- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Oil rose today

Oil rose today

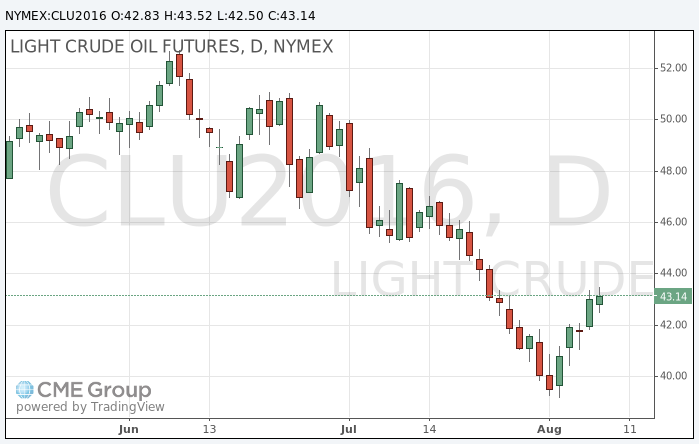

Today, during the American session oil rose while market participants expect the publication of fresh weekly report on US oil and petroleum products.

The American Petroleum Institute is scheduled to release its report on stocks today, while government data expected on Wednesday may show the decrease in inventories by 1.0 million barrels for the week ending 5 August.

Gasoline stocks are expected to decline by 1.2 million barrels, while, according to analysts, distillate stocks, including heating oil and diesel fuel, will increase by 375,000 barrels.

On Monday in New York crude oil futures jumped $ 1.22, or 2.92%, as renewed hopes for an agreement between the exporters supported the market by freezing production.

Despite the recent growth, the market experts believe that increased fuel product inventories amid slowing global demand growth, most likely, will put pressure on prices in the short term.

Futures for WTI crude oil lost nearly 17% this year after falling from highs above $ 50 per barrel reached in early June amid signs of recovery in the US drilling activity combined with higher fuel product inventory.

According to Baker Hughes, the number of drilling rigs in the US increased by 7 to 381 last week, increasing the sixth week in a row and the ninth week of the last ten.

Number of oil rigs in the United States increases the sixth consecutive week, increasing concern about the over-saturation of the oil market.

A day earlier, the price of Brent crude rose $ 1.12, or 2.53%, as sentiment rose amid renewed hopes for an agreement on exporting production freeze.

According to some sources, several OPEC members, including Venezuela, Ecuador and Kuwait, want to revive the idea of limits on oil production in an attempt to stabilize the market this fall.

Qatar's Energy Minister Mohammed bin Saleh Al Sada, who has served as president of OPEC this year, has confirmed that the cartel will hold an informal meeting of 26-28 September at the International Energy Forum in Algiers.

Nevertheless, market participants are still skeptical about this meeting. Earlier this year, an attempt to freeze level of production was not a success because of Iran's refusal to participate in the initiative.

Meanwhile, Venezuela's oil minister Eulogio del Pino said that the meeting of OPEC and countries outside the cartel could take place "in the coming weeks", but Alexander Novak, Minister of Energy of Russia sees no grounds for the resumption of freeze negotiations.

Brent lost almost 15% from the high in early June, $ 52.80, as the prospects for increasing exports from the Middle East and North African countries, such as Iran, Libya and Nigeria, have raised concern that an excess of oil will reduce demand from refiners.

The cost of the September futures on WTI rose to 43.52 dollars per barrel.

September futures price for North Sea petroleum mix of mark Brent fell to 45.77 dollars a barrel on the London Stock Exchange ICE Futures Europe.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.