- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Asian session review: the Yen was sold on Bank of Japan news

Asian session review: the Yen was sold on Bank of Japan news

The following data was published:

1:30 Australia Consumer Price Index q / q II quarter -0.2% 0.4% 0.4%

1:30 Australia Consumer Price Index y / y in the II quarter 1.3% 1.1% 1.0%

01:30 Australia Consumer Price Index (truncated average method), q / q II quarter 0.2% 0.4% 0.5%

1:30 Australia Consumer Price Index (truncated average method), y / y in the II quarter 1.7% 1.5% 1.7%

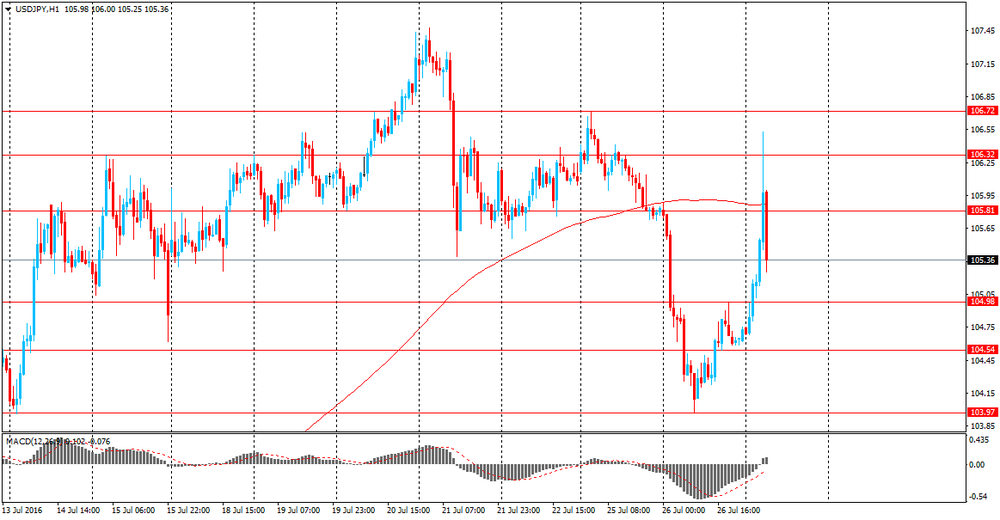

In the Asian session, USD / JPY trading above 105.40 after briefly rose to the level of 106.50. This happened after reports in the WSJ said that Japan is considering 50-year Japanese government bonds. The maturity of these bonds would be the longest in the postwar period.

Support for the pair also had =Japanese Prime Minister Shinzo Abe who said that the stimulus package amounting to 27 trillion yen. Later, the news agency Kyodo reported that Japanese Prime Minister Abe stated that the economic stimulus package will be more than Y28 trillion. He also announced that the government will decide on a package of measures.

Earlier it was reported that the Japanese government will make less extensive than expected incentives. These reports led markets to doubt the ability of Tokyo to restart the economy and trigger a weakening of the national currency.

Investors have been paying more attention to the dynamics of the yen on the eve of the two-day meeting of the Bank of Japan, which will end on Friday. Some economists have suggested that the central bank may implement a number of stimulus measures, from increasing purchases of assets and helicopter miney, ie direct financing of fiscal stimulus measures.

The Australian dollar rose half a cent to $ 0.7565 US immediately after the release of the consumer price index, but then fell, reaching yesterday's low of $ 0.7455.

The Consumer Price Index, published by the Australian Bureau of Statistics, in the second quarter quarter grew by 1.0% compared to the same period of the previous year. Analysts had expected an increase of 1.1%. Base CPI index rose by 0.4% compared with the first quarter, which corresponds to the forecast. In the first quarter the index fell by -0.2%.

RBA signaled a tendency to mitigate the monetary policy in connection with data on inflation, the labor market and housing sector. Rates are already at a record low of 1.75%. The last time the central bank has lowered the rate was in May.

Analysts at JPMorgan said that inflation in Australia is low enough to convince the RBA to further support the economy.

Now the Reserve Bank of Australia may refrain from lowering rates until November," - said Citigroup economists.

Earlier Citi said that core inflation was unpleasant surprise, forcing the RBA to lower the official interest rate next month. Now it is expected that the rate will be lowered by 25 basis points in November.

