- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EUR/USD: Fed's relatively dovish statement fails to move the needle out of familiar territories

EUR/USD: Fed's relatively dovish statement fails to move the needle out of familiar territories

- The Fed disappoints the US dollar bulls with a benign outcome in the statement.

- EUR/USD sits around pre-event levels awaiting Fed's chair Powell.

The Federal Open Market Committee's two-day meeting has concluded on Wednesday and the statement has been released along with the Fed's interest rate decision in a highly anticipated event for financial markets.

Markets were expecting the Fed to give guidance on asset purchases that were expected to conclude in March. However, traders were looking for hints around the starting point for QT or "sooner" and "faster" on hikes.

Fed's statement, key takeaways

A rather mixed and fairly dovish statement ticked some of the boxes as follows:

As expected, the benchmark interest rate was unchanged; The Target Range stands at 0.00% - 0.25% - Interest Rate on Excess Reserves is also unchanged at 0.15%.

There were no mentions of early rate hikes, let alone a 50bp hike (which some analysts have been expecting).

QE is not indicated to end early either and that the balance sheet shrinking would start after rate hikes commence.

The Fed has warned that soon it will be appropriate to raise rates.

The Fed has stated that both the economy/employment have strengthened and that jobs gains are solid.

"Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses," is an unchanged statement that indicates we are no closer to lift off than of the prior meeting.

Subsequent to this statement, Fed's funds futures are looking for four rate hikes for this year.

EUR/USD: Reaction and technical analysis

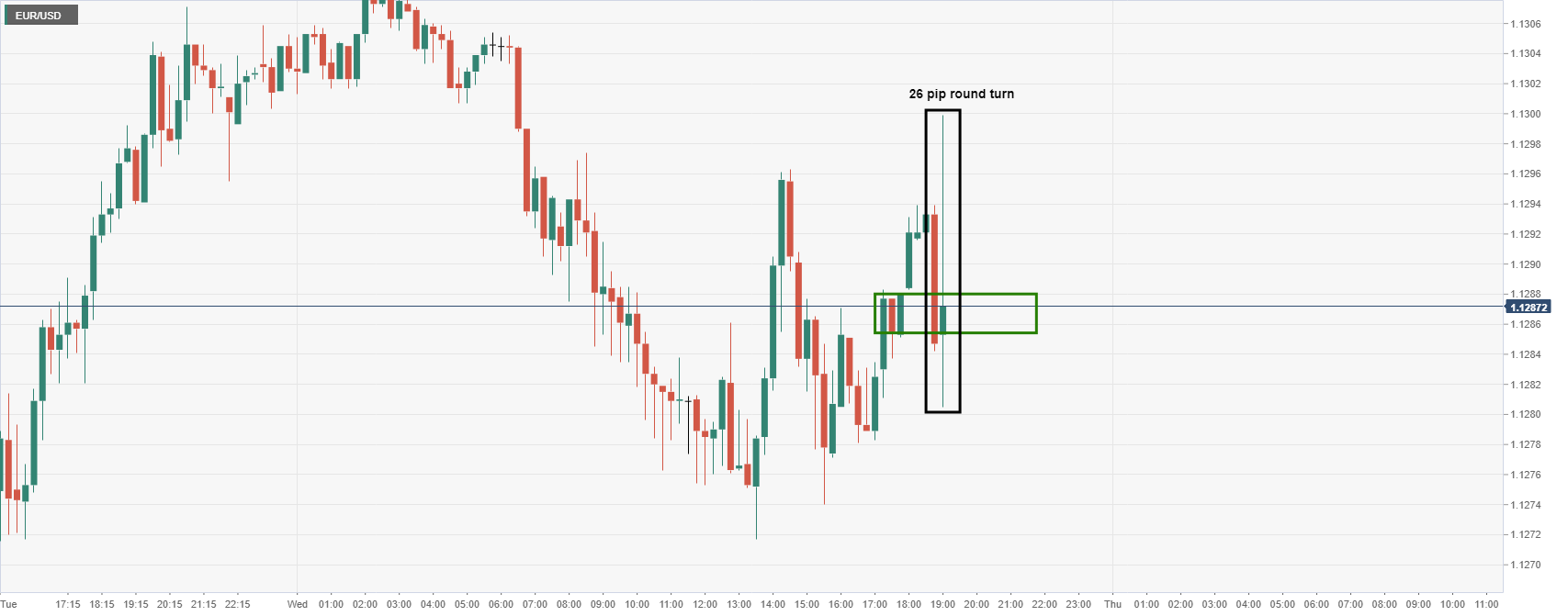

Following the Fed's statement, EUR/USD has made a round trip of between 26 pips and is pretty much stationed to where it was before the release:

