- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

Forex-novosti i prognoze od 23-05-2023

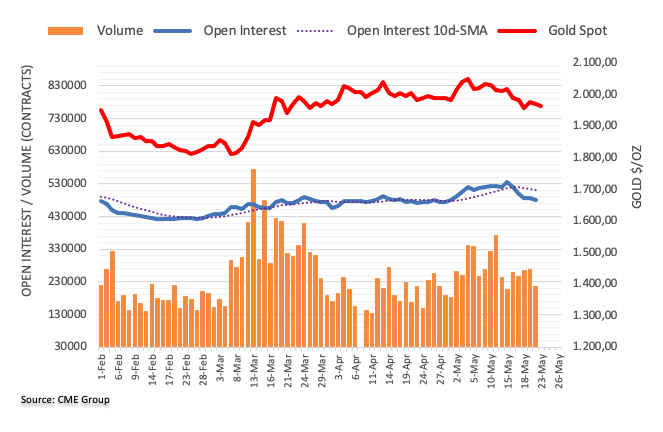

- USD/CAD is oscillating in a narrow range around 1.3500 ahead of FOMC minutes.

- Republicans are not agreeing on levying extra taxes on the Wealthy community or supporting higher spending initiatives.

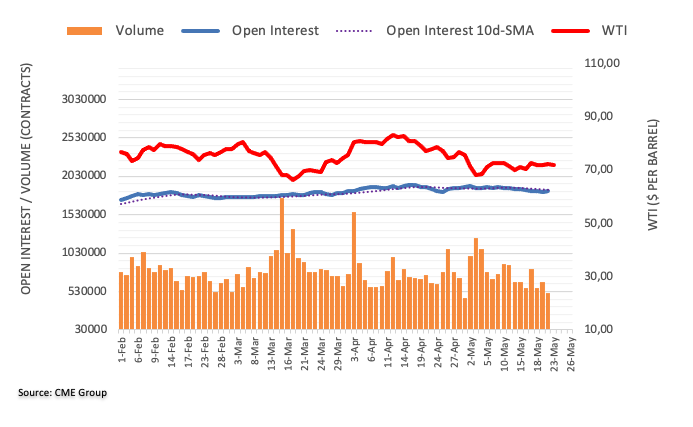

- The oil price has printed a fresh three-week high around $74.00 as global central banks are reaching the terminal rate.

The USD/CAD pair is demonstrating topsy-turvy moves near the psychological figure of 1.3500 in the early Asian session. The Loonie asset is expected to remain sideways ahead of the release of the Federal Open Market Committee (FOMC) minutes for May’s monetary policy meeting.

S&P500 futures have added some gains in early Tokyo after a bearish Tuesday. The overall market mood is still risk-off amid deepening issues associated with US debt-ceiling case. US House Speaker Kevin McCarthy told House Republicans during a closed GOP meeting on Tuesday that “I need you all to hang with me on the debt limit, we are nowhere near a deal yet,”

Uncertainty about US borrowing cap issue soars after US President Joe Biden called partisan terms proposed by Speak McCarthy ‘extreme’. The latter is not agreed on levying extra taxes on the Wealthy community nor is he supporting higher spending initiatives.

The US Dollar Index (DXY) is showing signs of volatility contraction after reaching near the previous week’s high above 103.62. More gains are in the pipeline ahead of the FOMC minutes, which will provide a detailed explanation behind the 25 basis points (bps) interest rate hike by the Federal Reserve (Fed). Also, it will report current economic prospects and would deliver guidance on interest rates.

Meanwhile, the oil price has printed a fresh three-week high around $74.00 as investors seem confident that the US economy will not default and would find a bipartisan deal with Republicans. Also, other central banks are reaching the terminal rate, which is easing fears of a further slowdown.

It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices will support the Canadian Dollar.

- US Dollar Index remains sidelined after refreshing two-month high.

- Hawkish Fed bets, risk-off mood allows DXY to remain firmer despite pullback in yields.

- Upbeat US PMIs, concerns about Fed’s next move highlight today’s Minutes.

- US policymakers struggle to overcome the deadlock in debt ceiling talks ahead of early June expiry.

US Dollar Index (DXY) bulls take a breather at a nine-week high, making rounds to 103.50 as traders await the latest Federal Open Market Committee (FOMC) Meeting Minutes. Also challenging the greenback’s gauge versus six major currencies are the fears of the US default. However, hawkish Federal Reserve (Fed) concerns and upbeat US data put a floor under the DXY price during early Wednesday.

A lack of progress in the talks to avoid the US debt ceiling expiration and fears that the US may mark the ‘catastrophic’ default weighed on the market sentiment of late. Recently, US House Speaker Kevin McCarthy crossed wires, via Reuters, while suggesting no deal on the debt ceiling extension today but repeating previous optimism that they will get an agreement before June 01. Previously, Washington rolled out news stating the US Treasury has asked multiple agencies if they can delay the payment demands.

Talking about the data, preliminary figures of the May monthly PMIs signaled that the US Services sector keeps outgrowing the manufacturing ones and fuelled the Composite PMI figure to the highest levels in a year. That said, the US S&P Global Manufacturing PMI eased to 48.5 from 50.2 versus 50.0 market forecasts whereas Sevices PMI rose to 55.1 compared to 52.6 expected and 53.6. With this, the Composite PMI marked 54.5 figures versus the analysts’ expectations of 50.0 and 53.4.

On the other hand, the latest comments from Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin and San Francisco President Mary C Daly who backed the calls for higher Fed rates while citing the inflation woes, which in turn propelled the betts on the Fed rate increase in June. The same push back the Fed rate cut and allows the US Dollar to remain firmer despite a retreat in the US Treasury bond yields. It should be noted that the US 10-year and two-year Treasury bond yields retreated from the highest levels since early March the previous day.

With this, the Wall Street benchmarks saw the red but the S&P 500 Futures seem to struggle for clear directions, marking mild gains of late.

Looking ahead, the qualitative factors affecting the market sentiment, like US debt ceiling talks, US-China tension and Fed commentary, are the key catalysts to direct short-term US Dollar Index moves ahead of the Fed Minutes.

Also read: FOMC Minutes Preview: The complicated task of searching for clues

Technical analysis

Unless providing a daily close below the 100-DMA, around 102.85 by the press time, US Dollar Index remains on the buyer’s radar.

- EUR/USD pares the biggest daily loss in a week amid cautious markets.

- Comparatively upbeat US PMIs jostle with the hawkish ECB talks and pre-event anxiety to prod Euro traders.

- US policymakers’ inability to strike debt ceiling deal weighs on sentiment, EUR/USD price.

- Fed Minutes, headlines about US default will be the key to watch for immediate directions.

EUR/USD bears take a breather around 1.0770 during early Wednesday in Asia, after posting the biggest daily loss in a week. That said, escalating fears of the US default, hawkish Fed bets and anxiety ahead of the Fed Minutes seem to contribute the maximum in the latest sour sentiment, as well as to the EUR/USD weakness. Additionally weighing on the Euro price is the US-China tension and the West versus Russian jitters.

No progress in the talks to avoid the US debt ceiling expiration and fears that the US may mark the ‘catastrophic’ default weighed on the market sentiment of late. Recently, US House Speaker Kevin McCarthy crossed wires, via Reuters, while suggesting no deal on the debt ceiling extension today but repeating previous optimism that they will get an agreement before June 01. Previously, Washington rolled out news stating the US Treasury has asked multiple agencies if they can delay the payment demands.

On Tuesday, preliminary figures of the May monthly PMIs signaled that the US Services sector keeps outgrowing the manufacturing ones and fuelled the Composite PMI figure to the highest levels in a year. That said, the US S&P Global Manufacturing PMI eased to 48.5 from 50.2 versus 50.0 market forecasts whereas Sevices PMI rose to 55.1 compared to 52.6 expected and 53.6. With this, the Composite PMI marked 54.5 figures versus the analysts’ expectations of 50.0 and 53.4.

On the other hand, the first readings of Eurozone HCOB monthly PMIs for May came in a little interesting despite an upbeat 55.9 number for the Services activity gauge.

Apart from the data, the latest comments from Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin and San Francisco President Mary C Daly who backed the calls for higher Fed rates while citing the inflation woes, which in turn propelled the betts on the Fed rate increase in June. The same push back the Fed rate cut and allows the US Dollar to remain firmer despite a retreat in the US Treasury bond yields.

At home, European Central Bank (ECB) Vice President Luis de Guindos and policymaker Joachim Nagel ruled out policy pivot talks while citing the higher inflation to defend the rate hike bias.

Against this backdrop, Wall Street closed in the red and helped the US Dollar despite downbeat yields.

Looking ahead, the Eurozone calendar remains empty and may add strength to the latest EUR/USD inaction. However, risk catalysts and the latest Federal Open Market Committee (FOMC) Meeting Minutes will be crucial to watch for clear directions.

Also read: FOMC Minutes Preview: The complicated task of searching for clues

Technical analysis

EUR/USD remains bearish between a three-week-old descending resistance line and an upward-sloping trend line support stretched from late November 2022, respectively between 1.0805 and 1.0745.

