- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- GBP/USD drops into daily support structure in session lows

GBP/USD drops into daily support structure in session lows

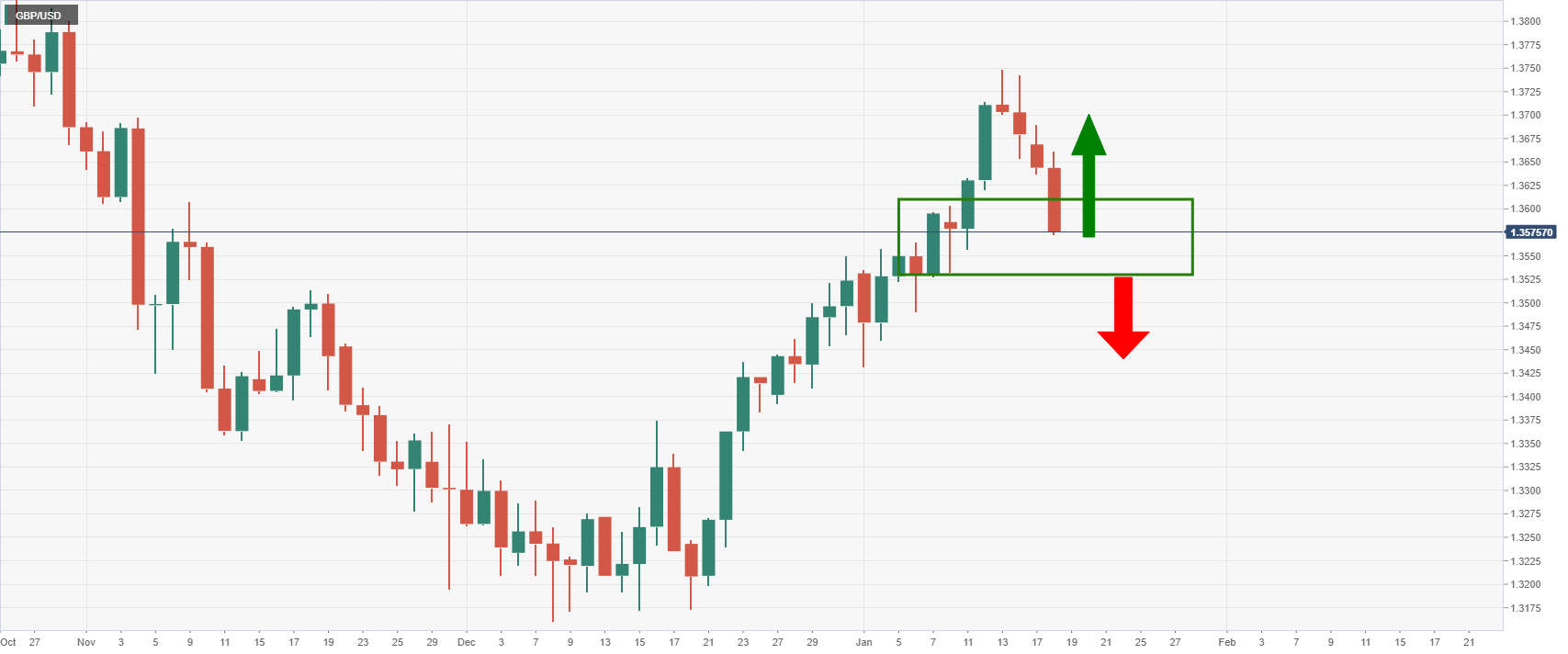

- GBP/USD sinks into critical demand territory as the dollar finds demand on a spike in US yields.

- A break below 1.3530 opens risk to the January 3 low a cent lower near 1.3430.

At 1.3574, GBP/USD has fallen some 0.51% on Tuesday from a high of 1.3661 to a fresh low of 1.3573. The surge in US Treasury yields has lifted the US dollar out of the doldrums while UK politics weighs on the tainted British currency as well.

