- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- GBP/USD bears are back in play regardless of hawkish BoE

GBP/USD bears are back in play regardless of hawkish BoE

- GBP/USD bears are back in play following bullish early morning NY correction.

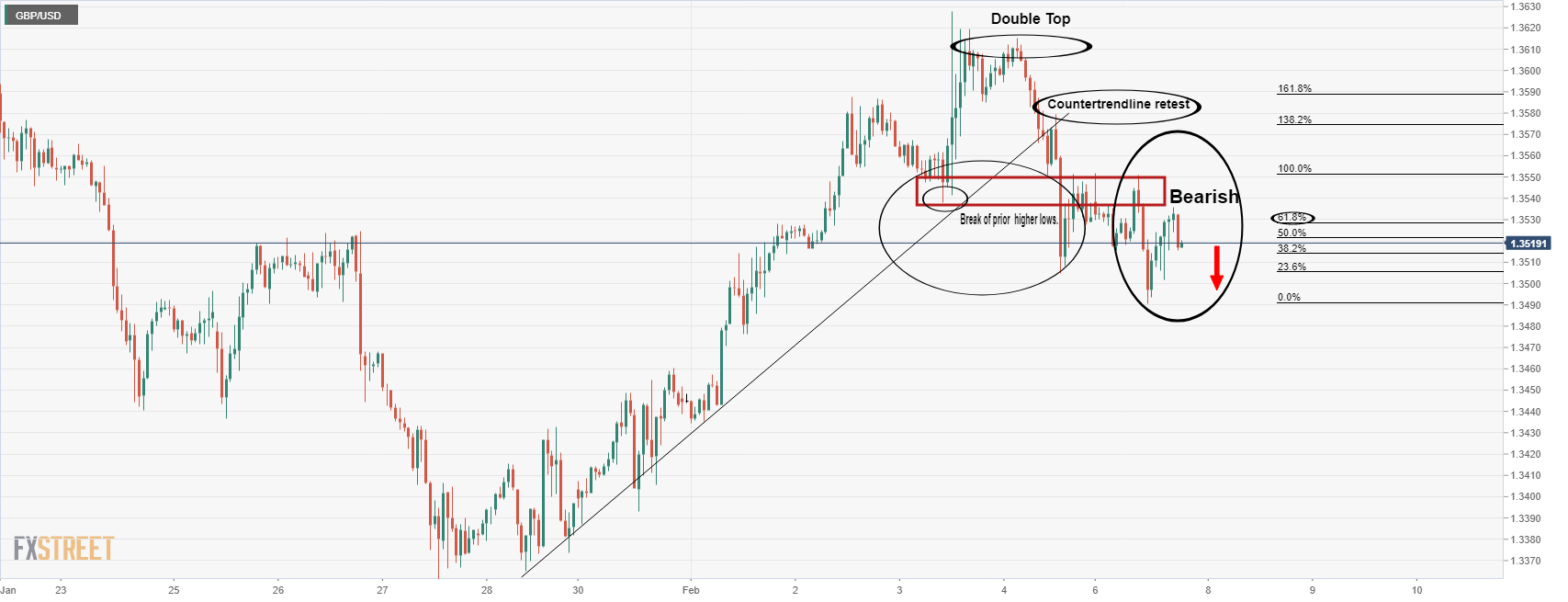

- From a bearish perspective, bears could be targetting the 1.3450's prior breakout levels.

- US inflation, UK GDP and central banks in focus.

GBP/USD has fallen onto the back foot in recent trade and is pressuring back below 1.3515 following a significant correction to 1.3535 that started in the early New York session from the 1.3490s. It is a US dollar and euro story at the start of the week as traders digest the importance of last week's main events in the central bank meetings and US jobs data.

As expected, the Bank of England (BoE) raised the Bank Rate by 25bp to 0.50% and announced the beginning of "passive QT" (ceasing reinvestments of maturing bonds) last week. However, the big surprise was that four out of nine policymakers voted for a 50bp rate hike. This set cable higher to test 1.3630.

However, on Friday, there was an unexpected jump in US jobs created in January according to Nonfarm Payrolls that bizarrely completely contradicted the ADP report that was also reported last week. Nevertheless, the NFP report has raised the outlook for a faster timetable for Federal Reserve rate hikes.

Payrolls grew 467,000 jobs last month and data for December was revised higher to show 510,000 jobs created instead of the previously reported 199,000. Reuters had forecast 150,000 jobs added in January while estimates ranged from a decrease of 400,000 to a gain of 385,000 jobs.

In stark contrast, the ADP private payroll jobs fell 301k in January, versus expectations for a 180k rise. That drop followed a weak initial claims report for the labour market survey week in January. This had resulted in a wave of downward revisions for Friday’s official nonfarm payrolls release, which was flipped on its head ad traders moved back into the US dollar.

The outcome has resulted in some analysts questioning the reliance of such a gauge. ''I have repeatedly stressed how ridiculous it is to look at US jobs data when they are just estimates of the small monthly delta of a very large number strained through an algorithm and seasonal adjustments,'' an analyst at Rabobank argued.

''Worse,'' the analysts exclaimed, ''there were vast backward revisions for years. The million jobs created last summer now happened this winter. Economic history was just rewritten – and we are supposed to take it seriously.''

Nevertheless, the financial markets depend on the data and the outcome reignites expectations the Fed hikes rates by 50 bps in March. GBP/USD, consequently, fell when the US dollar rallied 0.1% on the back of Friday's data.

For the week ahead, there are two key data events. One, market participants are waiting to see the release of US Consumer Price data for January on Thursday and on Friday, preliminary UK Gross Domestic Product is due for the fourth quarter and December.

''We look for UK GDP to contract 0.8% MoM in December, thus bringing GDP below its pre-COVID level once again,'' analysts at TD Securities said.

''Manufacturing likely declined 0.3% MoM, while we expect the services sector to contract 0.9% moM, in part driven by voluntary COVID measures and a substantial amount of people isolating due to the Omicron surge, but also due to a fade in consumer demand.''

GBP/USD technical analysis

As illustrated above, we have seen a break of the counter trendline and restest that failed. This was followed by a break of the old support structure as the prior higher lows which is now expected to continue acting as a resistance on multiple retests. failures would be expected to lead to a downside continuation for the week ahead. From a bearish perspective, the near term price trajectory on the H1 chart could play out as follows, targetting the 1.3450's:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.