- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- AUD/USD could get pummeled by the outcome of the Fed

AUD/USD could get pummeled by the outcome of the Fed

- AUD/USD traders await the Fed for clues with regards to the divergence between the RBA and Fed.

- Bearish head & shoulders taking shape could leave 0.70 vulnerable to a test in the coming sessions.

AUD/USD started out the New York day better bid until an avalanche of demand came in for the greenback ahead of the Federal Open Market Committee event today. At the time of writing, AUD/UD is licking its wounds near 0.7125 and up by some 0.3% still. The price has traded between a range of 0.7097 and a high of 0.7151 where it peaked just ahead of the North American session.

AUD/USD dropped 40 pips in the Wall Street open when US stocks fell, with the Nasdaq Composite leading the charge, as investors expected the Federal Reserve to unveil in the next few hours an unwinding of its highly accommodative, pandemic era policies.

''A faster taper, a higher dot-plot and more hawkish forecasts should be the hallmarks of this meeting,'' analysts at TD Securities said. ''That should cast a long shadow over the other key central bank decisions this week, leaving the USD likely in firm standing overall.''

Fed/RBA divergence to pummle AUD/USD

The commodity complex and high beta FX will be put under pressure should we get the most hawkish of outcomes from the meeting with the Fed seeking to battle stickier inflation risks. The divergence between the Reserve Bank of Australia, especially, leaves the Aussie vulnerable as a consequence.

''We expect the monthly pace to be doubled to $30bn from $15bn, consistent with QE ending in mid-March instead of mid-June,'' the analysts at TDS said. ''Officials will likely also convey a more hawkish tone through changes to the statement, the economic projections, and the dot plot. We expect the median dot to show a 50bp increase in the funds rate in 2022.''

By contrast, while inflation is increasing globally, according to the RBA, in Australia it is of a different order. The RBA has stated that the labour market scarcity and “significant” wage growth have yet to emerge before higher inflation is considered sustainable. The RBA has also argued that there is still significant slack in the Australian labour market.

''We believe it will take at least a year before the required condition of “significant” wage growth set by the RBA is met,'' analysts at Rabobank argued. The analysts note that current levels of wage growth are still well below the historic average and have much catching up to do.

AUD/USD technical analysis

The daily chart is a compelling case for the downside following the recent correction that has met a 50% mean reversion of the prior bearish run from the 0.7370s to the 0.6990s. Should the market break those lows, then the next feasible target comes near to 0.6940.

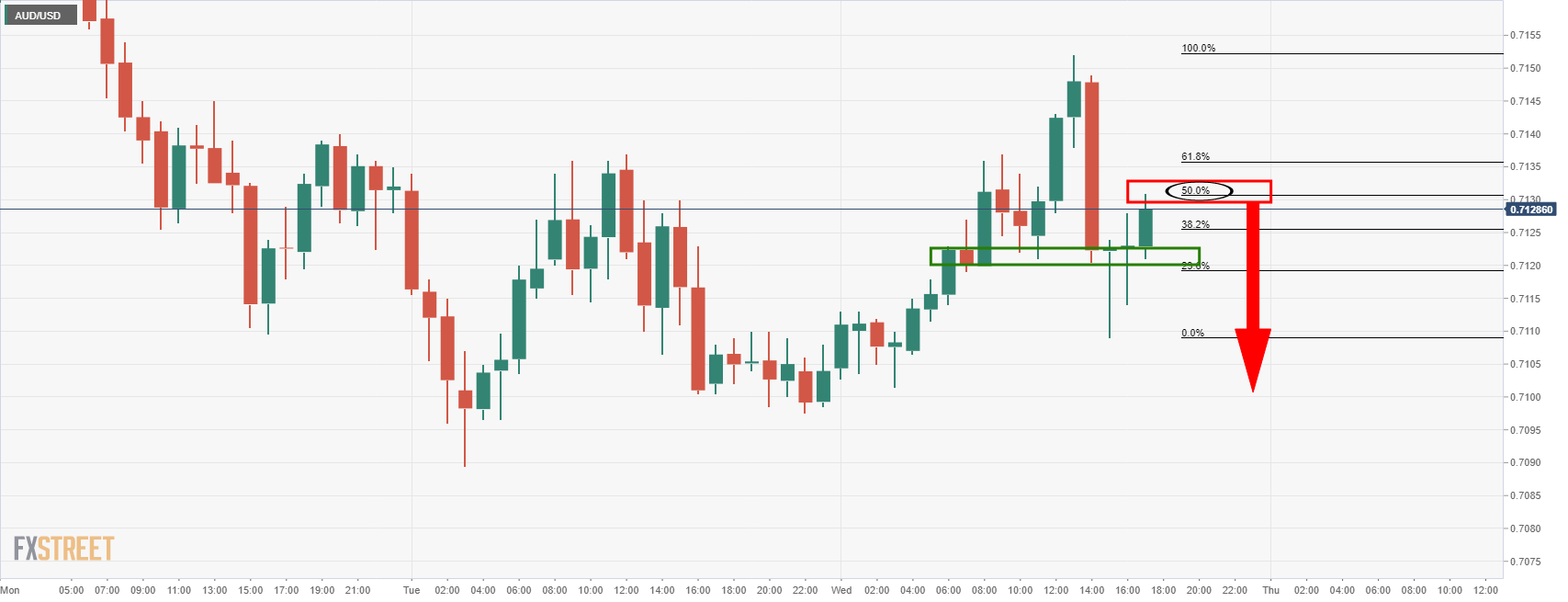

We are also seeing a 50% mean reversion of the hourly chart as follows:

A rejection here would lead to the prospects of a bearish head & shoulders and leave 0.70 vulnerable to a test on the downside in the coming sessions.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.