- AUD/NZD has displayed a decent recovery after a sheer contraction in NZ Q1 Retail Sales to 1.4%.

- The RBNZ is expected to raise interest rates further by 25 bps to 5.50%.

- Australian Employment has been hit hard amid a slowdown in the economy due to higher interest rates.

The AUD/NZD pair has shown a solid recovery above 1.0580 as Statz New Zealand has reported downbeat Q1 Retail Sales data. The economic data has contracted by 1.4% while the street was anticipating a contraction of 0.4%. NZ Retail Sales contracted by 0.6% in the last quarter of CY2022. A spree of a decline in retail demand would weigh heavily on inflationary pressures ahead.

Later on Wednesday, the interest rate decision by the Reserve Bank of New Zealand (RBNZ) will be of utmost importance. Analysts at ING stated “Markets are pricing in a peak at around 5.80%, but we think the RBNZ can deliver an extra bit of hawkishness and signal tightening until the 6.00% mark as it hikes by 25 bps this week. That would have positive implications for NZD in the near term.”

Investors should note that RBNZ Governor Adrian Orr hiked its Official Cash Rate (OCR) surprisingly by 50 basis points (bps) to 5.25% in April’s monetary policy meeting as inflationary pressures remained sticky. New Zealand’s inflation softened to 6.7% in the first quarter of CY2023 from the former release of 7.2% but is still far from the desired rate.

On the Australian Dollar front, the Reserve Bank of Australia (RBA) is expected to remain steady in June as Australian Employment has hit hard amid a slowdown in the economy due to higher interest rates. RBA policymakers already hinted that a sharp slowdown could affect the economy and inflation would remain under pressure. This may allow RBA Governor Philip Lowe to keep rates steady and further assess the impact of current interest rate hikes ahead.

“Business sentiment at big Japanese manufacturers turned positive for the first time this year and service-sector morale hit a five-month high, providing more evidence of an economy on the mend after a COVID-led recession,” per the monthly results of the Reuters Tankan survey.

Key findings

Manufacturers' mood is expected to rise further over the coming three months, while the service-sector morale slid only slightly.

The sentiment index for big manufacturers stood at +6, up from April, the according to the survey of 493 firms, of which 241 responded during May 10-19.

It was the first positive reading this year and is expected to rise further in August.

The service-sector index grew a tad from the previous month to 25, led by retailers and real estate/construction firms. The index hit its highest this year.

USD/JPY dribbles

The data fails to inspire USD/JPY bears as the Yen pair remains sidelined around 138.50, waiting for Tokyo open.

- NZD/USD holds lower grounds as New Zealand’s Q1 Retail Sales growth disappoints ahead of RBNZ.

- Fears of US default weigh on market sentiment, as well as on Kiwi prices, amid lackluster debt ceiling talks.

- Hopes of witnessing one last rate hike from RBNZ keeps NZD/USD bears on the lookout for dovish signs.

- Fed Minutes, risk catalysts can entertain traders past RBNZ.

NZD/USD fades bounce off intraday low on downbeat New Zealand Retail Sales, as well as the risk-off mood, to around 0.6250 during early Wednesday. In doing so, the Kiwi pair portrays the market’s hesitance in reacting to the key NZ data as traders await the Reserve Bank of New Zealand (RBNZ) Monetary Policy Decision.

Also read: RBNZ Interest Rate Decision Preview: Kiwi set to fly on a hawkish rate hike

New Zealand’s first quarter (Q1) Retail Sales marked a contraction of 1.4% QoQ versus -0.4% expected and -0.6% prior while the YoY figures dropped to -4.1% versus -4.0% previous readings.

Apart from the downbeat NZ data, the market’s risk aversion also weighs on the NZD/USD price. That said, escalating fears of the US default and anxiety ahead of the RBNZ interest rate decision seems to contribute the maximum in the latest sour sentiment. Furthermore, the US-China tension and the West versus Russian jitters are also on the table to challenges the mood, as well as the Kiwi pair price.

That said, no progress in the talks to avoid the US debt ceiling expiration and fears that the US may actually mark the ‘catastrophic’ default weighed on the market sentiment of late. Recently, US House Speaker Kevin McCarthy crossed wires, via Reuters, while suggesting no deal on the debt ceiling extension today but repeating previous optimism that they will get agreement before June 01. Previously, Washington rolled out news stating the US Treasury has asked multiple agencies if they can delay the payment demands.

On the other hand, hawkish Fed bets increased after preliminary figures of the May monthly PMIs signaled that the US Services sector keeps outgrowing the manufacturing ones and fuelled the Composite PMI figure to the highest levels in a year. That said, the US S&P Global Manufacturing PMI eased to 48.5 from 50.2 versus 50.0 market forecasts whereas Sevices PMI rose to 55.1 compared to 52.6 expected and 53.6. With this, the Composite PMI marked 54.5 figures versus the analysts’ expectations of 50.0 and 53.4.

Additionally fueling the hawkish Fed concerns are the latest comments from Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin and San Francisco President Mary C Daly who backed the calls for higher Fed rates while citing the inflation woes, which in turn propelled the betts on the Fed rate increase in June. The same pushes back the Fed rate cut and allows the US Dollar to remain firmer despite a retreat in the US Treasury bond yields.

Moving on, the Reserve Bank of New Zealand’s (RBNZ) Monetary Policy Meeting and risk catalysts can entertain the NZD/USD pair during the early part of the day. Following that, the latest Federal Open Market Committee (FOMC) Meeting Minutes will be crucial to watch. That said, the RBNZ is expected to announce 0.25% rate hike but the future guidance for the rates will be the key to watch.

Ahead of the RBNZ, Analysts at the ANZ said, “We expect a 25bp hike but wouldn’t at all be surprised to see 50bp. But what we think matters most given the focus on carry is where the OCR peaks in the RBNZ’s projections. Anything with a 6-handle is likely to be NZD-supportive, global issues notwithstanding.”

Technical analysis

A fortnight-old symmetrical triangle restricts immediate moves of the NZD/USD between 0.6225 and 0.6270 as RSI, as well as the MACD, teases bears.

- After achieving a weekly high of 150.05, EUR/JPY retreats to 149.24 amid souring sentiment.

- The failure to surpass the 150.00 threshold and harmful Eurozone data create downward pressure.

- Market players eye crucial cues from upcoming ECB speakers and Japanese inflation figures.

Following Tuesday’s session, EUR/JPY floats at around 149.24, which witnessed the EUR/JPY pair hitting a new weekly high of 150.05, before the cross tumbled as sentiment deteriorated, finishing Tuesday’s session with losses of 0.40%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart suggests the pair remains neutral but slightly downward biased, as it remains below the year-to-date (YTD) high of 151.61. in the last three trading days, the EUR/JPY failed to conquer the 150.00 figure, and bad Eurozone (EU) economic data on Tuesday exposed the pair to selling pressure. That would likely keep the EUR/JPY trapped within the 149.00-150.00 area unless fundamental catalysts like European Central Bank (ECB) speakers or Japanese inflation figures give some cues about the EUR/JPY’s trend direction.

On the upside, the EUR/JPY first resistance is 150.00. A breach of it, and the cross could rally toward 151.00, ahead of the YTD high of 151.61. Conversely, the EUR/JPY first support is 149.00. A successful move below this resistance will pave the way for a pullback toward the 20-day Exponential Moving Average (EMA) at 148.42 before dipping toward the 148.00 figure. The next stop would be the 59-day EMA at 146.85.

The Relative Strength Index (RSI) indicator is stills in bullish territory but turned flat, suggesting that buyers are taking a respite, while the 3-day Rate of Change (RoC) shifts neutral.

EUR/JPY Price Action – Daily chart

- GBP/USD is displaying a sideways auction as the focus has shifted to UK Inflation.

- BoE Bailey reiterated that they must use the tool of interest rate rises carefully.

- GBP/USD is auctioning in a Falling Wedge pattern in which each pullback is considered as a selling opportunity.

The GBP/USD pair is displaying a back-and-forth action around 1.2420 in the early Tokyo session. Earlier, the Cable showed significant recovery after defending the downside near 1.2380. A power-pack action is anticipated from the Pound Sterling ahead of the United Kingdom’s Consumer Price Index (CPI) data (April).

Headline inflation is seen softening sharply to 8.2% from the former release of 10.1%. The core CPI is expected to remain steady at 6.2%. On Tuesday, Bank of England (BoE) Governor Andrew Bailey said "I think we are nearer to the peak than we were” and reiterated that they must use the tool of interest rate rises carefully.

The US Dollar Index (DXY) is looking to surpass the crucial resistance of 103.62 amid US debt-ceiling issues. International Monetary Fund (IMF) Managing Director Kristalina Georgieva cited on Tuesday that "A lack of solution would have a detrimental impact on the US and world economy,” "Hopefully we won't have to wait to the 11th hour for a solution on the US debt-ceiling."

