- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the weaker-than-expected construction PMI data from the U.K.

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the weaker-than-expected construction PMI data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

06:45 France Trade Balance, bln March -5.12 Revised From -5.18 -4.4 -4.37

07:50 France Services PMI (Finally) April 49.9 50.8 50.6

07:55 Germany Services PMI (Finally) April 55.1 54.6 54.5

08:00 Eurozone Services PMI (Finally) April 53.1 53.2 53.1

08:30 United Kingdom PMI Construction April 54.2 54 52

09:00 Eurozone Retail Sales (MoM) March 0.3% Revised From 0.2% -0.1% -0.5%

09:00 Eurozone Retail Sales (YoY) March 2.7% Revised From 2.4% 2.5% 2.1%

10:15 Eurozone ECB's Jens Weidmann Speaks

11:00 U.S. MBA Mortgage Applications April -4.1% -3.4%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Private sector in the U.S. is expected to add 196,000 jobs in April, according the ADP report on Wednesday.

Preliminary productivity in the U.S. non-farm businesses is expected to decline at a 1.4% annual rate in the first quarter, after a 2.2% drop in the fourth quarter.

Preliminary unit labour costs are expected to increase 3.3% in the first quarter, after a 3.3 gain in the fourth quarter.

The U.S. factory orders are expected to rise 0.6% in March, after a 1.7% fall in February.

The U.S. trade deficit is expected to narrow to $41.5 billion in March from $47.06 billion in February.

The ISM non-manufacturing purchasing managers' index is expected to rise to 54.7 in April from 54.5 in March.

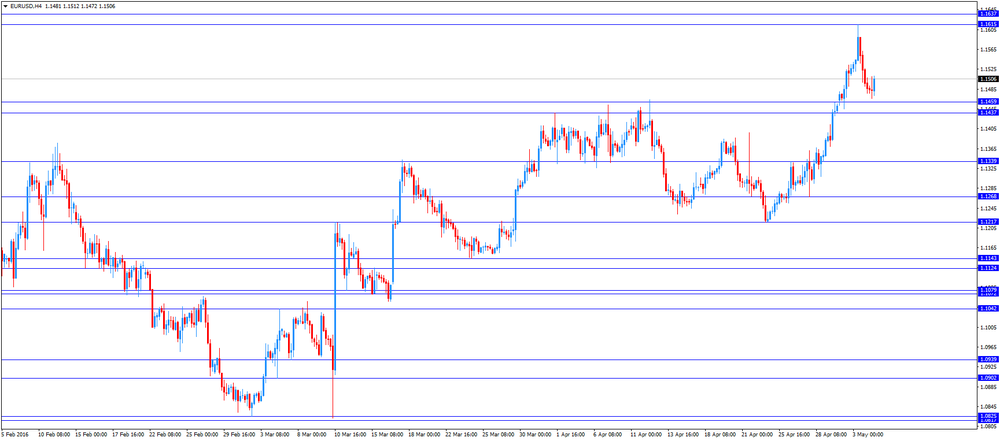

The euro traded mixed against the U.S. dollar after the release of the weaker-than-expected economic data from the Eurozone. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services PMI remained unchanged at 53.1 in April, down from the preliminary reading of 53.2.

Eurozone's final composite output index fell to 53.0 in April from 53.1 in March, in line with the preliminary reading.

The decline was mainly driven by a fall in output prices.

"The final PMI data confirm the earlier flash estimate that the Eurozone economy grew at a steady but unspectacular annual rate of 1.5% at the start of the second quarter," Chief Economist at Markit Chris Williamson said.

"However, while still tepid, the sustained Eurozone growth contrasts with slowdowns in the US and UK, suggesting the ECB's more aggressive stimulus is helping to drive a steady recover," he added.

Germany's final services PMI fell to 54.5 in April from 55.1 in March, down from the preliminary reading of 54.6. The index was mainly driven by a slower growth in employment, while backlogs of work declined.

France's final services PMI increased to 50.6 in April from 49.9 in March, down from the preliminary reading of 50.8. The index was mainly driven by rises in new business, backlogs of work and input prices.

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone decreased 0.5% in March, missing expectations for a 0.1% fall, after a 0.3% gain in February. February's figure was revised up from a 0.2% increase.

Non-food sales decreased 0.5% in March, food, drinks and tobacco sales slid 1.3%, while automotive fuel sales were down 0.4%.

On a yearly basis, retail sales in the Eurozone climbed 2.1% in March, missing forecasts of a 2.5% gain, after a 2.7% increase in February. February's figure was revised up from a 2.4% rise.

