- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Asian session review: tight ranges across the board

Asian session review: tight ranges across the board

During the Asian session, the US dollar traded in a narrow range against major currencies after widespread fall on Friday as weak data on economic growth have exacerbated doubts about the likely increase in US Federal Reserve interest rates this year.

The US Commerce Department announced that US economic growth stalled in the second quarter. According to seasonally adjusted data, gross domestic product grew by 1.2% annually in the second quarter. The last reading was well below the average forecast (+ 2.6%). We also add that economic growth for the first quarter was revised downward to + 0.8% from + 1.1%. The economy expanded by less than 2% for three consecutive quarters. Despite the fact that the recession was over seven years ago, the growth rate has not accelerated since. The average annual growth rate during the current business cycle remains the weakest since 1949.

The weakness of the economy has increased concerns about whether it will be able to transfer the increase in rates this year. On Wednesday, the US Federal Reserve left monetary policy unchanged.

Futures on interest rates on Friday indicate that investors see 12% chance of a rate hike in September, compared with 18% a day ago, according to CME Group.

The Australian dollar rose after the publication of positive data on the index of business activity in the manufacturing sector of China from Caixin. The index rose in July to 50.6, higher than analysts expectations of 48.7 and the previous value of 48.6. This is the first increase in the index for the last 17 months. New orders increased, but new export orders fell again. The unemployment rate rose, showing a significant loss of jobs. According to Markit Economics China's economy began to show signs of stabilization due to the gradual implementation of fiscal policy. However, the pressure on economic growth remain, and supportive fiscal and monetary policy should be continued.

Also, the Chinese Federation of Logistics and Supply were published data on the index of business activity in the service sector, according to which the index rose to 53.9 from 53.7 the previous value.

The index of activity in the manufacturing sector of the Australia, published by the Australian Industry Group, was 56.4 in July, higher than the previous value of 51.8. The group explores the results of a survey of 200 hundred producers in the aspect of assessment of business conditions including employment, production, orders, prices and stocks, as well as short-term planning. A reading above 50 is positive for the Australian dollar. New orders increased by 4.7 points, employment had grown to the highest level since December 2014. Sales increased by 6.5 points, which is the highest rate since September 2009. Inventories rose by 1.4 points. Exports increased by 9.6 points on the month to its highest level since March 2008

Sales of new homes in Australia in June increased by 8.2% after a decline of -4.4% in May. This indicator expresses the volume of new home sales in Australia. It evaluates the conditions of the housing market. Thus, the high value of the index is a positive factor for the Australian currency..

According to Australia's Housing Association new home sales rose in June after two months of decline. Sales of detached houses increased by 7.2%, while sales of apartments by 11.5%.

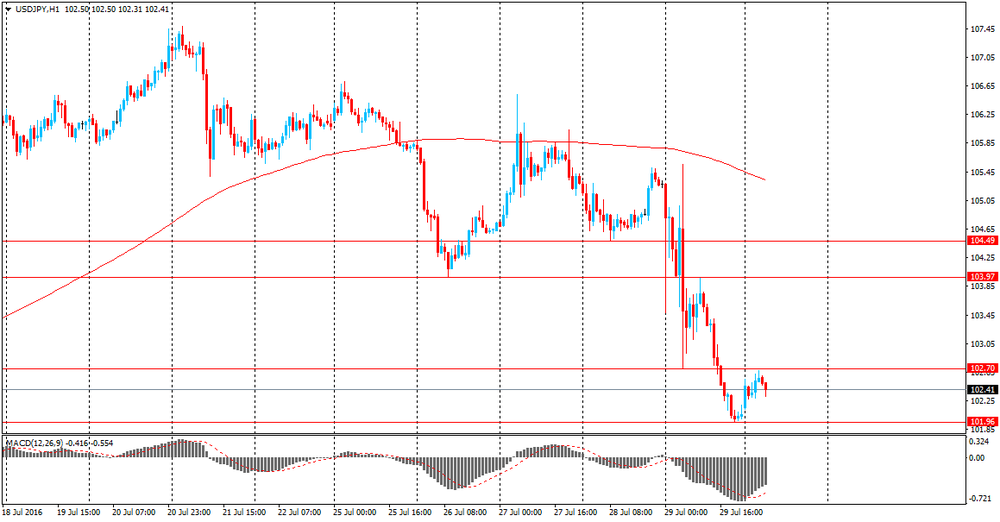

The yen weakened against the dollar as investors took profits after the Japanese currency on Friday rose sharply as the Bank of Japan decided on additional measures that fell short of investors' expectations. The central bank announced its intention to increase the purchase of ETF, but left interest rates and the amount of the bond purchase program unchanged.

