- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- European session review: the euro rebounded against the US dollar

European session review: the euro rebounded against the US dollar

The following data was published:

(Time / country / index / period / previous value / forecast)

7:30 Switzerland decision of the Swiss National Bank's base rate -0.75% -0.75% -0.75%

07:30 Meeting of Switzerland Swiss National Bank on Monetary Policy

8:30 UK Retail Sales m / m 1.9% Revised August from 1.4% -0.4% -0.2%

8:30 UK Retail sales, y / y in August to 6.3% Revised 5.9% 5.4% 6.2%

9:00 Eurozone Consumer Price Index m / m in August -0.6% 0.1% 0.1%

9:00 Eurozone Consumer Price Index y / y (final data) August 0.2% 0.2% 0.2%

09:00 Eurozone Consumer Price Index, the base value, y / y (final data) June 0.9% 0.8% 0.8%

9:00 The Eurozone trade balance, without seasonal adjustments in July 29.2 25 25.3

11:00 UK program volume BoE decision on asset purchases 435,435

11:00 UK Bank of England Minutes of the meeting

11:00 UK Bank of England Interest Rate Decision 0.25% 0.25%

The euro rebounded to the opening level against the US dollar after data on inflation and trade balance. Eurozone annual inflation was 0.2% in August 2016, stable compared with July. In August 2015, this figure was 0.1%. In the European Union annual inflation was 0.3% in August 2016, compared with 0.2% in July. A year earlier the rate was 0.0%. These figures are from Eurostat In August 2016 were reported negative rates in twelve Member States.

The lowest annual rates were recorded in Croatia (-1.5%), Bulgaria (-1.1%) and Slovakia (-0.8%). The highest rates were recorded in Belgium (2.0%), Sweden (1.2%) and Estonia (1.1%). Compared with July 2016, annual inflation fell in seven Member States, remained stable in six and rose in fifteen. The largest upward impact on the annual inflation in the euro area came from restaurants & cafés (+0.10 percentage points), fruits and vegetables (+0.07 percentage points), while fuels for transport (-0.35 p. n.), heating oil and gas (-0.12 percentage points) were the biggest downward impacts.

The British pound declined with delay after the Bank of England kept interest rates and quantitative easing program unchanged.

The statement was ambiguous, as the central bank's leaders recognized that a number of short-term economic indicators in some ways turned out to be stronger than expected. Also, they expect at least a significant slowdown in economic growth in the second half of the year.

The Bank of England left its key interest rate unchanged, but signaled its readiness to reduce it again later in the year if the UK's economic growth will continue to slow in line with expectations.

According to the text of the monthly statements of the Bank of England, all nine members of the Monetary Policy Committee at the September meeting unanimously voted to keep the key rate at 0.25%. In August, the rate was reduced to 0.25%.

The decision on lowering rates was part of a package of measurea to which the bank has resorted to support the economy after the unexpected results of the referendum on the UK's membership of the EU. The Bank of England also renewed an invalid bond purchase program and corporate securities included in the list of allowed for purchase.

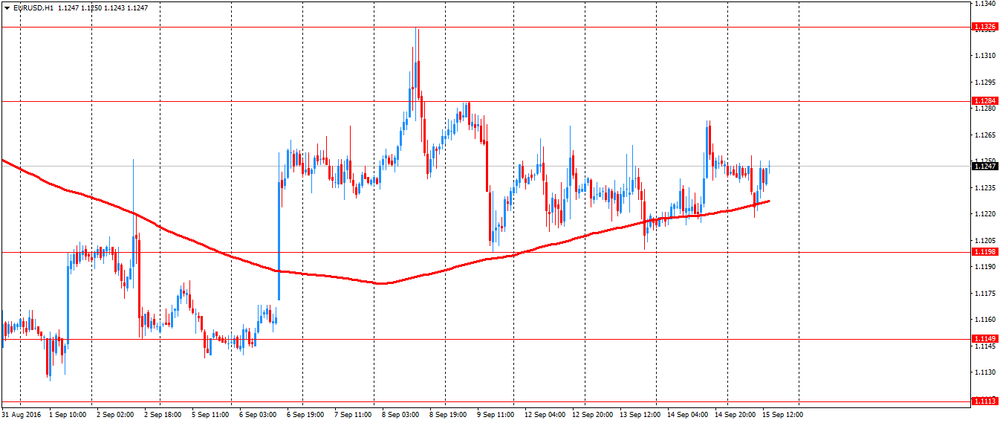

EUR / USD: during the European session the pair fell to $ 1.1218 and retreated

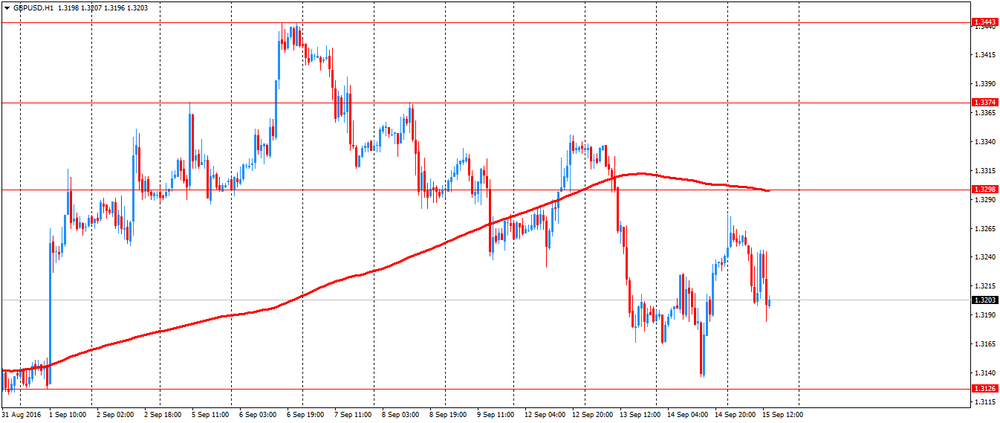

GBP / USD: during the European session, the pair fell to $ 1.3184

USD / JPY: during the European session, the pair rose to Y102.54

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.