- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 25-05-2023

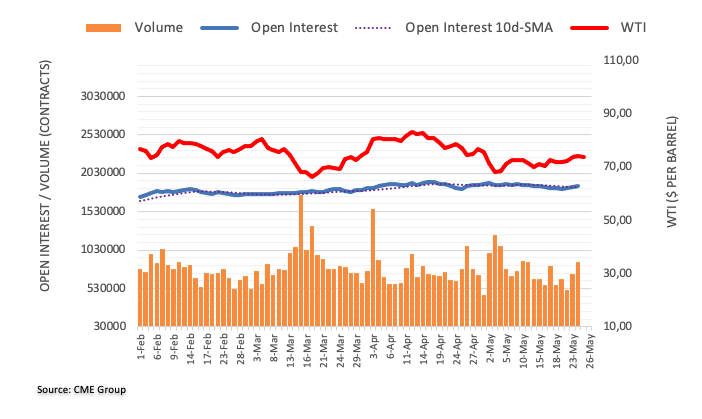

- The oil price has faced selling interest after a recovery move to near $72.00 as OPEC is not expected to cut its overall output ahead.

- Continuous negotiations over US debt-ceiling issues indicate that a bipartisan will be there before the US Treasury meeting default.

- The oil price is at a make or a break level near the upward-sloping trendline plotted from May 04 low at $67.47.s

West Texas Intermediate (WTI), futures on NYMEX, have faced tough barricades after a recovery attempt to near $72.00 in the early Asian session. The oil price is anticipated to resume its downside journey further as OPEC is not expected to cut its overall output further in its next meeting on June 04.

Russian Deputy Prime Minister Alexander Novak said he expected no new steps from OPEC+ at its meeting on June 4. Contrary to that, Saudi Energy Minister Abdulaziz bin Salman had hinted at the possibility of another round of production cuts at the meeting.

The US Dollar Index (DXY) has corrected to near 104.21 as continuous negotiations between the White House and Republican leaders are indicating that a bipartisan will be there before the US Treasury meeting deadline of default.

A responsive selling action dragged the oil price sharply after it failed to sustain above the 50% Fibonacci retracement (plotted from April 12 high at $83.40 to May 03 low at $64.31) at $73.94 on a four-hour scale. Also, the 200-period Exponential Moving Average (EMA) at $73.72 acted as a barrier for the oil bulls.

The oil price is at a make or a break level near the upward-sloping trendline plotted from May 04 low at $67.47.

A slippage into the bearish range of 20.00-40.00 by the Relative Strength Index (RSI) (14) will trigger the downside momentum.

Going forward, a downside move below May 25 low at $71.03 will weigh heavily on the oil price and will drag it toward the crucial support at $70.00 followed by the 23.6% Fibo retracement at $68.88.

In an alternate scenario, a solid recovery above the 50% Fibo retracement at $73.94 will drive the asset toward a 61.8% Fibo retracement at $$76.16. Further recovery above the latter would expose the oil price to April 26 high at $77.86.

WTI four-hour chart

-638206552483363499.png)

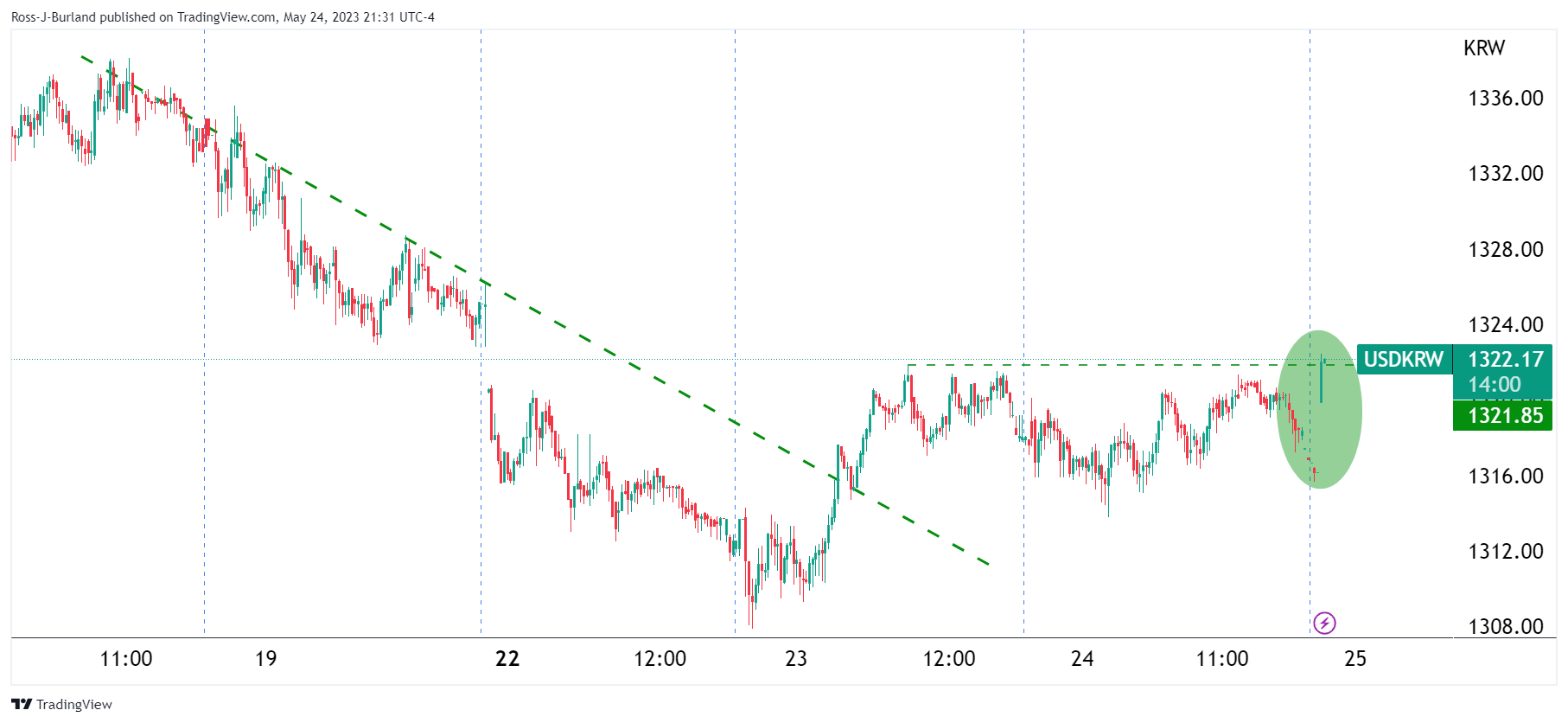

- USD/JPY bounces off intraday low after retreating from six-month high.

- Tokyo Consumer Price Index eases to 3.2% YoY in May versus 3.9% expected, 3.5% prior.

- Hawkish BoJ signals, upbeat Japan economics lure Yen buyers.

- Risk aversion, strong US data puts a floor under the prices.

USD/JPY pares intraday losses around the 140.00 round figure, bouncing off the daily low, as it jumps back towards the Year-To-Date (YTD) high marked the previous day. That said, the Yen pair picks up bids after Japan’s inflation gauge eased during early Friday.

Tokyo Consumer Price Index (CPI) eased to 3.2% YoY from 3.5% previous readings and 3.9% market forecasts. On the same line is the Tokyo CPI ex Fresh Food while the Tokyo CPI ex Food, Energy edged higher but stays below the market forecasts for the said month.

Given the downbeat Japanese inflation, the Bank of Japan (BoJ) policymakers’ defense of easy money policies remains valid and favors the Yen pair buyers. On Thursday, Bank of Japan (BoJ) Governor Kazuo Ueda said that they could tweak the Yield Curve Control (YCC) strategy if the balance between the benefit and the cost of the policy were to shift, as reported by Reuters.

In addition to the BoJ concerns, strong Treasury bond yields and upbeat US data also underpin the USD/JPY pair’s strength as it remains near the highest levels since November 2022. On Thursday, the second estimation of the US Annualized Gross Domestic Product (GDP) for Q1 2023 was revised up to 1.3% versus 1.0% first forecasts. Further, the Chicago Fed National Activity Index for April improved to 0.07 from -0.37 prior and -0.02 market estimations. On the same line, Kansad Fed Manufacturing Activity improved to -2 for May compared to -21 previous readings and analysts’ estimations of -11. It’s worth noting that the US Pending Home Sales for April improved on YoY but eased on MoM whereas Core Personal Consumption Expenditures also rose to 5.0% during the preliminary readings versus 4.9% prior.

It should be noted that Japan’s economic optimism and looming fears of US debt ceiling expiration are extra catalysts that define the USD/JPY pair’s current status. Japanese Cabinet Office released the monthly assessment report on Thursday and raised the overall economic view for the first time since July 2022 in May. The government report also noted that the economy is 'recovering moderately'.

Against this backdrop, the US Dollar Index (DXY) rose to the highest levels in 10 weeks, to 104.20 at the latest, whereas the US 10-year and two-year Treasury bond yields rose to the early March highs of around 3.82% and 4.54% in that order. That said, Wall Street closed mixed but S&P500 Futures is mildly offered at the latest.

Having witnessed the initial reaction to Japan’s inflation numbers, the USD/JPY sellers may find it difficult to keep the reins amid the market’s risk-off mood and upbeat US data favoring the US Dollar, not to forget the upbeat yields. With this, the updates surrounding the US debt ceiling negotiations and a slew of the US data will be eyed for clear directions.

Technical analysis

Despite the latest pullback, a two-week-old ascending support line and the resistance-turned-support line stretched from mid-December 2022, respectively near 139.55 and 137.70, restrict short-term downside of the USD/JPY pair.

- Silver Price remains pressured at two-month low after four-day losing streak.

- Clear downside break of 200-day EMA, bearish MACD signals favor XAG/USD sellers.

- Oversold RSI (14) prods further downside of bullion.

Silver Price (XAG/USD) stays on the back foot at around $22.75 after falling to the lowest levels since late March the previous day. That said, the precious metal declined in the last four consecutive days before licking its wounds on early Friday.

The XAG/USD’s latest fall broke the key 200-day Exponential Moving Average (EMA) support, now immediate resistance near $22.85, which in turn joins the bearish MACD signals to keep the Silver sellers hopeful. However, the oversold conditions of the RSI (14) line prod the metal’s further downside.

