- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- European session review: the pound fell after weak data on industrial activity

European session review: the pound fell after weak data on industrial activity

The following data was published:

(Time / country / index / period / previous value / forecast)

France 7:50 PMI in the manufacturing sector (the final data) July 48.3 48.6 48.6

Germany 7:55 PMI in the manufacturing sector (the final data) July 54.5 53.7 53.8

8:00 Eurozone PMI in the manufacturing sector (the final data) July 52.8 51.9 52

8:30 UK PMI Manufacturing Index July 52.1 49.1 48.2

The British pound fell against the dollar after data confirmed the reduction of manufacturing activity in July, down more than the initial estimation, reinforcing fears about the prospects for economic growth.

The British manufacturing sector has been hit by the uncertainty associated with "Brexit", both production and orders declined, and the activity was the weakest since the beginning of 2013, showed Markit data.

The final purchasing managers' index for the manufacturing sector fell to 48.2 from 52.4 in June, noting the lowest level since February 2013. Preliminary estimate for the index was 49.1.

PMI value below 50 indicates a reduction in activity. It was only the second time since the beginning of 2013, when the index fell below the neutral mark, according to Markit.

Production dropped at the strongest pace since October 2012, with reductions in all areas.

While domestic demand has suffered from pre- and post-Brexit uncertainty, export orders rose for the second month in a row, mainly due to the recent decline in the exchange rate and efforts of companies to provide new contracts.

However, employment fell the seventh consecutive month. The weaker new orders and a decline in outstanding business volumes also suggest that employment could still fall in the coming months, Markit said.

Purchasing price inflation rose to a maximum of five years in July, due to the increase sterling induced import prices and higher prices for metals and commodities. As a result, selling prices increased at the fastest pace in two years.

"The trend of weakening orders and rising costs of inflation in the future to present a problem for manufacturers," said Markit senior economist Rob Dobson.

"On this account, the weak figures are powerful arguments in favor of quick action policies to prevent recession and will hopefully play a role in restoring confidence and achieve a speedy recovery."

Weak data triggered concerns about the strength of the UK economy and the increased expectations of a rate cut by the Bank of England's meeting monetary policy this week.

Euro traded slightly lower against the US dollar after the release of mixed data on manufacturing activity in the euro area.

Eurozone manufacturing activity grew at a slower pace in July, but the growth rate was faster than the initial estimate showed on Monday.

The manufacturing purchasing managers index fell to 52.0 in July from 6-month high of 52.8 in June. The preliminary reading for July was 51.9.

A reading above 50 indicates expansion. The Index signaled the expansion for 37 consecutive months.

The main factor behind the fall was weaker positive contributions from new orders growth. Although the pace of job creation were slightly lower, they were the fastest in the last five years.

Slower growth was recorded in three of the "big four" economies, namely Germany, Italy and Spain. At the same time, the decline in France continued.

Manufacturing PMI from Markit / BME for Germany fell to 53.8 in July from a 28-month high of 54.5 in On the other hand, the French industrial activity continued to decline in July. The final PMI rose to 48.6, according to initial estimates, from 48.3 in June.

The latter figure was the highest in the last four months, and pointed to a moderate rate of deterioration of operating conditions.