GBP/USD is auctioning in a Falling Wedge chart pattern on a two-hour scale in which each pullback is considered a selling opportunity by the market participants. Also, the chances of a bullish reversal remain higher. The 50-period Exponential Moving Average (EMA) at 1.2440 is acting as a barrier for the Pound Sterling bulls.

Meanwhile, a 40.00-60.00 range oscillation by the Relative Strength Index (RSI) (14) will get a decisive move after the release of the UK Inflation.

Should the asset decline below May 19 low at 1.2390, US Dollar bulls will get strengthened further and will drag the Cable toward April 10 low at 1.2344 followed by April 03 low at 1.2275.

On the flip side, a recovery move above May 09 high at 1.2640 will drive the major toward the round-level resistance at 1.2700 and 26 April 2022 high at 1.2772.

GBP/USD two-hour chart

- AUD/USD holds lower grounds at weekly bottom after posting the biggest daily loss in a week.

- Risk appetite weakens after chatters that US Treasury requested agencies to delay payment while policymakers appear less optimistic of late.

- Fed Minutes, US default talks will be the key catalysts to watch for clear directions.

AUD/USD remains pressured around 0.6600 as market sentiment worsens on early Wednesday in Asia, amid fears of the US default, as well as hawkish Federal Reserve (Fed) concerns ahead of the Fed Minutes. Also challenging the Aussie pair is the mixed prints of Aussie data versus comparatively stronger US PMIs. However, hopes that the US policymakers will be able to avoid US default seem to put a floor under the Aussie pair prices.

Recently, US House Speaker Kevin McCarthy crossed wires, via Reuters, while suggesting no deal on the debt ceiling extension today but before June 01. Previously, Washington rolled out news stating the US Treasury has asked multiple agencies if they can delay the payment demands.

Elsewhere, the preliminary figures of the May monthly PMIs suggest that the US Services sector keeps outgrowing the manufacturing ones and fuelled the Composite PMI figure to the highest levels in a year. On the contrary, the Aussie activity numbers for the said month were less impressive. The same joins the latest divergence in the market’s bets on the Federal Reserve (Fed) versus the Reserve Bank of Australia (RBA) to exert downside pressure on the AUD/USD prices.

Apart from the US default fears and Fed concerns, the US-China tussles are also luring the Aussie pair bears, due to the Australia-China ties. Recently, Russia flaunts its ties with Beijing and that strengthens the global dislike for the dragon nation. Additionally, the US-China trade tussle continues, becoming an additional reason supporting the risk-off mood.

Amid these plays, Wall Street closed in the red and helped the US Dollar despite downbeat yields.

Moving on, there are no major data/events from Australia but the Reserve Bank of New Zealand’s (RBNZ) Monetary Policy Meeting and risk catalysts can entertain the risk-barometer pair during the early part of the day. Following that, the latest Federal Open Market Committee (FOMC) Meeting Minutes will be crucial to watch.

Technical analysis

A daily closing below one-month-old previous support, now resistance around 0.6625, directs AUD/USD towards the yearly low of around 0.6575.

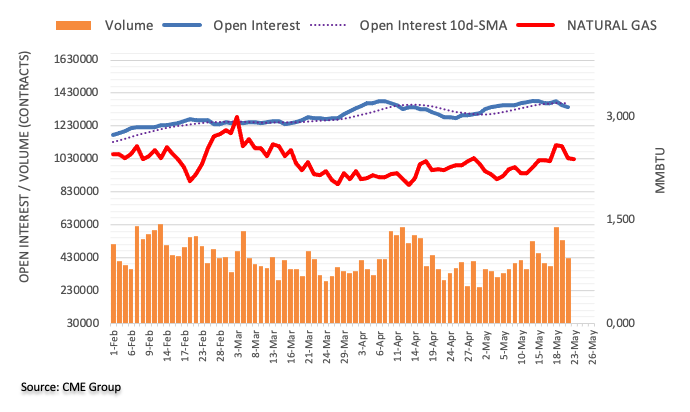

- Gold price has shifted comfortably above $1,970.00 ahead of FOMC minutes.

- The release of May’s FOMC minutes will provide a detailed explanation behind 25 bps interest rate hike by the Fed.

- Mixed preliminary S&P PMI data (May) weighed on US Treasury yields.

Gold price (XAU/USD) has shifted its auction comfortably above the crucial resistance of $1,970.00 in the Asian session. The precious metal is expected to extend its rally further ahead of the release of the Federal Open Market Committee (FOMC) minutes for May’s monetary policy meeting on Wednesday.

S&P500 futures witnessed a steep fall on Tuesday, dragged by a sell-off in technology stocks. The market mood remained negative as the United States economy is getting closer to a situation of default as the Federal government will be out of funds by June 01. An absence of positive development in raising the US debt-ceiling is terrifying investors as a default by the US economy could result in chaos in global financial markets and a spike in interest rates.

The US Dollar Index (DXY) is showing signs of volatility contraction after gaining to near the previous week’s high above 103.60. Going forward, the release of May’s FOMC minutes will provide a detailed explanation behind the 25 basis points (bps) interest rate hike by the Federal Reserve (Fed). Also, it will provide cues about upcoming policy action.

Meanwhile, the release of the mixed preliminary S&P PMI data (May) weighed on US Treasury yields. The Yields offered on 10-year US government bonds dropped below 3.70%.

Gold technical analysis

Gold price has shown a stellar recovery after a Double Bottom formation plotted from May 18 low at $1,952.01, which indicates a bullish reversal. Gold bulls will get further strength after breaking above the immediate resistance placed from March 19 high at $1,984.25. The downward-sloping trendline market from all-time highs at $2,079.76 will act as a major barrier for the Gold price.

The yellow metal has climbed above the 20-period Exponential Moving Average (EMA) at $1,970.00, which indicates that the short-term trend has turned positive.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00, which signals that the downside momentum has faded.

Gold hourly chart

- GBP/JPY is trading almost flat near the 172.00 mark as market sentiment dips due to a lack of agreement between the White House and the US Congress.

- GBP/JPY maintains an upward bias despite the stall in its rally towards the falling-wedge measured objective of 174.30.

- Clearing the 173.00 area could pave the way toward the 174.00 figure.

- Negative divergence between GBP/JPY price action and the RSI signals a pullback.

GBP/JPY retraces from around the 172.60 area and hovers nearby the 172.00 figure as market sentiment deteriorates. Failure to reach an agreement between the White House (WH) and the US Congress dampened investors’ mood as the June 1 deadline approached. As the Asian session begins, the GBP/JPY is trading at 172.01, almost flat.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY is still upward biased, but since the break of a falling wedge, the pair’s rally towards the measured objective at 174.30 stalled. In three consecutive sessions, the GBP/JPY failed to reach the 173.00 area, which, once cleared, could pave the way towards the 174.00 figure, ahead of getting the measured objective of the falling wedge.

Nevertheless, as the GBP/JPY price action achieved successive higher highs, the Relative Strength Index (RSI) indicator prints lower peaks. That means a negative divergence between price action and the RSI could open the door for a pullback.

Hence, the GBP/JPY first support is the 172.00 mark. A break below and the GBP/JPY will get to the 20-day Exponential Moving Average (EMA) at 170.20, with the 170.00 figure up for grabs.

GBP/JPY Price Action – Daily chart

- NZD/USD bears are testing key support.

- RBNZ is the focus with rate rises on the way.

NZD/USD is trading around 0.6240 in a phase of consolidation but under pressure. Global equities slid on Tuesday as talks over the US debt ceiling continued without resolution. We also have yields on one-month US Treasury bills running into a record high. Rising yields and a stronger US Dollar pressured the high beta NZD.

´´The Kiwi is lower this morning, having followed equities down overnight, with newswires attributing the equity rout to a lack of progress on the US debt ceiling and the US Treasury asking agencies if they have capacity to delay payments (demonstrating how down to the wire it is),´´ analysts at ANZ Bank explained.

´´The US does benefit from safe-haven buying in such instances, and that makes sense, recalling that other than the NZD, no other currency has a higher cash rate. So, expect volatility as this issue percolates, the analysts added.

RBNZ in focus

´´Today is of course all about the RBNZ. We expect a 25bp hike but wouldn’t at all be surprised to see 50bp. But what we think matters most given the focus on carry is where the OCR peaks in the RBNZ’s projections. Anything with a 6-handle is likely to be NZD-supportive, global issues notwithstanding,´´ the analysts explained.

The key event during the Asian session will be the Reserve Bank of New Zealand meeting. Additionally, retail sales data is due in New Zealand. Later in Europe, focus will shift to UK inflation data. During the American session, the Federal Reserve will release the FOMC minutes.

Here is what you need to know on Wednesday, May 24:

The US Dollar strengthened on Tuesday amid risk aversion, while both the Nasdaq and the S&P 500 experienced declines of over 1%. Although US yields dropped, the US Dollar Index (DXY) rose, reaching two-month highs before retracing to 103.50.

The debt-ceiling drama remains unresolved as negotiations continued on Tuesday following a "positive" meeting between President Biden and House Speaker McCarthy. In terms of economic data, the US S&P Global PMI showed mixed results, while New Home Sales exceeded expectations. On Wednesday, the Federal Reserve (Fed) will release the minutes of its latest meeting.