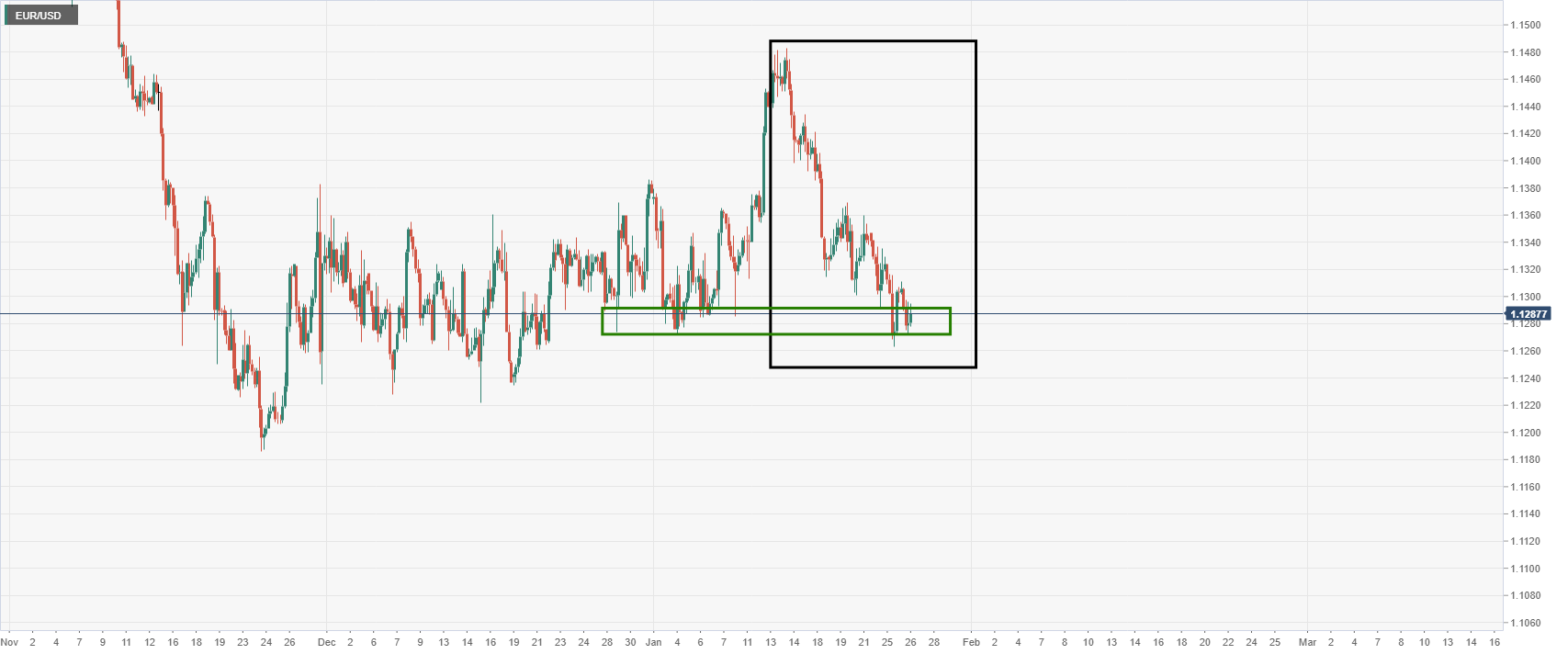

Meanwhile, the euro recently denied bulls an extension to and through the 1.15 psychological level when reaccumulation failed to play out following the breakout of the late 1.13 area near 1.1390:

Instead, the price plummeted back into the consolidation area, weighed heavily by risk-off markets due to geopolitical angst over tensions between Russia and the Ukraine:

Given that the statement is leaning slightly dovish compared to some of the more hawkish expectations in the markets, the US dollar could continue to struggle in the event that geopolitical angst abates. The euro would be expected to benefit in a pick up of risk apatite in global equities as well. EUR/USD bulls will need to get back above 1.13 the figure though...

Meanwhile, the markets will now look for clarity from the Fed's chair, Jerome Powell. His comments could provide volatility for EUR/USD traders:

Watch Live: Fed's chair, Jerome Powell

Jerome Powell, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 19:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.