- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EUR/USD: Bears move in and fade the correction, eye 1.1250s

EUR/USD: Bears move in and fade the correction, eye 1.1250s

- EUR/USD bears are taking on the bullish commitments as the greenback strengths.

- Coronavirus risk is abating and that is translating to a risk-on environment in markets.

- The euro is tracking the yen and CHF which are both being offloaded as flows move back into risk.

EUR/USD is back under pressure in the mid-New York session as bears fade the corrective attempts on the day. The pair trades near 1.1280 at the time of writing and is down some 0.27%. The single currency fell from a high of 1.1313 to print a session low earlier on Monday of 1.1266.

The US dollar and commodity currencies are fairing the best reassuring news on the Omicron COVID-19 variant. At the start of the week, Bloomberg reported that ''initial data from a major hospital complex in South Africa’s omicron epicentre show that while Covid case numbers have surged, patients need less medical intervention.''

Meanwhile, Omicron has now been detected in at least 24 countries around the world, according to the World Health Organization (WHO). While Omicron has spread to about one-third of US states as of Sunday, Dr. Anthony Fauci, the top US infectious disease official, told CNN that "thus far it does not look like there's a great degree of severity to it," though he cautioned that it's too early to be certain.

Nevertheless, the sentiment is more positive which is giving the US dollar a boost as markets stablise and risk currencies, such as the yen and Swiss franc bare the brunt. The euro is also pressured having picked up a bid throughout last week's turmoil which is being unwound.

The focus now shifts to consumer prices in the United States, which are projected to show the greatest annual increase in decades, putting additional pressure on the Federal Reserve to tighten policy more quickly. On December 10, US Consumer Price Index will be released and analysts at TD Securities explained that they expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease. '

'We don't expect the data to be validating in the near term,'' they said. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

In contrast, Euro zone inflation is still seen as temporary and may have already peaked, soon beginning a decline that will continue through next year, European Central Bank President Christine Lagarde said on Friday.

"I see an inflation profile that looks like a hump," Lagarde said in an interview at the Reuters Next conference. "And a hump eventually declines." "We are firmly of the view, and I'm confident, that inflation will decline in 2022," she said. Lagarde's comments came despite the eurozone hitting a record-high 4.9% last month, more than twice the ECB's 2% target. Other indicators are implying that it will only fall below that mark in late 2022, at the earliest.

This month will hold both the Federal Reserve and the European Central Bank meetings. The Fed has been clear that it is about to discuss a faster pace of tapering due to the risk of persistent inflation risks. Meanwhile, high inflation will likely complicate the ECB's crucial Dec. 16 policy meeting. Policymakers will almost certainly end a 1.85 trillion euro emergency stimulus scheme but also will consider ramping up other support measures to fill the void.

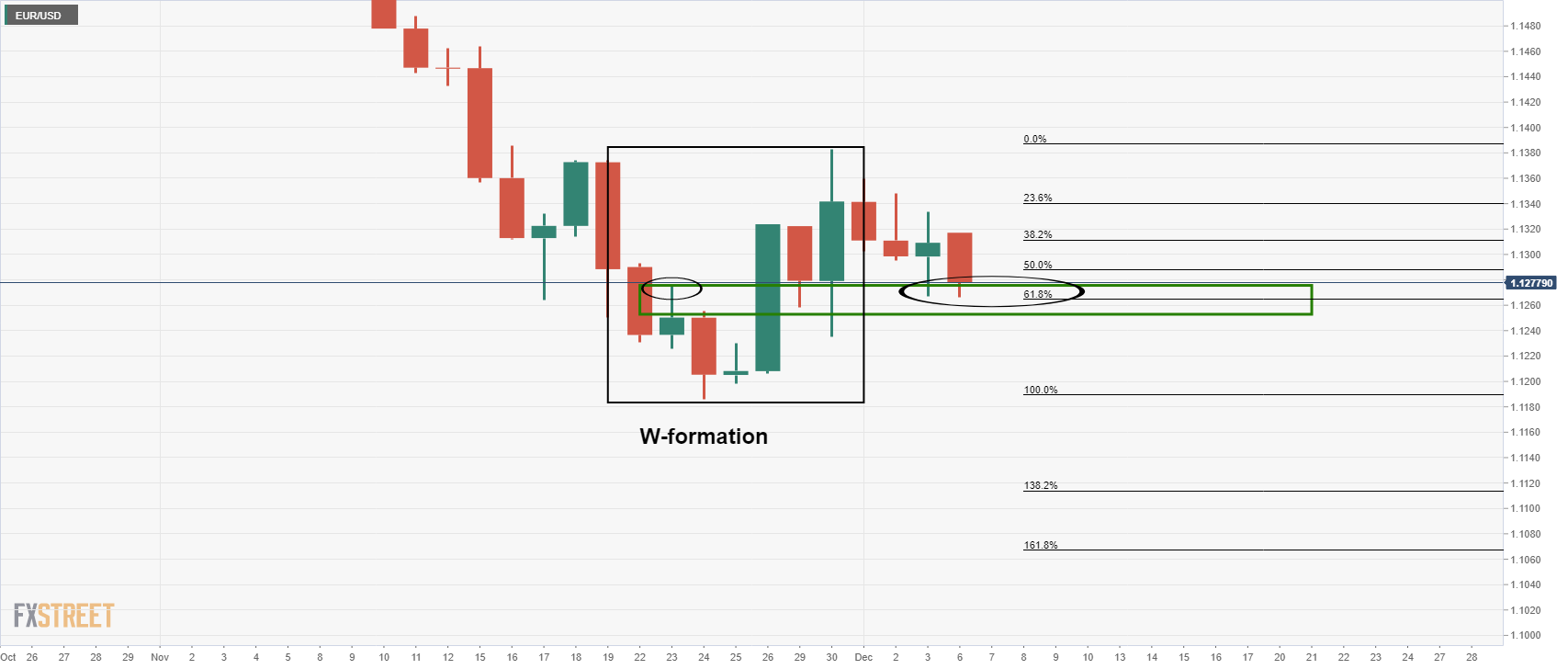

EUR/USD technical analysis

The price at this juncture would be expected to hold as this is a firm area of support. However, following a breakdown of consolidation, the bears will be seeking a move towards the 1.1250s.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.