- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 18-08-2022

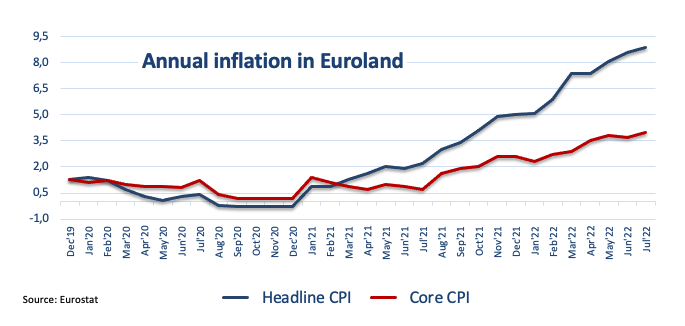

- EUR/USD holds lower ground after refreshing monthly bottom the previous day.

- ECB policymakers, German Finance Ministry’s report contribute to the economic slowdown fears.

- Fed policymakers, firmer US data adds strength to the US dollar.

- German PPI, risk catalysts to help determine short-term directions.

EUR/USD dribbles around 1.0090 during the sluggish Asian session on Friday, after crashing to refresh monthly low the previous day. The major currency pair recently bear the burden of a firmer US dollar, as well as grim economic concerns at home.

The US dollar jumped to the highest levels in one month late Thursday as price-positive numbers from Philadelphia Fed Manufacturing Survey and the weekly Initial Jobless Claims rejected the US recession fears. The activity gauge rallied to 6.2 for August versus -5 expected and -12.3 prior while the weekly jobless claims dropped to 250K, below 265K market consensus and 252K revised prior. With this, the US Dollar Index (DXY) refreshed its monthly high to 107.56, at 107.51 by the press time.

Hawkish Fedspeak and economic concerns surrounding China, as well as Europe, also contributed to the DXY strength, mainly due to the greenback’s safe-haven demand. San Francisco Fed President Mary Daly mentioned that they (Fed) will continue to raise the rates to "right-size it." The policymaker added that either 50 basis points or a 75 basis points hike would be appropriate while signaling the move for the September rate decision. However, Minneapolis Federal Reserve Neel Kashkari mentioned that, per Reuters, he does not believe the county is currently in a recession. Further, the all-time hawk St. Louis Fed President James Bullard said he is leaning towards another 75 bps rate hike in September.

Goldman Sachs and Nomura both cut the dragon nation’s growth forecasts after witnessing the latest jump in the covid numbers. Also negatively impacting the Chinese economy are the doubts over the People’s Bank of China’s (PBOC) capacity to tame recession woes. Additionally, comments from the US Trade Representative’s office stating, “Early this autumn, the US and Taiwan will begin formal negotiations on a trade initiative,” seem to renew the fears of the US-China tussle and also roil the mood.

“The economic outlook for Germany, Europe's largest economy, is gloomy due to energy price rises and supply chain disruptions,” the German Finance Ministry said in its August monthly report, per Reuters.

Elsewhere, ECB executive board member Isabel Schnabel said on Thursday, "Recession on its own would not be enough to control inflation." The policymaker also backed the regional central bank’s current policies. Following that, ECB Governing Council member Martins Kazaks said in an interview with Latvia’s TV3 on Thursday, “the ECB will continue to hike interest rates to tame inflation,” per Bloomberg.

Against this backdrop, Wall Street closed mixed and restrict the S&P 500 Futures while the US 10-year Treasury yields retreated from their monthly high to 2.875% by the press time.

Looking forward, Germany’s Producer Price Index (PPI) for July, expected 32% YoY versus 32.7% prior, will decorate the calendar. However, major attention will be given to qualitative catalysts for better trade-related decision-making.

Technical analysis

A clear downside break of a three-week-old ascending trend line, around 1.0180 by the press time, keeps EUR/USD bears hopeful of revisiting the yearly low of 0.9952.

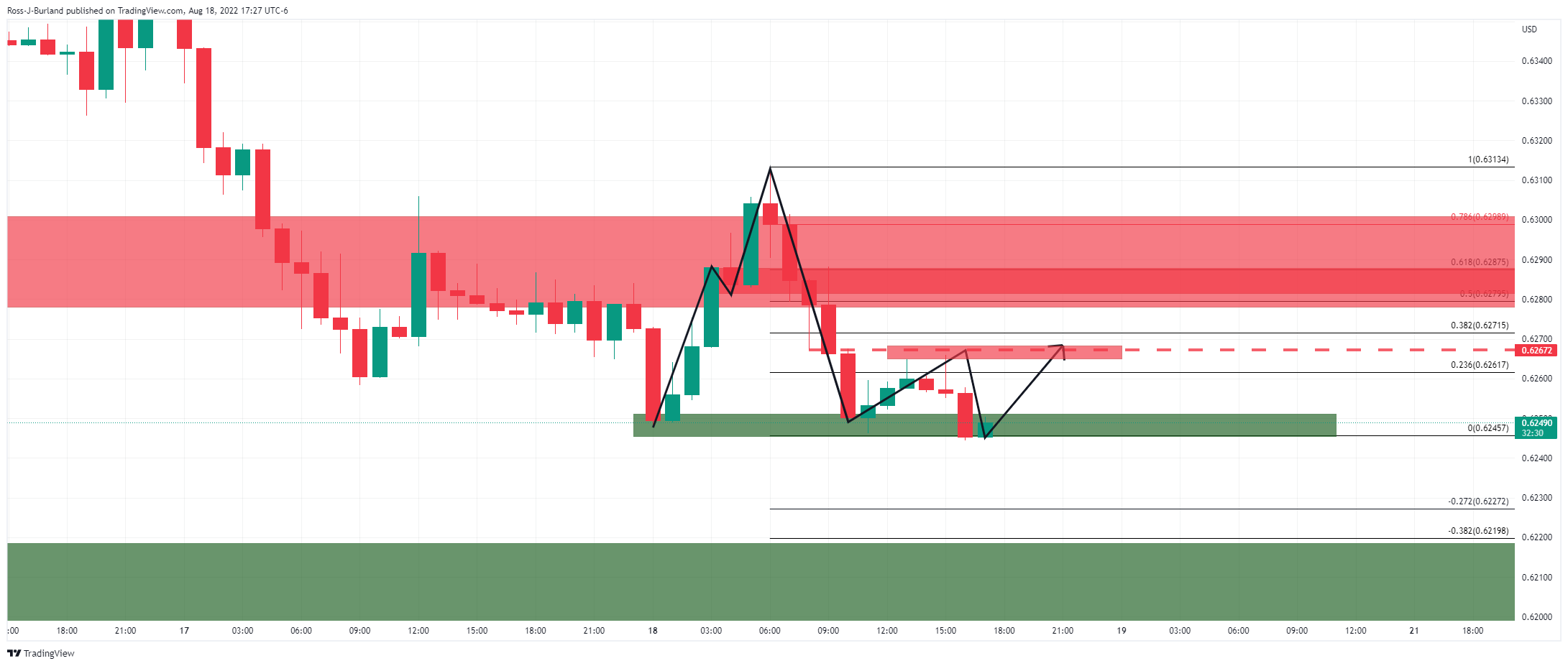

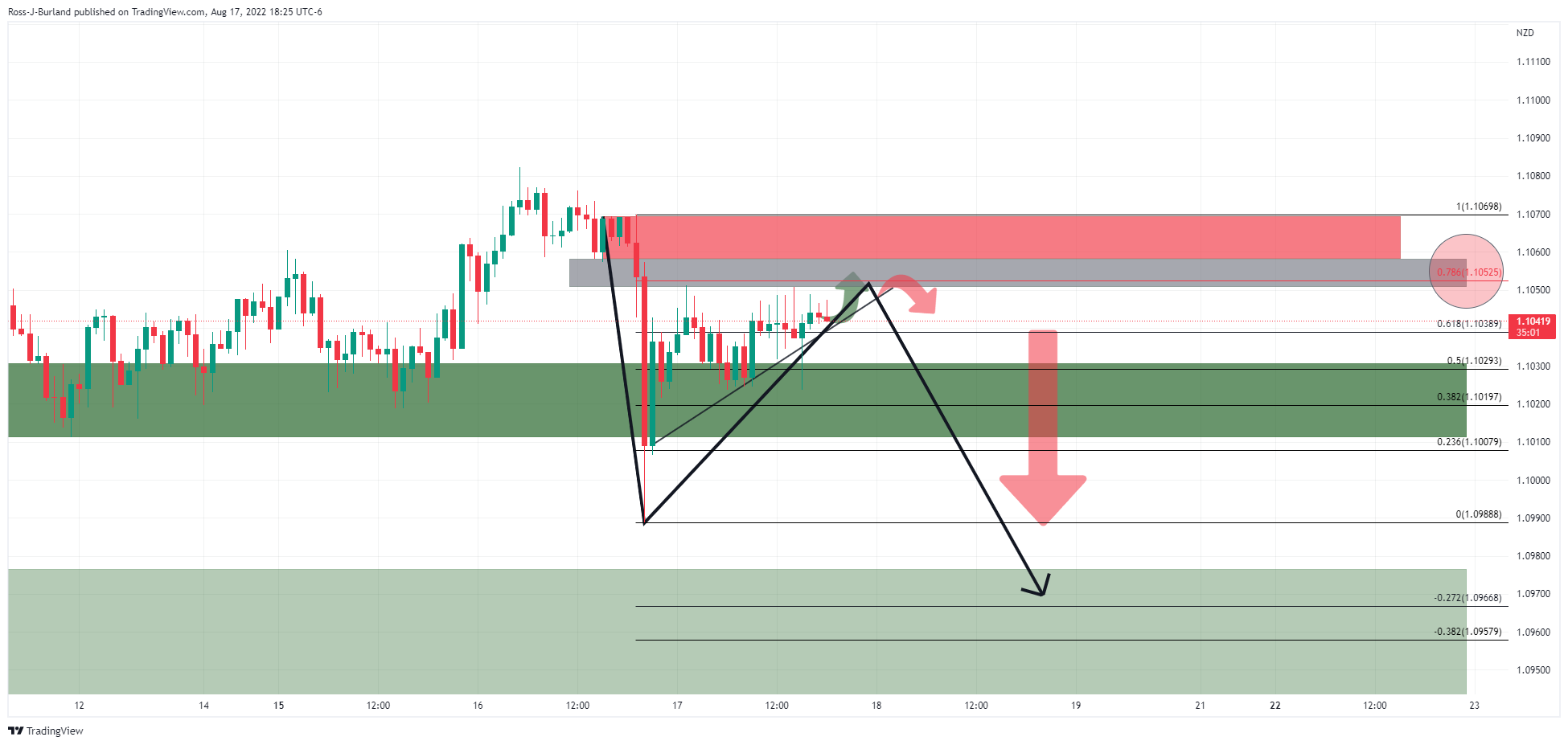

- NZD/USD bears moved in early doors, could be clearing the path for a bullish correction.

- US dollar is stalling on the bid which is bullish for commodity-fx.

