- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 21-05-2012

European stocks climbed, rebounding from last week’s biggest selloff since September, as China’s pledge to boost growth outweighed concern that Greece may be forced to leave the euro area.

In China, Premier Wen Jiabao called for “putting stabilizing growth in a more important position” and refrained from mentioning concern about inflation in remarks published yesterday by the official Xinhua News Agency. China may announce stimulus actions in the near term, according to a front-page commentary today in the China Securities Journal, published by Xinhua.

German Finance Minister Wolfgang Schaeuble will, for the first time, discuss the euro at a meeting with his newly installed French counterpart, Pierre Moscovici, in Berlin today as European Union leaders prepare to meet in Brussels on May 23.

Group of Eight leaders on May 19 urged Greece to stay within the euro area as polls in the country showed a close race between parties supporting and opposing austerity measures linked to the EU-led bailout.

National benchmark indexes climbed in 12 of the 18 western European markets. The U.K.’s FTSE 100 gained 0.7 percent and Germany’s DAX increased 1 percent, while France’s CAC 40 rose 0.6 percent. Italy’s FTSE MIB lost 0.3 percent as 29 of the gauge’s companies traded without the right to their latest dividends.

Carmakers were among the biggest gainers of the 19 industry groups on the Stoxx 600, rebounding from a five-day selloff. Renault rallied 4.7 percent to 32.02 euros as UBS AG added the French carmaker to its European “key calls” list.

Fiat climbed 8.6 percent to 3.64 euros in Milan, the biggest gain in more than two months. Sanford C. Bernstein & Co. upgraded the carmaker to outperform, the equivalent of a buy recommendation, from market perform with a price estimate of 5 euros. That’s 51 percent above last week’s close.

Barclays rose 2.2 percent to 180 pence after the lender said it plans to sell its entire holding in BlackRock before the latest round of Basel rules stops it from counting the holding as capital.

Banco Popolare SC surged 19 percent to 1.04 euro cents, the biggest jump since at least July 2007, as analysts from Bank of America Corp. to Exane BNP Paribas upgraded the shares after Italy’s fourth-biggest bank said regulatory approval to use internal risk models boosted its Tier 1 capital.

Man Group Plc gained 4.7 percent to 78.8 pence, recouping some of last week’s 14 percent slump. The world’s largest publicly traded hedge fund has agreed to buy FRM Holdings Ltd., adding $8 billion of assets invested in other hedge fund managers as its own stock price sinks.

weaken the nation’s foreign-exchange rates. BOJ officials will gather for a two-day meeting starting tomorrow. The central bank expanded its asset-purchase program in February and April. Last week, two bond-buying operations failed to attract the central bank’s target for sell offers.

The euro erased losses against the dollar as German Finance Minister Wolfgang Schaeuble said Germany and France will do “everything necessary” to keep Greece in the shared currency. German Finance Minister Wolfgang Schaeuble met with his newly installed French counterpart, Pierre Moscovici, in Berlin today as European Union leaders prepare for a summit meeting in Brussels on May 23.

U.S. stocks advanced, driving the Standard & Poor’s 500 Index toward the biggest increase in almost a month, after China signaled it would support the economy and German and French officials met before a summit.

Stocks rebounded from a four-month low as Chinese Premier Wen Jiabao pledged to focus more on bolstering growth. Germany and France agree that they will do “everything necessary” to ensure Greece remains in Europe’s single currency, Finance Minister Wolfgang Schaeuble said today in Berlin after a meeting with French Finance Minister Pierre Moscovici. European Union leaders are preparing for a summit in Brussels on May 23.

Greece may have to exit the 17-nation euro and the monetary union should plan for it to ensure

Cooper Industries jumped 26 percent, the most in the S&P 500, to $70.58. Each Cooper share will be exchanged for $39.15 in cash and 0.77479 Eaton share. That offer is valued at $72 a share based on Eaton’s May 18 closing price, 29 percent more than Cooper’s price that day, according to the statement.

Financial shares in the S&P 500 rallied, following last week’s 7 percent tumble, even as JPMorgan Chase & Co. (JPM) retreated. The lender, which lost 3.7 percent earlier today, fell 1.7 percent to $32.92. JPMorgan suspended its daily stock repurchase program because the bank needs the money to meet international capital rules, not because of trading losses, Chief Executive Officer Jamie Dimon said.

