- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Asian session review: Australian and New Zealand dollar fell

Asian session review: Australian and New Zealand dollar fell

The following data was published:

2:00 China Investment in fixed assets in July 9.0% 8.8% 8.1%

2:00 China Retail sales, y / y in July 10.6% 10.5% 10.2%

2:00 China Industrial Production y / y in July 6.2% 6.1% 6.0%

6:00 Germany Consumer Price Index m / m (final data) July 0.1% 0.3% 0.3%

6:00 Germany CPI, y / y CPI, y / y

(Final data) July 0.3% 0.4% 0.4%

6:00 Germany GDP q / q (preliminary data) II quarter 0.7% 0.2% 0.4%

6:00 Germany GDP y / y (preliminary data) II quarter 1.3% 1.5% 3.1%

Australian and New Zealand dollars fell from the beginning of the session on weaker-than-expected macroeconomic data from China. As reported today by the National Bureau of Statistics of China, industrial production in the period from January to July increased by 6% compared to the same period of the previous year (+6.2%). Economists had expected an increase of 6.1%. Compared with the previous month, industrial production increased by 0.52% after rising 0.47% in June.

The official representative Sheng Layyun said that in July, due to flooding in a number of provinces, as well as high temperature and the low level of external demand growth has slowed a number of indicators. At the same time, he noted that in general the overall state of the Chinese economy is stable.

Chinese retail sales in July increased by 10.2% compared to the same period of the previous year, after rising 10.6% in June. The indicator was lower than the forecast, which anticipated an increase of 10.5%. Compared with June sales increased by 0.75% after rising 0.92% a month earlier.

The volume of investments in fixed assets in China, with the exception of agriculture, on an annualized basis, increased by 8.1%. Economists had expected agrowth rate of 8.8%, after rising by 9.0% a year earlier.

Investment in China's mining industry grew by 20.6%. In the industrial sector investment rose by 3.5%. In the service sector the inflow of investments in the first quarter of 2016 grew by 10.8%, more than in 2015.

In China, there is a slowdown in the growth of investment in fixed assets. According to the forecast of the Chinese government, this year the volume of investments in fixed assets, with the exception of agriculture, increase by 10.5%.

Also, retail sales in New Zealand in the second quarter increased by 2.3%, after rising 0.8% in the first quarter. Analysts had expected an increase of 1.0%. In annual terms, retail sales increased by 6%. Retail sales excluding auto sales rose 2.6%, higher than the forecast of 1.1%.

According to the report total retail sales growth was at a record high in dollar terms. Twelve of the 15 sectors were higher.

The index of business activity in the manufacturing sector of New Zealand, assessing conditions in the business environment of the country in July was 55.8 points, lower than the previous value, revised from 57.7 to 57.7 points. Manufacturing PMI is considered an important indicator of overall economic conditions. Despite the slight decline, the result above 50 indicates growth in activity and is a positive factor for the New Zealand currency.

The US dollar traded in a narrow range against the euro in the absence of new orientations regarding the future prospects of monetary policy the US. Disappointing data on the performance and growth of the US economy, published last week, triggered a weakening dollar.

Minutes of the July meeting of the Fed will be presented next week, and Fed Chairman Janet Yellen will speak at Jackson Hole later this month, which can also cause investors to reconsider expectations for a rate hike prospects.

The market saw a 12% chance of Fed raising rates in September and 39% probability in December, according to the CME Group.

The next test of strength for the dollar will be the publication of the report on retail sales. The indicator will be published today at 12:30 GMT. Retail sales rose 0.6% in June, after finishing a strong second quarter. It is expected that data for July will be strong, and with a monthly growth of 0.4%.

