- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Labor Cash Earnings, YoY March 0.7% Revised From 0.9% 1.4%

05:00 Japan Consumer Confidence April 41.7 40.8

06:00 Germany Factory Orders s.a. (MoM) March -0.8% Revised From -1.2% 0.7% 1.9%

07:15 Switzerland Consumer Price Index (MoM) April 0.3% 0.1% 0.3%

07:15 Switzerland Consumer Price Index (YoY) April -0.9% -0.6% -0.4%

07:30 United Kingdom Halifax house price index 3m Y/Y April 10.1% 9.6% 9.2%

07:30 United Kingdom Halifax house price index April 2.2% Revised From 2.6% 0.1% -0.8%

08:30 Eurozone Sentix Investor Confidence May 5.7 6.2

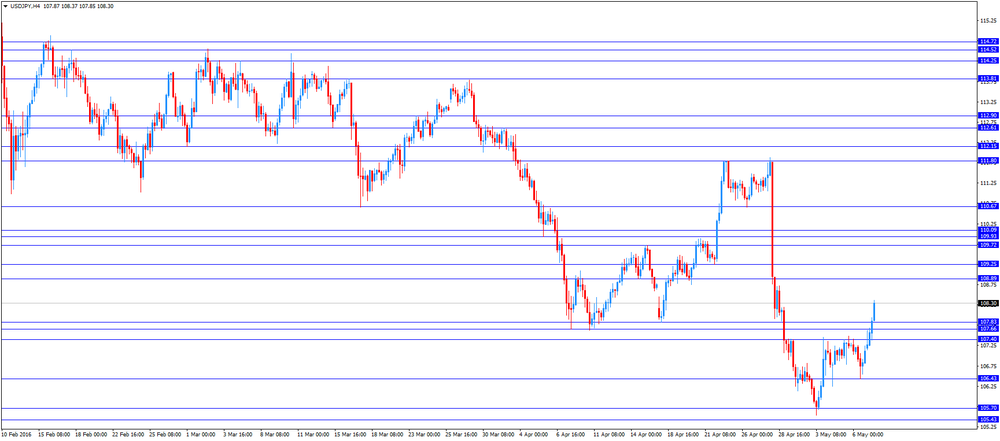

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major economic reports.

Market participants continued to eye the U.S. labour market data. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 160,000 jobs in April, missing expectations for a rise of 202,000 jobs, after a gain of 208,000 jobs in March. March's figure was revised down from a rise of 215,000 jobs. The increase was driven by rises in professional and business services, health care, and financial activities.

The U.S. unemployment rate remained unchanged at 5.0% in April, in line with expectations.

Average hourly earnings increased 0.3% in April, in line with forecasts, after a 0.2% rise in March. March's figure was revised down from a 0.3% increase.

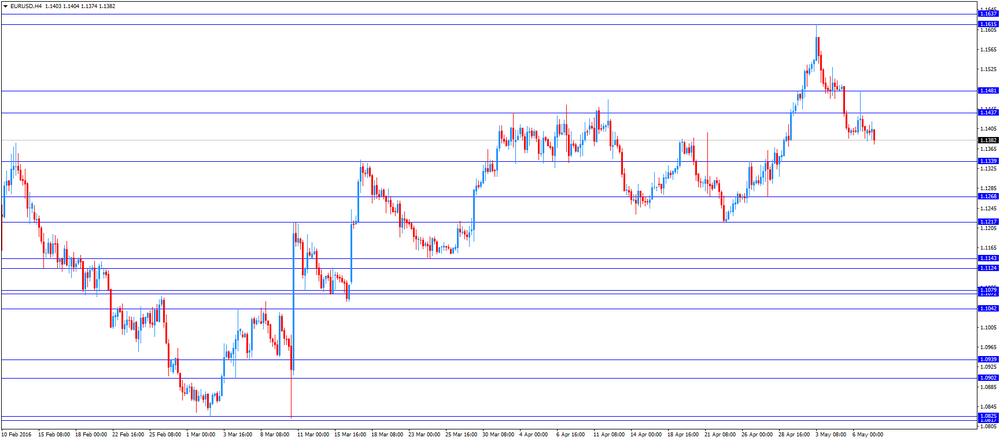

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index rose to 6.2 in May from 5.7 in April.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Economic expectations for the Eurozone remain resilient as investors perception about the future development of Japan continues to deteriorate," Sentix said in its statement.

"Moreover, in May investors get wary about the situation of the US economy. Emerging markets proceed their recovery," Sentix added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders jumped 1.9% in March, exceeding expectations for a 0.7% increase, after a 0.8% fall in February. February's figure was revised up from a 1.2% drop.

The rise was driven by an increase in foreign orders. Foreign orders increased by 4.3% in March, while domestic orders declined by 1.2%.

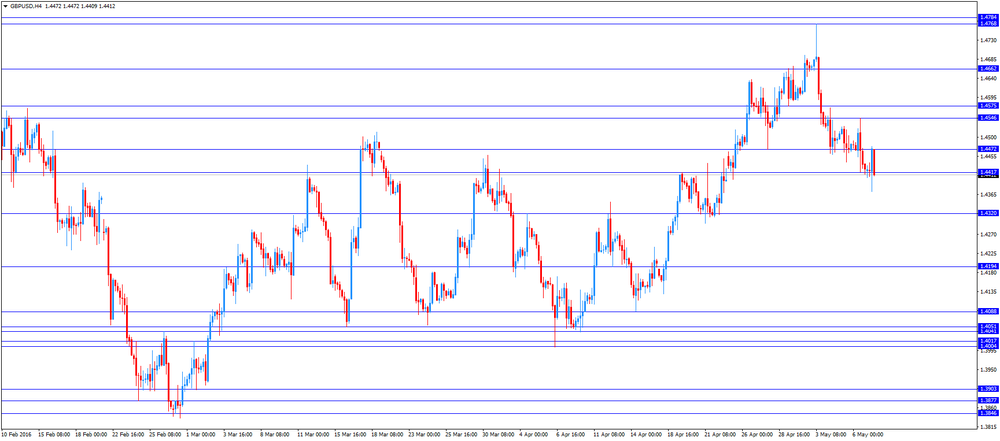

The British pound traded mixed against the U.S. dollar. Halifax released its house prices data for the U.K. on Monday. House prices in the U.K. fell 0.8% in April, missing expectations for a 0.1% rise, after a 2.2% increase in March. March's figure was revised down from a 2.6% rise.

On a yearly basis, house prices jumped 9.2% in the three months to April, missing forecasts of a 9.6% gain, after a 10.1% increase in the three months to March.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Candian housing market data. Housing starts in Canada are expected to decline to 191,500 in April from 204,300 in March.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Monday. Switzerland's consumer price index rose 0.3% in April, exceeding expectations for a 0.1% gain, after a 0.3% increase in March.

The increase was mainly driven by higher prices for petroleum products, and clothing and footwear.

On a yearly basis, Switzerland's consumer price index increased to -0.4% in April from -0.9% in March, beating forecasts of a rise to -0.6%.

EUR/USD: the currency pair fell to $1.1374

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y108.37

The most important news that are expected (GMT0):

12:15 Canada Housing Starts April 204.3 191.5

14:00 U.S. Labor Market Conditions Index April -2.1

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.