It became known that the index of business activity in the manufacturing sector of Japan in July amounted to 49.3 points, which is higher than the previous value of 48.1 and economists' expectations of 49.0. However, this indicator is below 50 for the fifth month in a row on a background of weak demand. In addition, the strong yen is a negative impact on exports.

Production and new orders fell again, but at a slower pace. Slightly more positively proved the employment component, which has recently reached a historic high.

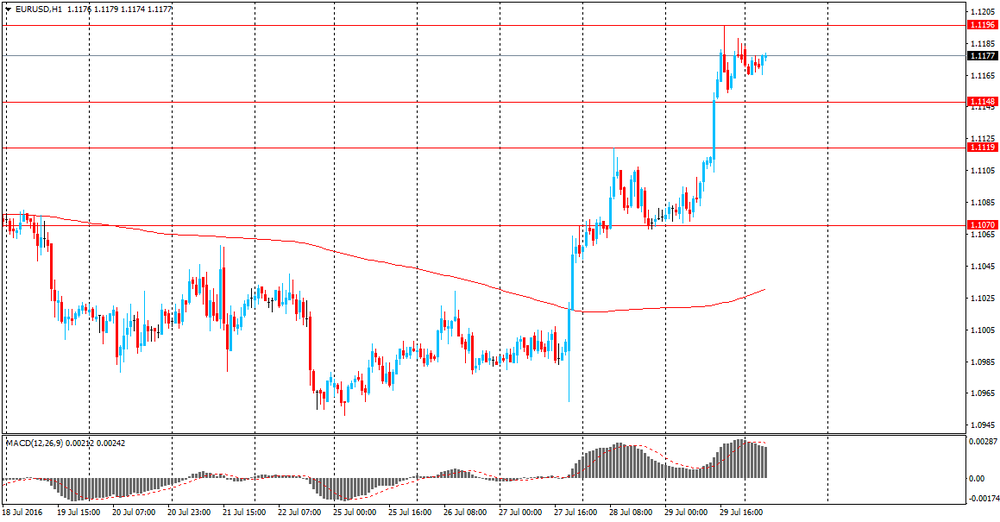

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-65 range

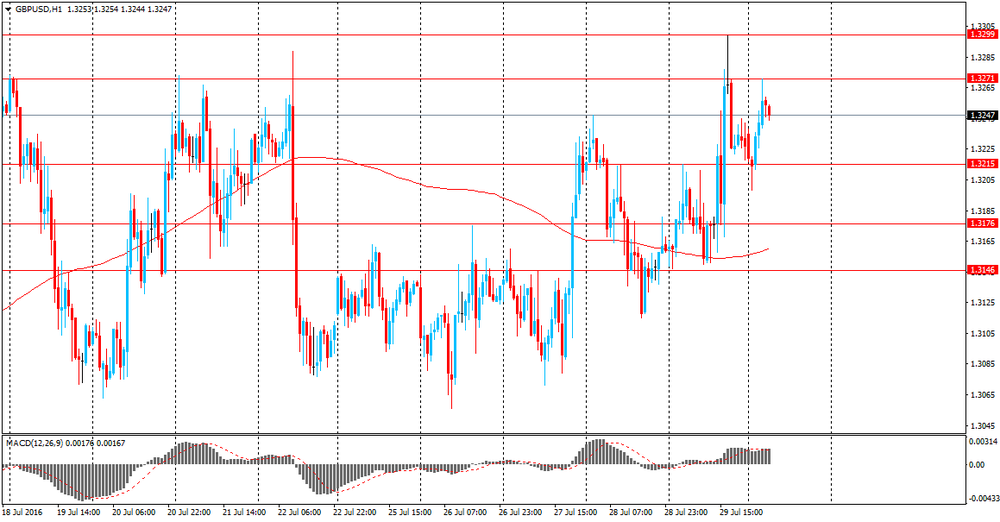

GBP / USD: during the Asian session, the pair was trading in the $ 1.3200-40 range

USD / JPY: during the Asian session, the pair was trading in Y102.15-50 range

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.