Facebook tumbled 11 percent to $34.05. It rose 0.6 percent in its first day of trading on May 18. The offering valued Facebook at 107 times trailing 12-month earnings, more than every S&P 500 member except Amazon.com Inc. and Equity Residential. Facebook is trying to attract more marketers to boost sales as competition increases. General Motors Co. last week announced plans to cut Facebook advertising.

Lowe’s Cos. slumped 9.7 percent, the most in the S&P 500, to $25.73. The second-largest U.S. home-improvement retailer reduced its forecast for full-year earnings to a range of $1.73 to $1.83 from $1.75 to $1.85 because of a smaller increase in profit margins than it had previously expected.

Oil rose for the first time in seven days in New York as China pledged to boost the nation’s economy and Goldman Sachs Group Inc. said the balance between the supply and demand of crude is tightening.

Futures climbed as much as 1 percent from the lowest level in more than six months after Chinese Premier Wen Jiabao said his country will focus more on bolstering growth. China is the second-biggest crude consuming country after the U.S.

This weekend, leaders of the Group of Eight nations urged Greece to stay in the euro area and to maximize economic expansion.

The extent of oil’s drop was unwarranted, Goldman said in a report.

Crude oil for June delivery rose to $92.41 a barrel on the New York Mercantile Exchange. Brent oil for July settlement increased $1.03, or 1 percent, to $108.17 a barrel on the London-based ICE Futures Europe exchange. The European benchmark grade is heading for the biggest gain since April 12.

The price of gold is increasing in trading Monday on the background of the summit of the leaders of the G8 in the American Camp David.

G8 leaders noted that the global economy is showing positive signs, but serious problems still remain. In this regard, the country's "eight" will continue to take measures to strengthen the economy.

In addition, during the G8 summit of heads of state said that they welcome the on going discussions in Europe on measures aimed at enhancing growth while maintaining the commitment to fiscal consolidation on the basis of the structure. In their view, a strong and united eurozone is important for global stability and economic recovery, and therefore, particularly in the euro area should remain Greece.

The cost of the June gold futures on the COMEX today rose to a high of $ 1599.0 per ounce.

Resistance 3:1330 (May 17 high)

Resistance 2:1320 (resistance line from May 15)

Resistance 1:1310 (May 18 high)

Current price: 1305,00

Support 1:1288 (session low)

Support 2:1275 (МА (200) for D1)

Support 3:1240 (area of Dec 28-29 lows)

EUR/USD $1.2700, $1.2780, $1.2800, $1.2900.

USD/JPY Y79.50, Y79.75, Y80.00

GBP/USD $1.5785, $1.5880, $1.5900

EUR/GBP stg0.8000

U.S. stock futures rose as China signaled it would support the economy and German and French officials prepared to meet before a summit.

Global Stocks:

Nikkei 8,633.89 +22.58 +0.26%

Hang Seng 18,922.32 -29.53 -0.16%

Shanghai Composite 2,348.3 +3.78 +0.16%

FTSE 5,297.87 +30.25 +0.57%

CAC 3,014.67 +6.67 +0.22%

DAX 6,310.49 +39.27 +0.63%

Crude oil $91.59 (+0.12%)

Gold $1588.00 (-0.24%)

Morgan Stanley (MS) was downgraded to Underperform from Outperform.

Citigroup (C) was downgraded to Underperform from Market Perform.

JPMorgan (JPM) was downgraded to Underperform from Market Perform.

Bank of America (BAC) was downgraded to Underperform from Market Perform.

Data:

05:45 Switzerland SECO Consumer Climate Quarter I -19 -18 -8

The yen declined on speculation the Bank of Japan (8301) will add to stimulus measures this week to support growth and weaken the nation’s foreign-exchange rates.

Japan’s currency slid as speculation European officials may step up efforts to tackle the debt crisis damped demand for haven assets.

The euro fell before German and French officials meet today to discuss ways to contain Europe’s financial turmoil.

Australia’s dollar snapped a six-day drop against the greenback and an index of implied volatility fell.

EUR/USD: the pair returned to area of session low $1,2750.

GBP/USD: the most part of the European session the pair was limited $1,5790-$ 1,5840.

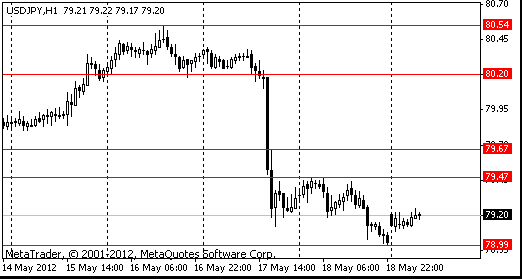

USD/JPY: the pair receded in Y79.20 area after showed session high at Y79.45.

EUR/USD

Offers $1.2860/80, $1.2850, $1.2820, $1.2810/15

Bids $1.2750, $1.2710/00, $1.2640

GBP/USD

Offers $1.6000, $1.5950/55, $1.5900/10, $1.5880, $1.5840/60

Bids $1.5780/70, $1.5755/50, $1.5720, $1.5700

AUD/USD

Offers $0.9980/85, $0.9960/65, $0.9950, $0.9920/25, $0.9895/00, $0.9875/80

Bids $0.9825/20, $0.9805/00, $0.9780/60, $0.9750, $0.9700, $0.9665/60

USD/JPY

Offers Y80.35/40, Y80.15/20, Y80.00, Y79.60/65, Y79.50

Bids Y78.80, Y78.55/50, Y78.00

EUR/JPY

Offers Y102.70/75, Y102.50, Y102.30/40, Y102.00, Y101.65/70

Bids Y101.00, Y100.90/85, Y100.50, Y100.00, Y99.80

EUR/GBP

Offers stg0.8140/50, stg0.8120, stg0.8090/100

Bids stg0.8050/40, stg0.8025/20, stg0.8000, stg0.7980, stg0.7965/60, stg0.7950

Resistance 3: Y80.55/60 (area of high of May)

Resistance 2: Y79.80 (МА (200) for Н1)

Resistance 1: Y79.50 (session high, May 18 high)

Current price: Y79.28

Support 1: Y79.00 (session high)

Support 2: Y78.55 (МА (200) for D1)

Support 3: Y78.20 (earlier resistance, area of high of December’2011 and January’2012)

Resistance 3: Chf0.9600 (area of high of January)

Resistance 2: Chf0.9500 (May 18 high)

Resistance 1: Chf0.9420 (session high)

Current price: Chf0.9404

Support 1: Chf0.9370 (area of session low and МА (200) for Н1)

Support 2: Chf0.9330 (May 15 low, 38,2 % FIBO Chf0,9040-Chf0,9500)

Support 3: Chf0.9300 (earlier resistance, area of May 9-11 highs)

Комментарии: пара не сумела закрепится выше линии сопротивления от ноября 2010 года и отступила (для ее преодоления паре необходимо было прошлую неделю выше уровня Chf0,9440, однако сил покупателей было не достаточно и пара завершили неделю на отметке Chf0,9397).

Resistance 3 : $1.5990 (intraday high on May 16, МА (200) for Н1)

Resistance 2 : $1.5930 (May 17 high)

Resistance 1 : $1.5870 (session high, May 18 high, МА (200) and МА (100) for D1)

Current price: $1.5818

Support 1 : $1.5730 (May 18 low)

Support 2 : $1.5700 (psychological level)

Support 3 : $1.5600 (psychological level, low of March)

Resistance 3 : $1.2900 (May 14 high)

Resistance 2 : $1.2870 (May 15 high)

Resistance 1 : $1.2820 (area of session high and МА (200) for Н1)

Current price: $1.2772

Support 1 : $1.2750 (earlier resistance, area of session low and May 16-17 highs)

Support 2 : $1.2640 (May 18 low)

Support 3 : $1.2620 (low of January)

European stocks climbed as China’s pledge to boost growth helped offset concern over Greece’s possible exit from the euro area. U.S. index futures rose, while Asian shares pared gains.

Currently:

FTSE 5,293.91 +26.29 +0.50%

CAC 3,018.35 +10.35 +0.34%

DAX 6,320.15 +48.93 +0.78%

China Premier Wen Jiabao said China will focus more on bolstering economic growth in the world’s second-largest economy.

Barclays Plc gained 1.7% after the lender said it plans to sell its entire holding in BlackRock Inc. through a registered offering and related buyback by BlackRock. Barclays Capital, Morgan Stanley and Bank of America Merrill Lynch are acting as joint bookrunners in the offering.

Man Group Plc (EMG) gained 6.2%. The world’s largest publicly traded hedge fund has agreed to buy FRM Holdings Ltd., adding $8 billion of assets invested in other hedge fund managers as its own stock price sinks.

Man will pay as much as $82.8 million in cash over three years, depending on the level of assets FRM retains following the takeover.

Ryanair (RYA) fell 2.4% after the Europe’s largest discount airline forecast net income will probably be in the range of 400 million euros to 440 million euros this year amid higher fuel costs.

The company still posted a 25% increase in net income to 502.6 million euros ($643 million) in the 12 months to March 31. Ryanair had forecast earnings of 480 million euros on Jan. 30 and analysts had expected a figure of 487 million euros. The stock pared its earlier decline of as much as 6.6%.

EUR/USD $1.2700, $1.2780, $1.2800, $1.2900.

USD/JPY Y79.50, Y79.75, Y80.00

GBP/USD $1.5785, $1.5880, $1.5900

EUR/GBP stg0.8000

Asian stocks rose, with the regional index rebounding from its biggest drop in six months, after Premier Wen Jiabao said China will focus more on bolstering economic growth.

Nikkei 225 8,633.89 +22.58 +0.26%

S&P/ASX 200 4,073.6 +27.14 +0.67%

Shanghai Composite 2,348.3 +3.78 +0.16%

China Overseas Land & Investment Ltd., a developer controlled by the nation’s construction ministry, rose 1.5 percent in Hong Kong.

BHP Billiton Ltd. climbed 2 percent in Sydney after RBC Capital Markets said the world’s largest mining company may start a new share buyback.

Nintendo Co., a manufacturer of game consoles that gets a third of its sales in Europe, fell 1.2 percent in Tokyo. OCI Co., a petro and coal chemicals maker, slumped 4.4 percent in Seoul after delaying expansion plans because of Europe’s debt crisis.

00:00 Canada Bank holiday -

04:30 Japan All Industry Activity Index, m/m March -0.1% 0.0% -0.3%

05:00 Japan Leading Economic Index March 96.6 96.4

05:00 Japan Coincident Index - 96.5 96.7

The yen dropped versus all of its major counterparts amid speculation the Bank of Japan will add to stimulus measures this week to support growth and weaken the nation’s currency. BOJ officials will gather for a two-day meeting starting tomorrow. The central bank expanded its asset-purchase program in February and April. Last week, two bond-buying operations failed to attract the central bank’s target for sell offers.

The yen trimmed its gain from last week against the U.S. dollar before a May 23 report that may show Japan had a trade deficit for a second-straight month. Japan probably had a trade shortfall of 470.8 billion yen ($5.9 billion) last month after a revised deficit of 84.5 billion yen in March, according to the median estimate of economists in a Bloomberg News survey before the data is released May 23.

Demand for the euro was limited ahead of data forecast to show consumer confidence in the 17-nation currency bloc dropped to a four-month low in May amid concern the debt crisis is worsening. An index of consumer sentiment in Europe probably dropped to minus 20.5 this month from minus 19.9 in April, a survey showed before the Brussels-based European Commission reports the figure tomorrow. That would be the lowest level since January.

Spain is scheduled to sell three- and six-month bills tomorrow. The nation revised its 2011 budget shortfall to 8.9 percent of gross domestic product from 8.5 percent previously, the Budget Ministry said in a statement e-mailed on May 18.

The Dollar remained lower after a one-day decline as Asian stocks advanced, curbing demand for the relative safety of the U.S. currency. The Group of Eight nations pushed for Greece, which will be holding its second national vote in six weeks, to stay in the euro area, leaders said at a weekend gathering at U.S. President Barack Obama’s retreat outside Washington.

EUR/USD: the pair gain above $1.2800, however receded later.

GBP/USD: the pair rose to Friday’s high, however receded later.

USD/JPY: the pair has slightly grown.

At 0700GMT, Bank of England MPC Member Adam Posen speaks at the Tokyo Conference on Global Financial Regulatory Issues. Ahead of that, at 0915GMT, Atlanta Fed President Dennis Lockhart speaks at the Tokyo seminar on "limits of monetary policy: what more can central bankers do to stabilize global economy and underpin global growth?".

