- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: Bulls stay in control and take on the $1,850s ahead of the Fed

Gold Price Forecast: Bulls stay in control and take on the $1,850s ahead of the Fed

- Gold moves into a key psychlogical area on its northerly trajectory.

- The Fed is what counts for the forthcoming sessions.

Gold (XAU/USD) has rallied on Tuesday, adding around 0.5% to the scale after climning from a low of $1,834.95 to a high of $1,853.88 so far. The US dollar has come under pressure after reaching a a two-week peak over tensions between Russia and the West. However, there was a five-year Treasury auction that has weighed on the US dollar considering the bond market's appatite for US Treasurys at the current coupon.

The angst in centrak Asia took a back seat today to the outcome of the Federal Open Market Committee's two-day meeting that draws to a close on Wednesday. Investor were expecying the Fed to announce the end of QE prematurely and signal a readiness to hike in March.

In turn, there was a focus on today's 5-year Treasury auction. The bid-to cover ratio was high and so too was the yield wth the US selling 5-year notes at 1.533% vs WI 1.547%on a $55 billion sale. That was the highest yield since October 2019. The prior was 1.263% and the bid to cover at 2.50 vs 2.41 prior. This indicates that the market could be pricing the Fed too hawkish for the medium term. This is a bullish theme for gold.

Moreover, markets will be looking to take profit in the Fed which could be playing out in the reenback as we apprach month end as well. Given the recent rout in markets, a growing cohort of participants will be hoping that the Fed will manage to provide a soothing tone for markets.

''Considering that Chair Powell's primary goal is to prevent a de-anchoring of inflation expectations, it's unlikely that the Fed will pivot from their plan to start hiking rates as soon as March, and start quantitative tightening soon after,'' analysts at TD Securities argued.

''Certainly, markets have priced-in a March hike for some time, which takes the sting out of this form of tightening, but participants have begun to question whether the strike on the Fed's put is further from the market in a regime where the central bank is battling inflation.''

''In this context,'' the analysts said, ''evidence that quantitative tightening might be more impactful for asset prices suggests that the Fed could still eventually use this tool to manage the strike on its put, without necessarily causing undue harm to its primary objective of keeping inflation expectations bounded. For precious metals, this signals few immediate avenues for relief.''

The analysts exlained that ''while gold ETFs recorded massive inflows, these may have been distorted by options-related activity, with the concurrent rise in volatility suggesting only some additional safe-haven flows.

The evidence continues to overwhelmingly point to Chinese purchases as the single largest source of inflows, which are vulnerable with Lunar New Year around the corner. CTA trend followers are set to liquidate some gold length should prices break below $1815/oz.''

