- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/CAD bears remain on top desite hawkish Fed, oil prices and BoC support CAD

USD/CAD bears remain on top desite hawkish Fed, oil prices and BoC support CAD

- USD/CAD bears are in control and eye a significant downside breakout.

- BoC and Fed are driving NA yields higher and the oil is supporting the CAD also.

Of the dollar bloc currencies, NZD, AUD and CAD, the latter is outperforming by a mile. In fact. ot is the only one that is higher vs the US dollar despite the uber hawkish surprises in the Federal Open market Committee minutes on Wednesday. The following details some of the factors going into the bull trend of the CAD.

At 1.2716, the price in Asia is flat and is stuck in a tight 1.2715 1.2730 range so far for the day. The day ahead will be busy with the North American jobs market's in focus so this could be the quiet before the storm in that regard.

Meanwhile, the Federal Reserve has laid the groundwork for its initial tapering decision and the accelerated QE wind-down suggests rates will rise in the first half of this year, perhaps as soon as March.

The US dollar knee-jerked higher following Wednesday's minutes into offers which enabled the CAD t run higher as the market took profits in the greenback. However, in the middle of the US session, the greenback made a slight comeback and the bulls cheered affirmations from St. Louis Federal Reserve Bank President James Bullard who said that a rate increase as early as March was on the table.

"The FOMC is in (a) good position to take additional steps as necessary to control inflation, including allowing passive balance sheet runoff, increasing the policy rate, and adjusting the timing and pace of subsequent policy rate increases," Bullard said.

"With the real economy strong but inflation well above target, US monetary policy has shifted to more directly combat inflation pressure," Bullard said, adding that he expects cases of the omicron variant to slow in the coming weeks.

As a result, the FOMC could decide to increase rates sooner and faster than previously expected, Bullard said, echoing statements in the FOMC minutes of the December meeting released on Wednesday.

"The FOMC could begin increasing the policy rate as early as the March meeting in order to be in a better position to control inflation," Bullard said. "Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments."

BoC in focus

This sentiment has sunk the likes of the Aussie yet the CAD thrives. It is down to central bank divergences.

Net speculators’ CAD net short positions have been dropping back and the strong November Canadian jobs report from last month supported the talk of a spring 2022 Bank of Canada rate hike. The BoC would be expected to take the long view and signal rate hikes are coming even with some covid restrictions being reintroduced.

Overall, policymakers expected to view Omicron as a short-term speedbump so there could be some fellow hawkishness to continue with the BoC’s January meeting, likely to signal upcoming rate hikes. The Canadian 10 -year yields have climbed to the highest level since November this week from 1.4250% to a 1.7180% high as a consequence.

''The BoC will provide an early litmus test on how central banks are managing evolving Omicron risks,'' RBC economic wrote in a note recently. ''Even with containment measures set to slow Canada’s recovery early this year, we think the BoC will lean hawkish in January and lay the groundwork for near-term rate increases.''

Canadian data a positive for CAD

Overnight, the Canadian trade balance printed above the market forecast at $3.1bn in November (market: $2bn, TD: $3bn), with both exports (+3.8%) and imports (+2.4%) posting decent gains on the month. ''Export strength was broadly based (8 of 11 categories up), and the expected boosts from autos (+4%) and energy (+2.8%) did materialize. In volume terms exports were up 3.5% while imports rose by 0.8% m/m, while in geographical terms the boost in the trade balance reflected increased trade with the US,'' analysts explained.

This is good news, especially in light of the rise of the oil price, one of Canada's biggest incomes. ''Rising geopolitical and operational risks are driving prices higher, despite OPEC+ agreement to raise output by 400k bpd next month,'' the analysts at TD Securities noted,

Meanwhile, the dual employment reports will be the focal point for the day ahead.

''While we are broadly in line with the market for Canadian jobs, we think a positive surprise (particularly on wages) could impact the CAD and OIS pricing (raising odds for January). We look for labour market gains to moderate with 30k jobs added in December, well below the 6m (126k) trend, which should leave the unemployment rate stable at 6.0%.'' the analysts at TD Securities explained, adding, ''we like the risk/reward of legging into CAD longs ahead of this month's BOC meeting.''

USD/CAD technical analysis

As per the prior analysis, USD/CAD Price Analysis: Bears get their discounts, now need to break critical 4-hour support, the CAD is firm and it has marked the price action on the daily chart as follows:

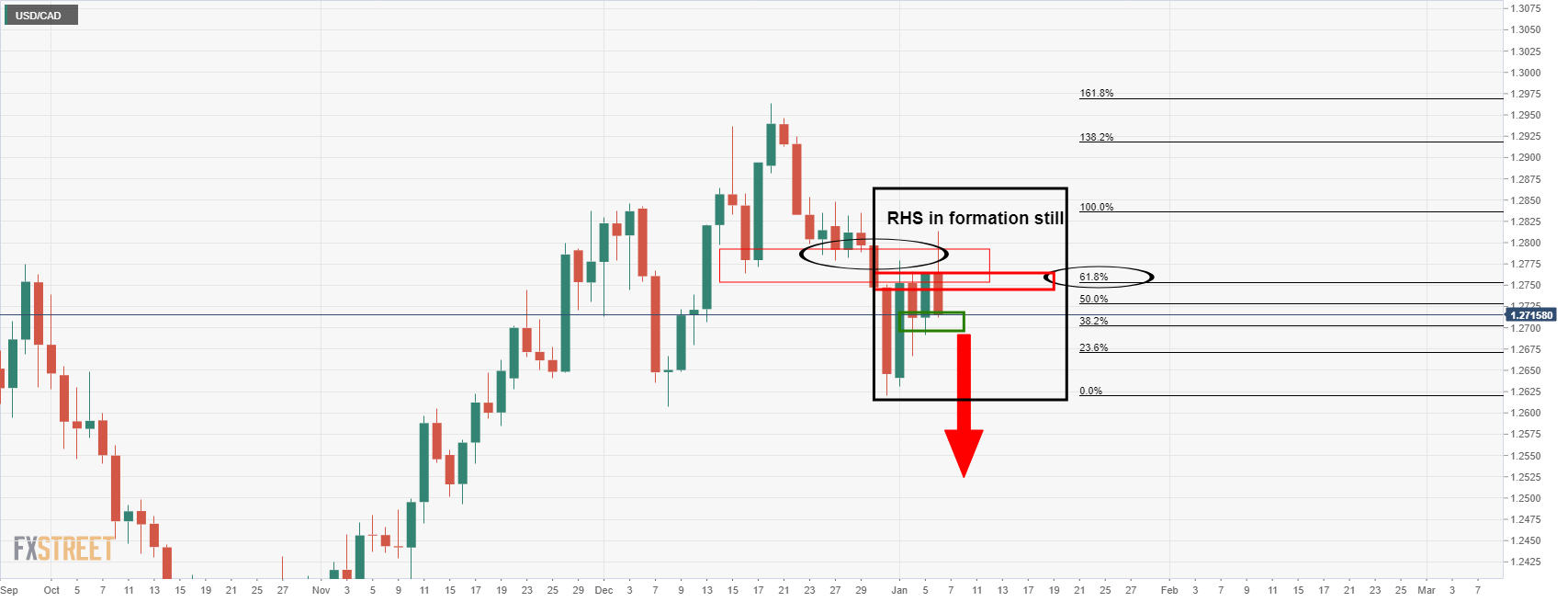

The right-hand shoulder (RHS) of the head and shoulders is taking shape. We now need to see a break out below the 4-hour support for a run to the H&S neckline between 1.2620 and 1.2600:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.