The US dollar was little changed against the euro in the run-up to the announcement of the decision of the Federal Reserve on monetary policy. Market participants believe that the probability of a US Federal Reserve interest rates in the coming months has increased thanks to a series of strong economic data. The Fed on Wednesday is likely to leave interest rates unchanged, but investors see a 26% chance the central bank's tightening policy in September, whereas previously, this possibility was evaluated as 12%, according to CME Group data.

"The rhetoric of the Fed is expected to have support for the US dollar in the coming weeks and months", - Deutsche Bank.

Higher rates have a positive impact on the US dollar, increasing its attractiveness for investors.

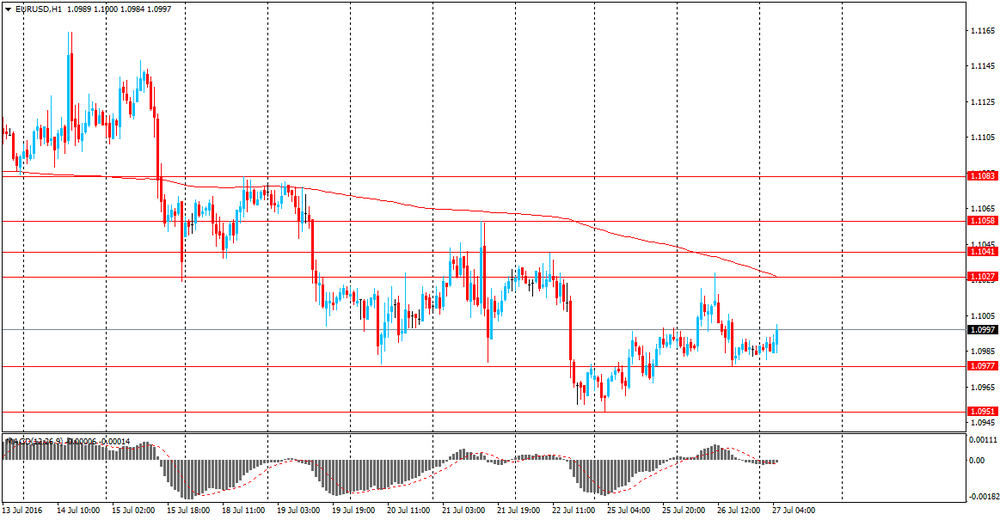

EUR / USD: during the Asian session, the pair was trading in $ 1.0980-1.0995 range

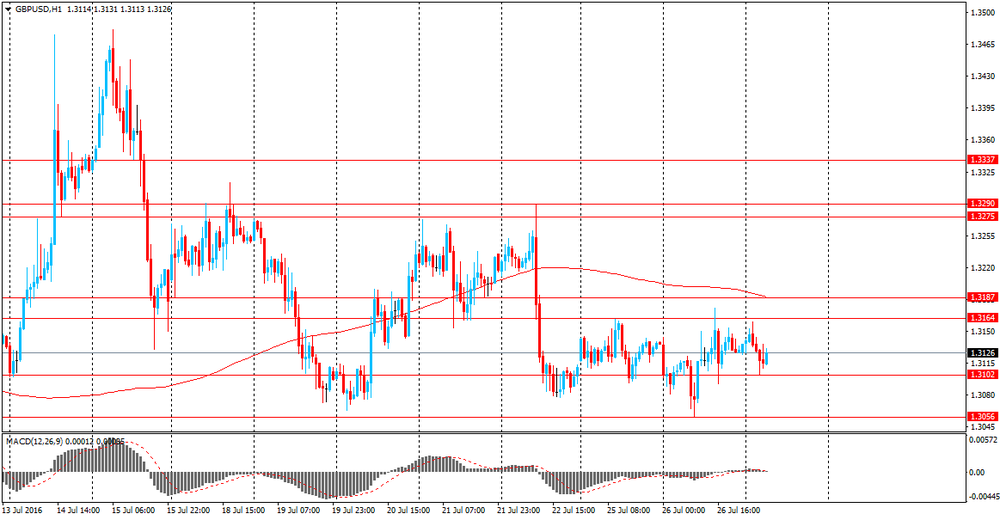

GBP / USD: during the Asian session, the pair was trading in $ 1.3105-1.3125 range

USD / JPY: during the Asian session, the pair was trading in Y104.70-106.50 range

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.