Firstly, benchmark US Treasury yields jumped to two-year highs and major equity market indexes dropped more than 1% on Tuesday as traders braced for the Federal Reserve to be more aggressive in tightening monetary policy to tackle inflation.

The US dollar struck a six-day high following the jump in Treasury yields. The US 10-year yield also hit a two-year peak of 1.866% overnight. In line with Treasury yields, the dollar strengthened against a basket of currencies, hitting a one-week high of 95.83 DXY.

UK politics in focus

The UK's prime minister Boris Johnson is caught up in the ''Partygate'' scandal for which he has denied any wrongdoing and has lied to parliament about a lockdown party. His premiership is under threat. The uncertainty is a negative factor for the pound which is already pressured over European politics in the Brexit saga.

However, in the coming few months ahead, Johnson's popularity and sterling's robustness will be scrutinised once again when local elections are held across England, Scotland and Wales on May 5. A civil investigation in Partygate is underway but it is broadly accepted across the party that removing Johnson before this date would be extremely dangerous, as no one could be certain what the consequence would actually be. This could bring some solace to the pound.

Meanwhile, Brexit is a potentially bigger risk for the pound. despite Truss’ first meeting with EU officials seeming to indicate somewhat of a less confrontational approach, the discussions over the Northern Ireland protocol are still set to prove challenging.

As for UK economic data, British employers added a record number of staff in December failed to prop up sterling, despite the Unemployment Rate that fell slightly to 4.1% (vs. expectations: 4.2%). Both headline and ex-bonus wage growth continued to fall as more base effects disappear from the data, with headline wage growth falling slightly.

''Employment data for the three months ending in November continued to confirm the MPC's view that the transition from the furlough scheme went relatively smoothly,'' analysts at TD Securities explained.

''Moreover, vacancies rose to a record high, further highlighting the tightness of the labour market, and flash December PAYE data shows further signs of strength as it registered +184k despite effects from Omicron.''

''The Bank of England will now turn to tomorrow's inflation release, but as it stands, this labour report should pave the way for another rate hike in February—in line with our expectations—especially as Omicron appears to have had a relatively benign impact on the economy compared to previous waves.''

Casting minds back, in December, the BoE became the first major central bank to raise interest rates since the pandemic took hold in 2020. In response, the cable managed to rally over 4% from its December lows, but has lost ground in the last three sessions.

"Expectations have already run quite far," wrote Commerzbank analyst You-Na Park-Heger.

BoE eyed

She explained that there will be attention paid to what the BoE governor Andrew Bailey has to say on Wednesday when speaking to the Treasury Select Committee when inflation data is also due.

Traders will have noted that Gross Domestic Product data on Friday showed that the UK economy was better off than before the first COVID-19 lockdown which can help to underpin the pound as traders wait to see what will come of the BoE's monetary policy decisions in the coming months.

However, the latest positioning data shows that GBP net short positions have dropped back sharply from their recent highs following the 15 bps December rate hike from the BoE.

''The money market is still positioned for a fair amount of tightening next year though the fact that speculators are still net short of GBP still suggests that some types of investors remain sceptical of its outlook,'' analysts at Rabobank explained.

On the other hand, as analysts at Brown Brothers Harriman point out in a note today, ''WIRP suggests over 90% odds of another hike February 3, followed by hikes at very other meeting that would take the policy rate to 1.25% by year-end.'

The analysts at BBH said that they ''think this pricing overstates the BOE’s need to tighten, as headwinds abound from Brexit, higher energy costs, and fiscal tightening. ''

''Along the way, Quantitative Tightening will also kick in as the policy rate moves higher. The hawkish BOE outlook that had helped sterling outperform is getting crowded out a bit lately by the more hawkish Fed outlook. ''

GBP/USD technical analysis

Cable is down three straight days:

A break below 1.3530 opens risk to the January 3 low a cent lower near 1.3430.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.