- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: Bears wait in the flanks below counter-trendline daily resistance

Gold Price Forecast: Bears wait in the flanks below counter-trendline daily resistance

- Gold holds in a corrective territory on the daily chart as markets remain in anticipation of NFP.

- The US dollar has been pressured to start the week by a chorus of less hawkish Fed remarks.

At $1,800, gold, XAU/USD, is consolidating within a bullish correction on the daily chart after hitting a 38.% Fibonacci retracement level in Tuesday's trading. The yellow metal has benefitted from a switch in risk appetite and less hawkish rhetoric from a chorus of Federal reserve speakers since the Fed's governors uber hawkish tone.

Several US Federal Reserve officials are playing down the prospects of aggressive rate hikes coming imminently. For instance, although St. Louis Fed president Bullard (hawkish, voter) said that market pricing of 5 rate hikes this year is not a bad bet, he also said that a 50bp move probably is not helpful.

Over the weekend, Raphael Bostic reiterated that he is sticking to his prediction that three 25 bp hikes this year is the most likely outcome whilst warning that “Every option is on the table for every meeting.” Philadelphia Fed President Patrick Harker was equally cautious and he pushed back on a rate increase of half a percentage point in March, saying he would need to be convinced it was needed. Consequently, the dollar index eased to 96.235 (DXY) and off its recent 19-month high of 97.441.

Looking ahead, there will be a focus on the US jobs market in Nonfarm Payrolls. ''The recovery in employment was probably temporarily interrupted by the Omicron-led surge in COVID cases,'' analysts at TD Securities said.

''Many of the employees who had to isolate likely continued to be paid, and thus remained on payrolls, but many were likely not paid. The report will probably show continued strength in wage gains. The report will include the annual revision to the data.''

However, if there is a weak jobs print owing to the virus, it is unlikely to sway the Fed from its decisively hawkish tone. Traders could decide to look past recent weakness as being related to Omicron's fallout, analysts at TD Securities argued in a note on Tuesday.

''In this context, the data doesn't help to inform global macro participants on whether we are facing a new regime at the Fed, or whether they are jawboning to tame inflation expectations. We expect that the precious metals complex will struggle to attract capital in this context.''

''Given that Chinese demand overwhelmingly supported gold in recent weeks, a seasonal lull following Lunar New Year could mark the end of supportive Chinese demand, suggesting prices are vulnerable to a deeper consolidation in support of our tactical short gold position.

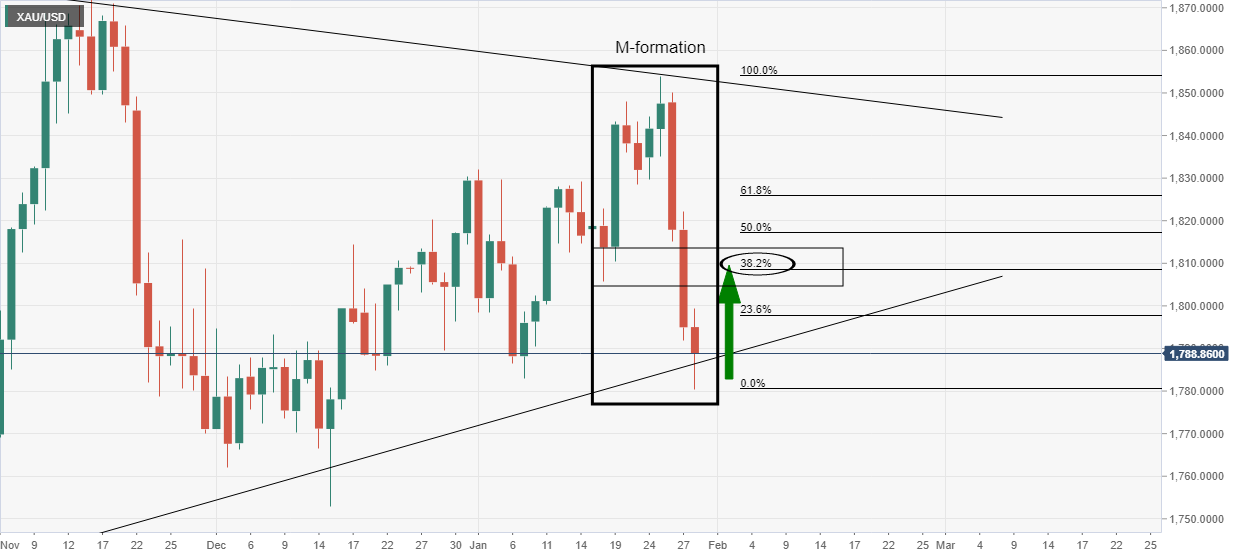

Gold daily chart

In a prior analysis, it was stated that ''considering the trendline support and the daily M-formation, the technicians would argue that a significant correction of the bearish impulse could be in play''...

The analysis noted that the M-formation is a reversion pattern. ''In the case above, the 38.2% Fibonacci retracement level near $1,810 has a confluence with prior structure as illustrated.''

''Should this playout,'' it was stated, ''and if the bears commit near to here, then additional supply could be straw that breaks the camelback for a sizeable continuation to crack the trendline support as follows:''

Gold live market

The price hot the target in Tuesday's trade and the bears will be now monitoring for a bearish structure in anticipation of a bearish continuation in the coming days:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.