- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- The day we have all been waiting for - Bank of America Merrill

The day we have all been waiting for - Bank of America Merrill

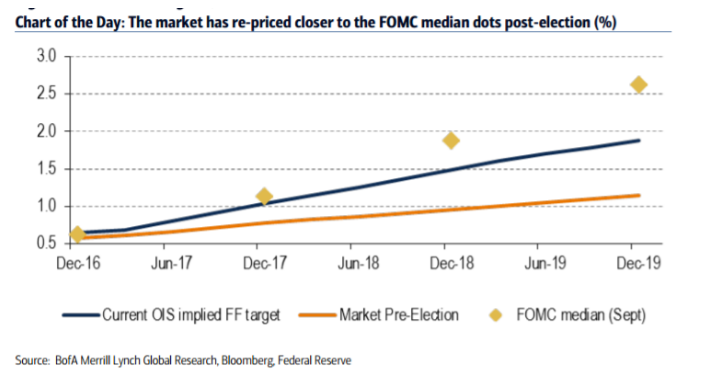

"It is the day we have all been waiting for - the FOMC is very likely to hike 25bp to a range of 50-75bp at the 14th December meeting. This is the second hike in the cycle, following the move last December. Since the rate hike is largely expected, the focus will be on the statement, SEP (specifically the dots) and the press conference. Since the Presidential election, the market has priced in a faster trajectory of hikes, putting it much closer to the Fed's expectations for the next two years (see Chart of the Day).

We think the risk is that the FOMC statement and SEP lean hawkish, given the potential for an upward shift in the dots and the possible limited extent of concern about the recent tightening in financial conditions. However, Chair Yellen is likely to maintain a cautious tone at the press conference.

In our view, the risk is for near-term rates to increase and the dollar to strengthen following the meeting.

FX: focus on 2017 and 2018…

Similar to the market response after the December 2015 hike, we think the key for the FX market will be the signal of the pace of hikes in 2017 and 2018 The main determinant here will be the dot plots, tone of press conference, as well as any nod (implicit or explicit) to the recent tightening of financial conditions amid higher yields and a stronger USD. While market rates have consistently traded below the dots in recent years, the risk of an upward trend in wages and inflation likely means market rates will continue to shift further towards the dots going forward. Indeed, as our rates team has argued, if market rates matched the dot plot, 5-year rates would rise 50 basis points. Therefore, a shift up in the 2017 dots from 2 to 3 hikes would provide USD support through higher front-end yields. That said, given the dollar's over-3% rise since the election and with hedge fund positioning looking stretched, we will need to see further evidence on the data front supporting a faster pace of Fed hikes for the move to be sustained.

Aside from the impact of a mechanical rise in yields, we think short-term USD gains could be tempered by Yellen's tone. She will be careful to not engender a further tightening of financial conditions and will likely adopt a cautiously optimistic tone, reiterating the gradual pace of hikes relative to historical cycles. However, with growth rebounding, inflation rising, and the unemployment rate through the Fed's estimate of NAIRU, we are unlikely to get strong pushback against tighter financial conditions (and a stronger USD) for now.

The dollar is certainly a risk to growth and inflation but given that the recent moves have been driven by US factors (better growth expectations) and not foreign central bank easing, we expect the Fed is more likely to see it as a positive sign. Additionally, while the trade-weighted dollar has rallied a few percent since the election, the year-over-year changes are still flat; so, the growth impact will be muted for now. Despite this, any signs of concern from the Fed would limit near-term USD gains, in our view".

Copyright © 2016 BofAML, eFXnews™

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.