- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- European session review: The markets are waiting for a very important NFP

European session review: The markets are waiting for a very important NFP

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK index of business activity in the construction sector, m / m in August 45.9 46.1 49.2

9:00 Eurozone Producer Price Index m / m in July from 0.8% Revised 0.7% 0.1% 0.1%

9:00 Eurozone Producer Price Index y / y in July -3.1% -2.9% -2.8%

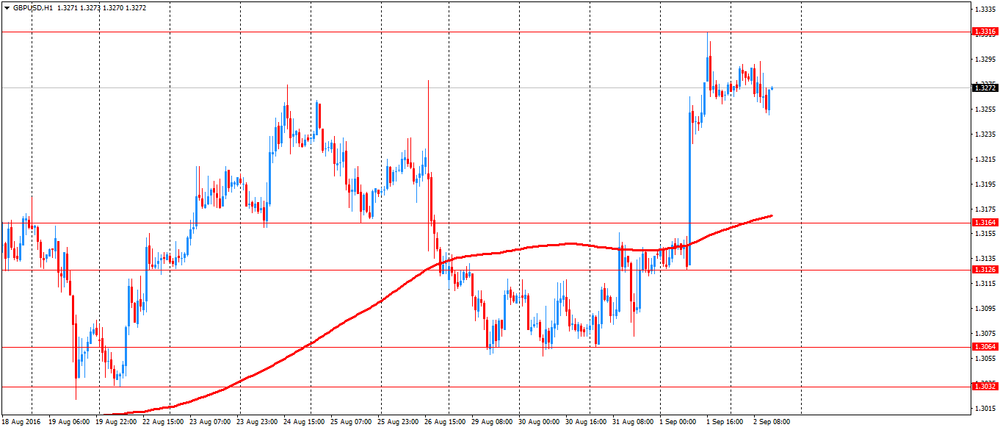

The British pound was trading almost flat against the dollar after a sharp rise the previous day. Today, investors evaluated data on the index of business activity in the construction sector.

UK construction sector registered a sustained reduction of business activity, but the rate of decline was only slight, showed Markit data.

Purchasing Managers Index from the Chartered Institute of Purchasing and Supply / Markit rose more than expected to 49.2 in August compared with a 85-month low of 45.9 in July. Last reading signaled the slowest rate of decline since the recession began in June.

Index value below 50 indicates a contraction in the sector. The index was forecast to rise to 46.1 was.

"The latest survey shows only a partial transition to stabilization, rather than a return to business as usual" said Tim Moore, senior economist at Markit.

The transition to stabilization correlated with more optimistic data on the UK manufacturing PMI for August, and gives us hope that in the short-term adverse fallout from the uncertainty of Brexit will be less severe than feared, Moore said.

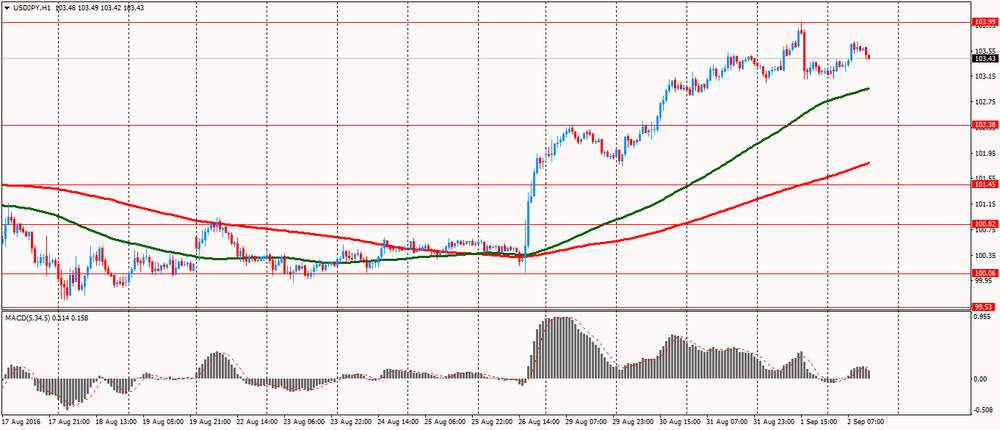

The US dollar is rose slightly on the eve of employment data, which will help to assess the probability of a rate hike in September. Analysts at ING prefer "tactical long positions on the dollar" against the New Zealand dollar, the British pound and the Japanese yen, which are sensitive to changes in interest rates.

According to the consensus forecast of economists surveyed by the WSJ, the number of US jobs outside agriculture rose by 180 000. In August, ING expect an increase in the number of jobs at 150,000 and increase wages by 0.3% compared with the previous month. The consensus forecast assumes growth of wages by 0.2%. That should be enough to "spur the Fed's leadership," they say in ING.

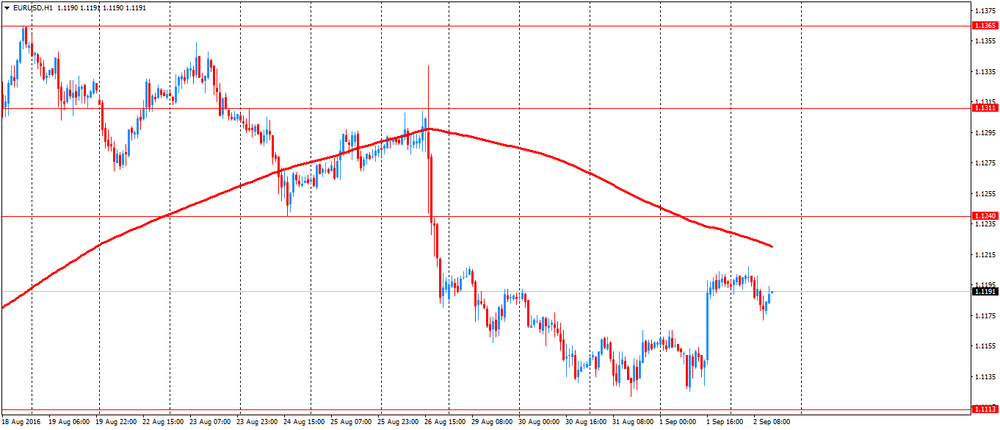

Euro moderately weakened against the US dollar against the strengthening US currency and under the influence of data on producer prices in the euro area.

Eurozone producer prices continued to fall in July, but the rate of decline decreased for the third month in a row, according to Eurostat preliminary data released on Friday.

Producer prices fell by 2.8 percent year on year, after falling 3.1 percent in June. Economists had forecast a decline of 2.9 percent.

Compared with the previous month, producer prices rose 0.1 percent in July, after rising 0.8 percent in June, from a revised 0.7 percent. The last increase was in line with economists' expectations. Prices rose for the third month in a row.

EUR / USD: during the European session, the pair fell to $ 1.1172

GBP / USD: during the European session, the pair fell to $ 1.3250

USD / JPY: during the European session, the pair rose to Y103.70

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.