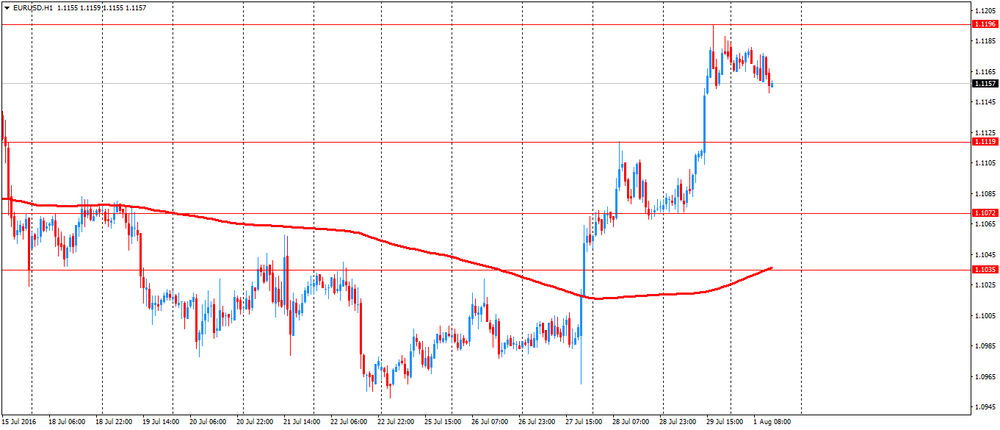

EUR / USD: during the European session, the pair fell to $ 1.1156

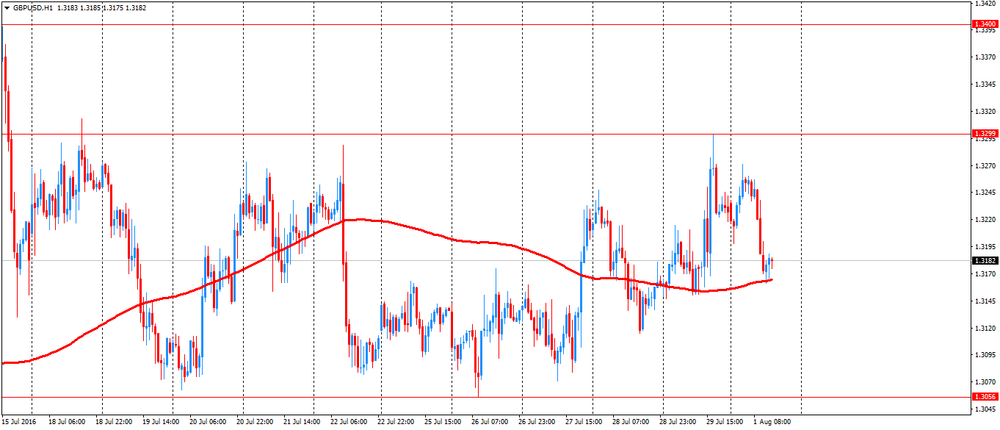

GBP / USD: during the European session, the pair fell to $ 1.3161

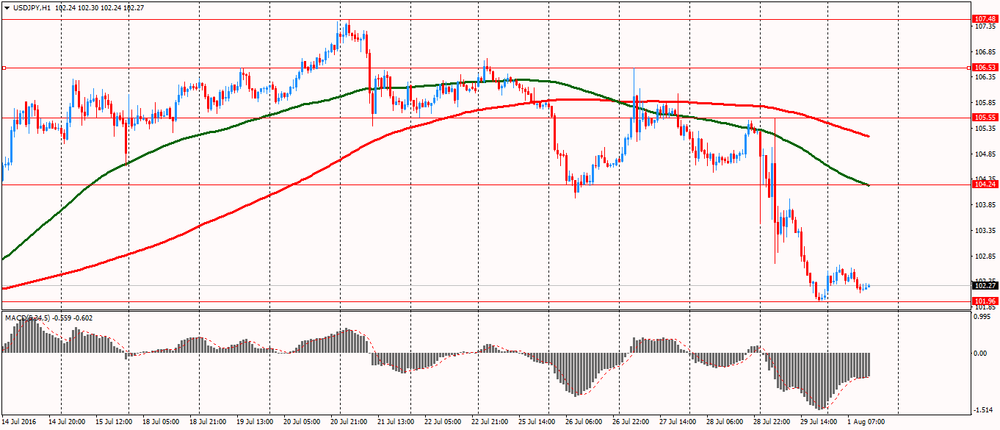

USD / JPY: during the European session, the pair fell to Y102.12

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.