- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- When are the UK CPIs and how could they affect GBP/USD?

When are the UK CPIs and how could they affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for November month is due early on Wednesday at 07:00 GMT. Given the recently strong employment data, coupled with the International Monetary Fund’s (MF) push to the Bank of England (BOE) for a rate hike, not to forget the Omicron crisis, today’s inflation numbers will be watched closely by the GBP/USD traders.

The headline CPI inflation is expected to rise to 4.7% YoY versus 4.2% prior while the Core CPI, which excludes volatile food and energy items, is likely to improve to 3.7% from 3.4% in November. Talking about the monthly figures, the CPI could ease to 0.4% MoM from 1.0% marked in October.

It’s worth noting that the supply crunch also highlights the Producer Price Index (PPI) for immediate GBP/USD direction. That being said, the PPI Core Output YoY may jump from 6.5% to 7.1% on a non-seasonally adjusted basis whereas the monthly prints can decline from 0.7% to 0.4%. Furthermore, the Retail Price Index (RPI) is also on the table for release, expected 6.7% YoY versus 6.0% prior.

In this regard, analysts at TD Securities said,

Headline inflation likely continued to increase in November to reach 4.8% y/y (market forecast: 4.7%). Energy prices will continue to be a significant driver of headline inflation through 2022, but we also expect core prices to be an integral driver, as we look for core inflation to reach 3.8% y/y (expecations: 3.7%)—its highest reading since 1992. However, we expect that the BoE will not hike rates in December even if inflation turns out to surprise to the upside, as the Omicron variant has introduced significant levels of uncertainty to the economic outlook.

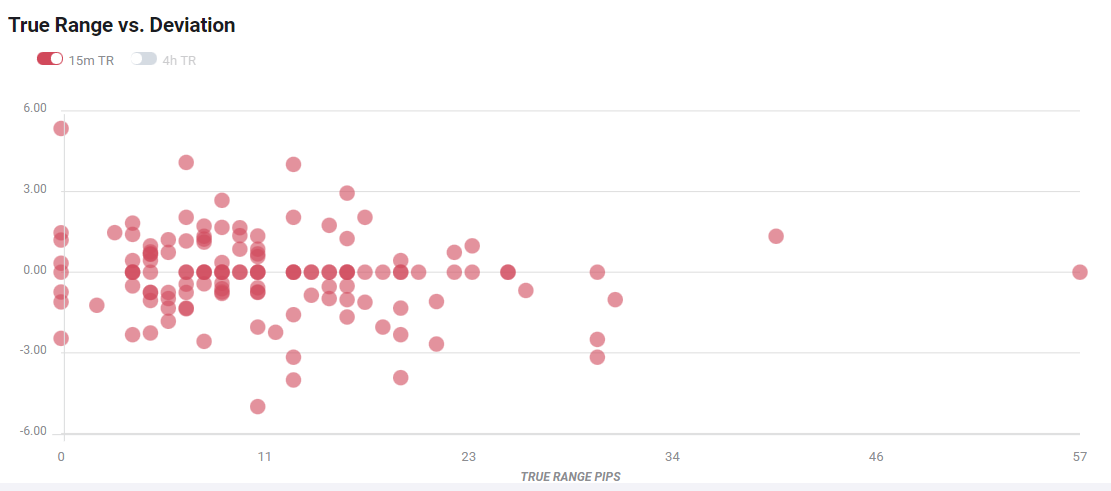

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could it affect GBP/USD?

GBP/USD extends the previous day’s rebound from weekly low, staying around 2021 bottom, heading into Wednesday’s London open.

The cable pair recently benefited from the increasing odds of the Bank of England’s (BOE) rate hike, backed by strong UK employment data and comments from the IMF. Also helping the intraday GBP/USD buyers is the US dollar pullback ahead of the key Federal Open Market Committee (FOMC) meeting.

It should, however, be noted that fears that the British hospital will soon be flooded with covid cases and the Brexit deadlock keeps the cable pair sellers hopeful.

That said, today’s inflation numbers will add to the hawkish hopes from the “Old Lady” should the outcome matches upbeat expectations. On the contrary, disappointment from the data will have additional arguments, relating to Omicron and Fed, to favor the bears.

Hence, a firmer CPI print should recall the GBP/USD buyers but a daily close past the 10-DMA level near 1.3245 becomes necessary for the pair to ignore odds of visiting the yearly low surrounding 1.3160.

Key notes

GBP/USD Price Forecast 2022: Brexit and the BOE set to pull in different directions

GBP/USD Price Analysis: 1.3250 is important for the day ahead

GBP/USD retreats towards 1.3200 on coronavirus, Brexit fears, UK inflation, Fed in focus

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.