- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Fed's Bullard: Could raise interest rates as soon as March

Fed's Bullard: Could raise interest rates as soon as March

St. Louis Fed President James Bullard said on Thursday that the Federal Reserve could raise interest rates as soon as March.

The official, known as an uber hawk and aligned with the market sentiment, explained that the Fed is now in a "good position" to take even more aggressive steps against inflation, as needed after a policy reset last month.

How comments follow yesterday's hawkish minutes and the spike in US yields and the greenback as a consequence.

In December, the Fed agreed to end its asset purchases in March and laid the groundwork for the start of rate increases that all policymakers, even the most dovish, now feel will be appropriate in 2022.

Today, Bullard explained that the Fed "is in good position to take additional steps as necessary to control inflation, including allowing passive balance sheet runoff, increasing the policy rate, and adjusting the timing and pace of subsequent policy rate increases," Bullard said in prepared remarks to the CFA Society of St. Louis.

''Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments," Bullard said.

The tone reinforces the idea that an initial rate increase could be approved "as early as the March meeting.

Reuters explained in a note following Bullard's comments that ''projections issued in December showed half of the Fed policymakers expect three quarter-percentage-point rate increases will be needed this year.''

''Inflation is now running at more than twice the Fed's 2% target, and Bullard said that the inflation 'shock' experienced by the country means the central bank should be able to satisfy its inflation targeting goals now for several years to come.''

Covid will not throw Fed of course

Additionally, Bullard said he did not think the current wave of cases would throw the US economy or the Fed off course.

He explained that Infections in the United States "are projected to follow the pattern where the variant was first identified," while citing projections that daily case counts may peak late this month.

Key notes

St. Louis Fed's Bullard says the first interest rate hike could come in March.

Bullard says the Fed is now in a 'good position' to address inflation with rate increases, balance sheet runoff if needed.

Bullard says expects omicron infections to peak late this month, following a path similar to that seen in South Africa.

Bullard says the recent inflation shock means Fed's average 2% target should be met for next several years.

Bullard says focus on returning US labour force participation to pre-pandemic levels ignores trend decline.

US dollar remains in a familiar consolidated range

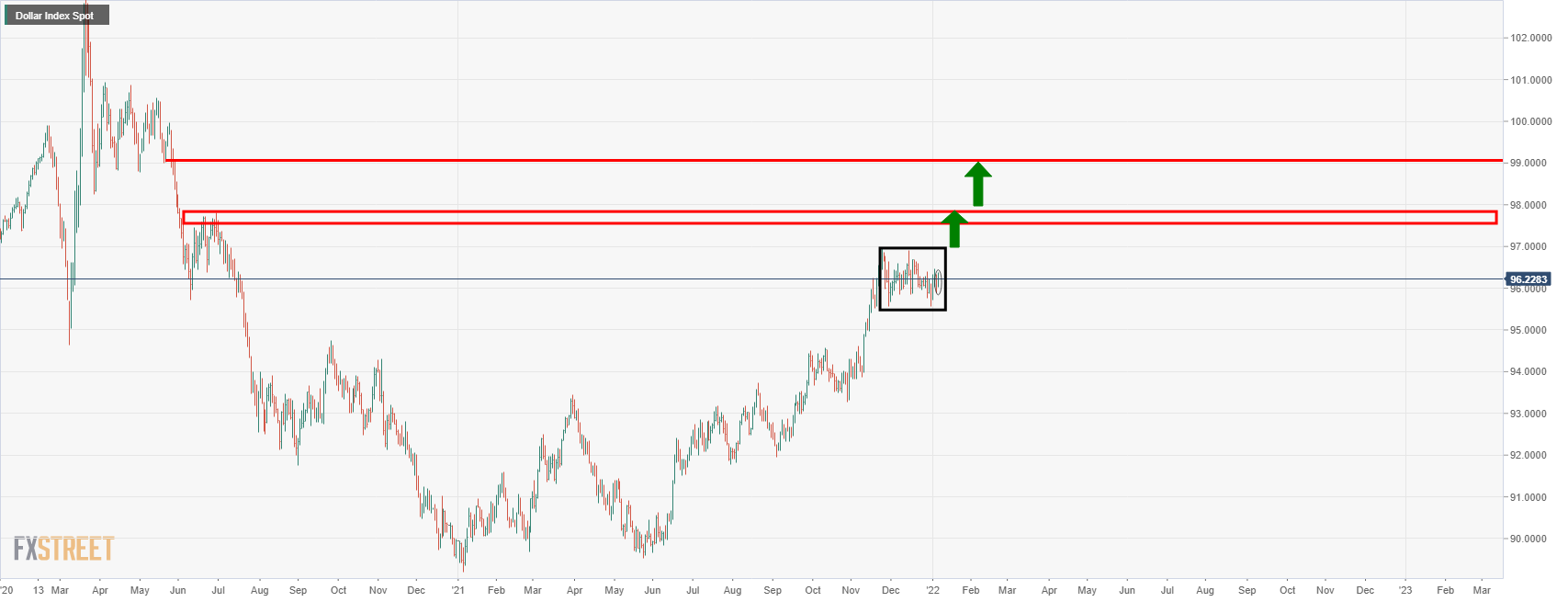

Despite the hawkishness, the greenback remains in the familiar consolidation on the daily chart.

However, if this is a phase of reaccumulation, then 98 the figure and then 99 the figure would be expected to be revisited in due course:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.