- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/EUR bounces off three-week low under €1,600 as Euro eases on mixed concerns

Gold Price Forecast: XAU/EUR bounces off three-week low under €1,600 as Euro eases on mixed concerns

- Gold snaps three-day downtrend in Euro terms amid sluggish markets.

- Fears of faster Fed rate hike, virus woes underpin USD rebound and weigh on the bloc’s currency.

- Light calendar, off in Japan adds strength to the market’s consolidation.

Gold (XAU/EUR) pares recent gains around €1,583 heading into Monday’s European session. In doing so, the yellow metal prices in Euro terms rise for the first time in four days, not to forget mentioning the rebound from the lowest levels last seen on December 16, flashed the previous day.

Although market sentiment stays sluggish amid mixed concerns and a light calendar, not to forget the holiday in Japan, Euro remains on the back foot as the US dollar consolidates Friday’s losses. On the same line could be the Fed versus ECB battle, which recently gained attention from the International Monetary Fund (IMF). “Emerging economies must prepare for U.S. interest rate hikes, the International Monetary Fund said, warning that faster than expected Federal Reserve moves could rattle financial markets and trigger capital outflows and currency depreciation abroad,” per Reuters.

The old continent’s currency gained the previous day, dragging the XAU/EUR towards a refreshing multi-day low, after Eurozone inflation firmed versus the mixed prints of the US jobs report. That said, the US Dollar Index (DXY) dropped the most in six weeks on Friday after the headline US Nonfarm Payrolls (NFP) disappointed markets with 199K figures for December versus 400K forecasts and 249K prior (upwardly revised from 210K).

On the other hand, the first readings of the Eurozone CPI for December offered a positive surprise of 5.0% while crossing the previous month’s figure of 4.9% and 4.7% market consensus. As the inflation figures reached the highest level since the early pandemic days, EUR/USD bulls recollect Thursday’s comments from European Central Bank Chief Economist Philip Lane to tighten the grips. Following that, ECB board member Isabel Schnabel said on Saturday, “Rising energy prices may force the European Central Bank to stop ‘looking through’ high inflation and act to temper price growth.”

Against this backdrop, stock futures in the US and Europe post mild gains, following a downbeat start to the week, whereas Antipodeans keep Friday’s upside momentum.

It should be noted that the scheduled release of the US Consumer Price Index (CPI) for December, on Wednesday, highlights the inflation fears and help the greenback to recover some losses during the light calendar day, which in turn may weigh on the XAU/EUR prices. Though, strong recovery in German Bund yields could challenge the gold prices in Euro terms.

Read: Inflation and geopolitics in the week ahead

Technical analysis

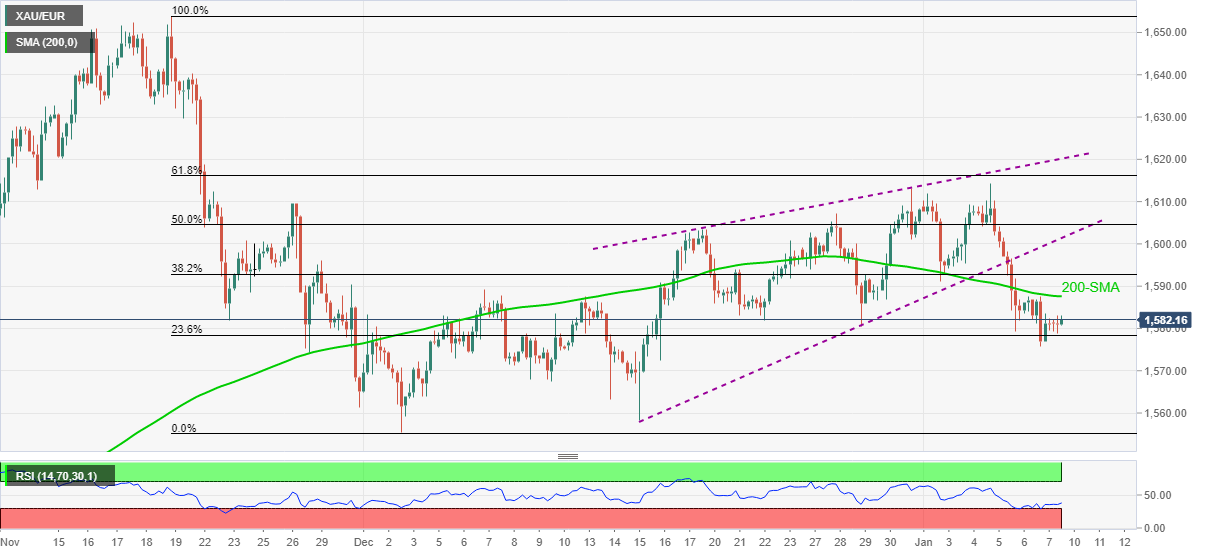

Although 23.6% Fibonacci retracement (Fibo.) of November-December downtrend, around €1,578, restricts XAU/EUR’s short-term downside, confirmation of the rising wedge bearish pattern on the four-hour (4H) chart joins sustained trading below 200-SMA to favor sellers.

It should be noted, however, that nearly oversold RSI conditions hint at a further corrective pullback of gold prices in Euro towards the 200-SMA level near €1,590.

Following that, the support-turned-resistance line of the short-term wedge, around €1,600 by the press time, will be crucial to watch for the commodity buyers.

Alternatively, a downside break of the 23.6% Fibo. level near €1,578 will quickly direct the quote towards the last month’s bottom surrounding €1,555.

In a case where XAU/EUR keeps the reins past €1,555, November’s low near €1,519 could tease the bears.

XAU/EUR: Four-hour chart

Trend: Bearish

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.