- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/CAD bears are seeking discounts between 1.2720/2750

USD/CAD bears are seeking discounts between 1.2720/2750

- USD/CAD is moving on a significant portion of the start of the week's supply.

- USD/CAD Bears monitoring the hourly time frame for optimal entry as a discount.

USD/CAD is under pressure at the start of this week and at 1.2707, begins a new trading day in bearish territory on the lower time frames. The greenback was sliding on Monday and the Canadian dollar strengthened as a consequence. USD/CAD fell from near 1.2780 to a low of 1.2681 and now finds resistance in a correction of Monday's downside around 1.2720.

Meanwhile, there are a number of factors related to the loonie which are being priced, from the rise in oil prices, better trade terms between Canada and the US in terms of lumbar, global equities and central banks. For instance, the Bank of Canada Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers will appear on Wednesday before the Senate banking committee. Last Wednesday, the central bank left its benchmark interest rate on hold at a record low of 0.25%. However, the noise that followed the event has been very hawkish.

"We're starting at ultralow. And it's clear we need to move up,'' Bank of Canada's governor Tiff Macklem said in a subsequent interview with Globe & Mail.

''At first, I think the implications are fairly obvious for interest rates. The further down the path you get, the more finely balanced those decisions will become, the more data-dependent they will become," Mr. Macklem said, seeming to suggest the first few hikes could happen soon.

Later today, we will see the Reserve Bank of Australia's first statement for 2022,'' with significant changes in the outlook likely and a decision to end QE expected,'' analysts at ANZ Bank said.

''With regard to forward guidance, we note that the Board’s December statement removed any specific date reference about the timing of rate hikes,'' the analysts added. ''Rather, the statement ended by saying that for inflation to be sustainably within the 2-3% band requires 'the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time and the Board is prepared to be patient.' A similar formulation in today’s statement will be seen as pushing back against market expectations of near-term hikes.''

In this light, equity markets have started the week supported by greater clarity on the Federal Reserve's policy normalisation path and buoyed by central banks’ focus on securing a sustainable business cycle. s a consequence, the broader market's tone, which is suggestive of risk appetite is supporting the commodity sector.

Oil prices and yield spreads remain supportive of the Canadian dollar in this regard. West Texas Intermediate crude oil rose to a fresh seven-year high on Monday, pushed up by continuing worries over the security of supply as Russia, the world's No.2 oil exporter, continues to threaten Ukraine.

Meanwhile, the recent news that the US has lowered duties on Canadian lumbar is also a positive factor for the loonie. The US Commerce Dept today issued its third administrative review of duties on Canadian lumber and lowered the rate to 11.64% from 17.99%.

As for positioning, speculators have raised their bullish bets on the Canadian dollar to the highest since July last year, data from the US Commodity Futures Trading Commission showed on Friday.

Looking ahead, Canada's jobs report for January, due on Friday, could provide further clues on the outlook for interest rates.

USD/CAD technical analysis

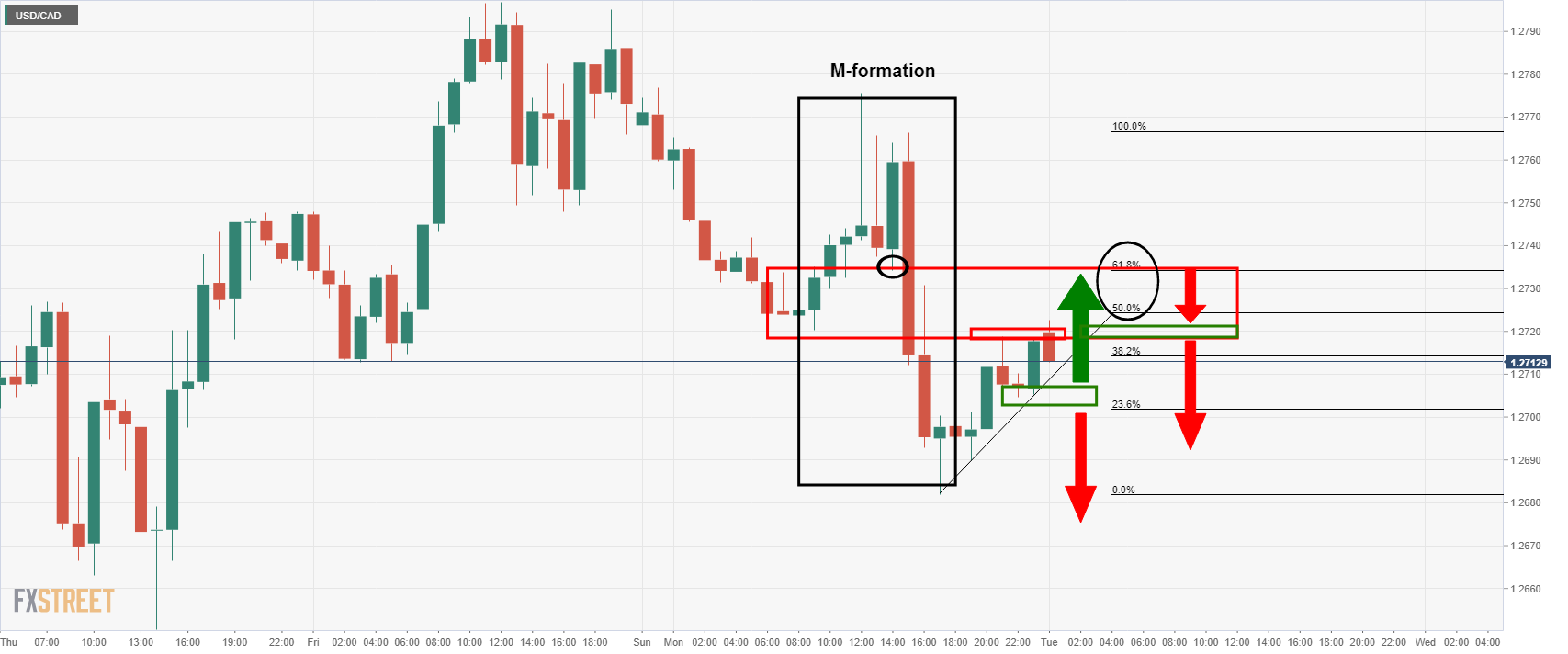

The price is rising in stages towards the neckline of the M-formation on the hourly time frame which has a confluence of the 61.8% Fibonacci retracement level of the prior bearish impulse. First, the bulls need to get past the current resistance near the highs of 1.2722. If this or the 61.8% ratio were to hold initial tests, the bears could start to engage at a discount (near 1.2720/2750) and force a fresh wave of supply to the downside for the coming hours. On the other hand, the price could continue higher if the neckline gives way towards 1.2780 tests.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.