- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- NZD/USD struggles in the face of a stronger US dollar despite hot RBNZ inflation expectations

NZD/USD struggles in the face of a stronger US dollar despite hot RBNZ inflation expectations

- NZD/USD bears are lurking in an attempt to take on the daily trendline support.

- A Doji candle followed by a daily engulfing could signal more to come from the bears in the days ahead.

- RBNZ inflation extensions are at a 31-year high, but US CPI trumps at a 40 year high already.

At 0.6658, NZD/USD is 0.17% lower on the day as the greenback continues to dominate the top spot on the forex leader board. On an hourly basis, the US dollar is leading while the commodity currencies are the laggards.

In recent trade, the Reserve bank of New Zealand released its Two-Year Inflation Expectations:

- RBNZ: OCR expectations continue to rise in the short and medium-term

- Q1: 3.27% (prev 2.96%).

- OCR expectations continue to rise in the short and medium-term.

- One year ahead CPI Inflation expectations rose to a 31-year high of 4.40%.

- Unemployment expectations reach all-time lows.

- House price expectations responses show uncertainty in the housing market.

''CPI inflation pressures are set to remain strong in the near term, and that should be reflected in rent and food prices out next wee,'' analysts at ANZ Bank reported earlier 'But the housing market is slowing, as REINZ housing data should confirm. This should take some heat out of the CPI in time.''

Meanwhile, this has failed to move the needle and the markets are instead consolidating the volatility from overnight when the US Consumer Price Index arrived hot, causing two-way price action in the New York day. the data was accompanied by very hawkish comments from James Bullard, a voting member at the Federal Reserve.

His rhetoric unleashed a wave of bets on aggressive rate hikes. Bullard told Bloomberg he'd like to see 100 basis points of hikes by July and that inter-meeting rate hikes could be considered. This has led some Fd watchers to talk of a rate rise before the March meeting. Rates futures have shifted to price a better-than-even chance of a 50 bp hike next month and more than 160 bps of tightening by the end of the year.

Thursday data showed US Consumer Price Index was up 7.5% year-on-year in January, a fourth straight month above 6% and slightly higher than economists' forecasts for a 7.3% rise. Consequently, US Treasury yields leapt and the dollar jumped to a five-week high of 116.34 yen. The kiwi was bod for part of the day on a flight to commodities but turned on a dime when Bullard came on the scene and has been under pressure ever since. New Zealand dollars each dropped about 0.3% in morning trade.