As a result, the quote is likely to decline towards the 61.8% Fibonacci retracement of its March-May upside around $22.30. However, the Silver Price weakness past the key Fibonacci retracement, also known as the golden Fibonacci ratio, appears difficult.

Even if the quote breaks the $22.30 Fibonacci ratio, a broad horizontal area comprising multiple levels marked since mid-February, near $21.50-30, could challenge the XAG/USD bears.

Following that, an upward-sloping support line from late 2022, around $20.80, will be in the spotlight.

On the contrary, the XAG/USD rebound past the 200-day EMA level of around $22.85 isn’t an open invitation to the Silver buyers as a convergence of the three-week-old descending trend line and 50% Fibonacci retracement, near $23.05, will check the metal’s further upside.

Silver Price: Daily chart

Trend: Limited downside expected

- USD/CHF is displaying a sideways performance above 0.9050 ahead of US Durable Goods Orders data.

- Weekly Fed emergency lending to banks fell to its lowest level since the banking sector ran into trouble in March.

- The overall market mood is still cautious as investors are worried that the US economy could announce a default

The USD/CHF pair is demonstrating topsy-turvy moves above 0.9050 in the early Tokyo session. The Swiss Franc asset is expected to remain sideways as investors have shifted their focus toward the release of the United States Durable Goods Orders data.

S&P500 futures have displayed some losses in early Asia after a solid recovery on Thursday. The overall market mood is still cautious as investors are worried that the United States economy could announce a default in making obligated payments due to diverged proposals from the White House and Republican leaders.

Meanwhile, House of Representatives Kevin McCarthy said it's difficult to reach an agreement after diverged opinions on budget’s spending but we're working and will keep working till we finish.

The US Dollar Index (DXY) has shown some exhaustion in the upside momentum after printing a fresh two-month high of 104.31 as the resilience in the United States economy is releasing heat.

Weekly Federal Reserve (Fed) emergency lending to banks fell to its lowest level since the banking sector ran into trouble in March, as reported by Reuters. Tighter credit conditions and bleak economic outlook have forced firms to operate with their ploughed-back profits and that too at reduced operating capacity. This could result in easing labor market conditions which would allow the Fed to remain neutral on interest rates in June’s monetary policy meeting.

Going forward, US Durable Goods Orders data (April) will remain in focus. The economic data is seen contracting by 1.0% against an expansion of 3.2% reported earlier.

On the Swiss Franc front, Q1 Employment Level data will be keenly watched. As per the preliminary report, the Swiss labor market has added fresh 35K employees in the first quarter.

- The US Dollar Index continues its climb, currently trading above 104.000, driven by robust US Treasury bond yields.

- A third consecutive daily close above the 200-day EMA could solidify a bullish outlook, putting 105.000 within reach.

- Downside risks persist, with a potential fall towards 103.000 if the DXY drops below the 200-day EMA.

The US Dollar Index (DXY), which measures a basket of six currencies against the US Dollar (USD), extended its rally to four consecutive days, distances from the 200-day Exponential Moving Average (EMA) at 103.743, claimed on May 24, underpinned by high US Treasury bond yields. At the time of writing, the DXY is trading hands at 104.211, gaining 0.31%, with bulls eyeing the 105.000 mark.

US Dollar Index Price Analysis: Technical outlook

On Wednesday, I wrote, “The US Dollar Index is neutral to bullish biased, but it could cement its bias as bullish once the DXY achieves a decisive break above the 200-day EMA.” For two consecutive days, the DXY stays above the latter suggesting that bulls are gathering momentum. Nevertheless, a third daily close above the 200-day EMA could cement the bias as bullish, and with the double-bottom in play, the 105.000 is up for grabs.

Must read:

- US Dollar Index: Could a double bottom at the weekly chart drive the DXY to 111.000?

- US Dollar Index: Reclaims 200-day EMA, surpasses 2017 yearly high, as bulls stepped in eyeing 104.000

If the US Dollar Index claims the year-to-date (YTD) high of 105.883, that will validate the double-bottom chart pattern, but the buck must surpass crucial resistance levels on its uptrend. Meanwhile, the Relative Strength Index (RSI) indicator is in bullish territory, with some room before hitting overbought levels, while the 3-day Rate of Change (RoC) suggests that buyers are in charge.

If the DXY reclaims 104.000, the next resistance level to test would be the March 15 daily high of 105.103. Break above, and the DXY will have a clear run toward testing an eight-month-old resistance trendline around the 105.300-600 area, ahead of piercing the YTD high at 105.883

Downside risks for the DXY remain below the 200-day EMA, which could send the greenback sliding towards the 100-day EMA at 103.212. A clear break will send the DXY toward the May 22 swing low of 102.964, slightly below the 103.000 mark.

US Dollar Index Price Action – Daily chart

- NZD/USD fades bounce off the lowest levels in six months.

- RBNZ’s Deputy Governor Christian Hawkesby confirms easing of LVR restrictions, NZ Consumer Confidence stays flat in May.

- Firmer US data, fears of US default underpin US Dollar demand.

- Slew of US statistics ahead to entertain Kiwi pair traders, US debt ceiling headlines are the key.

NZD/USD licks its wounds at the lowest levels since November as the Reserve Bank of New Zealand (RBNZ) announces easing of lending restrictions on early Friday. Also exerting downside pressure on the Kiwi pair is the broadly firmer US Dollar and flat New Zealand Consumer Confidence. That said, the quote seesaws around 0.6060 by the press time after falling in the last three consecutive days to refresh the Year-To-Date (YTD) low.

"The risks to financial stability posed by high-LVR lending have reduced to a level where we believe the current restrictions may be unnecessarily reducing efficiency," said RBNZ Deputy Governor Christian Hawkesby while announcing the easing on the Loan-to-Value Restrictions (LVR).

On the other hand, New Zealand’s Consumer Confidence gauge slightly fell to 79.2 in May from April's 79.3, per the ANZ-Roy Morgan survey for May. "While the labour market remains tight, conferring both a high degree of job security and strong wage growth, ongoing cost of living increases, including higher mortgage rates for the 38% of households who have a mortgage, continue to bite," ANZ Chief Economist Sharon Zollner said in a statement, reported Reuters.

Elsewhere, the second estimation of the US Annualized Gross Domestic Product (GDP) for Q1 2023 was revised up to 1.3% versus 1.0% first forecasts. Further, the Chicago Fed National Activity Index for April improved to 0.07 from -0.37 prior and -0.02 market estimations. On the same line, Kansad Fed Manufacturing Activity improved to -2 for May compared to -21 previous readings and analysts’ estimations of -11. It’s worth noting that the US Pending Home Sales for April improved on YoY but eased on MoM whereas Core Personal Consumption Expenditures also rose to 5.0% during the preliminary readings versus 4.9% prior.

Apart from the upbeat US data, looming fears of the US default also allow the US Dollar to dominate. Recent, US House Speaker Kevin McCarthy announced no agreement on the debt deal, as well as continuation of talks by saying, “It’s hard. But we’re working and we’re going to continue to work until we get this done.”

Amid these plays, the US Dollar Index (DXY) rose to the highest levels in 10 weeks, to 104.20 at the latest, whereas the US 10-year and two-year Treasury bond yields rose to the early March highs of around 3.82% and 4.54% in that order. That said, Wall Street closed mixed but S&P500 Futures is mildly offered at the latest.

Moving on, multiple US data stand tall to direct the NZD/USD moves, apart from the US debt ceiling negotiations. . Among them, the US Durable Goods Orders for April and the Core Personal Consumption Expenditure (PCE) Price Index for the said month, known as the Fed’s preferred inflation gauge, will be crucial to watch.

Technical analysis

A daily closing below an upward-sloping support line from mid-November, now immediate resistance around 0.6100, keeps the NZD/USD bears hopeful.

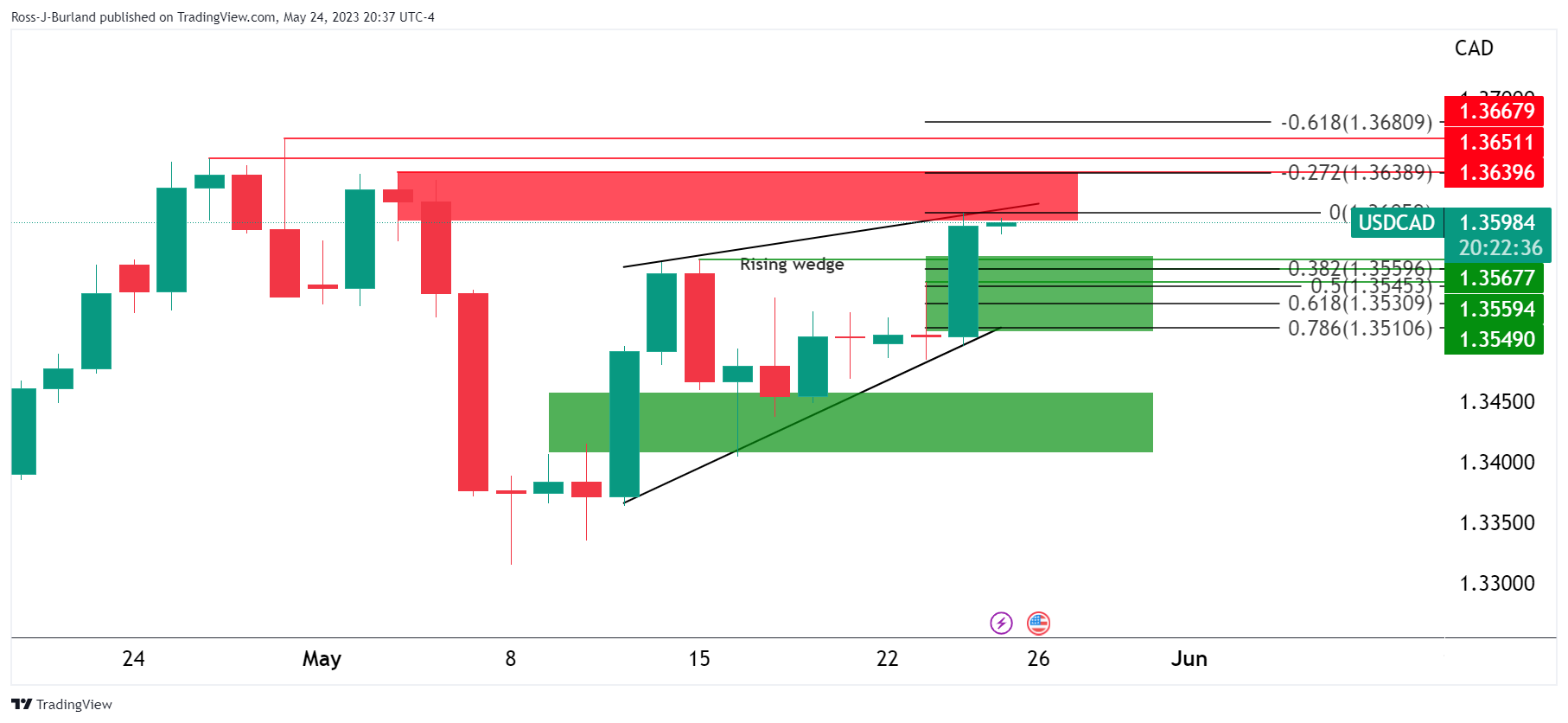

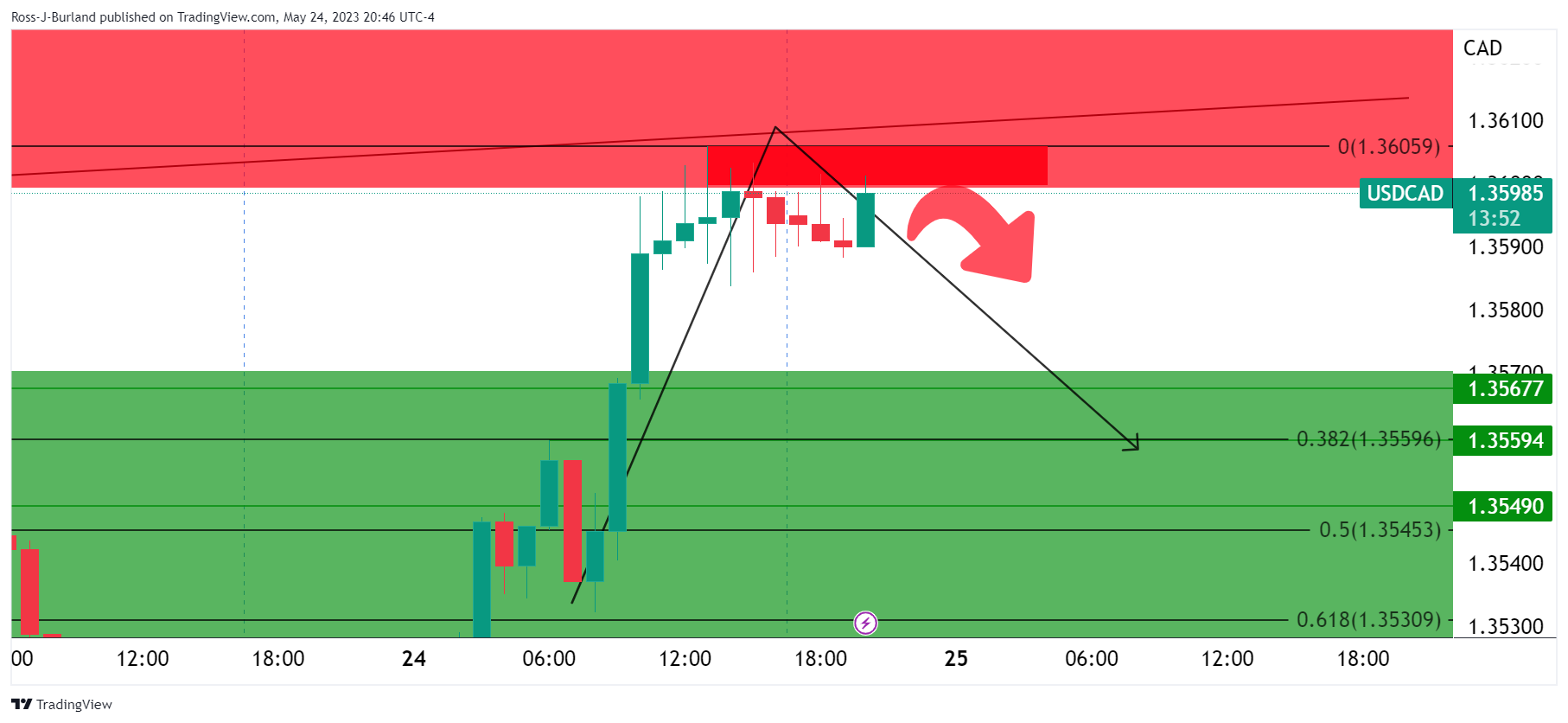

- USD/CAD is eyeing a break above the immediate resistance of 1.3640 amid broader strength in the US Dollar.

- Oil prices tumbled after Russian Novak said he expected no new steps from OPEC+ at its meeting on June 4.

- The US Dollar bulls have got strength after climbing above the downward-sloping trendline plotted from 1.3862.

The USD/CAD pair is gathering strength for a break above the immediate resistance of 1.3640 in the early Asian session. The Loonie asset remained in bullish territory amid strength in the US Dollar Index (DXY) and a weakness in the oil price.

Oil prices tumbled after Russian Deputy Prime Minister Alexander Novak said he expected no new steps from OPEC+ at its meeting on June 4. At the press time, the oil price has shown some recovery, however, the downside bias is still solid. It is worth noting that Canada is the leading exporter of oil to the United States and lower oil prices impact the Canadian Dollar significantly.

The US Dollar Index (DXY) has corrected marginally after a solid upside after the White House Communications Director said we are getting closer to a deal on the debt ceiling. Going forward, US Durable Goods orders data (April) will remain in the spotlight.

USD/CAD has shown a stellar upside action after a breakout of the Symmetrical Triangle formed on a four-hour scale. The US Dollar bulls have got strength after climbing above the downward-sloping trendline plotted from March 10 high at 1.3862. The Loonie asset is approaching the previous month’s high at 1.3668.

A range shift move by the Relative Strength Index (RSI) (14) into the 60.00-80.00 territory from the 40.00-60.00 zone indicates that the upside momentum has been triggered.

Investors should wait for a marginal correction to near the immediate support of 1.3610 for a fresh buy, which will deliver gains till the previous month’s high at 1.3668 followed by the round-level resistance at 1.3700.

On the flip side, a break below May 23 high at 1.3550 will drag the asset toward the psychological support at 1.3500. A breakdown below the latter will expose the Loonie asset to April 20 low at 1.3448.

USD/CAD four-hour chart

"Negotiators will continue working to get a deal on the debt ceiling," U.S. House Speaker Kevin McCarthy said on Thursday as Republicans and Democrats race to secure an agreement and avoid default.

More to come

- EUR/USD dips to 1.0707 amidst soaring US Treasury bond yields, but mixed market sentiment prevents a steeper fall.

- The pair could witness further losses if sellers successfully reclaim the 1.0700 mark, shifting the bias downward.

- Staying above 1.0700 could lead to a EUR/USD comeback, with 1.0900 in sight if key resistance levels are broken.

EUR/USD hit a new two-month low at around 1.0707, though it remains neutral to downward biased unless the pair suffers more weakness, which could send the EUR/USD sinking below the 1.0700 mark toward the 200-day Exponential Moving Average (EMA) at 1.0684. Nevertheless, a mixed market sentiment capped the Euro{s (EUR) fall, even though US Treasury bond yields skyrocketed, underpinning the US Dollar (USD). As the Asian session begins, the EUR/USD trades at 1.0727, up 0.02%.

EUR/USD Price Analysis: Technical outlook

Two days ago, the EUR/USD slumped below the 100-day Exponential Moving Average (EMA) at 1.0776, with sellers taking advantage of it, as the EUR/USD registered three straight sessions of losses. Although the pair will likely print additional losses, sellers must reclaim the 1.0700. That would leave the pair exposed, and once the EUR/USD dives below the 200-day EMA, that would shift the pair bias downwards.

That said, the EUR/USD first support would be the 2020 yearly low of 1.0636, ahead of falling to 1.0600. Break below will expose the March 15 daily low of 1.0516 before dropping to the year-to-date (YTD) low of 1.0482.

Conversely, if EUR/USD stays afloat above 1.0700, the EUR/USD could stage a comeback, initially to the 100-day EMA at 1.0776. A breach of the letter will expose 1.0800 before the EUR/USD threatens the confluence of technical indicators, like the 50 and 20-day EMAs, at around 1.0845-1.0857. Once the intersection gives way, 1.0900 is on the cards.

EUR/USD Price Action – Daily chart

- GBP/USD stays depressed at the lowest levels in seven week after falling in the last four consecutive days.

- Broad US Dollar strength amid cautious markets, hawkish Fed talks and firmer US data weigh on Pound Sterling.

- US debt ceiling negotiations remain dicey, the latest easing of differences appears promising.

- UK Retail Sales, US Durable Goods Orders and PCE Price Index will be important to watch on the calendar.

GBP/USD bears take a breather at the lowest levels since early April, making rounds to 1.2320-25 after falling in the last four consecutive days. In doing so, the Cable pair bears the burden of the upbeat US data, hawkish Federal Reserve bets and the market’s rush towards US Dollar amid the looming US default. That said, the hawkish comments from the Bank of England (BoE) officials fail to inspire the Cable pair buyers ahead of today’s UK Retail Sales and a slew of the US data.

On Thursday, the second estimation of the US Annualized Gross Domestic Product (GDP) for Q1 2023 was revised up to 1.3% versus 1.0% first forecasts. Further, the Chicago Fed National Activity Index for April improved to 0.07 from -0.37 prior and -0.02 market estimations. On the same line, Kansad Fed Manufacturing Activity improved to -2 for May compared to -21 previous readings and analysts’ estimations of -11. It’s worth noting that the US Pending Home Sales for April improved on YoY but eased on MoM whereas Core Personal Consumption Expenditures also rose to 5.0% during the preliminary readings versus 4.9% prior.

At home, the UK energy regulator, Ofgem, announced a reduction in its price cap on household energy bills from July to an annual level of GBP2,074 ($2,617.60) for a typical dual-fuel household. The same could help the UK to ease inflation and could provide headwinds to the GBP/USD pair.

That said, Bank of England (BoE) policymaker Jonathan Haskel recently said, “Further increases in bank rates cannot be ruled out.” On the contrary, Richmond Fed President Thomas Barkin said, “Fed is in a test and learn situation to determine how slowing demand lowers inflation.” On the different front, Boston Federal Reserve President Susan Collins said on Thursday that the Fed "may be at or near" the time to pause interest rate increases, as reported by Reuters.

It’s worth noting that the market’s recent disbelief in the BoE officials’ hawkish comments and ignorance of the upbeat British data keeps the Pound Sterling on the bear’s radar, especially amid firmer US data and the calls for further rate hikes from the Federal Reserve.

Additionally, the concerns about US policymakers’ inability to clinch a deal on the US debt ceiling extension, as well as the latest chatters suggesting a $70.0 gap left to be filled by the negotiators to get the much-awaited deal also weigh on the XAU/USD prices, via the firmer US Dollar and yields.

That said, the US Dollar Index (DXY) rose to the highest levels in 10 weeks, to 104.20 at the latest, whereas the US 10-year and two-year Treasury bond yields rose to the early March highs of around 3.82% and 4.54% in that order.

Looking ahead, the UK Retail Sales for April, expected 0.3% MoM versus -0.9% prior, will precede a slew of the US data to direct intraday moves of the GBP/USD pair. Among them, the US Durable Goods Orders for April and the Core Personal Consumption Expenditure (PCE) Price Index for the said month, known as the Fed’s preferred inflation gauge, will be crucial to watch. Above all, US debt ceiling negotiations should be traced for clear directions.

Technical analysis

With a clear downside break of the 50-DMA and the Cable pair’s sustained observance of a two-week-old resistance line, respectively near 1.2435 and 1.2370, the GBP/USD pair remains all set to prod the 100-DMA support of around 1.2285.

- AUD/USD is expected to continue its three-day losing streak after dropping below 0.6500.

- The USD index showed a marginal correction as the White House and Republican leaders met virtually on Thursday.

- Australian Retail Sales are seen expanding by 0.2%, lower than the prior expansion of 0.4%.

The AUD/USD pair has found an intermediate cushion near the round-level support of 0.6500 in the early Asian session. The Aussie asset has registered a three-day losing streak and is expected to continue the downside spell after dropping below the aforementioned support. A cautious market mood has trimmed the appeal for risk-perceived currencies sharply.

S&P500 delivered a decent recovery on Friday as the Federal Reserve (Fed) is expected to pause its rate-hiking regime in June’s monetary policy meeting. Gains in the 500-US stocks basket were supported by a solid recovery in technology and financial stocks.

The US Dollar Index (DXY) remained super solid on Thursday and refreshed a two-month high at 104.31 amid an absence of further development in US debt-ceiling issues. In the late New York session, the USD index showed a marginal correction after Reuters reported that the White House and Republican leaders met virtually on Thursday and are near cracking bipartisan, which inculcates large spending cuts and a raise of the government’s $31.4 trillion debt-ceiling.

Going forward, the United States Durable Goods Orders (April) data will be of utmost importance. The economic data is seen contracting by 1.0% against an expansion of 3.2% reported earlier.

On the Australian Dollar front, investors are keeping an eye on monthly Retail Sales data (April). As per the consensus, households’ demand is seen expanding by 0.2%, lower than the prior expansion of 0.4%. Declining retail demand would allow the Reserve Bank of Australia (RBA) to keep interest rates steady ahead.

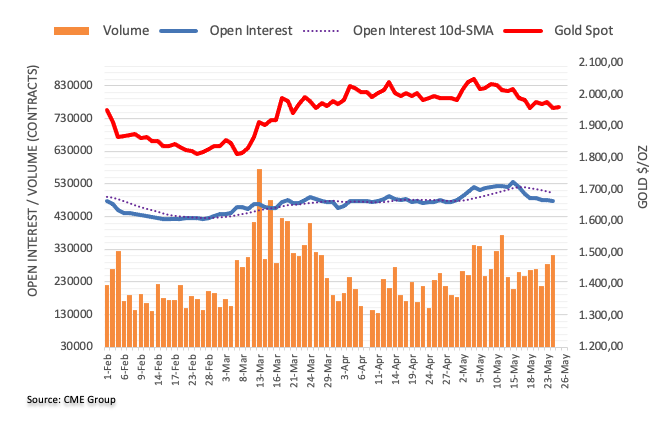

- Gold Price appears well set for third consecutive weekly loss.

- Strong United States data, hawkish Federal Reserve talks favor US Dollar, weighs on XAU/USD.

- Escalating fears of US debt ceiling expiration also favor Gold bears as policymakers struggle for a deal.

- Multiple US statistics lined up to direct intraday Gold Price, risk catalysts are the key.

Gold Price (XAU/USD) remains on the back foot at the two-month low surrounding $1,941 amid early Friday morning in Asia and remains pressured around the lowest levels since late March after falling in the last two consecutive days. The yellow metal’s weakness could be linked to the market’s risk-off mood and upbeat United States data ahead of a slew of the US statistics, which in turn favor the US Dollar's strength.

Gold Price drops as firmer US data, risk-aversion underpins US Dollar, yields

Gold Price witnesses heavy downside pressure as it braces for the third consecutive weekly loss amid broadly firmer United States statistics and fears of the US default. In doing so, the XAU/USD justifies firmer US Dollar and Treasury bond yields.

Talking about the United States statistics, the second estimation of the US Annualized Gross Domestic Product (GDP) for Q1 2023 was revised up to 1.3% versus 1.0% first forecasts. Further, the Chicago Fed National Activity Index for April improved to 0.07 from -0.37 prior and -0.02 market estimations. On the same line, Kansad Fed Manufacturing Activity improved to -2 for May compared to -21 previous readings and analysts’ estimations of -11. It’s worth noting that the US Pending Home Sales for April improved on YoY but eased on MoM whereas Core Personal Consumption Expenditures also rose to 5.0% during the preliminary readings versus 4.9% prior.

Following the data, Richmond Fed President Thomas Barkin said, “Fed is in a test and learn situation to determine how slowing demand lowers inflation.” On the different front, Boston Federal Reserve President Susan Collins said on Thursday that the Fed "may be at or near" the time to pause interest rate increases, as reported by Reuters.

Given the firmer US data and mostly hawkish Federal Reserve (Fed) comments, the US Dollar and Treasury bond yields grind higher, which in turn weighs on the Gold Price ahead of a slew of the US statistics relating to the activity and inflation.

Apart from the US data and Fed talks, the concerns about USpolicymakers’ inability to clinch a deal on the US debt ceiling extension, as well as the latest chatters suggesting a $70.0 gap left to be filled by the negotiators to get the much-awaited deal also weigh on the XAU/USD prices, via the firmer US Dollar and yields.

That said, the US Dollar Index (DXY) rose to the highest levels in 10 weeks, to 104.20 at the latest, whereas the US 10-year and two-year Treasury bond yields rose to the early March highs of around 3.82% and 4.54% in that order.

Moving on, the Gold price remains vulnerable to the further downside amid the market’s rush for the haven demand and hawkish Federal Reserve bets, backed by upbeat US data and US debt ceiling talks. Talking about the data, US Durable Goods Orders for April and the Core Personal Consumption Expenditure (PCE) Price Index for the said month, known as the Fed’s preferred inflation gauge, will also be important to watch for clear directions. Above all, risk catalysts are the key.

Gold Price technical analysis

Gold price prods two-month low on breaking the key support line stretched from early April, now immediate resistance around $1,956.

Adding strength to the XAU/USD downside bias are the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator and the metal’s sustained trading below the 50-SMA, as well as the monthly resistance line, currently joining around $1,975.

It’s worth noting, however, that the oversold conditions of the Relative Strength Index (RSI) line, placed at 14, allow the Gold price to rebound from the 61.8% Fibonacci retracement of its February-May upside, near $1,909.

Following that, the mid-March swing low of near $1,85 can act as the last defense of the Gold buyers.

On the contrary, the aforementioned resistances around $19,56 and $1,975 may prod the XAU/USD bulls before giving them control.

Even so, the 200-SMA near the $2,000 psychological magnet and the previous monthly high surrounding $2,050 can challenge the upside momentum of the Gold price before directing it to the record high of $2,080.

Overall, the Gold price is likely to drop further but the road towards the south appears bumpy.

Gold Price: Four-hour chart

Trend: Further downside expected

- Tech stock advancement creates mixed investor sentiment, allowing GBP/JPY to sustain gains.

- GBP/JPY upward trend continues, eyeing potential reversal upon Bank of Japan's policy shifts.

- In case of a dip below 172.00, GBP/JPY could test the two-week low of 171.19 and further the 170.00 mark.

GBP/JPY edges high but fell shy of reaching a new year-to-date (YTD) high above 172.79 and remains in positive territory, albeit a mixed sentiment amongst investors, as tech stocks advance. Consequently, safe-haven peers like the Japanese Yen (JPY) retraced some of their earlier gains sustained in the Asian session. At the same time, inflation data from the United Kingdom (UK) justifies the need for further tightening, underpinning Sterling (GBP). At the time of writing, the GBP/JPY is trading at 172.46.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY uptrend would continue before fundamental reasons change, like the Bank of Japan (BoJ) shifting its monetary policy, could open the door for a good reversal. Nevertheless, once the GBP/JPY falling wedge was broken to the upside, and Cable regained momentum above the May 2 high of 172.33, that opened the door for further gains. Since then, the GBP/JPY consolidated at 171.20-172.79 as buyers prepared to launch an assault and hit the falling-wedge measured target at 174.30.

Hence, the GBP/JPY path of least resistance is upwards. The first line of defense for GBP/JPY sellers would be the YTD high of 172.79, which is broken; the pair will move upwards and test 173.00. A breach of the latter will expose the 174.00 figure, ahead of the falling-wedge objective at 174.30.

On the flip side, if GBP/JPY slips below 172.00, that could pave the way to test the latest two-week low of 171.19 before testing the 170.00 mark. If GBP/JPY dives below that level, the 20-day Exponential Moving Average (EMA) could cap the downfall at around 170.65.

GBP/JPY Price Action – Daily chart

Here is what you need to know on Friday, May 26:

The US Dollar strengthened yet again on Thursday for the fourth consecutive day of trade vs. a basket of currencies as per the DXY index. DXY rallied from a low of 103.84 to a high of 104.312.

US data pointed to a resilient economy while progress on US debt ceiling talks remained elusive, helping Treasury yields higher and the US Dollar to score its highest level in over two months. Traders were wary of a possible default in early June while US President Joe Biden and top congressional Republican Kevin McCarthy were still not able to put a deal together. However, the two sides are now just $70 billion apart on a deal according to market chatter.

As for data, the number of Americans filing new claims for unemployment benefits rose modestly last week, and the prior week's data was revised sharply lower, the Labor Department said. US Jobless Claims in the week to 20 May came in at 229k, slightly above the previous week but lower than expected. Elsewhere, it was shown that the US economy is growing quicker than expected with real Q1 Gross Domestic Product up 1.3% QoQ.

As for the Federal Reserve speak, Boston Fed President Susan Collins said on Thursday the time may be at hand for the Fed to push the pause button on its interest-rate-hiking campaign to assess the impact of past tightening.

In forex, EUR/USD was down 0.31% to 1.0715. The Japanese yen fell 0.52% versus the greenback to 140.16 per US Dollar as investors wait for Tokyo Consumer Price Index on Friday. GBP/USD fell to a low of 1.2309. AUD was under pressure as was the Kiwi ahead of Aussie Retail Sales today with AUD/USD hitting a fresh cycle low below 0.6500. Gold sank to its lowest level in two months on Thursday and Oil prices dropped by $3 a barrel after Russian Deputy Prime Minister Alexander Novak played down the prospect of further OPEC+ production cuts at its meeting next week. BTC rallied from the day´s lows in midday trade and traveled between a low of 25,878 and 26,611.

- USD/JPY reaches yearly highs and positions near the 140.00 level.

- US Q1 GDP grew by 1.3%, surpassing expectations, while Jobless Claims exceeded estimates. Core PCE inflation rose 5% in Q1.

- Investors are eagerly anticipating today's release of the May Tokyo Consumer Price Index.

The Ninja continue edging higher on Thursday, maintaining yearly highs and approaching the key level of 140.00. This surge comes amidst positive economic developments, with the US Q1 GDP growth surpassing expectations and Jobless Claims exceeding estimates. Additionally, core PCE inflation rose by 5% in the first quarter. In that sense, the positive economic data from the United States, coupled with the rise in US bond yields due to the increased likelihood of a Fed adjustment, further favored the US Dollar.

On the other hand, investors will closely monitor the May Tokyo Consumer Price Index, which is expected to further impact the USD/JPY pair.

US economic data came in above expectations

The US Bureau of Economic Analysis recently announced that the United States experienced a 1.3% quarter-on-quarter expansion in Gross Domestic Product (GDP) during Q1 of 2023, surpassing the initial estimate of 1.1%. Additionally, Jobless Claims for the week ending on May 19 came in at 229k, lower than the expected consensus of 245k. Furthermore, Core PCE inflation rose to 5% in Q1, exceeding the projected rate of 4.9%.

In response to concerns expressed by the Federal Open Market Committee (FOMC) regarding economic activity, the CME FedWatch Tool now indicates a higher probability of a 25 bps interest rate increase. This development has fueled an increase in US bond yields, with the 10-year yield reaching 3.79%, reflecting a 3.22% rise in a single day. Additionally, the 2-year yield currently stands at 4.46%, representing a gain of 2.61%, while the 5-year yield sits at 3.87%, showing a 3.22% increase. These movements in bond yields provide further support to the US Dollar.

Levels to watch

Based on the daily chart analysis, the USD/JPY exhibits a bullish outlook in the short term. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators indicate the dominance of buyers while the pair remains above its key moving averages.

If the USD/JPY continues to gather momentum, it is likely to encounter resistance at the 140.00 level, followed by the 140.50 zone and the psychological level of 141.00. Conversely, on the downside, important support levels to monitor include the 139.50 zone, the 139.00 level, and the weekly low at 138.50.

- WTI bulls are in and have broken a 50% mean reversion level.

- If the bears were to commit, then there will be prospects of a move into $70.50s.

West Texas Intermediate, WTI, is currently trading at $71.93 and has traveled between a low of $71.03 and $74.33. Meanwhile, comments from Russia's oil minister, who said next month's OPEC+ meeting was unlikely to end with further cuts to production, have weighed on the black gold.

Reuters reported Russian oil minister Alexander Novak said further cuts from OPEC+ were unlikely following more than one-million barrels per day of voluntary cuts that took effect at the start of May.

´´The likelihood of OPEC cutting further only a month later is low. Signs of stronger demand should provide some comfort to bullish speculator,´´ analysts at ANZ Bank said. ´´Chinese demand is growing strongly as restrictions on international travel into China are eased. The rise in gasoline demand in the US comes ahead of the US holiday weekend.´´

Meanwhile, analysts at TD Securities explained that´´Saudi Arabia's warning shot to short sellers managed to squeeze CTA trend follower shorts, but only for a single trading session. WTI crude and Brent crude prices are now catching up with the ongoing deterioration in commodity demand trends, after a large-scale short covering program from algorithmic trend followers provided a sufficiently large offset for prices to buck the trend.´´

´´With price action already turning over, CTAs are likely to aggressively add back some shorts. In fact, we estimate that algos are set to add a whopping -21% of max size to their net short in WTI crude, along with -11% in Brent. This flow will help give credence to the slumping demand narrative, as China continues to battle with a surge in Covid-19 infections,´´ the analysts explained further.

WTI technical analysis

The bulls have moved in and are reaching a resistance area, breaking a 50% mean reversion level. If the bears were to commit, then there will be prospects of a move into $70.50s.

- USD/MXN rebounds to around 17.8040 after a more than 2000-pip dip.

- Robust US labor market data and Q1 growth revision boost the USD/MXN from 17.7000 to a daily high of 17.8785.

- Upcoming data: Mexico’s Q1 GDP, US Durable Good Orders, and Consumer Sentiment reports are set to sway the USD/MXN exchange rate.

USD/MXN stages recovery after diving more than 2000 pips, below the 20-day Exponential Moving Avera(EMA), which, acting as a solid support price level, capped the USD/MXN pair losses amidst a risk-off impulse. US political developments about raising the debt ceiling, and upbeat economic data amidst political uncertainty in Mexico, were the main drivers of USD/MXN price action. At the time of writing, the USD/MXN climbs and trades at around 17.8040.

Political uncertainty in Mexico and robust US data drive USD/MXN recovery; upcoming economic readings to impact the exchange rate

Discussion in Washington shows signs of moving forwards, according to US President Joe Biden, while Kevin McCarthy, the US House Speakers added that not “everybody is going to be happy at the end of the day” regarding making some concessions as Democrats and Republicans try to agree on a deal.

Aside from hits, the economy of the United States continues to grow, as shown by solid labor market data and a revision of growth figures for Q1 2023. Initial Jobless Claims for the week ending on May 20 rose by 229K less than the 245K expected by analysts, while the Q1 Gross Domestic Product (GDP) on its second estimate jumped to 1.3%, from 1.1% in the advanced and estimated data.

Once the US data crossed the wires, the USD/MXN increased from around the daily low of 17.7000 to the daily high of 17.8785. Notably, the US Dollar Index (DXY), a gauge that measures the buck’s value against a basket of six currencies, is trading nearby two-month highs reached during the day at 104.312, putting some ground between the 200-day EMA at 103.748 and the current price.

Across the border, the Mexican economic agenda revealed the Trade Balance of Mexico, which printed a deficit of $2,965 billion in April when adjusted for seasonal swings, INEGI reported.

During the week, the USD/MXN traded with gains of 0.30% after achieving two successive weeks of losses, dragging the pair to multi-year new lows at around 17.4238. However, the USD/MXN has been recovering more than 2.50% since the last week, as the USD/MXN pair is approaching the psychological 18.0000 figure.

Upcoming events

The Mexican economic agenda will feature final readings for Q1 Gross Domestic Product (GDP), expected at 1% in QoQ readings, while compared to the last year, the Mexican economy is estimated to grow by 3.9%. Worse than predicted figures, the Bank of Mexico (Banxico) pausing rates could trigger flows toward the safe-haven US Dollar, sending the USD/MXN pair toward the 18.00 handle. On the US front, Durable Good Orders, Consumer Sentiment, and the University of Michigan Consumer Sentiment are expected to rock the boat in the USD/MXN exchange rate.

USD/MXN Technical Levels

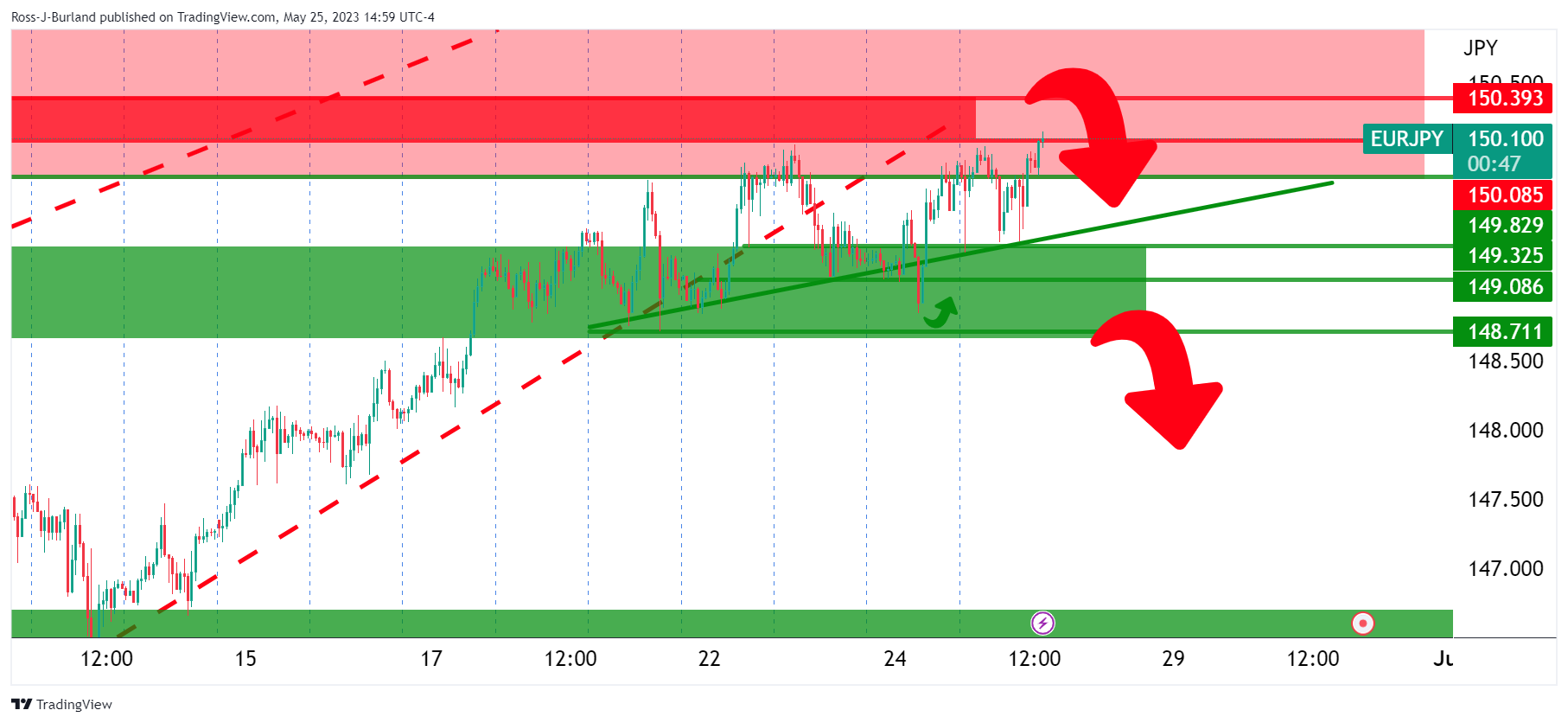

- EUR/JPY bulls ahve run into test the 150s.

- Resistance could prove tough and lead to a retest of trendline support.

EUR/JPY is currently trading at 150.10 and has traveled between a low of 149.37 and a high of 150.15 so far on the day. The following illustrates the market that is attempting to break into the resistance area although shows prospects of a meanwhile correction into trendline support.

EUR/JPY daily chart

EUR/JPY is testing resistance and has been supported along the way in the late 148s and the 149s so far.

EUR/JPY H1 chart

From an hourly perspective, we have the price climbing the trendline support and now moving steeply away from it to test the 150s. However, resistance here could prove fatal for the bulls. If the bears get below the trendline support, 148.70s will start to look vulnerable.

- XAU/USD falls to $1,940.00, during the American session.

- US GDP is revised up to 1.3% in the first quarter of the year (Q1), while Jobless Claims come in below expectations.

- Core PCE inflation rises by 5% in Q1.

The XAU/USD drops to its lowest level since March 22 due to strong economic data and a high Personal Consumption Expenditures (PCE) inflation. This leads investors to place higher bets on a 25 basis points interest rate hike by the Federal Reserve (Fed) in the upcoming June meeting. Consequently, US bond yields increase, exerting pressure on Gold prices and favoring the US Dollar.

The Gold price, as of the time of writing, is trading at $1,943.62, which is 0.7% below its opening price. Meanwhile, the US Dollar Index (DXY) Index is currently at the 104.22 level, showing a gain of 0.32% today.

The US reports strong economic activity data.

The US Bureau of Economic Analysis has reported that the Gross Domestic Product (GDP) of the United States expanded by 1.3% quarter-on-quarter in the first quarter of 2023, surpassing the preliminary estimate of 1.1% which was expected to remain unchanged. In contrast, Jobless Claims for the week ending on May 19 came in at 229k, lower than the consensus of 245k. Additionally, Core PCE inflation increased to 5% quarter-on-quarter in Q1, exceeding the expected rate of 4.9%.

After the Federal Open Market Committee (FOMC) expressed concerns about economic activity, positive US data has led investors to believe that there may be more room for another interest rate hike in the upcoming decision in June. As a result, the CME FedWatch Tool now places a 49.3% probability of a 25 basis points hike, compared to yesterday's odds of around 36%.

As a reaction, US bond yields are experiencing gains across the curve. The 10-year bond yield rose to 3.79%, marking a 3.22% increase on the day. Similarly, the 2-year yield stands at 4.46%, showing a gain of 2.61%, while the 5-year yield is at 3.87%, reflecting a gain of 3.22%. These increases in bond yields are further pressuring the price of Gold.

Levels to watch

According to the daily chart, Gold has a bearish outlook for the short term, as indicated by the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), both of which are pointing down in line with price and suggesting that sellers have control.

Immediate support for Gold is observed at the $1,940.00 level, followed by the 100-day Simple Moving Average at $1,930.00 and the $1,920.00 zone. Moreover, if the precious metal gains momentum, the following resistance levels are seen at the psychological mark of $1,950.00, followed by the $1,970 zone and the 20-day Simple Moving Average at $2,000.00.

-638206364828364836.png)

- GBP/USD bulls comer up for air at key demand area.

- Bears need to stay committed on the front side of dynamic resistance.

GBP/USD is down on the day and trading at 1.2330 currently. The pair has traveled from a high of 1.2387 to a low of 1.2308 so far. The price is moving into an area of potential support but while on the front side of the bearish trend, the bears are in control and there are prospects of a downside continuation if the bears commit. The following illustrates a couple of scenarios that respect the dynamic resistance lines and also the horizontal support area:

GBP/USD H4 chart

The market has corrected and the question is whether the bears are going to stay committed.

If the bears engage again, we have the 38.2% Fibonacci and the 50% mean reversion resistance area that they could lean against.

On the flip side, if this area were to break, then the bulls will be taking over and the bullish schematic could unfold with the trendline resistance looking vulnerable.

- EUR/USD hits a two-month low amidst US debt-ceiling uncertainty and positive US economic data.

- Fitch places US “AAA” debt rating on negative watch despite lower unemployment claims and a rise in Q1 GDP.

- Germany’s Q1 GDP plunge puts additional pressure on the Euro, with central bank commentary stirring markets.

EUR/USD continued to fall for three straight days and reached a new two-month low of 1.0707, as the greenback remains strengthening across the FX board. Uncertainty around the US debt-ceiling discussions and upbeat US economic data bolstered the US Dollar (USD). Therefore, the EUR/USD is trading at 1.0725 after hitting a high of 1.0756.

German recession adds weight to falling Euro, as central bank comments stir sentiment

US debt-ceiling discussions resumed on Wednesday, with US GOP House Speaker Kevin McCarthy saying that he does not expect an agreement today, tough added there has been “some progress” between both parties. Woes of a potential US default bolstered the US Dollar, though Fitch Ratings warned that US “AAA” debt ratings were put on negative watch.

On another front, data from the US Bureau of Labor Statistics (BLS) revealed that unemployment claims for the last week rose by 229K below estimates of 245K, signaling a solid labor market. At the same time, growth in the US for the first quarter was upwardly revised, revealing the BLS. Gross Domestic Product (GDP) rose by 1.3%, against the preliminary 1.1% figure, portraying a solid economy.

On the Eurozone (EU) front, the largest economy of the bloc, Germany, was in recession in Q1 as GDP plunged 0.3%, weighing on the Euro (EUR), which extended its losses from 1.0740 toward the 1.0710 area.

In the meantime, central bank speakers crossed the wires on both sides of the Atlantic. On the US front, Boston Fed President Susan Collins commented that the time to pause its tightening cycle is getting closer. On Wednesday, the Fed revealed its May minutes, showing policymakers are leaning towards pausing hikes, though officials did not commit to writing off interest rate increases.

Across the pond, the European Central Bank (ECB) member Klass Know said that “at least” two more rate hikes of 25 bps are needed in the Euro Area and stressed the need to stay put for a significant time.

EUR/USD Technical Levels

Bank of England interest rate-setter Jonathan Haskel has crossed the wires again today by saying, ´´if we do see evidence of more inflation persistence, we will tighten policy.´´

Additional comments

I decline to comment on market pricing but cannot rule out further rate rises.

We are monitoring inflation persistence very closely.

Earlier, the Monetary Policy Committee member Haskel said that the Bank of England needs to lean against the risk of persistent momentum in inflation, and may need to raise interest rates further.

"I prefer to lean against the risks of inflation momentum. As difficult as our current circumstances are, embedded inflation would be worse," Haskel said in a speech at the Peterson Institute of International Economics in Washington.

"Further increases in Bank rate cannot be ruled out," he added.

GBP/USD update

GBP/USD is at a key area of support and this could lead to a move back toward trendline resistance or, if bears commit, then we could see a sell-off towards 1.2270.

In an interview with Italy's Corriere della Sera, European Central Bank (ECB) policymaker Klaas Knot said that the ECB needs to raise the policy rate at least two more times, as reported by Reuters.

Knot further argued that rates should stay put for a significant period of time following these increases.

Additional takeaways

"Headline inflation peak behind us but not sure if at peak of underlying inflation."

Most of impact of ECB's monetary tightening is still in the pipeline."

"Next two ECB hikes should be 25 bps each."

"I am totally open-minded on what happens with rates after the summer."

"Market pricing of rate cuts is overly optimistic."

Market reaction

These comments failed to help the Euro gather strength against its rivals. As of writing, EUR/USD was down 0.35% on a daily basis at 1.0712.

- US bond yields climb amid debt ceiling uncertainty, with the 10-year rate reaching 3.789%, a high since the Silicon Valley Bank collapse.

- US economy displays recovery signs with lower-than-expected jobless claims and an upwardly revised Q1 GDP, while the Fed hints at a pause in rate hikes.

- Canadian Manufacturing Sales declined by 0.2% in April, highlighting the economic contrast between the US and Canada.

USD/CAD reclaims the 1.3600 figure after hitting a daily low of 1.3586, climbs for two consecutive days toward the April 28 swing high at 1.3667, on mixed market sentiment, as the Nasdaq rises. The financial markets narrative remains the same, with Republicans and Democrats unable to reach an agreement despite Fitch Ratings threatening to review the US qualification. The USD-CAD is trading at 1.3639.

US economy bounces back amidst debt ceiling stalemate; Canadian Manufacturing Sales stumble

US House Speaker Kevin McCarthy said that both sides made some progress but that “There are still outstanding issues. I’ve directed our team to work 24/7 to solve this problem.” Uncertainty around the negotiations keeps US Treasury bond yields climbing, with the US 10-year benchmark note rate at 3.789%, its highest level since the Silicon Valley Bank (SVB) collapse on March 10.

Meanwhile, US Treasury Secretary Janet Yellen continued her campaign putting pressure on the US Congress, stating the US would run out of cash by June 1. Some consequences of the political drama in Washington triggered a reaction by Fitch Rating, warning that the US AAA rating is under threat.