EUR/USD weakened and fell toward weekly lows, nearing 1.0750. The Euro underperformed following data indicating a further contraction in the Eurozone manufacturing sector in May. On Wednesday, the German IFO Survey will be released.

GBP/USD dropped on Tuesday but closed far from the lows. The pair bottomed at 1.2367, the lowest level in a month and then rebounded back above 1.2400. EUR/GBP fell to test April lows under 0.8680. On Wednesday, the UK will report April inflation.

USD/JPY hit fresh six-month highs near 139.00. It is currently hovering around 138.50/60 as the Japanese yen stabilizes amid a decline in Treasury yields.

AUD/USD posted its lowest daily close since late April, although it managed to hold above the key level of 0.6600. The deterioration in market sentiment weighed on the Australian dollar, which failed to capitalize on a rebound in commodity prices.

NZD/USD suffered its worst day in a week, falling from 0.6300 to 0.6240. The Reserve Bank of New Zealand (RBNZ) will announce its decision on Wednesday. Also, Retail Sales data is due.

Analysts at TD Securities wrote:

We expect the Bank to deliver a 50bps hike this week and lift our estimate of RBNZ terminal from 5.50% to 6%. Upside to inflation from budget stimulus and higher net migration raise the risk that inflation does not return to within the 1-3% band by the end of next year as the RBNZ assumed in its Feb MPS. Elevated twin deficits (significant forecast deterioration in budget deficits implied in last week's Budget and the record current account deficit) also warrant more aggressive RBNZ action.

The USD/CAD pair finished the session flat around 1.3500 after failing to hold on to earlier gains. The pair surged to a one-week high of 1.3546, but later pulled back as the Canadian dollar outperformed, boosted by rising crude oil prices and higher-than-expected wholesale inflation data from Canada.

Gold finished modestly higher, trading above the $1,970 level after a $20 rally during the American session. Silver, on the other hand, dropped again but finished far from its daily low, hovering around $23.40.

RBNZ Interest Rate Decision Preview: Kiwi set to fly on a hawkish rate hike

Like this article? Help us with some feedback by answering this survey:

- EUR/USD bears eye a run towards 1.0750.

- Bulls need to get over the trendline resistances.

EUR/USD eyes a 50% mean reversion and resistance near 1.0790. However, the bears are in the market and the bias remains to the downside while on the front side of the bearish trendlines. A move to test the depths of the 1.07s as illustrated above could be on the cards.

EUR/USD technical analysis

EUR/USD bears are in the market with the price on the front side of the trendline resistances. The bears are targeting the potential supporting areas as marked up on the chart above.

EUR/USD H4 charts

Zooming down to the 4-hour charts, the bulls are engaged at support. A bullish scenario would see the price break resistances and move in on 1.0850 and 1.0900.

A 50% mean reversion aligns with the trendline resistance near 1.0790. If bears commit, then we could see a move to test the depths of the 1.07s as illustrated above.

- The USD/ZAR is correcting lower after hitting record highs last week.

- The US Dollar rises on Tuesday across the board amid risk aversion, limiting the downside in the pair.

- Key events ahead: South African inflation, FOMC minutes and SARB interest rate decision.

Despite a prevailing negative market outlook and a stronger US Dollar, the South African Rand (ZAR) has exhibited resilience by maintaining its position, supported by expectations of interest rate hikes by the South African Central Bank. The USD/ZAR pair declined to 19.16, reaching its lowest level since the previous Wednesday, before bouncing back to 19.20.

US economic data showed mixed results

The US S&P Global/CIPS Manufacturing Purchasing Managers' Index (PMI) unexpectedly contracted in May, dropping to 48.5, while market expectations were for a reading of 50. Conversely, the Services index surpassed predictions, rising to 55.1 compared to the anticipated 52.6.

The S&P 500 index (SPX) and the Nasdaq Composite both closed with declines of over 1%. The risk aversion sentiment bolstered the US Dollar, leading to a 0.30% climb in the DXY as it tested weekly highs.

South Africa: inflation data and SARB

On Wednesday, inflation data will be released in South Africa. Market consensus is for a modest slide in the annual inflation rate from 7.1% to 7.0% and the Core Consumer Price Index to rise from 5.2% to 5.3%.

The South African Reserve Bank (SARB) will announce its monetary policy decision on Thursday. There is an expectation of a 25 basis points rate hike, raising the interest rate from 7.75% to 8.00%. However, there are also risks of a larger rate increase, which has supported the Rand.

USD/ZAR outlook

After surging to 19.51 on Friday, the USD/ZAR started to correct lower. The correction found support above 19.15. On the 4-hour chart, the pair remains below a bearish 20-period Simple Moving Average, currently at 19.30. If it rises above this level, it could potentially test 19.50 again.

On the flip side, below Tuesday's low at 19.15, the next support level is seen at 19.10, followed by 18.99 (May 15, 16 low).

Technical levels

- USD/CHF pair surges past the 0.9000 figure, aiming for a 50-day EMA test at 0.9025 after printing a bullish hammer on the daily chart, turning bias to neutral upwards.

- USD/CHF rally could challenge the 100-day EMA at 0.9137 if the 50-day EMA is breached, setting sights on the April 3 daily high of 0.9196.

- Despite a neutral 3-day RoC, RSI indicates a bullish turn, suggesting USD/CHF bulls are gathering momentum.

USD/CHF climbs above the 0.9000 figure, eyeing a 50-day Exponential Moving Average (EMA) test at 0.9025 after printing a bullish hammer in the daily chart. The USD/CHF is trading at 0.9015, after hitting a daily low of 0.8975, trades above its opening price by 0.42%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF pair is neutral to downward biased unless it claims the 50-day EMA at 0.9025, which would turn the bias to neutral upwards. It should be said the USD/CHF printed a new daily high, above the May 2 high of 0.8995, opening the door for further upside. If USD/CHF cracks the 50-day EMA, the pair will test last week's high of 0.9063 before rallying toward the 0.9100 mark. That would further cement a bullish bias, with the USD/CHF about to challenge the 100-day EMA at 0.9137, on its way to the April 3 daily high of 0.9196.

Notably, the Relative Strength Index (RSI) indicator turned bullish and just bounced off the 50-midline, a sign of USD/CHF bulls gathering momentum; while the 3-day Rate of Change (RoC) remains neutrally biased.

Therefore, the USD/CHF trend would likely continue upward. On the downside, the USD/CHF's first support would be the 0.9000 figure, which, once cleared, the pair would dip to the 20-day EMA At 0.8968.

USD/CHF Price Action – Daily chart

- USD/CAD bulls are giving way to the bears.

- USD/CAD bears are breaking the trendline support.

USD/CAD has ranged between a low of 1.3484 and a high of 1.3548 on the day. The bears are in the market and attempting to break down the bullish trend that has been building since the start of May. The following illustrates two scenarios, bullish and bearish, on the hourly chart.

USD/CAD H1 charts

The bullish scenario above sees the price testing counter-trendline resistance and the M-formation´s neckline. If the bears engage fully, then we could see the makings of a downside continuation into the 1.3470s.

A bullish scenario would see a break of the resistance and move into the shorts from the peak formation, moving back onto the front side of the bullish trendline.

- USD/MXN reaches a three-week high amid actions by the Mexican Government, stirring uncertainty in the business community and resulting in outflows from the Mexican Peso.

- Despite positive talks between President Biden and House Speaker McCarthy, US debt-ceiling agreement remains elusive, casting a shadow over US economic data and causing a downturn in US equities.

- Mexico’s recent nationalization actions generated concerns among the business community and negatively impacted USD/MXN recovery.

USD/MXN reached a new three-week high at the brisk of the psychological 18.0000 barrier, at around 17.9976, sponsored by several factors. Firstly, the discussion of the US debt ceiling keeps investors on their toes, spurring a flight to a safe haven. Also, uncertainty in the business community in Mexico, as the Government commenced to seize private lands and railroads, triggered outflows from the emerging market currency. At the time of writing, the USD/MXN is trading at 17.9489, up 0.34%.

Flight to safety bolstered the USD/MXN, as US bond yield rise, Mexico’s Government actions stirred uncertainty amongst the national and international business community

US equities continued to trend downward as the US debt-ceiling discussions have overshadowed US economic data. The prevailing concern over raising the national debt ceiling has cast a long shadow over other discussions, despite positive assertions by US President Joe Biden and House Speaker Kevin McCarthy that their Monday talks were fruitful. However, the path to a definitive agreement still seems winding and far off.

Reflections of the uncertain political environment in the US are underpinning the US Dollar (USD) as yields on US Treasury bonds continue to climb, with the 10-year bond yield hitting 3.726%. This creates an adverse environment for the recovery of USD/MXN, which remains under pressure amidst domestic issues in Mexico.

