- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- European session review: pound rose

European session review: pound rose

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Industrial Production (m / m) in May 0.5% Revised to 0.8% 0% -1.3%

France 6:45 Trade balance, bn May -5.2 -4.9 -2.8

7:15 Switzerland Consumer Price Index m / m in June 0.1% 0.1% 0.1%

7:15 Switzerland Consumer Price Index y / y in June -0.4% -0.5% -0.4%

7:30 UK House Price Index from Halifax, m / m in June from 0.9% Revised 0.6% 0.4% 1.3%

7:30 UK House Price Index from Halifax, 3m y / y in June 9.2% 7.7% 8.4%

8:30 UK Industrial Production m / m in May 2.1% Revised from 2% to 1% -0.5%

8:30 UK Industrial Production y / y in May from 2.2% Revised 1.6% 0.5% 1.4%

8:30 UK Manufacturing production m / m in May to 2.4% Revised 2.3% -1% -0.5%

8:30 UK Manufacturing production, y / y in May 0.8%

11:30 Eurozone ECB's report on the meeting dedicated to monetary policy

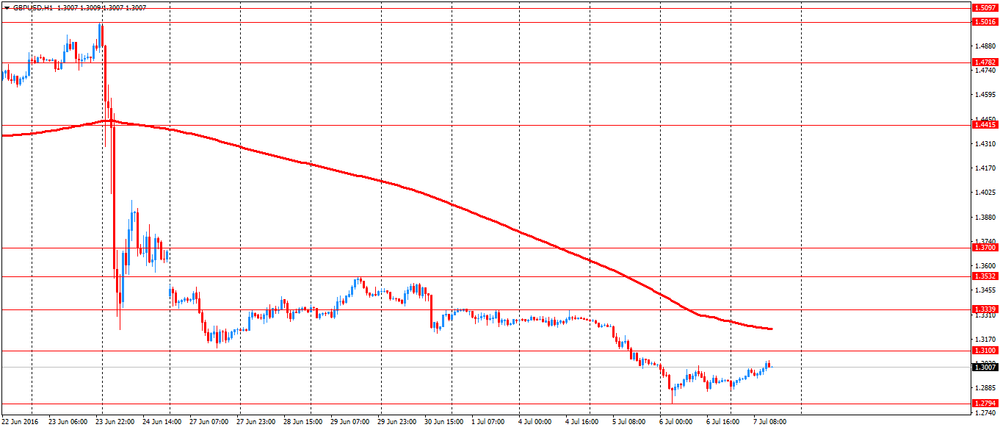

The pound rose from record lows against the US dollar after the release of positive manufacturing data in Great Britain, although concerns about Brexit consequences for the national economy continue to weigh.

The Office for National Statistics said that output in the UK manufacturing fell in May to a seasonally

The volume of industrial production decreased by 0.5 percent in May after the growth with 2.1 percent in April. It was the biggest drop in the past five months, but less than the expected decline of 1 percent.

In addition, manufacturing output fell by 0.5 percent, in contrast to an increase of 2.4 percent a month ago.

In annual terms, industrial production growth slowed to 1.4 percent in May, compared with 2.2 percent. Economists had forecast an increase of 0.5 percent.

Investors are now preparing for the meeting of the Bank of England next week, after the head of the central bank Governor Mark Carney signaled last week that it may take action during the summer, increasing expectations of the upcoming rate cut.

On Tuesday, the Bank of England warned of "representing the complexity of financial stability risks resulting after" Brexit and reduced requirements for the volume of capital reserves for banks.

Mark Carney said that this move implies "substantial changes" to help the economy to overcome the consequences of Britain leaving the EU.

At the same time, sentiment on the dollar slightly weakened after the June Fed meeting minutes released on Wednesday showed that officials of the US central bank decided that it is necessary to postpone the increase in interest rates, while evaluating British referendum consequences.

The minutes also stated that members of FOMC agreed to "reasonable wait for the new statistics before considering another rate hike".

Euro fell against the dollar after the release of weak data on industrial production in Germany. In May, industrial production in Germany fell by 1.3% compared with the previous month, according to the Ministry of Economics and Labour.

The decline os the index was the most significant since August 2014, on average the market is not expected to change. Industrial production decreased by 0.4% compared to May last year.

The April growth rate of industrial production in Germany was revised from 0.8% to 0.5% compared to March and from 1.2% to 0.8% in annual terms.

Construction output in May decreased by 0.9% compared with the previous month, the release of capital goods fell by 3.9%. Electricity generation increased by 3.9%, consumer goods production - by 0.5%.

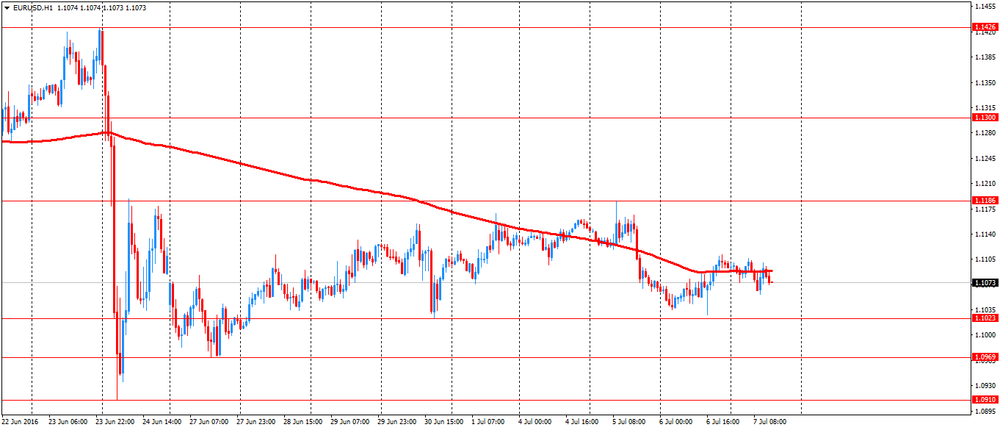

EUR / USD: during the European session, the pair fell to $ 1.1056

GBP / USD: during the European session, the pair has risen to $ 1.3046

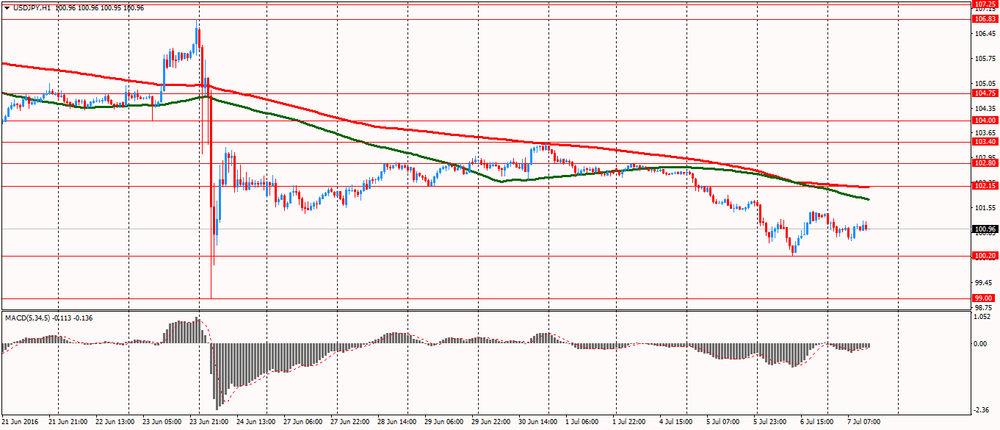

USD / JPY: during the European session, the pair fell to Y100.62 and then rose to Y101.19

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.