Non-food sales gained 2.1% year-on-year in March, gasoline sales jumped 2.5%, while food, drinks and tobacco sales rose 1.5%.

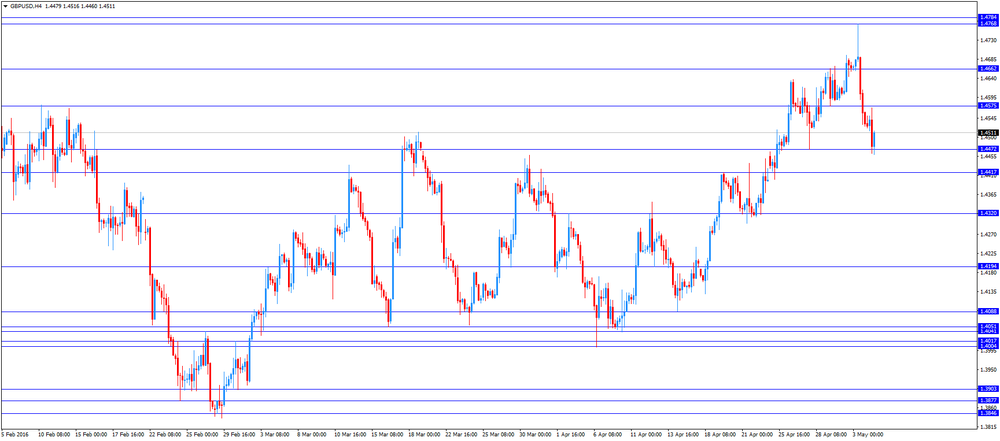

The British pound traded lower against the U.S. dollar after the release of the weaker-than-expected construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction PMI for the U.K. dropped to 52.0 in April from 54.2 in March, missing expectations for a decrease to 54.0. It was the lowest level since June 2013. The decline was mainly driven by a drop in new work.

"UK construction firms reported their worst month for almost three years in April, meaning that the first quarter slowdown is unlikely to prove temporary," Senior Economist at Markit, Tim Moore, said.

"Softer growth forecasts for the UK economy alongside uncertainty ahead of the EU referendum appear to have provided reasons for clients to delay major spending decisions until the fog has lifted," he added.

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.7% year-on-year in April, after a 1.7% decline in March.

The decline was mainly driven by a drop in non-food prices, which plunged 2.9% year-on-year in April. Food prices rose at an annual rate of 0.1% in April.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian trade data. The Canadian trade deficit is expected to narrow to C$1.4 billion in March from C$1.91 billion in February.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.4460

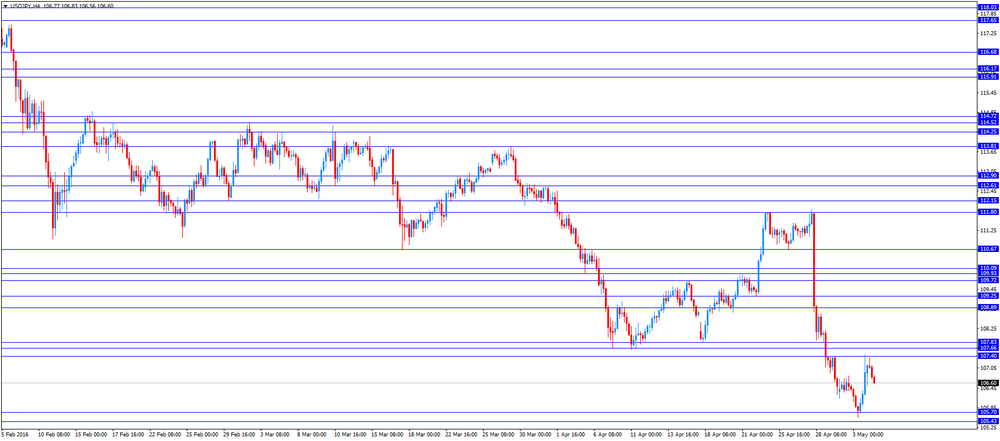

USD/JPY: the currency pair declined to Y106.56

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report April 200 196

12:30 Canada Trade balance, billions March -1.91 -1.4

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter I 3.3% 3.3%

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter I -2.2% -1.4%

12:30 U.S. International Trade, bln March -47.06 -41.5

13:45 U.S. Services PMI (Finally) April 51.3 52.1

14:00 U.S. Factory Orders March -1.7% 0.6%

14:00 U.S. ISM Non-Manufacturing April 54.5 54.7

14:30 U.S. Crude Oil Inventories April 1.999 1.444

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.