- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- CIBC: Stay Short The Loonie Even As Oil Creeps Higher

CIBC: Stay Short The Loonie Even As Oil Creeps Higher

"If crude oil's slide was the nail in the coffin for a strong Canadian dollar, why isn't the loonie rising from the dead as oil stages a comeback? Because it's a rally for the wrong reasons, of insufficient magnitude, and its role in weakening the exchange rate has been overstated in the first place.

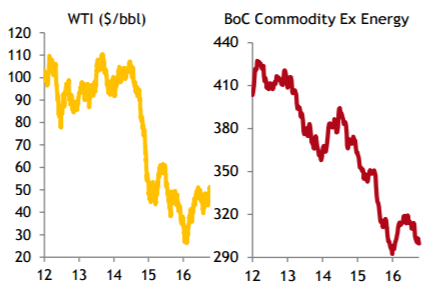

Oil's rally is a story about a pending supply cut by OPEC, not a signal of accelerating demand. Had it been a demand-pull story, we would historically have seen other cyclical commodities on the mend, but that's not generally the case. The Bank of Canada's exenergy commodity price index, weighted to the country's activity in the resource space, remains moribund (Chart). Canada's export basket does not live by oil alone, and the weakness in prices for such commodities as copper, potash and uranium, for example, are signposts that global markets aren't yet in great shape. Their softness will still be weighing on Canada's nominal trade balance, one of the drivers for the currency.

The oil rally also isn't nearly enough to get now-delayed mega-projects back on the drawing board. Rig counts in Canada have bottomed, but they're also turning higher stateside, with a US shale oil return representing a wall of supply that will keep higher cost oil sands projects off the table for a few years to come.

Oil can't bear all the blame, because even when we flirted with triple digit WTI prices in 2011-13, Canada was running a large trade and current account deficit. Instead, most of the drop in the Canadian dollar was an overdue correction from an overvalued level attained after the Bank of Canada went solo with rate hikes in 2010.

Much of what the Bank of Canada will say in the week ahead should already be priced in. Governor Poloz is unlikely to cut rates immediately, and the market should already have taken note of hints of a downgrade in the BoC's medium term growth forecast.

But if there's any reaction in the currency, it will be a modest weakening. The OIS futures market has not priced in any chance of an ease in the quarters ahead. While our base case also has a flat path for Canadian overnight rates, don't be surprised if the market prices in some chance of a cut in the months ahead. New mortgage rules should reduce the BoC's fear that a rate cut would fuel a more worrisome housing bubble, and might raise concerns of that a slowing in homebuilding will eat into growth.

Look for a dovish tone in the Bank's message to at least open the door a crack to a rate cut if necessary, a contrast to a more hawkish Fed. That's reason enough to stay short the loonie even as oil creeps higher.

CIBC targets USD/CAD ta 1.35 by the end of the year".

Copyright © 2016 CIBC, eFXnews™

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.