- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Analysis: Bears in charge as US dollar firms

Gold Price Analysis: Bears in charge as US dollar firms

- Gold is under pressure as the US dollar continues to move higher.

- DXY was in a few pints away from the 97 figure on Wednesday as hawks circle above the Fed.

The price of gold on Wednesday was pressured by a surging US dollar and higher volatility on the day. The greenback is in favour as hawkish best ramp up surrounding the Federal Reserve. XAU/USD is down -0.12% at the time of writing and up from the lows of $1,778.61 as the US dollar consolidates into the Thanksgiving holidays and close on Wall Street.

ECB/Fed divergence underpinning the US dollar

On the day, the greenback printed a fresh 16-month high against the euro and the DXY marked territory just shy of 97 the figure. Investors are pricing up the prospect of the Federal Reserve hiking rates in mid-2022 and tapering at a faster pace, potentially commencing such an adjustment as soon as the December meeting. By contrast, the European Central Bank is concerned about covid and growth more so and remains in the dovish camp.

Fed officials sounding more hawkish

Fed officials have been sound far more hawkish of late due to stubbornly high inflation and in today's trade, San Francisco Fed President Mary Daly changed her tune. "If things continue to do what they've been doing, then I would completely support an accelerated pace of tapering," Daly said during an interview with Yahoo Finance published on Wednesday.

daly now advocates for a faster pace of tapering, echoing the rhetoric of Fed Vice Chair Richard Clarida. The vice-chair said last week that the December 14-15 meeting would be an appropriate time to have such a discussion.

The Fed minutes underscored the hawkishness at the Fed today as well. Participants judged prices may take longer to ease and some participants said faster taper could be warranted.

Germany in a thorn in EZs side

Additionally, playing into the hands of the US dollar and weighing on the precious metal, the single currency is under pressure due to newly released covid data in Germany. The reports show that more than 70,000 new coronavirus cases have been reached, by far the biggest one-day increase on record, with some areas yet to report.

This, coupled with economic prints on the day that show German business morale has deteriorated for the fifth month running in November is bound to weigh on the euro. In turn, this could underpin US dollar strength and see the DXY above 97 and underpinned for the foreseeable future.

Mixed outlook for gold

Meanwhile, analysts at TD Securities explained that gold is vulnerable to a deeper consolidation. ''Precious metals prices continue to melt following the Fed Chair's renomination.''

''However, given TD Securities' forecast of slowing growth and inflation next year, market pricing for Fed hikes may ultimately prove too hawkish,'' the analysts added.

Gold technical analysis

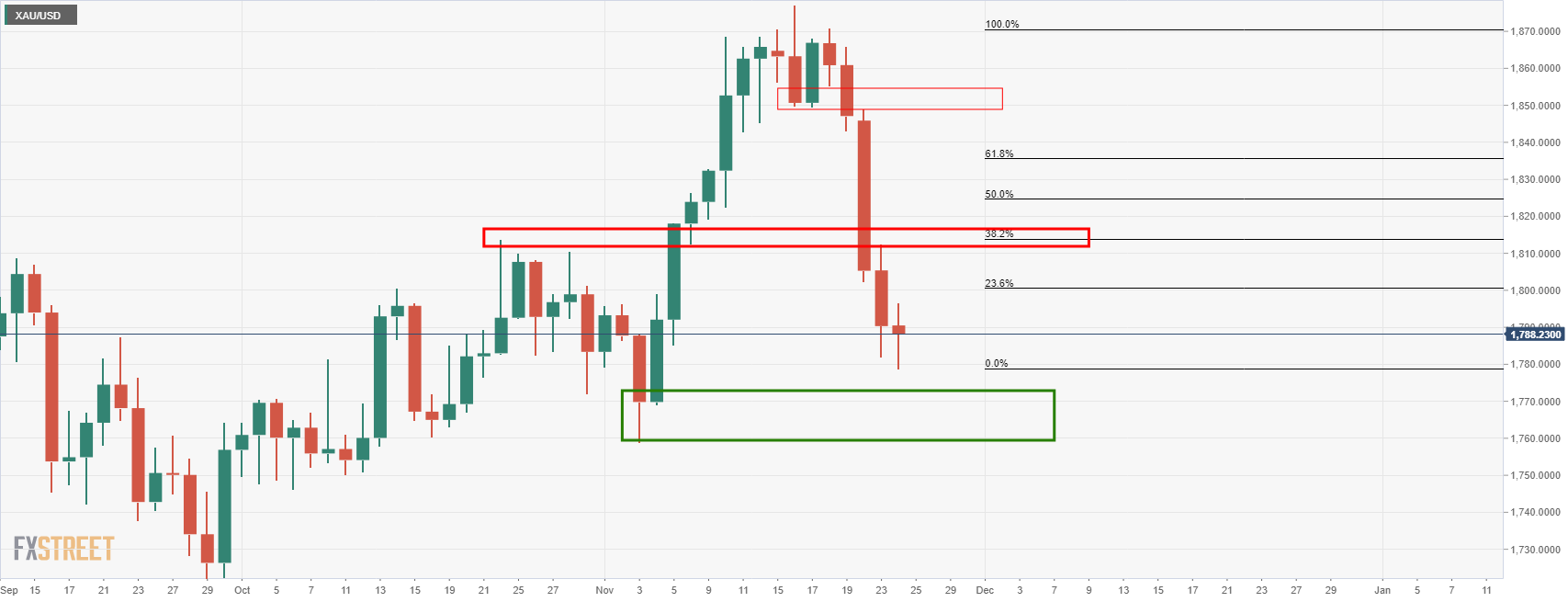

From a daily perspective, gold is in no man's land. The price is stalling but is yet to reach the level of support as illustrated above. However, given the current rejection from the day's lows, there are prospects of consolidation and that could lead to a move higher. Bulls would be looking for a meaningful correction and that brings in the 38.2% Fibonacci retracement near $1,1810. This aligns with old highs for the month of October.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.