On Monday the euro dropped to its lowest level in almost four months against the dollar as a leadership vacuum in Greece prompted European officials to weigh prospects for the currency union’s first Alexis Tsipras, who heads Greece’s anti-bailout Syriza party, wouldn’t attend a meeting called by President Karolos Papoulias today, the Athens-based party said in a statement. Syriza rejected a unity government last week following inconclusive elections on May 6. Greece may face another vote unless leaders can agree on a new coalition.

On Tuesday the euro fell to the lowest in almost four months versus the dollar as talks to form a Greek government failed, fueling concern the nation may leave the shared currency and boosting investor demand for safety. Greek President Karolos Papoulias’ meeting in Athens with political leaders failed to produce a government after an inconclusive May 6 vote. He called for a meeting to form a caretaker government to lead the country until the vote. A second election threatened to extend the country’s political gridlock and reignited speculation Greece will renege on its pledges to cut spending, required by the terms of its 240 billion euros ($306 billion) in bailouts. It added to bets Europe’s sovereign-debt crisis will worsen.

On Wednesday the euro fell to a four-month low against the dollar after the European Central Bank said it will temporarily stop lending to some Greek banks and as the nation’s leaders prepare for a second election.

The euro dropped for a fourth day versus the greenback as the ECB said it will push the responsibility for lending onto Greece’s central bank until the banks have sufficiently boosted their capital.

The pound fell the most in a month against the dollar as the Bank of England said U.K. growth will stay “subdued” in the near term.

On Thursday the yen extended its gain against the dollar after data showed U.S. jobless claims for unemployment benefits were unchanged last week and another report showed Philadelphia- area manufacturing decreased in May. The euro fell to a four-month low as Spain’s borrowing costs rose at an auction, stoking concern that the region’s financial contagion is spreading from Greece. Europe’s shared currency declined against most of its major counterparts as the European Central Bank said it will temporarily stop lending to some Greek banks.

On Friday the euro touched a four-month low against the dollar as German Finance Minister Wolfgang Schaeuble said financial-market turmoil may last another two years, adding to concern Europe’s crisis is worsening. The 17-nation currency reversed its losses as a technical indicator signaled its recent decline came too fast. The euro was headed for a fourth weekly decline versus the yen before a meeting of Group of Eight nations’ leaders beginning. German Chancellor Angela Merkel and fellow European leaders will face pressure from their G-8 counterparts to do more to quell the turmoil after speculation Greece will exit the euro wiped almost $4 trillion from global stock markets this month. Fitch lowered Greece’s ranking to CCC from B-, saying the strong showing of “anti-austerity” parties in elections on May 6 and subsequent failure to form a government underscored the lack of public and political support for the country’s bailout from the European Union and International Monetary Fund.

Moody’s yesterday lowered the credit ratings of Spain’s biggest banks including Banco Santander SA (SAN) and Banco Bilbao Vizcaya Argentaria SA, citing economic weakness and the government’s mounting budget strain.

Asian stocks fell, with the regional benchmark index erasing this year’s gains, after U.S. economic data missed estimates and ratings agencies downgraded Spanish banks and Greece as Europe’s debt crisis deepens.

Nikkei 225 8,611.31 -265.28 -2.99%

Hang Seng 18,901.01 -299.92 -1.56%

S&P/ASX 200 4,046.46 -110.95 -2.67%

Shanghai Composite 2,344.52 -34.37 -1.44%

Samsung Electronics Co., a consumer-electronics maker that gets 40 percent of sales from Europe and America, dropped 4.7 percent in Seoul as exporters tumbled.

Japanese machinery makers plunged in Tokyo after sales growth slowed at industry bellwether Caterpillar Inc.

The Hang Seng China Enterprises Index of Hong Kong-listed Chinese companies fell as much as 20 percent from its high for the year on Feb. 29 after home prices slid in a record number of mainland cities during April.

European stocks fell for a fifth day, posting their biggest weekly selloff since September, amid signs of slowing growth in China and continued concern that Greece will have to leave the euro area.

Almost $4 trillion has been wiped from global equity markets in May amid mounting concern Greece will have to leave the euro currency union. The country’s credit rating was reduced one level by Fitch Ratings late yesterday amid concern it will not muster the political support needed to remain a member of the 17-nation euro area.