NZD/USD techncial analysis

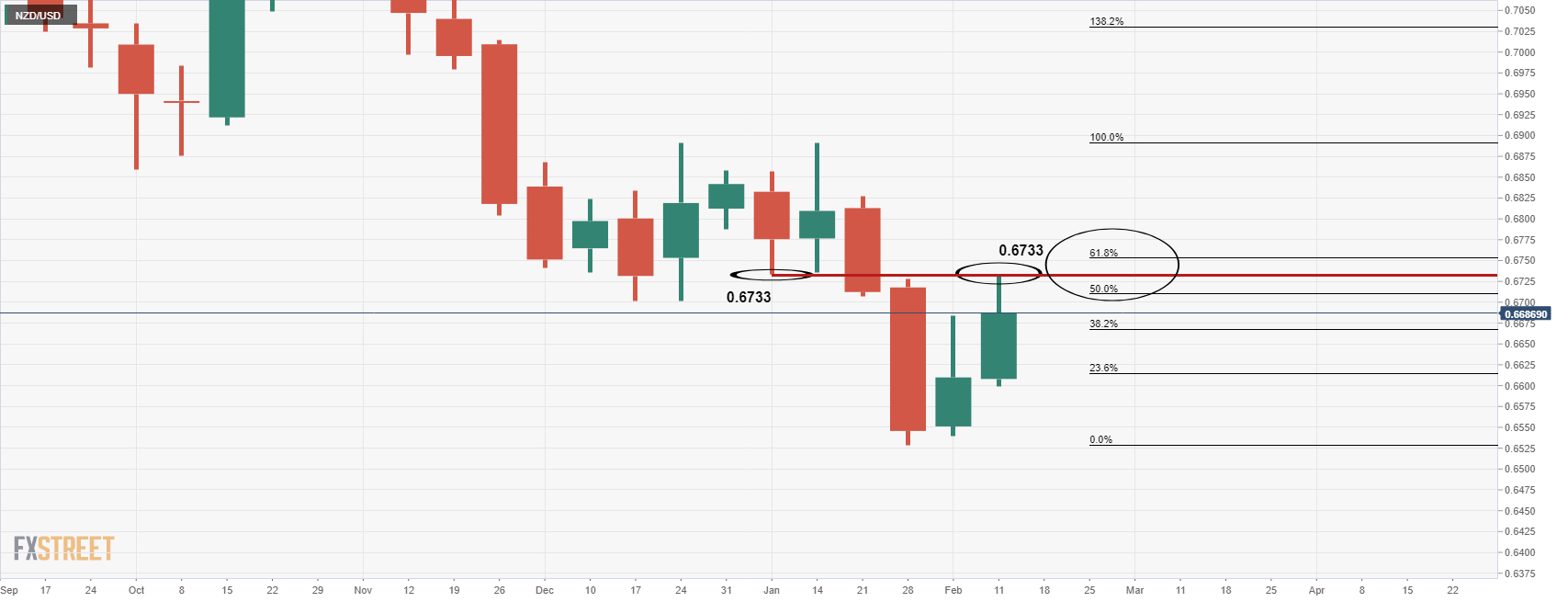

As per the prior analysis, whereby it was noted: ''NZD/USD bulls are taking charge in a significant correction,'' that was moving ''in on old lows near 0.67 the figure and towards the neckline of the M-formation near 0.6733,'' the price reached the target on Thursday. This resided between the 50% mean reversion and the 61.8% ratio as follows:

NZD/USD prior and live analysis

NZD/USD daily chart

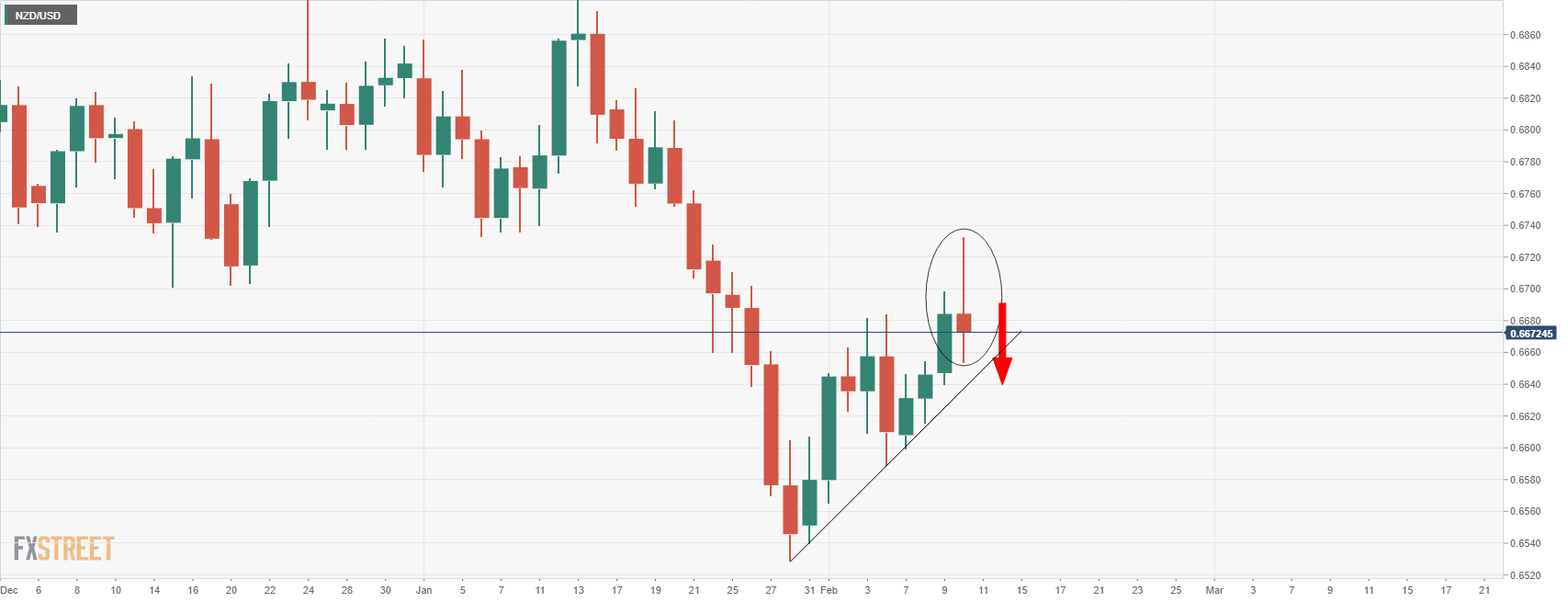

The Doji candle, if followed by a bearish close on Friday, could set the case for a downside continuation for next week's business:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.