook