- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 16-08-2022

- EUR/USD defends the bounce off two-week low ahead of the key EU, US data/events.

- Economic fears surrounding Europe, China join mixed US data to challenge pair buyers.

- Firmer yields, equities challenge bears amid market’s indecision.

- FOMC Minutes will be eyed for clues of 0.75% rate hike in September.

EUR/USD treads water around 1.0175, keeping the previous day’s rebound in a choppy trading range during Wednesday’s Asian session, as traders await the week’s key catalysts. Also challenging the pair traders are the mixed concerns surrounding growth and central banks.

Fears of economic slowdown, mainly emanating from China and Europe, join firmer Treasury yields and positive equities to confuse the traders. It’s worth noting that the US dollar also retreated amid the market’s indecision.

With this, the US Dollar Index (DXY) refreshed its three-week high before reversing from 106.94. That said, the DXY previously benefited from the flight to safety as China’s readiness for multiple measures to tame recession woes joined Europe’s signals to renew the nuclear deal with Iran while pushing back plans for the closure of Germany’s last three nuclear power plants. On the same line was the Washington Post (WaPo) news that mentioned that Chinese authorities ordered factories to suspend production in several major manufacturing regions to preserve electricity, as the country face the worst heat wave in six decades.

Talking about the data, US Industrial Production grew 0.6% in July versus 0.3% expected and upwardly revised 0.0% prior whereas Building Permits also increased to 1.674M MoM during the stated month versus 1.656 market expectations and 1.696M previous readings. It should be noted that the Housing Starts dropped to 1.446M from 1.599M prior and 1.54M expected. Further, ZEW Sentiment data from Germany and Europe came in weaker for Economic Sentiment but improved a bit for Current Situation.

Amid these plays, Wall Street managed to close on a positive side, despite retreating by the end of the day. That said, the US 10-year Treasury yields snapped a two-day downtrend by regaining 2.80% at the latest. It should be noted that the US 10-year Treasury yields pause the previous day’s rebound while the S&P 500 Futures print mild losses at the latest.

Looking forward, EUR/USD traders will initially respond to the second readings of the Eurozone Gross Domestic Product (GDP), expected to confirm the 0.7% QoQ forecasts, ahead of preliminary readings of Eurozone Employment Change for the second quarter (Q2), expected 2.5% versus 2.9% prior. Also crucial will be the US Retail Sales for July, expected 0.1% versus 1.0% prior. Above all, the Federal Open Market Committee (FOMC) meeting minutes appear as the key event of the day, as well as for the week.

It’s worth noting that the Minutes statement will be eyed to confirm another hawkish move in September despite the latest reduction in the inflation fears.

Technical analysis

EUR/USD bounces off 23.6% Fibonacci retracement of late May to mid-July downturn, around 1.0150, with the previous support from July, at 1.0245 now, likely to restrict immediate upside.

- AUD/NZD has corrected in a 50% mean reversion ahead of key data events.

- Bears are looking for a break of the trendline support and structure at 1.0952.

AUD/NZD is flat on the day so far ahead of the release of the Monetary Policy Statement from the Reserve Bank of New Zealand today that is expected to see another 50bp lift in the OCR to 3.0%. The cross has been stalling on the bid within familiar ranges. AUD/NZD has stuck to 1.1057 and 1.1069 on the day.

''We are expecting a hawkish tone today as the RBNZ tries to reiterate the battle to bring down surging inflation is far from over. Upside surprises in domestic inflation and wage growth, along with the recent falls in domestic mortgage rates given the Monetary Policy Committee little choice but to send a clear message,'' analysts at ANZ Bank explained.

Meanwhile, the Aussie jobs data will be keenly monitored tomorrow whereby analysts at TD Securities said ''wages growth may accelerate in Q2 as firms face record labour constraints while workers may demand higher base wages with inflation at a 21-year high.'' The analysts added ''July is a seasonally strong month for job gains and we look for the unemployment rate to trend lower. Another strong labour print should give the RBA the assurance that the economy can withstand a cash rate of 3% by end-2022.''

AUD/NZD technical analysis

The price has corrected in a 50% mean reversion and should the bears now move in, then a break of the trendline support and structure at 1.0952 will be a significant development.

- GBP/USD keeps the previous day’s rebound, the consecutive third one from 50% Fibonacci retracement since late July.

- Steady RSI, impending bull cross on MACD teases buyers to overcome immediate hurdle.

- 100-SMA adds to the upside filters, multiple supports to challenge bears.

GBP/USD picks up bids to extend the previous day’s recovery to 1.2100 during Wednesday’s Asian session. In doing so, the Cable pair approaches a one-week-old resistance line while also portraying the third bounce off the 50% Fibonacci retracement level of July-August advances.

In addition to the sustained rebound from the key Fibonacci support, steady RSI and a looming bull cross of the MACD also keep the GBP/USD buyers hopeful of overcoming the 1.2110 immediate hurdle.

Even so, the 100-SMA level of 1.2130 acts as an extra filter to the north before giving control to the bulls.

Following that, the 1.2200 threshold may act as an intermediate halt during the run-up to the monthly high near 1.2295.

Alternatively, pullback moves may initially test the 200-SMA, around 1.2045 at the latest, before revisiting the 50% Fibonacci retracement level of 1.2030.

In a case where the GBP/USD bears keep reins past 1.2030 key support, the 61.8% Fibonacci retracement level and late July’s swing low, respectively around 1.1965 and 1.1890, will be in focus.

GBP/USD: Four-hour chart

Trend: Further upside expected

- EUR/JPY bounced off weekly lows and gained almost 1% on Tuesday.

- Albeit recovering from Monday’s losses, faltering of achieving a daily close above 137.00 left the EUR/JPY vulnerable to selling pressure.

The EUR/JPY reached a new weekly low at 134.94 on Tuesday but staged a comeback and hit a daily high at 136.92 before closing at 136.50, off the day’s high. At the time of writing, the EUR/JPY is trading at 136.56, slightly up 0.02% as Wednesday’s Asian Pacific session begins.

EUR/JPY Price Analysis: Technical outlook

EUR/JPY Tuesday’s price action witnessed a shared currency recovery but faltering to close above Monday’s open at 136.89, leaving the cross vulnerable to sellers. Until Wednesday’s price action shows that the EUR/JPY trading above 137.00, the cross-currency pair is neutral-to-downward biased. Nevertheless, if the previously-mentioned scenario plays out, a rally towards the 50-day EMA at 138.00 is on the cards.

Therefore, the EUR/JPY’s first resistance would be the 20-day EMA at 137.24. Once broken, the next supply zone would be the 100-day EMA at 138.09, followed by the 50-day EMA at 139.34.

On the other hand, failure at 137.00 would open the door for further losses. The EUR/JPY first support would be 136.00. Break below will expose the weekly low at 134.94, followed by the 200-day EMA at 133.98.

EUR/JPY Key Technical Levels

- NZD/USD stays defensive at one-week low ahead of the key events.

- New Zealand PPI grew more than forecast in Q2 but came in softer-than-prior.

- Economic fears surrounding China, concerns over Fed’s September rate hike exert downside pressure.

- RBNZ is likely to announce fourth consecutive 0.50% rate increase but bulls need more to retake control.

NZD/USD struggles to defend the latest bounce off the 100-DMA as it seesaws near 0.6350 heading into the key interest rate announcement by the Reserve Bank of New Zealand (RBNZ) early Wednesday in Asia. In doing so, the Kiwi pair justifies the market’s indecision as the Fed Minutes also highlight today as the key day in the calendar.

Recession woes join mixed data and anxiety ahead of September Federal Open Market Committee (FOMC) meeting weigh on the NZD/USD prices of late. However, firmer equities and the US dollar’s pullback ahead of the Fed Minutes seem to challenge the Kiwi pair sellers. On the same line could be New Zealand’s second quarter (Q2) Producer Price Index (PPI) data.

New Zealand’s PPI-Input rose past 2.2% expected to 3.1% in Q2 but stayed below 3.6% in previous readings. In the same way, the PPI-Output also crossed the 2.1% market forecasts with 2.4% QoQ figures while easing beneath the previous 2.6% prior.

On the other hand, China’s state planner announced multiple measures to fight back the recession woes after downbeat data and the failure of the People’s Bank of China’s (PBOC) rate cut in impressing traders. Also, Washington Post (WaPo) mentioned that Chinese authorities ordered factories to suspend production in several major manufacturing regions to preserve electricity, as the country face the worst heat wave in six decades.

It should be noted that the US Dollar Index (DXY) refreshed its three-week high before reversing from 106.94. The greenback’s gauge versus six major currencies previously benefited from the flight to safety before the firmer equities and consolidation ahead of FOMC Minutes joined mixed data to weigh on the quote.

That said, US Industrial Production grew 0.6% in July versus 0.3% expected and upwardly revised 0.0% prior whereas Building Permits also increased to 1.674M MoM during the stated month versus 1.656 market expectations and 1.696M previous readings. It should be noted that the Housing Starts dropped to 1.446M from 1.599M prior and 1.54M expected.

While portraying the mood, Wall Street managed to close on the positive side, despite retreating by the end of the day. That said, the US 10-year Treasury yields snapped a two-day downtrend by regaining 2.80% at the latest.

Looking forward, NZD/USD traders will pay attention to the RBNZ’s announcement as New Zealand’s central bank is up for the seventh back-to-back increase in its benchmark interest rate, from 2.5% to 3.0%, not to forget a fourth straight 50 basis points (bps) rate hike. It’s worth noting that the 0.50% rate lift is discussed and priced in, which in turn signals the “need for more” by the pair buyers. Following that, the Fed Minutes will be eyed to confirm another hawkish move in September despite the latest reduction in the inflation fears.

Also read: Reserve Bank of New Zealand Preview: Growth fears could temper hawkish rhetoric

Technical analysis

NZD/USD recently bounced off the 100-DMA support around 0.6320 amid bullish RSI divergence. The recovery moves, however, need validation from a downward sloping resistance line from late April, close to 0.6460 by the press time

- AUD/USD fades bounce off one-week low, stays sidelined of late.

- Fears emanating from China, mixed message from RBA Minutes challenge buyers.

- US dollar pullback, firmer equities restrict immediate downside ahead of the key Aussie data.

- RBA emphasizes firmer wage growth, Fed Minutes eyed for stronger rate hikes.

AUD/USD portrays the market’s anxiety as it seesaws around 0.7020 ahead of the key Australia wage price data and the Federal Open Market Committee (FOMC) meeting minutes on early Wednesday in Asia. That said, the risk barometer pair dropped during the last two days amid recession and geopolitical fears before bouncing off a one-week low in late Tuesday.

Pessimism surrounding Australia’s major customer China and the Reserve Bank of Australia’s (RBA) cautious remarks over the next rate hike move appeared to have exerted major downside pressure on the AUD/USD prices of late.

On Tuesday, the RBA Minutes mentioned that the board expects to take further steps in the process of normalizing monetary conditions over the months ahead, but it is not on a pre-set path, per Reuters. On the other hand, China’s state planner announced multiple measures to fight back the recession woes after downbeat data and the failure of the People’s Bank of China’s (PBOC) rate cut in impressing traders. Also, Washington Post (WaPo) mentioned that Chinese authorities ordered factories to suspend production in several major manufacturing regions to preserve electricity, as the country face the worst heat wave in six decades.

Talking about data, US Industrial Production grew 0.6% in July versus 0.3% expected and upwardly revised 0.0% prior whereas Building Permits also increased to 1.674M MoM during the stated month versus 1.656 market expectations and 1.696M previous readings. It should be noted that the Housing Starts dropped to 1.446M from 1.599M prior and 1.54M expected.

Against this backdrop, Wall Street managed to close on the positive side, despite retreating by the end of the day. That said, the US 10-year Treasury yields snapped a two-day downtrend by regaining 2.80% at the latest.

Moving on, Australia’s second quarter (Q2) Wage Price Index, expected at 0.8% QoQ versus 0.7% prior, will be important for immediate AUD/USD moves as RBA emphasizes more on the wage data and inflation. Following that, the Fed Minutes will be crucial for clear directions as traders doubt a 0.75% rate hike in September after the latest easing in inflation.

Technical analysis

A four-month-old previous resistance line restricts immediate AUD/USD downside to around 0.6990. The recovery moves, however, need validation from the 200-DMA hurdle surrounding 0.7120. That said, the RSI (14) favors the quote’s further upside as the oscillator backs the higher low on prices with a higher low on the histogram.

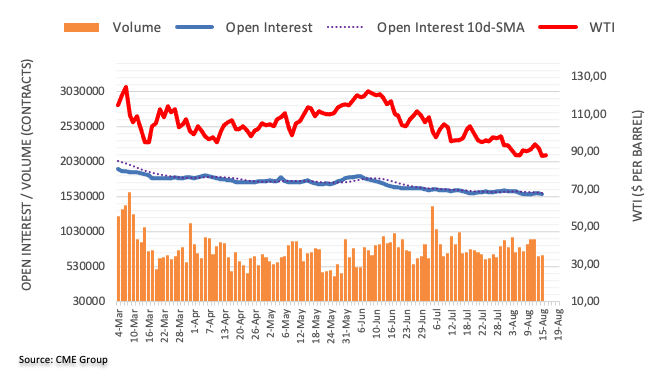

- Gold price holds lower ground near one-week low after two-day downtrend.

- Mixed sentiment, anxiety ahead of Fed Minutes kept XAU/USD on the back foot.

- Recession talks gained major attention, China, Europe in focus.

- FOMC Minutes will be eyed closely to confirm 75 bps rate hike in September.

Gold price (XAU/USD) prints a three-day downtrend as it grinds lower around $1,775 during the initial hours of Wednesday’s Asian session. In doing so, the precious metal fades the late Tuesday’s bounce off $1,772 as traders turn cautious ahead of today’s key Federal Open Market Committee (FOMC) meeting minutes.

That said, fears of economic slowdown, mainly emanating from China and Europe, join firmer Treasury yields and positive equities to confuse the traders. It’s worth noting that the US dollar also retreated amid the market’s indecision.

US Dollar Index (DXY) refreshed its three-week high before reversing from 106.94. The greenback’s gauge versus six major currencies previously benefited from the flight to safety as China’s readiness for multiple measures to tame recession woes joined Europe’s signals to renew the nuclear deal with Iran while pushing back plans for the closure of Germany’s last three nuclear power plants. On the same line was the Washington Post (WaPo) news that mentioned that Chinese authorities ordered factories to suspend production in several major manufacturing regions to preserve electricity, as the country face the worst heat wave in six decades.

Elsewhere, US Industrial Production grew 0.6% in July versus 0.3% expected and upwardly revised 0.0% prior whereas Building Permits also increased to 1.674M MoM during the stated month versus 1.656 market expectations and 1.696M previous readings. It should be noted that the Housing Starts dropped to 1.446M from 1.599M prior and 1.54M expected. On a different page, UK’s employment numbers failed to impress traders while Canada’s inflation matched consensus. Further, ZEW Sentiment data from Germany and Europe came in weaker for Economic Sentiment but improved a bit for Current Situation.

Amid these plays, Wall Street managed to close on a positive side, despite retreating by the end of the day. That said, the US 10-year Treasury yields snapped a two-day downtrend by regaining 2.80% at the latest.

Moving on, headlines surrounding China and inflation may entertain XAU/USD traders but major attention will be given to the Minute Statement wherein traders are more interested in the hints of a 75 basis point (bps) rate hike in September.

Also read: FOMC July Minutes Preview: Can it influence September Fed rate hike expectations?

Technical analysis

Gold defends the early week's downside break of the 50-day EMA amid steady RSI and receding bullish bias of the MACD, suggesting further weakness in XAU/USD prices.

That said, the 23.6% Fibonacci retracement of the April-July downtrend, near $1,755, is likely immediate support for the yellow metal.

Following that, multiple levels around $1,740 and $1,710 could entertain the commodity bears ahead of targeting the yearly low near $1,680.

Meanwhile, the 50-EMA level near $1,784 restricts the immediate upside of the gold price before the 38.2% Fibonacci retracement level near $1,803.

It’s worth noting, however, that a convergence of the 200-EMA, descending trend line from late April and a one-month-old upward sloping resistance line highlight $1,820-25 as the key hurdle for the bulls to cross to retake control.

Gold: Daily chart

Trend: Further weakness expected

- GBP/JPY eradicates Monday’s gains and gained more than 1% on Tuesday.

- The GBP/JPY is downward biased, but Tuesday’s price action opened the door for further upside, targeting the 50-DMA at 163.86.

The GBP/JPY pares Monday’s losses and some more, forming a bullish-engulfing candle pattern, meaning buyers overcome sellers, reciaiming the 162.00 figure on its way north. However, solid resistance lies ahead of the current exchange rate, with the 20 and 100-day EMAs hovering around the 162.80-163.00 area. At the time of writing, GBP/JPY is trading at 162.39.

GBP/JPY Price Analysis: Technical outlook

The cross-currency pair is exchanging hands below the 20, 100, and 50-day EMAs, suggesting that the GBP/JPY is downward biased. Nevertheless, Tuesday’s rally towards the 162.80-163.00 area, although rejected, it opened the door for further gains. So from a technical perspective, a break above the latter will put the 50-day EMA at 163.086 in play, ahead of the July 27 high at 166.33.

On the flip side, the GBP/JPY first support will be the 162.00 mark. Once cleared, the next support will be the figure at 161.00, ahead of the August 16 low at 160.08.

GBP/JPY Daily chart

GBP/JPY Key Technical Levels

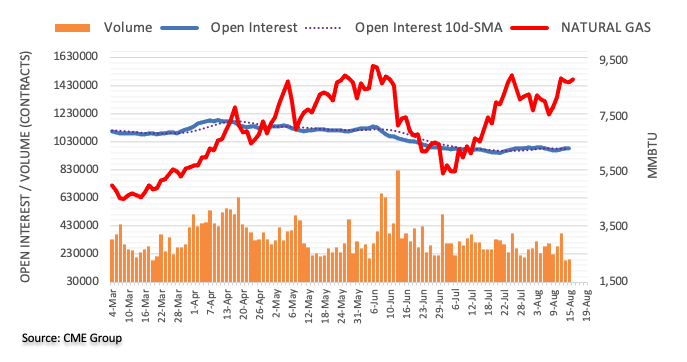

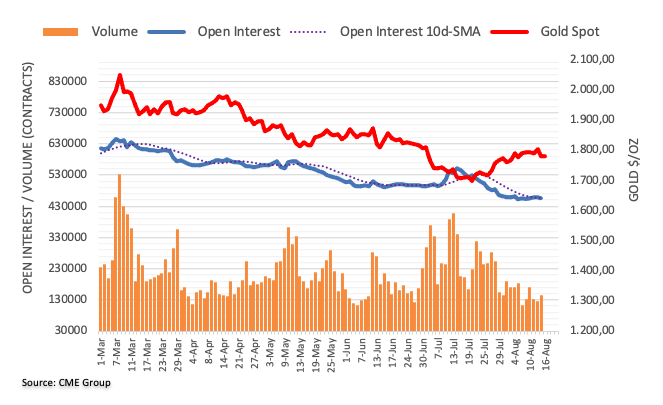

- Western Texas Intermediate (WTI) drops almost 1%, extending its losing streak to three days.

- Mixed US data and weaker Industrial Production and Retail Sales from China keep producers uncertain of total oil requirements.

- The Iran nuclear deal agreement would free additional crude to the global market, a sign of lower energy prices.

US crude oil benchmark, known as WTI, drops to six-month lows on recession fears, alongside mounting speculation of an Iran deal, which would free more than 700K barrels per day to the battered oil market. In the meantime, Wester Texas Intermediate (WTI) exchanges hands at $87.15 PB, slightly down 0.80%.

Investors’ mood remains upbeat, with US equities posting recoveries, despite an ongoing deceleration in the US economy. Albeit US Industrial Production exceeded estimations to the upside, underpinned by motor vehicles and higher manufacturing output, US Building Permits and Housing Starts for August plunged into contractionary territory, courtesy of higher interest rate increases by the Federal Reserve.

Worth noting that the Atlanta Fed GDPNow for the third quarter (Q3) dropped from 2.5% to 1.8%, though slightly better than the Q2 advanced reading.

The factors abovementioned weighed in oil prices, with WTI further tumbling below the 200-DMA at $95.51. Additionally, Monday’s data from China revealed that Retail Sales and Industrial Production missed expectations, increasing uncertainty about oil’s demand.

Elsewhere, talks between Iran and the EU regarding the nuclear accord seem to be progressing. Sources cited by Bloomberg commented that the “potential for a deal is being priced in.” That said, volatility around the oil market should increase until a final announcement is made.

If Iran’s nuclear deal is approved, oil from Teheran would be seen as a relief to high energy prices, particularly consumers, which had been dealing with skyrocketing petrol and gasoline prices, with countries like the US battling inflation at 4-decade highs.

WTI Key Technical Levels

- EUR/USD was pressured overnight to below the trendline support.

- Bears seek a break of 1.0141 structure that would be expected to open up the downside.

EUR/USD is trading at 1.0166 after a day where the US dollar was little changed against a basket of currencies with key data events ahead including the US Retail Sales and minutes from the Federal Reserve's July meeting on Wednesday.

On the day, there was mixed economic data from the US with better than expected earnings data that led to a rally on Wall Street. US July industrial production data for the US was much stronger than expected rising 0.6% MoM – twice the expected increase. Meanwhile, US housing starts dropped 9.6% in July to 1446k indicating a sharp retrenchment in residential construction.

Investors will now be looking to the release of Federal Reserve minutes following the meeting where the centralbank hiked rates by 75bp for a second consecutive meeting in July, "expeditiously" reaching the milestone of a neutral stance. ''With that under the belt, Chair Powell made clear that the Fed will now abstain from offering forward guidance to the extent they did on their way to "neutral". However, we expect the minutes to offer further colour around the Fed's near-term plans,'' analysts at TD Securities said. Fed funds futures traders are currently pricing in a 60% chance of a 50 basis points increase and a 40% probability of a 75 basis points hike.

The greenback has bounced from a six-week low last week as investors ramp up bets that the Fed will continue to hike rates aggressively as inflation remains persistently high. DXY made a high of 106.943. In other data, US Retail Sales today will also offer new insight into the state of the consumer. It is expected to show that sales rose by 0.1% in July compared with June.

EUR/USD daily chart

The price is being pressured below the counter trendline and a break of 1.0141 structure will be a significant development that would be expected to open up the downside.

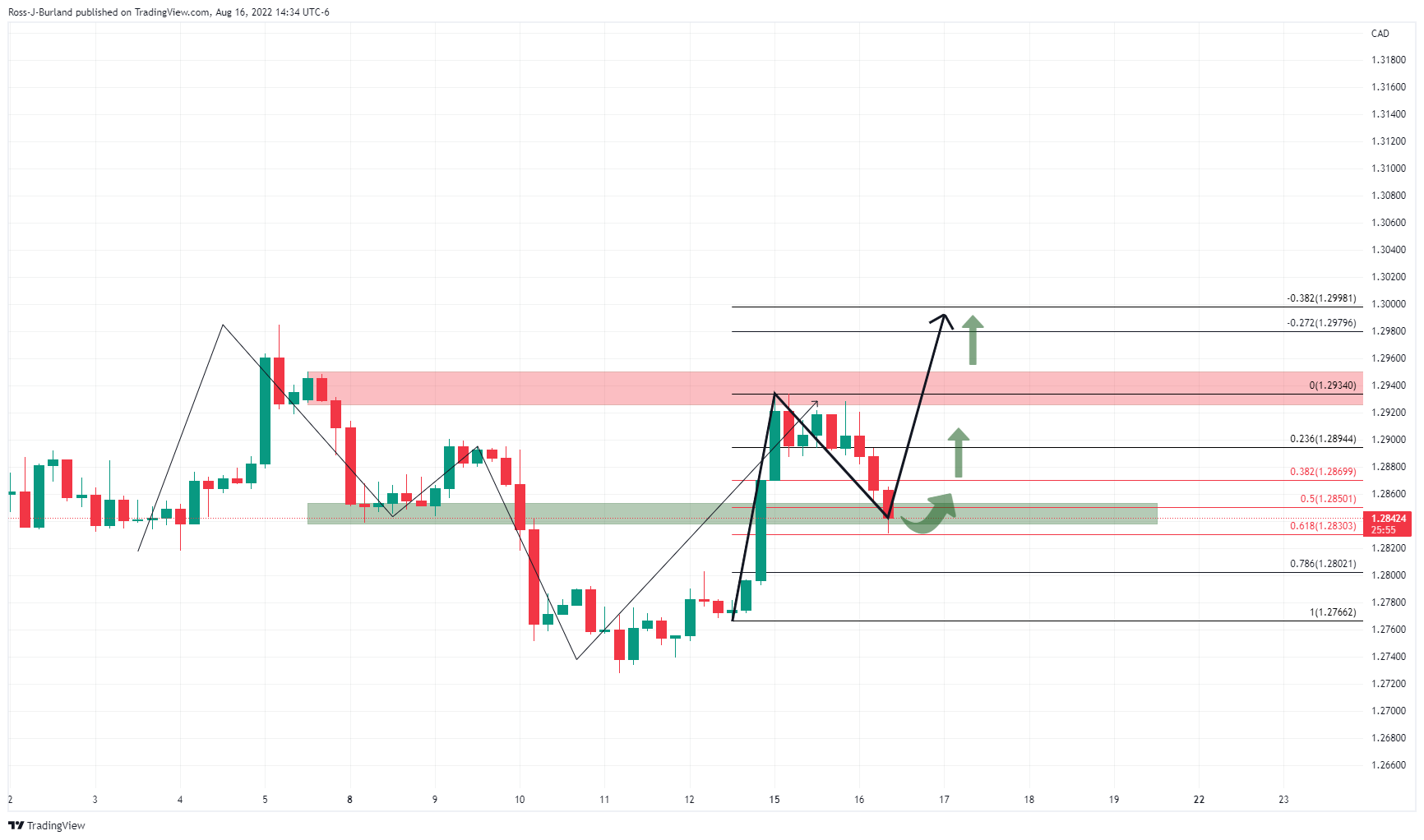

- USD/CAD bears seek a break of the 4H 61.8% ratio to the downside.

- Bulls eye an extension towards 1.3000.

As per the prior analysis, USD/CAD Price Analysis: Bulls could be about to clean up, and USD/CAD Price Analysis: Bulls seeking a break of 1.2790/00, whereby it stated that ''a resurgence in the greenback would be expected to see USD/CAD rally in due course, the price indeed moved higher as follows:

The following is an update of the prior analysis:

As illustrated, the price has rallied as anticipated but the bulls broke the neckline of the M-formation which sets up a bullish bias on the chart as shown above.

USD/CAD H4 chart

A break of the 61.8% ratio to the downside would be a significant move but while it holds, the bias is to the upside as per the chart above.

What you need to take care of on Wednesday, August 17:

Caution prevailed on Tuesday, with the focus still on a potential global recession. The dollar maintained its dominance despite a short-lived knee-jerk at the beginning of the American session.

The EUR/USD pair extended its weekly decline to 1.0121, ending the day at around 1.0160. The European energy crisis remains in the eye of the storm as the Union aims to reach a nuclear deal with Iran. Meanwhile, Germany has plans to postpone the closure of the country’s last three nuclear power plants.

GBP/USD trades around 1.2090 following the release of unimpressive UK employment data. The ILO unemployment rate held steady at 3.8% in the three months to June,

The USD/CAD pair edged lower, ending the day at 1.2840. Bank of Canada Governor Macklem said inflation may have peaked after the country released the July Consumer Price Index, which rose by less than anticipated.

AUD/USD finished the day unchanged at around 0.7020.

The greenback appreciated against safe-haven rivals, with USD/CHF trading at around 0.9500 and USD/JPY around 134.20.

Gold eased modestly, now changing hands at $1,777 a troy ounce. Crude oil prices were firmly down, and WTI trades at $86.30 a barrel.

Treasury yields advanced, and the yield curve remains inverted. The yield on the 10-year note currently stands at 2.81%.

Wall Street is mixed, with the DJIA posting substantial gains, the S&P 500 modestly up, and the Nasdaq Composite shedding some ground.

The macroeconomic calendar will turn more interesting on Wednesday, with Australian wages figures, EU GDP and US FOMC Meeting Minutes.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: No FUD, just charts

Like this article? Help us with some feedback by answering this survey:

- NZD/USD drops during the day by some 0.36% as investors prepare for the RBNZ.

- Mixed US economic data reignited recession fears in the US.

- The RBNZ is expected to hike the OCR by 50 bps to 3% on Wednesday.

The NZD/USD tumbles in the North American session, due to broad US dollar strength, despite a risk-on impulse in the financial markets, after US economic data came mixed, so recession fears reemerged. At the time of writing the NZD/USD is trading at 0.6341, down 0.35%.

US equities reflect investors’ upbeat mood, courtesy of positive US data. Industrial Production for July increased at a 0.6% MoM pace, exceeding estimations, underpinned by motor vehicle sales. Even though the news was positive, the Building Permits and Housing Starts missing estimations, recording negative prints, put a cap on higher US dollar prices.

Therefore, the NZD/USD trimmed some of its earlier losses after hitting a daily low at 0.6316. However, a monetary decision of the Reserve Bank of New Zealand (RBNZ) looming keeps NZD/USD buyers hopeful of higher prices, with expectations of a 50 bps hike fully priced in.

According to a Reuters poll, the RBNZ is expected to increase the Overnight Cash Rate (OCR) by 50 bps to 3.00%, which would be its most aggressive tightening since 1999.

Also read: RBNZ Preview: Forecasts from five major banks, all eyes on future policy path

In the meantime, five major banks, in their previews, expect that the RBNZ will hike rates by 50 bps on Wednesday, but there are some differences regarding the forward guidance the bank will use.

ANZ and Westpac expect a hawkish commentary, and the central bank would clearly communicate that the fight against inflation is well underway.

Bank of America estimates that guidance would remain hawkish, but they expect the bank to add “conditionality” on the scale of following rate hikes. Additionally, expect the bank to acknowledge that growth is softening.

TDS estimates the bank will emphasize that inflation risks are skewed to the upside and should dominate the RBNZ’s communication. Contrarily, ING estimates the bank would hike 50 bps but suggests the RBNZ “will have to revise its rate path projections lower.”

What to watch

On Wednesday, the Reserve Bank of New Zealand will unveil its monetary policy decision. On the US front, the docket will feature US Retail Sales, FOMC’s July minutes, and Fed speaking.

NZD/USD Key Technical Levels

- Gold is pressured below a key daily counter-trendline.

- The US dollar is carving out a move to the upside as recent data has reignited global recession fears.

The gold price is under pressure by some 0.15%, sliding from a high of $1,783.19 to a low of $1,771.52 on Tuesday as the safe-haven US dollar hit a one-week high after weak global economic data, particularly in China. The data has reignited global recession fears.

Figures for Industrial Production, Retail Sales and fixed asset investments, as released by the National Bureau of Statistics, came in below expectations in July. Additionally, worries about a more pronounced cooling rose from a surprising rate cut by the Chinese central bank, PBoC. The unexpected decision to cut has given the impression that the PBoC is alarmed about the extent of economic weakening as it tries to revive credit demand to support the COVID-hit economy after a string of weak economic data releases for July.

US Treasury yields rose due to the recession worries with the Federal Reserve expected to continue with steep rate hikes despite nascent signs of a slowdown in inflation. Several Fed policymakers have spoken of the need for continued rate hikes despite the lower-than-expected outcome of last week's Consumer Price Index. "Fed officials have no choice but to sound tough in the face of a very, very tight labour market and far too high inflation," Kit Juckes, the head of FX strategy at Societe Generale argued. "It's hard to build a compelling case to sell the dollar in that world."

''While Chair Powell catalyzed a Fed pivot narrative at the latest FOMC, particularly as the latest print in inflation pointed to cooling pressures, price action in Treasuries supported a rally across all assets,'' analysts at TD Securities said. The yield curve between 2-year and 10-year Treasury notes remained inverted at minus 38.60 basis points on Tuesday. This is viewed as an indicator of an impending recession. The DXY, an index that measures the greenback vs. a basket of currencies reached a peak of 106.94 in early European trading, recovering from the losses that were made on the back of lower-than-expected US inflation data. The index was last seen slightly in the green at 106.52.

Meanwhile, ''odds of a short squeeze in gold are notably declining,'' the analysts at TDS argued. ''However, our CTA positioning estimates suggest that a trend followers buying program contributed to lower rates over the past month, as algos were forced to cover shorts. While this supported higher prices in gold, the bar is razor thin for algorithmic trend followers to add to selling pressures in US10y Treasuries once more,'' the analysts said.

''This should further sap appetite to buy the yellow metal, while the bar for additional short covering rises further. Meanwhile, Shanghai traders are also likely to appear on the offer, particularly amid a weakening CNY. Gold prices are vulnerable, considering we see signs that gold sellers are lurking. Ultimately, prop traders are still holding a massive amount of complacent length, suggesting we have yet to see capitulation in gold, which argues that the pain trade remains to the downside.''

Gold technical analysis

The price of the US dollar is taking on a resistance level that guards a continuation higher on the daily chart above. Below, gold is carving out a bearish case below the counter trendline on the daily chart as follows:

- USD/JPY bounces off weekly lows around 132.50, underpinned by high US bond yields.

- The major faces solid resistance around 134.50-65; once cleared, a jump to 135.00 is on the cards.

- In the near term, a USD/JPY pullback towards the 133.50-60 area is on the cards before resuming upwards.

The USD/JPY jumps from around weekly lows to a crowded resistance area, with the 20-day EMA at 134.62, alongside a downslope resistance trendline, drawn from July tops (also the YTD highs), which passes near the 20-DMA. At the time of writing, the USD/JPY is trading at 134.27.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the major bias is neutral-upward biased, but a wall of resistance is emerging ahead of the 135.00 figure. However, the RSI crossing above its 7-day RSI SMA, also about to cross over the 50-midline, illustrates buying pressure is mounting on the pair. That, alongside higher US Treasury bond yields, can underpin the USD/JPY towards higher prices.

Therefore, the USD/JPY’s first resistance would be the 20-day EMA. Once broken, its next resistance would be the 135.00 figure, followed by a test of the August MTD high at 135.58.

Zooming into the one-hour scale, the USD/JPY is upward-biased, but in the last hours, the pair retraced due to RSI’s entering overbought conditions. Hence, the major might print a leg down before resuming the higher-time frame uptrend towards 135.00 and beyond.

Therefore, the USD/JPY first support would be the 50% Fibonacci retracement at 133.81. Break below will expose the confluence of the 50-day EMA and the 61.8% Fibonacci retracement at 133.50-60. After that, the USD/JPY might resume upwards, towards the August 9 daily high at 135.30.

USD/JPY Hourly chart

USD/JPY Key Technical Levels

- AUD/USD bulls move in to put the Aussie into the green for the day.

- China and recession worries flared up a flight to the US dollar.

AUD/USD has been pressured on Tuesday after weak global economic data, particularly in China, reignited global recession fears. The safe-haven US dollar has benefitted in the forex space and it hit a one-week high while risk-friendly currencies such as the Australian dollar have taken the brunt. At 0.7027, AUD/USD is in the green by some 0.01%, after falling from a high of 0.7040 to mark a low of 0.6991 before recovering in midday US trade.

Fears of a significant slowdown of the Chinese economy put a dampener on the commodity markets and the Australian dollar took a knock on lower demand for iron ore and other assets from China. Figures for Industrial Production, Retail Sales and fixed asset investments, as released by the National Bureau of Statistics, came in below expectations in July. Additionally, worries about a more pronounced cooling rose from a surprising rate cut by the Chinese central bank PBoC. The unexpected move gave the impression that the PBoC is alarmed about the extent of economic weakening as it tries to revive credit demand to support the COVID-hit economy after a string of weak economic data releases for July. Australia's close trade ties with China mean traders sometimes treat its currency as a liquid proxy for China's yuan.

In the US, Treasury yields rose due to the recession worries and along with the concerns that the Federal Reserve will continue its steep interest rate hikes despite nascent signs of a slowdown in inflation. Several Fed policymakers have spoken of the need for continued rate hikes despite the lower-than-expected outcome of last week's Consumer Price Index.

Additionally, the yield curve between 2-year and 10-year Treasury notes remained inverted at minus 38.60 basis points on Tuesday. This is viewed as an indicator of an impending recession. The dollar index DXY meanwhile hit a peak of 106.94 in early European trading, recovering from the losses that were made on the back of lower-than-expected US inflation data. The index was last seen flat at 106.46.

"Fed officials have no choice but to sound tough in the face of a very, very tight labour market and far too high inflation," Kit Juckes, the head of FX strategy at Societe Generale argued. "It's hard to build a compelling case to sell the dollar in that world."

Meanwhile, the minutes from the Reserve Bank of Australia’s (RBA) August policy meeting showed that the Board of the central bank expected further rate hikes given inflation was far above target and the labour market at its tightest in decades. There will be more from the labour market this week where analysts at TD Securities said ''wages growth may accelerate in Q2 as firms face record labour constraints while workers may demand higher base wages with inflation at a 21-year high.'' The analysts added ''July is a seasonally strong month for job gains and we look for the unemployment rate to trend lower. Another strong labour print should give the RBA the assurance that the economy can withstand a cash rate of 3% by end-2022.''

AUD/USD technical analysis

The hourly chart has left behind a W-formation that pulled the price into the neckline before the bulls moved in again. The price would be expected to move higher to mitigate inefficiencies on the lower time frames before reaching the resistance for a test of the 0.7030s.

On the 15-min time frame, there are a few imbalances of price to the downside that could be mitigated prior to a test towards the resistance area. The neckline of the W-formation aligns with a price imbalance near 0.7012.

- USD/CHF extends its weekly gains and erases last week’s losses, up by 1%.

- The USD/CHF aims higher and could test the 20-day EMA; otherwise, further losses will extend towards 0.9400.

The USD/CHF climbs for the second straight day, widening the gap between the 200-day EMA and the exchange rate, courtesy of broad US dollar strength, underpinned by high US T-bond yields, in the mid-North American session. At the time of writing, the USD/CHF is trading at 0.9501, up by 0.55%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is about to test the top-trendline of a descending channel. It’s worth noting that albeit a successive series of lower highs/lows confirm the pair is in a downtrend, sellers’ failure to capture the 200-day EMA at 0.9431 exposed the pair to buying pressure. Therefore, the USD/CHF edged higher, from around multi-month lows below 0.9400, towards current price levels.

If USD/CHF buyers would like to reclaim control, they need a break above the top trendline of the channel, which also intersects with the 20-day EMA at 0.9549. Once cleared, that would pave the way towards the 100-day EMA at 0.9631, followed by the 50-day EMA at 0.9651.

On the other hand, if the major tumbles and closes below 0.9500, that could pave the way for further losses. Hence, the USD/CHF first support would be the August 16 low at 0.8445, followed by the 200-day EMA at 0.9431 and the MTD low at 0.9370.

USD/CHF Daily chart

USD/CHF Key Technical Levels

- GBP/USD marches firmly towards the confluence of the 20/50-DMA around 1.2110.

- US Industrial Production surprises to the upside, while housing data continues to worsen.

- UK employment figures were better-than-expected, further cementing the case for a 50 bps BoE rate hike.

The GBP/USD snaps three days of losses and approaches the 1.2100 figure as the greenback begins to weaken, in the middle of the North American session, courtesy of resurfacing recession fears with US data showing signs of an economic slowdown.

The GBP/USD is trading at 1.2081, after hitting a daily low at 1.2007, during the European session, but bounced back on modest UK employment figures and reclaimed the 1.2050 area.

Data-wise, the US Federal Reserve reported that Industrial Production for July rose by 0.6% MoM, underpinned by motor vehicles, propelled by easing supply chain disruptions. Before Wall Street opened, July’s Building House Permits and Housing Starts plummeted, indicating the ongoing deterioration in the housing market, spurred by higher mortgage rates.

Alongside that, Monday’s New York Fed Empire State Manufacturing Index for August dropped to the contractionary territory at -31.1 headline, less than 5 estimated.

The GBP/USD reacted to that, pushing through the 20-day EMA, extending its gains, and hitting a daily high at 1.2117.

On the UK side, employment data was better than estimated, with Claimant Count Change, falling by 10K, better than the 32K estimated, while the Unemployment Rate stood at 3.8%. Even though data shows signs of a robust labor market, the Bank of England is expected to lift rates at their next meeting by 50 bps, regardless of projecting that the UK’s economy might tap into a recession late in the year.

Elsewhere, the political spectrum has not been a driver of the British pound. However, the upcoming election in September might increase volatility in the GBP/USD, and depending on who is elected as Prime Minister; we would likely see the pair’s first reaction to that.

What to watch

On Wednesday, the UK economic calendar will feature the Retail Price Index and inflation figures in consumer and producer side sources. The US docket will reveal Retail Sales for July, alongside the FOMC’s last meeting minutes and Fed speeches.

GBP/USD Key Technical Levels

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 1.8% in the third quarter, down from 2.5% in the previous estimate.

"After recent releases from the US Department of the Treasury's Bureau of the Fiscal Service, the US Bureau of Labor Statistics, the US Census Bureau, and the Federal Reserve Board of Governors, a decrease in the nowcast of third-quarter real gross private domestic investment growth from 0.2% to -3.6% was slightly offset by an increase in the nowcast of third-quarter real government spending growth from 1.7% to 2.0%," Atlanta Fed explained in its publication.

Market reaction

The US Dollar Index largely ignored this report and was last seen posting small daily gains at 106.58.

On Wednesday, inflation data is due in the United Kingdom. Analysts at Well Fargo, expect the CPI to show an increase of 0.4% in July in line with market consensus. According to them, the British economy has not yet experienced peak inflation and they believe CPI is likely to trend closer to 10%.

Key Quotes:

“U.K. inflation is currently the highest on record, with the June CPI hitting 9.4% year-over-year. While core inflation dipped slightly in June, the core CPI is running close to 6% year-over-year, a signal of broad price pressures across the entire economy. Around the world, we have gotten preliminary evidence that inflation may be peaking; however, those dynamics may not apply to U.K. CPI. Contrary to the U.S., we believe U.K. inflation rose in July and the British economy has not yet experienced peak inflation.”

“European energy prices continue to move higher as a result of limited exports from Russia and supply shortages across the continent. As inflation rockets higher, we believe the U.K. economy will be one of the first major economies to tip into recession by the end of this year. Q2 GDP data reveal the recession may be imminent as the economy contracted in the second quarter. Bank of England policymakers also forecast a recession lasting through 2023 due to energy shortages and more aggressive tightening.”

The annual inflation rate in Canada dropped from 8.1% to 7.6% as expected. Despite the slowdown analysts at CIBC consider the Bank of Canada (BoC) is probably keeping a close eye on inflation ex food/energy these days that showed an acceleration, “not good news for the Bank, which should still be on track for a 75bps increase in rates at its next meeting.”

Key Quotes:

“Canadian inflation has taken its foot off the gas, but other elements in July’s inflation story were not as reassuring. Headline CPI inflation decelerated to 7.6% year-over-year in July on a much smaller 0.1% month-over month increase, roughly in line with consensus expectations. As expected, gasoline prices were the main driver of the slowdown. In what is bad news for consumers, food prices resumed their climb in July after taking a pause in June.”

“CPI inflation excluding food and energy spelled further trouble with an increase of 0.5% on a seasonally adjusted basis. Prices for services impacted by the pandemic, such as hotels, air transportation and restaurants all increased.”

“While inflation seems to finally have started its long descent, the acceleration in inflation excluding food and energy will be a concern for the Bank of Canada. With gasoline prices set to decline further in August, so should headline CPI, but that is not what the Bank will be watching. The focus should be on shelter prices (outside of mortgage costs), which should decelerate with the cooling housing market, and overall service inflation. For now, the Bank of Canada remains on track for a 75 bps increase at its September rate decision.

Data released on Tuesday showed Industrial Production rose 0.6% in July in the US, surpassing expectations. Analysts at Wells Fargo point out that the jump in industrial production was due largely to a surge in auto production but also came with upward revisions that lessened the June decline in manufacturing output. They consider sustained production growth will require continued demand for durable goods and improvement in supply chains; “both look iffy at the moment”.

Key Quotes:

“Industrial production notched a solid 0.6% increase in July. The non-manufacturing output measures more-or-less canceled one another out. Mining output rose 0.7% and utilities output sank 0.8%. So the headline gain is mostly a function of what happened in terms of factory output.”

“The auto industry has been particularly affected by these struggles and even as the economy cools, there is still pent-up demand for certain vehicle models.”

“Other manufacturing data point to slower activity ahead. The new orders component of the ISM manufacturing index slipped further into contraction territory in July, and this component tends to track industrial production relatively well.”

“We continue to expect manufacturing activity will hold up a bit better than other parts of the economy, but we see a slower pace of activity ahead. Thawing supply chains could help facilitate easier production, but a full normalization still looks a ways off. The dent to optimism from mounting recession fears, a pullback in consumers' demand for goods and tighter financial conditions will all also likely pressure businesses desire for capital outlays.”

Commenting on the Wall Street Journal report claiming that Germany was planning to postpone the closure of nuclear power plants, a spokesperson for the German economy ministry said that the media report was lacking a factual basis.

The German government will make a decision on whether to keep the last nuclear power plants running following the results of ongoing stress tests on electricity stability, the spokesperson further explained, as reported by Reuters.

Market reaction

These comments don't seem to be having a significant impact on the shared currency's performance against its rivals. As of writing, EUR/USD was up 0.1% on the day at 1.0170.

- US Dollar loses momentum during the American session amid risk appetite.

- EUR/USD turns positive after hitting the lowest level since August 3.

The EUR/USD rose more than 50 pips from the weekly low it reached earlier at 1.0121. The euro printed a fresh daily high at 1.0194 and then pulled back modestly. The move higher was supported by a weaker dollar amid risk appetite.

The DXY is flat after erasing gains. The Index hit two-week highs near 107.00 and then dropped back toward 106.50. In Wall Street, the Dow Jones is up by 0.73% and the S&P 500 climbs 0.28%. US yields are modestly higher, keeping the dollar’s retreat limited. Economic data from the US came in mixed. Industrial Production rose above expectations in July (0.6% vs 0.3%) while Housing Starts tumbled 9.6%.

Technical outlook

The EUR/USD found support above 1.0120/25, like last week. While above losses seem limited for the euro. The bias in the short-term still points to the downside with price under key moving averages in four hours and daily chats. The critical support level continues to be 1.0100 with a consolidation below exposing the parity.

On the upside, immediate resistance is seen at 1.0200 followed by 1.0215 (20-day Simple Moving Average) followed by 1.0270/80.

Technical levels

In a policy U-turn, the German government plans to keep the last three nuclear power plants operational, the Wall Street Journal reported on Tuesday.

After having shut down three of the six remaining power plants back in January, German economy and environment ministers reaffirmed in March that the costs and risks of keeping nuclear facilities open outweighed the limited benefits. The last three nuclear power plants were scheduled to go offline in December.

Market reaction

There was no immediate market reaction to this headline and the EUR/USD pair was last seen posting modest daily gains at 1.0175.

The United States has received, through the European Union, Iran's comments on the EU's nuclear proposal and is studying them, a spokesperson for the State Department said on Tuesday, as reported by Reuters.

Market reaction

Crude oil prices fell sharply on this development and the barrel of West Texas Intermediate was last seen losing 0.8% on the day at $87.20.

In case the US and Iran reach an agreement to revive the 2015 nuclear deal, Iranian gas and oil supply could enter the markets via the removal of sanctions.

- Gold price is falling on high US yields and a risk-on impulse.

- US housing data keeps worsening, adding to Monday’s NY Fed Manufacturing Index, which reignites recession fears.

- Investors are eyeing the last meeting FOMC minutes on Wednesday and further Fed speakers.

Gold price slides due to an uptick in US bond Treasury yields, amidst a mixed market sentiment, with EU and US equities split between gainers and losers as the North American session begins. Meanwhile, mixed US economic data keeps traders assessing the US economic outlook in the near-to-medium term. At the time of writing, XAU/USD is trading at $1776.72 a troy ounce.

XAU/USD slides on high US bond yields amidst mixed US data

Gold is pressured by a slight improvement in sentiment. In the meantime, Industrial Production in the US rose for the first time in three months, 0.6% MoM reading, underpinned by motor vehicles, which benefitted from improvements in chip supplies. Earlier, Building Permits and Housing Starts plunged, each decreasing by -1.3% MoM and -9.6% MoM, respectively, signaling that increases in the Federal funds rate (FFR) are taking their toll on the housing market.

Besides, a dismal reading in Federal Reserve’s Regional Banks, led by the NY Fed Empire State Index, paints a battered picture of an upcoming US recession.

Aside from this, US Treasury Yields, a headwind for the yellow metal price, are rising, led by the short term of the curve. The US 10-year T-bond yield is at 2.851%, up six basis points, erasing Monday’s losses.

Meanwhile, the US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, is almost flat at 106.473, slightly down 0.02%,

What to watch

The US economic docket will feature the Federal Reserve Open Market Committee minutes from their last meeting and Fed speaking, led by Kansas City Fed’s Esther George and Minnesota Fed’s Neil Kashkari.

Gold Price Analysis (XAU/USD): Technical outlook

From a daily chart perspective, XAU/USD is neutral biased, clinging underneath the 50-day EMA at $1780. It’s worth noting that the RSI points downwards, closing to the 50-midline, and the 100-day EMA crossed below the 200-day EMA, which could exacerbate a lower move. Nevertheless, unless sellers reclaim the 20-day EMA at $1760.70, consolidation in the $1780-$1810 area is on the cards.

GBP/USD has staged a rebound after testing key, short-term support at 1.2005. However, economists at Scotiabank still expect cable to move downward in the weeks ahead.

Short-term trend remains bearish

“Rising rates and falling private consumption amid surging prices are boosting recession risks in the UK and will maintain broader pressure on the GBP in the weeks ahead.”

“The short-term trend remains bearish and trend momentum signals are aligned bearishly for the pound currently, putting the market at clear risk of running back to (and a bit below) the July low at 1.1763.”

Canadian inflation dropped lower in July. But not enough to derail the Bank of Canada (BoC) from its currently aggressive hiking path. USD/CAD edges lower, however, economists at TD Securities expect dips in the pair to be bought into 1.28.

Positioning for topside around the BoC meeting

“Unless the data takes a huge nosedive between now and the September meeting, a 75 bps hike seems like a prudent bet. We are generally viewing the CAD as living on borrowed time however.”

“While this number may help to introduce modest downside into USD/CAD, we expect dips to be bought into 1.28. This is because the BoC meeting next month could be construed as peak hawkishness.”

“We like the idea of legging into CAD shorts around the BoC meeting as the Bank may start to change its tune just as the impact of higher rates begins to show in the data.”

- USD/TRY adds to Monday’s gains near the 18.00 mark.

- The current consolidation remains capped by 18.00.

- The CBRT is expected to keep the current status quo.

The lira depreciates further and motivates USD/TRY to once again challenge the upper end of the current range just below the 18.00 yardstick on Tuesday.

USD/TRY now looks to the CBRT

USDS/TRY clinches the second session in a row with gains on the back of the continuation of the bid bias in the greenback, always amidst persistent risk-off tone and helped further by rising US yields.

In the meantime, the lira is expected to remain under scrutiny ahead of the interest rate decision by the Turkish central bank (CBRT) later in the week. Consensus among investors, however, sees the central bank staying on the sidelines and keeping the One-Week Repo Rate unchanged at 14.00%.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and stays on course to revisit the key 18.00 zone.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: Budget Balance (Monday) – CBRT Interest Rate Decision (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.13% at 17.9604 and faces the immediate target at 17.9874 (2022 high August 3) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.1903 (weekly low July 15) would pave the way for 16.3438 (100-day SMA) and finally 16.0365 (monthly low June 27).

- USD/JPY gains strong positive traction on Tuesday and is supported by a combination of factors.

- Hawkish Fed expectations, rising US bond yields continue to underpin the USD and act as a tailwind.

- The Fed-BoJ policy divergence weighs on the JPY, though recession fears could limit deeper losses.

- Investors might also prefer to wait for the release of the key FOMC meeting minutes on Wednesday.

The USD/JPY pair builds on its intraday positive move and climbs to the 134.65-134.70 area, or a four-day high during the early North American session.

The US dollar is prolonging its recovery from over a one-month low touched in the aftermath of the softer US CPI report and gaining traction for the third successive day on Tuesday. The momentum pushes the buck to a fresh monthly peak and acts as a tailwind for the USD/JPY pair.

The recent hawkish remarks by several Fed officials suggest that the US central bank would stick to its policy tightening path. This, along with a pickup in the US Treasury bond yields, continues to underpin the USD and remain supportive of the USD/JPY pair's strong move up.

Apart from this, a big divergence in the Fed-Bank of Japan (BoJ) monetary policy stance is driving flows away from the Japanese yen and providing an additional lift to spot prices. It is worth recalling that the BoJ has repeatedly said that it would retain its ultra-easy policy settings.

That said, the prevalent cautious market mood - amid growing worries about a global economic downturn - extends some support to the safe-haven JPY. This might turn out to be the only factor that might hold back bulls from placing fresh bets and cap any further gains for the USD/JPY pair.

Traders might also prefer to move on the sidelines ahead of the FOMC minutes, scheduled for release on Wednesday. Investors would look for clues about the possibility of a 75 bps rate hike in September, which would influence the USD and provide a fresh directional impetus to the USD/JPY pair.

Technical levels to watch

- Industrial Production in the US rose at a stronger pace than expected in July.

- US Dollar Index clings to daily gains near 106.70 after the data.

The data published by the US Federal Reserve showed on Tuesday that Industrial Production rose by 0.6% on a monthly basis in July. This print came in better than the market expectation for an expansion of 0.3%. In the same period, Manufacturing Production increased by 0.7% after having contracted by 0.4% in each of the previous two months.

"Capacity utilization moved up 0.4 percentage point in July to 80.3%, a rate that is 0.7 percentage point above its long-run (1972–2021) average," the publication further read.

Market reaction

These figures don't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.23% on the day at 106.73.

- EUR/USD drops further and revisits the 1.0120 area.

- Extra losses should meet solid support around 1.0100.

EUR/USD challenges the August lows in the vicinity of 1.0120 on turnaround Tuesday.

While further correction appears likely in the short-term horizon, the lower end of the recent range in the 1.0100 zone should offer decent support prior to a potential challenge of the psychological parity level.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0880.

EUR/USD daily chart

Gold sellers are lurking, according to economists at TD Securities. Therefore, the pain trade remains to the downside.

Shanghai traders are likely to appear on the offer

“The bar is razor thin for algorithmic trend followers to add to selling pressures in US 10Y Treasuries once more. This should further sap appetite to buy the yellow metal, while the bar for additional short covering rises further.”

“Shanghai traders are likely to appear on the offer, particularly amid a weakening CNY.”

“Gold prices are vulnerable, considering we see signs that gold sellers are lurking.”

- USD/CAD edges lower and refreshes daily low during the early North American session.

- The mixed Canadian/US macro data fails to provide any meaningful impetus to the pair.

- The fundamental backdrop supports prospects for the emergence of some dip-buying.

The USD/CAD pair witnessed some selling during the early North American session and refreshes it's daily low in reaction to US/Canadian macro data. The pair is currently trading with modest intraday losses, just below the 1.2900 round-figure mark.

A modest bounce in crude oil prices seems to underpin the commodity-linked loonie and act as a headwind for the USD/CAD pair. Spot prices edge lower and seem rather unaffected by Canadian consumer inflation figures. Statistics Canada reported that the Canadian CPI decelerated to the 7.6% YoY rate in July from the 8.1% in the previous month. More importantly, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, unexpectedly eased to the 6.1% YoY rate from the 6.2% in June.

This, along with some follow-through US dollar buying for the third straight day, should offer some support to the USD/CAD pair. In fact, the USD climbs to a fresh monthly high and continues to draw support from expectations that the Fed would stick to its policy tightening path. Apart from this, an uptick in the US Treasury bond yields and recession fears offset mixed US housing market data and favour the USD bulls, supporting prospects for the emergence of some dip-buying around the major.

Traders, meanwhile, might refrain from placing aggressive bets ahead of the FOMC monetary policy meeting minutes, scheduled for release on Wednesday. The markets have priced in at least a 50 bps Fed rate hike at the September meeting and the minutes would be looked upon for clues about the possibility of a larger, 75 bps move. Hence, it would be prudent to wait for strong follow-through selling before confirming that the recent recovery from over a two-month low touched last week has run its course.

Technical levels to watch

- Housing Starts in the US fell sharply in July.

- US Dollar Index edged slightly lower with the initial reaction.

The monthly data published by the US Census Bureau showed on Tuesday that Housing Starts declined by 9.6% on a monthly basis in July following the 2.4% increase recorded in June. Moreover, Building Permits fell by 1.3% in the same period.

"Single‐family housing starts in July were at a rate of 916,000; this is 10.1% below the revised June figure of 1,019,000," the publication further read.

Market reaction

The US Dollar Index (DXY) retreated modestly from the 20-day high it touched at 106.95 earlier in the day with the immediate market reaction. As of writing, the DXY was up 0.3% on the day at 106.80.

- Annual CPI inflation in Canada declined to 7.6% in July as expected.

- USD/CAD continues to fluctuate at around 1.2900 after the data.

Inflation in Canada, as measured by the Consumer Price Index (CPI), declined to 7.6% on a yearly basis in July from 8.1% in June, the data published by Statistics Canada revealed on Tuesday. This print came in line with the market expectation.

The Bank of Canada's (BOC) Core CPI, which excludes volatile food and energy prices, edged lower to 6.1% from 6.2% in the same period, compared to analysts' estimate of 6.7%.

Market reaction

With the initial market reaction, the USD/CAD pair edged slightly lower before staging a rebound. As of writing, the pair was trading flat on the day at 1.2900.

Senior Economist at UOB Group Alvin Liew comments on the publication of Japanese Q2 GDP figures.

Key Takeaways

“Japan’s 2Q 2022 GDP missed market expectations, as it grew by 0.5% q/q, 2.2% q/q SAAR (versus Bloomberg est: 2.6% q/q SAAR, but in line with UOB est 2.2% q/q SAAR) while the -0.5% contraction in 1Q was revised to a surprising 0.1% expansion. It is also notable that the 2Q growth (and 1Q upward revision) finally lifted the real GDP of Japan to JPY542.1 trillion, above the pre-pandemic level of JPY 540.9tn in 4Q 2019.”

“Sequential expansion in 2Q was due to increases in private consumption, business spending, government consumption and a surprise rebound in public investment. The key drag on the economy was the 0.4ppt decline from private inventories while net external demand/net exports of goods and services did not contribute to sequential growth.”

“We expect the Japanese economy to continue its rebound although the extent could be curbed by stronger inflation impacting domestic demand. Japan remains slow to re-open borders to tourism with daily COVID-19 infections still high at 200,000. Meanwhile, weaker growth outlook in Japan’s key trading partners (especially Eurozone) will also imply weaker demand for Japan’s exports, adding further downside to growth.”

“Despite the slightly more positive growth outcome in 1H 2022, there will greater caution on the external outlook which has deteriorated materially compared to three months ago and the external risks include: 1) the on-going Russia-Ukraine conflict, 2) monetary policy tightening stance in the advanced economies, 3) geopolitical risks, and 4) COVID-19 risk of potential new variants.”

“We expect Japan to continue its growth trajectory but are mindful of the external risks. We are comfortable with our current full-year 2022 GDP growth forecast at 1.5%, a slowdown from 1.7% in 2021. We expect growth to remain at a lacklustre 1.4% for 2023, due to the uncertain external outlook. With Japan’s moderate economic recovery and the challenging external growth outlook while inflation driven by commodities, it means that the BOJ will not be tightening or signaling to do so anytime in 2022.”

- DXY extends the recovery and flirts with 107.00.

- Further up comes the weekly high around 107.40.

DXY extends the rebound from recent lows and trades closer to the key barrier at the 107.00 zone on Tuesday.

The continuation of the upside momentum could extend to the August high near the 107.00 yardstick (August 5). Once cleared, the index could attempt to confront the post-FOMC meeting high at 107.42 (July 27).

Looking at the broader scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.16.

DXY daily chart

- Silver loses ground for the second straight day and slides to over a one-week low.

- The downfall marks a bearish breakdown below a one-week-old trading range.

- Bears still need to wait for a sustained break below $20.00 before placing fresh bets.

Silver witnesses selling for the second successive day on Tuesday and drops to over a one-week low, around the $20.00 psychological mark during the mid-European session.

The decline follows last week's failure near the 61.8% Fibonacci retracement level of the $22.52-$18.15 downfall and marks a bearish break below a one-week-old trading range. Adding to this, acceptance below the 50% Fibo. level and the 50-day SMA supports prospects for a further depreciating move for the XAG/USD.

That said, oscillators on the daily chart - though have been losing traction - are yet to confirm the negative outlook. This makes it prudent to wait for sustained weakness below the $20.00 mark before placing fresh bearish bets and positioning for a subsequent slide below the 38.2% Fibo. level, around the $19.80 region.

The next relevant support is pegged near the $19.55 area (last week's swing low), which should now act as a key pivotal point. A convincing break below would shift the bias in favour of bearish traders and expose the 23.6% Fibo. level, around the $19.20-$19.15 region. The XAG/USD could eventually drop to the $19.00 mark.

On the flip side, the 50% Fibo. level, around the $20.35 region, now seems to act as immediate strong resistance. Any subsequent move up could attract fresh selling near the $20.65 horizontal zone. This, in turn, should keep a lid on any further gains for the XAG/USD near the 61.8% Fibo. level, around the $20.85 region.

Silver daily chart

-637962486619829804.png)

Key levels to watch

The GBP/USD pair manages to defend the 1.2000 psychological mark on Tuesday. A drop under 1.1965 would set up a test of the July 14 low near 1.1760, according to economists at BBH.

UK reported labor market data

“Break below 1.1965 would set up a test of the July 14 low near 1.1760.”

“Employment rose 160K in the three months through June vs. 268K expected, while the unemployment rate remained steady at 3.8%.”

“Real wages fell by 3% during the same period, the most since the series began in 2001, as rising inflation and slowing nominal wage gains are clearly hurting household income. Expect consumption to continue weakening in the coming months.”

“Of note, job vacancies for the three months through July fell 19.8K, the first drop since August 2020 and possibly signaling weaker labor market conditions ahead.”

EUR/USD declines toward 1.0100. A drop under this level would set up a test of the July 14 cycle low near 0.9950, economists at BBH report.

German August ZEW consumer survey was weak

“A break below 1.0110 would set up a test of the July 14 cycle low near 0.9950.”

“Expectations came in at -55.3 vs. -52.7 expected and -53.8 in July, while current situation came in at -47.6 vs. -49.0 expected and -45.8 in July. ZEW noted that ‘The still high inflation rates and the expected additional costs for heating and energy lead to a decrease in profit expectations for the private consumption sector’.”

Enrico Tanuwidjaja, Economist at UOB Group, reviews the latest trade balance figures in Indonesia.

Key Takeaways

“Indonesia’s trade surplus narrowed to USD 4.2bn in Jul, a decrease from the preceding month’s USD 5.1bn, but still higher than market expectations of USD 3.9bn.”

“Exports grew 32.03% y/y, beating market expectations of 29.73% to achieve USD 25.6bn, driven by increased palm oil exports. Imports soared, growing at 39.9% y/y compared to consensus estimates of 37.3%, reaching USD 21.4bn, a sign of post-pandemic recovery.”

“We expect the overall trade surplus in 2022? to match 2021’s record of USD35.3bn, amidst soaring imports and exports as supply chains resume pre-pandemic levels of efficiency.”

- EUR/JPY trades with decent gains after two daily drops in a row.

- If the rebound gathers pace, then the cross could revisit 138.40.

EUR/JPY leaves behind two consecutive daily pullbacks and advances beyond 136.00 the figure on Tuesday.

In case the recovery becomes more serious, then the cross should meet the next barrier at the 100-day SMA at 138.08 prior to the more relevant August peak at 138.39 (August 10).

While above the 200-day SMA, today at 133.94, the prospects for the pair should remain constructive.

EUR/JPY daily chart

- AUD/USD turns lower for the second straight day and drops to a multi-day low.

- Hawkish Fed expectations continue to underpin the USD and exert pressure.

- Recession fears further benefit the USD and weigh on the risk-sensitive aussie.

The AUD/USD pair struggles to capitalize on its intraday recovery move and meets with a fresh supply near the 0.7040 region on Tuesday. Spot prices turn back lower for the second successive day and slip below the 0.7000 psychological mark, hitting a four-day low during the first half of the European session.

The US dollar catches some bids for the third straight day and climbs back closer to the monthly peak, which turns out to be a key factor exerting downward pressure on the AUD/USD pair. Despite last week's softer US CPI report, the recent hawkish comments by Fed officials suggest that the US central bank would stick to its policy tightening path. This remains supportive of elevated US Treasury bond yields and continues to offer support to the greenback.

Apart from this, growing worries about a global economic downturn tempers investors' appetite for perceived riskier assets. The anti-risk mood is evident from a generally softer tone around the equity markets, which further underpins the safe-haven buck and contributes to driving flows away from the risk-sensitive aussie. This, along with weaker commodity prices, exerts additional downward pressure on the resources-linked Australian dollar and the AUD/USD pair.

Bulls seem unimpressed by the Reserve Bank of Australia’s (RBA) August meeting minutes, showing that board members agreed it was appropriate to continue to process of normalizing monetary conditions. Furthermore, weakness below the 0.7000 mark could be seen as a fresh trigger for bearish traders and supports prospects for further losses. The fundamental/technical backdrop suggests that the path of least resistance for the AUD/USD pair is to the downside.

Market participants now look forward to the US economic docket, featuring housing market data and Industrial Production figures, for some impetus later during the early North American session. Traders will further take cues from the US bond yields, which should influence the USD price dynamics. This, along with the broader market risk sentiment should allow traders to grab short-term opportunities around the AUD/USD pair.

Technical levels to watch

Economist at UOB Group Ho Woei Chen, CFA, comments on the recent releases in the Chinese calendar and the rate cut by the PBoC.

Key Takeaways

“Broad economic weakness resurfaced in Jul as China’s data including the industrial production (IP), retail sales and fixed asset investment (FAI) missed expectations.”

“The national surveyed jobless rate has continued to ease but concerns for the job market have centred on providing employment for new graduates as the youth unemployment rate rose further to a fresh record high of 19.9% in Jul.”

“The People’s Bank of China (PBoC) unexpectedly cut its 1Y medium-term lending facility (MLF) rate by 10 bps to 2.75% … The 7-day reverse repo rate was also cut to 2.00% from 2.10%. However, the central bank withdrew liquidity as expected, by rolling over CNY400 bn out of CNY600 bn of MLF that are maturing this week.”

“This is the first cut since Jan when the 1Y MLF was also reduced by 10 bps, leading to a corresponding 10 bps drop in the 1Y loan prime rate (LPR) subsequently. This time, we are also expecting the 1Y LPR to be fixed lower by 10 bps to 3.60% on 22 Aug while the 5Y LPR may also move lower in addition to the 15 bps reduction in May (current rate at 4.45%). We are retaining our end-3Q22 forecast for the 1Y LPR at 3.55% and then expect the rate to stay on hold through to 1Q23. Further rate reductions in China will be limited as domestic inflation rises while there are also increasing concerns over excessive liquidity in the banking system as credit demand has stayed weak due to the economic uncertainties.”

- Gold witnesses selling for the second straight day on Tuesday amid modest USD strength.

- Hawkish Fed expectations and elevated US bond yields continue to underpin the greenback.

- Recession fears could limit losses for the safe-haven XAU/USD ahead of the FOMC minutes.

Gold attracts fresh selling near the $1,783 region on Tuesday and turns lower for the second successive day. The XAU/USD drops back closer to a one-week low touched the previous day, around the $1,774 area during the first half of the European session and now seems vulnerable to slide further.

Following a brief consolidation through the early part of trading on Tuesday, the US dollar gains some positive traction for the third straight day and exerts some pressure on the dollar-denominated gold. Despite last week's softer US CPI report, Fed officials stressed that it is too soon to declare a victory on inflation and have maintained a hawkish tone. This, in turn, suggests that the Fed would stick to its policy tightening path and continues to underpin the greenback.

In fact, the markets are currently pricing in a greater chance of at least a 50 bps rate hike at the next FOMC policy meeting in September. This remains supportive of elevated US Treasury bond yields, which turns out to be another factor driving flows away from the non-yielding yellow metal. The downside, however, seems cushioned, at least for the time being, as investors might now prefer to move on the sidelines ahead of the FOMC meeting minutes, scheduled for release on Wednesday.

Investors would look for clues about the possibility of a larger 75 bps rate hike move in September. This would play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for gold. In the meantime, growing worries about a global economic downturn could lend some support to the safe-haven precious metal. Traders now look forward to the housing market data and Industrial Production figures from the US for some impetus on Tuesday.

Technical levels to watch

Economist at UOB Group Enrico Tanuwidjaja reviews the latest GDP figures in Thailand.

Key Takeaways

“Thai GDP expanded by 2.5% y/y in 2Q22, faster compared to 2.3% in 1Q22 as household consumption continue to improve as the economy reopens more sustainably.”

“We are much more sanguine for growth momentum in the second half of the year (3Q and 4Q will likely grow circa the 4% region).”

“We keep our 2022 GDP forecast unchanged at 3.2% and to accelerate further to 3.7% next year.”

- Economic sentiment continued to deteriorate in the euro area and in Germany.

- EUR/USD stays under bearish pressure, declines toward 1.0100.

The Economic Sentiment Index component of the ZEW Survey for Germany declined to -55.3 in August from -53.8 in July. This reading came in worse than the market expectation of -53.8. Furthermore, the Current Situation Index declined to -47.6 from -45.8. Finally, the Economic Sentiment Index for the eurozone slumped to -54.9 from -51.5, missing analysts' estimate of -42.5 by a wide margin.

Key takeaways

"Financial market experts expect a further decline in the already weak economic growth in Germany."

"Still high inflation rates and the expected additional costs for heating and energy lead to a decrease in profit expectations for the private consumption sector."

"In contrast, the expectations for the financial sector are improving due to the supposed further increase in short-term interest rates."

Market reaction

The shared currency stays on the backfoot after this report and EUR/USD was last seen losing 0.3% on the day at 1.0128.

- GBP/USD remains depressed for the fourth straight session and drops closer to the monthly low.

- The BoE's gloomy economic outlook continues to undermine sterling amid sustained USD buying.

- The mixed UK employment data fail to impress bullish traders or provide any impetus to the pair.