Over the weekend, news headlines said that the Mexican Government headed by President Andres Manuel Lopez Obrador, known as AMLO, “nationalized” a section of track in the state of Veracruz, operated by Grupo Mexico, a private company. That weighed on the company’s stock, as its main shareholder German Larrea, one of the bidders for Citigroup’s retail branch in Mexico, said that he would withdraw from the bid, saying that “I’m not going to pay 7,000 million dollars for something they can take away from me tomorrow,” according to a Tweet from Dario Celis, a Mexican reporter from El Financiero.

In the meantime, on Monday, AMLO expropriated privately-owned land in the state of Mexico to build a commuter train three days after the seizure of a part of a rail line owned by German Larrea’s Grupo Mexico. AMLO’s recent decisions are generating worries amongst the business community in Mexico, as AMLO is contradicting campaign promises that he would not expropriate private property.

Given the backdrop, the USD/MXN had weakened more than 3% since last Tuesday, when the pair printed a new multi-year low of 17.4038. The USD/MXN, on its rally, reclaimed the 20-day EMA at 17.8007 and is closing to challenge the 18.0000 psychological figure.

Turning to the data front in the United States, final readings for S&P Global PMIs for May are of particular interest. A surprising dip in the Manufacturing Index to 48.5, contrary to estimates and the previous reading of over 50, is offset by a rise in the Services Index to 55.1. The Composite Index landed at 54.5, and the surge in services slowed its advance.

US New Home Sales have soared to a level unseen in 13 months. With a 4.1% rise or 683K units in April, it marked the most substantial figure since March of the previous year, as the US Commerce Department reported.

Aside from this, USD/MXN traders will remain focused on upcoming events, like the Mid-month inflation report from Mexico, with core CPI estimated to ease from 7.75% YoY May 2022 to 7.49%, as projected by analysts. Regarding the US, the minutes of the May meeting of the Federal Reserve (Fed) will be revealed.

USD/MXN Price Analysis: Technical outlook

USD/MXN has shifted neutrally biased, as the Mexican Peso (MXN) has weakened for six days in a row. Upside risks lie at the 50-day EMA at 18.0167, a tick above the psychological 18.0000 figure; once cleared, that would open the way for further gains. The USD/MXN first resistance level would be the April 27 high at 18.1968, followed by the confluence of April 5 and the 100-day EMA at around the 18.3604-18.4010 area. Conversely, if USD/MXN drops below 17.7994, where the 20-day EMA lies, a re-test of the YTD low of 17.4038 is on the cards.

- USD/JPY is in the hands of the bears that eye a break of trendline support.

- Below trendline support, the 138.20s and then the 137.70s will be exposed.

USD/JPY touched a six-month high of 139 in the Asian session on Tuesday whereby talks over a debt-ceiling deal in the US risk running into a brick wall while investors get set for key economic events this week. At the time of writing, USD/JPY is flat at 0% with the price traveling between 138.23 and a high of 138.91.

Global equities slid on Tuesday as talks over the US debt ceiling continued without resolution. We also have yields on one-month US Treasury bills running into a record high. Rising yields and a stronger US Dollar pressured the Yen that has been pressured by the Bank of Japan's ongoing reluctance to tighten monetary policy further.

Meanwhile, President Joe Biden and House Speaker Kevin McCarthy could not reach an agreement on Monday over the debt ceiling with just 10 days before a possible default. President Biden prefers a clean raise of the debt limit, one without cuts. Republicans want to cut spending now.

On the preferred approach to raising the debt ceiling, three-quarters of Democrats want the limit raised first without cuts. On the other hand, two-thirds of Republicans said they want cuts tied to it. Independents were split, but a slight plurality – 48% to 45% – said they want to see cuts. Nevertheless, both sides stressed the need to avoid default with a bipartisan deal and said they would continue to talk.

As for the Federal Reserve, on Wednesday, the Federal Reserve Open Market Committee will publish its minutes from the central bankers’ meeting three weeks ago. The market will expect that the Fed has dropped hints over the timeline of rate increases.

Just this week, Minneapolis Federal Reserve President Neel Kashkari said on Monday that it was a "close call" as to whether he would vote to hike again or pause at next month's meeting, and St. Louis Fed President James Bullard said another 50 basis points of hikes might be required. Consequently, there are fewer expectations for US rate cuts from July towards November or December, sending ten-year and two-year US yields to highs not seen since March and weighing on the Yen. Besides the minutes, the Fed’s preferred inflation measure, personal-consumption expenditure index (PCE) will also be released on Friday where markets are expècting a 4.6% year-over-year increase, while the Fed is looking to bring that figure below its target of 2%.

USDJPY H1 chart

USD/JPY is testing the trendline support that guards the 138.20s and then the 137.70s.

- GBP/USD fell further due to uncertainty surrounding US debt-ceiling negotiations and mixed US economic data, with investors flocking to the perceived safety of the US Dollar.

- Despite discussions between President Biden and House Speaker McCarthy, US debt-ceiling deadlock persists; Treasury Secretary Yellen warns of cash crunch by June 1.

- Final readings of the S&P Global PMIs for May reveal contrasting trends; New Home Sales record a 13-month high despite a gloomy sentiment on Wall Street.

GBP/USD drops extending its losses past the 20-day Exponential Moving Average (EMA), as a risk-off impulse triggered a flight to safety, favoring the US Dollar (USD) to the detriment of the Pound Sterling (GBP). Uncertainty about the debt-ceiling negotiations in the United States (US), and mixed US economic data bolstered the US Dollar. The GBP/USD is trading at 1.2414, below its opening price by almost 0.20%.

GBP/USD dips below 20-day EMA amid US debt-ceiling disarray, mixed data, and risk-off impulse

The prevailing mood on Wall Street is decidedly gloomy as stocks tread downward. Ongoing debates concerning the increase of the US debt ceiling are eclipsing the latest economic figures from the United States. Even though President Joe Biden and House Speaker Kevin McCarthy declared their Monday discussions productive, they are yet to resolve. Meanwhile, Treasury Secretary Janet Yellen emphasizes the imminent cash crunch in the US, anticipated by June 1.

Amid these circumstances, yields on US Treasury bonds have seen an uptick. The yield on the 10-year bond has risen to 3.726%, bolstering the greenback. The US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, advances 0.33%, up at 103.564.

On the data front, the final readings of the S&P Global PMIs for May were revealed. The Manufacturing Index took a steep fall, hitting 48.5, disappointing forecasts, and falling short of the previous reading above 50. In contrast, the Services Index climbed to 55.1. Consequently, the Composite Index settled at 54.5, pulled up by the buoyant services sector.

New Home Sales have soared to their highest level in 13 months, having grown by 4.1% or 683K units in April. According to the US Commerce Department, this is the most significant increase recorded since March 2022. Given these indications of a revival in the US housing market, Federal Reserve (Fed) officials’ divergent views on adjusting or maintaining rates at the forthcoming June meeting will be interesting.

Recently, there has been a steep drop in the Richmond Fed’s Manufacturing and Services Index readings. Manufacturing is currently at -15, lower than the predicted -8, whereas Services have shown some improvement, increasing to -10 from April’s -29.

Across the pond, the United Kingdom (UK) calendar featured the S&P Global PMIs for May, which showed that business activity came beneath expectations, weighing on the GBP/USD, sending the Sterling towards a new one-month low of 1.2373. That happened despite the International Monetary Fund (IMF) improving the economic outlook of the UK, saying that it no longer expects a recession in the country.

Bank of England (BoE) policymakers led by Governor Andrew Baily appeared before the parliament. Bailey said that “I can’t tell you whether we’re near to the peak, I can’t tell you whether we are at the peak. I think we are nearer to the peak than we were,” as GBP/USD traders brace for Wednesday’s release of the UK’s Consumer Price Index (CPI).

GBP/USD Price Analysis: Technical outlook

After dropping to a fresh one-month low of 1.2373, Cable has recovered some ground above the 1.2400 figure, claiming on its way north of the 50-day Exponential Moving Average (EMA) at 1.2408. Nevertheless, the GBP/USD failed to rally toward the 20-day EMA at 1.2478, exposing the pair to sellers. The Relative Strength Index (RSI) indicator shifted bearish, suggesting that further downward action is expected. A breach below the 50-day EMA will pave the way to 1.2400. Once broken, the GBP/USD can fall toward the 1.2300 figure before testing the 100-day EMA At 1.2291. Conversely, if GBP/USD rallies past the 20-day EMA, it could challenge the 1.2500 figure.