Consequently, the US Dollar Index (DXY), which measures the performance of a basket of six currencies vs. the greenback, trades at 104.266, gains 0.36%. Therefore, the USD/CAD climbs on a strong US Dollar (USD), and weaker oil prices, as WTI tmbles more than 3%.

Aside from geopolitical jittery, US economic data shows the economy regaining momentum, as the Initial Jobless Claims for the week ending on May 20 expanded by 229K below expectations of 245K, as revealed by the US Bureau of Labor Statistics (BLS). In another report, the second estimate of the US Gross Domestic Product (GDP) for Q1 was revised from 1.1% to 1.3%.

On Wednesday, the US Federal Reserve revealed the May meeting minutes, which showed that the US central bank is open to pause rates at the upcoming meetings, though emphasized that some flexibility is needed in the case of needing higher rates. Furthermore, participants commented the current monetary policy is impacting the economy as bank credit tightened, that no rate cuts are expected in 2023, and that the Fed will be data-dependent.

On the Canadian front, Manufacturing Sales plunged -0.2% in April, below March’s 0.7% increase.

USD/CAD Technical Levels

- Silver price is on a 4-day losing streak.

- Bears running out of steam near overbought RSI.

- 100 and 200-day SMAs could serve as support and resistance levels in sideways trading period.

Silver price (XAG/USD) trades with 0.57% losses at $22.93 at the time of writing, after bottoming at a low of $22.75 during the early Asian session. The precious metal price is trading in the red for a fourth consecutive day, and buyers should not ignore that technical indicator on the daily chart are approaching oversold conditions.

That being said, the Relative Strength Index (RSI) is just above the overbought threshold while the Moving Average Convergence Divergence (MACD) has been standing in negative territory since mid-April, suggesting that a technical correction may be on the horizon.

In addition, XAG/USD lost the 100-day Simple Moving Average (SMA) for the first time since March and now has its last support at the 200-day SMA at $22.01. So, considering the possibility of an upwards correction, the price can use the mentioned moving averages as support and resistances for consolidating the losses and then entering a period of sideways trading.

- The AUD/USD takes a hit, trading at around 0.6505, as US debt ceiling discussions fail to conclude and tech stocks gain momentum due to rising interest in AI.

- The US economy demonstrates resilience with robust Retail Sales, Industrial Production, and a firm labor market, countering rising Initial Jobless Claims.

- Debt ceiling deadlock stirs fears over US AAA rating; Yellen warns of potential cash crunch by June.

AUD/USD tanks as Thursday’s North American session begins, amidst mixed market sentiment, with US debt ceiling discussions being the center stage, while the AI frenzy has taken tech stocks higher. In the meantime, the United States (US) economy is proving resilient amidst the recent data released. At the time of writing, the AUD/USD is trading at around 0.6511 after hitting a six-month low of 0.6503.

US economy shows resilience with the improved job market and GDP growth; the Australian economy faces pressure

US economic data showed that Initial Jobless Claims for the week ending on May 20 rose by 229K below estimates of 245K, according to data from the US Department of Labor. The US economy has gained momentum as Retail Sales, Industrial Production, business activity, and a “tight” labor market underpinned the US Dollar (USD). In a separate report, the US Bureau of Labor Statistics (BLS) showed that the second estimate of Gross Domestic Product (GDP) for Q1 was revised from 1.1% to 1.3%.

In the meantime, the US Dollar Index, which measures the buck’s performance against a basket of six currencies, rises for four consecutive trading days, up 0.21%, at 104.103. It should be said that a double-bottom chart pattern looms, and with an upside break above 105.883, that will validate the pattern.

Must read: US Dollar Index: Reclaims 200-day EMA, surpasses 2017 yearly high, as bulls stepped in eyeing 104.000

US debt ceiling talks hit an impasse as the White House (WH) and the US Congress, led by US House Speaker Kevin McCarthy, failed to seal an agreement that could lift the US ceiling so that the country can pay its obligations, which, according to US Treasury Secretary Janet Yellen, saying the US would run out of cash by June 1. Some consequences of the political drama in Washington triggered a reaction by Fitch Rating, warning that the US AAA rating is under threat.

The AUD/USD continues to be pressured amidst the lack of a catalyst on the Australian front. The Reserve Bank of Australia’s (RBA) minutes showed the central bank’s beliefs that higher rates, inflation, and income tax would contribute to a slowdown in consumer spending.

Additionally, China’s economy losing momentum would likely keep the AUD/USD tilted to the downside. According to Bloomberg, “Recent data suggest gross domestic product growth this year will be closer to the government’s target of about 5%, contrary to expectations of a large overshoot formed earlier in the year.”

AUD/USD Price Analysis: Technical outlook

From a daily chart perspective, the AUD/USD is neutral to downward biased, with a clear path of challenging the November 10 daily low of 0.6386, but firstly, the AUD/USD pair must fall below crucial support levels. The first one would be 0.6500. A decisive break will expose the 0.6400 figure before testing the abovementioned area at the 0.6200 handle. Otherwise, if AUD/USD stays above 0.6500, the 0.6600 psychological figure is up for grabs.

The USD rallied across the board last week. Economists at TD Securities discuss greenback outlook.

Near-term outlook has turned less USD bearish

“The USD has further upside to start the summer simply just to work off legacy shorts that were built up before the implosion of China and European data surprises.”

“However, while the near-term outlook has turned less USD bearish, we still forecast a weaker USD through H2.”

See: Outside chance that the Fed will implement another step is positive for the USD – Commerzbank

Thomas Barkin, president of the Federal Reserve Bank of Richmond, said on Thursday that the US labor market remains tight and added noted that some business are still saying that they need to raise prices, per Reuters.

Additional takeaways

"Demand is definitely cooling, in part because it was overstimulated during the pandemic."

"Fed rate hikes are also helping reduce demand, as is credit tightening due to bank failures."

"Data on productivity has been moving the wrong way but much is unknown about COVID impacts on hiring, labor force."

"Fed is in a test and learn situation to determine how slowing demand lowers inflation."

Market reaction

The US Dollar Index clings to modest daily gains above 104.00 after these comments.

Boston Federal Reserve President Susan Collins said on Thursday that the Fed "may be at or near" the time to pause interest rate increases, as reported by Reuters.

"While inflation is still too high, there are some promising signs of moderation," Collins further elaborated.

"I also believe it is important to make each policy decision based on a holistic assessment of information available at the time - and the next policy meeting will be in mid-June," she added and reiterated that they will continue to monitor a wide range of data to evaluate how the economy is doing.

Market reaction

The US Dollar Index retreated modestly from daily highs following these comments and was last seen gaining 0.2% on the day at 104.10.

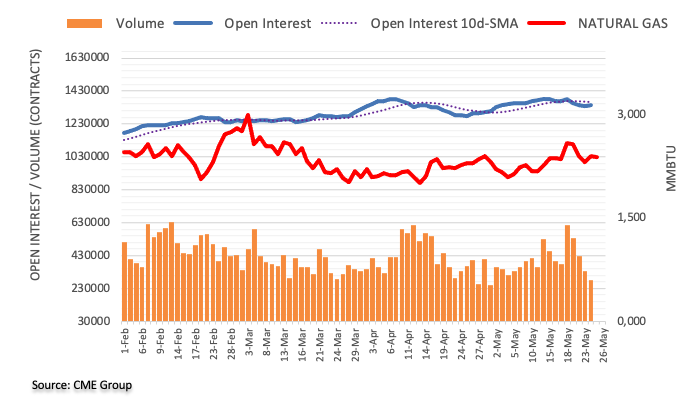

Europe managed to escape severe shortages in Gas amid mild temperatures and plentiful LNG supply. However, we cannot rule out another energy crisis next winter, in the opinion of strategists at ANZ Bank.

Prices to remain volatile

“Our base case scenario is that Europe will get through another winter without any significant disruptions to energy supply. However, we think there is a 30% chance of the worst-case scenario playing out, a risk we feel the market is underestimating.”

“The uncertainty around the energy market’s outlook is expected to increase volatility in European Gas prices. Any signs that our worst-case scenario may be unfolding will likely see a re-rating by the market, leading to further upside in prices.”

The Mexican central bank has ended its cycle of interest rate hikes but continues to signal attractive real interest rates. This supports the Peso, although downside risks emanate from US economic developments, economists at Commerzbank report.

An important risk factor for the MXN remains developments in the US

“If inflation falls as expected, we see room for rate cuts towards the end of this year or early in 2024. However, we do not expect the Peso to depreciate significantly against the USD as any rate cuts are likely to be in line with the Fed's own easing efforts.”

“If the US economy cools down more than expected, this would also weigh on the Mexican outlook. This would likely limit upside risks to inflation and could imply a sharper cut in Mexican interest rates and a correspondingly less attractive real interest rate outlook, which would weigh on the Peso.”

“In our baseline scenario, however, we expect solid domestic demand and Banxico's vigilance to continue to support the Peso in the face of a still uncertain inflation outlook.”

Source: Commerzbank Research

- USD/JPY regained its traction and climbed above 139.50.

- US Dollar benefits from upbeat macroeconomic data releases from the US.

- BoJ's Ueda hinted at a possible tweak to YCC strategy.

USD/JPY reversed its direction and advanced beyond 139.50 in the American session following a decline to the 139.20 area in the European session. At the time of press, the pair was up 0.12% on the day at 139.63.

USD regathers strength after latest data

Earlier in the day, Bank of Japan (BoJ) Governor Kazuo Ueda said that they could tweak the Yield Curve Control (YCC) strategy if the balance between the benefit and the cost of the policy were to shift. "It is possible to keep 5-year bond yield stable and low even by targeting 10-year yield, as long as the shape of yield curve is an upward slope," Ueda added and helped the Japanese Yen stay resilient against its rivals.

In the second half of the day, the US Dollar (USD) capitalized on strong data releases and caused USD/JPY to turn north. Annualized first-quarter Gross Domestic Product (GDP) growth got revised higher to 1.3% from 1.1% and the weekly Initial Jobless Claims came in at 229,000, mush lower than the market expectation of 245,000.

Nevertheless, the positive opening in Wall Street seems to be limiting the USD's gains for the time being and capping USD/JPY's upside. The S&P 500 and the Nasdaq Composite indexes were last seen rising 0.4% and 1.9% on a daily basis, respectively.

Market participants will pay close attention to comments from Federal Reserve (Fed) officials in the American session. According to the CME Group FedWatch Tool, the probability of the Fed leaving its policy rate declined below 55% from nearly 70% on Wednesday.

