- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD bulls eye $1,850 for the start of the year

Gold Price Forecast: XAU/USD bulls eye $1,850 for the start of the year

- Gold is meeting a critical resistance level on the charts on a busy start to the week.

- The US calendar is key for gold traders with the FOMC minutes and NFPs.

- Gold 2022 Outlook: Correlation with US T-bond yields to drive yellow metal.

The price of gold was firm on the last trading day of 2020 and rallied some 0.77% to print a high of $1,830.38 on Friday. The yellow metal is now on track for a test of $1,850 as per the technical analysis below. However, in the meantime, there are plenty of risk events for the week ahead with a close eye on the risks associated with COVID-19.

Gold has benefited from weakness in the greenback and stronger global equities while real yields remain subdued. However, in the absence of any new marginal hawkish developments, gold might struggle to get much higher from here beyond the next layer of technical existence.

'' With precious metal markets well priced for the hawkish Fed, as noted by falling ETF holdings and skew toward short positions in the latest CFTC data, upside CTA had been the main driver keeping the yellow metal elevated,'' analysts at TD Securities explained.

However, the analysts also noted that the yellow metal could begin to lose steam so long as Fed expectations remain as status quo. ''In this sense, omicron fears and their potential impact on the economy will be a key focus in the near-term, and we would likely need to see economic weakness generate doubts that the Fed will be able to deliver on their hawkish stance for the yellow metal to maintain the recent momentum.''

In that sense, this week will reveal the minutes of the Federal Open Market Committee after the Fed's move to double the pace of QE tapering with its projection of a significantly more hawkish dot plot. Traders will be looking for clues of just how hawkish the Fed will be in the first quarter of 2022.

Additionally, US president Joe Biden's nominations for three Fed governor seats could also garner attention. At the end of the week, the US jobs market will be back in vogue with the US Nonfarm Payrolls report. ''The late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor,'' analysts at TD Securities explained.

DXY 95 the figure is key

Meanwhile, the US dollar is teasing bulls with a move to the downside in the DXY index following a break of the support near 96. There was a move all the way into 95.50s, but it still remains in the 95-97 trading range that has largely held since mid-November. This leaves 95 the figure as a major level for the start of the New Year and a critical milestone for gold should it be breached.

Gold technical analysis

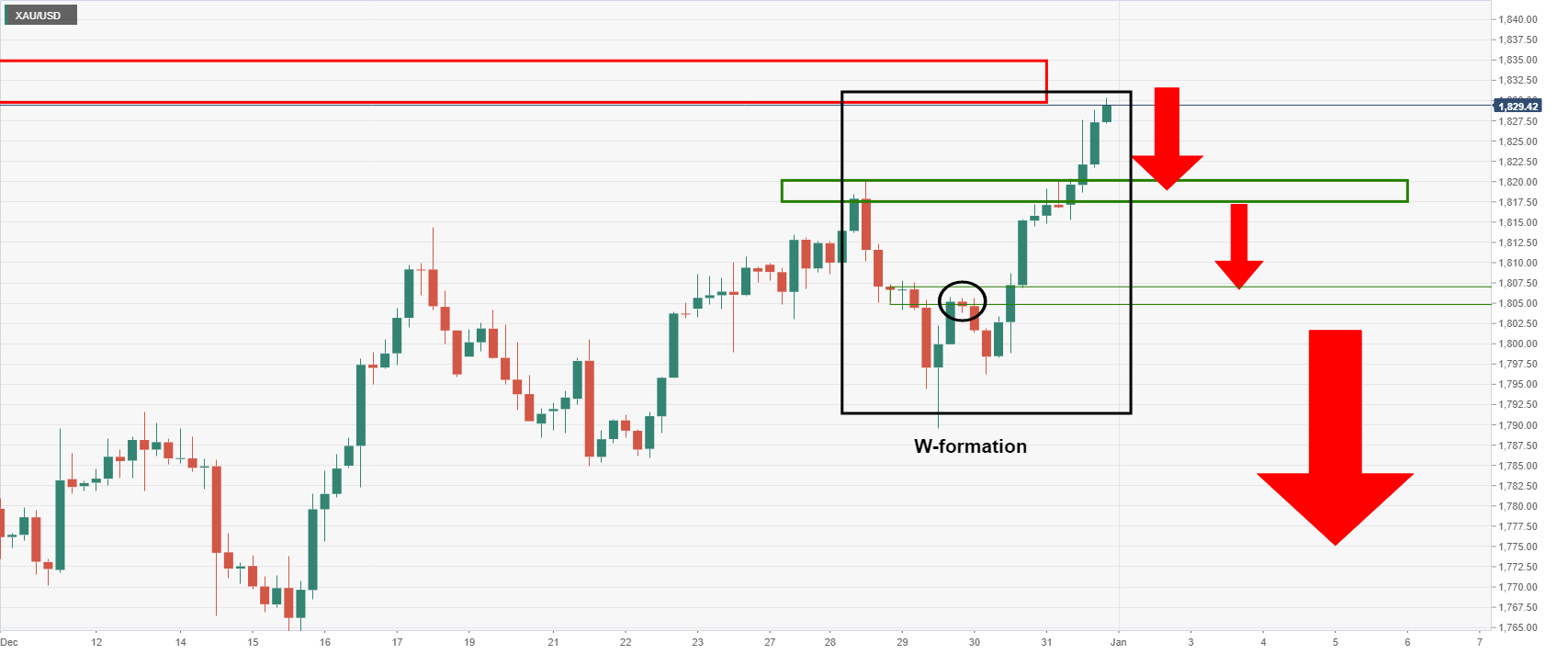

Gold, Chart of The Week: XAU/USD meeting critical resistance near $1,830

For the very near term, the focus is on the resistance and prospects for a correction as follows:

The 4-hour chart above sees the formation of a W pattern which is a reversion formation whereby the price would be expected to retest the prior highs or even the neckline of the W-formation.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.