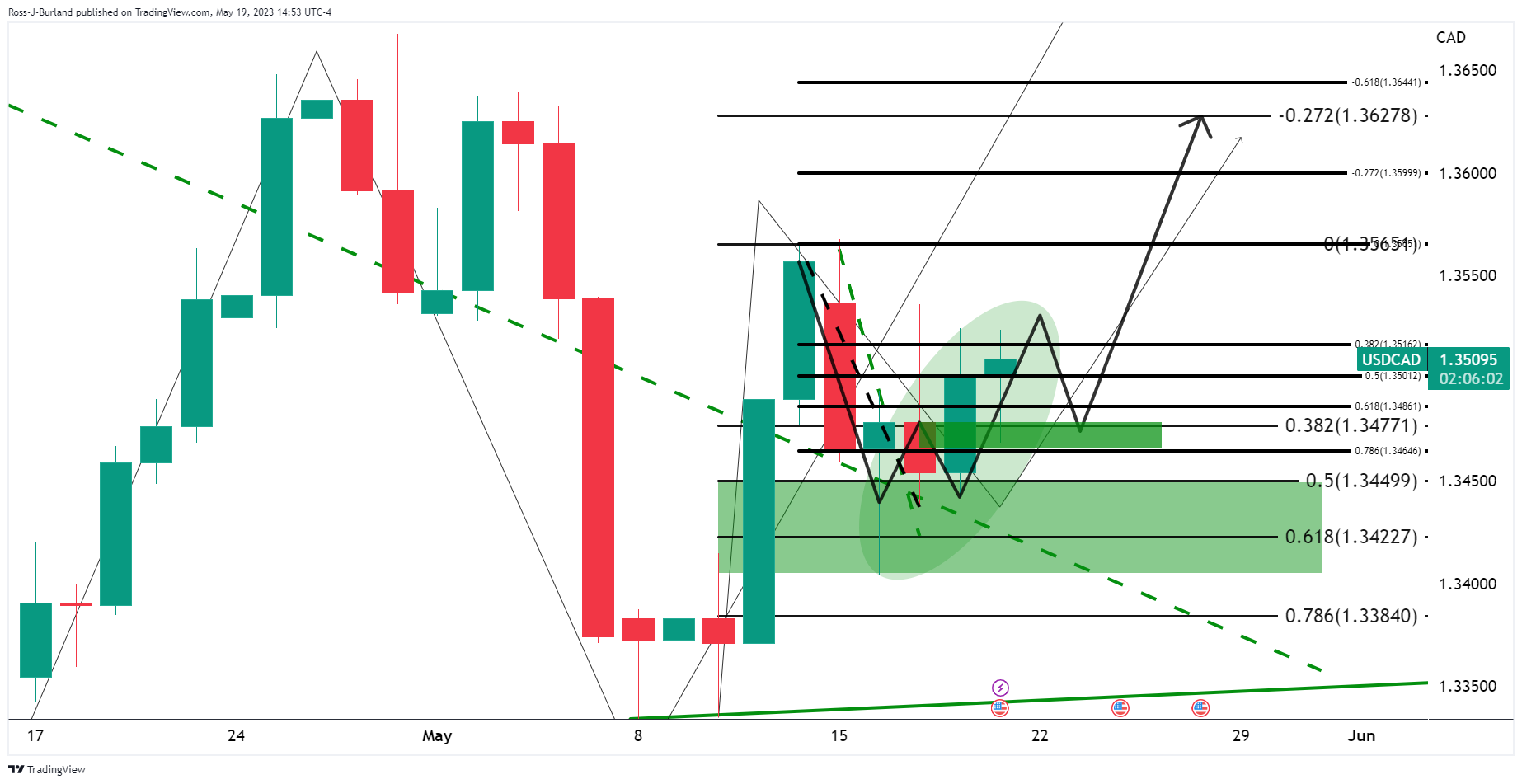

- Gold price dips slightly as uncertainty around US debt-ceiling discussions causes US Treasury bond yields to rise, negatively impacting XAU/USD’s recovery.

- Despite productive talks between President Biden and House Speaker Kevin McCarthy, an agreement on raising the debt ceiling is yet to be reached.

- US is set to run out of cash by June 1, according to Treasury Secretary Yellen.

Gold price is trimming some of its earlier losses, though stills trading negative in the day, down 0.06%, as US Treasury bond yields rise due to uncertainty around US debt-ceiling discussions. Hence, US Treasury bond yields rise, underpinning the US Dollar (USD), a headwind for XAU/USD’s prices. At the time of writing, the XAU/USD is trading at $1968.28, below its opening price.

US Treasury bond yields rise amid tense debt-ceiling discussions, dampening XAU/USD’s recovery

Wall Street portrays a sour sentiment, with equities trading lower. The economic data revealed in the United States (US) is overshadowed by discussions about raising the debt ceiling in the US. Although US President Joe Biden and US House Speaker Kevin McCarthy called Monday’s talks productive, an agreement remains far from being done. In the meantime, US Treasury Secretary Janet Yellen continued to pressure that the US will run out of cash by June 1.

Given the backdrop, US Treasury bond yields extended its gains, with the 10-year bond yielding 3.726%, a headwind for XAU/USD’s recovery. Therefore, US real yields, calculated using the nominal yield minus inflation expectations, taken from Treasury Inflation-Protected Securities (TIPS), sit at 1.49%, about to cross above 1.50%.

Data-wise, the US economic agenda features S&P Global PMIs for May on their final readings. The Manufacturing Index plunged to 48.5 below estimates and the prior reading above 50, while the Services Index rose to 55.1. The Composite Index stood at 54.5, dragged by the rise in services.

US New Home Sales rose to a 13-month high, expanded by 4.1% or 683K units in April, the highest figure reported since March 2022, according to the US Commerce Department. Given that housing data from the United States showed signs of a recovery, it should be interesting to hear from US Federal Reserve (Fed) officials, who remain split between skipping or lifting rates at the upcoming June meeting.

Recently, Richmond’s Fed Index for Manufacturing and Services readings dropped sharply, with manufacturing at -15 vs. -8 expected. Services improved to -10 from -29 in April.

Upcoming events

The US Federal Reserve Open Market Committee (FOMC) May minutes on Wednesday, followed by Initial Jobless Claims, Gross Domestic Product (GDP) on Thursday, and inflation and consumer sentiment on Friday.

XAU/USD Price Analysis: Technical outlook

From a daily chart perspective, the XAU/USD is still neutral to upward biased. The yellow metal dip below the 50-day Exponential Moving Average (EMA) at $1976.52, opening the door to register a weekly low of $S1954.37 before finding bids that lifted Gold toward the current spot price. Nevertheless, the Relative Strength Index (RSI) indicator is still in bearish territory, suggesting that sellers remain in charge, so the jump in XAU/USD price, could pave the way for better entry prices. The first support would be the weekly low of $1954.37 before testing $1950, ahead of reaching the 100-day EMA of 1932.97. Conversely, reclaiming the 50-day EMA will expose the 20-day EMA At $1993.31 before reaching $2000.

Gold price slumped significantly last week. However, the growing risk of a US default is set to underpin the yellow metal, economists at Commerzbank report.

Both the Fed and the SNB would have considerable scope to lower interest rates in the event of a crisis

“Gold price is likely to profit more than any other investments if the US defaults. After all, one reason why Gold is suitable as a safe haven is the fact that it does not yield any interest itself and thus suffers no disadvantage in an environment in which monetary policy will in all likelihood be loosened and yields will fall accordingly. This gives Gold an advantage over other conventional safe havens such as the US Dollar, the Swiss Franc and the Japanese Yen – especially just now.”

“Both the Fed and the Swiss National Bank, following their recent rate hikes, would have considerable scope to lower interest rates in the event of a crisis – such as that which a US default could trigger.”

“The Bank of Japan, which was one of the few central banks to tighten its monetary policy hardly at all in response to the significantly increased inflation and is therefore still pursuing an ultra-expansionary monetary policy, is not very likely to loosen its monetary policy any further, however, it cannot be ruled out entirely either, which tends to put the Yen too at a disadvantage as compared to Gold, albeit to a lesser extent than the Dollar and the Franc.”

“I need you all to hang with me on the debt limit, we are nowhere near a deal yet,” US House Speaker Kevin McCarthy told House Republicans during a closed GOP meeting on Tuesday, Punchbowl News reporter Jake Sherman tweeted out.

On a similar note, Republican debt ceiling negotiator Garret Graves reportedly said that things were not going well over debt-ceiling talks.

Market reaction

Markets remain cautious following these headlines. As of writing, the S&P 500 Index was down 0.35% on a daily basis.

- New Home Sales in the US continued to rise in April.

- US Dollar Index stays in positive territory above 103.00.

Sales of new single‐family houses rose 4.1% in April to a seasonally adjusted annual rate of 683,000, the data published jointly by the US Census Bureau and the Department of Housing and Urban Development showed on Tuesday.

This reading followed the 4% growth (revised from +9.6%) recorded in March and came in slightly better than the market expectation for an increase of 3.3%.

Market reaction

The US Dollar Index showed no reaction to this report and was last seen rising 0.2% on the day at 103.43.

Expectations of global economic stagnation could boost the US Dollar, according to economists at Crédit Agricole.

US debt-ceiling resolution could result in the USD rising further

“Global economic stagnation, even a potential recession, might be the dominant narrative for the rest of 2023 given recent disappointing economic data and the uncertain US economic outlook due to monetary and credit tightening, as well as debt ceiling fears. This backdrop, coupled with a sluggish recovery in China, and cyclical headwinds keeping commodity prices in check, has led many FX clients to prepare for stagnation or a downturn. Historically, such periods often lead to underperformance in pro-cyclical currencies (like those of commodity and manufacturing exporters) and better performance of safe-haven currencies like the USD.”

“The USD has already seen gains due to increasing hopes that a debt ceiling crisis will be averted ahead of the 1st June soft X-date. A resolution could result in the USD rising further, especially against G10 smaller currencies, in line with past debt ceiling episodes. This could occur due to a potential ramp-up in US Treasury issuance and the paring back of Fed rate cut expectations in the rates markets, boosting the rate appeal of the USD.”

Economists at Rabobank discuss AUD/NZD outlook ahead of the Reserve Bank of New Zealand (RBNZ) meeting.

AUD/NZD to turn higher over the medium-term

“Hawkish commentary from the RBNZ this week could encourage a move in the AUD/NZD pair towards the 1.05 area near-term. That said, we favour Australia’s fundamentals over those of New Zealand and expect AUD/NZD to turn higher over the medium-term.”

“We maintain our 12-month forecast of AUD/NZD 1.13.”

See – Reserve Bank of New Zealand: Banks Preview, more surprises in store?

UK inflation will be in focus this week and MUFG Bank’s GBP bias has turned more neutral too given scope for lower inflation than the BoE expects.

UK inflation should now start offering BoE scope for pause

“The OIS market indicates two 25 bps hikes remain nearly fully priced. Our view is for only one further hike suggesting scope for yields to adjust lower.”

“We have held a bullish GBP bias since the start of the year but with inflation potentially now about to start undershooting BoE forecasts, our bias is now turning more neutral. The BoE may turn to faster balance sheet shrinkage as an offset as they move to a pause on lifting rates.”

“GBP direction will continue to be dictated by policy divergence expectations and that could see GBP/USD underperforming further over the short-term.”

- USD/JPY remains confined in a range just below a fresh YTD peak touched this Tuesday.

- The fundamental/technical backdrop favours bulls and supports prospects for further gains.

- Any meaningful slide is likely to get bought into and remain limited near the 200-day SMA.

The USD/JPY pair consolidates its recent strong gains to the 139.00 neighbourhood, or a fresh YTD peak touched this Tuesday and seesaws between tepid gains/minor losses through the early North American session. The pair is currently placed just below mid-138.00s, down less than 0.15% for the day, though any meaningful retracement slide still seems elusive.

A combination of supporting factors pushes the US Dollar (USD) to a fresh two-months, which, in turn, is seen acting as a tailwind for the USD/JPY pair. The overnight hawkish remarks by a slew of Federal Reserve (Fed) officials reaffirmed expectations that the US central bank will keep interest rates higher for longer. This, along with hopes that US politicians can come together on a debt ceiling deal, remains supportive of elevated US Treasury bond yields and continues to benefit the Greenback.

A further rise in the US bond yields, meanwhile, widens the US-Japan rate differential and drives flow away from the Japanese Yen (JPY). Apart from this, a more dovish stance adopted by the Bank of Japan (BoJ) undermines the JPY and adds credence to the near-term positive outlook for the USD/JPY pair. That said, a softer risk tone - amid worries about slowing global economic growth - lends some support to the safe-haven JPY and keeps a lid on any further gains for the USD/JPY pair.

Even from a technical perspective, the recent breakout through the very important 200-day Simple Moving Average (SMA) and a subsequent move beyond the previous YTD peak favour bullish traders. The constructive setup is reinforced by the fact that oscillators on the daily chart are holding in the positive territory and are still far from being in the overbought zone. This, in turn, suggests that the path of least resistance for the USD/JPY pair is to the upside and any downtick is likely to get bought into.

Spot prices seem poised to surpass the 139.00 round-figure mark and test the next relevant hurdle near the 139.55-139.60 region. The upward trajectory could get extended further and allow the USD/JPY pair to reclaim the 140.00 psychological mark for the first time since November 2022.

On the flip side, the 138.00 round figure is likely to protect the immediate downside ahead of the 137.55-137.50 horizontal resistance breakpoint. Any further decline is likely to attract fresh buyers and remain limited near the 137.00 mark. The said handle coincides with the 200-day SMA and should act as a strong base for the USD/JPY pair. A convincing break below might prompt some technical selling and pave the way for some meaningful near-term corrective decline.

USD/JPY daily chart

Key levels to watch

- EUR/USD accelerates losses and revisits monthly lows near 1.0760.

- US debt ceiling talks continue to drive the mood among traders.

- US flash PMIs also came mixed for the current month.

EUR/USD loses further ground and slips back to the area of monthly lows around 1.0760 on Tuesday.

EUR/USD pokes with May lows near 1.0760

EUR/USD maintains its bearish tone on Tuesday, seeing its decline accelerate to the 1.0760 area as the dollar continues to face upward pressure, while unease over the US debt ceiling continues to weigh on sentiment.

Meanwhile, talks over the US debt ceiling are expected to continue to drive sentiment in global markets in the near term, while speculation of further rate hikes by the ECB at its June and July meetings, and likely in September, continues to grow.

In the US, advanced Manufacturing PMI is seen deflating to 48.5 in May and the Services PMI is expected to improve to 55.1.

Later in the session, US New Home Sales are also due.

What to look for around EUR

EUR/USD loses the grip and flirts with the monthly lows around 1.0760 on Tuesday.

The movement of the euro's value is expected to closely mirror the behaviour of the US Dollar and will likely be impacted by any differences in approach between the Fed and the ECB with regards to their plans for adjusting interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Germany, EMU Advanced Manufacturing/Services PMI (Tuesday) – Germany IFO Business Climate (Wednesday) – Germany Final Q1 GDP Growth Rate, GfK Consumer Confidence (Thursday) – Italy, France Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle in June and July (and September?). Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.31% at 1.0778 and faces immediate contention at 1.0759 (monthly low May 19) seconded by 1.0712 (low March 24) and finally 1.0516 (low March 15). On the upside, a break above 1.0872 (55-day SMA) would target 1.1000 (round level) en route to 1.1095 (2023 high April 26).

- US S&P Global Manufacturing PMI dropped below 50 in May.

- US Dollar Index clings to modest daily gains near 103.50.

The business activity in the US private sector expanded at a strengthening pace in early May with the S&P Global's Composite PMI rising to 54.5 from 53.4 in April.

In the same period, S&P Global Manufacturing PMI declined to 48.5 from 50.2, revealing a contraction in the manufacturing sector's activity. On the other hand, the Services PMI rose to 55.1 from 53.6, surpassing the market expectation of 52.6.

Commenting on the data, “the US economic expansion gathered further momentum in May, but an increasing dichotomy is evident," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence."

"While service sector companies are enjoying a surge in post-pandemic demand, especially for travel and leisure, manufacturers are struggling with over-filled warehouses and a dearth of new orders as spending is diverted from goods to services," Williamson added. “Jobs growth has accelerated as service providers companies seek to meet demand, but this tightening labour market amid strong demand will be a concern as a fuel of further inflationary pressures.”

Market reaction

These data don't seem to be having a noticeable impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was up 0.25% on the day at 103.50.

The Reserve Bank of New Zealand (RBNZ) will announce its monetary policy decision on Wednesday, May 24 at 02:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of six major banks.

The RBNZ is expected to raise the key Official Cash Rate (OCR) by 25 basis points (bps) in May. All eyes remain on the updated projection for OCR peak and Governor Orr’s presser.

ANZ

“We expect the RBNZ will raise the OCR 25 bps to 5.50%. We see a 20% chance of a 50 bps hike and a 5% chance of a pause. Either could backfire by driving down future OCR expectations. We are building one more 25 bps hike in July into our own OCR forecast, which would take the OCR to 5.75%. The (relatively) happy place to sit and ‘watch, worry and wait’ keeps inching just out of reach. We expect a relatively firm tone from the RBNZ, but also words that leave all doors open depending on how the data evolves from here, which could be up, down or sideways relative to their expectations.”

TDS

“We lift our estimate of RBNZ terminal from 5.50% to 6% and expect the Bank to deliver a 50 bps hike this week. The RBNZ's net migration forecasts and fiscal stimulus assumptions will likely be revised higher. Both add upside risks to domestic inflation. There is also no evidence that offshore Central Banks are making progress on bringing down core inflation. However, the risk to our 50 bps call is the Bank viewing monetary policy as sufficiently restrictive. Given monetary policy is contractionary, the Bank may opt for a 25 bps hike.”

Danske Bank

“We expect the RBNZ to hike the cash rate by 25 bps to 5.50%.”

ING

“Markets are pricing in a peak at around 5.80%, but we think the RBNZ can deliver an extra bit of hawkishness and signal tightening until the 6.00% mark as it hikes by 25 bps this week. That would have positive implications for NZD in the near term.”

Citi

“The RBNZ is expected to increase the OCR by 25 bps. The step down to 25 bps is largely expected on the back of a slowdown in domestic activity, yet inflation still remains higher than the central bank’s target. The recent deceleration in inflation expectations would also help steer the hawkish RBNZ towards a lower quantum of rate hikes. We expect this to be the last rate hike the Bank delivers, which is also in-line with the Bank’s guidance. However, given the NZ Budget last week and substantial amount of rebuilding expected in H2’23, there are hawkish risks which could see the RBNZ continue to signal more rate hikes could be needed. Forecasts in the MPS are unlikely to change materially, although there might be some upgrade to growth estimates in H2 because of reconstruction post-Cyclone. The RBNZ though, is likely to continue to suggest that inflation risks remain skewed to the upside and is unlikely to turn dovish anytime soon with rate cuts also unlikely in 2023.”