NZD/USD bulls could be about to step in following an early Asian slide due to the trade deficit hitting a record high. This has seen the price take on a key support area and prior lows early doors. However, if the equities start off on the right foot in Tokyo on the heels of a positive close on Wall Street, then we could see a move higher in the kiwi. The following illustrates such prospects:

NZD/USD daily chart

The daily chart shows that the price has broken below the trendline and a reversion could be on the cards for the day ahead. The support area, however, could be seen first given the momentum of the price. With that being said, the US dollar could be on the verge of a bearish correction:

DXY H1 chart

NZD/USD H1 chart

The M-formation is a reversion pattern that could see the price moved in towards the neckline, or at least for a higher correction.

NZD/USD 5-min chart

The price will not likely do anything until Tokyo and given the low volume overnight on Wall Street and the volatility, those trading the kiwi could be in for a bumpy and drawn-out ride. However, The 5-min chart's structures are illustrated above and should the bulls commit, then a correction could play out something along the lines of the above over the course of Friday.

- Silver price stumbles under the $20.00 figure, post-FOMC minutes.

- US economic data was mixed, though the labor market still signals the economy is solid.

- Fed officials remain committed to tackling inflation, though the US economic outlook remains unknown.

Silver price slides, extending its losses to five consecutive days, amidst an upbeat market mood, late in the Wall Street close, which weighed on the non-yielding metal. Additionally, broad US dollar strength kept the white metal prices pressured as a reaction to Fed officials reiterating the need to bring inflation down, while US jobs data further cemented the case for a September rate hike.

The XAG/USD is trading at $19.50, slightly down, after hitting on Thursday a daily high of $19.93.

Wall Street finished with solid gains amidst thin liquidity trading. The US Department of Labour reported that claims for unemployment in the week ending on August 13 slid less than estimations, while the housing market showed signs of cooling down. Existing Home Sales for July decreased by 5.9%, the lowest since May 2020.

Regarding Fed commentary, San Francisco’s Mary Daly said it is too early to declare victory on inflation and backed a 50 or 75 bps hike for September. Esther George of the Kansas City Fed added that core inflation is “hardly comforting” and that further rate hikes are coming.

Late in the day, the St. Louis Fed uber-hawk James Bullard commented that he’s leaning towards a 75 bps rate hike in September, while Minnesota Fed’s Neil Kashkari said there’s more work to be done while adding that he’s not sure if the Fed can avoid a recession.

Even though Kashkara acknowledged that he’s unsure about reaching the Fed’s goal without a recession, most officials remain laser-focused on tackling inflation. Meaning, that further rate hikes are expected for the rest of 2022 and probably the first half of 2023.

In the meantime, money market futures STIRs, have fully priced a 50 bps hike in September. But odds of a 75 bps increase are up at 78%, after tumbling towards 50% on Wednesday, following the release of July’s FOMC minutes.

Aside from this, the US Dolar Index, a measure of the greenback’s value against a basket of peers, reached three-week highs, gaining 0.77%, up at 107.492, a headwind for precious metals prices. On the contrary, most US Treasury bond yields, led by the 10-year benchmark note rate, edged down two basis points, at 2.886%.

That said, XAG/USD prices would remain downward pressured, due to the US Federal Reserve tightening cycle. If the US central bank can achieve a “soft” landing, silver traders should expect further selling pressure stepping in. Contrarily, if US economic growth decelerates and causes a recession, safe-haven flows could benefit the white metal.

Silver (XAG/USD) Key Technical Levels

- AUD/NZD holds onto the previous day’s bullish bias after New Zealand foreign trade numbers for July.

- Trade deficit widened on YoY but eased on MoM, Imports-Exports rose during July.

- Convergence of 100-SMA, three-week-old resistance line challenge bulls.

AUD/NZD bulls attack a short-term key hurdle surrounding 1.1070 on New Zealand’s mixed trade numbers for July, published early Friday. With this, the pair extends the previous day’s recovery moves amid a sluggish Asian session.

New Zealand Trade Balance dropped to $-11.64B YoY versus $-10.94B prior while improving on MoM to $-1092M from $-1102M previous readings. Further, Imports grew to $7.77B from $7.38B whereas Exports rose to $6.68B compared to $6.27B prior.

Technically, the pair pokes the convergence of the 100-SMA and a downward sloping resistance line from late July.

Given the recent highlight low on the RSI (14) backing the higher low on AUD/NZD prices, the quote is likely to remain firmer.

However, the weekly top surrounding 1.1085 acts as an extra upside filter for the pair buyers to watch before taking control. Following that, a run-up towards the monthly high near 1.1135 can’t be ruled out.

Alternatively, 61.8% and 78.6% Fibonacci retracement of June-July upside, respectively around 1.1040 and 1.10000, could challenge the AUD/NZD bears.

AUD/NZD: Four-hour chart

Trend: Further upside expected

- AUD/USD stays defensive around two-week low, after four-day downtrend.

- Fedspeak, firmer US data underpins DXY run-up to refresh monthly high.

- Downbeat Aussie Employment Change, fears surrounding China also favor bears.

- Light calendar at home and abroad keeps risk catalysts in the driver’s seat.

AUD/USD remains depressed at around 0.6910 during Friday’s initial Asian session, after refreshing a fortnight low during the four-day downtrend. That said, the Aussie pair’s latest weakness could be linked to the broad US dollar strength, as well as downbeat catalysts surrounding Australia and China, due to strong Aussie-China trade ties.

The greenback’s gauge versus the six major currencies, namely the US Dollar Index (DXY), rose to the highest levels in one month during the previous day as price-positive numbers from Philadelphia Fed Manufacturing Survey and the weekly Initial Jobless Claims rejected the US recession fears. The activity gauge rallied to 6.2 for August versus -5 expected and -12.3 prior while the weekly jobless claims dropped to 250K, below 265K market consensus and 252K revised prior.

In addition to the upbeat US data, hawkish Fedspeak also favored the DXY bulls. San Francisco Fed President Mary Daly mentioned that they (Fed) will continue to raise the rates to "right-size it." The policymaker added that either 50 basis points or a 75 basis points hike would be appropriate while signaling the move for the September rate decision. However, Minneapolis Federal Reserve Neel Kashkari mentioned that, per Reuters, he does not believe the county is currently in a recession. Further, the all-time hawk St. Louis Fed President James Bullard said he is leaning towards another 75 bps rate hike in September.

Elsewhere, economic fears surrounding China and Europe add strength to the US dollar’s safe-haven demand, as well as exert downside pressure on the AUD/USD prices. Goldman Sachs and Nomura both cut the dragon nation’s growth forecasts after witnessing the latest jump in the covid numbers. Also negatively impacting the Chinese economy are the doubts over the People’s Bank of China’s (PBOC) capacity to tame recession woes. Additionally, comments from the US Trade Representative’s office stating, “Early this autumn, the US and Taiwan will begin formal negotiations on a trade initiative,” seem to renew the fears of the US-China tussle and also roil the mood.

“The economic outlook for Germany, Europe's largest economy, is gloomy due to energy price rises and supply chain disruptions,” the German Finance Ministry said in its August monthly report, per Reuters.

It should be noted that Australia’s headline Employment Change surprised markets with a slump to -40.9K for July versus 25K expected and 88.4K prior while Unemployment Rate eased to 3.4% versus 3.5% expected and prior. Previously, Australia’s second quarter (Q2) Wage Price Index (Q2) also eased below market forecasts and marked downbeat real growth due to high inflation in Canberra.

Against this backdrop, Wall Street closed mixed while the US 10-year Treasury yields retreated from their monthly high.

Looking forward, AUD/USD traders should keep their eyes on the risk catalysts amid a light calendar.

Technical analysis

50-DMA joins multiple levels marked since early July to restrict AUD/USD downside around 0.6900, a break of which could extend the latest south-run towards 0.6760 before highlighting the yearly low of 0.6678 to the bears. Alternatively, corrective pullback remains elusive until crossing one-month-old previous support around 0.6890.

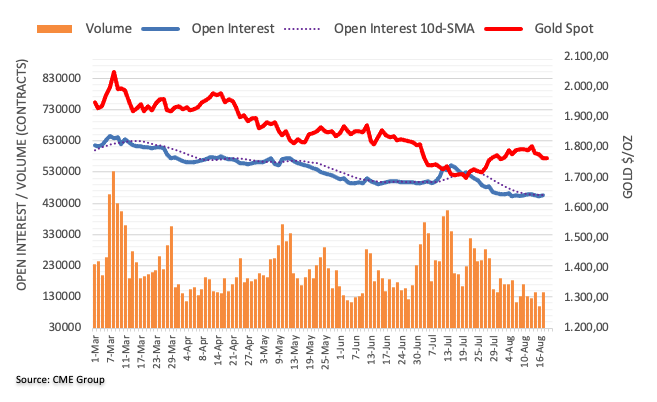

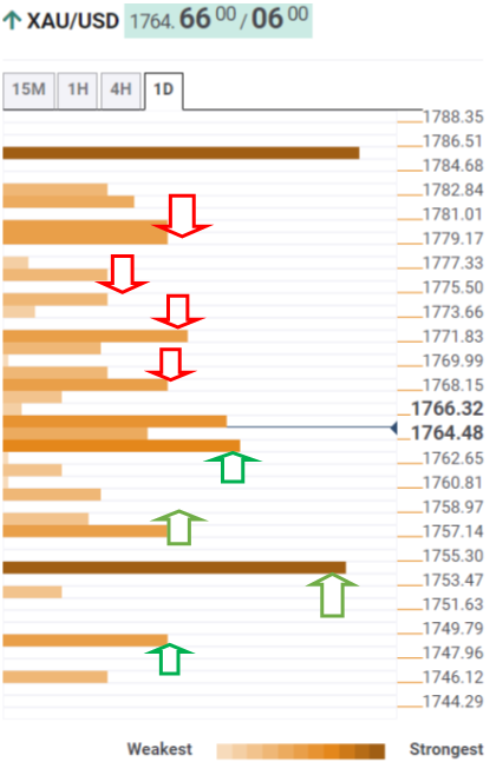

- Gold price stays pressured inside a bullish chart pattern after declining for four consecutive days.

- Mostly hawkish Fedspeak, fears surrounding China recession exert downside pressure.

- Firmer US data also helped XAU/USD bears to keep reins.

- A light calendar keeps risk catalysts in the driver’s seat and could help extend downside bias.

Gold price (XAU/USD) licks its wounds around a fortnight low near $1,760, flashed the previous day, as traders seek fresh clues inside a bullish chart pattern during Friday’s initial Asian session. That said, the precious metal dropped during the last four consecutive days amid the broad US dollar strength, mainly favored by the hawkish Fedspeak and the firmer US data, not to forget recession woes in China and Europe.

US Dollar Index (DXY) rose to the highest levels in one month during the previous day on price-positive numbers from Philadelphia Fed Manufacturing Survey and the weekly Initial Jobless Claims. That said, the activity gauge rallied to 6.2 for August versus -5 expected and -12.3 prior while the weekly jobless claims dropped to 250K, below 265K market consensus and 252K revised prior.

Elsewhere, San Francisco Fed President Mary Daly mentioned that they (Fed) will continue to raise the rates to "right-size it." The policymaker added that either 50 basis points or a 75 basis points hike would be appropriate, while signaling the move for the September rate decision. However, Minneapolis Federal Reserve Neel Kashkari mentioned that, per Reuters, he does not believe the county is currently in a recession. Further, the all-time hawk St. Louis Fed President James Bullard said he is leaning towards another 75 bps rate hike in September.

It should be noted that Goldman Sachs and Nomura both cut the dragon nation’s growth forecasts after witnessing the latest jump in the covid numbers. Also negatively impacting the Chinese economy are the doubts over the People’s Bank of China’s (PBOC) capacity to tame recession woes. Additionally, comments from the US Trade Representative’s office stating, “Early this autumn, the US and Taiwan will begin formal negotiations on a trade initiative,” seem to renew the fears of the US-China tussle and also roil the mood. Considering Beijing’s status as among the world’s top gold consumers, negatives for the nation weigh on the XAU/USD prices.

On a different page, "The economic outlook for Germany, Europe's largest economy, is gloomy due to energy price rises and supply chain disruptions," the German Finance Ministry said in its August monthly report, per Reuters.

Amid these plays, Wall Street closed mixed while the US 10-year Treasury yields retreated from their monthly high.

Looking forward, a lack of major data/events could help gold sellers to keep reins.

Technical analysis

Gold price holds lower ground near the support line of a one-week-old falling wedge bullish chart pattern.

Given the nearly oversold RSI conditions and the metal’s refrain to defy the wedge, by breaking below the support line figure of $1,754, XAU/USD price may remain doubtful for further declines.

Even if the quote drops below $1,754, the 200-SMA level of $1,750 could act as an extra challenge for the metal bears.

Meanwhile, upside clearance of the $1,769 will confirm the bullish chart pattern, which in turn (theoretically) suggests a run-up towards $1,820. However, the 50-SMA and the monthly high, respectively around $1,782 and $1,808, could challenge the gold buyers in between.

Gold: Four-hour chart

Trend: Limited downside expected

- The GBP/JPY snapped two days of losses and erased Wednesday’s gains on Thursday.

- In the near term, the GBP/JPY hourly chart formed a head-and-shoulders chart pattern, targeting 161.00.

On Thursday, the GBP/JPY finished the session in the red after hitting a daily high at 163.24 but tumbled towards the 162.10s region due to a shift in sentiment. As the Asian Pacific session begins, the GBP/JPY edges slightly up, trading at 162.10 at the time of writing.

Wall Street closed Thursday’s session in the green, erasing earlier losses. Asian equity futures are mixed, while in the FX space, the British pound is the laggard, while the yen position is slightly better than its British counterpart.

GBP/JPY Price Analysis: Technical outlook

Reviewing the daily chart, the GBP/JPY is still neutral-biased. On Thursday, the GBP/JPY failure to decisively break above the 100-day EMA exacerbated a fall from above 163.00s to current price levels, meaning sellers regained control.

If GBP/JPY sellers decisively break below August’s 18 low at 161.68, that could pave the way for further downside. On the flip side, a break above the 20-day EMA at 162.65 could send the pair rallying towards the 100-day EMA at 163.69.

Zooming into the one-hour scale, the GBP/JPY formed a head-and-shoulders chart pattern, meaning further downside pressure is expected. Nevertheless, a break above 162,37 would negate the chart pattern.

The GBP/JPY first support would be the 100-hour EMA at 161.96. A breach of the latter will expose the August 17 low at 161.68, followed by the S1 daily pivot at 161,41, before hitting the head-and-shoulders pattern at 161.00.

GBP/JPY Hourly chart

GBP/JPY Key Technical Levels

“Chinese banks will likely trim their benchmark loan prime rates Monday for the first time in months to help spur borrowing demand and reverse a sharp slump in consumer and business sentiment,” per Bloomberg’s latest survey published on late Thursday.

Key findings

The one-year loan prime rate -- the de facto benchmark lending rate for banks --is expected to be cut by 10 basis points to 3.6%, according to all 16 economists polled by Bloomberg. That would be the first reduction in that rate since January.

Economists are more divided on the five-year LPR, a reference for mortgage costs. The median estimate is for a 10-basis point reduction to 4.35%, though six of the 16 economists expect that rate to be trimmed by an even larger margin of 15 points. Lenders last reduced the long-term loan rate in May by 15 basis points, a record.

Some economists have warned of a 'liquidity trap' in China, where low interest rates fail to spur lending in the economy, given very weak consumer and business confidence levels.

Even with the recent policy rate cut and moves by banks to spur lending, economists have warned the country will need to do more to bolster growth in the months ahead, including boosting fiscal policy.

Economists have been downgrading their gross domestic product forecasts further below 4% as Covid Zero and the mortgage crisis batter the economy.

The economic outlook for Germany, Europe's largest economy, is gloomy due to energy price rises and supply chain disruptions, the Finance Ministry said in its August monthly report, published on Friday, reported Reuters.

Key statements

The outlook for the further development (of the economy) is currently noticeably gloomy, marked by ‘a high degree of uncertainty’.

The significantly lower gas supplies from Russia, the persistently high price increases for energy and, increasingly, other goods, as well as the longer-than-expected supply chain disruptions, also in connection with China's zero-COVID policy, are weighing heavily on the economy's development.

The government will present updated economic projections on Oct. 12.

Market reaction

Given the early Asian session’s inaction, EUR/USD fails to react to the news and was last seen around the one-month low flashed the previous day, at 1.0900 by the press time.

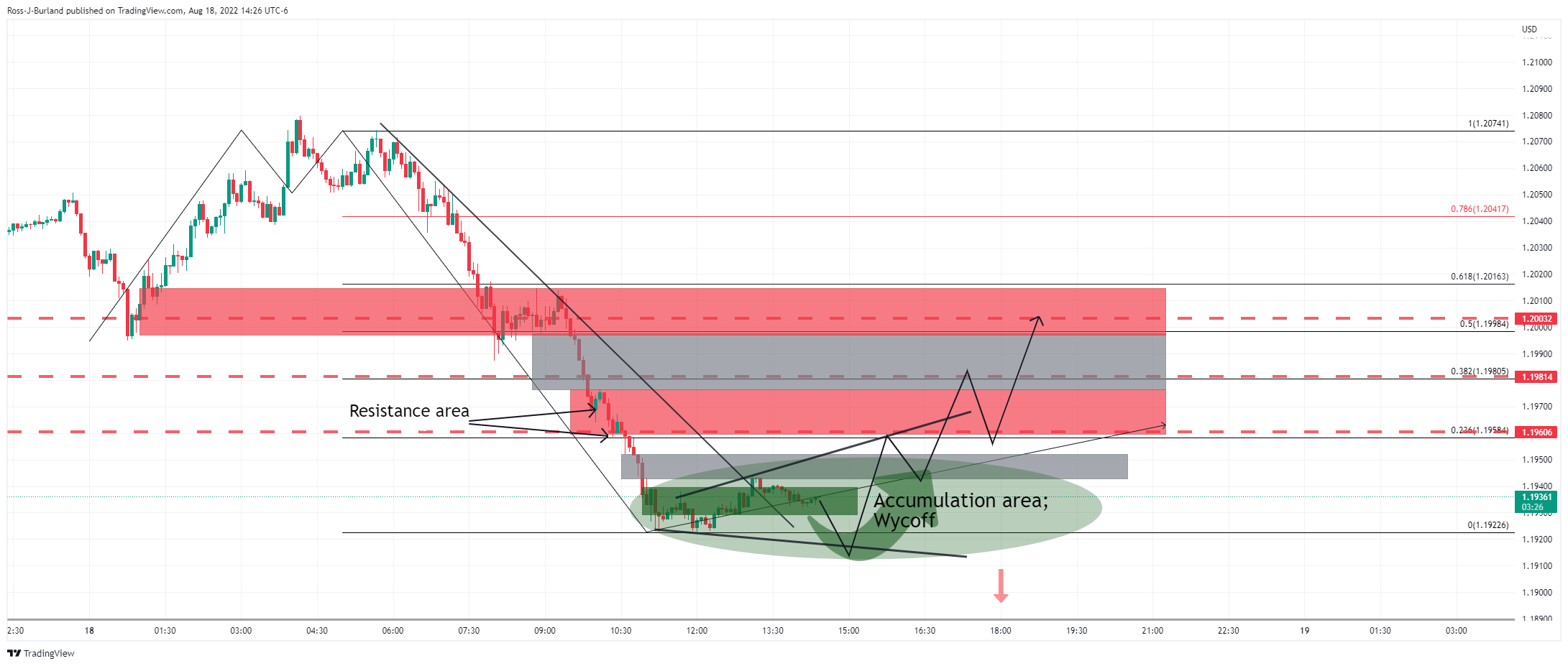

- The EUR/USD breached the 1.0100 mark; a daily close below 1.0096 paves the way towards parity.

- In the near term, the EUR/USD could print a leg-up towards 1.0120-30, before re-testing parity.

The EUR/USD slides below the 1.0100 figure for the first time since July 27, as EUR sellers eye a daily close below 1.0096, which could pave the way for a re-test of the pair’s parity. At the time of writing, the EUR/USD is trading at 1.0089, well below its opening price, after reaching a daily high of 1.0184.

EUR/USD Price Analysis: Technical outlook

Since the beginning of the week, the EUR/USD began its free fall, from around 1.0268, exacerbated by the release of important US economic data. That, alongside the release of the FOMC minutes, were the reasons for initial EUR weakness. Nevertheless, buyers hold the fort around 1.0100 before giving way to EUR/USD sellers.

On Thursday, the EUR/USD broke below the July 27 daily low at 1.0096, positioning sellers before launching an assault towards parity. The Relative Strength Index (RSI) at 39.65, pointing downwards, provides enough room for sellers before reaching oversold conditions.

Therefore, the EUR/USD’s next support would be July’s 8 daily low at 1.0078. Once cleared, there’s nothing in the way for a re-test of 1.0000, followed by the YTD low at 0.9952.

EUR/USD Daily chart

EUR/USD Daily chart

In the one-hour scale, the EUR/USD is also downward biased, but the Relative Strength Index (RSI) at oversold territory might suggest the pair can print a leg-up before resuming the downtrend. If the EUR/USD jumps above the 1.0099 intraday swing high, that could exacerbate a move towards August’s 16 low at 1.0122 or to the 50% Fibonacci retracement at 1.0133. Once that’s said and done, a fall towards 1.0000 is on the cards.

EUR/USD Hourly chart

EUR/USD Key Technical Levels

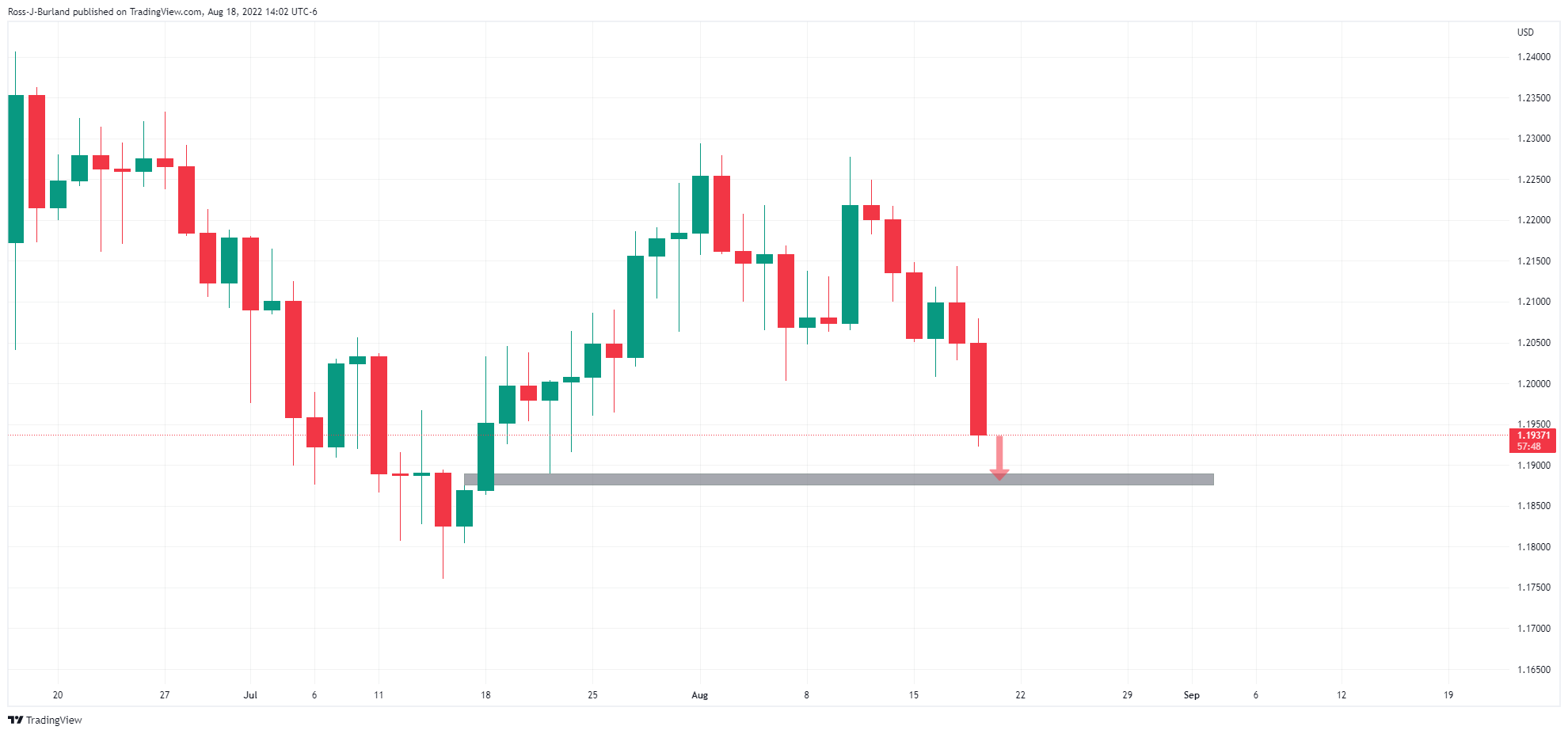

- GBP/USD short-term time frame bulls are moving in and the focus is on a bullish correction.

- The daily chart, however, offers the prospects of a lower low for the day ahead.

GBP/USD is under pressure following a resurgence in the US dollar and the following illustrates the volatility seen around the Federal Open Market Committee minutes with two-way business around the 24-hour forex session on Thursday.

In the prior analysis, GBP/USD bulls correcting the price towards 1.2050 into the FOMC minutes, it was noted that the bulls were in play with eyes on a move higher in order to restest resistance and mitigate price imbalances on the hourly and 15-min charts respectively, and as follows:

It was stated that the hourly chart, above, showed that the price could have been on the verge of a downside extension. However, it was also noted that it was in a corrective phase at the time of writing. The 15-minute charts identified areas of price imbalances, as per the greyed-out areas below:

This left a 38.2% ratio and the 50% mean reversion level vulnerable in and around the FOMC minutes.

GBP/USD live market

The price corrected higher, but the volatility and lack of structure have been a tricky one to navigate due to fake out after fakeout, at least on the hourly chart.

With that being said, the price is now starting to accumulate, so a potential reversion of the bearish impulse could be opening an opportunity for the day ahead. However, there is a caveat to this due to the prospects of a deeper move on the daily chart:

GBP/USD daily chart

The bears could be on the verge of mitigation of the price imbalance between 1.1875 and 1.1889 which makes buying the dip on the lower time frames like trying to catch a falling knife.

Nevertheless, should the minuite charts offer a bullish structure and opportunity, it could look something like as follows:

The hourly charts Fibonacci retracement scale aligns with prior structure areas as illustrated above and below, zoomed in:

The M-formation is a reversion pattern, and the price would be expected to correct higher now that we have seen a deceleration of the supply. This gives rise to an opportunity to buy into the correction on lower time frames:

GBP/USD 15 & 5-min charts

As illustrated, the price is in a phase of accumulation, moving out of the resistance trendline. Should the bulls stay in charge, then the above scenarios could play out in either an imminent breakout of the structure higher or a protracted phase of price discovery allowing for a dip lower and some sideways price action within a broadening formation and range.

What you need to take care of on Friday, August 19:

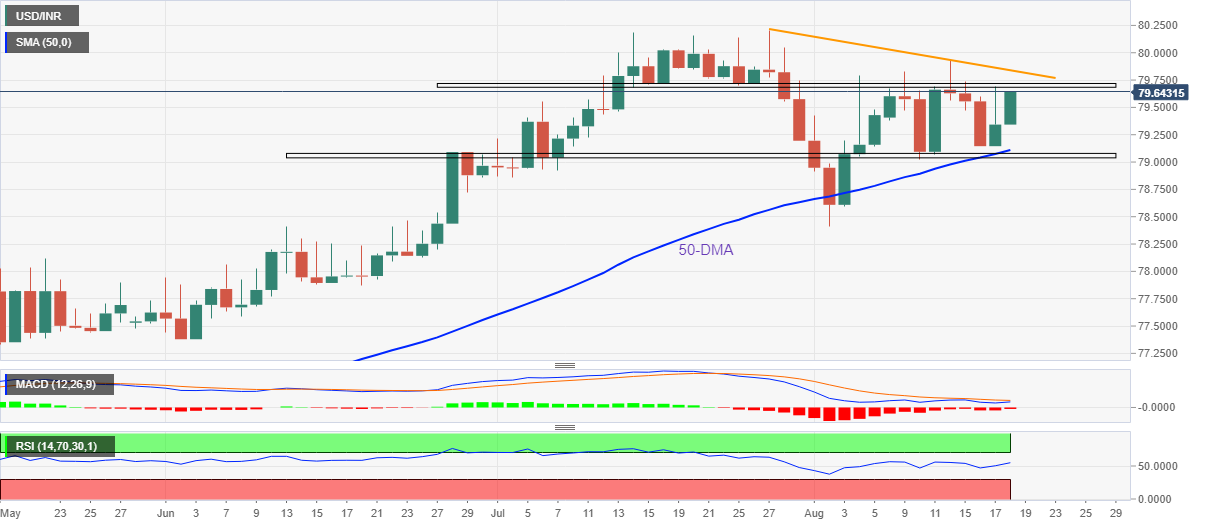

The greenback strengthened during US trading hours, soaring across the FX board. Market players assessed several encouraging US macroeconomic figures that suggest the economy has a good chance of skipping a recession, despite technically on it.

Investors changed their minds regarding the latest Federal Reserve announcement. The Minutes from the latest FOMC Meeting published on Wednesday were initially seen as dovish, particularly considering policymakers expressed their concerns about the risk of raising the rate benchmark to a level it would become more a problem than a solution.

Nevertheless, the latest US figures hint at a much better situation than initially feared. Inflation has finally begun easing while the employment sector remains solid. Additionally, other indicators related to business activity have surprised to the upside.

US Federal Reserve officials were on the wires with a mixed message. Minneapolis Federal Reserve Neel Kashkari said that if they keep raising rates, the risk of a recession could increase, although he does not believe the county is currently in a recession. On the other hand, the usual hawk, Bank of St. Louis Jim Bullard said he is leaning towards another 75 bps rate hike in September.

The EUR/USD pair plunged below the 1.0100 mark and trades near a daily low of 1.0078. GBP/USD, in the meantime, trades around 1.1930.

Safe-haven rivals are ending Thursday near their intraday lows against the dollar, with USD/CHF at around 0.9560, while USD/JPY trades at 135.95.

The AUD/USD pair trades around 0.6910/20, with the aussie additionally weighed by dismal Australian employment figures. USD/CAD stands at 1.2940, as Canadian Industrial Production unexpectedly contracted in July.

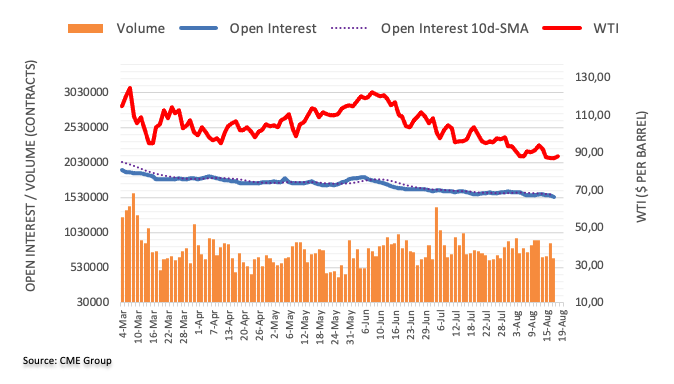

The broad dollar's strength pushed gold to a fresh weekly low of $1,755.30 a troy ounce. Crude oil prices, on the other hand, recovered their bullish poise, and the barrel of WTI currently stands at around $90.50 a barrel.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Gepetto's Guilty Pleasure pt.2

Like this article? Help us with some feedback by answering this survey:

- Gold price stumbles below the $1760 threshold due to overall US dollar strength.

- Fed officials pushed back against a “dovish” stance by the central bank; emphasized the need to get inflation back down “urgently.”

- US labor and housing data were mixed, though mainly ignored by market participants.

Gold price retraces from daily highs reached around $1772, shy of the 50-day EMA, but stumbled below its 20-day EMA, extending its losses for the fourth consecutive trading day. Despite falling US Treasury bond yields, broad US dollar strength, bolstered by hawkish Fed commentary, weighed on the yellow metal prices.

XAU/USD is trading at $1760 a troy ounce, below its opening price, while the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, rises 0.80%, sitting at 107.509. Contrarily, the US 10-year bond yield drops to 2.882% after reaching a high of 2.913%.

Fed speakers underpinned the greenback, to the detriment of gold prices

During the last few hours, Fed officials grabbed attention. Firstly was San Francisco Fed’s Mary Daly, who said that it is too early to declare victory on inflation and said that 50 or 75 bps is reasonable for the September meeting, via CNN.

Later Kansas City Fed President Esther George added that although inflation data was “encouraging” last month, it’s not time for a “victory lap.” George said that core inflation is “hardly comforting” and noted that the case for raising rates remains strong. At the same time, the St. Louis Fed’s James Bullard commented he’s leaning towards a 75 bps rate hike and foresees an 18-month process of getting inflation back to the Fed’s 2% target.

The last to hit the stand was the Minnesota Fed’s Neil Kashkari. He said that the Fed needs to get inflation down “urgently” while adding that economic fundamentals are strong and emphasized that it does not feel like a recession now.

Elsewhere, before Wall Street opened, US Initial Jobless Claims for the week ending on August 13 decelerated to 250K from 265K foreseen. At the same time, the US housing market is still cooling down due to higher interest rates. Existing Home Sales for July dropped 5.9%, at a rate of 4.8 million units in July, the lowest level since May 2020, when sales hit their lowest point during the Covid-19 lockdowns.

According to sources cited by Reuters, “Assuming the Fed will fight inflation without pushing the economy into recession, safe-haven demand will fade further, causing gold to move gradually lower on a medium to longer-term horizon.”

Gold Key Technical Levels

The US dollar and yields have rallied on Thursday as the hawks continue to circle above 2051 Constitution Ave. The DXY index, which measures the greenback vs. a basket of major currencies hit a three-week high on Thursday as investors reevaluated Wednesday's minutes from the Federal Reserve’s July meeting as more hawkish than originally interpreted.

Additionally, Fed speakers on Thursday, including San Francisco Federal Reserve Bank President Mary Daly, Kansas City Federal Reserve President Esther George, CEO of the Federal Reserve Bank of St. Louis Jim Bullard and finally, president of the Minneapolis Federal Reserve Neel Kashkari have all been heard signing from the same hawkish hymn sheet.

The most hawkish of the chorus of Fed officials on Thursday was Bullard who expressed a desire for a 75bp hike at September's meeting and added he isn’t ready to say the economy has seen the worst of the inflation surge.

“We should continue to move expeditiously to a level of the policy rate that will put significant downward pressure on inflation” and “I don’t really see why you want to drag out interest rate increases into next year,” Mr. Bullard said in a Wall Street Journal interview.

More recently, we have heard from Kahkari, who has turned far more hawkish in recent weeks, especially when compared to his uber dovish pre-pandemic tone, expressing his concerns for runaway inflation amongst his worries of an imminent recession.

In prior speeches, Kashkari said that he wants to raise the central bank’s benchmark interest rate to 3.9% by the end of this year, and to 4.4% by the end of 2023. That made him the most hawkish participant on the Fed’s rate-setting Federal Open Market Committee at the time, according to the so-called “dot plot” of interest-rate projections published after the central bank’s June policy meeting. On Thursday, he repeated that the Fed has more work to do to get inflation down and that the central bank needs to get inflation down urgently.

At the start of the New York session, Daly had crossed the wires and said in an interview with CNN it was way too early to declare victory on inflation and that said either a 50 basis point or a 75 basis points hike would be appropriate. This was pushing back against the market's interpretation of the minutes yesterday of just a 50bp hike where the futures markets were pricing in a 60% chance thereof. Her comments ignited the bullish tinder under the US dollar that was rising 0.12% on the day at 106.78 which has since gone on to print a 107.560 to trade some 0.8% higher.

Meanwhile, the US dollar is much higher, with the DXY approaching an area of imbalance that guards a resistance at 108.03 ahead of 109.29:

- USD/JPY rallied more than 0.60% once it broke above a one-month-old downslope trendline on Thursday.

- The 4-hour chart depicts buyers breaking above the 200-EMA, approaching the 136.00 figure.

- If the USD/JPY surpasses the 136.00 figure, a move towards 137.47 is on the cards.

The USD/JPY advances sharply in the North American session, breaking above its 50-day EMA, aiming towards the 136.00 figure, amidst a mixed market mood, with US equities fluctuating between gainers/losers. At the time of writing, the USD/JPY is trading at 135.87, above its opening price.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the USD/JPY is upward biased, further reinforced by buyers reclaiming the 50-day EMA at 135.40, while the Relative Strength Index (RSI) pushes towards its 60 reading, with enough room to spare, suggesting that an assault of 136.00, is on the cards.

Worth noting that on Wednesday, the USD/JPY broke above a one-month-old downslope resistance trendline, signaling that buyers are in charge.

Therefore, the USD/JPY first supply zone will be the 136.00 mark. Once cleared, the next resistance would be the 137.00 figure, followed by the July 27 daily high of 137.42.

In the near term, on the 4-hour scale, the chart illustrates the USD/JPY as upward biased. Buyers cleared the 200-EMA hurdle at 135.50, exacerbating a jump of 30-plus pips towards the USD/JPY daily highs at 135.89. Once the major clear the 136.00 figure, a rally towards 137.46 is imminent, with no supply zones on its way north.

USD/JPY 4-hour chart

USD/JPY Key Technical Levels

- AUD/USD is recording minimal losses of almost 0.20% due to a fragile market mood.

- Upbeat US jobs data, added to industrial production and retail sales, gives enough ammunition for another Fed rate hike in September.

- Australia’s employment report was softer than estimated, though the unemployment rate fell to 3.4%.

The AUD/USD trims some Wednesday losses, registering modest losses after bouncing off the 50-day EMA during the European session. Factors like Fed speakers pushing against markets expecting Fed rate cuts in 2023, alongside broad US dollar strength, keep investors’ sentiment mixed. At the time of writing, the AUD/USD is trading at 0.6917, below its opening price, after hitting a daily high at 0.6969.

AUD/USD slides on mixed data, hawkish Fed speaking

Before Wall Street opened, the US Department of Labor revealed that unemployment claims for the week ending on August 13 increased by 250K, less than the 265K estimated, while also previously week’s data was downwardly revised. That said, US economic data revealed in the week, led by industrial production, solid retail sales, and a strong labor market, would further cement the case for additional tightening by the Federal Reserve.

In the meantime, the US housing market continues deteriorating. Existing Home Sales for July dropped 5.9%, at a rate of 4.8 million units in July, the lowest level since May 2020, when sales hit their lowest point during the Covid-19 lockdowns.

Elsewhere, San Francisco Fed’s Mary Daly pushing back against a “dovish” tilt by the Fed, perceived by market participants on the release of the FOMC minutes on Wednesday, turned sentiment sour. The greenback is staying a comeback, with the US Dollar Index up 0.63%, above the 107.00 thresholds.

In the Asian session, a softer than expected Australian job report slightly weighed on the AUD/USD. The Australia Bureau of Statistics reported that the unemployment rate dropped to 3.4% from 3.5% estimates. Still, Full Employment Change slashed 40K jobs from the economy, less than a 25K increase estimated by the street.

The AUD/USD ticked lower towards 0.6927, but money market futures still price in further rate hikes by the Reserve Bank of Australia (RBA).

Further data revealed during the week showed that wage prices rose more modestly than estimated, which sent Australia’s bond yields down, dragging the AUD/USD from above the 0.7000 figure to 0.6910.

Therefore, the AUD/USD would likely remain neutral-to-downward biased due to a more aggressive than expected Federal Reserve.

AUD/USD Key Technical Levels

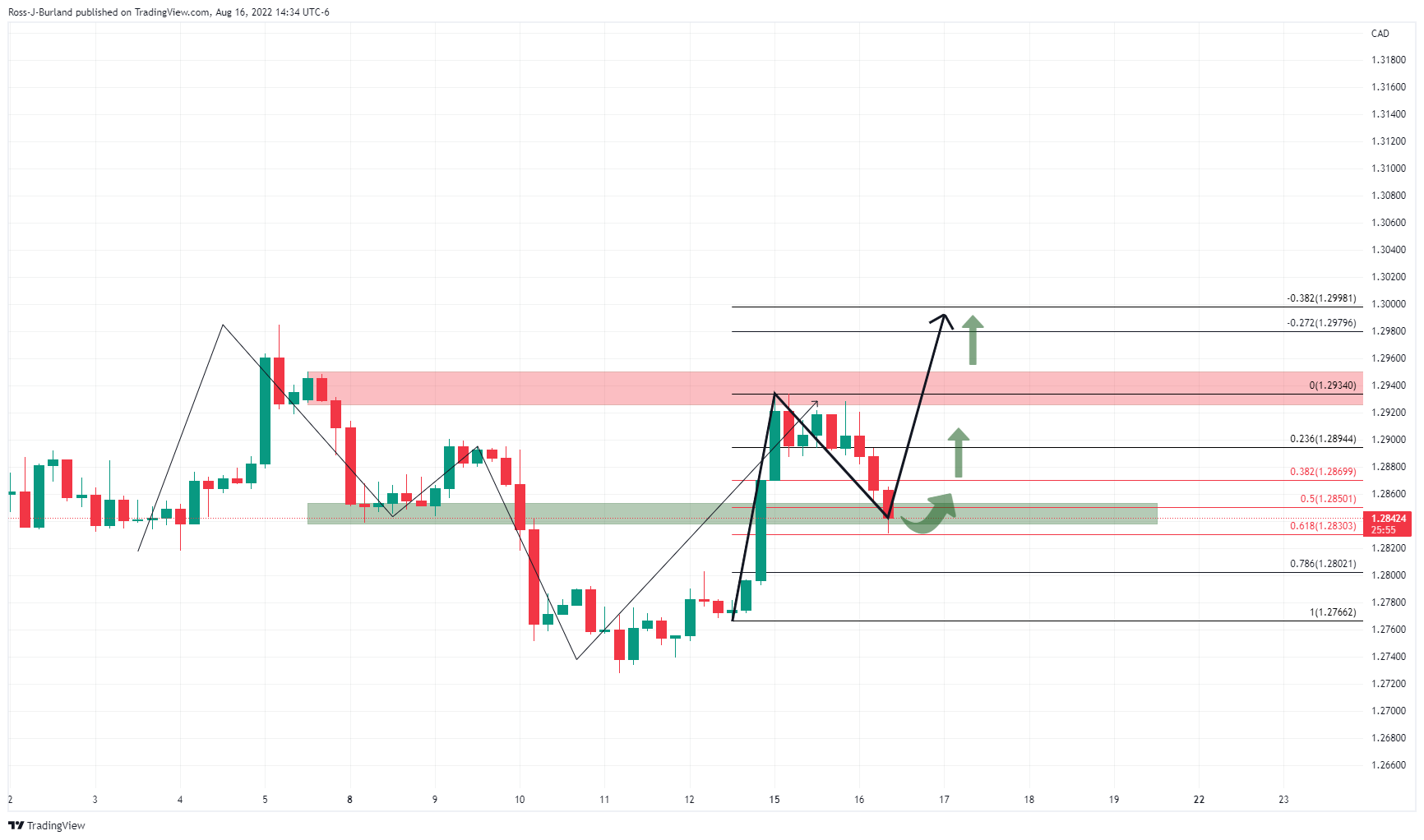

- USD/CAD is rallying as the US dollar picks up a bid again.

- Bulls eye the 1.3000s for a test of bear's final commitments.

USD/CAD is 0.26% higher at the time of writing, entering the midday session of the New York trade. The bulls have taken the price up to a key resistance area, with the price rallying from a low of 1.2880 reaching today's high so far of 1.2946.

The market has been dominated by speculation around the Federal Reserve. The US dollar index hit a three-week high on Thursday as investors reevaluated Wednesday's minutes from the July meeting as more hawkish than first interpreted. Additionally, the US data has been favourable to the bulls that will likely warrant a string of aggressive rate hikes from the central bank.

Analysts at TD Securities explained that the minutes also note ''a risk of remaining in the restrictive territory, which could imply a lean against immediate cuts even during a major slowdown.'' Jackson Hole offers a venue to explore this more deeply for which markets will be tuned into on August 27 - 29.

In addition, Federal Reserve Bank of San Francisco President Mary Daly said the central bank should raise interest rates “a little” above 3% by the end of the year to cool inflation. This is on contrary to the market's belief yesterday that officials would then reverse course.

Analysts at Rabobank argued that both Daly and the minutes of the Fed’s latest policy minutes have suggested that ''the Fed could favour a ‘raise and hold’ strategy, suggesting that rates could be higher for longer through next year and beyond relative to the levels the market has been expecting. This is not good news for equity bulls; however, it is supportive for the medium-term outlook for the USD.''

Another factor supporting the greenback for its safe haven qualities comes with the potential for more geopolitical chaos, including further weaponization of supply chains, as analysts at TD Securities noted that tests the mettle of risk seekers. ''This should reinforce nascent correlations that show G10FX very positively correlated with global equities, adding to further USD resilience that supports our EUR/USD short and bias to leg into USD/CAD topside around the Bank of Canada's decision.''

USD/CAD technical analysis

As per the prior series of technical analysis, USD/CAD Price Analysis: Bulls eye 1.3000 for the sessions ahead, the bulls move din on the resistance that is guarding the 1.3000 psychological area as the following prior analysis and update illustrates:

As shown, the price followed the projected price trajectory and is embarking on a break of prior highs for a path to the higher 1.3000 targets:

- US Dollar rises across the board during the American session.

- EUR/USD under pressure, testing critical support.

- Break under 1.0100 could trigger a test of parity.

The EUR/USD dropped sharply during the American session and hit at 1.0107, the lowest level since July 27. It remains near the lows, under pressure amid a stronger Us dollar across the board.

The greenback strengthened even as US yields remained steady and also as stocks in Wall Street sideways. The DXY is up 0.55%, at monthly highs near 107.30.

Regarding economic data, the weekly report showed Initial Jobless Claims declined to 250K, below market consensus; the Philly Fed jumped to 6.2 in August from -12.3, also surpassing expectations. On the negative front, Existing Home Sales tumbled to 4.81M, posting the sixth monthly decline in a row.

Short-term outlook

The EUR/SD is facing increasing bearish pressure and is near a critical support at 1.0110. A break below 1.0100 would expose the parity level, ending with weeks of a range. The bearish pressure in the short-term will likely persist while under 1.0135.

The euro needs to recover 1.0135 to avoid more losses. The next resistance stands at 1.0160 followed by the strong barrier near 1.0200.

Technical levels

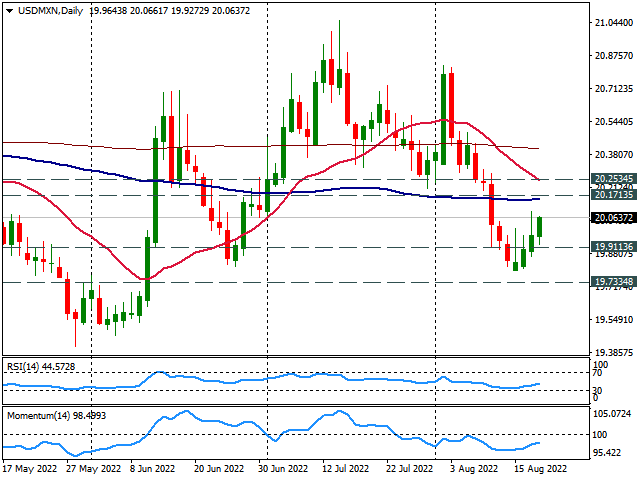

- USD/MXN rises for the third consecutive day, again above 20.00.

- The dollar needs to hold above 20.00, next resistance at 20.15/20.

- Slide under 19.90 to remove bullish bias.

The USD/MXN is rising for the third consecutive day, although so far it failed to print fresh weekly highs. The upside remains capped below 20.10. The next critical resistance area is seen around 20.15/20, an area that contains horizontal resistances and also the 100-day Simple Moving Average.

A firm break above 20.25 would open the doors more gains targeting the 20.50 area.

In the very short-tern, the bias is to the upside, with technical indicators flat to bullish. The momentum is not strong enough and appears to be fading. The bias will weaken with a decline back under 20.00. While a daily close well above 20.00 would be a positive sign for the bulls.

A key support emerges at 19.90 that if fails to hold, USD/MXN could drop further to test again the 19.80 area.

USD/MXN Daily chart

- GBP/USD sellers eye a break below 1.2000, which would pave the way towards 1.1800.

- Fed’s Daly: 50 or 75 bps hike in September is reasonable; rates will go up and remain on hold until inflation subsidies.

- US jobless claims fall; housing data continues weakening.

The GBP/USD remains defensive after tumbling below the 20 and 50-DMAs on Wednesday, extending its losses for the second straight day. Factors like San Francisco Fed’s Mary Daly pushing back against a “dovish” tilt by the Fed, perceived by market participants on the release of the FOMC minutes on Wednesday, turned sentiment sour. The greenback is staying a comeback, with the US Dollar Index up 0.48%, above the 107.00 threshold.

The GBP/USD is trading at 1.2005, below its opening price, after hitting a daily high at 1.2079 early in the European session.

GBP/USD falls on sentiment shift, with Fed speakers pushing back rate-cuts

Mary Daly, San Francisco Fed’s President, commented that it is too early to declare victory on inflation and said that 50 or 75 bps is reasonable for the September meeting, via CNN. She added that core inflation is still increasing and that the market lacks understanding, but consumers understand that rates won’t go down right after going up.

In the meantime, US Initial Jobless Claims for the week ending on August 13 dropped to 250K, less than 265K estimated by analysts, while the housing market continued to cool down due to further evidence of Federal Reserve rate hikes. Existing Home Sales for July dropped 5.9%, at a rate of 4.8 million units in July, the lowest level since May 2020, when sales hit their lowest point during the Covid-19 lockdowns.

Elsewhere, on Wednesday, the UK reported inflation in July, which cleared the 10% threshold for the first time in 40 years. The Office for National Statistics revealed that the Consumer Price Index (CPI) rose 10.1%, from a year earlier, after recording a 9.4% in June. After the report, money market futures priced in nearly 200 bps of rate hikes, in the BoE rate to 3.75%, by May of 2023.

The GBP/USD is still neutral to downward bias, but central bank monetary policy convergence could lead to range-bound trading. With rates in both countries elevating, growth differences between them will enter into play to dictate the direction of the pair.

GBP/USD Key Technical Levels

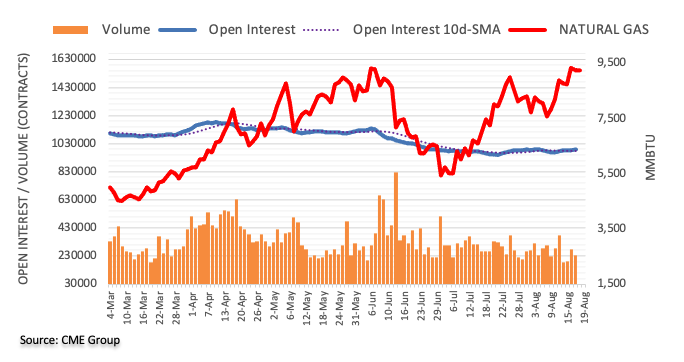

OPEC's new secretary general Haitham al-Ghais told Reuters on Thursday that he was relatively optimistic on the oil market outlook for 2023 and added that the world was dealing with economic pressures of inflation in a very good way.

"I want to be very clear about it - we could cut production if necessary, we could add production if necessary," as-Ghais further elaborated. "It all depends on how things unfold. But we are still optimistic, as I said. We do see a slowdown in 2023 in demand growth, but it should not be worse than what we've had historically."

Market reaction

Oil prices continued to rise after these comments and the barrel of West Texas Intermediate was last seen rising 3.% on a daily basis at $90.28.

Additional takeaways

"Fears of Chinese slowdown taken out of proportion."

"Oil price slide reflects fears about the economy, physical oil demand is robust."

"Premature to say what OPEC+ will do at September 5 meeting."

- Existing Home Sales in US fell for the sixth straight month in July.

- US Dollar Index holds above 107.00 despite the disappointing data.

Existing Home Sales in the US declined for the sixth straight month in July to a seasonally adjusted annual rate of 4.18 million, the National Association of Realtors reported on Thursday. Sales were down 5.9% and 20.2% on a monthly and yearly basis, respectively.

Further details of the report revealed that the median price for Existing Home Sales rose by 10.8% from one year ago to $403,800, down from $10,000 from last month's record high of $413,800.

Market reaction

With the initial reaction, the US Dollar Index edged slightly lower from the multi-week high it touched at 107.14 earlier in the day.

- Gold gains some positive traction on Thursday, albeit lacks follow-through buying.

- Retreating US bond yields, recession fears offer support to the safe-haven XAU/USD.

- Hawkish Fed expectations, a stronger USD should keep a lid on any meaningful upside.

Gold holds on to its modest intraday gains through the early North American session and is currently placed just below the $1,770 region. The attempted recovery from a two-week low touched the previous day, however, lacks bullish conviction and runs the risk of fizzling out rather quickly.

The prevalent cautious mood - as depicted by a softer tone around the equity markets - turns out to be a key factor benefitting the safe-haven gold. The anti-risk flow is reinforced by a modest pullback in the US Treasury bond yields, which offers additional support to the non-yielding yellow metal. That said, some follow-through US dollar buying should hold back bulls from placing aggressive bets around the dollar-denominated commodity and cap gains, at least for the time being.

In fact, the USD shot to a fresh monthly high amid firming expectations that the Fed would continue to tighten its monetary policy. The FOMC minutes released on Wednesday, though did not hint at a particular pace of future rate hikes, indicated that policymakers remain committed to raising interest rates to tame inflation. The bets were further reaffirmed by the incoming better-than-expected US macro data, which remain supportive of the underlying bullish sentiment surrounding the greenback.

The Philly Fed Manufacturing Index jumped to 6.2 in August, surpassing consensus estimates for an improvement to -5 from the -12.3 reported in the previous month. Separately, the US Initial Jobless Claims unexpectedly fell to 250K during the week ended August 12 from the previous week's downwardly revised reading of 252K (262K reported previously). This comes a day after upbeat US consumer spending data and reinforces hawkish Fed expectations, supporting prospects for further USD gains.

The fundamental backdrop suggests that the path of least resistance for gold is to the downside. Even from a technical perspective, the recent repeated failures to find acceptance, or build on the momentum beyond the $1,800 mark favours bearish traders. This, in turn, suggests that any further positive move might still be seen as a selling opportunity and is more likely to remain capped.

Technical levels to watch

- EUR/USD reverses part of recent gains and revisits 1.0130.

- Immediately to the downside turns up the weekly low at 1.0096.

EUR/USD resumes the downside and revisits the 1.0130/25 band following two consecutive daily advances.

Further losses should meet the next support at the weekly low at 1.0096 (July 27). In case sellers push harder, then the pair could confront the psychological parity level in the not-so-distant future

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0867.

EUR/USD daily chart

- DXY adds to Wednesday’s uptick and retargets 107.00.

- Above 107.00 the index could revisit the weekly high at 107.42.

DXY extends the upside for the second session in a row on Thursday, although another test of the 107.00 neighbourhood remains elusive for the time being.

The continuation of the upside momentum could extend to the August high near the 107.00 mark (August 5). The breakout of this level should motivate the index to challenge the post-FOMC meeting high at 107.42 (July 27).

Looking at the broader scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.28.

DXY daily chart

In an interview with CNN on Thursday, San Francisco Fed President Mary Daly reiterated that it was way too early to declare victory on inflation, as reported by Reuters.

Daly further noted that core services inflation was still rising while adding that they will continue to raise the rates to "right-size it." Regarding the September rate decision, Daly said either a 50 basis points or a 75 basis points hike would be appropriate.

Market reaction

The US Dollar Index edged slightly higher on these comments and was last seen rising 0.12% on the day at 106.78.

Additional takeaways

"When we get closer to the meeting will make a decision on the September rate hike."

"We need to get rate a little more above 3% next year."

"We need to bridle economy a bit, slow pace of inflation."

"The markets have a lack of understanding, but consumers understand, that rates won't go down right after they go up."

"The raise and hold strategy pays off."

"A hump-shaped path for rates is not what's on my mind."

- USD/JPY seesaws between tepid gains/minor losses through the early North American session.

- The Fed-BoJ policy divergence continues to undermine the JPY and offers support to the major.

- Retreating US bond yields seem to act as a headwind for the USD and cap any meaningful gains.

The USD/JPY pair struggles to capitalize on its gains recorded over the past two sessions and meets with some supply ahead of the 135.50 area. Spot prices drop to a fresh daily low during the early North American session, albeit quickly bounce back to the 135.00 psychological mark.

A big divergence in the monetary policy stance adopted by the Bank of Japan and the Federal Reserve continues to undermine the Japanese yen, which, in turn, acts as a tailwind for the USD/JPY pair. In fact, the BoJ has repeatedly said that it would retain its ultra-easy policy settings. In contrast, the Fed is expected to stick to its policy tightening path despite signs of easing US inflation.

The bets were reaffirmed by the minutes of the July 26-27 FOMC policy meeting, which indicated that policymakers would not consider pulling back on rate hikes until inflation came down substantially. Apart from this, better-than-expected US macroeconomic releases assist the US dollar to stand tall near the monthly low. This is seen as another factor lending some support to the USD/JPY pair.

Data released this Thursday showed that the Philly Fed Manufacturing Index climbed to 6.2 in August, beating consensus estimates for an improvement to -5 from the -12.3 reported in the previous month. Separately, the US Initial Jobless Claims unexpectedly fell to 250K during the week ended August 12 from the previous week's downwardly revised reading of 252K (262K reported previously).

That said, retreating US Treasury bonds yields seem to hold back the USD bulls from placing aggressive bets and capping the upside for the USD/JPY pair, at least for the time being. Nevertheless, the fundamental backdrop supports prospects for a further near-term appreciating move for the USD/JPY pair, suggesting that any meaningful dip could be seen as a buying opportunity and remain limited.

Technical levels to watch

Germany is looking at a potential agreement with Canada on LNG deliveries in the medium term, not in the next one or two years, Reuters reported on Thursday, citing a German government source.

"Russia wanted to divide western allies with Siemens turbine debate" the government source further told Reuters and added that Russia was looking for excuses not to deliver gas.

Market reaction

This headline doesn't seem to be having a significant impact on the shared currency's performance against its rivals. As of writing, EUR/USD was down 0.2% on the day at 1.0160.

On Wednesday, gold closed the third straight day in negative territory as the FOMC minutes were a dud. Strategists at TD Securities believe that the Jackson Hole symposium next week could dent demand for the yellow metal as Fed Chair Powell may push back against market pricing for rate cuts.

Chair Powell's remarks at the Jackson Hole symposium next week will be key

“Markets are still pricing in 47% odds of a 75 bps hike in September and a 3.67% terminal rate, which is only marginally less than pre-minutes, as the dated minutes provided little additional information for markets to digest.”

“Jackson Hole could provide a platform for the Fed to push back against market pricing for rate cuts, which should sap investment appetite for gold and silver.”

“At the same time, as commodity demand continues to slide, silver markets are particularly vulnerable, given little exposure to the rise in supply risk premia that has been supporting industrial metals.”

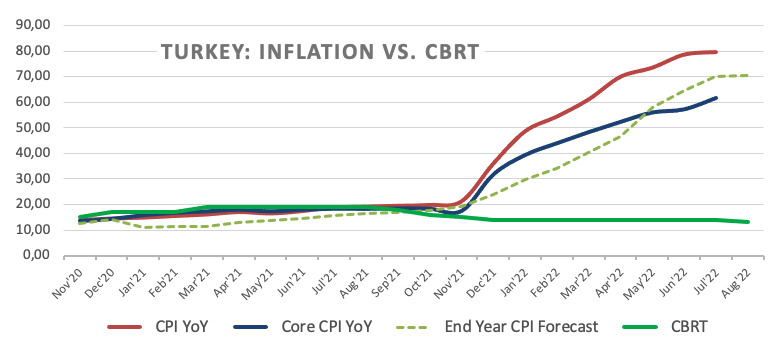

Turkey's central bank, the CBRT, surprisingly cut the benchmark one-week repo rate by 100 bps to 13%. Economists at TD Securities believe that their current USD/TRY forecast of 19.00 by the end of the quarter is a fairly optimistic one.

Lira must fall if rates are not allowed to vent in the right direction

“The CBRT surprisingly cut the repo rate by 100 bps to 13%, defying the unanimous consensus expectation and our call for a hold today.”

“With this decision, the CBRT drops any residual pretense to be targeting inflation and reveals its overarching goal of supporting growth. With inflation at 80%, however, this recipe only spells disaster.”

“We still think that rates will need to be hiked – the only question is when? In the meantime, one conclusion looks inescapable – the lira must fall.”

“We continue to forecast USD/TRY at 19.00 by end of Q3, a forecast that looks increasingly optimistic given the circumstances.”

- EUR/JPY looks offered after two daily advances in a row.

- Next on the upside appears the August top at 138.40.

EUR/JPY corrects lower after bumping into the weekly resistance just below the 1380.00 yardstick on August 17.

In case the recovery becomes more serious, then the cross should meet the next barrier at the 100-day SMA at 138.13 prior to the more relevant August high at 138.39 (August 10). The upside is expected to gather fresh steam once the latter is cleared.

While above the 200-day SMA, today at 134.01, the prospects for the pair should remain constructive.

EUR/JPY daily chart

- USD/CAD witnessed an intraday turnaround from over a one-week high touched on Thursday.

- Rebounding oil prices underpin the loonie and exert pressure amid a modest USD pullback.

- The upbeat US macro data, hawkish Fed expectations should limit the USD and lend support.

The USD/CAD pair retreats from a one-and-half-week high touched earlier this Thursday and drops to a fresh daily low during the early North American session. The pair is currently trading just below the 1.2900 mark and is pressured by a combination of factors.

Crude oil prices gain some positive traction and move away from over a six-month low set on Tuesday, which underpins the commodity-linked loonie and acts as a headwind for the USD/CAD pair. This, along with a modest US dollar pullback from a fresh monthly peak, attracts some selling at higher levels and further contributes to the intraday slide.

The overnight bullish Energy Information Administration (EIA) report, showing a steeper-than-expected drawdown in US crude stocks helps offset concerns that a global economic downturn would hit fuel demand. Furthermore, expectations that the European Union embargoes on Russian oil imports could tighten supply offer support to the black liquid.

The USD, on the other hand, fails to capitalize on its modest intraday uptick amid retreating US Treasury bond yields. Apart from this, a goodish intraday recovery in the equity markets prompts some profit-taking around the safe-haven greenback. That said, upbeat US macro releases help limit the downside for the buck and the USD/CAD pair.

In fact, the Philly Fed Manufacturing Index came in at 6.2 for August against consensus estimates for an improvement to -5 from the -12.3 reported in the previous month. Separately, the US Initial Jobless Claims unexpectedly fell to 250K during the week ended August 12 from the previous week's downwardly revised reading of 252K (262K reported previously).

This comes a day after the FOMC minutes indicated that policymakers would not consider pulling back on interest rate hikes until inflation came down substantially and reaffirmed hawkish Fed expectations. Market participants seem convinced that the Fed would stick to its policy tightening path, which supports prospects for the emergence of some USD dip-buying.

The fundamental backdrop suggests that the path of least resistance for the USD/CAD pair is to the upside, suggesting that any subsequent slide might still be seen as a buying opportunity. Hence, it would be prudent to wait for strong follow-through selling before confirming a near-term top and positioning for any meaningful decline.

Technical levels to watch

- Initial Jobless Claims fell by 2,000 in the week ending August 13.

- US Dollar Index trades flat on the day above 106.50.

There were 250,000 initial jobless claims in the week ending August 13, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 252,000 (revised from 262,000) and came in lower than the market expectation of 265,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 246,750, a decrease of 2,750 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending August 6 was 1,437,000, an increase of 7,000 from the previous week's revised level," the DOL further noted in its publication.

Market reaction

The US Dollar Index edged slightly higher with the initial reaction and was last seen trading flat on the day at 106.70.

- US Philly Fed Manufacturing Index recovered into positive territory in August.

- US Dollar Index continues to fluctuate in its tight daily range.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity rose to 6.2 in August from -12.3 in July. This print came in much better than the market expectation of -5.

Further details of the publication revealed that the Prices Paid Index declined to 43.6 from 52.2, the Employment Index improved to 24.1 from 19.4 and the Six-month Business Conditions Index advanced to -10.6 from -18.6.

Market reaction

The US Dollar Index is struggling to make a decisive move in either direction and was last seen posting small losses at 106.65.

- USD/TRY clinches new YTD tops beyond the 18.00 mark.

- The pair now targets the all-time top at 18.25 (December 20 2021).

- The Turkish central bank reduced the policy rate by 100 bps.

The Turkish lira debilitates to fresh lows vs. the greenback and pushes USD/TRY past the 18.00 yardstick for the first time since December 2021.

USD/TRY now targets the all-time high at 18.25

USD/TRY leaves behind the key barrier at 18.00 after the Turkish central bank (CBRT) caught the markets off guard and reduced the One-Week Repo Rate by a full point to 13.00% at its meeting earlier on Thursday. the central bank also cut the Overnight Borrowing Rate and the Overnight Lending Rate by 100 bps to 11.50% and 14.50%, respectively.

In its statement, the CBRT continues to see domestic inflation largely driven by higher energy costs exclusively on the back of geopolitical events and “effects of pricing formations that are not supported by economic fundamentals”.

Also, according to the bank’s statement, the disinflationary process is expected to start in response to measures taken… which would be…?

In line with previous meetings, the “liraization” strategy remains the way to reach a permanent fall in inflation to the bank’s 5% target, which the CBRT expects to hit at some point in H2 2023. If we consider that inflation ran at nearly 80% YoY in July and that the CBRT forecasts the CPI at 70% by year end, reaching that goal is no less than a chimera in the current context.

It is worth noting that USD/TRY closed with gains in every month of the current year. Since January 2021, the pair recorded monthly losses in only four occasions; January, July, August and December 2021.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and now targets the all-time peak around 18.25 following the recent unexpected move by the CBRT.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: CBRT Interest Rate Decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.81% at 18.0856 and faces the immediate target at 18.1260 (2022 high August 18) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 16.4104 (100-day SMA) and finally 16.0365 (monthly low June 27).

GBP/USD has reversed its direction after having tested 1.2000 earlier in the day. The pair could extend recovery if 1.2050 support holds, FXStreet’s Eren Sengezer reports.

GBP/USD could test 1.2000 if sellers flip 1.2050 into resistance

“In case the market mood improves and Wall Street's main indexes rise decisively following Wednesday's decline, GBP/USD could gather bullish momentum and stretch higher and vice versa.”

“GBP/USD was last seen trading above 1.2050. As long as this level holds, additional gains toward 1.2100 (Fibonacci 38.2% retracement) and 1.2130 (100-period SMA) and 1.2175 (Fibonacci 23.6% retracement) could be witnessed.”

“On the downside, GBP/USD could test 1.2000 (daily low, psychological level, Fibonacci 61.8% retracement) if sellers flip 1.2050 into resistance. Below 1.2000, 1.1940 (static level) could be seen as the next bearish target.”

Over the last month, the US dollar has dropped against most of the G10 and EM complex. This setup raises the question of whether it has peaked. In the view of economists at TD Securities, the USD turn is coming, but not yet.

A pivot will require patience and better data

“The time to see a peak in the dollar is coming, but not yet, especially as the key factor to lean against the USD rests on the global growth outlook.”

“A pullback in rates vol would match the hopes of peak terminal rate pricing, raising the carry appeal. And the USD's super-rich to stagflation risks. A pivot will require patience and better data, but this is a healthy reminder to stay nimble.”

Brent Crude Oil has fallen swiftly over recent weeks. Notwithstanding, strategists at UBS continue to see a tight oil market and retain our positive price outlook.

Oil looks set to recover after recent slide

“We continue to believe that the recent decline in oil prices does not fully account for constraints on global supply, and we expect the price to rebound to $125 a barrel by the end of the year.”

“Our $125/bbl Brent forecast through mid-2023 also supports our preference for energy stocks.”

The Central Bank of the Republic of Türkiye (CBRT) lowered its benchmark interest rate, the one-week repo rate, by 100 basis points to 13% from 14%.

Market reaction

With the initial market reaction, USD/TRY jumped to a multi-month high of 18.15 before retreating toward 18.10.

Key takeaways from policy statement

"Increase in inflation is driven by the lagged and indirect effects of rising energy costs resulting from geopolitical developments."

"Expecting disinflation process to start."

"It is important that financial conditions remain supportive to preserve the growth momentum."

"Assessed that the updated level of policy rate is adequate under the current outlook."

"Negative consequences of supply constraints in some sectors, particularly basic food, have been alleviated by the strategic solutions facilitated by Türkiye."

"Will continue to use all available instruments decisively within the framework of liraization strategy until strong indicators point to a permanent fall in inflation."

"Job creation has been stronger than peers."

"Effects of pricing formations that are not supported by economic fundamentals, strong negative supply shocks caused by the rise in global energy, food and agricultural commodity prices also push inflation higher."

"Growth dynamics are supported by structural gains."

"Stronger than expected contribution of tourism revenues to the current account balance continues."

"Leading indicators for the third quarter point to some loss of momentum in economic activity."

"Recent increase in the spread between the policy rate and the loan interest rate is considered to reduce the effectiveness of monetary transmission."

- AUD/USD stages a goodish bounce from over a one-week low touched earlier this Thursday.

- An unexpected drop in the Australian unemployment rate offers some support to the aussie.

- A modest USD pullback further provides a lift amid a goodish recovery in the risk sentiment.

The AUD/USD pair reverses an intraday dip to sub-0.6900 levels and stages a goodish bounce from a one-and-half-week low touched earlier this Thursday. The pair prolongs its recovery move through the first half of the European session and touches a fresh daily high, around the 0.6970 region in the last hour.

The Australian dollar draws some support from an unexpected fall in the domestic unemployment rate to a 48-year low level of 3.4% in July. Apart from this, a positive turnaround in the global risk sentiment triggers a modest US dollar pullback from a fresh monthly high and benefits the risk-sensitive aussie. That said, any meaningful positive move still seems elusive, warranting caution for aggressive bullish traders and positioning for any further gains.

The surprise downtick in the Australian jobless rate was sponsored by a decline in the participation rate. Moreover, the economy shed 40.9K jobs during the reported month, missing expectations for an addition of 25K by a big margin. This comes on the back of softer wage growth data on Wednesday, which could force the Reserve Bank of Australia to be more flexible in its policy tightening cycle and act as a headwind for the domestic currency.

Meanwhile, growing worries about a global economic downturn should keep a lid on any optimistic move in the markets. Furthermore, expectations that the Fed would stick to its policy tightening path support prospects for the emergence of some USD dip-buying. The bets were reaffirmed by the minutes of the July 26-27 FOMC meeting, which indicated that policymakers would not consider pulling back on interest rate hikes until inflation came down substantially.

The hawkish Fed expectations remain supportive of elevated US Treasury bond yields, which further favours the USD bulls. This, in turn, suggests that the path of least resistance for the AUD/USD pair is to the downside and any subsequent move up might still be seen as a selling opportunity. Traders now look forward to the US economic docket - featuring the Philly Fed Manufacturing Index, the usual Weekly Initial Jobless Claim and Existing Home Sales data.

Technical levels to watch

German Chancellor Olaf Scholz said on Thursday that they are planning to lower the sales tax on gas to 7% temporarily through March 2024, as reported by Reuters.

Scholz further noted that the German government agreed that consumers should not incur further costs from sales tax on gas.

Market reaction

These comments don't seem to be having a significant impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was down 0.12% on the day at 1.0168. Meanwhile, Germany's DAX 30 Index was last seen rising 0.8% on a daily basis at 13,742.

Stocks tend to outperform after midterm elections. Will the trend hold? Liz Ann Sonders, Schwab's Chief Investment Strategist, gives her point of view.

Will midterms affect market performance?

“Post-election outperformance is often driven by the market's expectation of increased government spending from a new Congress. But an additional infusion of funds seems unlikely this year, given the government's historic levels of spending and stimulus in response to the pandemic.”

“The combination of high inflation, the war in Ukraine, and a lingering pandemic has already made this cycle unlike prior midterm years. With so many other forces at play in the market, I wouldn't put much weight in historical midterm-year performance.”

- EUR/GBP attracts fresh selling on Thursday and retreats from the vicinity of the weekly high.

- Europe's energy supply concerns, a downward revision of the monthly HICP weighs on the euro.

- Expectations for a gradual BoE rate hike, recession fears could cap sterling and limit the downside.

The EUR/GBP cross meets with a fresh supply on Thursday and retreats over 40 pips from the vicinity of the weekly high. The cross drops to a fresh daily low, around the 0.8425 region in the last hour, and reverses a part of the previous day's strong bounce from a nearly two-week low.

The shared currency continues to be undermined by mounting energy supply concerns, which could drag the Eurozone economy faster and deeper into recession. This turns out to be a key factor acting as a headwind for the EUR/GBP cross and attracting fresh sellers at higher levels. Meanwhile, the latest leg down follows a sharp downward revision of the Eurozone Harmonised Index of Consumer Prices (HICP) for July to 0.1% MoM from the 0.8% reported previously.

The British pound, on the other hand, draws some support from a modest US dollar pullback from the monthly high set earlier this Thursday. This was seen as another factor exerting additional downward pressure on the EUR/GBP cross. That said, speculations that an economic downturn might force the UK central bank to adopt a gradual approach to raising interest rates could cap any meaningful gains for sterling and lend some support to the EUR/GBP cross.

The mixed fundamental backdrop could hold back traders from placing aggressive bets and contribute to limiting the downside for the EUR/GBP cross, at least for the time being. Even from a technical perspective, the recent price action within a broader trading range witnessed over the past two weeks or so points to indecision among traders. This further makes it prudent to wait for some follow-through selling before positioning for further intraday losses.

Technical levels to watch

EUR/USD fluctuates in a relatively tight range above 1.0150. However, the pair is set to continue its move downward, economists at MUFG Bank note.

Short-term spreads dragging EUR/USD lower have further to run

“The reality is that the fundamental backdrop for EUR remains negative and short-term spreads dragging EUR/USD lower has further to run.”

“We view there is a much greater risk of the ECB delivering less than the current OIS pricing implies – 115 bps compared to the risk of the Fed underdelivering the 125 bps priced by year-end.”

Following the opposition from China’s Commerce Ministry, the country’s Foreign Ministry also said on Thursday that Beijing will take resolute measures to defend its territorial integrity and urges the US not to make a wrong judgment after Washington and Taipei agreed to initiate trade talks early this autumn.

This comes after Deputy United States Trade Representative (USTR) Sarah Bianchi said early Thursday, the US-Taiwan trade negotiations “will deepen our trade and investment relationship, advance mutual trade priorities based on shared values, and promote innovation and inclusive economic growth for our workers and businesses.”

“We plan to pursue an ambitious schedule for achieving high-standard commitments and meaningful outcomes covering the eleven trade areas in the negotiating mandate that will help build a fairer, more prosperous and resilient 21st-century economy,” she added.

Market reaction

Amid a rebound in risk sentiment, the aussie dollar is benefiting the most amongst the higher-yielding currencies, ignoring the US-China spat over Taiwan.

AUD/USD is trading at 0.6961, adding 0.45% on the day, at the time of writing.

EUR/USD has managed to erase a small portion of its daily losses after having tested 1.0150. But the pair is not out of the woods yet, FXStreet’s Eren Sengezer reports.

Bearish bias stays intact

“In case safe-haven flows continue to dominate the financial markets in the second half of the day, EUR/USD could have a difficult time gathering recovery momentum.”

“EUR/USD stays within a touching distance of 1.0150 support. If that level fails, interim support seems to have formed at 1.0120 ahead of 1.0100 and 1.0050.”

“On the upside, the 200-period SMA on the four-hour chart aligns as immediate resistance at 1.0180 before 1.0200 and 1.0230.”

- EUR/USD’s upside momentum falters near the 1.0200 mark.

- Final Inflation Rate in the euro area came at 8.9% in July.

- US Initial Claims, Philly Fed Index take centre stage across the pond.

The selling pressure returns to the European currency and forces EUR/USD to give away part of the recent gains and return to the mid-1.0100s.

EUR/USD weaker on USD-buying

EUR/USD fades two consecutive daily advances and comes under pressure amidst shy losses on Thursday, all against the backdrop of some unostentatious rebound in the greenback.

Indeed, not much happening in the FX universe, as market participants refocus on upcoming US data and continue to digest Wednesday’s release of the FOMC Minutes.

The move lower in the pair also comes in tandem with further recovery in the German 10y Bund yields, which so far clinch the third consecutive daily gain near the 1.15% region.

In the euro docket, final inflation figures in the euro area showed the headline CPI rose 8.9% in the year to July and 0.1% vs. the previous month.

In the US calendar, usual weekly Claims and the Philly Fed Manufacturing Index will take centre stage seconded by the CB Leading Index, Existing Home Sales and speeches by FOMC’s George and Kashkari.

What to look for around EUR

EUR/USD now appears somewhat stabilized in the 1.0150 region against the backdrop of a firm recovery in the demand for the US dollar.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: EMU Final Inflation Rate (Thursday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is losing 0.14% at 1.0164 and a break below 1.0096 (weekly low July 27) would target 1.0000 (psychological level) en route to 0.9952 (2022 low July 14). On the other hand, the next up barrier comes at 1.0368 (monthly high August 10) seconded by 1.0486 (100-day SMA) and finally 1.0615 (weekly high June 27).

- Gold gains positive traction on Thursday and snaps a three-day losing streak to a two-week low.

- Recession fears weigh on investors’ sentiment and offer support to the safe-haven precious metal.

- Hawkish Fed expectations continue to underpin the USD and might cap gains for the commodity.