- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the U.K. labour market data

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the U.K. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence June 8.5% -1.0%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.2% Revised From 2.0% 2.1% 2.3%

08:30 United Kingdom Average Earnings, 3m/y April 2.0% Revised From 2.1% 1.7% 2.0%

08:30 United Kingdom ILO Unemployment Rate April 5.1% 5.1% 5%

08:30 United Kingdom Claimant count May 6.4 Revised From -2.4 -0.1 -0.4

09:00 Eurozone Trade balance unadjusted April 28.6 26 27.5

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the Fed's interest rate decision. Analysts expect the Fed to keep its interest rate unchanged.

The U.S. PPI is expected to increase 0.3% in May, after a 0.2% rise in April.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in May, after a 0.1% gain in April.

The U.S. industrial production is expected to decline 0.2% in May, after a 0.7% rise in April.

The euro traded mixed against the U.S. dollar. Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion. Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

The British pound traded higher against the U.S. dollar on the U.K. labour market data. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the manufacturing shipments data from Canada. Canadian manufacturing shipments are expected to rise 0.6% in April, after a 0.9% fall in March.

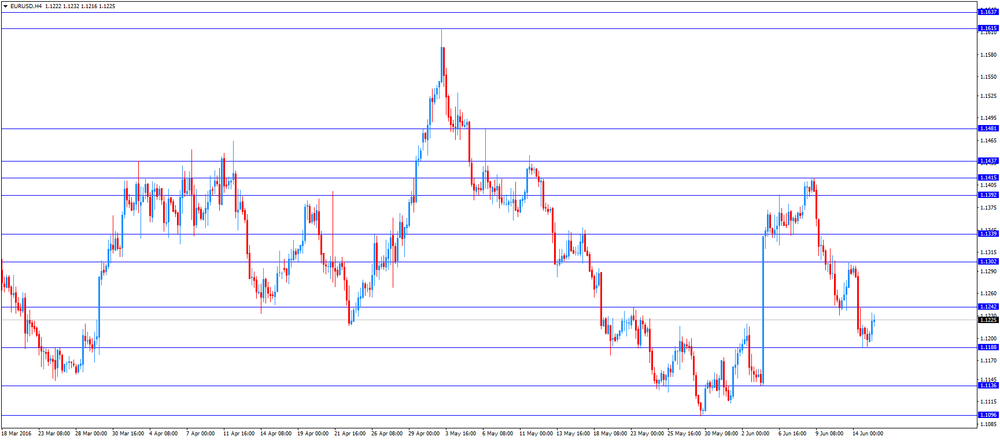

EUR/USD: the currency pair traded mixed

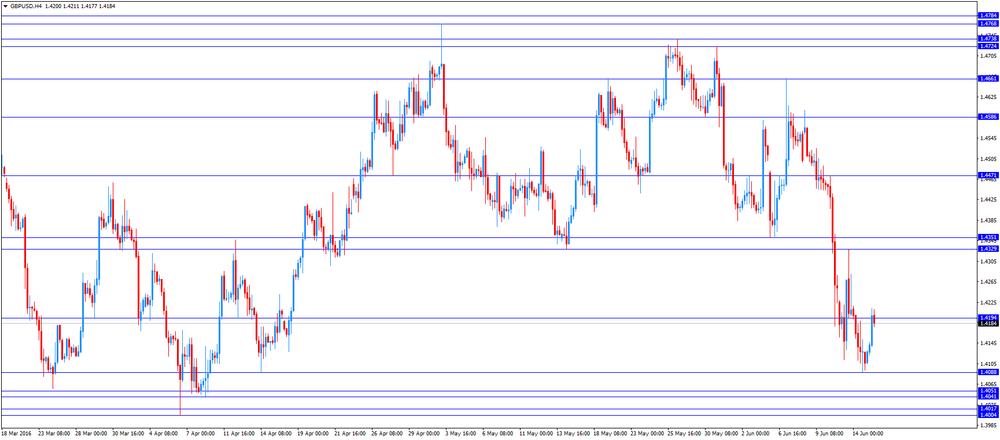

GBP/USD: the currency pair rose to $1.4213

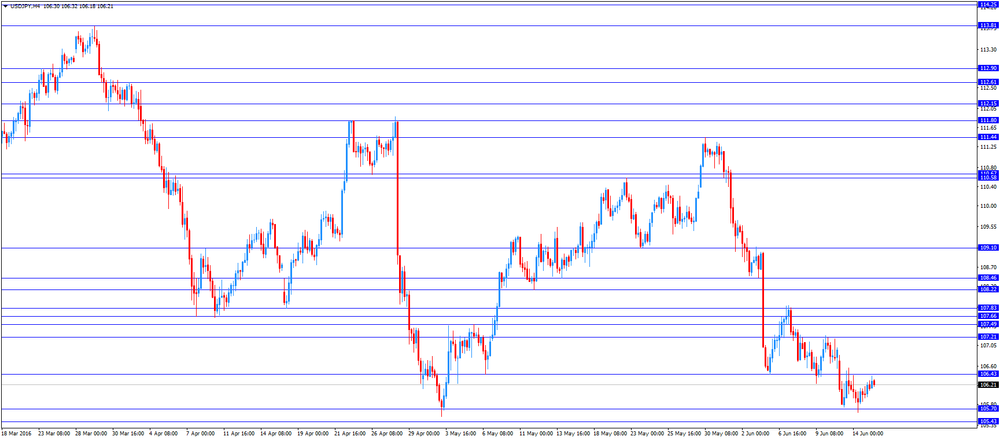

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) April -0.9% 0.6%

12:30 U.S. PPI, m/m May 0.2% 0.3%

12:30 U.S. PPI, y/y May 0% -0.1%

12:30 U.S. PPI excluding food and energy, m/m May 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y May 0.9% 1%

13:15 U.S. Capacity Utilization May 75.4% 75.2%

13:15 U.S. Industrial Production (MoM) May 0.7% -0.2%

13:15 U.S. Industrial Production YoY May -1.1%

14:00 Eurozone ECB's Jens Weidmann Speaks

14:30 U.S. Crude Oil Inventories June -3.226 -2.27

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I 0.9% 0.5%

22:45 New Zealand GDP y/y Quarter I 2.3% 2.6%

23:55 Canada BOC Gov Stephen Poloz Speaks

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.