Wells Fargo

“We fully expect the RBNZ to hike rates 25 bps. Moreover, while we believe that will be the peak for the current cycle, we will be scrutinizing the central bank's updated economic projections for any insight into whether policy rates might still need to be raised further.”

Lower volatility is favouring the carry trade, where currencies in Latin America and Central and Eastern Europe offer the highest risk-adjusted yields, economists at ING report.

Dollar does ok in a carry trade world

“The stand-out is the lower levels of traded FX volatility around the world – both in the developed and emerging FX space. Lower levels of volatility go hand-in-hand with a slightly more constructive risk environment, where the MSCI World equity index is edging up to the highs of the year.”

“The currencies of Latin America (especially the Mexican Peso) and Central and Eastern Europe (especially the Hungarian Forint) offer the best risk-adjusted return. These have been the outperformers this year and could continue to do well unless US debt ceiling negotiations take a turn for the worse.”

“Expect the Dollar to stay slightly bid in this rangy FX environment until there are much clearer signs of US disinflation and a slowing activity – which we have argued is more a story for the third quarter.”

- Silver breaks through the 100-day SMA support and drops to a nearly two-month low.

- The technical setup favours bearish traders and supports prospects for further losses.

- A sustained strength beyond the $24.00 mark is needed to negate the bearish outlook.

Silver continues losing ground for the second successive day on Tuesday and confirms a fresh bearish breakdown through the 100-day Simple Moving Average (SMA). The white metal maintains its heavily offered tone through the early North American session and currently trades around the $23.25-$23.30 region, just above a nearly two-month low.

The recent repeated failures near the $24.00 round-figure mark and the subsequent slide below a technically significant moving average could be seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone. This, in turn, supports prospects for an extension of the recent retracement slide from over a one-year top, around the $26.15 region touched earlier this month.

Some follow-through selling below the $23.00 mark, which coincides with the 50% Fibonacci retracement level of the March-May rally, will reaffirm the negative outlook. The XAG/USD might then accelerate the fall towards intermediate support near the $22.60-$22.55 region before eventually dropping to the 61.8% Fibo. level, around the $22.25-$22.20 region. This is followed by the $22.00 mark, which if broken decisively will set the stage for a further near-term depreciating move.

On the flip side, attempted recovery back above the 100-day SMA, currently around the $23.35 region, is more likely to attract fresh sellers near the 38.2% Fibo. level, around the $23.75 area. This, in turn, should cap the upside for the XAG/USD near the $24.00 round-figure mark. Some follow-through buying beyond the $24.20-$24.25 region, however, might negate the near-term bearish outlook and prompt an aggressive short-covering rally towards the $25.00 psychological mark.

Silver daily chart

Key levels to watch

EUR/USD is at potential support zone of 1.0730/1.0710. A break below here could open up further losses, analysts at Société Générale report.

High formed last week at 1.0910 is likely to cap

“EUR/USD is challenging the 100-DMA; it is worth noting that this MA had cushioned downside in March.”

“The pair is close to potential support of 1.0730/1.0710 representing the 23.6% retracement from last year. An initial bounce is not ruled out however the high formed last week at 1.0910 is likely to cap.”

“Failure to defend 1.0730/1.0710 can extend the decline towards 1.0650 and perhaps even towards March low of 1.0510.”

- Oil price continues sluggish recovery on budding optimism US lawmakers will reach agreement to raise US debt ceiling.

- A bullish triangle price pattern forms on the 4-hour chart increasing the evidence the bearish trend may be reversing.

- API inventory data to be released later on Tuesday could inject some volatility into Crude Oil price action.

Oil price trades marginally higher on Tuesday, continuing its recovery from the poor open at the start of the week. Financial markets in general suffer a lack of volatility due to uncertainty over the United States debt ceiling. In the event of a default, US demand would plummet, resulting in lower Oil prices. Optimism after talks on Monday raises hopes, with history showing a last-minute deal is the norm.

At the time of writing, WTI Oil is trading in the mid $72s and Brent Crude Oil in the lower $76s. A bullish right-angled triangle has formed on the 4-hour chart, challenging the overall bear trend.

Oil news and market movers

- Oil rises marginally on Tuesday as United States lawmakers continue negotiations to raise the debt ceiling and avoid a US default.

- Republican House Leader Kevin McCarthy expresses optimism after Monday’s talks, saying, “I believe we can still get there. I believe we can get it done.” Adding that he thought the talks were the most productive so far.

- Oil price opened substantially lower at the beginning of the week, partly as a result of global trade concerns after major economies clashed at the G7 summit in Japan.

- China further provoked the US by banning imports of memory chips from US manufacturer Micron, citing security risks.

- The US Dollar catches a bid on Tuesday as Federal Reserve (Fed) officials continue to talk about the possibility of more rate hikes, providing a headwind for Oil, which is priced in USD.

- API inventory data out at 20:30 GMT will provide an indication of demand and supply dynamics in the crude market and could impact Oil prices if it comes out substantially higher or lower than last week’s 3.69 million barrels figure.

- A higher result would signal increasing supply and weigh on Oil prices and vice versa for a lower data point.

- S&P Global PMI data at 13:45 GMT could also impact Oil prices via the US Dollar – if it beats expectations it is likely to support USD and weigh on Oil and vice versa if lower.

Crude Oil Technical Analysis: Downtrend increasingly compromised

WTI Oil is in a long-term downtrend, making successive lower lows. Given the old adage that the trend is your friend, this favors short positions over long positions. WTI Oil is trading below all the major daily Simple Moving Averages (SMA) and all the weekly SMAs except the 200-week which is at $66.89.

-638204433309415027.png)

WTI US Oil: Daily Chart

A break below the year-to-date (YTD) lows of $64.31, however, would be required to re-ignite the downtrend, with the next target at around $62.00 where trough lows from 2021 will come into play, followed by support at $57.50.

Despite the bearish trend dominating, there are growing signs pointing to a possible conclusion and reversal. The mild bullish convergence between price and the Relative Strength Index (RSI) at the March and May 2023 lows – with price making a lower low in May that is not matched by a lower low in RSI – is a sign that bearish pressure is easing.

The long hammer Japanese candlestick pattern that formed at the May 4 (and year-to-date) lows is a sign that it could be a key strategic bottom.

Further, a right-angled triangle can also be seen forming on the 4-hour chart below, which because of its shape is biased to breakout higher.

-638204433755452264.png)

WTI US Oil: 4-hour Chart

The triangle could have formed after price recovered from the May 4 YTD lows. The initial rebound off the May 4 lows could be seen as a Wave A, with B descending between May 8-15. Wave C then probably rose in the week that followed before the market turned again at the start of this week, in what might be a Wave D. The recovery currently underway could be Wave E. Since most triangles are only composed of five waves this would be the last wave before the pattern breaks out.

There is a chance the triangle might break in either direction, but it is biased to break higher. This is because the top border is flat (it is right angled). Such a move would see price rise in a volatile rally to a potential target of $79.75, calculated by taking 61.8% the height of the triangle and extrapolating it higher. This is also at the level of the 200-day SMA which is likely to provide tough resistance to any further gains.

Such a break would probably mean price breaking above the $76.85 lower high of April 28, thereby, bringing the dominant bear trend into doubt.

False breaks are common with this pattern, however, and traders should ideally wait for a ‘decisive’ break. Such a break is characterized by a longer-than-average bullish green bar which pierces completely through the upper borderline of the triangle and closes near the 4-hour period’s highs, or alternatively three green bars in a row that also pierce above the borderline.

Given the downtrend is dominant, however, there is still also a possibility WTI Oil price could break lower, with a decisive break below the lower border, likewise required, and a target at $67.27. This is just above where the 200-week SMA is located and likely to offer support. Traders might even wish to wait for a break below the lows of Wave B at $69.40 for added confirmation.

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- USD/CAD gains some positive traction and climbs to over a one-week high on Tuesday.

- A combination of factors continues to push the USD higher and lend support to the pair.

- An intraday rise in Crude Oil prices underpins the Loonie and caps any meaningful gains.

The USD/CAD pair struggles to capitalize on its intraday positive move and retreats a few pips from the vicinity of mid-1.3500s, or over a one-week high touched earlier this Tuesday. The pair trades with a mild positive bias heading into the North American session and is currently placed just above the 1.3500 psychological mark.

Crude Oil prices rally over 1% amid hopes for an improvement in US fuel demand and disruptions in Canadian supply due to wildfires in the oil-rich Alberta province. This, in turn, underpins the commodity-linked Loonie and turns out to be a key factor acting as a headwind for the USD/CAD pair, though resurgent US Dollar (USD) demand should help limit the downside, at least for the time being. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, climbs to a fresh two-month high and draws support from a combination of factors.