Moody’s lowered the debt ratings of 16 Spanish banks after the close of U.S. trading yesterday, citing mounting loan losses, the country’s recession, restricted access to funds and the reduced ability of the government to support lenders as its own creditworthiness diminishes.

National benchmark indexes retreated in 14 of the 17 western-European market that opened today. The U.K.’s FTSE 100 slid 1.3 percent, while Germany’s DAX slid 0.6 percent. France’s CAC 40 slipped 0.1 percent.

Rio Tinto, the world’s third-biggest mining company, retreated 2.4 percent to 2,788 pence. Vedanta Resources Plc lost 2.7 percent to 958.5 pence and Xstrata Plc dropped 4.3 percent to 914.7 pence.

Volkswagen dropped 2 percent to 128.20 euros, Porsche SE slid 2.4 percent to 39.93 euros and Bayerische Motoren Werke AG lost 2.3 percent to 61.31 euros. Volvo AB sank 4.6 percent to 78.45 kronor.

LSE jumped 2.9 percent to 992 pence after Europe’s oldest independent bourse posted profit for the six months to the end of March that surged to 405.9 million pounds ($641 million), boosted by money earned from deposits at its Italian central counterparty.

U.S. stocks dropped for a sixth day, the longest slump since November for the Standard & Poor’s 500 Index, as Facebook Inc.’s record initial public offering failed to boost confidence in a market rattled by Europe’s debt crisis.

Stocks fell a third week in the longest losing streak since August. German Finance Minister Wolfgang Schaeuble said turmoil in the financial markets caused by Europe’s crisis may last another two years, as Group of Eight leaders prepared to discuss Greece and its impact on the global economy. LCH Clearnet Ltd., Europe’s biggest clearing house, raised the extra deposit it demands from clients to trade some Spanish government bonds.

Equities rallied earlier today amid optimism about Facebook’s trading debut. The delayed opening and halts in other companies including Zynga weighed on the market following the year’s most anticipated IPO.

Yahoo! Inc. rallied 3.7 percent to $15.42. The company is in talks to sell about 20 percent of Alibaba Group Holding Ltd. back to the Chinese Internet company for about $7 billion, according to a person with knowledge of the matter.

Salesforce.com Inc. advanced 8.8 percent to $145.58 for the biggest gain in the S&P 500. The largest seller of online customer-management software forecast fiscal second-quarter sales that beat estimates as it signs more large deals with corporate customers.

Resistance 3: Y80.20 (May 16 low)

Resistance 2: Y79.65 (May 14 low)

Resistance 1: Y79.45 (May 18 high)

The current price: Y79.20

Support 1: Y79.00 (May 18 low)

Support 2: Y78.70 (Feb 15 high)

Support 3: Y78.15 (Feb 15 low)

Resistance 3: Chf0.9525 (Jan 16 low)

Resistance 2: Chf0.9500 (May 18 high)

Resistance 1: Chf0.9420 (session high)

The current price: Chf0.9393

Support 1: Chf0.9370 (session low)

Support 2: Chf0.9330 (May 15 low)

Support 3: Chf0.9305 (May 14 low)

Resistance 3 : $1.5930 (May 17 high)

Resistance 2 : $1.5885 (May 16 low)

Resistance 1 : $1.5840 (session high)

The current price: $1.5839

Support 1 : $1.5795 (session low)

Support 2 : $1.5730 (Mar 18 low)

Support 3 : $1.5695 (Mar 16 low)

Resistance 3 : $1.2905 (May 11 low, May 14 high)

Resistance 2 : $1.2870 (May 15 high)

Resistance 1 : $1.2810 (session high)

The current price: $1.2788

Support 1 : $1.2750 (session low)

Support 2 : $1.2640 (Jan 18 low)

Support 3 : $1.2625 (low of Jan)

00:00 Canada Bank holiday -

04:30 Japan All Industry Activity Index, m/m March -0.1% 0.0%

05:00 Japan Leading Economic Index March 96.6

05:00 Japan Coincident Index - 96.5

05:45 Switzerland SECO Consumer Climate Quarter I -19 -18

07:00 United Kingdom MPC Member Posen Speaks -

09:15 U.S. FOMC Member Dennis Lockhart Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.