Gold and US dollar technical analysis

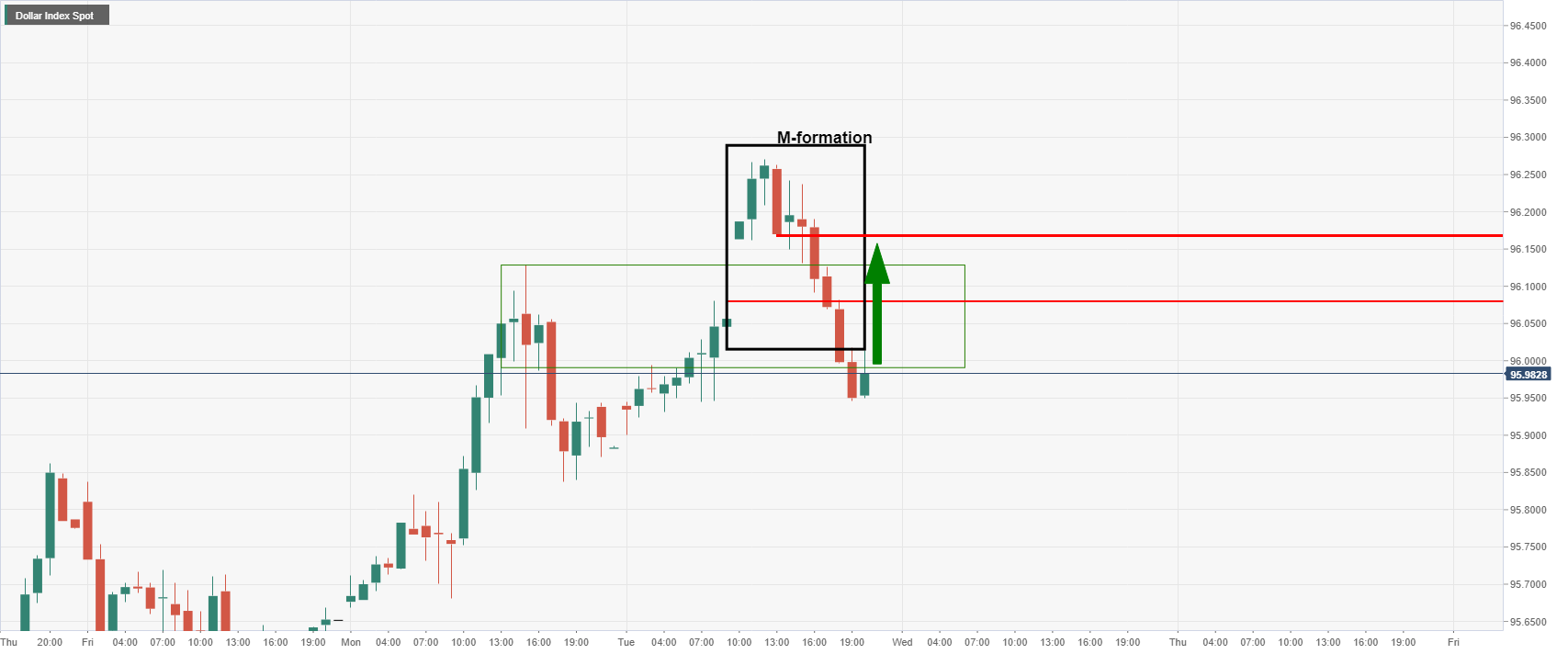

Firsltly, the US dollar could be finding a bid here and the Russian risks remains a supporting factor:

Additionally, the M-formation is a reversion pattern, so a move higher in the greenback could infold in coming hours as markets get set for the Federal Reserve. Therefore, runaway gold prices may not be in strore for the immeaduate future.

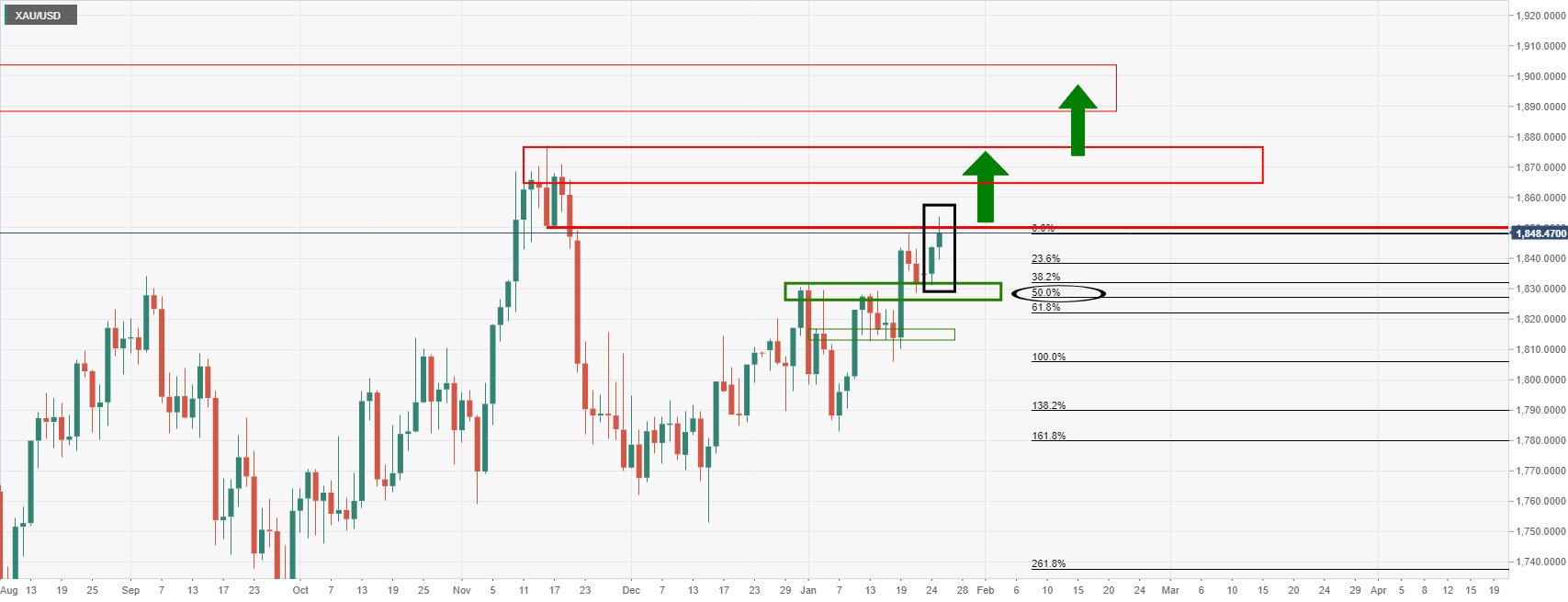

Meanwhile, as per the start of the week's analysis, Chart of the Week: Bulls pining for $1,850+, could be just a Fed away, the bulls have reached the psychological $1,850 target. This was forcasted to leave the bulls in good stead towards the $1,870's as last major defence for the $1,900s:

Gold's prior analysis

Gold live market, daily chart

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.