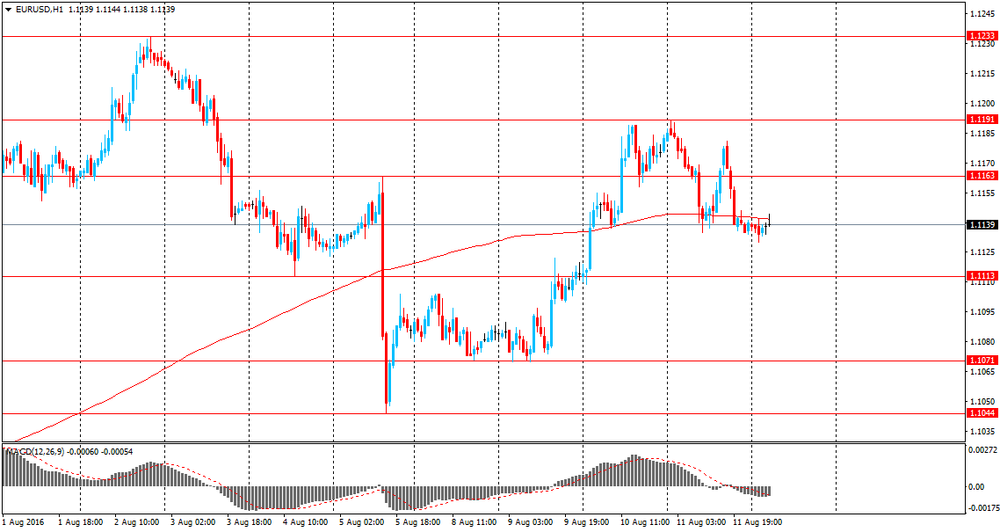

EUR / USD: during the Asian session, the pair was trading in the $ 1.1130-40 range

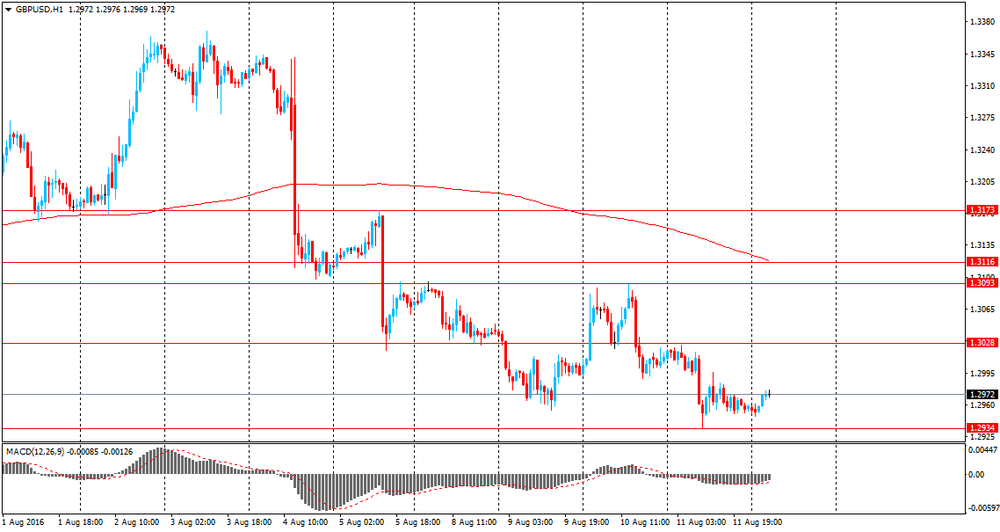

GBP / USD: during the Asian session, the pair was trading in the $ 1.2945-60 range

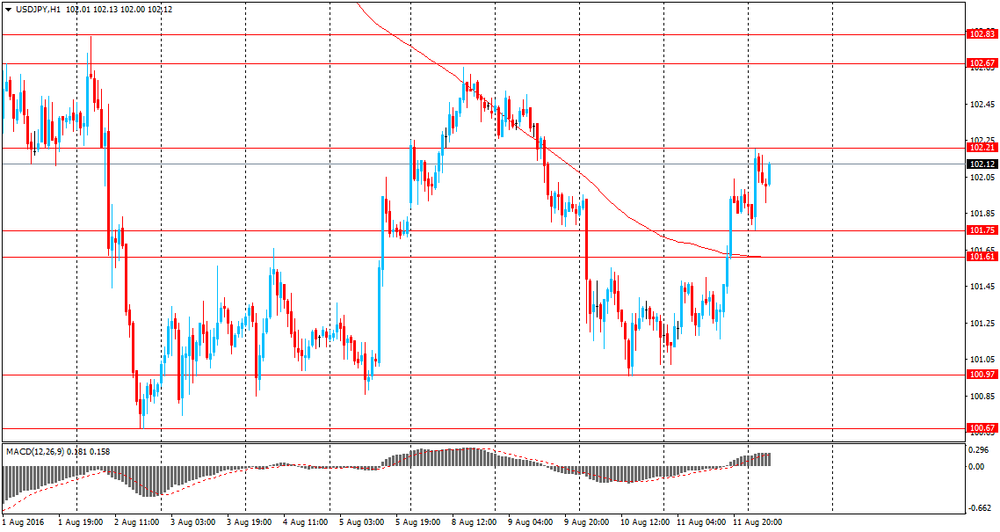

USD / JPY: during the Asian session, the pair was trading in Y101.75-102.10 range

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.