Technical levels to watch for

- GBP/USD drops to the 1.2330 region earlier on Thursday.

- Persistent buying pressure in the greenback keeps the pound depressed.

- UK CBI Distributive Trades dropped to -10 for the current month.

Further strength in the greenback weighs on the risk complex and drags GBP/USD to revisit the area of multi-week lows near 1.2330 on Thursday.

GBP/USD faces the next support near 1.2270

GBP/USD retreats for the fourth session in a row and extends further the rejection from 2023 peaks near 1.2680 (May 10), an area also coincident with the 2021-2023 resistance line and the 100-week SMA.

In the meantime, recession concerns in the UK economy appears to have been reignited following sticky inflation figures in the UK during April ([published on May 24), which in turn seem to have reinforced the idea of extra tightening by the BoE in the upcoming MPC meetings.

In the United Kingdom, Car Production increased 9.9% year-on-year to April, while the CBI Distributive Trades fell to -10 for the current month (from 5).

GBP/USD levels to consider

As of writing, the pair is losing 0.21% at 1.2338 and faces the next support at 1.2283 (100-day SMA) seconded by 1.2274 (monthly low April 3) and finally 1.2010 (weekly low March 15). On the other hand, the surpass of 1.2668 (2023 high May 8) would open the door to 1.2864 (200-week SMA) and then 1.3000 (psychological level).

Economists at Rabobank discuss GBP outlook and share their GBP/USD and EUR/GBP forecasts.

EUR/GBP to trade in a choppy range in the coming weeks

“The government’s position has altered significantly since September, but many of the underlying weakness in UK fundamentals remain.”

“Positioning suggests that both the Pound and the EUR are ill-equipped to face disappointing economic data currently and we expect EUR/GBP to trade in a choppy range in the coming weeks. That said, we see scope for cable to drop to 1.22 on a three-month view.”

- Gold price came under renewed bearish pressure on Thursday.

- First-quarter US GDP growth revised higher to 1.3%.

- 10-year US Treasury bond yield is up more than 1% near 3.8%.

Gold price turned south and dropped to its weakest level since late March slightly below $1,945 on Thursday before staging a modest rebound. As of writing, XAU/USD was down 0.55% on the day at $1,945.

US yields rise on strong data

The US Bureau of Economic Analysis announced that it revised the annualized Gross Domestic Product (GDP) growth for the first quarter to 1.3% from the advance estimate of 1.1%. Additionally, the US Department of Labor's weekly report revealed that there were 229,000 initial claims for unemployment benefits in the week ending May 20, much lower than the market expectation of 245,000.

Boosted by the upbeat macroeconomic data releases, the benchmark 10-year US Treasury bond yield gained nearly 1% and reached 3.8% for the first time since the second week of March, weighing on the inversely-correlated XAU/USD.

According to the CME Group FedWatch Tool, markets are currently pricing in a less than 60% probability of the US Federal Reserve leaving its policy rate unchanged in June, compared to nearly 80% earlier this week.

Later in the session, April Pending Home Sales and Kansas Fed Manufacturing Activity data for May will be featured in the US economic docket. Investors will continue to pay close attention to fresh developments surrounding the debt-limit negotiations as well.

Technical levels to watch for

Economists at Commerzbank discuss whether further rate hikes are possible and their implications for the US Dollar.

Number of FOMC members over the past days in favor of ‘skipping’ the June meeting

“We had a number of FOMC members over the past days who were in favor of ‘skipping’ the June meeting (so no rate hike), but who do not want this to be understood as the end of the rate cycle. Governor Christopher Waller was the last to do so yesterday. Of course, the market had doubted the story spread by the Fed officials for some time. So there might have been a number of market participants who heard the comments but did not believe them.”

“It is nonetheless positive for the Dollar that there is still an outside chance that the Fed will implement another step. And that skipping a meeting in June does not mean that this opportunity will not arise.”

- Initial Jobless Claims in the US decreased by 4,000 in the week ending May 20.

- US Dollar Index clings to daily gains above 104.00.

There were 229,000 initial jobless claims in the week ending May 20, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 225,000 (revised from 242,000) and came in better than the market expectation of 245,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 231,750, unchanged from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending May 13 was 1,794,000, a decrease of 5,000 from the previous week's unrevised level of 1,799,000," the DOL further added in its press release.

Market reaction

The US Dollar continues to outperform its rivals after this data and the US Dollar Index was last seen rising 0.25% on the day at 104.15.

- The US BEA revised Q1 GDP higher to 1.3% from 1.1%.

- US Dollar Index stays in positive territory above 104.00.

The real Gross Domestic Product (GDP) of the US expanded at an annualized rate of 1.3% in the first quarter, the US Bureau of Economic Analysis' (BEA) second estimate showed on Thursday. This reading came in above the advance estimate and the market expectation of 1.1%.

"The increase in real GDP reflected increases in consumer spending, exports, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by decreases in private inventory investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased," the BEA explained in its publication.

Market reaction

The US Dollar preserves its strength after this report and the US Dollar Index was last seen gaining 0.22% on the day at 104.12.

- EUR/USD retreats to fresh monthly lows near 1.0715.

- The loss of the 1.0700 region exposes a deeper decline.

EUR/USD maintains the bearish note well in place and revisits the vicinity of 1.0700, or monthly lows, on Thursday.

In the meantime, the ongoing bearish development could force the pair to extend the move to the March low of 1.0516 (March 15) in case the 1.0700 region is cleared in a sustainable fashion.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0477.

EUR/USD daily chart

- Oil price declines as traders take profit and the debt-ceiling impasse continues without a deal in sight.

- Set against, however, Oil is supported by EIA inventory data, showing a steep drawdown in the prior week, reflecting rising demand.

- Comments by the Saudi Oil Minister warning short-sellers and the start of the US driving season are bullish factors.

Oil price rolls over and heads south on Thursday due to continued unease around the debt ceiling and traders booking profits from the recent rally. Crude is mainly priced in the US Dollar and this is getting stronger, putting further pressure on the Oil price. The Dollar Index (DXY) has broken above the 104.00 psychological level on safe-haven flows.

At the time of writing, WTI Oil is trading in the upper $72s and Brent Crude Oil in the upper $76s. A bullish right-angled triangle has completed on the 4-hour chart, posing a challenge to the overall bear trend.

Oil news and market movers

- A lack of traction in US debt-ceiling talks weighs on the Oil price as it raises the specter of the US defaulting and triggering a global recession.

- The US Dollar catches a bid from a combination of safety flows and greater expectations the Federal Reserve (Fed) will continue to hike rates. US macro data remains supportive.

- Energy Information Administration (EIA) inventory data released on Wednesday showed a much larger-than-expected 12.5 million barrel drawdown, indicating robust demand. Analysts’ expectations had been for a 775,000 rise.

- Oil was supported by comments from Saudi Oil Minister, Prince Abdulaziz bin Salman, who warned Oil speculators to "watch out" and that they might suffer as they did "in April".

- His comments have been taken as warning to short-sellers that the Oil price might rise.

- Abdulaziz defended OPEC and its decision to cut production by 2 million barrels per day (bpd) at its meeting in October 2022. Given the Oil price is at similar levels to October, it may suggest there is a risk the cartel will announce another supply cut in June.

- The US Memorial Day weekend kicks off on May 27 and marks the beginning of the US summer driving season, which will provide a seasonal lift to demand, supporting Oil prices.

Crude Oil Technical Analysis: Triangle in downtrend

WTI Oil is in a long-term downtrend from a technical perspective, making successive lower lows. Given the old adage that the trend is your friend, this favors short positions over long positions. WTI Oil is trading below all the major daily Simple Moving Averages (SMA) and all the weekly SMAs except the 200-week, which is at $66.89.

-638206144141310735.png)

WTI US Oil: Daily Chart

A right-angled triangle has formed since price recovered from the May 4 YTD lows, as shown by the dotted lines. The initial rebound off the May 4 lows could be a Wave A, with Wave B descending between May 8-15. Wave C rose in the week that followed, before pulling back in a Wave D. The recovery this week is probably a Wave E. Since most triangles are only composed of five waves it is now likely complete. It could break out at any moment.

There is a chance the triangle might break in either direction, but it is biased to break higher because the top border is flat (it is right-angled). A breakout higher could see price rise in a volatile rally to a potential target in the $79.70s, calculated by using the usual technical method, which is to take 61.8% of the height of the triangle and extrapolate it from the breakout point higher. Oil price could even go as far as a 100% extrapolation in bullish cases, however, the 61.8% level roughly coincides with the 200-day SMA and the main trendline for the bear market, heightening its importance as a key resistance level.

Assuming Oil price reaches its target, a bullish break would mean price moving above the $76.85 lower high of April 28, thereby, bringing the dominant bear trend into doubt.

The three green bars in a row that represent the rally this week (Wave E) and the tentative breakout that accompanied Wednesday’s rally, are a strong bullish sign. Price could still recover despite the bearish action on Thursday, and eventually continue higher.

As well as the triangle, the long hammer Japanese candlestick pattern that formed at the May 4 (and year-to-date) lows is a sign that it could be a key strategic bottom.

Further, the mild bullish convergence between price and the Relative Strength Index (RSI) at the March and May 2023 lows – with price making a lower low in May that is not matched by a lower low in RSI – is a sign that bearish pressure is easing.

Given the downtrend is dominant, however, there is still also a possibility WTI Oil price could break lower, with a decisive break below the triangle’s lower border, likewise required, and a target at $67.27. This is just above where the 200-week SMA is located and likely to offer support. Traders might even wish to wait for a break below the lows of Wave B at $69.40 for added confirmation.

-638206144608419505.png)

WTI US Oil: Weekly Chart

A break below the year-to-date (YTD) lows of $64.31 would be required to re-ignite the downtrend, with the next target at around $62.00 where trough lows from 2021 will come into play, followed by support at $57.50.

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Bank of Japan (BoJ) Governor Kazuo Ueda said on Thursday that they could tweak the Yield Curve Control (YCC) strategy if the balance between the benefit and the cost of the policy were to shift, as reported by Reuters.

Additional takeaways

"Shortening the duration of bond yield BoJ targets to 5-year zone from current 10-year would be among options if we were to tweak YCC in the future."

"It is possible to keep 5-year bond yield stable and low even by targeting 10-year yield, as long as the shape of yield curve is an upward slope."

"BoJ must avoid tightening monetary policy prematurely."